Europe Contrast And Imaging Agents In Interventional X Ray Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

1.97 Billion

2024

2032

USD

1.32 Billion

USD

1.97 Billion

2024

2032

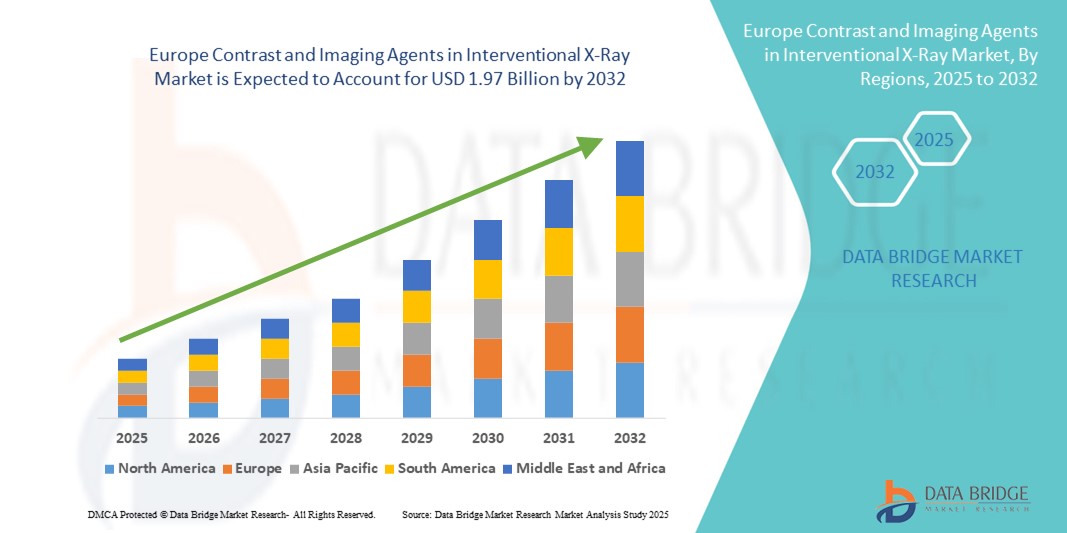

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 1.97 Billion | |

|

|

|

|

Europe Contrast and Imaging Agents in Interventional X-Ray Market Size

- The Europe contrast and imaging agents in interventional X-Ray market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 1.97 billion by 2032, at a CAGR of 5.13% during the forecast period

- The market growth is primarily driven by the increasing adoption of minimally invasive procedures and rising demand for precise diagnostic imaging across cardiology, oncology, and neurology, strengthening the use of contrast agents in interventional X-ray applications

- Moreover, technological advancements in contrast media formulations, coupled with the growing geriatric population and rising incidence of chronic diseases in Europe, are fueling market expansion. These converging dynamics are positioning contrast and imaging agents as indispensable tools in interventional imaging, thereby accelerating the industry’s growth trajectory

Europe Contrast and Imaging Agents in Interventional X-Ray Market Analysis

- Contrast and imaging agents, essential for enhancing visualization in interventional X-ray procedures, are becoming increasingly vital across Europe’s healthcare systems due to their ability to improve diagnostic precision and support minimally invasive treatments in cardiology, oncology, and neurology

- The market’s growth is primarily driven by the rising prevalence of chronic diseases, increasing adoption of image-guided interventions, and continuous advancements in contrast formulations and X-ray imaging technologies, supported by healthcare spending across major European economies

- Germany dominated the Europe contrast and imaging agents in interventional X-Ray market with the largest revenue share of 29.2% in 2024, attributed to its advanced hospital infrastructure, high diagnostic imaging volumes, and strong presence of global contrast media manufacturers

- Poland is expected to be the fastest-growing country in the Europe contrast and imaging agents in interventional X-Ray market during the forecast period, driven by expanding healthcare modernization programs, rising government investment in diagnostic services, and growing accessibility to interventional imaging procedures

- The iodinated contrast media segment dominated the Europe contrast and imaging agents in interventional X-ray market with a market share of 46.8% in 2024, driven by its proven efficacy in vascular imaging and wide adoption across hospitals and diagnostic centers

Report Scope and Europe Contrast and Imaging Agents in Interventional X-Ray Market Segmentation

|

Attributes |

Europe Contrast and Imaging Agents in Interventional X-Ray Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Contrast and Imaging Agents in Interventional X-Ray Market Trends

Advancements in Safer and More Specialized Contrast Media

- A significant and accelerating trend in the Europe contrast and imaging agents in interventional X-ray market is the development of safer, lower-risk, and more specialized contrast formulations to improve diagnostic accuracy while minimizing adverse reactions such as nephrotoxicity or allergic responses

- For instance, Bracco Imaging has expanded its low-osmolar iodinated contrast media portfolio in Germany and France, aiming to reduce kidney-related complications in patients undergoing angiographic and cardiovascular procedures. Similarly, Guerbet introduced advanced contrast solutions tailored for interventional oncology applications in leading European hospitals

- Advances in specialized contrast agents are also enabling improved visualization of targeted pathologies. For instance, novel iodinated formulations are being designed for enhanced vascular clarity during cardiac catheterizations, while newer barium-based agents support better gastrointestinal assessments

- The growing emphasis on patient safety has led European regulatory agencies to push for the adoption of next-generation contrast agents that meet stricter compliance requirements, encouraging innovation and safer clinical practices

- Companies such as Bayer AG and GE HealthCare are increasingly investing in research collaborations with academic centers across Germany, the UK, and France to refine formulations that reduce dosage levels without compromising imaging quality

- This trend toward safer, patient-centric, and procedure-specific imaging agents is reshaping the European interventional imaging landscape, leading to stronger adoption rates in hospitals and diagnostic centers

Europe Contrast and Imaging Agents in Interventional X-Ray Market Dynamics

Driver

Rising Chronic Disease Burden and Adoption of Image-Guided Therapies

- The increasing prevalence of cardiovascular diseases, cancers, and neurological disorders in Europe, coupled with the growing preference for minimally invasive and image-guided procedures, is a major driver of market growth

- For instance, in March 2024, Bayer announced new clinical data from its contrast agent Gadavist, demonstrating improved diagnostic accuracy in neurovascular imaging in leading European hospitals. Such initiatives highlight the industry’s push toward advanced, high-quality imaging solutions

- Patients and clinicians are increasingly relying on interventional X-ray with contrast agents for precise diagnosis and treatment planning, reducing hospital stays and overall treatment costs compared to invasive surgeries

- Furthermore, national healthcare programs in Germany, France, and the UK are expanding funding for advanced diagnostic imaging infrastructure, accelerating the adoption of contrast agents in public and private hospital networks

- The combination of a rapidly aging population, rising procedure volumes, and technological progress is making contrast agents indispensable to interventional radiology in Europe

Restraint/Challenge

Adverse Reactions, High Costs, and Regulatory Barriers

- Concerns about adverse effects such as contrast-induced nephropathy (CIN) and allergic reactions continue to restrain adoption, particularly among patients with renal impairment or comorbidities, limiting broader usage in sensitive populations

- For instance, several EU pharmacovigilance updates in 2023 flagged potential risks of iodinated contrast media, prompting stricter usage guidelines in hospitals across Germany and Italy

- In addition, the high costs of advanced contrast formulations compared to generic alternatives can burden smaller hospitals and diagnostic centers, creating disparities in access across Europe

- The regulatory framework in the EU is also stringent, requiring extensive clinical validation and compliance with the European Medicines Agency (EMA) standards, often leading to delays in product approvals

- While multinational companies such as Guerbet, Bracco Imaging, and GE HealthCare emphasize their safety data and advanced manufacturing standards, price-sensitive healthcare systems in Eastern Europe still face challenges in adopting premium solutions

- Overcoming these hurdles through innovation in safer agents, broader reimbursement coverage, and cost-optimized solutions will be crucial for sustaining market growth in Europe

Europe Contrast and Imaging Agents in Interventional X-Ray Market Scope

The market is segmented on the basis of agent type, application, and end user.

- By Agent Type

On the basis of agent type, the Europe contrast and imaging agents in interventional X-Ray market is segmented into iodinated contrast media, barium-based contrast media, microbubble contrast media, gold nanoparticle contrast agents, and others. The iodinated contrast media segment dominated the market with the largest revenue share of 46.8% in 2024, owing to its proven efficacy in vascular and cardiovascular imaging, broad clinical usage, and widespread adoption across hospitals and diagnostic centers. Its versatility in angiography, interventional cardiology, and oncology ensures consistent demand across European healthcare systems.

The microbubble contrast media segment is anticipated to witness the fastest growth rate of 8.4% from 2025 to 2032, driven by its growing role in real-time ultrasound imaging and applications in cardiology and oncology. Rising research initiatives in targeted molecular imaging and increasing approval of microbubble formulations are further boosting adoption in advanced diagnostic settings. Hospitals and imaging centers are increasingly preferring microbubble-based agents for their ability to enhance vascular imaging without additional radiation exposure.

- By Application

On the basis of application, the Europe contrast and imaging agents in interventional X-Ray market is segmented into cardiology, gastroenterology, neurology, oncology, urology, and general surgery. The cardiology segment dominated the market with the largest share of 31.5% in 2024, fueled by the high prevalence of cardiovascular diseases in Europe and the widespread use of contrast agents in angiography, percutaneous coronary interventions, catheterization, and structural heart interventions. Leading European hospitals in Germany, France, and the UK conduct thousands of such procedures annually, driving consistent demand.

The oncology segment is expected to register the fastest CAGR of 7.6% from 2025 to 2032, driven by the increasing incidence of cancers, rising adoption of interventional oncology procedures like tumor ablation and embolization, and advancements in precision imaging for tumor detection, staging, and treatment monitoring. Contrast agents are critical in CT, MRI, and ultrasound-guided interventions, enabling oncologists to visualize tumor vascularity and monitor therapy response.

- By End User

On the basis of end user, the Europe contrast and imaging agents in interventional X-Ray market is segmented into imaging centers, hospitals, clinics, diagnostic centers, ambulatory surgical centers, and private practices. The hospitals segment held the largest market revenue share of 49.2% in 2024, attributed to the high patient inflow, well-equipped radiology departments, and significant volume of interventional procedures performed in hospital settings. The presence of advanced infrastructure and reimbursement support in countries such as Germany, France, and the UK further strengthens hospital dominance.

The ambulatory surgical centers (ASCs) segment is projected to experience the fastest growth at a CAGR of 8.1% from 2025 to 2032, driven by the shift toward outpatient care, shorter procedure times, and growing preference for cost-effective diagnostic and interventional solutions. Increasing investments in ASC imaging infrastructure across Europe are further propelling growth in this segment. Investments in ASC imaging infrastructure, particularly in emerging European markets like Poland, Spain, and Eastern Europe, are further driving growth.

Europe Contrast and Imaging Agents in Interventional X-Ray Market Regional Analysis

- Germany dominated the Europe contrast and imaging agents in interventional X-Ray market with the largest revenue share of 29.2% in 2024, attributed to its advanced hospital infrastructure, high diagnostic imaging volumes, and strong presence of global contrast media manufacturers

- Clinicians in the country place high value on contrast agents that deliver enhanced diagnostic precision and patient safety, particularly for cardiovascular and oncology applications, where Germany sees some of the highest procedure rates in Europe

- This strong adoption is further supported by high healthcare expenditure, well-established reimbursement systems, and continued investments in minimally invasive treatment facilities, positioning Germany as the leading hub for contrast and imaging agent utilization in Europe

The Germany Contrast and Imaging Agents in Interventional X-Ray Market Insight

The Germany contrast and imaging agents in interventional X-ray market captured the largest revenue share of 29.2% in 2024, supported by its advanced healthcare infrastructure, high diagnostic volumes, and the presence of leading pharmaceutical and imaging companies. German hospitals prioritize contrast media that ensure safety and precision in cardiovascular and oncology procedures, aligning with the country’s focus on innovation and patient-centric care. Ongoing investments in radiology departments and a strong reimbursement environment continue to make Germany the leading hub for contrast agent usage in Europe.

France Contrast and Imaging Agents in Interventional X-Ray Market Insight

The France contrast and imaging agents in interventional X-Ray market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a rising incidence of cancers and cardiovascular diseases, coupled with strong adoption of interventional radiology. French healthcare providers are increasingly integrating advanced iodinated and microbubble contrast agents for both routine and specialized procedures. Furthermore, the presence of Guerbet, headquartered in France, strengthens domestic production and innovation, further accelerating adoption in hospitals and imaging centers.

U.K. Contrast and Imaging Agents in Interventional X-Ray Market Insight

The U.K. contrast and imaging agents in interventional X-Ray market is projected to grow considerably, supported by an increasing demand for advanced diagnostic imaging in both public and private healthcare systems. Rising cases of neurological and cardiovascular conditions are creating strong demand for safe and effective contrast agents. Hospitals and diagnostic centers in the U.K. are emphasizing patient safety and compliance with stringent MHRA regulations, encouraging the use of next-generation imaging agents. The integration of AI-assisted imaging platforms further complements growth in interventional applications.

Poland Contrast and Imaging Agents in Interventional X-Ray Market Insight

The Poland contrast and imaging agents in interventional X-Ray market is expected to be the fastest-growing market in Europe, with a projected CAGR of 7.9% from 2025 to 2032, fueled by rapid healthcare modernization, expanding diagnostic infrastructure, and government initiatives to improve access to advanced imaging solutions. The demand for cost-effective contrast agents is strong, with local hospitals increasingly adopting iodinated and barium-based formulations. Growing collaborations with multinational players are further enhancing the availability of cutting-edge imaging agents in the country.

Italy Contrast and Imaging Agents in Interventional X-Ray Market Insight

The Italy contrast and imaging agents in interventional X-Ray market is steadily expanding, supported by high procedure volumes in cardiology and oncology, where contrast agents are indispensable. Italian hospitals are prioritizing the adoption of low-risk and safer contrast formulations to minimize adverse events, particularly in elderly populations with comorbidities. Increasing investments in interventional radiology units, alongside strong participation in EU-wide research initiatives, are expected to strengthen Italy’s position as a key growth market within Southern Europe.

Europe Contrast and Imaging Agents in Interventional X-Ray Market Share

The Europe Contrast and Imaging Agents in Interventional X-Ray industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- GE Healthcare (U.S.)

- Bracco Imaging S.p.A (Italy)

- Guerbet Group (France)

- Lantheus Holdings, Inc. (U.S.)

- Daiichi Sankyo Company, Limited (Japan)

- Sanochemia Pharmazeutika GmbH (Austria)

- J.B. Chemicals & Pharmaceuticals Ltd. (India)

- Trivitron Healthcare (India)

- Spago Nanomedical AB (Sweden)

- Magnus Medical GmbH (Germany)

- Curium (France)

- Subhra Pharma Pvt. Ltd. (India)

- Cyclomedica Europe Ltd. (U.K.)

- iThera Medical GmbH (Germany)

- United Imaging Healthcare (China)

- Nanobiotix S.A. (France)

- Miltenyi Biotec GmbH (Germany)

- Aspen Pharmacare Holdings Limited (South Africa)

What are the Recent Developments in Europe Contrast and Imaging Agents in Interventional X-Ray Market?

- In March 2025, Bracco Imaging revealed two significant initiatives at ECR 2025: (1) launching AiMIFY, an AI-powered software designed to enhance contrast visibility in MRI scans, enabling better imaging with lower gadolinium exposure; and (2) collaborating with Zereau to pilot an innovative urine filtration system that captures excreted contrast agents (iodine and gadolinium) before they enter hospital wastewater—representing a leap forward in sustainable imaging practices

- In February 2025, GE Healthcare announced a major EUR 132 million investment to significantly expand its contrast media manufacturing facility in Cork, Ireland. The expansion will enable production of an additional 25 million patient doses per year by the end of 2027, bolstering supply capacity of injectable contrast agents used in X-ray, CT, and interventional imaging across Europe

- In February 2025, Bayer presented late-breaking clinical results from its Phase III study of gadoquatrane, a novel low-dose, high-relaxivity macrocyclic gadolinium-based MRI contrast agent, during the European Congress of Radiology (ECR) in Vienna. The data highlighted its efficacy at a gadolinium dose of 0.04 mmol/kg, significantly lower than standard agents, offering potential safety and imaging advantages. The presentation was part of a broader showcase of Bayer’s radiology innovations, including enhancements to its MEDRAD Centargo CT injector system

- In October 2024, Bracco Imaging’s Gadopiclenol (Vueway) was honored with the JFR 2024 Innovation Award, recognizing its breakthrough in MRI imaging quality and patient safety achieved through lower-dose gadolinium efficacy

- In February 2024, At the European Congress of Radiology (ECR), Guerbet unveiled Elucirem (Gadopiclenol) to European radiologists following its approval in Europe, highlighting its enhanced relaxivity for high-quality imaging with reduced gadolinium dosage

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.