Europe Construction Product Certification Market

Market Size in USD Billion

CAGR :

%

USD

11.50 Billion

USD

22.42 Billion

2025

2033

USD

11.50 Billion

USD

22.42 Billion

2025

2033

| 2026 –2033 | |

| USD 11.50 Billion | |

| USD 22.42 Billion | |

|

|

|

|

Europe Construction Product Certification Market Size

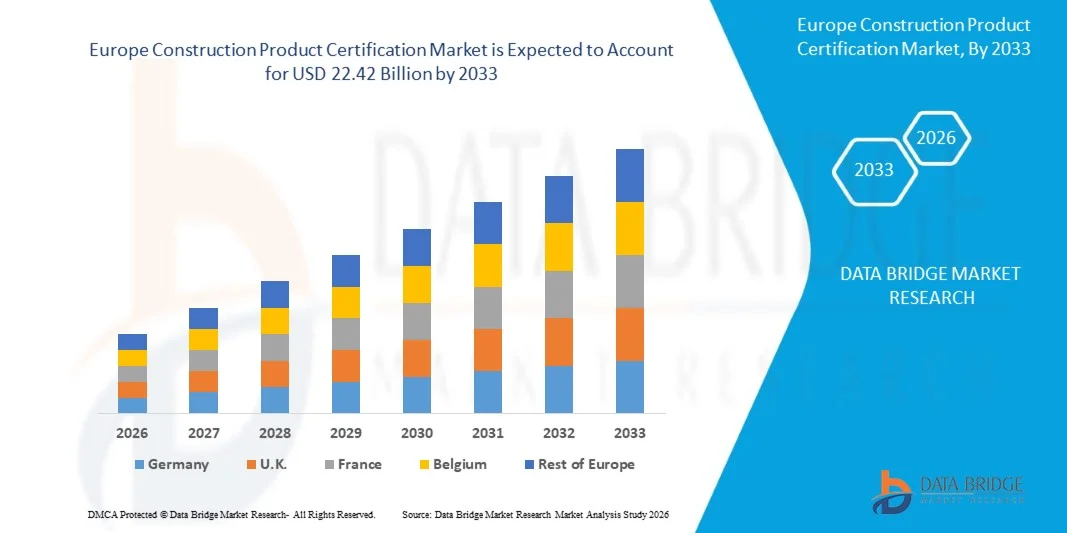

- The Europe Construction Product Certification Market was valued at USD 11.50 billion in 2025 and is projected to reach USD 22.42 billion by 2033, registering a CAGR of 8.70% over the forecast period.

- Growth across the region is primarily driven by the expanding implementation of standardized building practices, coupled with advancements in digital inspection and compliance technologies, which are enhancing verification accuracy and efficiency.

- Additionally, the rising emphasis on safety, sustainability, and regulatory conformity is increasing the demand for certified construction materials, positioning product certification as a critical requirement and significantly accelerating market expansion.

Europe Construction Product Certification Market Analysis

- Europe Construction Product Certification, which ensures that building materials comply with regional safety, quality, and performance standards, is becoming increasingly essential across residential, commercial, and industrial projects due to stricter regulatory frameworks, sustainability mandates, and the growing emphasis on high-quality construction practices.

- The rising need for standardized, compliant, and energy-efficient construction materials, coupled with heightened awareness of building safety and environmental impact, is significantly driving the demand for certification services across Europe.

- Germany dominated the global Construction Product Certification Market with a revenue share of 32% in 2025, supported by stringent EU regulations, rapid adoption of digital compliance tools, and the strong presence of established certification bodies, with major economies such as Germany, the U.K., and France showing accelerated adoption driven by advanced construction technologies and sustainability requirements.

- U.K. region is expected to be the fastest-growing market during the forecast period, propelled by rapid urban development, increasing construction activities, and growing alignment with international building standards.

- The Construction and Building Products segment dominated the market with the largest revenue share of 38.4% in 2025, driven by the high demand for certified materials such as concrete, steel products, insulation, and fire-rated components.

Report Scope and Europe Construction Product Certification Market Segmentation

|

Attributes |

Europe Construction Product Certification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Europe Construction Product Certification Market Trends

“Enhanced Compliance Through Digitalization and AI-Driven Certification”

- A significant and accelerating trend in the Europe Construction Product Certification Market is the deepening integration of digital technologies, AI-driven assessment tools, and advanced building information modeling (BIM) platforms. This convergence is greatly enhancing the speed, accuracy, and transparency of certification processes across the construction sector.

- For Instance, leading certification bodies are increasingly adopting AI-enabled document verification systems that streamline conformity assessments, while BIM-integrated certification modules allow seamless validation of product data directly within digital building models.

- AI integration enables capabilities such as automated detection of compliance gaps, predictive quality assessments, and intelligent reporting. Certain testing facilities also employ machine-learning algorithms to improve the accuracy of structural, fire, and environmental performance evaluations over time. Furthermore, digital submission and remote auditing tools provide faster, more efficient certification workflows for manufacturers.

- The seamless connection of certification systems with broader construction management platforms, digital twins, and sustainability assessment tools enables centralized oversight of materials, documentation, and regulatory compliance, creating a unified and traceable project environment.

- This trend toward more intelligent, intuitive, and interconnected certification ecosystems is reshaping market expectations for compliance in modern construction. As a result, certification agencies across Europe are developing digital-first solutions featuring automated conformity checks, real-time monitoring dashboards, and enhanced data integration capabilities.

- The demand for certification services supported by AI, automation, and digital collaboration tools is expanding rapidly across residential, commercial, and infrastructure projects, as stakeholders increasingly prioritize efficiency, regulatory accuracy, and full lifecycle transparency.

Europe Construction Product Certification Market Dynamics

Driver

“Growing Need Driven by Stricter Regulations and Sustainability Requirements”

- The increasing emphasis on building safety, environmental performance, and regulatory compliance across Europe is a major driver behind the rising demand for construction product certification.

- For Instance, the tightening of EU Construction Products Regulation (CPR) requirements and the growing adoption of energy-efficient and low-carbon building materials are compelling manufacturers to obtain more rigorous certifications to meet market and legal standards. Such policy advancements and industry shifts are expected to significantly accelerate market growth over the forecast period.

- As developers, contractors, and building owners become more aware of structural safety risks, fire hazards, and environmental impacts, certified products offer enhanced reliability through verified performance and safety documentation, making them a preferred choice over uncertified alternatives.

- Furthermore, Europe’s transition toward sustainable buildings, circular materials, and green construction practices is pushing certification bodies to verify compliance with environmental labels and energy-efficiency standards, making certification integral to achieving project approvals.

- The need for transparent documentation, lifecycle assessments, and proof of regulatory conformity is also driving adoption across residential, commercial, and infrastructure projects. The rise of digital construction workflows and remote audits is further supporting market expansion.

Restraint/Challenge

“Complex Regulatory Requirements and High Certification Costs”

- The complexity of Europe’s multi-layered regulatory environment—spanning EU-wide standards, national building codes, and sector-specific guidelines—presents a significant challenge for manufacturers seeking certification. Navigating these regulatory frameworks can be time-consuming and resource-intensive.

- For instance, frequent updates to the EU CPR and stricter sustainability reporting obligations have increased the amount of documentation and testing required, leading some small and medium-sized manufacturers to delay or avoid certification.

- Addressing these challenges requires clearer guidance, harmonized standards, and streamlined certification pathways. Certification bodies are increasingly offering digital support platforms, technical advisory services, and simplified testing workflows to help manufacturers comply more efficiently.

- Another major barrier is the high cost associated with testing, audits, and ongoing compliance, which can be prohibitive for smaller companies. Advanced certifications—such as those for fire safety, structural durability, or environmental performance—often require sophisticated laboratory testing, raising total expenses.

- While digital tools and automation are gradually reducing administrative burdens, the perceived high cost and complexity of certification can still hinder broader participation. Expanding financial support programs, improving access to technical assistance, and raising awareness of long-term cost benefits will be critical for sustained market growth.

Europe Construction Product Certification Market Scope

The construction product certification market is segmented on the basis of product, application and end user.

• By Product

On the basis of product, the Europe Construction Product Certification Market is segmented into Construction and Building Products, Power Generation and Energy Storage, Industrial and Hazardous Location Equipment, Information and Communications Technology, Lighting Products, Medical and Laboratory Equipment, Personal Protective Equipment, Tools and Outdoor Equipment, and Others. The Construction and Building Products segment dominated the market with the largest revenue share of 38.4% in 2025, driven by the high demand for certified materials such as concrete, steel products, insulation, and fire-rated components. Europe’s stringent regulatory ecosystem, including the Construction Products Regulation (CPR), compels manufacturers to obtain certification to ensure safety, sustainability, and performance compliance.

The Power Generation and Energy Storage segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rapid renewable energy adoption, rising deployment of certified solar modules and battery systems, and increasing emphasis on energy efficiency standards across European Union member nations.

• By Application

On the basis of application, the Europe Construction Product Certification Market is segmented into Insulation, Roofing, Exterior Siding, Interior Finishing, and Others. The Insulation segment accounted for the largest market revenue share of 34.7% in 2025, driven by Europe’s aggressive push toward energy-efficient buildings, mandatory thermal performance standards, and incentives supporting the renovation of older housing stock. Certified insulation materials ensure compliance with fire safety, environmental, and energy-efficiency requirements, making them essential in both residential and commercial construction.

The Exterior Siding segment is anticipated to witness the fastest CAGR from 2026 to 2033, supported by the rising use of certified fire-resistant cladding, improved weather-resilient façades, and stricter building codes introduced in response to safety concerns. Growing urban development and the demand for sustainable façades are further driving adoption of certified exterior siding materials across Europe.

• By End User

On the basis of end user, the Europe Construction Product Certification Market is segmented into Industrial, Commercial, and Residential. The Industrial segment dominated the market with the largest revenue share of 41.2% in 2025, supported by stringent regulatory and safety requirements for factories, logistics hubs, infrastructure projects, and energy facilities. Industrial environments demand certified construction materials that meet strict performance, durability, and fire-safety standards, resulting in consistently high certification volume.

The Commercial segment is projected to witness the fastest CAGR from 2026 to 2033, driven by increasing construction of office buildings, retail spaces, hospitality facilities, and institutional establishments. The need for certified materials is rising due to greater emphasis on green building accreditation, fire compliance, environmental performance, and insurance eligibility. Developers and facility managers increasingly prioritize certified products to ensure safety, regulatory adherence, and long-term operational reliability.

Europe Construction Product Certification Market Regional Analysis

- Germany dominated the global Construction Product Certification Market with the largest revenue share of 32% in 2025, driven by stringent regulatory frameworks such as the EU Construction Products Regulation (CPR), increasing emphasis on sustainable construction, and the rising need for standardized building materials across the region.

- Manufacturers and developers in Europe place high value on certified products that ensure compliance, safety, and environmental performance, as they play a crucial role in meeting energy-efficiency targets, fire-safety requirements, and structural integrity standards in modern construction.

- This strong adoption is further supported by advanced construction practices, a well-established certification infrastructure, and widespread demand for high-quality materials across residential, commercial, and industrial sectors. Europe’s continued focus on green buildings, renovation programs, and lifecycle transparency reinforces certified products as the preferred choice for ensuring project reliability and regulatory conformity.

Germany Construction Product Certification Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, driven by stringent construction regulations, strong emphasis on safety, and the rising adoption of sustainable building practices. Increasing urbanization and industrial development are fostering demand for certified construction products across residential, commercial, and public infrastructure projects. German developers prioritize compliance with fire safety, structural, and environmental standards, making certification a key requirement. Moreover, the integration of certified materials into smart building projects is growing, reflecting Germany’s focus on technologically advanced, eco-conscious construction solutions.

France Construction Product Certification Market Insight

The France market is projected to grow at a substantial CAGR over the forecast period, fueled by government mandates for energy efficiency, building safety, and sustainability. Urban housing developments, renovation projects, and commercial construction increasingly rely on certified products to meet regulatory compliance and environmental standards. Rising awareness about green buildings and lifecycle performance of materials is further accelerating the adoption of certified construction products in both public and private construction projects.

U.K. Construction Product Certification Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strict building codes, energy-efficiency regulations, and a focus on sustainable construction practices. Both new residential developments and commercial projects are increasingly integrating certified materials to ensure compliance with fire safety, insulation, and environmental standards. The growing trend of retrofitting older buildings with certified products and the expansion of multi-family housing projects are also contributing to market growth.

Netherlands Construction Product Certification Market Insight

The Netherlands market is expected to expand at a robust CAGR during the forecast period, driven by strong regulatory enforcement, sustainable urban planning, and the demand for resilient infrastructure. Certified construction products are increasingly utilized in residential, commercial, and industrial projects to comply with stringent environmental, safety, and energy-efficiency standards. The country’s focus on flood-resistant construction, green building initiatives, and innovative architectural projects further encourages the adoption of certified materials, positioning the Netherlands as a growing hub for construction product certification in Europe.

Europe Construction Product Certification Market Share

The Construction Product Certification industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Saint-Gobain (France)

- LafargeHolcim (Switzerland)

- Sika AG (Switzerland)

- Knauf Insulation (Germany)

- Vicat Group (France)

- Holcim (Switzerland)

- AkzoNobel (Netherlands)

- GEZE GmbH (Germany)

- ArcelorMittal (Luxembourg)

- Schneider Electric (France)

- Siemens AG (Germany)

- Velux Group (Denmark)

- Compagnie de Saint-Gobain (France)

- ROCKWOOL International (Denmark)

- Knauf Group (Germany)

- Sto SE & Co. KGaA (Germany)

- Thermaflex (Netherlands)

- Aliaxis Group (Belgium)

- Trelleborg AB (Sweden)

What are the Recent Developments in Europe Construction Product Certification Market?

- In April 2024, BASF SE, a global leader in construction chemicals and materials, launched a strategic initiative in Germany aimed at promoting sustainable and certified building products for residential and commercial projects. This initiative underscores the company's commitment to delivering high-quality, compliant construction solutions aligned with EU regulations. By leveraging its expertise in innovation and sustainability, BASF SE is addressing regional regulatory requirements while reinforcing its position in the rapidly growing Europe Construction Product Certification Market.

- In March 2024, Saint-Gobain, a leading European building materials company, introduced a new range of certified energy-efficient insulation products specifically designed for commercial and residential construction. The innovative product line supports compliance with EU energy-efficiency standards and helps reduce carbon emissions, highlighting Saint-Gobain’s dedication to sustainability and safety in construction projects across Europe.

- In March 2024, Siemens AG successfully deployed a smart building certification project in Berlin, aimed at ensuring energy-efficient, compliant, and safe commercial properties. This project harnessed advanced monitoring and certified materials to meet both environmental and structural standards, demonstrating Siemens’ commitment to integrating innovation and regulatory compliance in urban infrastructure.

- In February 2024, Knauf Insulation, a global leader in insulation solutions, announced a strategic partnership with the Dutch Green Building Council to promote certified sustainable insulation materials for building projects. This collaboration is designed to enhance regulatory compliance, improve energy efficiency, and accelerate adoption of environmentally certified construction products in residential and commercial sectors.

- In January 2024, LafargeHolcim, a leading provider of cement and building materials, unveiled its new line of certified sustainable concrete products at the European Construction Expo 2024. The innovative product range ensures compliance with EU environmental and safety standards while offering enhanced durability and performance, highlighting LafargeHolcim’s commitment to integrating sustainability, safety, and certification into modern construction practices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Construction Product Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Construction Product Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Construction Product Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.