Europe Disposable Medical Devices Sensors Market

Market Size in USD Billion

CAGR :

%

USD

2.57 Billion

USD

17.91 Billion

2024

2032

USD

2.57 Billion

USD

17.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.57 Billion | |

| USD 17.91 Billion | |

|

|

|

|

Disposable Medical Devices Sensors Market Size

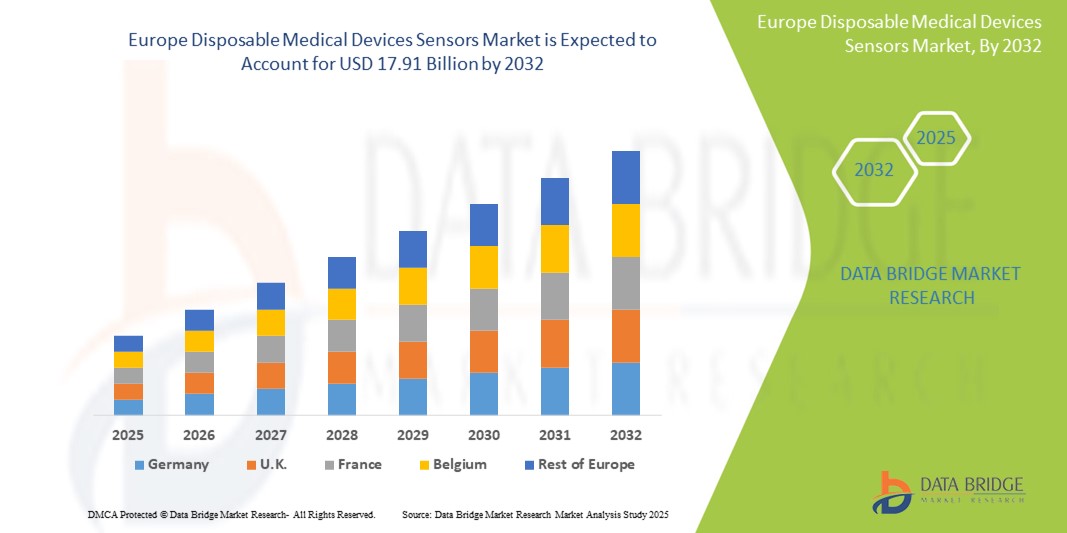

- The Europe Disposable Medical Devices Sensors market size was valued at USD 2.57 billion in 2024 and is expected to reach USD 17.91 billion by 2032, at a CAGR of 14.8% during the forecast period

- The Europe Disposable Medical Device Sensors market comprises a diverse range of single-use sensors designed for physiological monitoring, diagnostic testing, and therapeutic applications across various healthcare settings. These sensors are vital for tracking parameters such as temperature, heart rate, respiratory rate, blood oxygen levels, and glucose levels in real-time during patient care.

- Key types of disposable sensors include biosensors, accelerometers, pressure sensors, image sensors, and temperature sensors, which are commonly embedded in wearable medical devices, catheters, surgical instruments, and patches. These devices are widely used in hospitals, ambulatory surgical centers, homecare settings, and emergency care units throughout Europe.

- The increasing adoption of minimally invasive monitoring, infection control protocols, and real-time data collection has accelerated demand for disposable sensors. Integration with wireless technologies, digital platforms, and remote patient monitoring systems enhances clinical efficiency, supports early diagnosis, and improves patient outcomes while reducing the risk of cross-contamination.

Disposable Medical Devices Sensors Market Analysis

- The Europe Disposable Medical Device Sensors market is primarily driven by the growing demand for remote patient monitoring, the rising prevalence of chronic diseases such as diabetes and cardiovascular conditions, and an increased focus on infection control through single-use technologies. The expansion of homecare services and the shift towards value-based care further accelerate sensor adoption across the region.

- Technological advancements—such as miniaturized sensor design, wireless communication, and real-time physiological data tracking—are transforming patient care by enabling continuous, non-invasive monitoring. The integration of disposable sensors with digital health platforms and telehealth services supports early diagnosis, personalized treatment, and improved clinical outcomes.

- Germany leads the Disposable Medical Devices Sensors market in Europe, capturing the largest revenue share of 25.6% in 2025, supported by its strong medical device manufacturing ecosystem, well-established healthcare infrastructure, and rapid adoption of digital health technologies. The country's growing aging population, robust regulatory compliance, and focus on innovation make it a key contributor to market leadership.

- Germany is also projected to be the fastest-growing country in the European Disposable Medical Device Sensors market during the forecast period. Factors such as increased R&D investments, strategic collaborations between medical device companies and healthcare providers, and government initiatives promoting digital transformation in healthcare are driving rapid growth.

- Biosensors are expected to hold the largest market share of 32.8% in 2025 across Europe, owing to their critical role in glucose monitoring, infectious disease detection, and point-of-care diagnostics. Their high sensitivity, specificity, and compatibility with wearable technologies make them ideal for real-time patient monitoring and chronic disease management.

Report Scope and Disposable Medical Devices Sensors Market Segmentation

|

Attributes |

Disposable Medical Devices Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Disposable Medical Devices Sensors Market Trends

“Integration of Automation, AI, and Preventive Diagnostics”

- The Europe Clinical Chemistry Analyzer market is witnessing a significant trend toward the deployment of fully automated, high-throughput analyzers in diagnostic laboratories, enabling faster turnaround times and reduced manual workload in high-volume settings.

- For instance, in 2024, Germany’s Charité hospital network integrated Roche’s cobas pro platforms with artificial intelligence software for automated interpretation of liver and renal panels, significantly reducing turnaround time and manual error rates. This showcases how AI-enhanced automation is becoming central to modern diagnostic workflows in Europe’s top-tier hospitals.

- Integration of artificial intelligence and advanced data analytics into analyzers is enhancing real-time result interpretation, supporting personalized diagnostics and enabling clinicians to gain deeper insights into disease progression and metabolic functions.

- Demand for compact, user-friendly analyzers suitable for decentralized settings such as emergency rooms, outpatient clinics, and home care is rising, facilitating broader access to biochemical testing.

- Enhanced connectivity with digital health platforms, including Laboratory Information Systems (LIS) and Electronic Medical Records (EMRs), is improving data integration, clinical workflows, and remote access to diagnostic insights.

- The increasing prevalence of chronic illnesses such as diabetes, cardiovascular disease, and renal disorders is driving demand for routine clinical chemistry testing, supporting the shift toward preventive and continuous health monitoring.

Disposable Medical Devices Sensors Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases and Demand for Rapid Diagnostics”

- Growing cases of metabolic and lifestyle-related disorders across Europe are fueling the need for rapid, accurate, and routine diagnostic testing

- For instance, the widespread impact of COVID-19 across Europe accelerated the deployment of high-throughput clinical chemistry analyzers like Abbott’s ARCHITECT series in hospitals and public health labs, as these systems enabled faster screening and monitoring of patients with severe inflammatory responses. This shift reinforced the demand for automated solutions capable of managing large diagnostic workloads during health crises

- Government initiatives to enhance laboratory infrastructure and encourage early diagnosis are contributing to increased analyzer adoption.

- The rise in outpatient care, telehealth, and home-based diagnostics is accelerating demand for compact and portable chemistry.

Restraint/Challenge

“High Costs and Regulatory Compliance Burden”

- High capital investment associated with advanced analyzers and reagents limits accessibility among smaller labs and healthcare providers.

- For instance, smaller diagnostic laboratories in Central and Eastern Europe often face challenges adopting high-end clinical chemistry analyzers such as Siemens’ Atellica Solution or Roche’s cobas pro series due to the high upfront investment, limited reimbursement, and ongoing maintenance costs. Additionally, stringent EU MDR regulations prolong product approvals, creating barriers for manufacturers and slowing down innovation rollout across budget-constrained healthcare settings.

- Complex regulatory frameworks in Europe, such as MDR compliance and CE certification, increase product development costs and time to market.

- Shortage of skilled personnel to manage sophisticated diagnostic systems in rural or under-resourced regions further hampers widespread adoption.

Disposable Medical Devices Sensors Market Scope

The market is segmented on the placement of sensors, product, application, and distribution channel.

- By Placement of Sensors

On the basis of Placement of Sensors, the Disposable Medical Devices Sensors Market is into Ingestible Sensors, Implantable Sensors, Strip Sensors, Invasive Sensors, and Wearable Sensors. The Wearable Sensors segment is expected to dominate the market with the largest revenue share of 29.7% 2025, attributed to the growing adoption of wearable health monitoring devices such as patches and smart bandages, which are widely used in patient monitoring and chronic disease management.

The Ingestible Sensors segment is projected to witness the fastest CAGR from 2025 to 2032 driven by advancements in nanotechnology and increasing applications in gastrointestinal diagnostics and drug adherence tracking.

- By Product

On the basis of Product, the Disposable Medical Devices Sensors Market is into Image Sensors, Pressure Sensors, Temperature Sensors, Accelerometers, Biosensors, and Others. The Biosensors segment is expected to dominate the market with the largest revenue share, owing to their critical role in detecting biological markers for glucose monitoring, infection diagnostics, and metabolic analysis.

The Image Sensors segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing integration in endoscopic and capsule-based diagnostic imaging tools.

- By Application

On the basis of application, the Disposable Medical Devices Sensors market is segmented into Patient Monitoring, Diagnostics, Therapeutics, and Imaging Devices. The Patient Monitoring segment holds the largest revenue share in 2025, due to the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders that require continuous monitoring.

The Diagnostics segment is expected to exhibit the fastest CAGR during the forecast period, supported by rising adoption of disposable biosensors in point-of-care testing and infectious disease detection.

- By Distribution Channel

On the basis of Distribution Channel, the Disposable Medical Devices Sensors market is segmented into Direct Sales and Tender Sales. Direct Sales are expected to dominate with the largest revenue share in 2025, as manufacturers increasingly establish direct partnerships with hospitals, diagnostic labs, and device integrators for faster supply and customized sensor solutions.

The Tender Sales segment is projected to witness the fastest growth during the forecast PERIOD, driven by large-scale government procurement of medical sensor components, particularly for public health initiatives and pandemic response programs

Disposable Medical Devices Sensors Market Regional Analysis

- Germany leads the Disposable Medical Devices Sensors market in Europe, capturing the largest revenue share of 25.6% in 2025. This leadership is driven by the country’s robust medical device manufacturing ecosystem, strong adoption of smart diagnostic tools, and a well-funded healthcare infrastructure. German hospitals and diagnostic labs increasingly rely on wearable and ingestible sensors for patient monitoring and chronic disease management.

- Government support for digital health transformation, coupled with research collaborations between sensor technology firms and academic institutions, accelerates innovation. Furthermore, Germany's focus on telemedicine and remote diagnostics post-COVID-19 boosts demand for disposable biosensors and temperature sensors in ambulatory and home care settings.

France Disposable Medical Devices Sensors Market Insight

France is expected to witness steady growth in the disposable medical device sensors market, supported by national e-health programs and increasing investments in medical technology startups. Hospitals and research centers in Paris, Lyon, and Toulouse are adopting implantable and strip-based sensors for diagnostics and continuous monitoring of cardiovascular, respiratory, and metabolic disorders.The country’s universal healthcare model and favorable reimbursement policies enhance accessibility to advanced sensor-based solutions. With growing focus on early detection and outpatient care, France is seeing widespread uptake of disposable accelerometers and biosensors in diagnostics and therapeutic applications.

U.K. Disposable Medical Devices Sensors Market Insight

The U.K. is projected to be the fastest-growing country in the European Disposable Medical Devices Sensors Market during the forecast period. Rising demand for home-based and community care, driven by NHS transformation initiatives, is fueling adoption of wearable and remote sensors for real-time health monitoring. Healthcare providers across London, Birmingham, and Glasgow are integrating temperature and pressure sensors into remote patient management systems. Regulatory clarity post-Brexit, government investments in AI and medtech startups, and the surge in chronic disease prevalence are accelerating the use of biosensors and ingestible sensors for decentralized diagnostics and therapeutics.

Disposable Medical Devices Sensors Market Share

The Disposable Medical Devices Sensors industry is primarily led by well-established companies, including:

- Medtronic plc (Ireland)

- Abbott Laboratories (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- Smiths Medical (U.K.)

- TE Connectivity Ltd. (Switzerland)

- ICU Medical, Inc. (U.S.)

- Sensirion AG (Switzerland)

- Honeywell International Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- First Sensor AG (Germany)

- Amphenol Advanced Sensors (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Medline Industries, LP (U.S.)

- Cardinal Health, Inc. (U.S)

Latest Developments in Europe Disposable Medical Devices Sensors Market

- In March 2025, Medtronic plc introduced a new line of single-use wearable biosensors for real-time glucose and cardiac monitoring in select European countries. These sensors integrate Bluetooth connectivity and are designed for remote patient care, addressing the rising demand for continuous monitoring solutions in outpatient and home settings.

- In November 2024, Philips Healthcare launched its disposable temperature and respiration sensors for use in emergency and critical care units across European hospitals. These devices are designed to reduce cross-contamination risks and enhance infection control protocols, particularly in high-risk clinical environments.

- In August 2024, NXP Semiconductors partnered with European telehealth startups to develop smart patch sensors that combine pressure and motion detection for musculoskeletal and elderly care monitoring. The collaboration highlights the growing adoption of multi-sensor platforms in wearable, disposable formats.

- In May 2024, STMicroelectronics rolled out a new generation of disposable biosensors for point-of-care diagnostics, compatible with lateral flow devices and microfluidic cartridges. The sensors enable rapid testing for infectious diseases and chronic condition biomarkers, catering to decentralized healthcare delivery.

- In January 2024, Gentag, Inc., in collaboration with German hospitals, began pilot testing NFC-enabled ingestible sensors for medication adherence tracking and gastrointestinal diagnostics. This marks a significant move toward precision medicine through disposable smart pill technologies in Europe.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.