Europe Cpap Devices Market

Market Size in USD Million

CAGR :

%

USD

702.50 Million

USD

1,145.28 Million

2024

2032

USD

702.50 Million

USD

1,145.28 Million

2024

2032

| 2025 –2032 | |

| USD 702.50 Million | |

| USD 1,145.28 Million | |

|

|

|

|

Europe CPAP Devices Market Size

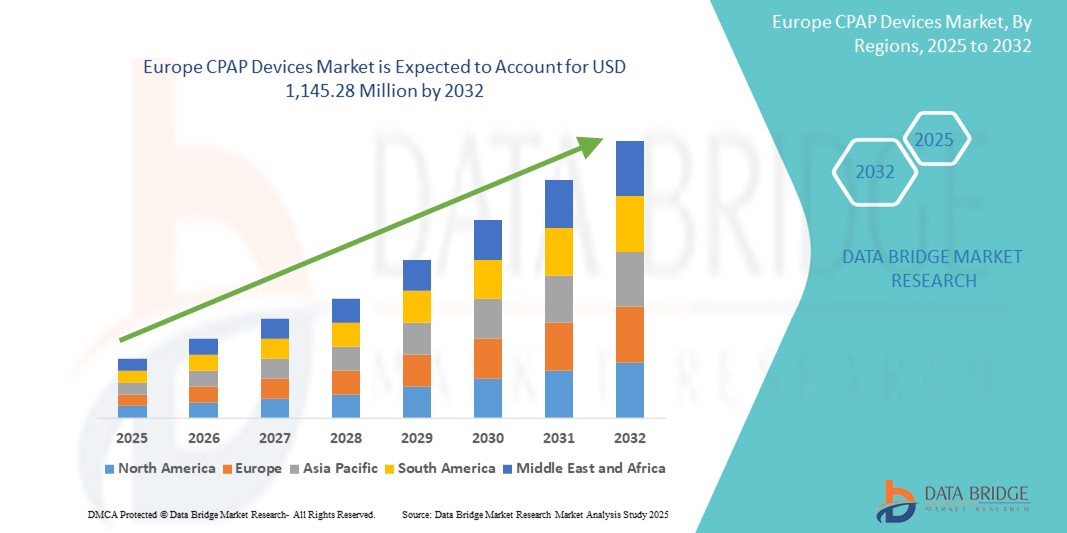

- The Europe CPAP devices market size was valued at USD 702.50 million in 2024 and is expected to reach USD 1,145.28 million by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of sleep apnea and heightened awareness regarding sleep-related disorders, driving demand for effective respiratory support technologies across the region

- Furthermore, favorable reimbursement frameworks, the rising geriatric population, and technological advancements in portable and connected CPAP devices are supporting sustained adoption across both clinical and homecare settings. These combined drivers are reinforcing the demand for CPAP solutions, thereby significantly boosting the industry's growth

Europe CPAP Devices Market Analysis

- CPAP devices, offering continuous positive airway pressure therapy, are increasingly vital components in the management of obstructive sleep apnea (OSA) and related sleep disorders across both home and clinical settings due to their therapeutic efficacy, ease of use, and growing acceptance in long-term respiratory care

- The escalating demand for CPAP devices is primarily fueled by the rising prevalence of sleep apnea, growing public and clinical awareness of sleep-related health risks, and an increasing preference for non-invasive, home-based treatment options

- Germany dominated the Europe CPAP devices market with the largest revenue share of 28.5% in 2024, characterized by a strong healthcare infrastructure, favorable reimbursement policies, and a high rate of diagnosis and treatment adherence, with widespread usage of CPAP devices in both hospital and home care environments

- Poland is expected to be the fastest growing country in the CPAP devices market during the forecast period due to improved healthcare access, increasing awareness initiatives, and rising adoption of portable CPAP solutions among undiagnosed patient populations

- CPAP Device segment dominated the Europe CPAP devices market by product type with a market share of 61.8% in 2024, driven by growing demand for technologically advanced devices with enhanced comfort, connectivity, and therapy monitoring features

Report Scope and Europe CPAP Devices Market Segmentation

|

Attributes |

Europe CPAP Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe CPAP Devices Market Trends

“Technological Advancements in Portable and Connected CPAP Devices”

- A significant and accelerating trend in the Europe CPAP devices market is the shift toward more compact, portable, and digitally connected devices, enhancing patient compliance and therapy personalization. These advanced CPAP systems are increasingly equipped with wireless connectivity, data tracking, and remote monitoring features, enabling real-time communication between patients and healthcare providers

- For instance, ResMed's AirMini and Philips’ DreamStation Go are widely adopted travel-friendly CPAP devices that integrate Bluetooth connectivity for easy tracking via mobile apps. Such devices help improve therapy adherence by allowing users and physicians to monitor usage, pressure levels, and events remotely

- The integration of cloud-based platforms and mobile applications enables detailed analysis of sleep patterns, providing healthcare professionals with actionable insights to adjust treatment plans. Moreover, AI-enabled software in some CPAP devices can adapt pressure levels based on the user’s breathing pattern throughout the night, enhancing comfort and therapeutic effectiveness

- This seamless connectivity not only supports better long-term outcomes but also aligns with the broader European trend toward digital health and home-based care models. National health systems and insurers across countries such as Germany and France are increasingly supporting telemonitoring of respiratory therapies to improve clinical oversight and reduce hospital visits

- The growing demand for smart, user-friendly, and connected CPAP solutions underscores a shift in patient expectations toward more integrated, manageable treatment experiences. As a result, leading players such as Löwenstein Medical and Fisher & Paykel Healthcare continue to invest in the development of lightweight, app-integrated, and AI-compatible devices that enable real-time therapy customization, data tracking, and improved patient comfort across European markets

Europe CPAP Devices Market Dynamics

Driver

“Increasing Prevalence of Sleep Apnea and Focus on Home-Based Respiratory Care”

- The growing incidence of obstructive sleep apnea (OSA) and heightened awareness regarding its serious health implications, such as cardiovascular disease and daytime fatigue, are driving demand for effective CPAP therapy solutions across Europe

- For instance, data from leading healthcare institutions in Germany and the U.K. highlight a year-over-year rise in sleep apnea diagnoses, prompting higher adoption of CPAP therapy as a frontline treatment. This demand is further supported by structured reimbursement schemes, public health campaigns, and partnerships with sleep labs and homecare providers

- The shift toward decentralized, patient-centric care has also propelled the use of CPAP devices in home settings. Patients now prefer portable, easy-to-use devices that allow greater mobility, discretion, and comfort without compromising therapy effectiveness

- The rising number of elderly patients with chronic respiratory disorders, along with the integration of digital monitoring tools, reinforces the utility of CPAP solutions beyond traditional clinical environments. As governments promote telehealth and at-home care initiatives, the CPAP market stands to benefit significantly from this transition

Restraint/Challenge

“Patient Discomfort, Device Compliance, and Reimbursement Variability”

- Despite clinical efficacy, one of the key challenges limiting CPAP device adoption in Europe is patient non-compliance due to discomfort, noise, and difficulty adjusting to the therapy particularly among new users. Issues such as nasal dryness, mask leakage, and pressure intolerance frequently lead to abandonment of treatment

- For instance, studies from sleep clinics in France and Italy report that a significant percentage of diagnosed patients either discontinue or inconsistently use their CPAP devices, resulting in suboptimal outcomes. Manufacturers are responding by designing quieter, more ergonomic devices and incorporating smart features such as automatic pressure adjustment and humidification to boost comfort

- In addition, variability in national reimbursement policies across Europe creates hurdles for uniform market growth. While countries such as Germany and the Netherlands offer comprehensive reimbursement, others such as Romania or Bulgaria lack standardized policies, limiting access for a large portion of the population

- Overcoming these challenges requires broader patient education, streamlined insurance frameworks, and continued innovation focused on user comfort and convenience. Enhanced collaboration between manufacturers, healthcare providers, and policymakers will be essential to improve access, adherence, and patient satisfaction across the European CPAP landscape

Europe CPAP Devices Market Scope

The market is segmented on the basis of product type, modality, and end user.

- By Product Type

On the basis of product type, the Europe CPAP devices market is segmented into CPAP devices and consumables. The CPAP devices segment dominated the market with the largest revenue share of 61.8% in 2024, driven by rising awareness and diagnosis rates of sleep apnea across major European countries such as Germany, France, and the UK. The segment benefits from technological innovations such as compact design, auto-adjusting pressure, and mobile connectivity features that improve user compliance and therapy outcomes. Healthcare professionals increasingly recommend CPAP devices as the first-line treatment for obstructive sleep apnea, further accelerating market demand.

The consumables segment is anticipated to witness the fastest growth from 2025 to 2032, propelled by the recurring need for items such as masks, filters, headgear, and tubing. Increased usage of CPAP therapy in home settings and hospital environments drives consistent demand for these accessories. Moreover, the emphasis on hygiene and regular replacement of consumables for effective therapy contributes to steady revenue growth in this category.

- By Modality

On the basis of modality, the Europe CPAP devices market is segmented into standalone and portable CPAP devices. The standalone segment held the largest revenue share of 58.6% in 2024, attributed to its wide usage in both clinical and home settings, offering stable performance and higher-pressure capabilities for chronic or severe sleep apnea cases. These devices are preferred for long-term therapy due to their durability and ease of configuration for specific therapeutic requirements.

The portable segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increasing patient preference for compact, travel-friendly, and lightweight devices. Portable CPAP machines are gaining traction among frequent travelers and individuals seeking discreet usage. Their integration with mobile apps, USB charging, and quiet operation features make them increasingly appealing, especially in home care and younger patient demographics.

- By End User

On the basis of end user, the Europe CPAP devices market is segmented into home care, hospitals, private clinics, and others. The home care segment dominated the market with the largest revenue share of 47.9% in 2024, fueled by the growing shift toward home-based sleep apnea management and the increasing availability of user-friendly CPAP systems. Government support for telemonitoring and chronic disease management at home, especially in Western Europe, enhances this segment’s dominance.

The private clinics segment is projected to exhibit the fastest growth during the forecast period due to rising investments in outpatient sleep labs, increased awareness campaigns, and more affordable diagnostics outside the hospital setting. Clinics offer faster, more accessible care and are increasingly adopting advanced CPAP technologies to enhance patient outcomes and satisfaction.

Europe CPAP Devices Market Regional Analysis

- Germany dominated the Europe CPAP devices market with the largest revenue share of 28.5% in 2024, characterized by a strong healthcare infrastructure, favorable reimbursement policies, and a high rate of diagnosis and treatment adherence, with widespread usage of CPAP devices in both hospital and home care environments

- Patients in Germany increasingly value the clinical effectiveness, comfort, and advanced connectivity features of modern CPAP devices, contributing to strong adoption across both public and private healthcare systems

- This widespread usage is further supported by national awareness campaigns, early screening programs, and integration of digital health solutions, establishing CPAP devices as a preferred treatment option for sleep-disordered breathing across hospitals, clinics, and home care settings

The Germany CPAP Devices Market Insight

The Germany CPAP devices market accounted for the largest revenue share in Europe in 2024, supported by a high diagnosis rate of sleep-related disorders and a strong reimbursement ecosystem. Germany’s mature healthcare system, combined with growing investment in telehealth and digital medical devices, is fostering greater adoption of advanced CPAP systems for both home and clinical use. The country’s focus on patient-centric care and innovative treatment technologies continues to reinforce its market leadership.

France CPAP Devices Market Insight

The France CPAP devices market is expected to expand at a significant CAGR during the forecast period, propelled by an increasing number of sleep labs, national awareness campaigns, and a growing elderly population. The French healthcare system emphasizes early detection and long-term management of chronic conditions, creating favorable conditions for CPAP therapy. Government support for homecare equipment and the growing presence of global manufacturers are also driving market expansion.

U.K. CPAP Devices Market Insight

The U.K. CPAP devices market is poised for notable growth, fueled by heightened awareness of sleep apnea and the NHS's growing focus on preventive care. The popularity of portable, connected CPAP devices is rising as more patients seek at-home, personalized respiratory therapy. The UK’s strong digital health ecosystem, combined with increased public health funding and the adoption of telemedicine platforms, is boosting CPAP adoption across both public and private healthcare settings.

Poland CPAP Devices Market Insight

The Poland CPAP devices market is anticipated to grow at the fastest CAGR in Europe during the forecast period, fueled by rising healthcare investments, growing awareness of sleep apnea, and expanded access to affordable diagnostic services. As Poland modernizes its healthcare delivery systems, the demand for home-based respiratory care is increasing. The availability of cost-effective CPAP solutions and the involvement of domestic distributors are further enhancing market accessibility and penetration.

Europe CPAP Devices Market Share

The Europe CPAP Devices industry is primarily led by well-established companies, including:

- ResMed Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Löwenstein Medical GmbH & Co. KG (Germany)

- Drive DeVilbiss Healthcare LLC (U.S.)

- Somnetics International, Inc. (U.S.)

- 3B Medical, Inc. (U.S.)

- BMC Medical Co., Ltd. (China)

- Apex Medical Corp. (Taiwan)

- Curative Medical Inc. (China)

- Weinmann Geräte für Medizin GmbH + Co. KG (Germany)

- Dehaier Medical Systems Ltd. (China)

- Nidek Medical Products, Inc. (U.S.)

- Teijin Pharma Limited (Japan)

- Koike Medical Co., Ltd. (Japan)

- Airmed Ltd. (U.K.)

- Sefam S.A.S (France)

- Medtronic (Ireland)

- VitalAire GmbH (Germany)

- O-Two Medical Technologies Inc. (Canada)

What are the Recent Developments in Global Europe CPAP Devices Market?

- In May 2024, ResMed expanded its AirView platform across several European countries, including Germany, the U.K., and France, enabling enhanced remote monitoring of CPAP devices. This expansion allows healthcare providers to track patient adherence, adjust therapy settings, and receive usage data in real time, reinforcing the shift toward connected, home-based respiratory care. The move reflects ResMed's commitment to digital health innovation and improving long-term treatment outcomes for sleep apnea patients across Europe

- In April 2024, Löwenstein Medical, a leading German medical technology firm, launched the Prisma SMART Max CPAP system, specifically tailored for the European market. This device integrates adaptive pressure regulation, Bluetooth connectivity, and AI-powered comfort features. The release demonstrates the company's focus on combining advanced German engineering with patient-centric design to improve CPAP therapy adherence and effectiveness

- In March 2024, Philips Respironics resumed full-scale distribution of its DreamStation 2 CPAP devices in select European countries following regulatory clearance after prior safety recalls. The updated models feature enhanced filtration and performance tracking, addressing both patient safety and device reliability. This development marks a significant step in restoring consumer trust and ensuring continuity of care for sleep apnea patients in Europe

- In February 2024, Fisher & Paykel Healthcare introduced its next-generation Evora Full CPAP mask across European markets, aimed at improving fit, comfort, and seal integrity. The launch targets growing demand in both hospital and homecare settings, reinforcing the brand’s reputation for ergonomically designed and clinically effective respiratory solutions

- In January 2024, the European Respiratory Society (ERS) and multiple national health authorities initiated a collaborative program to improve sleep apnea screening and access to CPAP therapy in underserved regions, including Eastern Europe. The initiative focuses on public education, subsidized diagnostic tools, and partnerships with device manufacturers to expand treatment availability and reduce regional disparities in respiratory care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.