Market Analysis and Size

E-commerce sector has grown rapidly in the past few years, especially during the outbreak of COVID-19. According to a report by the Fortune magazine Amazon has made over 100 million Prime subscribers across the globe due to its free and fast shipping feature. E-commerce is highly being adopted among consumers due to door to door delivery.

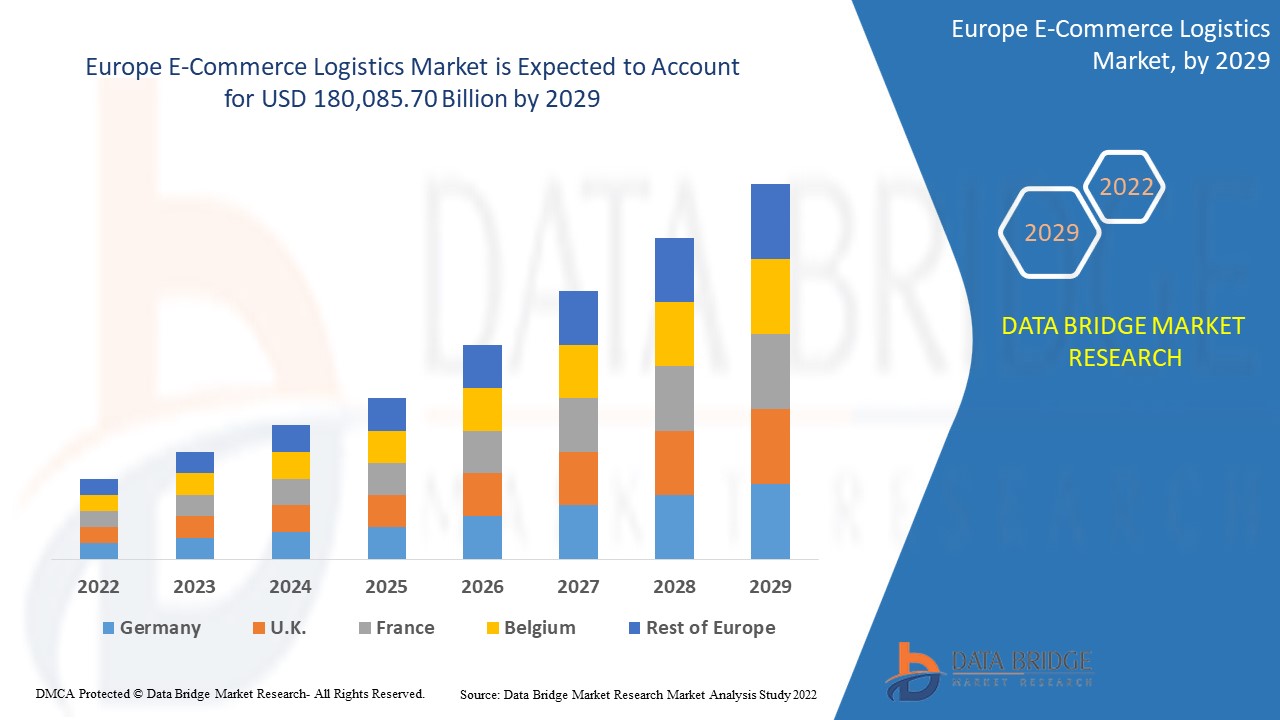

Europe E-Commerce Logistics Market was valued at USD 47,267.00 billion in 2021 and is expected to reach USD 180,085.70 billion by 2029, registering a CAGR of 14.20% during the forecast period of 2022-2029. “B2C” accounts for the largest end user segment due to the high purchase of personal use products. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

E-Commerce logistics, also known as logistics e-commerce or e-logistics, refer to the logistics of internet sales. This process includes setting up specific processes to respond to particular flow management. The logistics is generally accompanied by e-commerce transport that needs a a different organization of a retail transport.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Service Type (Transportation, Warehousing, Others), Product (Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products, Others), Operational Area (International, Domestic), End User (B2B, B2C) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, and Rest of Europe in Europe |

|

Market Players Covered |

FedEx (US), DHL International GmbH (Germany), Aramex (UAE), United Parcel Service of America, Inc. (US), XPO Logistics, Inc (US), CEVA Logistics (UK), SF Express (China), DPD (Germany), Agility (Kuwait), Clipper Logistics plc (UK), Blue Dart Express Limited (India), XpressBees (India), and Delhivery Limited (India), among others |

|

Market Opportunities |

|

E-Commerce Logistics Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Emergence of E-Commerce Websites

The rise in the emergence of numerous e-commerce websites and the availability of low-cost cargo acts and low-cost cargo is one of the major factors driving the e-commerce logistics market. The increase in the prominence of C2C and B2C e-commerce websites rising the demand for domestic as well as international logistics has a positive impact on the market.

- Sales of Foreign Goods

The surge in sales of foreign goods encouraging cross-border e-commerce activities accelerate the market growth. Also, the rise in the penetration of Internet of Things across the region making it feasible for consumers to purchase products online drives the market growth.

- Expansion of E-Commerce Sector

The rise in the e-commerce industry due to increased online purchase among consumers further influences the market. The increase in the popularity of e-commerce websites because of their fast delivery, door to door deliveries and high discounts assists in the expansion of the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the e-commerce logistics market.

Opportunities

Furthermore, incorporation of advanced technologies such as Artificial Intelligence (AI), Machine Learning (AI) and robotics in the logistics sector extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, an increase in number of smartphone sales will further expand the market.

Restraints/Challenges

On the other hand, regulatory issues and implementation of strict rules imposed by the European Union are expected to obstruct market growth. Also, concerns regarding system security are projected to challenge the e-commerce logistics market in the forecast period of 2022-2029.

This e-commerce logistics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on e-commerce logistics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on E-Commerce Logistics Market

COVID-19 positively impacted the e-commerce logistics market overall as consumers and businesses turned to online channels for their purchases during the lockdown. Business-to-consumers parcel delivery services witnessed a growth of 25% during the outbreak of pandemic. The strict lockdowns and social distancing encouraged people to adopt e-commerce websites for their purchase of essential and non-essential products. The market did face few challenges as well such as disruptions in supply chain. However, the e-commerce logistics market is expected to grow rapidly in the coming years due to increasing number of consumers adopting e-commerce sites to buy anything from cleaning supplies to groceries.

Recent Developments

- On 5th May’2022 Tata Motors launched the new Ace EV as a new addition in their -cargo transport solutions. This new launch is the electric counterpart of the 2005 launched Ace that was fossil-fuel-powered. These vehicles will be used to haul freight and offer logistical support for a host of e-commerce companies such as BigBasket, Amazon, DOT, LetsTransport, Flipkart, MoEVing, City Link, and Yelo EV.

Global E-Commerce Logistics Market Scope and Market Size

The e-commerce logistics market is segmented on the basis of service type, product, operational area and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Transportation

- Warehousing

- Others

Product

- Baby Products

- Personal Care Products

- Books

- Home Furnishing Products

- Apparel Products

- Electronics Products

- Automotive Products

- Others

Operational Area

- International

- Domestic

End User

- B2B

- B2C

E-Commerce Logistics Market Regional Analysis/Insights

The e-commerce logistics market is analysed and market size insights and trends are provided by country, type, services provided, and application as referred above.

The countries covered in the e-commerce logistics market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, and Rest of Europe in Europe.

France is ranking third largest e-commerce after the U.K. and Germany owing to factors such as internet penetration and share of internet users growing gradually in the region. The real estate market activity has been dynamic which is also boosting the market as per the requirement of XL warehouses which have grown in coordination with e-commerce.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and E-Commerce Logistics Market

The -commerce logistics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to -commerce logistics market.

Some of the major players operating in -commerce logistics market are

- FedEx (US)

- DHL International GmbH (Germany)

- Aramex (UAE)

- United Parcel Service of America, Inc. (US)

- XPO Logistics, Inc (US)

- CEVA Logistics (UK)

- SF Express (China)

- DPD (Germany)

- Agility (Kuwait)

- Clipper Logistics plc (UK)

- Blue Dart Express Limited (India)

- XpressBees (India)

- Delhivery Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE E-COMMERCE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 RESEARCH METHODOLOGY

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 SECONDARY SOURCES

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 BOOMING E-COMMERCE INDUSTRY

4.1.2 EXECUTION IN THIRD PARTY LOGISTICS (3PL)

4.1.3 ENHANCED RELATIONSHIPS BETWEEN SUPPLIERS & CUSTOMERS

4.2 RESTRAINTS

4.2.1 HIGH COST RELATED TO WAREHOUSE MANAGEMENT SOLUTIONS

4.2.2 REGULATORY ISSUES REGARDING GOVERNMENT REGULATIONS

4.3 OPPORTUNITY

4.3.1 EXTENDED EXECUTION OF SUPPLY CHAIN FOOTPRINT

4.4 CHALLENGES

4.4.1 CROSS BORDER E-COMMERCE/ONLINE SHOPPING

4.4.2 TRADE BARRIERS FOR TAXATION IN EU DIGITAL ECONOMY

5 EUROPE E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE

5.1 OVERVIEW

5.2 TRANSPORTATION

5.2.1 TRUCKING/OVER ROAD

5.2.2 AIRWAYS

5.2.3 RAIL

5.2.4 MARINE

5.3 WAREHOUSING

5.3.1 MEGA CENTERS

5.3.2 DELIVERY CENTERS

5.3.3 RETURN PROCESSING CENTERS

5.4 OTHERS

6 EUROPE E-COMMERCE LOGISTICS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 APPAREL PRODUCTS

6.3 ELECTRONICS PRODUCTS

6.4 PERSONAL CARE PRODUCTS

6.5 HOME FURNISHING PRODUCTS

6.6 BOOKS

6.7 BABY PRODUCTS

6.8 AUTOMOTIVE PRODUCTS

6.9 OTHERS

7 EUROPE E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA

7.1 OVERVIEW

7.2 DOMESTIC

7.2.1 URBAN

7.2.2 SEMI-URBAN

7.2.3 RURAL

7.3 INTERNATIONAL

8 EUROPE E-COMMERCE LOGISTICS MARKET, BY END USER

8.1 OVERVIEW

8.2 B2C

8.3 B2B

9 EUROPE E-COMMERCE LOGISTICS MARKET, BY COUNTRY

9.1 OVERVIEW

9.2 U.K.

9.3 GERMANY

9.4 FRANCE

9.5 ITALY

9.6 SPAIN

9.7 REST OF EUROPE

10 EUROPE E-COMMERCE LOGISTICS MARKET, COMPANY LANDSCAPE

11 COMPANY PROFILE

11.1 DHL INTERNATIONAL GMBH

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 SERVICE PORTFOLIO

11.1.4 RECENT DEVELOPMENTS

11.2 DPD

11.2.1 COMPANY SNAPSHOT

11.2.2 SERVICE PORTFOLIO

11.2.3 RECENT DEVELOPMENT

11.3 FEDEX

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 SERVICE PORTFOLIO

11.3.4 RECENT DEVELOPMENTS

11.4 CEVA LOGISTICS

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 SERVICE PORTFOLIO

11.4.4 RECENT DEVELOPMENT

11.5 UNITED PARCEL SERVICE OF AMERICA, INC.

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 SERVICE PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 AGILITY

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 SERVICE PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 ARAMEX

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 SERVICE PORTFOLIO

11.7.4 RECENT DEVELOPMENT

11.8 CLIPPER LOGISTICS PLC

11.8.1 COMPANY SNAPSHOT

11.8.2 REVENUE ANALYSIS

11.8.3 SERVICE PORTFOLIO

11.8.4 RECENT DEVELOPMENTS

11.9 SF EXPRESS

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 SERVICE PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 XPO LOGISTICS, INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 REVENUE ANALYSIS

11.10.3 SERVICE PORTFOLIO

11.10.4 RECENT DEVELOPMENT

12 CONCLUSION

List of Table

List of Table

TABLE 1. EUROPE E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 2. EUROPE TRANSPORTATION IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 3. EUROPE WAREHOUSING IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 4. EUROPE E-COMMERCE LOGISTICS MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 5. EUROPE E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 6. EUROPE DOMESTIC IN E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 7. EUROPE E-COMMERCE LOGISTICS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 8. EUROPE E-COMMERCE LOGISTICS MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 9. U.K. E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 10. U.K. TRANSPORTATION IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 11. U.K. WAREHOUSING IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 12. U.K. E-COMMERCE LOGISTICS MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 13. U.K. E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 14. U.K. DOMESTIC IN E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 15. U.K. E-COMMERCE LOGISTICS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 16. GERMANY E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 17. GERMANY TRANSPORTATION IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 18. GERMANY WAREHOUSING IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 19. GERMANY E-COMMERCE LOGISTICS MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 20. GERMANY E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 21. GERMANY DOMESTIC IN E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 22. GERMANY E-COMMERCE LOGISTICS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 23. EUROPE E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 24. FRANCE TRANSPORTATION IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 25. FRANCE WAREHOUSING IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 26. FRANCE E-COMMERCE LOGISTICS MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 27. FRANCE E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 28. FRANCE DOMESTIC IN E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 29. FRANCE E-COMMERCE LOGISTICS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 30. ITALY E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 31. ITALY TRANSPORTATION IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 32. ITALY WAREHOUSING IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 33. ITALY E-COMMERCE LOGISTICS MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 34. ITALY E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 35. ITALY DOMESTIC IN E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 36. ITALY E-COMMERCE LOGISTICS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 37. SPAIN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 38. SPAIN TRANSPORTATION IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 39. SPAIN WAREHOUSING IN E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2018-2027 (USD MILLION)

TABLE 40. SPAIN E-COMMERCE LOGISTICS MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 41. SPAIN E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 42. SPAIN DOMESTIC IN E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2018-2027 (USD MILLION)

TABLE 43. SPAIN E-COMMERCE LOGISTICS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 44. REST OF EUROPE E-COMMERCE LOGISTICS MARKET, BY TYPE, 2018-2027 (USD MILLION)

List of Figure

List of Figure

FIGURE 1. EUROPE E-COMMERCE LOGISTICS MARKET: SEGMENTATION

FIGURE 2. EUROPE E-COMMERCE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3. EUROPE E-COMMERCE LOGISTICS MARKET: RESEARCH SNAPSHOT

FIGURE 4. EUROPE E-COMMERCE LOGISTICS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5. EUROPE E-COMMERCE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6. EUROPE E-COMMERCE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7. RAPID BOOMING OF E-COMMERCE INDUSTRY, RELATIONSHIP BETWEEN CUSTOMER & SUPPLIER ALONG WITH EXECUTION IN THIRD PARTY LOGISTICS IS EXPECTED TO DRIVE EUROPE E-COMMERCE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 8. DRIVERS, RESTRAINTS, OPPORTUNITY AND CHALLENGES OF EUROPE E-COMMERCE LOGISTICS MARKET

FIGURE 9. EUROPE E-COMMERCE LOGISTICS MARKET, BY SERVICE TYPE, 2019

FIGURE 10. EUROPE E-COMMERCE LOGISTICS MARKET, BY PRODUCT, 2019

FIGURE 11. EUROPE E-COMMERCE LOGISTICS MARKET, BY OPERATIONAL AREA, 2019

FIGURE 12. EUROPE E-COMMERCE LOGISTICS MARKET, BY END USER, 2019

FIGURE 13. EUROPE E-COMMERCE LOGISTICS MARKET: SNAPSHOT (2019)

FIGURE 14. EUROPE E-COMMERCE LOGISTICS MARKET: COMPANY SHARE 2019 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.