Europe Diabetic Assays Market

Market Size in USD Billion

CAGR :

%

USD

1,005.40 Billion

USD

1,418.90 Billion

2022

2030

USD

1,005.40 Billion

USD

1,418.90 Billion

2022

2030

| 2023 –2030 | |

| USD 1,005.40 Billion | |

| USD 1,418.90 Billion | |

|

|

|

Europe Diabetic Assays Market Analysis and Size

Diabetes is one of the most severe endocrine diseases. In 2018, as per the records of Centers for Disease Control and Prevention (CDC), the total diabetes cases accounts about 30 million in total American population, wherein 95 to 90% of population was diagnosed with type 2 diabetes. The type 2 diabetes is highly diagnosed among younger population due to unhealthy routine around 75% of younger population in American region is close to type 2 diabetes. The demand for diabetes assays is being boosted by the need for easier, economic, and more efficient management of the Europe diabetes epidemic and increasing development of non-invasive techniques

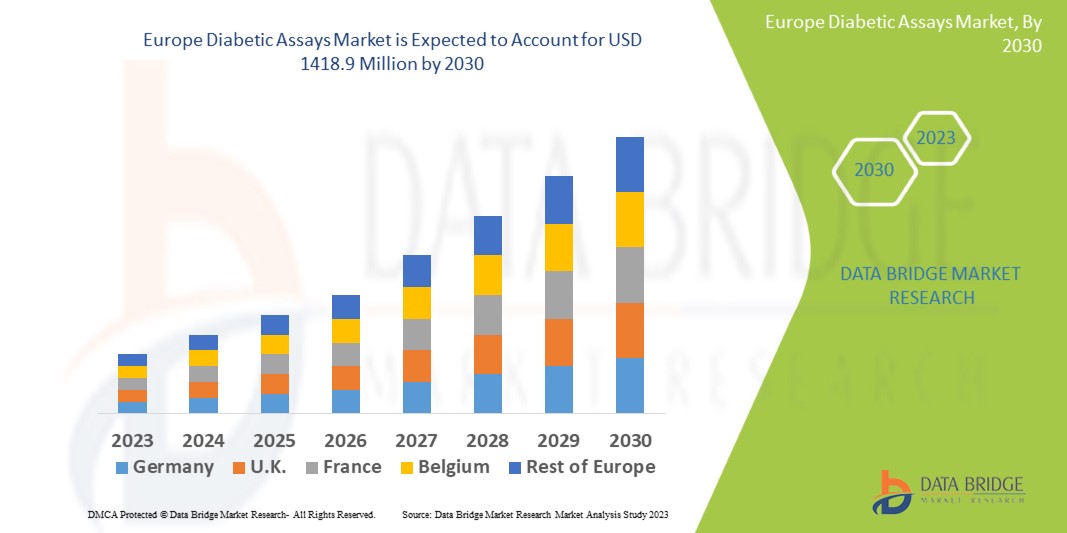

Data Bridge Market Research analyses a growth rate in the diabetic assays market in the forecast period 2023-2030. The expected CAGR of diabetic assays market is tend to be around 4.4% in the mentioned forecast period. The market is valued at USD 1005.4 million in 2022, and it would grow upto USD 1418.9 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Europe Diabetic Assays Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Assays, Devices, Consumables), Disease Type (Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes), Deployment (Automated, Manual), End-Users (Hospitals, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

Amgen Inc., Abbvie, Inc (U.S.), Novartis AG (Switzerland), Teva Pharmaceutical Industries Ltd (Israel), Pfizer Inc (U.S.), Merck & Co., Inc. (U.S.), Abbott (U.S.), Siemens Healthcare GmbH (Germany), Hologic, Inc. (U.S.), Dynatronics Corporation (U.S.), Biomerieux (France), Bio-Rad Laboratories, Inc. (U.S.), BioMarin (U.S.), Quotient Suisse SA (Switzerland), BAG Health Care GmbH (Germany), DiaSorin S.p.A (Italy), DRG INSTRUMENTS GMBH (Germany), PTS Diagnostics (U.S.), Ortho Clinical Diagnostics (U.S.), Diazyme Laboratories, Inc (U.S.), ETHOS BIOSCIENCES (U.S.), Abnova Corporation (Taiwan), Monobind Inc.(U.S.) |

|

Market Opportunities |

|

Market Definition

Diabetics assays such as auto-antibody assay, Electro-Chemiluminescence assays, enzyme inhibition assay, ELISA assay and others are widely used for the diabetes diagnosis. Diabetics cause severe damage to the heart, eyes, blood vessels, kidney and nerves. Increased risk of cardiac disorders related with diabetes requires successful testing and diagnosis options. Diabetics assays are widely used for diagnostics and monitoring who are at higher risk of developing diabetes.

Europe Diabetic Assays Market Dynamics

Drivers

- Increasing Technological Advancements

Rising adoption of insulin delivery devices and increasing occurrence of diabetes are boosting the market growth. Several key manufacturers are primarily focusing on technological innovations and development of different advanced products to gain a considerable market share. For instance, Novo Nordisk collaborated with Abbott in 2019 to incorporate its prefilled and durable connected pens directly into the FreeStyle Libre system (FreeStyle LibreLinkii mobile app and LibreViewiii cloud-based system). CGM is said to further collaborate with insulin delivery systems to ensure a single integrated system for efficient diabetes care management. Additionally, Diabetes Care launched its Slim X2 insulin pump, which is involved with Dexcom G6 CGM. Likewise, Ypsomed Holdings developed a CGM system called Mylife Unio Neva, that adds with the company’s insulin pump. Thus, this factor increases the market growth.

- Rising Awareness About Diabetic Assays and Diabetes

Increasing government awareness associated with the identification of diabetes among elderly and young population and high reimbursement policies services served by the government and private organizations are increasing the population towards the diagnosis of diabetes and focusing on their treatment. For instance, Ministry of Health Simon Harris in Ireland is offering reimbursement for diabetes reimbursement through Health Service Executive under the HSE Medicines Management Programme (MMP) through National Clinical Programme for Diabetes. Reimbursement policies has increased demand of diabetic strips for diabetic strips which is working as driver for diabetic assays market

Opportunities

- Wide Adoption of Blood Glucose Meters

The increasing adoption of blood glucose meters is slowly increasing because of advantages such as portability and accuracy. Several market players are also primarily focusing on developing these devices and are launching small blood glucose meters. Some of the smallest blood glucose meters with advanced technology are widely available in the U.K. These are Abbott Diabetes Care Freestyle Lite, Lifescan’s One Touch UltraEasy, Bayer’s CONTOUR NEXT USB, Accu-Chek Aviva Nano, TRUEone blood glucose meter and Accu-Chek Mobile. Introducing these small, discreet, and easy-to-use blood glucose meters is anticipated to increase segment growth in the upcoming years. This as a result, increases the demand for the market.

- Rising Cases of Diabetes and Obesity

Rise in prevalence of diabetes because of aging, obesity, and unhealthy lifestyle is one of the primary factors leading to the growth of the market. Obesity is a major factor leading to diabetes. According to World Health Organization, in 2016, more than 1.9 billion adults were overweight, of which, about 650 million people were obese. Several risk factors, such as obesity and overweight, are causing an increase in the prevalence of diabetes. Thus, risk factors such as overweight, obesity, smoking, and high cholesterol levels are anticipated to boost the prevalence of diabetes, thus fuelling the need for diabetes devices.

Restraints/Challenges

- High Cost of Treatment

The increasing expenditure associated with the glucose meters and other instruments and the cost required to conduct the assays impede the market growth. Numerous drugs and surgeries cost high, and people in highly developing and underdeveloped countries cause the under treatment of numerous patients. This impedes the market growth.

This diabetic assays market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the diabetic assays market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2019, Abbott (U.S.) and Tandem Diabetes Care, Inc (U.S.) launched integrated diabetes solutions that combine one of the top technologies which are glucose sensing, manufactured by Abbott with innovative insulin delivery systems of Tandem to provide more preferences for people to be able to manage their diabetes.

Europe Diabetic Assays Market Scope

The diabetic assays market is segmented on the basis of type, disease type, deployment, end-users and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Assays

- Devices

- Consumables

Disease Type

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

Deployment

- Automated

- Manual

End User

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Diabetic Assays Market Regional Analysis/Insights

The diabetic assays market is analyzed and market size insights and trends are provided by type, disease type, deployment, end-users and distribution channel as referenced above.

The major countries covered in the diabetic assays market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany has been witnessing a positive growth for diabetic assays market throughout the forecasted period because of the high prevalence cases of diabetes. The total expenditure and high occurrence rate focused towards the diagnosis of diabetes and increasing the growth of diabetes assays in forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Diabetic Assays Market Share Analysis

The diabetic assays market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to diabetic assays market

Key players operating in the diabetic assays market include:

- Abbvie, Inc (U.S.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd (Israel)

- Pfizer Inc (U.S.)

- Merck & Co., Inc. (U.S.)

- Abbott (U.S.)

- Siemens Healthcare GmbH (Germany)

- Hologic, Inc. (U.S.)

- Dynatronics Corporation (U.S.)

- Biomerieux (France)

- Bio-Rad Laboratories, Inc. (U.S.)

- BioMarin (U.S.)

- Quotient Suisse SA (Switzerland)

- BAG Health Care GmbH (Germany)

- DiaSorin S.p.A (Italy)

- DRG INSTRUMENTS GMBH (Germany)

- PTS Diagnostics (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Diazyme Laboratories, Inc (U.S.)

- ETHOS BIOSCIENCES (U.S.)

- Abnova Corporation (Taiwan)

- Monobind Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.