Global Coronavirus Test Kits Market

Market Size in USD Billion

CAGR :

%

USD

15.33 Billion

USD

67.23 Billion

2024

2032

USD

15.33 Billion

USD

67.23 Billion

2024

2032

| 2025 –2032 | |

| USD 15.33 Billion | |

| USD 67.23 Billion | |

|

|

|

|

Coronavirus Test Kits Market Size

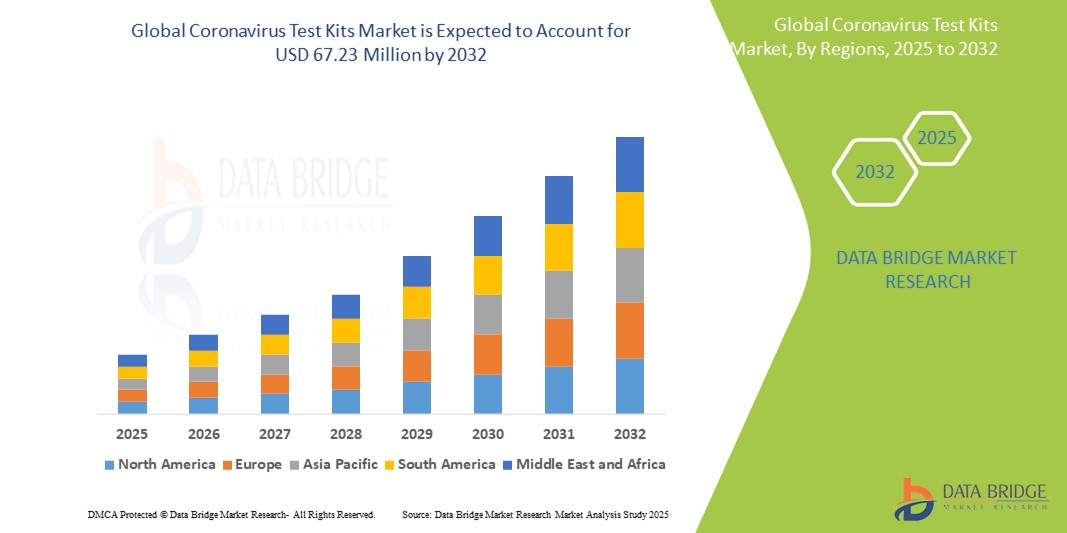

- The global coronavirus test kits market was valued at USD 15.33 billion in 2024 and is expected to reach USD 67.23 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 20.30%, primarily driven by the ongoing demand for diagnostic tools and innovations in testing technology

- This growth is driven by factors such as the continued need for pandemic preparedness, increasing awareness of infectious disease testing, and advancements in rapid and accurate diagnostic solutions

Coronavirus Test Kits Market Analysis

- Coronavirus test kits are essential diagnostic tools used to detect SARS-CoV-2 infections, playing a critical role in controlling the spread of COVID-19 and related respiratory diseases. These kits include RT-PCR tests, antigen tests, and antibody tests, each serving specific diagnostic needs

- The demand for coronavirus test kits is significantly driven by factors such as the emergence of new variants, government policies on testing, and the continued focus on pandemic preparedness. Widespread adoption of rapid and at-home testing has further fueled market expansion, particularly in regions with high population densities and frequent international travel

- The North America region stands out as one of the dominant markets for coronavirus test kits, driven by strong healthcare infrastructure, high testing rates, and government initiatives to ensure mass testing availability

- For instance, the U.S. government has consistently invested in COVID-19 testing programs, including free test kit distribution and partnerships with healthcare providers to increase accessibility

- Globally, coronavirus test kits rank among the most crucial diagnostic tools in infectious disease management, alongside influenza and tuberculosis testing systems. They continue to play a pivotal role in public health strategies, ensuring timely detection, containment, and treatment of COVID-19 cases

Report Scope and Coronavirus Test Kits Market Segmentation

|

Attributes |

Coronavirus Test Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Coronavirus Test Kits Market Trends

“Advancements in Rapid and At-Home Testing”

- One prominent trend in the global Coronavirus Test Kits Market is the increased adoption of rapid and at-home testing solutions

- These innovations enhance accessibility and convenience by providing quick, reliable results without requiring laboratory processing, making testing more efficient in both clinical and non-clinical settings

- For instance, In December 2020, Abbott's BinaxNOW COVID-19 Rapid Test was granted FDA Emergency Use Authorization for virtually guided at-home testing. This innovation leverages eMed's digital health platform, enabling users to conduct the test at home with professional telehealth guidance, providing rapid results in minutes

- At-home testing solutions have gained widespread acceptance, allowing individuals to monitor their health status easily, reducing the burden on healthcare facilities, and enabling early detection and isolation of cases

- This trend is transforming the diagnostic landscape, improving disease surveillance, and driving demand for innovative, user-friendly, and highly accurate test kits in the global market

Coronavirus Test Kits Market Dynamics

Driver

“Growing Demand Driven by Public Health Awareness and Technological Advancements”

- The persistent need for efficient and accurate diagnostic tools in the wake of the COVID-19 pandemic is a major driver of growth in the global coronavirus test kits market

- Increasing public health awareness and the emphasis on early disease detection have led to a surge in demand for rapid, reliable, and easily accessible test kits, including antigen, antibody, and PCR-based kits

- Governments and healthcare organizations across the globe continue to invest heavily in expanding testing capacities and preparedness for potential future outbreaks, reinforcing market demand

- Technological advancements in diagnostic testing, such as at-home self-test kits, digital result tracking, and AI-integrated diagnostic platforms, are improving testing speed, convenience, and accuracy—fueling further adoption

- The growing emphasis on decentralized and point-of-care testing, especially in rural and resource-limited regions, is also boosting the development and deployment of innovative, portable testing solutions

For instance,

- In January 2024, Abbott launched an upgraded version of its BinaxNOW COVID-19 Self Test with enhanced sensitivity and a digitally connected result-sharing feature, catering to the growing need for convenient and accurate at-home testing .

- In July 2023, Roche received emergency use authorization (EUA) for its new multiplex PCR test that detects COVID-19, influenza A/B, and RSV simultaneously—showcasing the trend toward multi-pathogen detection to streamline diagnostics

- As a result of continued vigilance around global public health, increasing awareness, and advancing technologies, there is sustained demand for rapid, user-friendly, and cost-effective coronavirus test kits—ensuring market stability even in post-pandemic conditions

Opportunity

“Enhancing Diagnostic Accuracy with Artificial Intelligence Integration”

- AI-powered coronavirus test kits can enhance diagnostic accuracy, automate result interpretation, and improve efficiency, enabling healthcare providers to make faster and more informed decisions

- AI algorithms can analyze test results in real time, reducing the likelihood of false positives or negatives and ensuring greater reliability in diagnosing COVID-19 and other respiratory infections

- AI-powered test kits can assist in data analysis, enabling healthcare professionals to track infection trends, identify emerging variants, and improve disease surveillance and response strategies

For instance,

- In January 2025, according to an article published in The Lancet Digital Health, AI-driven diagnostic tools have demonstrated high accuracy in detecting SARS-CoV-2 infections, significantly reducing the need for confirmatory laboratory testing. AI-integrated testing systems help streamline workflows, allowing for quicker and more efficient screening of large populations

- In November 2023, according to an article published in the National Library of Medicine, AI-powered test kits played a crucial role in optimizing diagnostic workflows by analyzing patient samples, detecting viral mutations, and improving test specificity and sensitivity. The ability of AI to identify new variants early has been instrumental in guiding public health responses and containment strategies

- The integration of AI in coronavirus test kits can lead to improved testing accuracy, faster result turnaround times, and enhanced pandemic preparedness. By leveraging AI-powered data analysis, healthcare systems can identify outbreaks early, implement targeted interventions, and reduce the impact of infectious diseases on global populations

Restraint/Challenge

“High Costs of Advanced Testing Kits Hindering Market Penetration”

- The high cost of advanced coronavirus test kits poses a significant challenge for market growth, particularly impacting the accessibility of testing in low- and middle-income countries

- Sophisticated diagnostic kits, such as RT-PCR and AI-integrated testing solutions, can be expensive, often requiring specialized laboratory equipment and trained personnel, making large-scale deployment financially challenging

- This substantial financial barrier can deter healthcare facilities, particularly in resource-limited settings, from adopting the latest testing technologies, leading to continued reliance on conventional or less accurate testing methods

For instance,

- In November 2024, according to an article published by the World Health Organization (WHO), the high cost of COVID-19 diagnostic kits remains a key concern, particularly in developing countries where healthcare budgets are constrained. The affordability of these kits directly affects testing accessibility, limiting the ability to conduct widespread screening and early detection efforts

- Consequently, such limitations can result in disparities in access to high-quality diagnostic tools, leading to delays in outbreak detection and containment, ultimately hindering the overall growth of the global coronavirus test kits market

Coronavirus Test Kits Market Scope

The market is segmented on the basis, product type, specimen type, test type, sample type, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Specimen Type |

|

|

By Test Type |

|

|

By Sample Type |

|

|

By End-User |

|

Coronavirus Test Kits Market Regional Analysis

“North America is the Dominant Region in the Coronavirus Test Kits Market”

- North America dominates the coronavirus test kits market, driven by advanced healthcare infrastructure, high adoption of rapid diagnostic solutions, and the strong presence of key market players

- The U.S. holds a significant share due to increased demand for widespread COVID-19 testing, ongoing surveillance programs, and continuous advancements in diagnostic technologies, including AI-powered and molecular testing

- The availability of well-established reimbursement policies, government funding for public health initiatives, and growing investments in research & development by leading biotech and pharmaceutical companies further strengthen the market

- In addition, the increasing focus on pandemic preparedness, early detection of emerging variants, and a high rate of adoption of at-home and point-of-care testing solutions are fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the coronavirus test kits market, driven by rapid expansion in healthcare infrastructure, increasing awareness about infectious diseases, and rising demand for mass testing solutions

- Countries such as China, India, and Japan are emerging as key markets due to the growing population, frequent outbreaks of respiratory infections, and government-led initiatives to improve diagnostic capabilities

- Japan, with its advanced medical technology and strong public health infrastructure, remains a crucial market for coronavirus test kits. The country continues to lead in the adoption of high-precision molecular diagnostic tools to enhance testing accuracy and efficiency

- China and India, with their large populations and increased investments in pandemic preparedness, are witnessing rising government and private sector funding for rapid testing solutions. The expanding presence of global diagnostic companies and improving accessibility to affordable, high-quality test kits further contribute to market growth

Coronavirus Test Kits Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- QIAGEN (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Seegene Inc (South Korea)

- SolGent Co. Ltd (South Korea)

- Curetis (Germany)

- KURBO INDUSTRIES LTD. (Japan)

- Devex (U.S.)

- Thermo Fisher Scientific Inc (U.S.)

- Mylab Discovery Solutions Pvt. Ltd (India)

- Abbott (U.S.)

- Getein Biotech, Inc (China)

- BioMaxima SA (Poland)

- CTK Biotech, Inc. (U.S.

- CDC (U.S.)

- BGI (China)

- Luminex Corporation (U.S.)

- PerkinElmer Inc (U.S.)

Latest Developments in Global Coronavirus Test Kits Market

- In December 2023, HiMedia Laboratories introduced its HiGenoMB RT-PCR kits, capable of detecting the JN.1 variant of SARS-CoV-2. This variant, a descendant of the BA.2.86 (Pirola) strain of Omicron, has been identified as a variant of concern due to its immune-escape capabilities, which are contributing to a rise in cases worldwide

- In September 2022, the FDA granted 510(k) clearance to DiaSorin’s Simplexa COVID-19 Direct kit, marking a significant advancement in the battle against the COVID-19 pandemic. This approval enables the detection of the SARS-CoV-2 virus using nasal or nasopharyngeal swab samples. Designed for use with the LIAISON MDX platform, a molecular diagnostic system recognized for its efficiency and accuracy, the kit enhances testing capabilities

- In January 2022, Roche Diagnostics India introduced a new COVID-19 At-Home Test, an over-the-counter test designed to detect SARS-CoV-2 infection in individuals experiencing COVID-19 symptoms. This test provides the convenience of at-home testing, offering a quick and accessible option for those who suspect they may have contracted the coronavirus

- In June 2022, Genes2Me launched the CoviEasy Self-Test Rapid Antigen test kit for COVID-19 in India, offering an easy-to-use solution that delivers faster results in just 10 minutes. Backed by an AI-driven Mobile App, this IVD product ensures a high level of sensitivity and a concordance rate of over 98% accuracy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.