Europe Contraceptive Devices Market

Market Size in USD Billion

CAGR :

%

USD

160.78 Billion

USD

192.20 Billion

2024

2032

USD

160.78 Billion

USD

192.20 Billion

2024

2032

| 2025 –2032 | |

| USD 160.78 Billion | |

| USD 192.20 Billion | |

|

|

|

|

Contraceptive Devices Market Size

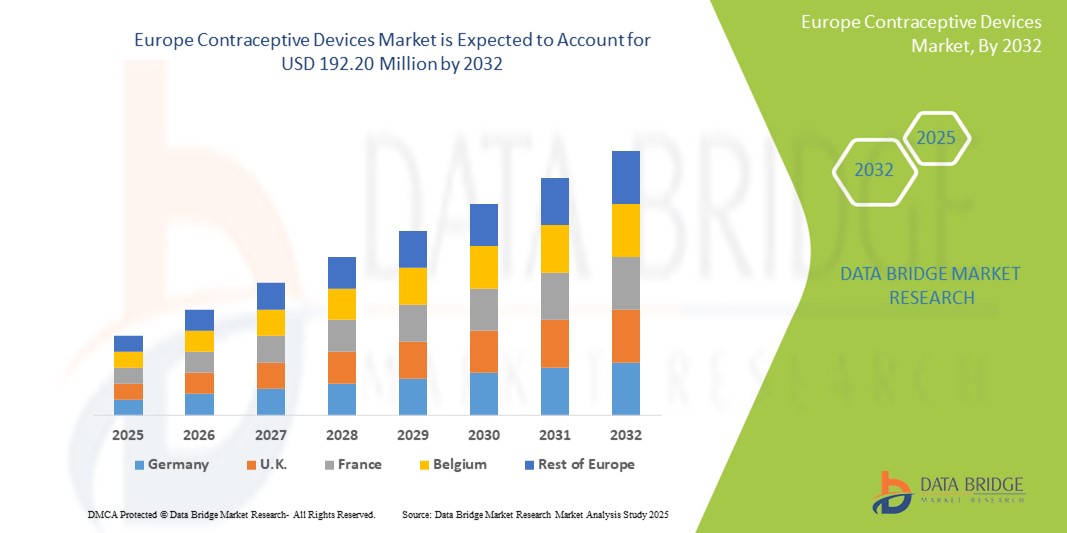

- The Europe Contraceptive Devices Market was valued at USD 160.78 million in 2024 and is expected to reach USD 192.20 million by 2032 is likely to grow at a CAGR of 5.2%

- The drivers of the Contraceptive Devices Market include the rising awareness about family planning and reproductive health, increasing government initiatives to promote contraceptive use, and the growing demand for effective and convenient birth control methods.

Europe Contraceptive Devices Market Analysis

- Contraceptive devices play a crucial role in reproductive health management by enabling individuals and couples to prevent unintended pregnancies and plan families effectively. These devices are essential tools in reducing maternal mortality, improving child health outcomes, and enhancing women's participation in the workforce and education.

- The demand for contraceptive devices in Europe is driven by increased awareness about sexual health, rising incidence of unintended pregnancies, and supportive governmental policies promoting family planning initiatives. Additionally, the growing acceptance of long-acting reversible contraceptives (LARCs), such as intrauterine devices (IUDs) and contraceptive implants, is propelling market growth.

- Europe stands as a dominant region in the Europe contraceptive devices market, supported by its advanced healthcare systems, high levels of public and private sector investment in women's health, and the presence of major industry players. The United States, in particular, has seen robust efforts from healthcare organizations and advocacy groups aimed at increasing access to a wide range of contraceptive options.

- For instance, as of 2023, nearly 65% of women aged 15–49 in Germany were using some form of contraception, with IUD usage accounting for a significant and growing portion of this demographic.

- Contraceptive devices such as IUDs, condoms, and subdermal implants rank among the most effective and widely used birth control methods. In North America, their availability and accessibility are continually enhanced through healthcare reforms, public health programs, and growing consumer preference for non-hormonal and minimally invasive options

Report Scope Contraceptive Devices Market Segmentation

|

Attributes |

Contraceptive Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Contraceptive Devices Market Trends

“Increased Adoption of Long-Acting and Non-Hormonal Contraceptive Solutions”

- Rising Preference for Long-Acting Reversible Contraceptives (LARCs): A growing number of women are opting for IUDs and implants due to their long-term efficacy, low maintenance, and reduced risk of user error compared to short-term methods like pills and condoms.

- Shift Toward Non-Hormonal Options: There's increasing demand for hormone-free contraceptive devices, such as copper IUDs, driven by consumer concerns over hormonal side effects and a preference for natural alternatives.

- For istance, in September 2023, CooperSurgical reported a significant rise in demand across Europe for its Paragard copper IUD, a non-hormonal, long-acting reversible contraceptive, citing increased consumer preference for hormone-free options and long-term birth control solutions.

Contraceptive Devices Market Dynamics

Driver

“High Awareness and Access to Family Planning Services”

- Federal and state-level programs in the U.S. and Canada, such as Title X in the U.S., are expanding access to affordable contraceptive services, significantly driving market growth.

- The continued emphasis on sexual wellness, education, and proactive reproductive health is leading to higher adoption of modern and effective contraceptive devices across demographics.

- The ease of access through retail outlets and e-commerce channels is increasing user convenience and boosting sales of over-the-counter contraceptive devices such as condoms and emergency contraception.

For instance,

- In February 2024, according to a report published by Market Data Forecast, one of the main drivers of the Europe contraceptive devices market is the rising prevalence of unintended pregnancies and sexually transmitted infections (STIs). This growing health concern has led to increased awareness and demand for effective and preventive contraceptive methods across the region.

- Consequently, heightened public health campaigns, improved access to contraceptive options, and supportive government initiatives are significantly fueling market growth

Opportunity

“Technological Advancements and Telehealth Expansion”

- Integration of digital technologies with contraceptive methods (e.g., fertility tracking apps paired with devices) is opening new market segments for tech-enabled family planning solutions.

- Policy improvements, including expanded Medicaid coverage and employer-provided health plans, offer new opportunities for growth and greater consumer access to a variety of contraceptive options.

- For instance, under the Affordable Care Act, most health insurance plans are required to cover FDA-approved contraceptive methods without charging a copayment or coinsurance.

For instance,

- In March 2024, according to a report published by the Centers for Disease Control and Prevention (CDC), increasing initiatives to expand access to contraception through telehealth services present a major opportunity for the Europe contraceptive devices market. Telemedicine platforms are making it easier for individuals, especially in rural and underserved areas, to consult healthcare providers and obtain contraceptive devices conveniently.

- Consequently, the growing integration of digital health solutions is expected to improve contraceptive accessibility, reduce disparities, and significantly drive market growth across the region

Restraint/Challenge

“Cultural Sensitivities and Access Inequities”

- In certain regions and communities, cultural or religious opposition to contraceptive use can hinder adoption, particularly of long-term or invasive devices.

- Despite overall availability, unequal access to insurance coverage and healthcare services—especially among low-income or rural populations—continues to limit equitable adoption of contraceptive devices.

For instance,

- In February 2024, according to a report published by the Guttmacher Institute, one of the major challenges facing the Europe contraceptive devices market is the persistent disparity in access to affordable contraception, particularly among low-income and rural populations. High costs, insurance coverage gaps, and limited availability of contraceptive options in underserved areas continue to restrict equitable access to effective birth control methods

- Consequently, these barriers can lead to higher rates of unintended pregnancies, impacting public health outcomes and slowing the overall growth of the contraceptive devices market in the region

Contraceptive Devices Market Scope

The market is segmented on the basis, product type, technology, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By Distribution Channel

|

|

In 2025, the Female Contraceptive Devices is projected to dominate the market with a largest share in product type segment

The female contraceptive devices segment is expected to dominate with the market share of 52.34% driven by growing awareness, rising demand for effective birth control methods, and increasing government initiatives promoting women's health. Advancements in device technology, offering greater convenience and fewer side effects, are enhancing adoption rates. Additionally, the rising focus on family planning, coupled with an increasing female population of reproductive age, significantly contributes to the segment’s market leadership.

The barrier contraceptives is expected to account for the largest share during the forecast period in technology market

In 2025, the barrier contraceptives segment is expected to dominate with the market share of 32.34% due to their ease of use, accessibility, and minimal side effects. As a widely preferred method for preventing unintended pregnancies and sexually transmitted infections, innovations in materials and designs enhance effectiveness and comfort. Growing awareness about safe sex practices and increased availability through pharmacies and online platforms further contribute to the segment’s strong market presence..

Contraceptive Devices Market Regional Analysis

“Germany is the Dominant Country in the Contraceptive Devices Market”

- Germany leads the Europe Contraceptive Devices market, fueled by a robust healthcare infrastructure, widespread access to modern contraceptive options, and strong presence of major industry players such as CooperSurgical, Bayer, and Church & Dwight.

- The Germany holds a substantial market share, driven by high awareness of reproductive health, supportive government policies including Title X and ACA contraceptive mandates, and rising demand for long-acting reversible contraceptives (LARCs) like IUDs and implants.

- Comprehensive insurance coverage, including no-cost access to FDA-approved contraceptive methods under the Affordable Care Act (ACA), significantly boosts product adoption and utilization across diverse population groups.

- Ongoing research & development investments, combined with increasing integration of contraceptive counseling into digital and telehealth platforms, are accelerating the adoption of user-friendly, personalized, and tech-integrated birth control solutions

“France is Projected to Register the Highest Growth Rate”

- France is witnessing steady growth in the Contraceptive Devices market, supported by a universal healthcare system, strong public health policies, and increasing emphasis on sexual and reproductive health education.

- Government-led initiatives, such as expanded access to contraceptives through provincial health plans and youth-focused sexual health programs, are driving wider adoption of both hormonal and non-hormonal contraceptive methods across the country.

- Urban centers such as Toronto, Vancouver, and Montreal are leading in the uptake of long-acting reversible contraceptives (LARCs) like IUDs and implants, reflecting a shift toward user-friendly, effective, and low-maintenance birth control options.

- With growing advocacy for reproductive rights, rising educational levels, and increased availability of digital health platforms offering contraceptive counseling, France is poised to become a more significant contributor to the North American contraceptive devices market

Contraceptive Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- CooperSurgical, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Medicines360 (U.S.)

- Veru Inc. (U.S.)

- Reckitt Benckiser Group plc (U.K.)

- Church & Dwight Co., Inc. (U.S.)

Latest Developments in Europe Contraceptive Devices Market

- In September 2023, Medicines360, a rare nonprofit pharma, spent USD 82 million to bring a $50 hormonal IUD, Liletta, to market. Despite hurdles like FDA regulations, funding challenges, and market resistance, it expanded access for low-income women, saving the U.S. healthcare system USD 100 million and sparking ongoing legislative efforts for nonprofit drug development.

- In January 2024, Medicines360, a nonprofit women’s health pharmaceutical organization, in partnership with Theramex, announced the commercial launch of LILETTA (levonorgestrel-releasing intrauterine system) in Canada. This milestone expands access to long-acting reversible contraceptives (LARCs) for Canadian women, aligning with public health efforts to improve reproductive health options and equity.

- In July 2021, the UK’s Medicines and Healthcare Products Regulatory Agency (MHRA) announced that progestogen-only contraceptive pills could be purchased without a prescription. Women can now access these pills after consulting with a pharmacist, improving access to contraception and promoting easier, more flexible healthcare services across pharmacies.

- In April 2021, Mayne Pharma Group Limited and Mithra Pharmaceuticals received U.S. FDA approval for NEXTSTELLIS, an oral contraceptive. It is the first and only pill containing estetrol, a natural estrogen produced from plant sources. NEXTSTELLIS offers a novel option for women seeking effective and hormone-balanced birth control.

- In January 2021, Teva Pharmaceuticals API launched a generic version of NuvaRing in the U.S. market. This estrogen/progestin combination hormonal contraceptive (CHC) is designed for women to prevent pregnancy. The generic release expands access to affordable birth control options, offering a trusted, ring-based alternative to branded products.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.