Europe Dental Silver Diamine Fluoride Sdf Market

Market Size in USD Million

CAGR :

%

USD

1.34 Million

USD

2.09 Million

2025

2033

USD

1.34 Million

USD

2.09 Million

2025

2033

| 2026 –2033 | |

| USD 1.34 Million | |

| USD 2.09 Million | |

|

|

|

|

Europe Dental Silver Diamine Fluoride (SDF) Market Size

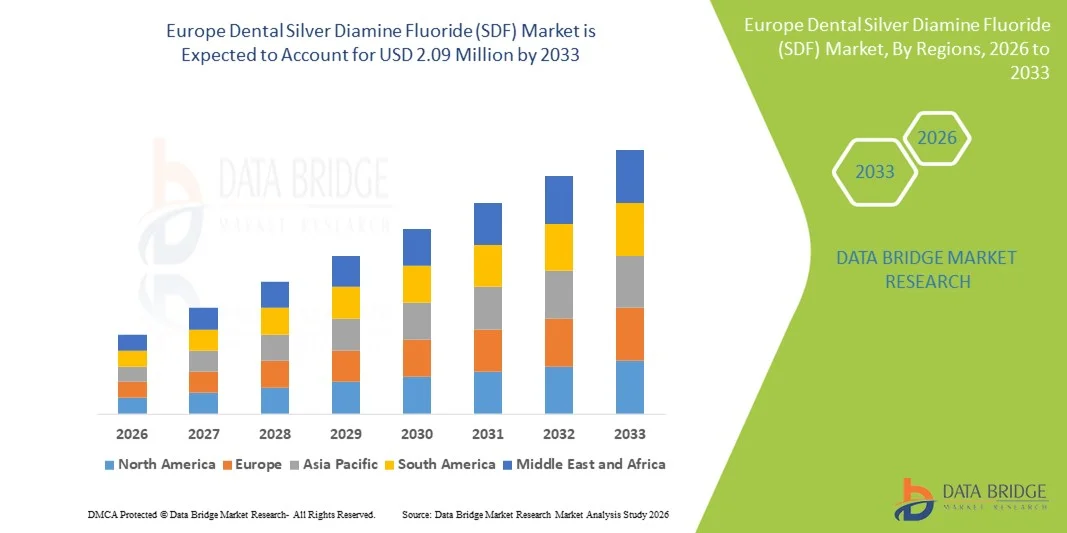

- The Europe Dental Silver Diamine Fluoride (SDF) market size was valued at USD 1.34 million in 2025 and is expected to reach USD 2.09 million by 2033, at a CAGR of 5.7% during the forecast period

- The market growth is primarily driven by increasing awareness of minimally invasive dental treatments, rising prevalence of dental caries, and the expanding geriatric population seeking preventive oral care solutions

- Moreover, advancements in SDF formulations, growing adoption by dental professionals, and supportive government initiatives for oral health programs are establishing SDF as a preferred non-invasive treatment option in both pediatric and adult dentistry. These combined factors are accelerating the adoption of SDF products, thereby substantially boosting the market's growth

Europe Dental Silver Diamine Fluoride (SDF) Market Analysis

- Europe Dental Silver Diamine Fluoride (SDF), a minimally invasive solution for arresting dental caries, is increasingly recognized as a vital component of modern preventive and restorative dentistry in both pediatric and adult patients due to its ease of application, cost-effectiveness, and effectiveness in non-invasive cavity management

- The growing demand for Dental Silver Diamine Fluoride (SDF) is primarily driven by increasing awareness of oral health, rising prevalence of dental caries, especially among children and the elderly, and a shift toward minimally invasive dental treatments over traditional restorative procedures

- Germany dominated the Europe Dental Silver Diamine Fluoride (SDF) market with the largest revenue share of 35% in 2025, characterized by high awareness of preventive dental care, well-established dental healthcare infrastructure, and strong adoption by dental professionals, supported by government oral health programs and widespread professional endorsement

- The U.K. is expected to be the fastest growing country in the Europe Dental Silver Diamine Fluoride (SDF) market during the forecast period due to increasing access to dental care, rising disposable incomes, and growing government initiatives promoting preventive dentistry

- The Caries Arrest segment dominated the Europe Dental Silver Diamine Fluoride (SDF) market with a market share of 45.9% in 2025, driven by its high efficacy in halting the progression of dental caries and suitability for pediatric, adult, and geriatric patients

Report Scope and Europe Dental Silver Diamine Fluoride (SDF) Market Segmentation

|

Attributes |

Europe Dental Silver Diamine Fluoride (SDF) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Dental Silver Diamine Fluoride (SDF) Market Trends

Rising Preference for Minimally Invasive Dentistry

- A significant and accelerating trend in the Europe Dental Silver Diamine Fluoride (SDF) market is the increasing adoption of minimally invasive and preventive dental care solutions that reduce the need for drilling and traditional restorative procedures

- For instance, pediatric dental clinics in Germany are increasingly applying SDF to arrest early-stage caries, reducing patient discomfort and improving treatment compliance

- SDF applications in adult and geriatric populations are gaining traction due to its ability to manage root caries non-invasively, offering dentists a practical alternative to conventional fillings

- The trend is supported by growing awareness among dental professionals of SDF’s clinical efficacy and simplicity, which allows for rapid, painless application and increased patient acceptance

- Increasing collaborations between dental product manufacturers and clinics to conduct training workshops are promoting proper SDF application techniques and awareness

- Digital tools and tele-dentistry platforms are being used to educate patients about SDF benefits and follow-up care, further boosting adoption

- This shift towards preventive and patient-friendly dental solutions is encouraging manufacturers to innovate higher-concentration formulations and user-friendly delivery systems for easier clinical use

- The demand for SDF products that support minimally invasive dentistry is growing rapidly across private and public dental care settings, as patients increasingly prioritize comfort, convenience, and preventive outcomes

Europe Dental Silver Diamine Fluoride (SDF) Market Dynamics

Driver

Increasing Prevalence of Dental Caries and Awareness of Oral Health

- The rising prevalence of dental caries among children, adults, and the elderly, coupled with growing awareness of preventive oral health, is a significant driver for the heightened demand for SDF in Europe

- For instance, in 2025, German public health programs promoted SDF usage in school dental check-ups to reduce early childhood caries, demonstrating government support and encouraging adoption

- As patients and caregivers seek safer, non-invasive, and cost-effective treatments, SDF provides a clinically effective solution to arrest caries progression and prevent tooth loss

- Furthermore, the increasing integration of SDF into professional dental protocols and preventive care guidelines is making it an essential component of modern dentistry across clinics and hospitals

- Rising consumer demand for painless and efficient dental treatments, combined with endorsements from professional dental associations, is propelling the adoption of SDF products throughout Europe

- Awareness campaigns, educational workshops, and demonstrations of clinical efficacy are further accelerating the uptake of SDF by dental professionals and patients asuch as

- Growth in dental insurance coverage and reimbursement policies supporting preventive treatments such as SDF is increasing patient accessibility and affordability

- Research and clinical studies highlighting the long-term effectiveness of SDF in caries management are strengthening professional trust and encouraging wider adoption

Restraint/Challenge

Discoloration, Limited Acceptance, and Regulatory Barriers

- Concerns surrounding the black staining of treated teeth and limited patient acceptance pose a significant challenge to the broader adoption of SDF in Europe

- For instance, reports from pediatric clinics in France have shown hesitation among parents to allow SDF treatment due to cosmetic concerns on anterior teeth, limiting its use in visible areas

- Regulatory requirements and approvals for higher-concentration formulations can delay product launches, creating additional hurdles for manufacturers seeking rapid market expansion

- Addressing aesthetic concerns through patient education and selective application strategies is crucial for encouraging acceptance while maintaining clinical efficacy

- The relatively low awareness of SDF among some general dentists and skepticism regarding its effectiveness versus traditional fillings can further slow adoption, particularly in countries with conservative dental practices

- Overcoming these challenges through awareness campaigns, regulatory compliance, and improved product formulations will be vital for sustained growth of the Europe Dental Silver Diamine Fluoride (SDF) market

- Variations in national dental guidelines and reimbursement policies can create inconsistent adoption rates across different European countries, limiting market uniformity

- Limited availability of trained dental professionals familiar with SDF application techniques in some regions may slow market penetration despite rising awareness

Europe Dental Silver Diamine Fluoride (SDF) Market Scope

The market is segmented on the basis of strength, indication, type of teeth, site of action, age, distribution channel, and end user.

- By Strength

On the basis of strength, the Europe Dental Silver Diamine Fluoride (SDF) market is segmented into 38%, 12%, 30%, and Others. The 38% SDF segment dominated the market with the largest share in 2025, driven by its optimal fluoride concentration for effectively arresting dental caries in both pediatric and adult patients. Dentists prefer 38% SDF for its proven efficacy, safety profile, and ability to provide long-term protection against caries progression. The higher concentration ensures quicker treatment outcomes, which is particularly beneficial in cases of severe caries or high-risk populations. Strong adoption in preventive programs, especially in Germany and France, has further cemented its leading position. In addition, the 38% formulation is widely recommended in clinical guidelines, contributing to consistent usage across dental hospitals and clinics. Its ease of application and minimal invasiveness also enhance patient compliance, strengthening market dominance.

The 12% SDF segment is expected to witness the fastest growth during the forecast period due to increasing awareness of its use for mild or early-stage caries, particularly in pediatric patients. Lower concentration formulations reduce aesthetic concerns such as tooth discoloration, making it more acceptable to parents and patients. The segment also benefits from growing adoption in community dental programs and school-based preventive initiatives. Its favorable safety profile and suitability for repeated application encourage wider use among general dentists. Manufacturers are also promoting 12% SDF as an entry-level preventive solution, which is increasing accessibility and fueling adoption. Rising clinical research highlighting its effectiveness in early caries management further supports market expansion.

- By Indication

On the basis of indication, the Europe Dental Silver Diamine Fluoride (SDF) market is segmented into caries arrest, dentin desensitization, and caries prevention. The Caries Arrest segment dominated the market in 2025, holding the largest share of 45.9% due to SDF’s primary function of halting active caries progression. It is widely used in pediatric, adult, and geriatric dentistry for both anterior and posterior teeth. Dentists favor SDF for its simplicity, non-invasiveness, and ability to provide immediate therapeutic effects without drilling. Public health programs across Germany, the U.K., and France have also emphasized caries arrest as a key preventive measure, increasing clinical adoption. The segment’s dominance is reinforced by clinical guidelines recommending SDF as a standard treatment for high-risk patients. In addition, cost-effectiveness and time efficiency for dental procedures make it a preferred choice in hospitals and clinics.

The Dentin Desensitization segment is expected to witness the fastest growth during the forecast period, driven by increasing awareness of SDF’s dual role in managing sensitivity while preventing caries. SDF offers a non-invasive approach for patients with exposed dentin or post-restorative sensitivity, which is particularly beneficial in geriatric populations. Rising cosmetic dentistry procedures and preventive care programs are fueling adoption. Manufacturers are developing SDF formulations specifically marketed for sensitivity management, encouraging growth. Increased patient preference for pain-free solutions supports segment expansion. Educational campaigns highlighting clinical benefits for sensitivity treatment also enhance market penetration.

- By Type of Teeth

On the basis of type of teeth, the Europe Dental Silver Diamine Fluoride (SDF) market is segmented into primary teeth and secondary teeth. The Primary Teeth segment dominated the market with the largest share in 2025, owing to high prevalence of dental caries among children. Pediatric dentists widely use SDF as a safe, minimally invasive option that reduces the need for drilling and sedation. Public health initiatives in schools and pediatric clinics, particularly in Germany and the U.K., have accelerated adoption. The segment benefits from strong parental acceptance due to its painless application. Clinical research supporting SDF’s effectiveness in primary dentition further drives demand. Its suitability for preventive programs and ease of administration in young patients consolidates its leading position.

The Secondary Teeth segment is expected to witness the fastest growth during the forecast period, fueled by increasing geriatric populations and adult patients seeking non-invasive solutions for root and permanent teeth caries. Rising awareness among adults about preventive dental care and minimally invasive treatments is boosting adoption. SDF is increasingly being applied in posterior permanent teeth with higher risk of caries, particularly in patients with limited access to dental clinics. Growing integration into routine dental check-ups and restorative protocols accelerates growth. In addition, dental insurance coverage for preventive treatments supports segment expansion.

- By Site of Action

On the basis of site of action, the Europe Dental Silver Diamine Fluoride (SDF) market is segmented into anterior teeth and posterior teeth. The Anterior Teeth segment dominated the market in 2025 due to the high focus on aesthetic preservation and preventive care in visible areas. SDF’s ability to quickly arrest caries in anterior teeth without invasive treatment makes it a preferred choice for pediatric and adult patients. Dental professionals emphasize its application in cosmetic-sensitive areas to prevent further tooth decay. Awareness campaigns and clinical guidelines support its widespread use. Parental and patient acceptance, despite minor discoloration, remains strong due to reduced procedural stress. Its rapid application in clinical settings also contributes to dominance.

The Posterior Teeth segment is expected to witness the fastest growth during the forecast period, driven by increasing adult and geriatric patients with molar and premolar caries. SDF provides a non-invasive alternative to traditional restorations in posterior teeth, which are often difficult to treat, especially in elderly patients. Rising adoption in preventive dental programs and high-risk populations is fueling growth. Clinical studies demonstrating efficacy in posterior teeth further encourage adoption. Ease of application in hard-to-reach molars supports segment expansion. Increased awareness of minimally invasive options in posterior caries management is boosting uptake.

- By Age

On the basis of age, the Europe Dental Silver Diamine Fluoride (SDF) market is segmented into pediatric, adult, and geriatric. The Pediatric segment dominated the market with the largest share in 2025 due to high incidence of childhood caries and strong preventive care initiatives. SDF is widely used in schools and pediatric clinics to reduce the need for invasive treatments. Parental preference for painless, non-drilling procedures reinforces its popularity. Government-supported oral health programs in Germany, the U.K., and France further support widespread adoption. Research validating safety and efficacy in children strengthens market dominance. The segment also benefits from easy application and short chair-time in clinical settings.

The Geriatric segment is expected to witness the fastest growth during the forecast period, fueled by increasing awareness of root caries and tooth sensitivity management in elderly populations. Aging populations across Europe are seeking non-invasive, preventive solutions. SDF is particularly suitable for adults with limited mobility or dental anxiety. Growth is supported by geriatric care programs and dental insurance coverage for preventive procedures. Increased educational efforts for dentists regarding geriatric oral health are accelerating adoption. Rising clinical studies demonstrating efficacy in older adults reinforce confidence in the segment.

- By Distribution Channel

On the basis of distribution channel, the Europe Dental Silver Diamine Fluoride (SDF) market is segmented into online and offline. The Offline segment dominated the market with the largest share in 2025 due to strong presence of dental hospitals, clinics, and physical distributors. Dentists and hospitals prefer sourcing SDF through traditional channels for quality assurance and regulatory compliance. Established supply chains ensure consistent availability in clinical settings. Offline sales also benefit from professional demonstrations and training sessions. Strong relationships between manufacturers and dental institutions reinforce market dominance. Patient trust in products obtained through professional channels further supports offline preference.

The Online segment is expected to witness the fastest growth during the forecast period, driven by increasing e-commerce adoption and ease of purchasing dental supplies directly from manufacturers or certified distributors. Smaller clinics and remote practices are leveraging online platforms to procure SDF conveniently. Digital marketing and awareness campaigns are expanding reach. Online channels offer competitive pricing and bulk purchase options, encouraging adoption. Rising trust in certified online dental product platforms is boosting segment growth. Tele-dentistry and virtual consultations also promote online procurement of SDF products.

- By End User

On the basis of end user, the Europe Dental Silver Diamine Fluoride (SDF) market is segmented into dental hospitals & clinics, dental academic & research institutes, and others. The Dental Hospitals & Clinics segment dominated the market with the largest share in 2025 due to primary usage of SDF in clinical treatments for pediatric, adult, and geriatric patients. Hospitals and clinics offer professional application ensuring safety and efficacy. Widespread adoption in preventive care programs supports strong market share. Availability of trained professionals and clinical guidelines further consolidates dominance. Institutional bulk purchasing also strengthens this segment. Patient preference for professional application enhances market stability.

The Dental Academic & Research Institutes segment is expected to witness the fastest growth, during the forecast period driven by increasing clinical studies and research programs focusing on SDF effectiveness and new formulation development. Academic institutions in Germany, the U.K., and France are expanding research in minimally invasive dentistry. Training dental students in SDF application is increasing professional familiarity and future adoption. Research grants and government-funded studies also contribute to segment growth. Collaboration with manufacturers for pilot programs and innovation enhances market penetration. Growing publications and clinical trials further encourage uptake across academic settings.

Europe Dental Silver Diamine Fluoride (SDF) Market Regional Analysis

- Germany dominated the Europe Dental Silver Diamine Fluoride (SDF) market with the largest revenue share of 35% in 2025, characterized by high awareness of preventive dental care, well-established dental healthcare infrastructure, and strong adoption by dental professionals, supported by government oral health programs and widespread professional endorsement

- Dental professionals and patients in the region highly value the ease of application, cost-effectiveness, and clinical efficacy of SDF in arresting dental caries across pediatric, adult, and geriatric populations

- This widespread adoption is further supported by government oral health programs, school-based dental initiatives, and professional training workshops, establishing SDF as a preferred non-invasive solution for caries management in both private and public dental care settings

The Germany Dental Silver Diamine Fluoride (SDF) Market Insight

The Germany Dental Silver Diamine Fluoride (SDF) market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of preventive dental care and well-established healthcare infrastructure. German dental professionals are increasingly adopting SDF in both pediatric and adult patients due to its proven effectiveness in arresting caries and its minimal invasiveness. Public health initiatives, school-based programs, and government oral health campaigns are further supporting adoption. The integration of SDF into routine dental practice is becoming prevalent, with a strong preference for evidence-based, safe, and patient-friendly treatments. In addition, German consumers’ trust in professional dental services enhances market growth, while manufacturers are focusing on product innovation and training programs to strengthen SDF usage.

U.K. Dental Silver Diamine Fluoride (SDF) Market Insight

The U.K. Dental Silver Diamine Fluoride (SDF) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of non-invasive dental treatments and preventive oral care. The increasing prevalence of childhood and adult caries, coupled with a growing emphasis on minimally invasive dentistry, encourages adoption among dental professionals and patients. The U.K.’s well-developed dental infrastructure and strong academic research support SDF usage in hospitals, clinics, and educational institutes. Public health campaigns promoting SDF for school children and high-risk populations are accelerating market growth. In addition, ease of application, cost-effectiveness, and patient acceptance further bolster the market’s expansion.

France Dental Silver Diamine Fluoride (SDF) Market Insight

The France Dental Silver Diamine Fluoride (SDF) market is growing steadily, driven by increasing adoption in pediatric and preventive dentistry, supported by government oral health initiatives. Dental clinics and hospitals are incorporating SDF into routine care due to its ability to arrest caries non-invasively. Rising awareness among parents and caregivers about the benefits of SDF for children and elderly patients is driving demand. French dental professionals are emphasizing minimally invasive treatments and training in SDF application. In addition, research studies and clinical endorsements are fostering trust and encouraging broader adoption across private and public dental settings.

Italy Dental Silver Diamine Fluoride (SDF) Market Insight

The Italy Dental Silver Diamine Fluoride (SDF) market is expected to grow at a steady pace due to increasing preventive dental care awareness and rising dental caries cases among children and adults. Dental hospitals and clinics are progressively using SDF to reduce invasive treatments and improve patient comfort. Academic institutes and research centers are promoting clinical studies highlighting SDF efficacy. Public campaigns and professional training workshops are supporting adoption. Cost-effectiveness and ease of application are driving acceptance among dental professionals and patients. Furthermore, Italy’s integration of preventive programs into routine dental practice accelerates market growth.

Europe Dental Silver Diamine Fluoride (SDF) Market Share

The Europe Dental Silver Diamine Fluoride (SDF) industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Straumann Group (Switzerland)

- Planmeca Oy (Finland)

- Ivoclar Vivadent AG (Liechtenstein)

- KaVo Kerr (Germany)

- Zimmer Biomet (U.S.)

- Septodont Holding (France)

- GC Europe (Belgium)

- Modern Dental Group Limited (Netherlands)

- Colosseum Dental Group (Denmark)

- Patterson Companies, Inc. (U.S.)

- European Dental Group (Sweden)

- Benco Dental (U.S.)

- Carestream Health, Inc. (U.S.)

- 3M (U.S.)

- Young Innovations (U.S.)

- VOCO GmbH (Germany)

- Premier Dental Products Company (U.S.)

- Sunstar Suisse SA (Switzerland)

- SDI Limited (Australia)

What are the Recent Developments in Europe Dental Silver Diamine Fluoride (SDF) Market?

- In May 2024, the ORCA–EFCD partnership published a new consensus report (Paper III) giving updated clinical guidance on individual-level caries diagnosis. This includes refined recommendations for using SDF as part of personalized treatment planning based on caries risk and lesion activity

- In April 2024, a single‑blind randomized clinical trial was conducted at Riga Stradins University (Latvia) comparing Riva Star SDF (35–40% silver fluoride) with a control in pediatric patients. The study demonstrated good clinical effectiveness and parent/patient satisfaction, supporting SDF use in real-world European public-dental settings

- In May 2023, a stability study evaluated five commercially available 38% SDF products and found that most maintained stable concentrations of silver and fluoride over time. This research (from European laboratories) helped build confidence in the consistency and reliability of SDF formulations used in clinical practice

- In July 2021, a consensus report by the European Organisation for Caries Research (ORCA) and the European Federation of Conservative Dentistry (EFCD) reaffirmed clinical recommendations that support the use of 38% SDF (silver diamine fluoride) in managing deep carious lesions in primary teeth. The European Academy of Paediatric Dentistry’s guidance recognized SDF as an effective, minimally invasive treatment in children

- In February 2021, Andrew Osafo published a commentary in Dentistry.co.uk highlighting the off-label use of SDF in the U.K. for caries control. Although SDF (Riva Star) is licensed in the UK only for dentine hypersensitivity, practitioners were increasingly using it for caries arrest, with an emphasis on careful patient consent due to its “off label” status

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.