Europe Electric Vehicle Market

Market Size in USD Million

CAGR :

%

USD

102,051.11 Million

USD

612,175.87 Million

2022

2030

USD

102,051.11 Million

USD

612,175.87 Million

2022

2030

| 2023 –2030 | |

| USD 102,051.11 Million | |

| USD 612,175.87 Million | |

|

|

|

Europe Electric Vehicle Market Analysis and Size

The increase in the promotion of electric vehicles by different government authorities plays an important role in the market growth. Increasing awareness about the negative impact of conventional vehicles on the environment from the emission of harmful gases encourages the market's growth. The ”battery electric vehicles (BEVs)“ is expected to be the fastest growing propulsion type segment due to their potential benefits such as energy security concerns, control over greenhouse gas (GHG) emissions, and control over local pollutants.

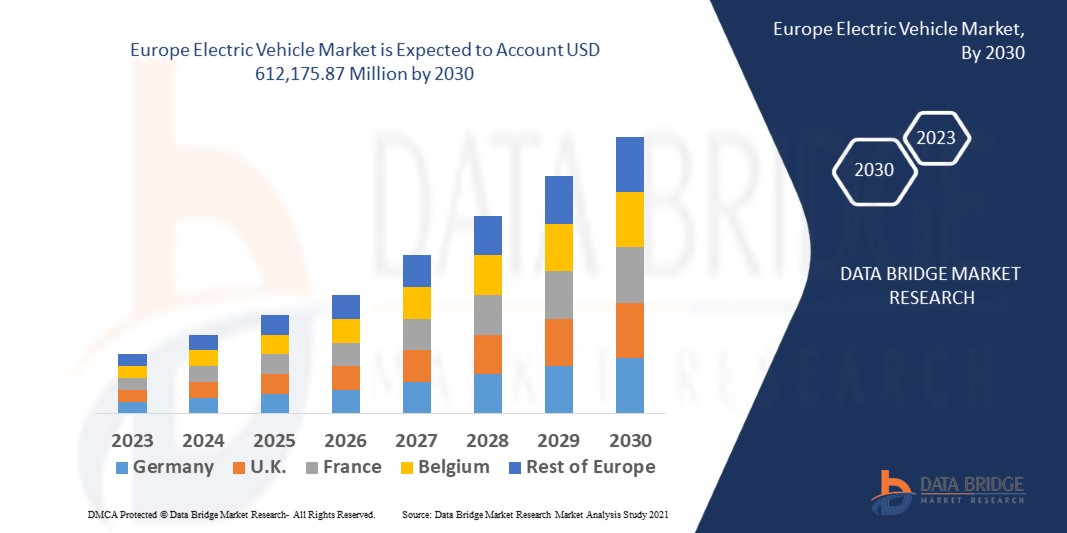

Data Bridge Market Research analyses that the electric vehicle market is expected to reach USD 612,175.87 million by 2030, which is USD 102,051.11 million in 2022, at a CAGR of 25.10% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Europe Electric Vehicle Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Battery Cells & Packs, On-Board Charger, Infotainment System, Others), Propulsion Type (Plug-In Hybrid Electric Vehicles (PHEVs), Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicles (FCEVs), Charging Station Type (Normal Charging, Super Charging), Class (Mid-Priced, Luxury), Power Train (Parallel Hybrid, Series Hybrid, Combined Hybrid), Vehicle Type (Passenger Cars, Two Wheelers, Commercial Vehicles) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

Ford Motor Company (U.S.), General Motors (U.S.), AUDI AG (Germany), Kia Motors Corporation (South Korea), Groupe Renault (France), Groupe PSA (France), SAIC Motor Corporation Limited (China), Tesla (U.S.), Daimler AG (Germany), BMW AG (Germany), Hyundai Motor Company (South Korea), BYD Company Ltd. (China), Continental AG (Germany), TOYOTA MOTOR CORPORATION (Japan), Nissan Motor Co., LTD. (Japan), Volkswagen AG (Germany), AB Volvo (Sweden), Honda Motor Co., Ltd. (Japan) |

|

Market Opportunities |

|

Market Definition

Electric vehicles offer various advantages over conventional fuel-based vehicles such as zero carbon emission, low operational cost and others. Electric vehicles operate on an electric motor at the place of internal-combustion engine which produces power by burning gases or fuel.

Europe Electric Vehicle Market Dynamics

Drivers

- Rising government towards plug in electric vehicles

Several government initiatives to adopt plug-in electric vehicles are expected to drive the growth for the market. For instance, Cleartax.in stated that they offers financial services, in May 2021, the Indian government has declared the incentive for purchase of electric vehicle under the 2019 union budget. A new section 80EEB has been introduced for registered e-vehicles and advanced battery that offers deduction on interest on the loan of electric vehicle. All these factors are projected to drive the growth for the market during the forecast period.

- Increasing demand for hybrid electric vehicle

The demand for hybrid electric vehicle increases because these vehicles offer electric motor and conventional engine. At higher speeds gas engine power is used and lower speeds electric engine power is used, which saves fuel and has low carbon emissions. Furthermore, hybrid car has regenerative braking system helps every time when the brake is applied during driving. Therefore, increasing demand for hybrid electric vehicles is anticipated to drive market growth during the forecast period.

Opportunities

- Rising number of initiatives to increase the sale of electric vehicles

A significant number of initiatives taken by government of various nations, such as subsidies & grants, tax rebates and other non-financial benefits in car registration will expected to increase the sale of electric vehicles and create numerous opportunities for the market growth during the forecast period. For instance, German car manufacturers have increased their cash incentives in 2019, for electric cars to move away from combustion engines to battery-powered engines to decrease emission of harmful gases. Different European countries have registered major growth in the sale of electric vehicles during the forecast period, contributing to the market growth.

- Increasing technological advancements associated with electric vehicle

There are various significant opportunities for battery providers and automakers in the global electric vehicle market. For instance, automobile manufacturers could design their vehicles to operate in multiple modes, offer a broad range of features and deploy charging infrastructure. Similarly, battery providers could focus on enabling augmented battery performance and range and evolving cost-effective solutions for automotive applications.

Restraints

- Lack of standardization among countries

Lack of standardization among countries may affect the charging station connections and hamper the growth of the market. Using various charging standards creates a problem to harmonizing electric vehicle charging stations worldwide. As a result, the lack of standardization hampers the growth of the market during the forecast period.

This electric vehicle market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the electric vehicle market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In 2021, BYD launched four new electric vehicle models that are manufactured with Blade batteries in Chongqing. These new vehicle models are Tang EV and Song plus EV, Qin plus EV, E2 2021, and are available in the market with advanced battery safety features.

- In 2021, Volkswagen launched 7 seater EV ID.6 Crozz and ID.6 X along with SAIC and FAW in China. The vehicles come in two battery versions, including 77 kWh and 58 kWh along with four powertrain configurations.

Europe Electric Vehicle Market Scope

The electric vehicle market is segmented based on the component, propulsion type, charging station type, class, power train and vehicle type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Battery Cells & Packs

- On-Board Charger

- Infotainment System

- Others

Propulsion Type

- Plug-In Hybrid Electric Vehicles (PHEVs)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Charging Station Type

- Normal Charging

- Super Charging

Class

- Mid-Priced

- Luxury

Power Train

- Parallel Hybrid

- Series Hybrid

- Combined Hybrid

Vehicle Type

- Passenger Cars

- Two Wheelers

- Commercial Vehicles

Electric Vehicle Market Regional Analysis/Insights

The electric vehicle market is analyzed and market size insights and trends are provided by country, component, propulsion type, charging station type, class, power train and vehicle type as referenced above.

The countries covered in the electric vehicle market report are report Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany dominates the electric vehicle market in terms of revenue growth and market share owing to high investments from major market players to make affordable electric vehicle in this region. Moreover, prevalence of incentives in the form of subsidies by the government for the adoption of electric vehicle will further boost the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Electric Vehicle Market Share Analysis

The electric vehicle market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to electric vehicle market.

Some of the major players operating in the electric vehicle market are:

- Ford Motor Company (U.S.)

- General Motors (U.S.)

- AUDI AG (Germany)

- Kia Motors Corporation (South Korea)

- Groupe Renault (France)

- Groupe PSA (France)

- SAIC Motor Corporation Limited (China)

- Tesla (U.S.)

- Daimler AG (Germany)

- BMW AG (Germany)

- Hyundai Motor Company (South Korea)

- BYD Company Ltd. (China)

- Continental AG (Germany)

- TOYOTA MOTOR CORPORATION (Japan)

- Nissan Motor Co., LTD. (Japan)

- Volkswagen AG (Germany)

- AB Volvo (Sweden)

- Honda Motor Co., Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.