Europe Courier Market

Market Size in USD Million

CAGR :

%

USD

103.62 Million

USD

171.49 Million

2025

2033

USD

103.62 Million

USD

171.49 Million

2025

2033

| 2026 –2033 | |

| USD 103.62 Million | |

| USD 171.49 Million | |

|

|

|

|

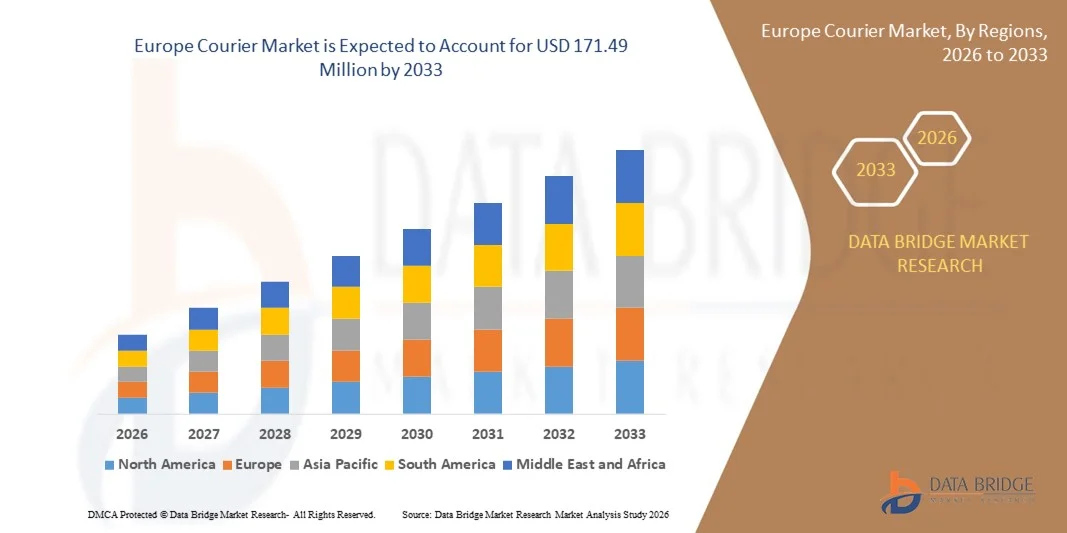

What is the Europe Courier Market Size and Growth Rate?

- The Europe courier market size was valued at USD 103.62 million in 2025 and is expected to reach USD 171.49 million by 2033, at a CAGR of6.50% during the forecast period

- The major factors driving the growth of the courier market are increasing adoption of contract manufacturing, adoption of new technologies in courier supply chain network systems, increasing Europe import and export activities and adoption of multiple services through smartphones and use of internet services

What are the Major Takeaways of Courier Market?

- Rising growth in Europeization is leading to cross-border courier services and creating opportunities for the growth of the market. Lack of proper infrastructure is acting as the major restraint for courier market. Congestions associated with trade routes is acting as a major challenge for the growth of the market

- Germany dominated the European courier market with an estimated 41.8% revenue share in 2025, driven by robust e-commerce growth, well-established urban infrastructure, and rising demand for fast, reliable parcel delivery across Germany

- Italy is projected to register the fastest CAGR of 7.32% from 2026 to 2033, supported by increasing e-commerce adoption, expanding SME parcel shipments, and growing demand for time-sensitive deliveries

- The Outbound segment dominated the market with an estimated 61.3% share in 2025, driven by the high volume of shipments sent by businesses, e-commerce platforms, manufacturers, and service providers to end customers

Report Scope and Courier Market Segmentation

|

Attributes |

Courier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Courier Market?

Increasing Shift Toward Digitalized, High-Speed, and Technology-Driven Courier Services

- The Courier market is witnessing a strong shift toward digital platforms, real-time tracking, and automated delivery management systems to improve speed, transparency, and customer experience

- Courier companies are increasingly adopting AI-powered route optimization, IoT-enabled shipment tracking, and data analytics to enhance operational efficiency and reduce delivery times

- Growing demand for same-day, next-day, and time-definite deliveries, driven by e-commerce and on-demand services, is reshaping service models Europely

- For instance, companies such as FedEx, UPS, DHL, SF Express, and Delhivery are investing in digital freight platforms, automated sorting centers, and smart logistics solutions

- Rising adoption of contactless delivery, mobile apps, and digital payment integration is accelerating service modernization

- As e-commerce volumes and cross-border trade expand, technology-enabled courier services will remain critical for fast, reliable, and scalable logistics operations

What are the Key Drivers of Courier Market?

- Rapid growth of e-commerce, online retail, and direct-to-consumer business models is significantly boosting parcel volumes

- For instance, in 2025, leading courier companies expanded last-mile delivery networks and automated hubs to manage rising shipment volumes efficiently

- Increasing demand for cross-border trade, international shipping, and express delivery services supports Europe market expansion

- Advancements in logistics automation, warehouse robotics, and fleet management technologies are improving speed and cost efficiency

- Rising urbanization and consumer preference for fast, trackable, and flexible delivery options are strengthening courier demand

- Supported by growing digital infrastructure and logistics investments, the Courier market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Courier Market?

- Rising fuel costs, labor shortages, and high last-mile delivery expenses continue to pressure profit margins

- For instance, during 2024–2025, fluctuations in fuel prices and increased wage costs impacted operational efficiency for several Europe courier operators

- Increasing complexity of managing high delivery volumes, reverse logistics, and urban congestion adds operational challenges

- Stringent regulatory requirements related to cross-border trade, customs clearance, and environmental compliance slow service execution

- Intense competition from local delivery startups, crowdsourced delivery platforms, and in-house e-commerce logistics networks creates pricing pressure

- To address these challenges, companies are focusing on automation, electric delivery vehicles, route optimization, and digital integration to enhance efficiency and expand Europe courier adoption

How is the Courier Market Segmented?

The market is segmented on the basis of type, delivery mode, customer type, destination, and end user.

- By Type

On the basis of type, the courier market is segmented into Outbound and Inbound services. The Outbound segment dominated the market with an estimated 61.3% share in 2025, driven by the high volume of shipments sent by businesses, e-commerce platforms, manufacturers, and service providers to end customers. Growth in online retail, cross-border trade, and direct-to-consumer business models continues to fuel outbound parcel movement Europely. Courier companies focus heavily on outbound logistics optimization to ensure timely delivery, cost efficiency, and customer satisfaction.

The Inbound segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising return shipments, reverse logistics, supplier deliveries, and inbound inventory replenishment. Increasing focus on efficient supply chain management and inventory optimization is accelerating demand for inbound courier services.

- By Delivery Mode

Based on delivery mode, the courier market is segmented into Normal Delivery and Express Delivery. The Normal Delivery segment held the largest market share of 54.8% in 2025, owing to its cost-effectiveness and widespread usage for non-urgent shipments across retail, manufacturing, and service sectors. Businesses continue to rely on standard delivery options to manage logistics costs while ensuring reliable service.

The Express Delivery segment is projected to register the fastest growth rate during 2026–2033, driven by rising consumer demand for same-day, next-day, and time-definite deliveries. Expansion of e-commerce, food delivery, healthcare logistics, and premium services is significantly boosting adoption of express courier solutions.

- By Customer Type

On the basis of customer type, the courier market is segmented into B2B (Business-to-Business), B2C (Business-to-Consumer), and Consumer-to-Consumer (C2C). The B2B segment dominated the market with a 46.5% share in 2025, supported by high shipment volumes across manufacturing, wholesale trade, pharmaceuticals, BFSI, and industrial supply chains. Reliable, scheduled, and contract-based courier services continue to drive strong B2B demand.

The B2C segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid expansion of e-commerce, digital marketplaces, and direct-to-consumer brands. Increasing consumer expectations for fast, trackable, and flexible delivery options are accelerating growth in B2C courier services.

- By Destination

Based on destination, the courier market is segmented into Domestic and International/Cross-Border deliveries. The Domestic segment accounted for the largest market share of 63.9% in 2025, driven by high intra-country parcel volumes, urban deliveries, and expansion of national e-commerce and retail networks. Efficient last-mile infrastructure and local courier networks support strong domestic demand.

The International/Cross-Border segment is anticipated to grow at the fastest CAGR from 2026 to 2033, supported by increasing Europe trade, cross-border e-commerce, and international shipping of documents and parcels. Improvements in customs processing, digital documentation, and international logistics networks are accelerating cross-border courier growth.

- By End User

On the basis of end user, the courier market is segmented into Wholesale and Retail Trade (E-Commerce), Medical Courier, Manufacturing, Services (BFSI), Construction, Utilities, and Primary Industries. The Wholesale and Retail Trade (E-Commerce) segment dominated the market with a 49.2% share in 2025, driven by massive parcel volumes generated by online shopping platforms, omnichannel retail, and digital marketplaces. Continuous growth in online consumer spending supports sustained demand.

The Medical Courier segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by rising demand for time-sensitive delivery of pharmaceuticals, diagnostic samples, medical equipment, and healthcare supplies. Increasing focus on healthcare logistics reliability and compliance is strengthening adoption.

Which Region Holds the Largest Share of the Courier Market?

- Germany dominated the European courier market with an estimated 41.8% revenue share in 2025, driven by robust e-commerce growth, well-established urban infrastructure, and rising demand for fast, reliable parcel delivery across Germany. High volumes of domestic and cross-border shipments, coupled with increasing adoption of digital logistics and tracking platforms, are fueling demand for courier services across the region.

- Leading courier companies in Europe are heavily investing in automated sorting centers, AI-driven route optimization, and eco-friendly last-mile delivery solutions, reinforcing regional logistics efficiency. Expansion of online retail, B2B trade, and courier partnerships with e-commerce marketplaces continues to strengthen Europe’s market leadership

- Strong industrial and manufacturing bases, high consumer purchasing power, and government-supported logistics infrastructure projects further consolidate Europe’s dominance in the global courier market.

Italy Courier Market

Italy is projected to register the fastest CAGR of 7.32% from 2026 to 2033, supported by increasing e-commerce adoption, expanding SME parcel shipments, and growing demand for time-sensitive deliveries. Digital logistics solutions and regional distribution upgrades support long-term market expansion.

U.K. Courier Market Insight

The U.K. contributes steadily due to strong B2C and B2B shipping demand, advanced urban distribution networks, and rising e-commerce adoption. Focus on fast, reliable, and same-day delivery solutions supports market expansion.

France Courier Market Insight

France contributes significantly, driven by high online retail volumes, cross-border shipments within the EU, and demand for premium express and refrigerated delivery services. Investments in regional sorting facilities and logistics innovation reinforce growth.

Which are the Top Companies in Courier Market?

The Courier industry is primarily led by well-established companies, including:

- FedEx (U.S.)

- Deutsche Post AG (Germany)

- United Parcel Service of America, Inc. (UPS) (U.S.)

- SF Express (China)

- Royal Mail Group Limited (U.K.)

- Yamato Transport Co., Ltd. (Japan)

- Koninklijke PostNL (Netherlands)

- Aramex (U.A.E.)

- Singapore Post Limited (Singapore)

- Sagawa Express Co., Ltd. (Japan)

- Qantas Airways Limited (Australia)

- Allied Express (Australia)

- Unique Air Express (India)

- Gati-Kintetsu Express Private Limited (India)

- DTDC Express Limited (India)

- Hermes Europe GmbH (Germany)

- GO! Express & Logistics (Deutschland) GmbH (Germany)

- GEODIS (France)

- Delhivery Pvt Ltd (India)

- LaserShip Inc (U.S.)

What are the Recent Developments in Europe Courier Market?

- In June 2025, JD.com launched its first self-operated international express service to strengthen its Europe logistics presence and compete directly with established courier leaders. This move reflects JD.com’s ambition to expand cross-border delivery capabilities and enhance control over international supply chains

- In May 2025, DHL eCommerce U.K. merged with Evri to create a large-scale delivery network handling over one million parcels annually across the country. This merger highlights industry consolidation aimed at improving last-mile efficiency, delivery speed, and nationwide coverage

- In February 2024, Emirates Post Group, rebranded as 7X, introduced EMX as a new subsidiary focused on transforming the courier, express, and parcel industry in the U.A.E. through advanced technologies and customer-centric logistics solutions. This initiative underscores the group’s strategy to modernize CEP services and strengthen regional competitiveness

- In May 2023, Interroll launched its High Performance Conveyor Platform designed specifically for courier, express, and parcel operations, featuring intelligent diverter modules and high-throughput sorting capabilities. This development demonstrates the growing importance of automation and efficiency in large-scale parcel handling environments

- In November 2022, DHL Express opened a fully automated digital service point at Dubai Digital Park, marking the first such facility in the Middle East and within DHL’s Europe network. This launch set a new benchmark for automated customer service and reinforced DHL’s leadership in logistics innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Courier Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Courier Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Courier Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.