Europe Electrical Steel Market

Market Size in USD Billion

CAGR :

%

USD

3.20 Billion

USD

4.99 Billion

2021

2029

USD

3.20 Billion

USD

4.99 Billion

2021

2029

| 2022 –2029 | |

| USD 3.20 Billion | |

| USD 4.99 Billion | |

|

|

|

|

Europe Electrical Steel Market Analysis and Size

The rising demands for electrical steel across major sectors is the vital factor boosting the growth of the market over the forecasted period of 2022-2029. For instance, in 2021, revenue in electrical steel market's energy sector increased quickly. Moreover, the rise in non-grain electrical steel segment and the construction of thermal power plants are also the factors boosting the growth of the market over the forecasted period.

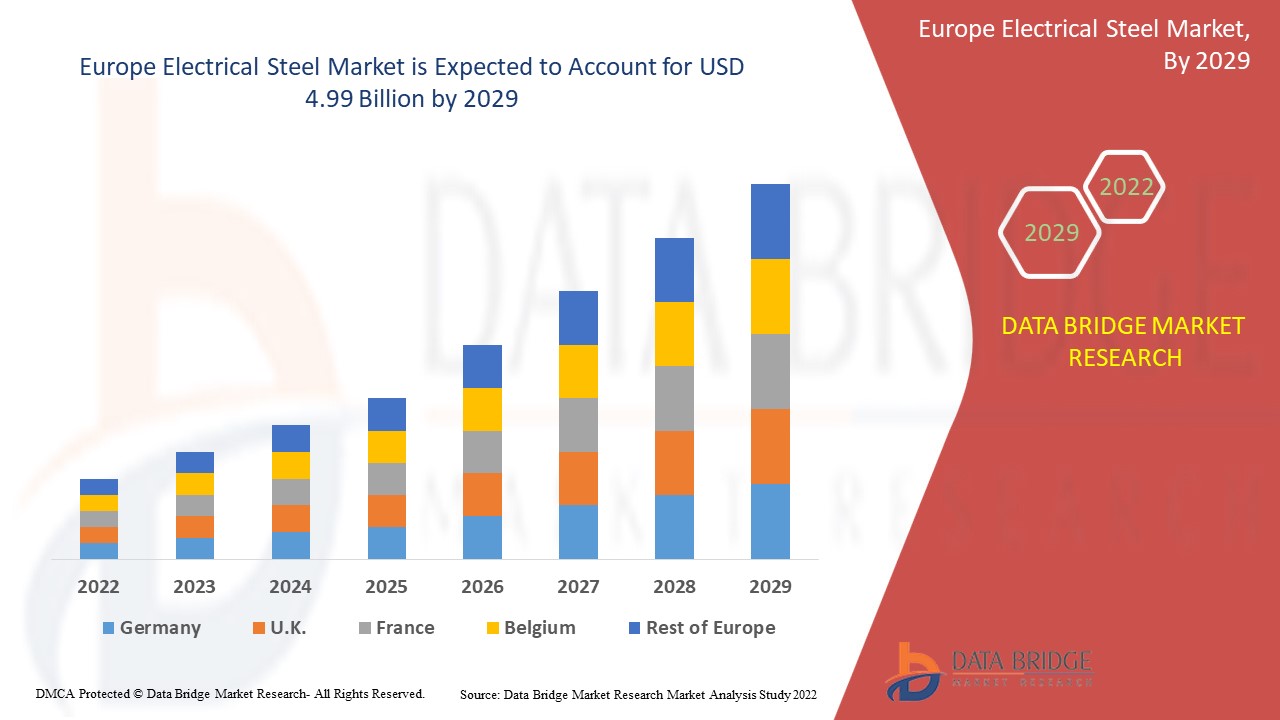

The global electrical steel market was valued at USD 3.20 billion in 2021 and is expected to reach USD 4.99 billion by 2029, registering a CAGR of 5.70% during the forecast period of 2022-2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Electrical Steel Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Grain Oriented Electrical Steel, Non-Grain Oriented Electrical Steel), Application (Inductors, Motors, Transformers), Thickness (0.23 mm, 0.27 mm, 0.30 mm, 0.35 mm, 0.5 mm, 0.65 mm, Others), Core Losses (Less Than 0.9 w/kg, 90 w/kg to 0.99 w/kg, 1.00 w/kg to 1.29 w/kg, 1.30 w/kg to 1.39 w/kg and Above 1.39 w/kg), Flux Density (Less Than 1.65 Tesla, 1.65 Tesla to 1.69 Tesla, 1.69 Tesla to 1.73 Tesla, 1.73 Tesla to 1.76 Tesla and Above 1.76 Tesla), End User (Automotive, Manufacturing, Energy, Household Appliance, Construction, Fabrication) |

|

Countries Covered |

Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe |

|

Market Players Covered |

Akzo Nobel N.V. (Netherlands), PPG Industries Inc., (U.S.), The Sherwin-Williams Company (U.S.), RPM International Inc., (U.S.), NIPSEA GROUP (Japan), Arkema (France), Cardolite Corporation (U.S.), BASF SE (Germany), Evonik Industries AG (Germany), Reichhold LLC 2, (U.S.), DSM (Netherlands), Qualipoly Chemical Corp. (Taiwan), Arakawa Chemical Industries,Ltd. (Japan), Alberdingk Boley (U.S.), Eternal Materials Co.,Ltd. (Taiwan), Wacker Chemie AG (Japan) and DIC CORPORATION (Japan) |

|

Market Opportunities |

|

Market Definition

Electrical steel is a magnetic material with enhanced electrical properties and is widely used across applications such as small relays, solenoids, electric motors, generators and other electromagnetic devices. They can decrease the dissipation of heat, an issue that results in energy wastage. They are actively being used in the interior decoration and can be folded and painted easily. They have a wide range of applications in batteries and home appliances as well.

Europe Electrical Steel Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High usage for construction purposes

Aluminum coatings are extensively used across construction industries. They are widely used in the building and construction sector to set the electric flow of current from the grid to domestic places through electrical steel rods, increasing its demands in developing regions. The expansion of end-use industries, coupled with the increase in urbanization and population, will further propel the growth rate of the electrical steel market.

Opportunities

- Rising benefits of electrical steel

Electrical steel is a soft magnetic material with enhanced electrical properties that create certain lucrative growth opportunities over the forecasted period. Electrical steel is widely used across applications such as small relays, solenoids, electric motors, generators, and other electromagnetic devices. They are also silicon or lamination steel and are mainly used in the construction or automotive sectors. The most widely used commercially available electrical steel contains about 3.25% Si as higher silicon content, proving to be an improved solution for enhanced magnetic and electrical properties. These latest technological innovations and developments will further expand the market's future growth.

Restraints/Challenges

- Fluctuations in raw material prices

The inconsistent raw material prices have a direct negative impact on the overall market's growth. The rising prices of steel have majorly negatively impacted the market. As a result, these fluctuations will pose a major challenge to the aluminum coatings market growth rate.

This electrical steel market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the electrical steel market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Electrical Steel Market

The recent outbreak of coronavirus harmed the electrical steel market. The market faced disruption in supply chains, lesser availability of workforce, fluctuations in prices, and availability of raw materials, which hampered the market largely. However, with the gradual upliftment of restriction and restoration of business operations, the steel industry is expected to grow steadily. Also, the market is estimated to revive as individual regulatory bodies relax these enforced lockdowns. The suspended and canceled operations will continue, and the market is estimated to expand

Recent Developments

- In 2021, JFE Steel Corporation signed a memorandum with JSW Steel Limited (JSW) to perform a feasibility study to develop a grain-oriented electrical steel sheet production and sales joint-venture firm in India.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Europe Electrical Steel Market Scope

The electrical steel market is segmented on the basis of product type, application, thickness, core losses, flux density and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Grain Oriented Electrical Steel

- Non-Grain Oriented Electrical Steel

- Fully Processed

- Semi-Processed

Application

- Inductors

- Motors

- 1 HP – 100 HP

- 101 HP – 200 HP

- 201 HP – 500 HP

- 501 HP – 1000 HP

- Above 1000 HP

- Transformers

- Transmission

- Portable

- Distribution

Thickness

- 0.23 mm

- 0.27 mm

- 0.30 mm

- 0.35 mm

- 0.5 mm

- 0.65 mm

- Others

Core Losses

- Less Than 0.9 w/kg

- 90 w/kg to 0.99 w/kg

- w/kg to 1.29 w/kg

- 1.30 w/kg to 1.39 w/kg

- Above 1.39 w/kg

Flux Density

- Less Than 1.65 Tesla

- 1.65 Tesla to 1.69 Tesla

- 1.69 Tesla to 1.73 Tesla

- 1.73 Tesla to 1.76 Tesla

- Above 1.76 Tesla

End User

- Automotive

- Manufacturing

- Energy

- Household Appliance

- Construction

- Fabrication

Electrical Steel Market Regional Analysis/Insights

The electrical steel market is analyzed and market size insights and trends are provided by product type, applications, thickness, core losses, flux density and end user as referenced above.

The countries covered in the electrical steel market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany dominates the market in terms of market share and market revenue and will continue to flourish dominance during the forecast period of 2022-2029. The market growth in this region is attributed to the increasing demand by power generation industries within the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Electrical Steel Market Share Analysis

The electrical steel market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to electrical steel market.

Some of the major players operating in the electrical steel market are

- AkzoNobel N.V. (Netherlands)

- PPG Industries Inc., (U.S.)

- The Sherwin-Williams Company (U.S.)

- RPM International Inc., (U.S.)

- NIPSEA GROUP (Japan)

- Arkema (France)

- Cardolite Corporation (U.S.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Reichhold LLC 2, (U.S.)

- DSM (Netherlands)

- Qualipoly Chemical Corp. (Taiwan)

- Arakawa Chemical Industries,Ltd. (Japan)

- Alberdingk Boley (U.S.)

- Eternal Materials Co.,Ltd. (Taiwan)

- Wacker Chemie AG (Japan)

- DIC CORPORATION (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ELECTRICAL STEEL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE ELECTRICAL STEEL MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 EUROPE ELECTRICAL STEEL MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 INDUSTRY INSIGHTS

11 EUROPE ELECTRICAL STEEL MARKET , BY PRODUCT TYPE, (2021-2030), (USD MILLION)

11.1 OVERVIEW

11.2 GRAIN ORIENTED ELECTRICAL STEEL

11.3 NON-GRAIN ORIENTED ELECTRICAL STEEL

11.3.1 FULLY PROCESSED

11.3.2 SEMI-PROCESSED

12 EUROPE ELECTRICAL STEEL MARKET , BY THICKNESS, (2021-2030), (USD MILLION)

12.1 OVERVIEW

12.2 0.23 MM

12.3 0.27 M

12.4 0.30 MM

12.5 0.35 MM

12.6 0.5 MM

12.7 0.65 MM

12.8 OTHERS

13 EUROPE ELECTRICAL STEEL MARKET , BY CORE LOSSES, (2021-2030), (USD MILLION)

13.1 OVERVIEW

13.2 LESS THAN 0.9 W/KG

13.3 90 W/KG TO 0.99 W/KG

13.4 1.00 W/KG TO 1.29 W/KG

13.5 1.30 W/KG TO 1.39 W/KG

13.6 ABOVE 1.39 W/KG

14 EUROPE ELECTRICAL STEEL MARKET , BY FLUX DENSITY, (2021-2030), (USD MILLION)

14.1 OVERVIEW

14.2 LESS THAN 1.65 TESLA

14.3 1.65 TESLA TO 1.69 TESLA

14.4 1.69 TESLA TO 1.73 TESLA

14.5 1.73 TESLA TO 1.76 TESLA

14.6 ABOVE 1.76 TESLA

15 EUROPE ELECTRICAL STEEL MARKET , BY APPLICATION, (2021-2030), (USD MILLION)

15.1 OVERVIEW

15.2 INDUCTORS

15.2.1 BY PRODUCT TYPE

15.2.1.1. GRAIN ORIENTED ELECTRICAL STEEL

15.2.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

15.3 MOTORS

15.3.1 BY PRODUCT TYPE

15.3.1.1. GRAIN ORIENTED ELECTRICAL STEEL

15.3.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

15.3.2 1 HP – 100 HP

15.3.3 101 HP – 200 HP

15.3.4 201 HP – 500 HP

15.3.5 501 HP – 1000 HP

15.3.6 ABOVE 1000 HP

15.4 TRANSFORMERS

15.4.1 BY PRODUCT TYPE

15.4.1.1. GRAIN ORIENTED ELECTRICAL STEEL

15.4.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

15.4.2 TRANSMISSION

15.4.3 PORTABLE

15.4.4 DISTRIBUTION

16 EUROPE ELECTRICAL STEEL MARKET , BY END USER, (2021-2030), (USD MILLION)

16.1 OVERVIEW

16.2 AUTOMOTIVE

16.2.1 BY PRODUCT TYPE

16.2.1.1. GRAIN ORIENTED ELECTRICAL STEEL

16.2.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

16.3 MANUFACTURING

16.3.1 BY PRODUCT TYPE

16.3.1.1. GRAIN ORIENTED ELECTRICAL STEEL

16.3.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

16.4 ENERGY

16.4.1 BY PRODUCT TYPE

16.4.1.1. GRAIN ORIENTED ELECTRICAL STEEL

16.4.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

16.5 HOUSEHOLD APPLIANCE

16.5.1 BY PRODUCT TYPE

16.5.1.1. GRAIN ORIENTED ELECTRICAL STEEL

16.5.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

16.6 CONSTRUCTION

16.6.1 BY PRODUCT TYPE

16.6.1.1. GRAIN ORIENTED ELECTRICAL STEEL

16.6.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

16.7 FABRICATION

16.7.1 BY PRODUCT TYPE

16.7.1.1. GRAIN ORIENTED ELECTRICAL STEEL

16.7.1.2. NON-GRAIN ORIENTED ELECTRICAL STEEL

17 EUROPE ELECTRICAL STEEL MARKET , BY GEOGRAPHY

17.1 EUROPE ELECTRICAL STEEL MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.2 EUROPE

17.2.1 GERMANY

17.2.2 U.K.

17.2.3 ITALY

17.2.4 FRANCE

17.2.5 SPAIN

17.2.6 SWITZERLAND

17.2.7 RUSSIA

17.2.8 TURKEY

17.2.9 BELGIUM

17.2.10 NETHERLANDS

17.2.11 REST OF EUROPE

18 EUROPE ELECTRICAL STEEL MARKET , COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: EUROPE

18.2 MERGERS & ACQUISITIONS

18.3 NEW PRODUCT DEVELOPMENT & APPROVALS

18.4 EXPANSIONS

18.5 REGULATORY CHANGES

18.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 SWOT ANALYSIS AND DATA BRIDGE MARKET RESEARCH ANALYSIS

20 EUROPE ELECTRICAL STEEL MARKET - COMPANY PROFILE

20.1 AKZONOBEL N.V.

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 SWOT ANALYSIS

20.1.4 REVENUE ANALYSIS

20.1.5 RECENT UPDATES

20.2 PPG INDUSTRIES INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 SWOT ANALYSIS

20.2.4 REVENUE ANALYSIS

20.2.5 RECENT UPDATES

20.3 THE SHERWIN-WILLIAMS COMPANY

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 SWOT ANALYSIS

20.3.4 REVENUE ANALYSIS

20.3.5 RECENT UPDATES

20.4 RPM INTERNATIONAL INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 SWOT ANALYSIS

20.4.4 REVENUE ANALYSIS

20.4.5 RECENT UPDATES

20.5 NIPSEA GROUP

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 SWOT ANALYSIS

20.5.4 REVENUE ANALYSIS

20.5.5 RECENT UPDATES

20.6 ARKEMA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 SWOT ANALYSIS

20.6.4 REVENUE ANALYSIS

20.6.5 RECENT UPDATES

20.7 CARDOLITE CORPORATION

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 SWOT ANALYSIS

20.7.4 REVENUE ANALYSIS

20.7.5 RECENT UPDATES

20.8 BASF SE

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 SWOT ANALYSIS

20.8.4 REVENUE ANALYSIS

20.8.5 RECENT UPDATES

20.9 EVONIK INDUSTRIES AG

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 SWOT ANALYSIS

20.9.4 REVENUE ANALYSIS

20.9.5 RECENT UPDATES

20.1 REICHHOLD LLC 2

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 SWOT ANALYSIS

20.10.4 REVENUE ANALYSIS

20.10.5 RECENT UPDATES

20.11 DSM

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 SWOT ANALYSIS

20.11.4 REVENUE ANALYSIS

20.11.5 RECENT UPDATES

20.12 QUALIPOLY CHEMICAL CORP

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 SWOT ANALYSIS

20.12.4 REVENUE ANALYSIS

20.12.5 RECENT UPDATES

20.13 ARAKAWA CHEMICAL INDUSTRIES,LTD.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 SWOT ANALYSIS

20.13.4 REVENUE ANALYSIS

20.13.5 RECENT UPDATES

20.14 ALBERDINGK BOLEY

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 SWOT ANALYSIS

20.14.4 REVENUE ANALYSIS

20.14.5 RECENT UPDATES

20.15 ETERNAL MATERIALS CO.,LTD.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 SWOT ANALYSIS

20.15.4 REVENUE ANALYSIS

20.15.5 RECENT UPDATES

20.16 WACKER CHEMIE AG

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 SWOT ANALYSIS

20.16.4 REVENUE ANALYSIS

20.16.5 RECENT UPDATES

20.17 DIC CORPORATION

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 SWOT ANALYSIS

20.17.4 REVENUE ANALYSIS

20.17.5 RECENT UPDATES

21 QUESTIONNAIRE

22 CONCLUSION

23 RELATED REPORTS

24 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Electrical Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Electrical Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Electrical Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.