Europe Dietary Supplements Market

Market Size in USD Billion

CAGR :

%

USD

37.61 Billion

USD

61.31 Billion

2024

2032

USD

37.61 Billion

USD

61.31 Billion

2024

2032

| 2025 –2032 | |

| USD 37.61 Billion | |

| USD 61.31 Billion | |

|

|

|

|

Europe Dietary Supplements Market Size

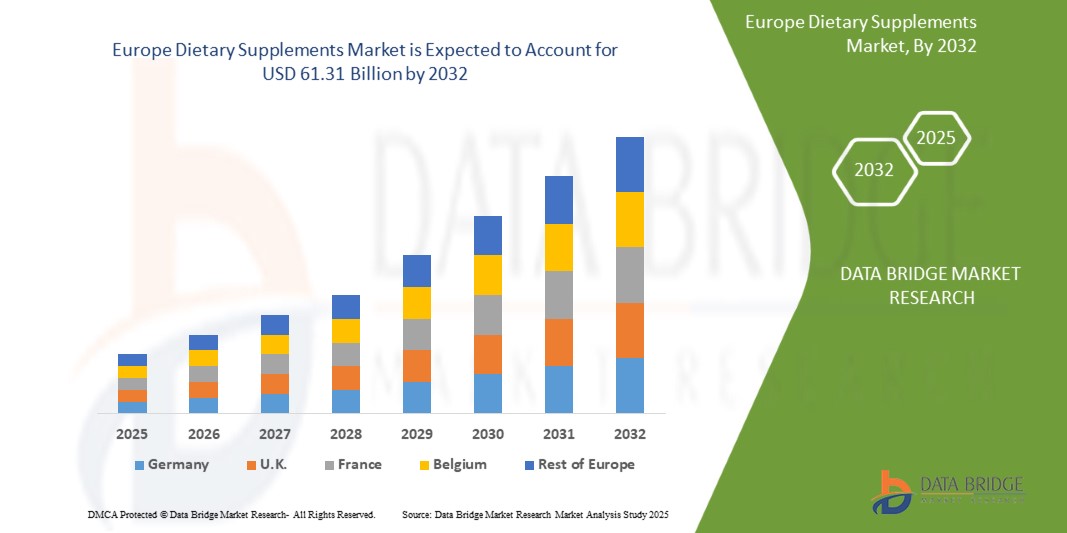

- The Europe Dietary Supplements Market size was valued at USD 37.61 billion in 2024 and is expected to reach USD 61.31 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth in Europe is largely fueled by the rising regional awareness regarding preventive healthcare and nutrition, coupled with significant advancements in product formulation technologies and personalized nutrition approaches, leading to improved consumer engagement and health outcomes

- Furthermore, increasing patient and consumer demand across the region for more effective, accessible, and science-backed supplement solutions for managing lifestyle-related conditions and enhancing overall well-being is establishing functional supplements, botanical blends, and probiotic-enriched products as the modern standard of dietary support. These converging factors are accelerating the uptake of dietary supplements in Europe, thereby significantly boosting the industry's regional growth

Europe Dietary Supplements Market Analysis

- The Europe Dietary Supplements Market, characterized by its growing emphasis on preventive health and wellness, is an increasingly vital area of focus in modern healthcare due to its significant role in enhancing immunity, managing chronic conditions, and improving overall quality of life, often used as an adjunct to conventional therapies or for addressing nutrient deficiencies

- The escalating demand for dietary supplements is primarily fueled by the rising health-consciousness among consumers, increasing aging population, growing prevalence of lifestyle-related disorders, and continuous advancements in supplement formulations and delivery systems, including gummies, effervescent tablets, and personalized nutrition platforms

- Italy holds a dominant position in the Europe Dietary Supplements Market, accounting for a substantial revenue share, characterized by stringent regulatory frameworks ensuring product quality, widespread adoption of self-care practices, high consumer purchasing power, and the strong presence of both global and regional nutraceutical companies

- Italy is expected to be the fastest-growing regions in the Europe Dietary Supplements Market during the forecast period due to increasing disposable incomes, shifting consumer attitudes toward natural health products

- The vitamin supplement segment is expected to dominate the Europe Dietary Supplements Market, driven by its established reputation for supporting immune health, bone strength, and overall vitality, its wide availability across various distribution channels, and ongoing innovations in bioavailability-enhanced formulations and tailored health solutions addressing specific demographic needs

Report Scope and Europe Dietary Supplements Market Segmentation

|

Attributes |

Europe Dietary Supplement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Dietary Supplements Market Trends

Enhanced Consumer Wellness Through AI and Digital Integration

- A significant and accelerating trend in the Europe Dietary Supplements Market is the deepening integration with artificial intelligence (AI) and digital health platforms, encompassing personalized nutrition apps, real-time health tracking, and smart supplement recommendation engines. This fusion of technologies is significantly enhancing consumer engagement, product personalization, and the effectiveness of supplement intake across diverse population segments

- For Instance, in February 2024, Orthomol initiated a joint venture to build a logistics and distribution hub in Leverkusen, Germany. This facility streamlines EU-wide supply chain efficiency, reduces delivery times, and supports expanded product distribution. The venture enhances Orthomol’s capacity to meet the growing demand for micronutrient supplements from consumers

- AI integration in dietary supplements enables features such as analyzing biomarker and lifestyle data to suggest customized supplement regimens, adjusting dosages based on user feedback, and predicting deficiencies before symptoms arise. For example, several European startups are developing AI-driven platforms that combine genomic and microbiome data with lifestyle inputs to generate hyper-personalized supplement kits, directly shipped to consumers. Furthermore, smart packaging technologies and app-based reminders are improving adherence and tracking, fostering better health outcomes

- The seamless integration of supplement tracking tools with broader digital health ecosystems facilitates centralized wellness management. Through a single interface, users can monitor nutrient intake, track health goals, reorder products, and receive live guidance from certified nutritionists—offering a cohesive and proactive consumer experience

- This trend towards more intelligent, intuitive, and interconnected supplement management systems is fundamentally reshaping consumer expectations in the European health and wellness space. Consequently, companies are investing in AI-powered personalization engines, digital diagnostics, and mobile-enabled delivery models that provide end-to-end support from assessment to supplement intake

- The demand for dietary supplement solutions that offer seamless AI and digital integration is growing rapidly across demographics, particularly among tech-savvy millennials and health-conscious seniors, as both consumers and wellness professionals increasingly prioritize precision, convenience, and holistic health improvement

Europe Dietary Supplements Market Dynamics

Driver

Increasing Health Awareness and Preventive Healthcare

- The rising consumer awareness regarding preventive healthcare and wellness, combined with increasing prevalence of lifestyle-related conditions such as obesity, cardiovascular issues, and digestive disorders, is a significant driver for the expanding demand for dietary supplements across Europe. This trend is further reinforced by advancements in personalized nutrition technologies and greater public interest in natural and functional health products

- For instance, according to Food Supplements Europe, over 80% of European adults report taking dietary supplements for health maintenance, with immune support, energy, and digestion being top priorities—demonstrating a strong and growing demand for supplement solutions tailored to specific needs and lifestyles

- As European consumers become more proactive about managing their health, the role of supplements has shifted from reactive support to ongoing preventive care. Technologies such as AI-driven nutrition assessments, genetic testing, and microbiome analysis are enabling the development of highly personalized supplement plans, giving users greater control over their health choices with data-backed confidence

- Furthermore, the surge in e-commerce and mobile health applications is offering convenient access to a wide range of supplement options, educational resources, and expert consultation, making it easier for consumers to make informed decisions. This, coupled with a rising preference for clean-label, organic, and plant-based formulations, reflects a broader shift toward sustainable and transparent wellness solutions

- The appeal of early nutritional intervention, combined with digital tools for tracking and optimizing intake, is enhancing supplement adherence and long-term wellness outcomes. Additionally, innovations in delivery forms—such as gummies, powders, and personalized daily sachets—are driving higher consumer engagement, making supplements more accessible and enjoyable, especially for younger and aging populations alike

Restraint/Challenge

Stringent and Complex Regulations

- Concerns surrounding regulatory inconsistencies across European countries, combined with growing consumer skepticism about the efficacy, quality, and safety of certain dietary supplements, pose a significant challenge to sustained market growth. Variability in permissible health claims, labeling standards, and approval processes under EU and individual national regulations often complicates product development, marketing, and cross-border distribution

- For instance, while the European Food Safety Authority (EFSA) has approved a limited number of health claims, many supplements marketed across Europe are restricted in the claims they can make, leading to consumer confusion and reduced trust in product benefits—especially when compared to more loosely regulated global markets

- Addressing these concerns requires greater regulatory harmonization, transparent scientific validation, and stronger enforcement against misleading or unsubstantiated claims. Additionally, instances of adulterated or poorly formulated supplements sold online have contributed to rising safety concerns, prompting calls for stricter quality control, especially within the e-commerce channel

- The relatively high price of premium, clean-label, and personalized supplements can also be a barrier to adoption, particularly in lower-income demographics or in regions where preventive health spending is not widely prioritized. Moreover, inconsistent advice from healthcare professionals regarding supplement

Europe Dietary Supplements Market Scope

The market is categorized into nine notable segments which are based on product type, nature, product form, function, packaging type, packaging size, consumer demography, gender, and distribution channel.

- Product Type

On the basis of product type, the market is segmented into vitamin supplements, mineral supplements, vitamin and mineral complexes/blends supplements, protein-based supplements, herbal/plant-based supplements, probiotic supplements, omega-3 and essential fatty acid supplements, amino acid supplements, fiber-based supplements, prebiotic supplements, synbiotic supplements, fat burners and thermogenic supplements, and others. In 2025, vitamin supplements segment dominate the largest market revenue share with 22.07%, driven by their widespread consumer trust, broad use for general health maintenance, and essential role in supporting immunity, metabolism, and energy. Products like vitamin D, vitamin C, and multivitamin blends are widely adopted across all age groups. The growing focus on immune health post-pandemic has further boosted their market relevance.

Probiotic supplements segment is anticipated to witness the fastest growth rate with CAGR 7.9% during the forecast period, fueled by rising consumer demand for gut health support, natural solutions, and clean-label products. Innovations in strain-specific probiotic formulations and herbal blends for stress relief, hormonal balance, and digestion are gaining popularity, particularly among younger and female consumers.

- Nature

On the basis of nature, the market is segmented into conventional and organic. In 2025, conventional segment hold the majority of market share by 81.99% due to their wide availability, lower cost, and long-standing brand presence in pharmacies, supermarkets, and online platforms.

The conventional segment is projected to grow at a faster pace with CAGR 6.5%, driven by increasing health consciousness, clean-label preference, and demand for chemical-free and sustainably sourced products. Consumers seeking natural lifestyles and transparency in sourcing are actively shifting toward organic supplements.

- Product Form

On the basis of product form, the market is segmented into tablets, capsules, soft gels, powders, gummies & jellies, liquids, premixes, and others. In 2025, tablets segment dominate the market with 25.70% due to their dosage accuracy, long shelf-life, and ease of consumption. These forms are preferred for a wide range of supplements including multivitamins, minerals, and herbal extracts.

Gummies & jellies segment is witnessing the fastest growth, especially among children, young adults, and the elderly. Their appealing taste, ease of intake, and rising application in vitamins and probiotics are making them a preferred alternative to traditional pills.

- Function

On the basis of function, the market is segmented into nutritional support, immune system enhancement, sports nutrition, preventive health, heart health, digestive health, cognitive and mental health, performance enhancement, weight management, gut health, aging support, skin health, bone and joint health, metabolic health, health maintenance, hormonal balance, immune health, and others. In 2025, nutritional support is the dominant segments with 35.65% market share, reflecting growing consumer interest in preventive health and chronic disease management. Daily multivitamins and immune-boosting formulations like vitamin C, D, and zinc are highly sought-after.

- Packaging Type

On the basis of packaging type, the market is segmented into bottles, pouches and sachets, jars and containers, blister packs, cans and tins, and others. In 2025, bottles segment lead the market with 31.85% market share due to their durability, reusability, and convenience for storing capsules, tablets, and gummies. They are a staple across both store-based and online retail channels.

Bottles segment is emerging as high-growth segments, particularly for powders, premixes, and single-serve supplements. Their portability and eco-friendly appeal resonate with on-the-go consumers and sustainability-conscious buyers.

- Packaging Size

On the basis of packaging size, the market is segmented into less than 100 grams, 100 to 250 grams, 250 to 500 grams, 500 to 750 grams, 750 to 1000 grams, and more than 1000 grams. In 2025, 100 to 250 grams segment is dominating the market, offering a balance between quantity and affordability, ideal for monthly or short-term use. It’s widely adopted across multivitamins, protein powders, and herbal blends.

- Consumer Demography

On the basis of consumer demography, the market is segmented into kids (under 14 years), youngs (14 to 24 years), adults (24 to 45 years), and seniors (above 45 years). In 2025, adults (24 to 45 years) segment is representing the largest consumer segment, actively investing in supplements for immunity, energy, fitness, and stress management. They form the primary target audience for most product innovations and digital wellness integrations.

Europe Dietary Supplements Market Regional Analysis

- Italy dominates the Europe Dietary Supplements Market with a substantial revenue share, driven by a high level of health consciousness, strong demand for preventive wellness solutions, and a well-regulated nutraceutical framework across major economies

- Consumers and healthcare professionals in the region highly value scientifically backed, high-quality supplements, supported by rigorous regulations from authorities like the European Food Safety Authority (EFSA), which ensure product safety, efficacy, and transparency

- This strong market presence is further reinforced by rising aging populations, increasing adoption of clean-label and plant-based formulations, and the widespread availability of dietary supplements through both traditional retail and rapidly expanding e-commerce channels. These factors collectively position Europe as a mature and innovation-driven hub for supplement consumption and product development

Germany Europe Dietary Supplements Market Insight

The German Europe Dietary Supplements Market captured a significant market size within Europe, often representing over USD 10.38 billion in 2025 , driven by its reputation for scientifically validated formulations, consumer preference for preventive health, and strong adherence to EFSA guidelines.

Additionally, the integration of dietary supplements into pharmacy and naturopathic care settings, along with robust innovation in probiotic and plant-based blends, continues to enhance adoption and supports long-term market growth.

France Europe Dietary Supplements Market Insight

The French Europe Dietary Supplements Market captured a significant market share within Europe, supported by a well-established herbal and homeopathic supplement culture and growing emphasis on holistic wellness. French consumers are increasingly turning to supplements for stress relief, skin health, and metabolic balance.

Furthermore, government-backed campaigns promoting micronutrient awareness and rising e-commerce penetration of specialized brands are strengthening the market's accessibility and consumer adherence to regular supplement regimens.

U.K. Europe Dietary Supplements Market Insight

The U.K. Europe Dietary Supplements Market captured a significant market share within Europe, fueled by rising health consciousness, strong digital retail infrastructure, and demand for personalized nutrition. U.K. consumers increasingly value supplements addressing immunity, cognitive function, and hormonal balance, especially among women and older adults.

Moreover, the growing influence of health tech startups and AI-based supplement subscription services, coupled with trusted regulation by the MHRA and EFSA-aligned standards, is accelerating market expansion and product innovation.

Europe Dietary Supplements Market Share

The European dietary supplement industry is primarily led by well-established companies, including:

- Nestlé (Switzerland)

- Abbott (U.S.)

- Amway Corp. (U.S.)

- Haleon Group of Companies (U.K.)

- Herbalife International of America, Inc. (U.S.)

- Orkla (Norway)

- FitLife Brands, Inc. (U.S.)

- Glanbia PLC (Ireland)

- BioGaia (Sweden)

- Procter & Gamble (U.S.)

- Sanofi (France)

- Evonik Industries AG (Germany)

- Arkopharma (France)

- Pharma Nord Inc. (Denmark)

- Pileje (France)

- Probi (Sweden)

- Nature’s Sunshine Products, Inc. (U.S.)

- Himalaya Wellness Company (India)

- Perrigo Company plc. (Ireland)

- Bio-Tech Pharmacal (U.S.)

- Wörwag Pharma (Germany)

Latest Developments in Europe Dietary Supplements Market

- In April 2025, Abbott is experiencing significant market development due favorable demographics propel growth in adult nutrition. This development highlights the increasing demand for nutritional products driven by an aging global population and rising health consciousness. The impact is enhanced business growth for Abbott, expanding its market share in adult nutrition. This allows the company to further leverage its established brands like Ensure and Glucerna, catering to the evolving health needs of adults worldwide

- In December 2024, Nestlé scientists have made a significant development by identifying specific bioactive nutrients, including vitamin B-related compounds and olive polyphenols, that target the cellular mechanisms of age-related muscle decline. This breakthrough, rooted in understanding sarcopenia, allows for the creation of innovative nutritional solutions. The impact is profound: it paves the way for new products that support faster muscle regeneration, boost cellular energy, and improve physical performance, ultimately contributing to healthier longevity and enhanced quality of life for an aging global population

- In September 2023, Nestlé has reached an agreement with Advent International to acquire a majority stake in Grupo CRM, a premium Brazilian chocolate company. The deal, expected to close in 2024, strengthens Nestlé’s presence in Brazil’s high-end confectionery market

- In January 205, Haleon Group of Companies is significantly investing in its global R&D footprint, notably with a recent USD 54 million upgrade to its Richmond, US R&D centre, supplementing its substantial annual R&D budget. This development aims to accelerate new product innovation across categories like OTC and VMS. The impact is enhanced capability to develop science-led solutions, foster a talent pipeline, and drive sustainable growth by delivering disruptive and locally relevant brand innovations to consumers worldwide

- In October 2024, Haleon Group of Companies has developed an AI-powered "Health Inclusivity Screener" tool to revolutionize advertising by enhancing its accessibility, simplicity, and representativeness. The development involves AI and machine learning to analyze digital marketing assets for readability, text legibility, captions, and diverse demographic representation (age, gender, skin tone). This innovative tool's impact is significant: it helps Haleon create more inclusive campaigns that resonate with a wider audience, including vulnerable groups, thereby improving consumer comprehension, brand performance, and ultimately contributing to better health outcomes globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE DIETARY SUPPLEMENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.3.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.3.1.1 JOINT VENTURES

4.3.1.2 MERGERS AND ACQUISITIONS

4.3.1.3 LICENSING AND PARTNERSHIP

4.3.1.4 TECHNOLOGY COLLABORATIONS

4.3.1.5 STRATEGIC DIVESTMENTS

4.3.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.3.3 STAGE OF DEVELOPMENT

4.3.4 TIMELINES AND MILESTONES

4.3.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.3.6 RISK ASSESSMENT AND MITIGATION

4.4 FUTURE OUTLOOK

4.4.1 PERSONALIZED NUTRITION

4.4.2 TECHNOLOGICAL INTEGRATION

4.4.3 SHIFTING CONSUMER PREFERENCES

4.4.4 AGING POPULATION

4.4.5 REGULATORY LANDSCAPE

4.4.6 ECONOMIC FACTORS

4.4.7 REGULATION COVERAGE

4.4.7.1 PRODUCT CODES

4.4.7.2 CERTIFIED STANDARDS

4.4.7.3 SAFETY STANDARDS

4.4.7.3.1 MATERIAL HANDLING & STORAGE

4.4.7.3.2 TRANSPORT & PRECAUTIONS

4.4.7.3.3 HAZARD IDENTIFICATION

4.5 PRICING ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM SIZE COMPANIES

4.8.3 END USERS

4.9 VALUE CHAIN ANALYSIS

4.1 BRAND COMPARATIVE ANALYSIS

4.11 COMPANY VS BRAND OVERVIEW

4.12 CONSUMER BUYING BEHAVIOUR

4.13 VENDOR SELECTION CRITERIA

4.14 TECHNOLOGICAL ADVANCEMENTS

4.15 COST ANALYSIS

4.16 PROFIT MARGIN ANALYSIS

5 TARIFFS & IMPACT

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING HEALTH AWARENESS AND PREVENTIVE HEALTHCARE

6.1.2 EXPANSION OF E-COMMERCE PLATFORMS

6.1.3 RISING INTEREST IN SPORTS NUTRITION AND FITNESS

6.1.4 1.1.4 DEVELOPMENT OF NEW & INNOVATIVE SUPPLEMENT FORMS

6.2 RESTRAINTS

6.2.1 COMPETITION FROM PHARMACEUTICALS AND NATURAL FOOD-BASED NUTRITION

6.2.2 STRINGENT AND COMPLEX REGULATIONS

6.3 OPPORTUNITIES

6.3.1 PLANT-BASED AND NATURAL SUPPLEMENTS

6.3.2 INNOVATIONS IN NUTRACEUTICALS

6.3.3 COLLABORATION AND MERGERS & ACQUISITIONS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN SUBSTANTIATING HEALTH CLAIMS

6.4.2 MAINTAINING QUALITY AND SAFETY STANDARDS

7 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 VITAMIN SUPPLEMENTS

7.3 MINERAL SUPPLEMENTS

7.4 VITAMIN AND MINERAL COMPLEXES/BLENDS SUPPLEMENTS

7.5 PROTEIN-BASED SUPPLEMENTS

7.6 HERBAL/PLANT-BASED SUPPLEMENTS

7.7 PROBIOTIC SUPPLEMENTS

7.8 OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS

7.9 AMINO ACID SUPPLEMENTS

7.1 FIBER-BASED SUPPLEMENTS

7.11 PREBIOTIC SUPPLEMENTS

7.12 SYNBIOTIC SUPPLEMENTS

7.13 FAT BURNERS AND THERMOGENIC SUPPLEMENTS

7.14 OTHERS

8 EUROPE DIETARY SUPPLEMENTS MARKET, BY NATURE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM

9.1 OVERVIEW

9.2 TABLETS

9.3 CAPSULE

9.4 SOFT GELS

9.5 POWDERS

9.6 GUMMIES & JELLIES

9.7 LIQUIDS

9.8 PREMIXES

9.9 OTHERS

10 EUROPE DIETARY SUPPLEMENTS MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 NUTRITIONAL SUPPORT

10.3 IMMUNE SYSTEM ENHANCEMENT

10.4 SPORTS NUTRITION

10.5 PREVENTIVE HEALTH

10.6 HEART HEALTH

10.7 DIGESTIVE HEALTH

10.8 COGNITIVE AND MENTAL HEALTH

10.9 PERFORMANCE ENHANCEMENT

10.1 WEIGHT MANAGEMENT

10.11 GUT HEALTH

10.12 AGING SUPPORT

10.13 SKIN HEALTH

10.14 BONE AND JOINT HEALTH

10.15 METABOLIC HEALTH

10.16 HEALTH MAINTENANCE

10.17 HORMONAL BALANCE

10.18 IMMUNE HEALTH

10.19 OTHERS

11 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE

11.1 OVERVIEW

11.2 BOTTLES

11.3 POUCHES AND SACHETS

11.4 JARS AND CONTAINERS

11.5 BLISTER PACKS

11.6 CANS AND TINS

11.7 OTHERS

12 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE

12.1 OVERVIEW

12.2 100 TO 250 GRAMS

12.3 250 TO 500 GRAMS

12.4 LESS THAN 100 GRAMS

12.5 500 TO 750 GRAMS

12.6 750 TO 1000 GRAMS

12.7 MORE THAN 1000 GRAMS

13 EUROPE DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY

13.1 OVERVIEW

13.2 ADULTS (24 TO 45 YEARS)

13.3 SENIORS (ABOVE 45 YEARS)

13.4 YOUNGS (14 TO 24 YEARS)

13.5 KIDS (UNDER 14 YEARS)

14 EUROPE DIETARY SUPPLEMENTS MARKET, BY GENDER

14.1 OVERVIEW

14.2 FEMALE

14.3 MALE

14.4 UNI-SEX

15 EUROPE DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 STORE BASED RETAILERS

15.3 NON-STORE BASED RETAILERS

15.4 EUROPE

15.4.1 ITALY

15.4.2 GERMANY

15.4.3 FRANCE

15.4.4 U.K

15.4.5 SPAIN

15.4.6 NETHERLANDS

15.4.7 RUSSIA

15.4.8 SWITZERLAND

15.4.9 BELGIUM

15.4.10 SWEDEN

15.4.11 POLAND

15.4.12 DENMARK

15.4.13 FINLAND

15.4.14 TURKEY

15.4.15 REST OF EUROPE

16 EUROPE DIETARY SUPPLEMENTS MARKET

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 NESTLÉ

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 ABBOTT

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 AMWAY CORP

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 HALEON GROUP OF COMPANIES

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 BRAND PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 HERBALIFE LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ARKOPHARMA

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BIOGAIA

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 BIO-TECH PHARMACAL.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 EVONIK INDUSTRIES AG

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 FITLIFE BRANDS, INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 GLANBIA PLC

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 GNC HOLDINGS, LLC

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 HIMALAYA WELLNESS COMPANY

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 NATURE'S SUNSHINE PRODUCTS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 NOW FOODS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 ORKLA

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 PERRIGO COMPANY PLC

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 PHARMA NORD INC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PILEJE

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 PROBI

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 PROCTER & GAMBLE

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 BRAND PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SANOFI

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SWANSON

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 VITABIOTICS LTD.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 VITACO

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 WÖRWAG PHARMA

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 ZEIN PHARMA

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 RECENT DEVELOPMENTS, HIGHLIGHTING NEW PRODUCT LAUNCHES, INNOVATIONS, AND TRENDS

TABLE 2 TIMELINES AND MILESTONES IN THE EUROPEAN DIETARY SUPPLEMENTS INDUSTRY

TABLE 3 BRAND COMPARATIVE ANALYSIS

TABLE 4 COMPANY V/S BRAND OVERVIEW

TABLE 5 CONSUMER BUYING BEHAVIOUR

TABLE 6 VENDOR SELECTION CRITERIA

TABLE 7 TECHNOLOGICAL ADVANCEMENTS

TABLE 8 COST ANALYSIS

TABLE 9 PROFIT MARGIN ANALYSIS

TABLE 10 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 12 EUROPE VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE FAT BURNERS AND THERMOGENIC SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE NON-STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE DIETARY SUPPLEMENTS MARKET, BY COUNTRIES, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE DIETARY SUPPLEMENTS MARKET, BY COUNTRIES, 2018-2032 (THOUSAND UNITS)

TABLE 46 ITALY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ITALY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 48 ITALY VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ITALY VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ITALY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ITALY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 52 ITALY PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 ITALY HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 ITALY CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 ITALY PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ITALY BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ITALY LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ITALY BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ITALY LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ITALY NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ITALY BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ITALY FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ITALY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 64 ITALY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 65 ITALY AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ITALY FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ITALY PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ITALY FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ITALY DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 70 ITALY DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 71 ITALY DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 72 ITALY DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ITALY BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 ITALY DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 75 ITALY DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 76 ITALY DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 77 ITALY DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 ITALY STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 ITALY NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 82 GERMANY VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 109 GERMANY DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 110 GERMANY DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 111 GERMANY DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 GERMANY STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 GERMANY NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 FRANCE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 116 FRANCE VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 FRANCE CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 FRANCE PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 FRANCE DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 138 FRANCE DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 FRANCE DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 143 FRANCE DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 145 FRANCE DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 FRANCE STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 FRANCE NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 150 U.K. VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.K. VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.K. MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.K. MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.K. CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.K. PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.K. BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.K. LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.K. NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 U.K. BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 U.K. FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.K. OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 U.K. OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 167 U.K. AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.K. FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.K. PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.K. FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 U.K. DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 172 U.K. DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 173 U.K. DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 174 U.K. DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.K. BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.K. DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 177 U.K. DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 178 U.K. DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 179 U.K. DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 180 U.K. STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.K. NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SPAIN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SPAIN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 184 SPAIN VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SPAIN VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SPAIN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SPAIN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 188 SPAIN PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SPAIN HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SPAIN CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SPAIN PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SPAIN BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SPAIN LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SPAIN BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SPAIN LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SPAIN NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SPAIN BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SPAIN FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SPAIN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 200 SPAIN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 201 SPAIN AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SPAIN FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SPAIN PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SPAIN FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SPAIN DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 206 SPAIN DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 SPAIN STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SPAIN NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 218 NETHERLANDS VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 NETHERLANDS VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 NETHERLANDS MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 NETHERLANDS MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 222 NETHERLANDS PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 NETHERLANDS HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 NETHERLANDS CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 NETHERLANDS PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 NETHERLANDS BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 NETHERLANDS LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 NETHERLANDS BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 NETHERLANDS LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NETHERLANDS NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 NETHERLANDS BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 NETHERLANDS FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 NETHERLANDS OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 234 NETHERLANDS OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 235 NETHERLANDS AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 240 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 241 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 242 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NETHERLANDS BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 245 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 246 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 247 NETHERLANDS DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 248 NETHERLANDS STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 NETHERLANDS NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 252 RUSSIA VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 RUSSIA VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 RUSSIA MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 RUSSIA MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 256 RUSSIA PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 RUSSIA HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 RUSSIA CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 RUSSIA PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 RUSSIA BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 RUSSIA LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 RUSSIA BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 RUSSIA LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 RUSSIA NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 RUSSIA BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 RUSSIA FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 RUSSIA OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 268 RUSSIA OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 269 RUSSIA AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 RUSSIA FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 RUSSIA PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 RUSSIA FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 RUSSIA DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 274 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 275 RUSSIA DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 276 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 RUSSIA BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 RUSSIA DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 279 RUSSIA DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 280 RUSSIA DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 281 RUSSIA DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 282 RUSSIA STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 RUSSIA NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 286 SWITZERLAND VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SWITZERLAND VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SWITZERLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SWITZERLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 290 SWITZERLAND PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SWITZERLAND HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SWITZERLAND CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 SWITZERLAND PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SWITZERLAND BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWITZERLAND LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SWITZERLAND BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SWITZERLAND LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWITZERLAND NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWITZERLAND BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWITZERLAND FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SWITZERLAND OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 302 SWITZERLAND OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 303 SWITZERLAND AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWITZERLAND FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SWITZERLAND PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWITZERLAND FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 308 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 309 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 310 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 SWITZERLAND BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 313 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 314 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 315 SWITZERLAND DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 316 SWITZERLAND STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 SWITZERLAND NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 320 BELGIUM VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 BELGIUM VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 BELGIUM MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 BELGIUM MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 324 BELGIUM PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 BELGIUM HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 BELGIUM CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 BELGIUM PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 BELGIUM BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 BELGIUM LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 BELGIUM BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 BELGIUM LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 BELGIUM NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 BELGIUM BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 BELGIUM FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 BELGIUM OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 336 BELGIUM OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 337 BELGIUM AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 BELGIUM FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 BELGIUM PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 BELGIUM FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 BELGIUM DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 342 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 343 BELGIUM DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 344 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 BELGIUM BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 BELGIUM DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 347 BELGIUM DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 348 BELGIUM DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 349 BELGIUM DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 350 BELGIUM STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 BELGIUM NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 354 SWEDEN VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 SWEDEN VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 SWEDEN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 SWEDEN MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 358 SWEDEN PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 SWEDEN HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 SWEDEN CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 SWEDEN PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 SWEDEN BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SWEDEN LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 SWEDEN BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 SWEDEN LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 SWEDEN NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 SWEDEN BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 SWEDEN FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 SWEDEN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 370 SWEDEN OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 371 SWEDEN AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 SWEDEN FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 SWEDEN PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SWEDEN FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SWEDEN DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 376 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 377 SWEDEN DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 378 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 SWEDEN BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 SWEDEN DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 381 SWEDEN DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 382 SWEDEN DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 383 SWEDEN DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 384 SWEDEN STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 SWEDEN NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 POLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 POLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 388 POLAND VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 POLAND VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 POLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 POLAND MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 392 POLAND PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 POLAND HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 POLAND CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 POLAND PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 POLAND BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 POLAND LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 POLAND BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 POLAND LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 POLAND NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 POLAND BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 POLAND FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 POLAND OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 404 POLAND OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 405 POLAND AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 POLAND FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 POLAND PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 POLAND FAT BURNERS AND THERMOGENIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 POLAND DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 410 POLAND DIETARY SUPPLEMENTS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 411 POLAND DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 412 POLAND DIETARY SUPPLEMENTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 POLAND BOTTLES IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 POLAND DIETARY SUPPLEMENTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 415 POLAND DIETARY SUPPLEMENTS MARKET, BY CONSUMER DEMOGRAPHY, 2018-2032 (USD THOUSAND)

TABLE 416 POLAND DIETARY SUPPLEMENTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 417 POLAND DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 418 POLAND STORE BASED RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 POLAND NON-STORE RETAILERS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 DENMARK DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 DENMARK DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 422 DENMARK VITAMIN SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 DENMARK VITAMIN B IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 DENMARK MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 DENMARK MINERAL SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 426 DENMARK PROTEIN BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 DENMARK HERBAL/PLANT-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 DENMARK CAFFEINE-BASED EXTRACTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 429 DENMARK PROBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 DENMARK BACTERIA BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 431 DENMARK LACTOBACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 432 DENMARK BIFIDOBACTERIUM IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 433 DENMARK LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 DENMARK NON-LACTIC ACID BACTERIA IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 DENMARK BACILLUS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 DENMARK FUNGI AND YEAST BASED IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 DENMARK OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 438 DENMARK OMEGA-3 AND ESSENTIAL FATTY ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 439 DENMARK AMINO ACID SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 DENMARK FIBER-BASED SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 DENMARK PREBIOTIC SUPPLEMENTS IN DIETARY SUPPLEMENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)