Europe Diagnostic Imaging Equipment Market

Market Size in USD Billion

CAGR :

%

USD

11.24 Billion

USD

17.91 Billion

2024

2032

USD

11.24 Billion

USD

17.91 Billion

2024

2032

| 2025 –2032 | |

| USD 11.24 Billion | |

| USD 17.91 Billion | |

|

|

|

|

Diagnostic Imaging Equipment Market Size

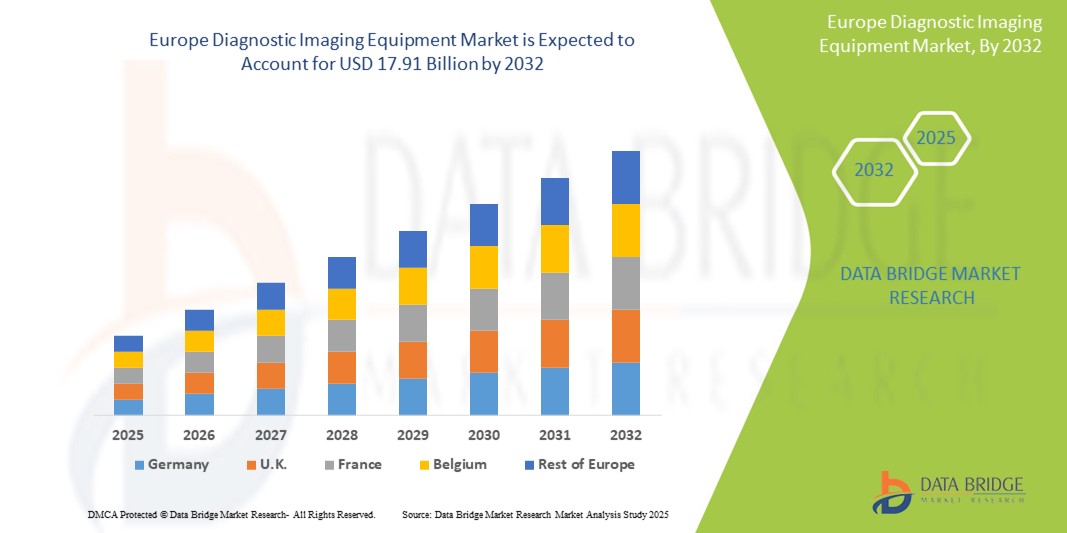

- The Europe Diagnostic Imaging Equipment market size was valued at USD 11.24 billion in 2024 and is expected to reach USD 17.91 billion by 2032, at a CAGR of 5.9% during the forecast period

- The Europe Diagnostic Imaging Equipment market encompasses a broad range of advanced imaging modalities used for visualizing internal body structures and diagnosing medical conditions. These include X-ray, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, nuclear imaging (PET and SPECT), and mammography.

- These technologies are essential tools for early disease detection, treatment planning, and disease monitoring across various medical specialties such as oncology, cardiology, neurology, orthopedics, and gynecology. Diagnostic imaging equipment is deployed extensively across hospitals, diagnostic centers, ambulatory surgical centers, and academic institutions for clinical evaluations and research.

Diagnostic Imaging Equipment Market Analysis

- The Europe Diagnostic Imaging Equipment market is primarily driven by the rising incidence of chronic diseases, expanding geriatric population, and growing demand for minimally invasive diagnostic procedures. Technological advancements—such as AI-powered imaging interpretation, 3D and 4D imaging, hybrid imaging systems (PET-CT, SPECT-CT), and portable devices—are enhancing diagnostic precision and accelerating adoption.

- The increasing use of imaging in preventive care, oncology screening, and trauma cases further fuels market growth. Additionally, favorable reimbursement frameworks, public health initiatives, and investments in digital health infrastructure are supporting the widespread adoption of diagnostic imaging technologies across Europe.

- Germany leads the Diagnostic Imaging Equipment market in Europe, capturing the largest revenue share of 26.4% in 2025, owing to its robust healthcare infrastructure, strong hospital networks, and early adoption of advanced imaging technologies such as MRI, CT, and PET scanners. Government support for digital health transformation and rising demand for early and accurate disease diagnosis contribute significantly to market dominance.

- Germany is also projected to be the fastest-growing country in the region’s diagnostic imaging market during the forecast period. Growth is driven by aging population demographics, increasing chronic disease prevalence, and continuous investment in AI-powered imaging systems and radiology workflow optimization. Strong collaborations between academic research institutions and medical device companies further enhance innovation in this space.

- MRI (Magnetic Resonance Imaging) is anticipated to be the largest imaging modality segment in the Europe Diagnostic Imaging Equipment Market, holding a significant market share of 29.7% in 2025. Its non-invasive nature, superior soft tissue contrast resolution, and expanding use in neurology, oncology, and musculoskeletal imaging make MRI a preferred diagnostic tool across clinical settings.

Report Scope and Diagnostic Imaging Equipment Market Segmentation

|

Attributes |

Diagnostic Imaging Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diagnostic Imaging Equipment Market Trends

“Advancements in Personalized and Digital Imaging Technologies”

- Technological Advancements in Imaging Modalities and Personalized Diagnostics: A major and rapidly evolving trend in the Europe Diagnostic Imaging Equipment Market is the advancement of imaging technologies such as MRI, CT, PET, and ultrasound, which now offer higher resolution, faster scan times, and functional imaging capabilities. These innovations are enabling more precise diagnostics and personalized imaging protocols tailored to patient-specific conditions, particularly in oncology, cardiology, and neurology.

- For instance, the adoption of hybrid imaging systems like PET/CT and PET/MRI is facilitating simultaneous anatomical and functional assessments, enhancing diagnostic accuracy.

- Integration with Digital Health Platforms and AI-Powered Imaging Analytics: The market is experiencing increasing convergence of diagnostic imaging with digital platforms and artificial intelligence. AI-powered imaging software assists radiologists by automating image interpretation, detecting anomalies, and generating preliminary reports, significantly improving workflow efficiency and diagnostic precision.

- For example, AI algorithms are now capable of identifying early-stage tumors or subtle changes in brain scans, enabling early intervention and improving clinical outcomes.

- Expansion of Portable and Point-of-Care Imaging Solutions: Compact and mobile imaging equipment, such as handheld ultrasound devices and portable X-ray systems, are gaining popularity across Europe. These solutions enhance access to diagnostic services in remote or resource-limited settings, as well as in emergency and critical care units.

Diagnostic Imaging Equipment Market Dynamics

Driver

“Increasing Chronic Disease Burden and Demand for Early, Accurate Diagnosis”

- The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions across Europe is significantly driving demand for advanced diagnostic imaging solutions

- For instance, early-stage detection of tumors through MRI and CT scans improves prognosis and enables timely, targeted treatment strategies

- Aging demographics in Europe contribute to a higher incidence of age-related diseases, necessitating regular and accurate imaging for monitoring and diagnosis.

- Increasing emphasis on preventive healthcare and early diagnosis is encouraging healthcare systems to invest in modern, high-resolution imaging equipment.

- Healthcare providers and patients are becoming more aware of the benefits of advanced diagnostic imaging in reducing treatment costs and improving outcomes.

- Favorable reimbursement policies and public health investments by European governments are supporting widespread adoption of imaging technologies across both public and private healthcare settings.

- Technological innovations such as digital imaging, AI-assisted interpretation, and hybrid imaging systems are enhancing diagnostic precision and patient throughput, further driving market expansion.

Restraint/Challenge

“High Equipment Costs and Regulatory Compliance Complexities”

- The high cost of procuring and maintaining advanced diagnostic imaging equipment such as MRI, PET-CT, and hybrid modalities poses a significant barrier to adoption, especially for smaller hospitals and diagnostic centers.

- For instance, installing a high-resolution MRI system with AI integration can require multi-million-euro investments, making it inaccessible to budget-constrained facilities.

- Stringent regulatory frameworks and prolonged approval timelines across Europe, including compliance with MDR (Medical Device Regulation), increase time-to-market and add to manufacturers' operational costs.

- Limited availability of skilled radiologists and trained technicians to operate complex imaging systems and interpret results affects the efficient utilization of equipment.

- Infrastructure challenges, such as insufficient space and shielding requirements for advanced imaging systems, deter installations in older or rural healthcare facilities.

- Concerns over radiation exposure and inconsistent imaging quality across different modalities may reduce clinician confidence and hinder full-scale deployment.

- Integration with hospital information systems and adherence to data protection regulations like GDPR complicate the adoption of AI-enabled and cloud-based imaging solutions

Diagnostic Imaging Equipment Market Scope

The market is segmented on the basis product type, application, types, therapy, portability and end users.

- By Product type

On the basis of Product type, the Diagnostic Imaging Equipment Market is into X-ray Imaging (Digital and Analog), MRI, Ultrasound, CT-Scan, and Nuclear Imaging. The MRI segment is expected to dominate the market with the largest revenue share of 29.7% 2025, due to its rising demand for high-resolution, non-invasive imaging in neurology, musculoskeletal disorders, and oncology, along with ongoing innovations in 3T and 7T MRI technologies.

The X-ray Imaging segment is projected to witness the fastest CAGR from 2025 to 2032, owing to its wide applicability in initial diagnostic assessments, cost-effectiveness, and increasing adoption of digital radiography systems.

- By Types

On the basis of Types, the Diagnostic Imaging Equipment Market is into Disposable and Reusable imaging components and accessories. The Reusable segment is expected to dominate the market with the largest revenue share, as most core diagnostic imaging equipment like MRI coils, ultrasound probes, and radiographic detectors are designed for repeated use in clinical settings. Their long lifecycle, reliability, and cost-efficiency support their widespread adoption in hospitals and diagnostic centers.

The Disposable segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing infection control protocols, demand for single-use imaging accessories (such as ultrasound probe covers and disposable X-ray drapes), and the growing use of portable and point-of-care imaging solutions in emergency and home care settings.

- By Application

On the basis of application, the Diagnostic Imaging Equipment market is segmented into Oncology, Cardiology, Orthopedics, and Others. The Oncology segment holds the largest revenue share in 2025, driven by growing cancer prevalence across Europe and the increasing use of PET-CT, MRI, and CT scans for tumor detection, staging, and treatment planning.

The Cardiology segment is expected to exhibit the fastest CAGR during the forecast period, owing to the rising burden of cardiovascular diseases and growing reliance on echocardiography and cardiac MRI for early diagnosis and monitoring.

- By Therapy

On the basis of Therapy, the Diagnostic Imaging Equipment market is segmented into Insulin, Glucagon-like Peptide-1 (GLP-1), Growth Hormones, Fertility, Osteoporosis, and Others. The Insulin segment dominates this category due to its frequent use in diabetic patient imaging for monitoring complications such as diabetic retinopathy and nephropathy through MRI or ultrasound modalities.

The GLP-1 and Osteoporosis segments are anticipated to show steady growth owing to increased awareness and early diagnosis using advanced imaging tools like DEXA scans for bone density.

- By Portability

On the basis of Portability, the Diagnostic Imaging Equipment market is segmented into Stationary X-ray Imaging Systems and Portable X-ray Imaging Systems. Stationary systems dominate the segment due to their widespread use in hospitals and diagnostic centers, offering higher image quality and integration with PACS (Picture Archiving and Communication Systems).

However, portable X-ray imaging systems are expected to grow at a faster rate, driven by their utility in emergency care, home settings, and resource-limited environments where mobility and quick deployment are crucial.

- By End users

On the basis of end users, the Diagnostic Imaging Equipment market is segmented into Hospitals, Diagnostic Centers, and Research Centers. Hospitals are expected to dominate with the largest revenue share in 2025, owing to their comprehensive diagnostic capabilities, infrastructure, and higher patient intake for a variety of imaging needs.

The Diagnostic Centers segment is projected to witness the fastest growth during the forecast period due to increased outsourcing of imaging services, shorter wait times, and expanding accessibility of imaging technologies in outpatient settings

Diagnostic Imaging Equipment Market Regional Analysis

- Germany dominates the Europe Diagnostic Imaging Equipment Market, accounting for the largest revenue share of 26.4% in 2025, driven by its advanced healthcare infrastructure, high diagnostic imaging utilization rates, and strong presence of major imaging equipment manufacturers. The country is at the forefront of adopting high-end technologies such as digital radiography, MRI, CT, and hybrid PET-CT systems, especially in tertiary care hospitals and research institutes.

- Germany’s investments in AI-integrated imaging, teleradiology platforms, and mobile diagnostic units further support its dominance. Major cities like Berlin, Hamburg, and Frankfurt serve as hubs for innovation, where public and private collaborations foster the development and deployment of cutting-edge imaging modalities. Reimbursement-friendly policies and early technology adoption continue to position Germany as a strategic leader in the European imaging diagnostics landscape.

France Diagnostic Imaging Equipment Market Insight

France is expected to witness robust growth in the diagnostic imaging equipment market over the forecast period, propelled by healthcare digitalization initiatives, increasing chronic disease burden, and expanding imaging access across public and private hospitals. The French government’s investment in radiological infrastructure modernization—including upgrades to MRI, CT, ultrasound, and nuclear imaging equipment—supports rapid market expansion. Hospitals in cities such as Paris, Marseille, and Lyon are adopting AI-based image interpretation tools and cloud-based PACS (Picture Archiving and Communication Systems) to improve diagnostic efficiency. Additionally, France's strong clinical research network supports imaging innovation, particularly in oncology, neurology, and cardiology, enhancing its market position.

U.K. Diagnostic Imaging Equipment Market Insight

The U.K. diagnostic imaging equipment market is poised for significant growth, backed by NHS funding initiatives, rising demand for early disease detection, and the adoption of portable and AI-enhanced imaging systems. The country is focusing on reducing diagnostic wait times by increasing the number of imaging units per capita and expanding community diagnostic centers. Despite regulatory uncertainties post-Brexit, the U.K. continues to align with international imaging safety and quality standards, facilitating seamless integration of imported technologies. Cities such as London, Manchester, and Birmingham are leading adopters of hybrid imaging (PET/MRI, SPECT/CT) and point-of-care ultrasound, with expanding use of machine learning algorithms for radiology workflow optimization and decision support.

Diagnostic Imaging Equipment Market Share

The Diagnostic Imaging Equipment industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Canon Medical Systems Corporation (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Hologic, Inc. (U.S.)

- Esaote SpA (Italy)

- Shimadzu Corporation (Japan)

- Samsung Medison (South Korea)

- Agfa-Gevaert Group (Belgium)

Latest Developments in Europe Diagnostic Imaging Equipment Market

- In February 2025, Siemens Healthineers launched the Magnetom Flow, a next-generation MRI scanner using minimal helium for greater sustainability. Designed for operational efficiency and eco-conscious healthcare, it delivers high-quality imaging with reduced maintenance needs, aligning with global efforts to lower the environmental impact of advanced medical technologies.

- In October 2024, GE HealthCare introduced the AI-powered Vscan Air™ CL, a wireless handheld ultrasound system, across Europe. Tailored for rapid point-of-care diagnostics, it enables clinicians to perform quick, accurate scans in diverse settings, from emergency rooms to rural clinics, enhancing accessibility and responsiveness in patient care.

- In July 2024, Philips launched the Incisive CT scanner featuring AI-powered dose optimization technology. The system enhances diagnostic precision while reducing radiation exposure and streamlining workflow. It is designed to improve patient safety and boost imaging productivity, particularly in high-demand clinical environments across Europe.

- In May 2024, Canon Medical Systems expanded the Aquilion ONE/PRISM Edition CT system across more European countries. Known for its advanced cardiac and neurological imaging capabilities, the system integrates intelligent automation, offering superior image clarity, reduced scan times, and enhanced diagnostic confidence in complex clinical scenarios.

- In March 2024, Fujifilm introduced the ARIETTA 750 DeepInsight, an advanced ultrasound system with AI-driven image enhancement. Specially developed for women’s health diagnostics, it improves imaging accuracy in gynecology and obstetrics. The system enhances clinical workflows and supports precise, early diagnosis through deep learning-based processing.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.