Europe Cryo Electron Microscopy Market

Market Size in USD Million

CAGR :

%

USD

206.19 Million

USD

384.49 Million

2024

2032

USD

206.19 Million

USD

384.49 Million

2024

2032

| 2025 –2032 | |

| USD 206.19 Million | |

| USD 384.49 Million | |

|

|

|

|

Europe Cryo-electron Microscopy Market Size

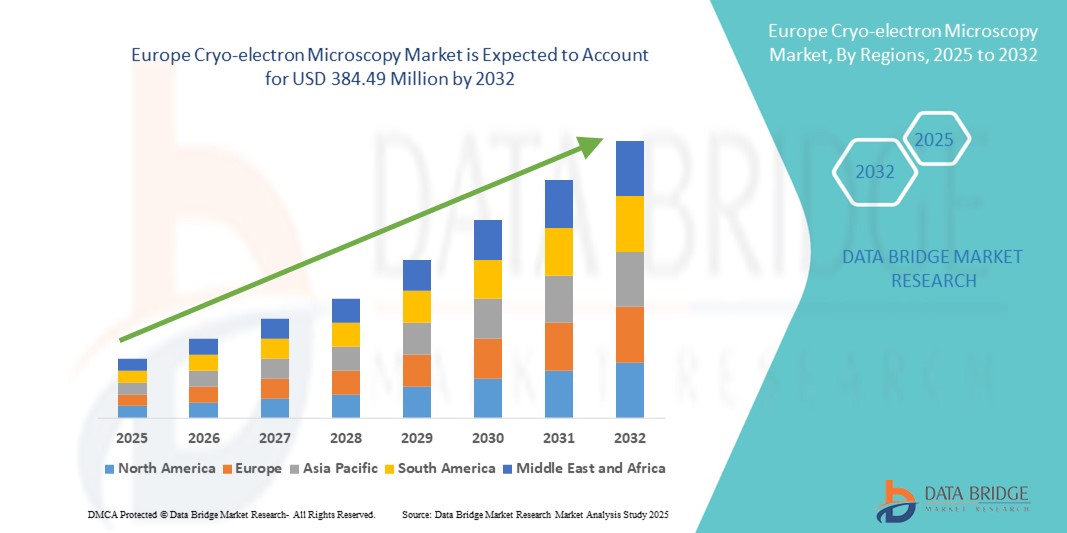

- The Europe cryo-electron microscopy market size was valued at USD 206.19 million in 2024 and is expected to reach USD 384.49 million by 2032, at a CAGR of 8.1% during the forecast period

- The market growth is largely fueled by the rising adoption of advanced imaging techniques in structural biology, drug discovery, and disease research, supported by strong investments in academic and pharmaceutical research institutions across Europe

- Furthermore, increasing demand for high-resolution molecular imaging, coupled with government-backed funding for biomedical innovation, is positioning cryo-EM as a critical tool in life sciences. These converging factors are accelerating the adoption of cryo-electron microscopy, thereby significantly boosting the industry's growth

Europe Cryo-electron Microscopy Market Analysis

- Europe Cryo-electron microscopy (cryo-EM), enabling near-atomic resolution imaging of biological macromolecules in their native state, is becoming a vital tool in Europe’s structural biology and pharmaceutical research due to its ability to accelerate drug discovery and provide critical insights into complex diseases

- The rising demand for cryo-EM is primarily fueled by advancements in life sciences research, strong academic–industry collaborations, and increasing government as well as private investments in biomedical innovation across leading European nations

- Germany dominated the Europe cryo-electron microscopy market with the largest revenue share of 29.4% in 2024, supported by its advanced research infrastructure, well-funded universities, and pharmaceutical companies heavily investing in cryo-EM for structural biology and drug development

- The U.K. is expected to be the fastest growing country in the Europe cryo-electron microscopy market during the forecast period, driven by rising R&D expenditure, expansion of world-class research facilities, and growing adoption of cryo-EM in precision medicine and biotechnology research

- Transmission Electron Microscope (TEM) segment dominated the Europe cryo-electron microscopy market with a market share of 46.8% in 2024, driven by its critical role in providing high-resolution imaging for molecular and structural biology applications

Report Scope and Europe Cryo-electron Microscopy Market Segmentation

|

Attributes |

Europe Cryo-electron Microscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Cryo-electron Microscopy Market Trends

Rising Demand for High-Resolution Structural Biology and Drug Discovery Applications

- A significant and accelerating trend in the Europe cryo-electron microscopy (cryo-EM) market is the increasing adoption of high-resolution imaging for structural biology, enabling scientists to visualize proteins, viruses, and macromolecules in near-native states. This is reshaping how drug discovery and disease research are conducted

- For instance, in 2024, Thermo Fisher Scientific launched advancements in its Titan Krios platform, widely deployed across European research institutes, offering enhanced automation and faster image acquisition for complex biomolecular studies. Similarly, European Molecular Biology Laboratory (EMBL) facilities have expanded cryo-EM capabilities, reinforcing regional leadership in molecular imaging

- Artificial intelligence (AI) integration with cryo-EM data analysis is emerging as a key trend, helping researchers reconstruct molecular structures more efficiently. Startups and research labs in Germany and the U.K. are using AI-driven algorithms to accelerate 3D structure determination and improve resolution

- The trend toward centralization of cryo-EM facilities in Europe, supported by EU-funded consortia such as Instruct-ERIC, allows shared access to expensive instruments, making the technology more accessible to both academic groups and biotech firms

- This growing ecosystem of advanced instruments, AI-driven analysis tools, and collaborative research frameworks is transforming cryo-EM from a niche imaging tool into a mainstream pillar of biomedical research across Europe. Consequently, demand is accelerating across pharmaceuticals, biotechnology, and academic sectors

Europe Cryo-electron Microscopy Market Dynamics

Driver

Expanding Biomedical Research and Pharmaceutical Investments in Europe

- The surge in demand for advanced imaging technologies in structural biology and precision medicine is a key driver of the Europe cryo-EM market. Pharmaceutical companies and academic institutes are increasingly leveraging cryo-EM to accelerate drug discovery pipelines

- For instance, in March 2024, AstraZeneca expanded its collaboration with leading U.K. universities to integrate cryo-EM into biologics and oncology drug development. Similarly, Germany’s Max Planck Institutes are significantly increasing cryo-EM adoption for structural biology programs

- The rising prevalence of complex diseases such as cancer and neurodegenerative disorders is pushing demand for high-resolution imaging, where cryo-EM plays a crucial role in visualizing disease mechanisms

- In addition, EU research funding and government-backed initiatives are ensuring rapid adoption across major European countries

- Continuous improvements in electron detectors, automated sample preparation systems, and software algorithms are enhancing throughput and resolution, enabling broader applications in drug discovery and structural biology

- Strategic partnerships between universities, research institutes, and biotech companies are increasing access to cryo-EM technologies, fostering innovation and accelerating translational research across Europe

Restraint/Challenge

High Instrument Costs and Skilled Workforce Shortage

- One of the most significant challenges in the Europe cryo-EM market is the high cost of equipment, often exceeding USD 5 million per system, coupled with ongoing operational and maintenance expenses. This limits adoption to large universities, research institutes, and pharmaceutical giants, restricting penetration among smaller labs

- For instance, many Central and Eastern European countries still face limited accessibility to advanced cryo-EM platforms due to budgetary constraints, relying instead on shared access facilities

- Another challenge is the shortage of skilled researchers trained in both cryo-EM operation and data interpretation. The complexity of sample preparation, imaging, and computational analysis demands specialized expertise that remains in short supply across Europe

- Addressing these challenges will require more affordable next-generation instruments, expansion of EU-funded shared facilities, and workforce training programs aimed at equipping researchers with cryo-EM expertise. Such efforts are critical to ensure sustained growth and broader accessibility across the region

- Cryo-EM generates massive datasets that require high-performance computing resources and robust data management solutions, which can be cost-prohibitive for some institutions

- Variability in sample preparation protocols, imaging standards, and quality control measures across European labs can slow adoption and complicate cross-institutional collaborations

Europe Cryo-electron Microscopy Market Scope

The market is segmented on the basis of product type, method type, nano formulations, technology, mounting technique, application, end user, and distribution channel

- By Product Type

On the basis of product type, the Europe cryo-electron microscopy market is segmented into hardware and software. The hardware segment dominated the market with the largest market revenue share of 57.4% in 2024, driven by the high demand for advanced cryo-EM microscopes such as TEM and SEM systems. These instruments are essential for high-resolution imaging, structural biology studies, and drug discovery, as well as for visualizing complex nanomaterials and biomolecules. Research institutes and pharmaceutical companies prioritize hardware investments due to their long-term utility and the critical need for accurate molecular-level data.

The software segment is anticipated to witness the fastest growth rate of 12.3% from 2025 to 2032, fueled by AI-based image processing, automated 3D reconstruction, and data analysis tools. Cryo-EM software allows researchers to efficiently handle massive datasets, improve structural accuracy, and reduce experimental errors, which is vital for accelerating biologics research, vaccine development, and precision medicine studies. Pharmaceutical companies increasingly rely on software to speed up mRNA vaccine development, optimize biologics design, and conduct high-throughput structural analyses

- By Method Type

On the basis of method type, the Europe cryo-electron microscopy market is segmented into electron crystallography, single particle analysis, cryo-electron tomography (cryo-ET), and others. The single particle analysis segment dominated with a revenue share of 49.6% in 2024, driven by its extensive application in studying proteins, viruses, and other macromolecules. Single particle analysis allows researchers to achieve near-atomic resolution without the need for crystallization, making it highly versatile for pharmaceutical research and structural biology.

The cryo-electron tomography segment is expected to witness the fastest growth during the forecast period, due to its ability to provide detailed 3D structural insights of cellular components, organelles, and protein complexes. Increasing adoption in life sciences, nanotechnology, and advanced biomedical research is driving this growth. Cryo-ET’s ability to visualize dynamic molecular processes in situ provides a competitive advantage over traditional imaging methods. Cryo-ET adoption is increasing in biopharmaceutical labs, nanotechnology research, and advanced cell biology studies.

- By Nano Formulations

On the basis of nano formulations, the Europe cryo-electron microscopy market is segmented into lipid nanoparticle formulations (LNFs), metal oxide formulations, metal formulations, and others. The LNF segment dominated with a share of 41.8% in 2024, owing to its role in mRNA vaccine delivery and drug carrier studies. Cryo-EM is widely used to characterize LNFs at the nanoscale, enabling pharmaceutical companies to optimize delivery efficiency and stability.

Metal oxide formulations are expected to witness the fastest CAGR from 2025 to 2032, driven by their increasing applications in nanotechnology and material science research. Cryo-EM provides detailed visualization of metal oxide nanostructures, helping researchers understand surface chemistry, morphology, and molecular interactions for advanced materials and catalysts. Cryo-EM helps researchers study surface chemistry, particle aggregation, and molecular interactions at nanoscale resolution, driving innovations in nanomaterials and semiconductor applications.

- By Technology

On the basis of technology, the Europe cryo-electron microscopy market is segmented into Transmission Electron Microscopy (TEM), Scanning Electron Microscopy (SEM), and Nuclear Magnetic Resonance (NMR) Microscopy. The TEM segment dominated the market with a 46.8% revenue share in 2024, due to its unmatched resolution, versatility, and ability to visualize macromolecular structures at atomic or near-atomic levels. TEM is critical for structural biology, nanomaterial characterization, and advanced drug discovery.

The SEM segment is expected to witness the fastest growth during the forecast period, driven by its increasing adoption in material science, semiconductor research, and surface characterization. SEM is particularly valuable for imaging large samples, analyzing surface morphology, and complementing TEM in multi-scale studies.

- By Mounting Technique

On the basis of mounting technique, the Europe cryo-electron microscopy market is segmented into surface mounting, edge mounting, film emulsion mounting, rivet mounting, and others. The surface mounting segment dominated with a market share of 38.7% in 2024, due to its efficiency in sample preparation, compatibility with various cryo-EM instruments, and suitability for both biological and material science applications.

The film emulsion mounting segment is expected to witness the fastest growth, particularly in advanced biological imaging and nanotechnology studies. This mounting technique preserves the native state of delicate biomolecules and enhances imaging resolution, making it essential for high-precision research in structural biology and drug discovery.

- By Application

On the basis of application, the Europe cryo-electron microscopy market is segmented into biological science, material science, nanotechnology, life sciences, medical, semiconductors, and others. The biological science segment dominated with a share of 52.1% in 2024, driven by the growing demand for protein structure analysis, virus studies, and vaccine development. Cryo-EM has become a core technology in molecular biology research due to its ability to generate detailed structural insights that inform drug discovery and therapeutic design.

The nanotechnology segment is expected to witness the fastest growth during the forecast period, supported by rising research in nanoparticles, nanomaterials, and molecular-level characterization. Cryo-EM enables visualization of nanoscale structures, surface properties, and interactions that are critical for innovation in material science, electronics, and biotechnology. Cryo-EM provides insights into nanoscale structures, surface morphology, and molecular interactions, supporting innovation in electronics, material science, and biotechnology.

- By End User

On the basis of end user, the Europe cryo-electron microscopy market is segmented into research laboratories and institutes, forensic and diagnostic laboratories, pharmaceutical and biotechnology companies, contract research organizations (CROs), and others. The research laboratories and institutes segment dominated with a market share of 44.5% in 2024, reflecting the widespread use of cryo-EM in academic research, government-funded projects, and collaborative scientific initiatives across Europe.

The pharmaceutical and biotechnology companies segment is expected to witness the fastest growth, driven by increasing reliance on cryo-EM for biologics development, mRNA vaccines, and drug discovery programs. These companies benefit from cryo-EM’s ability to reduce experimental timelines, improve molecular-level insights, and accelerate translational research.

- By Distribution Channel

On the basis of distribution channel, the Europe cryo-electron microscopy market is segmented into direct tenders, third-party distribution, and others. The direct tenders segment dominated with a 61.2% revenue share in 2024, as research institutes and pharmaceutical companies prefer direct procurement from manufacturers to ensure instrument reliability, warranty support, and service quality. Dominates as large research institutes and pharmaceutical companies prefer direct procurement from manufacturers to ensure instrument reliability, warranties, and after-sales support.

The third-party distribution segment is expected to witness the fastest growth during the forecast period, facilitated by regional distributors providing installation, maintenance, and software support. This channel increases accessibility of cryo-EM technology for smaller research facilities and emerging biotech companies, promoting broader adoption across Europe. Growth fueled by regional distributors offering installation, maintenance, and software support, making cryo-EM accessible to smaller labs, emerging biotech firms, and start-ups across Europe.

Europe Cryo-electron Microscopy Market Regional Analysis

- Germany dominated the Europe cryo-electron microscopy market with the largest revenue share of 29.4% in 2024, supported by its advanced research infrastructure, well-funded universities, and pharmaceutical companies heavily investing in cryo-EM for structural biology and drug development

- Researchers and institutions in Germany highly value the high-resolution imaging capabilities, automation, and reliability offered by cryo-EM systems, which enable accelerated molecular-level studies and precision in protein and virus structure analysis

- This widespread adoption is further supported by substantial government and EU research funding, well-established life sciences and nanotechnology sectors, and a collaborative ecosystem between academia and industry, establishing cryo-EM as a critical technology for both academic research and pharmaceutical development across the country

The U.K. Cryo-Electron Microscopy Market Insight

The U.K. cryo-electron microscopy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expansion of advanced life sciences and nanotechnology research initiatives. The country’s strong focus on academic-industry collaborations, government-funded research programs, and precision medicine initiatives is encouraging widespread adoption of cryo-EM systems. Increasing investments in high-resolution imaging technologies and the integration of cryo-EM into both pharmaceutical and academic research workflows are key factors propelling market growth in the U.K.

Germany Cryo-Electron Microscopy Market Insight

The Germany cryo-electron microscopy market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced research infrastructure, well-established pharmaceutical and biotech sectors, and strong emphasis on innovation in molecular and structural biology. German research institutions highly prioritize cryo-EM systems for protein structure analysis, vaccine development, and nanotechnology studies. The integration of cryo-EM with complementary techniques such as TEM and SEM, along with AI-assisted software for automated imaging, is increasingly prevalent, supporting both industrial and academic research needs.

France Cryo-Electron Microscopy Market Insight

The France cryo-electron microscopy market is witnessing significant growth, driven by the adoption of cryo-EM in life sciences research, biotechnology, and material science studies. The presence of leading universities, research centers, and biotech firms, combined with government and EU research funding, is encouraging widespread deployment of cryo-EM systems. French researchers are increasingly leveraging cryo-EM for high-resolution structural analysis, accelerating drug discovery, and improving understanding of complex biomolecular interactions.

Italy Cryo-Electron Microscopy Market Insight

The Italy cryo-electron microscopy market is witnessing steady growth, supported by rising government and EU funding for life sciences, structural biology, and nanotechnology research. Italian universities, research centers, and pharmaceutical companies are increasingly deploying cryo-EM systems for molecular-level imaging and advanced drug development studies. The country’s focus on innovation, adoption of AI-assisted imaging tools, and collaboration with international research organizations is driving market expansion.

Spain Cryo-Electron Microscopy Market Insight

The Spain cryo-electron microscopy market is growing gradually, driven by increased research activities in life sciences, biotechnology, and material sciences. Spanish research institutions and biotech firms are leveraging cryo-EM for high-resolution structural analysis, particularly in protein complexes and nanomaterial studies. Supportive government initiatives, EU funding programs, and collaborations with international research centers are facilitating wider adoption of cryo-EM systems in Spain.

Europe Cryo-electron Microscopy Market Share

The Europe cryo-electron microscopy industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- JEOL Ltd. (Japan)

- Hitachi High-Tech Corporation (Japan)

- Leica Microsystems (Germany)

- Carl Zeiss AG (Germany)

- Gatan, Inc. (U.S.)

- TESCAN ORSAY HOLDING (Czech Republic)

- Delong Instruments (Czech Republic)

- Oxford Instruments plc (U.K.)

- Andor Technology Ltd. (U.K.)

- FEI Company (U.S.)

- NanoImaging Services (NIS) (U.S.)

- DENSsolutions BV (Netherlands)

- Protochips, Inc. (U.S.)

- Direct Electron, LLC (U.S.)

- Bruker (U.S.)

- Changchun DeLong Instrument Co., Ltd. (China)

- Intertek Group plc (U.K.)

- Graz University of Technology (Austria)

- Vienna BioCenter Core Facilities (Austria)

What are the Recent Developments in Europe Cryo-electron Microscopy Market?

- In July 2025, Forschungszentrum Jülich in Germany received a state-of-the-art electron microscope designed for life sciences research, particularly in cryo scanning transmission electron microscopy (cryo-STEM). This unique instrument features a corrected electron column and utilizes a cryogenic solid-state battery charged with liquid helium, enhancing image quality and reducing molecular movement. It is expected to set new standards in structural analysis at the molecular level and will be accessible to scientists worldwide through the ER-C 2.0 project

- In May 2025, a study published in ScienceDirect highlighted recent developments in cryo-electron tomography (cryo-ET) for imaging native nervous tissues. The advancements allow for detailed visualization of cellular ultrastructure in its native state, providing new insights into the molecular architecture of neurons. This progress is significant for understanding neurological diseases and developing targeted therapies

- In March 2025, the SOLEIL Synchrotron facility in France announced the installation of a new 300 keV cryo-electron microscope. This state-of-the-art equipment aims to enhance high-resolution imaging capabilities for structural biology research. The microscope is scheduled to be available to users starting in 2025, following a call for projects

- In October 2023, a novel sample preparation technology named 'freeze-and-deposit' for cryo-electron microscopy received funding for its validation phase. This approach aims to streamline the sample preparation process, enhancing the efficiency and reproducibility of cryo-EM studies. The technology is expected to accelerate research workflows and improve the quality of imaging data

- In September 2023, Charité – Universitätsmedizin Berlin inaugurated a state-of-the-art Cryo-Electron Microscopy Core Facility at the Max Delbrück Center in Berlin Buch. This facility is designed to support advanced structural biology research, providing cutting-edge cryo-EM capabilities to researchers in Germany and beyond. The opening symposium highlighted the facility's potential to enhance understanding of complex biological structures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.