Europe Dental Implants And Prosthetics Market

Market Size in USD Billion

CAGR :

%

USD

13.91 Billion

USD

22.35 Billion

2024

2032

USD

13.91 Billion

USD

22.35 Billion

2024

2032

| 2025 –2032 | |

| USD 13.91 Billion | |

| USD 22.35 Billion | |

|

|

|

|

Dental Implants and Prosthetics Market Size

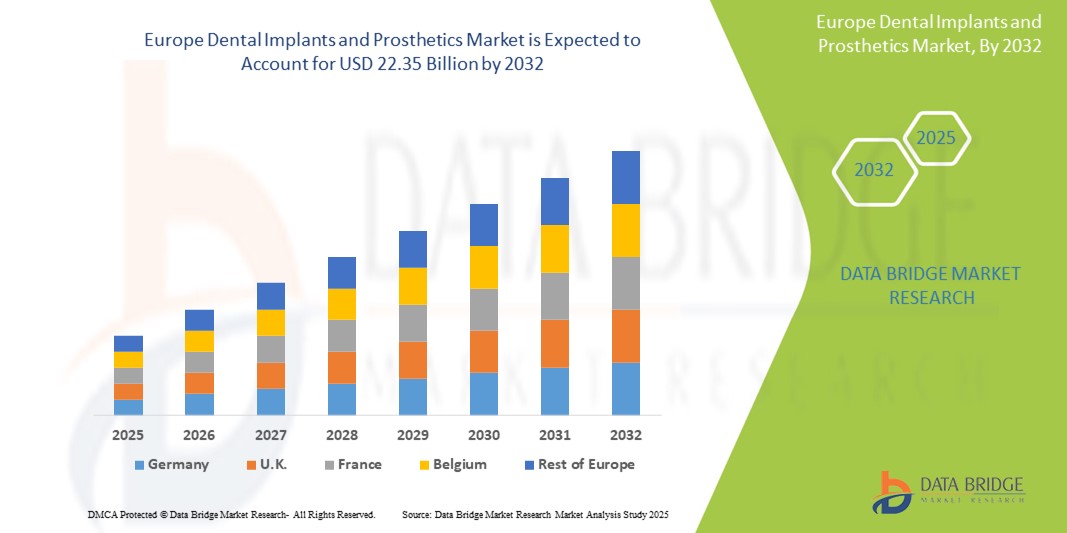

- The Europe Dental Implants and Prosthetics market size was valued at USD 13.91 billion in 2024 and is expected to reach USD 22.35 billion by 2032, at a CAGR of 6.1% during the forecast period

- The market encompasses a wide range of restorative dental solutions, including artificial tooth roots (implants) surgically placed into the jawbone and the various dental restorations (prosthetics) attached to them, such as crowns, bridges, dentures, veneers, inlays, and onlays.

- These solutions are vital for replacing missing teeth, restoring oral function, and improving dental aesthetics. The market also includes related materials like titanium and zirconium, and various implant designs.

Dental Implants and Prosthetics Market Analysis

- Dental Implants and Prosthetics market fueled by the rising prevalence of dental diseases, particularly tooth loss, across Europe, coupled with an increasing awareness and demand for dental aesthetics and permanent tooth replacement solutions. Furthermore, continuous technological advancements in dental materials, digital dentistry (e.g., CAD/CAM technologies, intraoral scanners), and surgical procedures are driving market expansion. These converging factors, alongside an aging population and higher disposable incomes, are accelerating the adoption of dental implants and prosthetics, thereby significantly boosting the industry's growth.

- The escalating demand for dental implants and prosthetics is primarily fueled by the increasing number of patients seeking treatment for dental concerns, the growing acceptance of cosmetic dentistry, and the desire for natural-looking and long-lasting tooth replacements.

- Germany leads the Dental Implants and Prosthetics Market in Europe, accounting for the highest revenue share of 30.1% in 2025, driven by the country’s high prevalence of dental disorders, well-established dental care infrastructure, and wide reimbursement coverage for dental procedures. The increasing demand for aesthetic dentistry, coupled with an aging population seeking long-term tooth replacement solutions, continues to bolster market growth. The country’s focus on quality care, access to skilled professionals, and integration of CAD/CAM technology in dental clinics further enhances its market leadership.

- Germany is also projected to be the fastest-growing country in the Europe Dental Implants and Prosthetics Market during the forecast period, supported by advancements in implant materials, rising dental tourism, and growing [AJ1] [PK2] awareness of oral health. Strategic collaborations among implant manufacturers and dental service providers are expanding access to innovative prosthetic solutions in both urban and rural settings, while digital workflows are accelerating treatment efficiency and outcomes.

- Dental Implants are expected to dominate the Europe Dental Implants and Prosthetics Market with a market share of 42.8% in 2025, owing to their long-term durability, high success rates, and growing preference over removable dentures. The expanding use of 3D imaging and guided implant surgery, along with the rising availability of cost-effective implant systems, is further fueling adoption across general dentistry practices and specialty dental centers.

Report Scope and Dental Implants and Prosthetics Market Segmentation

|

Attributes |

Dental Implants and Prosthetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Implants and Prosthetics Market Trends

“Widespread adoption of CAD/CAM technologies”

- Digitalization of Dentistry and Advanced Materials: A significant and accelerating trend in the Europe Dental Implants and Prosthetics market is the widespread adoption of digital dentistry workflows and the continuous innovation in advanced materials. This evolution is significantly enhancing precision, efficiency, and patient outcomes in dental restorative procedures.

- For instance, the shift towards computer-aided design/computer-aided manufacturing (CAD/CAM) for final abutments and prosthetics is gaining significant traction. Intraoral scanners and digital planning software are streamlining the impression-taking process and enabling more predictable implant placement.

- The development of new materials, such as advanced titanium alloys and zirconia, is leading to implants with superior biocompatibility, strength, and aesthetic properties. Zirconia implants, in particular, are becoming increasingly popular for their aesthetic appeal and long-lasting quality.

- There's also a growing trend towards tapered dental implants due to their improved initial stability and suitability for immediate loading, which shortens healing periods.

- This trend towards more digital, precise, and aesthetically pleasing dental solutions is fundamentally reshaping how dental professionals approach tooth replacement and restoration in Europe.

Dental Implants and Prosthetics Market Dynamics

Driver

“High prevalence of tooth loss and dental diseases”

- Rising Prevalence of Dental Diseases and Aging Population: The increasing incidence of dental diseases, particularly tooth loss, gum recession, and dental decay, coupled with a growing aging population across Europe, is a major driver for the growth of the dental implants and prosthetics market

- For instance, a significant portion of the adult population in Europe experiences tooth loss, necessitating permanent and effective replacement solutions. The geriatric population is more susceptible to dental problems, further accelerating the demand for dental implants and prosthetics

- The increasing willingness of people to invest in their dental health, driven by higher disposable incomes and a growing awareness of oral health's impact on overall well-being, is also propelling market growth.

- Furthermore, the demand for cosmetic dentistry treatments, aimed at smile restoration and aesthetic improvement, is significantly contributing to the market's expansion.

- The presence of well-established dental healthcare infrastructure and favorable reimbursement policies in many European countries also encourages the adoption of these advanced dental solutions

Restraint/Challenge

“High cost of dental implant and prosthetic procedures”

- High Procedure Costs and Inadequate Reimbursement: The substantial costs associated with dental implant and prosthetic procedures, coupled with inadequate or varying reimbursement policies across different European countries, present a significant challenge to widespread market adoption.

- For instance, dental implant procedures can be expensive, and while awareness is increasing, the initial cost can be a deterrent for some patients, particularly in regions with less comprehensive dental insurance coverage.

- The potential for high failure rates if implants are not customized or if complications like bone degradation or infection occur, also poses a risk to market growth and patient trust.

- Stringent regulatory guidelines for dental devices and materials can lead to lengthy approval processes and increased manufacturing costs, potentially limiting innovation and market entry for smaller companies.

- Additionally, challenges related to dental bridges resulting from tooth loss could also pose a threat to market expansion for prosthetics

Dental Implants and Prosthetics Market Scope

The market is segmented on the basis material, stage, product type, price, design, type and type of facility.

- By material

On the basis of material, the Dental Implants and Prosthetics Market is into Titanium, Zirconium, PFM (Porcelain Fused to Metal), and All Ceramics. The Titanium segment is expected to dominate the market with the largest revenue share of 39.2%, owing to its high biocompatibility, strength, durability, and widespread use in dental practices across Germany, France, and Italy. Titanium implants offer superior osseointegration and are considered the gold standard for long-term dental implant success.

The Zirconium segment is anticipated to witness the fastest growth rate of 5.2% from 2025 to 2032, driven by growing preference for metal-free, aesthetically superior materials. Demand for zirconium implants is increasing in cosmetic dentistry and among patients with metal allergies, particularly in countries like Sweden, Switzerland, and the Netherlands.

- By stage

On the basis of stage, the Dental Implants and Prosthetics market is segmented into Two-Stage and Single-Stage dental implants. The Two-Stage held the largest market revenue share in 2025, due to its clinical success rate and wide adoption in complex dental procedures that require bone grafting and staged healing. This method continues to be preferred in multi-tooth restorations and full-arch rehabilitation across dental centers in the UK and Germany.

The Single-Stage is expected to witness the fastest CAGR from 2025 to 2032, The increasing demand for minimally invasive procedures, reduced chair time, and faster healing—especially among aging populations in France and Spain—is propelling growth of this segment.

- By product type

On the basis of product type, the Dental Implants and Prosthetics market is segmented into Dental Implants and Dental Prosthetics. The Dental Implants held the largest market revenue share in 2025 accounting for the highest revenue share due to increased prevalence of edentulism, rising geriatric population, and high demand for durable tooth replacement solutions. Advancements in guided implantology and 3D printing technologies further support this segment’s dominance.

The Dental Prosthetics is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing uptake of custom crowns, bridges, and dentures designed for implant-supported restorations. Demand is rising in Eastern European countries where implant adoption is growing but still catching up to Western Europe.

- By price

On the basis of price, the Dental Implants and Prosthetics market is segmented into Premium Implants, Value Implants, and Discounted Implants. The Premium Implants held the largest market revenue share in 2025, supported by high-income patient groups and institutional demand for branded, high-quality implants in countries like Germany and Switzerland. These implants offer better long-term outcomes, aesthetics, and brand trust.

The Value Implants is expected to witness the fastest CAGR from 2025 to 2032, with growing demand in cost-sensitive markets like Poland, Portugal, and Greece. Dental tourism is further propelling adoption of value-priced implant solutions across southern Europe.

- By design

On the basis of design, the Dental Implants and Prosthetics market is segmented into Tapered Dental Implants and Parallel-Walled Dental Implants. The Tapered Dental Implants held the largest market revenue share in 2025, due to their better initial stability, especially in immediate implant placements and in cases of compromised bone density. These implants are favored in high-volume dental implant centers and university hospitals across Europe.

The Parallel-Walled Dental Implants is expected to witness the fastest CAGR from 2025 to 2032, particularly in procedures where bone volume is sufficient, and traditional surgical protocols are followed. Their simplicity and long track record support their continued use in many general practices.

- By type

On the basis of type, the Dental Implants and Prosthetics market is segmented into Root-Form Dental Implants and Plate-Form Dental Implants. The Root-Form Dental Implants held the largest market revenue share in 2025, being the most commonly used type due to their compatibility with a wide range of jaw anatomies and high success rates. This segment benefits from consistent innovation and training programs across European dental schools.

The Plate-Form Dental Implants is expected to witness the fastest CAGR from 2025 to 2032, mainly in cases where the jawbone is narrow or cannot accommodate root-form designs. This segment serves a niche but vital role in specialized prosthodontic practices.

- By type of facility

On the basis of type of facility, the Dental Implants and Prosthetics market is segmented into Hospitals, Ambulatory Surgical Centers (ASCs), and Orthopedic Clinics. The Hospitals and Clinics segment accounted for the largest market revenue share in 2024, due to increasing institutional investments in digital dental technologies, multidisciplinary care, and implant surgeries. Public and private dental hospitals across Germany, France, and Italy are leading adopters.

The Dental Laboratories segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for customized prosthetics, digital workflows, and in-house CAD/CAM systems. These labs are critical in supporting fast-turnaround and precision-crafted restorations for clinics and implantologists.

Dental Implants and Prosthetics Market Regional Analysis

- Germany dominates the Europe Dental Implants and Prosthetics market, capturing the largest revenue share of 30.1% in 2025, owing to its highly developed dental care infrastructure, strong insurance coverage for oral health, and growing geriatric population. The country’s dental sector is driven by a robust demand for premium implant systems and full-mouth restorations, supported by a well-established base of skilled dental professionals and advanced dental laboratories.

- Germany’s market dominance is further strengthened by the rapid adoption of digital dentistry tools such as CAD/CAM systems, 3D imaging, and guided implantology. Dental clinics and laboratories are heavily investing in technologies that support high-precision zirconia and ceramic prosthetics. Moreover, Germany’s extensive dental tourism network and favorable reimbursement schemes enhance access to quality implants and aesthetic restorations.

- Academic and research institutions in Germany also play a vital role in advancing implant design and biomaterials, contributing to continuous innovation. The presence of global and regional implant manufacturers further cements the country’s leadership in both product development and export activities.

France Dental Implants and Prosthetics Market Insight

The France Dental Implants and Prosthetics market is projected to grow at a notable CAGR during the forecast period, supported by national public health strategies aimed at improving oral care access and promoting early intervention for tooth loss and edentulism. The French population shows an increasing preference for aesthetic and metal-free solutions, fueling demand for zirconium implants and all-ceramic prosthetics. In addition, France is emerging as a hub for value implants and digital prosthetic workflows, driven by collaborations between dental tech startups, academic institutions, and public health bodies. Regulatory emphasis on product safety and quality, along with subsidies and insurance coverage improvements, is accelerating market penetration of technologically advanced and cost-effective implant systems.

U.K. Dental Implants and Prosthetics Market Insight

The U.K. Dental Implants and Prosthetics market is witnessing steady and resilient growth, propelled by increasing consumer awareness, NHS-backed oral health programs, and expanding private sector investments in cosmetic and restorative dentistry. Despite regulatory realignments post-Brexit, the U.K. continues to maintain a dynamic dental market aligned with international quality and material standards. The U.K. market is notably influenced by a rising elderly population and a growing demand for affordable dental implant options among middle-income groups. Clinics and dental chains are adopting a tiered approach, offering premium, value, and discounted implants to cater to diverse economic segments. Digital transformation is a key enabler in the U.K. market, with widespread use of intraoral scanners, 3D printing, and cloud-based case management systems. London and other metropolitan hubs are seeing a surge in demand for zirconia implants and same-day implant procedures. Meanwhile, rural regions are benefiting from mobile dental units and teleconsultation platforms offering implant-based treatments.

Dental Implants and Prosthetics Market Share

The Dental Implants and Prosthetics industry is primarily led by well-established companies, including:

- Institut Straumann AG (Switzerland)

- Envista Holdings Corporation (U.S.)

- Dentsply Sirona (U.S.)

- Henry Schein, Inc. (U.S.)

- Osstem Implant Co., Ltd. (South Korea)

- ZimVie Inc. (U.S.)

- Glidewell (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- Nobel Biocare Services AG (Switzerland)

- Anthogyr SAS (France)

- Medentis Medical GmbH (Germany)

- Thommen Medical AG (Switzerland)

- BioHorizons Camlog (Switzerland)

Latest Developments in Europe Dental Implants and Prosthetics Market

- In February 2025, Dentsply Sirona launched the MIS LYNX in the U.S. market as a premium, cost-effective, all-in-one dental implant solution, highlighting a commitment to accessible, high-quality dental solutions.

- In October 2024, Thommen Medical AG introduced NEVO, the world's first Gentle Implant, designed for optimal bone engagement, precise insertion, and high primary stability.

- In May 2024, Osstem Implant Co., Ltd. entered into an agreement to acquire Implacil de Bortoli, Brazil's third-largest dental implant firm, marking its expansion into the rapidly growing Latin American dental market.

- In June 2024, BioHorizons introduced the Tapered Pro Conical, its first dental implant featuring a deep conical connection, underscoring its ongoing commitment to innovation.

- In February 2022, Envista entered into a partnership with Vitaldent Group (Spain) for the supply of implants (Nobel Biocare) and clear aligners (Spark), expanding Envista's footprint in the European dental market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.