Europe Electronic Clinical Outcome Assessment Ecoa For Content Licensed Market

Market Size in USD Million

CAGR :

%

USD

704.70 Million

USD

2,067.34 Million

2025

2033

USD

704.70 Million

USD

2,067.34 Million

2025

2033

| 2026 –2033 | |

| USD 704.70 Million | |

| USD 2,067.34 Million | |

|

|

|

|

Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Size

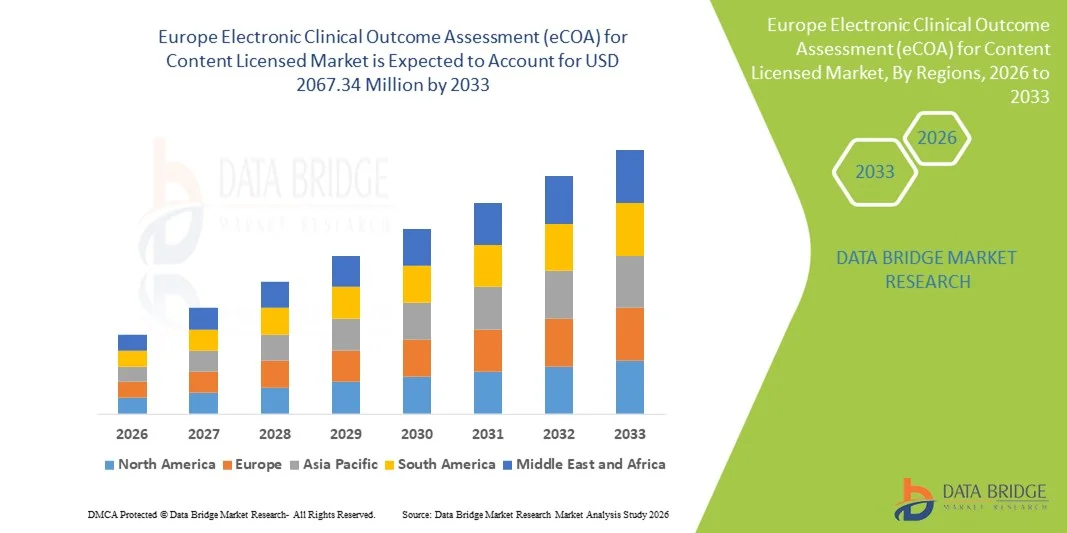

- The Europe electronic clinical outcome assessment (eCOA) for content licensed market size was valued at USD 704.7 Million in 2025 and is expected to reach USD 2067.34 Million by 2033, at a CAGR of 14.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital technologies in clinical trials, growing emphasis on patient-centric research, and the need for accurate and real-time data collection across therapeutic areas. The integration of cloud-based platforms, mobile applications, and electronic patient-reported outcomes (ePRO) is further driving the expansion of the Electronic Clinical Outcome Assessment (eCOA) for Content Licensed market

- Furthermore, rising demand for regulatory-compliant, user-friendly, and scalable clinical trial solutions is establishing eCOA systems as a critical component of modern clinical research. Enhanced efficiency, reduced administrative burden, and improved patient engagement are accelerating the uptake of Electronic Clinical Outcome Assessment (eCOA) for Content Licensed solutions, thereby significantly boosting market growth

Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Analysis

- Electronic Clinical Outcome Assessment (eCOA) for Content Licensed market growth is largely fueled by the increasing adoption of electronic patient-reported outcome (ePRO) and eCOA solutions in clinical trials, driven by the need for accurate, real-time data collection and improved patient monitoring across healthcare and pharmaceutical research

- Rising demand for streamlined clinical trial processes, regulatory compliance, and efficient data management is accelerating the uptake of Electronic Clinical Outcome Assessment (eCOA) for Content Licensed solutions, thereby significantly boosting the industry's growth

- The U.K. dominated the Electronic Clinical Outcome Assessment (eCOA) for Content Licensed market with the largest revenue share of approximately 38.7% in 2025, supported by a well-established healthcare infrastructure, strong adoption of digital clinical trial technologies, and robust regulatory support for electronic patient outcome tracking. The U.K. is witnessing substantial growth in eCOA implementations across clinical trials, driven by innovations in cloud-based platforms, mobile data collection, and integration with centralized clinical trial management systems

- Germany is expected to be the fastest-growing region in the Electronic Clinical Outcome Assessment (eCOA) for Content Licensed market during the forecast period, with strong double-digit CAGR growth projected. Growth is driven by increasing clinical trial activity, rising healthcare expenditure, expanding access to digital health solutions, and growing adoption of electronic data capture and patient-reported outcome technologies across hospitals, research centers, and pharmaceutical organizations

- The Cloud-Based Solutions segment dominated with a revenue share of 45.3% in 2025, driven by scalable deployment, ease of remote access, and integration with multiple devices

Report Scope and Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Segmentation

|

Attributes |

Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Trends

Rising Adoption of Digital Clinical Trial Solutions

- A major trend in the Global eCOA for Content Licensed market is the increasing adoption of digital and remote clinical trial solutions, driven by the need for efficient, real-time, and patient-centric data collection

- For instance, in March 2023, CRF Health (now part of Signant Health) expanded its eCOA platform across Europe to support fully decentralized clinical trials, enabling electronic patient-reported outcomes (ePRO) collection across multiple languages and study protocols

- Digital eCOA tools reduce errors, accelerate data collection, and improve patient compliance compared to traditional paper-based methods

- The COVID-19 pandemic accelerated this trend, highlighting the need for remote patient monitoring and contactless data capture, which is expected to persist post-pandemic

- Pharmaceutical companies and Contract Research Organizations (CROs) are increasingly integrating eCOA platforms with other digital clinical trial technologies, such as electronic clinical outcome assessments for digital biomarkers and wearable devices

Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Dynamics

Driver

Increasing Focus on Patient-Centric Clinical Trials

- The growing emphasis on patient-centricity in clinical trials is driving the adoption of eCOA platforms, enabling real-time capture of patient-reported outcomes (PROs), symptom tracking, and health-related quality of life data

- For instance, in July 2024, Parexel International launched a new eCOA solution tailored for oncology trials across Europe, allowing patients to report outcomes directly from home using web or mobile interfaces, improving engagement and retention

- Regulatory bodies, including the European Medicines Agency (EMA), are increasingly recommending digital PRO collection for drug approval submissions, encouraging wider adoption

- The ability to capture high-quality, standardized, and longitudinal data remotely allows sponsors to optimize trial design and reduce site burden

- Integration with Electronic Data Capture (EDC) systems and centralized trial management platforms provides a seamless workflow for clinical trial sponsors and CROs, further strengthening adoption

Restraint/Challenge

Data Privacy, Regulatory Compliance, and Implementation Costs

- The eCOA market faces challenges related to data privacy, GDPR compliance, and high implementation costs, which can slow adoption across globe

- For instance, in September 2022, several European CROs reported delays in deploying eCOA solutions in Germany and France due to stringent data protection regulations and the need for secure patient data storage

- Ensuring compliance with local laws, regulatory guidelines, and validation requirements adds complexity to eCOA implementation, particularly for multinational trials

- Furthermore, integration costs with existing clinical trial systems, including training personnel and software validation, can be significant, posing barriers for small-to-mid-sized CROs or sponsors

- Addressing these challenges requires investment in robust cybersecurity, regulatory alignment, and cost-effective, scalable deployment strategies to support long-term market growth

Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Scope

The market is segmented on the basis of product, approach, end user, and platform.

- By Product

On the basis of product, the Electronic Clinical Outcome Assessment (eCOA) for Content Licensed market is segmented into On-Premise Solutions, Cloud-Based Solutions, and Web-Based Solutions. The Cloud-Based Solutions segment dominated with a revenue share of 45.3% in 2025, driven by scalable deployment, ease of remote access, and integration with multiple devices. Cloud platforms allow sponsors, CROs, and clinical sites to centrally manage data, enhance compliance, and reduce IT overheads. High adoption in multi-site clinical trials, strong security protocols, and real-time reporting reinforce dominance. The flexibility of subscription-based models, regulatory alignment, and integration with EDC and ePRO systems further supports growth. Large pharmaceutical companies favor cloud solutions for global trials. The COVID-19 pandemic accelerated adoption due to remote monitoring needs. Improved uptime and vendor support strengthen market share. Standardized validation across sites ensures reliability. Cost-efficiency and workflow optimization further drive leadership. Enhanced analytics and dashboard features attract end users. Integration with mobile apps improves patient compliance. Overall, these factors sustain dominance.

The On-Premise Solutions segment is expected to witness the fastest CAGR of 14.8% from 2026 to 2033, driven by organizations requiring internal data control and customization. Hospitals, CROs, and biotech firms with strict data governance adopt on-premise systems. Integration with legacy IT infrastructure enhances appeal. High-security requirements for sensitive clinical data promote adoption. Rising demand in regions with stringent data privacy regulations fuels growth. Advanced reporting and analytics improve operational efficiency. Enterprise-scale deployments accelerate usage. Availability of customizable modules attracts large sponsors. Internal IT support ensures robust maintenance. Growing need for hybrid deployment options complements expansion. Pharma investment in personalized medicine trials further boosts adoption. Training and technical support strengthen implementation. Regulatory alignment for FDA and EMA compliance ensures accelerated uptake.

- By Approach

On the basis of approach, the market is segmented into ClinRO, PRO, ObsRO, and PerfO. The Patient Reported Outcome (PRO) segment dominated with a revenue share of 42.1% in 2025, driven by increasing use in regulatory submissions, patient-centric trials, and real-world evidence studies. PRO allows direct measurement of patient health status, treatment satisfaction, and quality-of-life metrics. Integration with mobile apps and cloud platforms enhances adoption. Strong guideline support from FDA and EMA reinforces demand. High prevalence of chronic diseases and oncology trials fuels usage. Clinical endpoints increasingly rely on PRO data. Multi-language support expands global deployment. Automated reminders improve compliance. Frequent data collection increases data volume and utility. Integration with eCOA, eDiary, and wearable devices strengthens workflow. Pharma investment in PRO-based endpoints accelerates adoption. Scalability across sites and trials supports dominance. Advanced analytics enable patient segmentation and outcome tracking.

The ObsRO segment is expected to grow at the fastest CAGR of 15.6% from 2026 to 2033, due to increasing adoption in rare diseases, pediatrics, and caregiver-reported outcomes. Observer-reported data enhances measurement in populations unable to self-report. Growth in pediatric and geriatric studies drives demand. Integration with remote monitoring platforms facilitates adoption. Pharma and biotech investment in rare disease trials supports expansion. Multi-site standardization improves data reliability. Cloud and web solutions accelerate uptake. Mobile-enabled observer reporting enhances compliance. Emerging markets increasingly adopt ObsRO approaches. Regulatory acceptance of ObsRO endpoints boosts growth. Training and site support encourage implementation. Technological advances reduce manual entry errors. High value for multi-stakeholder trials accelerates growth.

- By End User

On the basis of end user, the market is segmented into Commercial Service Providers, Hospitals and Transplant Centers, Research Laboratories, and Academic Institutions. The Hospitals and Transplant Centers segment dominated with a revenue share of 47.2% in 2025, due to extensive clinical trial activity, large patient populations, and the need for integrated outcome assessment systems. Hospitals implement eCOA for chronic disease management, oncology trials, and surgical outcome tracking. High adoption in multi-center trials strengthens usage. Integration with EHR and EMR systems enhances workflow efficiency. Regulatory mandates for clinical outcome data collection boost demand. Large-scale training and support programs ensure adoption. Data security and compliance with HIPAA/GDPR standards reinforce trust. Multi-device support improves patient and clinician engagement. Real-time analytics support operational decisions. Partnerships with CROs increase deployment. Remote patient monitoring expands reach. Investment in hospital-based clinical research drives leadership. Continuous improvement programs sustain dominance.

The Commercial Service Providers segment is expected to grow at the fastest CAGR of 16.3% from 2026 to 2033, driven by outsourcing trends in clinical trials and the growing need for specialized eCOA management. CROs and clinical vendors offer cloud and web-based solutions for multi-site trials. Increasing contract research in oncology, neurology, and rare diseases fuels growth. Flexibility in service delivery attracts mid-size and small pharma clients. Advanced reporting and analytics improve trial efficiency. Expansion in emerging markets supports adoption. Training and remote support reduce implementation barriers. Integration with EDC and PRO systems ensures seamless workflow. Data security and regulatory compliance remain key drivers. Scalability for global trials accelerates usage. Strategic partnerships with sponsors expand market reach. Innovation in mobile and wearable integration drives rapid adoption.

- By Platform

On the basis of platform, the market is segmented into Contract Research Organizations, Pharmaceutical and Biopharmaceutical Companies, Medical Device Manufacturers, Hospitals and Clinical Laboratories, Consulting Service Companies, Research and Academia, and Others. The Pharmaceutical and Biopharmaceutical Companies segment dominated with a revenue share of 44.7% in 2025, owing to large-scale clinical development programs, adoption of precision medicine trials, and reliance on electronic outcome data for regulatory submissions. Pharma companies invest in integrated eCOA platforms for oncology, cardiology, and chronic disease studies. High trial volumes and global operations support dominance. Integration with EDC, PRO, and wearable devices streamlines workflow. Regulatory compliance drives adoption. Centralized data management enhances trial efficiency. Long-term vendor partnerships strengthen leadership. Multi-device and multi-site deployment supports usage. Cloud-based solutions improve accessibility. Investment in companion diagnostics increases platform utilization. Real-time reporting enhances decision-making. Advanced analytics accelerate drug development programs.

The Contract Research Organizations (CROs) segment is expected to grow at the fastest CAGR of 15.8% from 2026 to 2033, driven by the outsourcing of clinical trials, increased trial complexity, and growing demand for full-service eCOA management. CROs provide scalable, cloud-based eCOA platforms for multi-national studies. Rapid adoption in emerging markets accelerates growth. Integration with sponsor systems improves operational efficiency. Advanced analytics and dashboards enhance trial insights. Flexible deployment models attract mid-size and small pharma clients. Training and technical support facilitate adoption. Global regulatory alignment boosts confidence. Multi-therapeutic area adoption fuels expansion. Mobile and remote reporting increase compliance. Strategic collaborations with hospitals and academia strengthen presence. Overall, these factors drive strong growth.

Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Regional Analysis

- The Europe electronic clinical outcome assessment (eCOA) for content licensed market is projected to expand at a substantial CAGR throughout the forecast period

- Driven by the rising adoption of digital clinical trial solutions, stringent regulatory support, and increasing demand for efficient patient outcome tracking

- Growth is fueled by the integration of cloud-based platforms, mobile data collection, and electronic patient-reported outcomes, along with the region’s focus on enhancing healthcare infrastructure and digitalization in clinical research

U.K. Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Insight

The U.K. electronic clinical outcome assessment (eCOA) for content licensed market dominated the Electronic Clinical Outcome Assessment (eCOA) for Content Licensed market with the largest revenue share of approximately 38.7% in 2025, supported by a well-established healthcare infrastructure, strong adoption of digital clinical trial technologies, and robust regulatory support for electronic patient outcome tracking. Substantial growth is being driven by innovations in cloud-based platforms, mobile data collection, and seamless integration with centralized clinical trial management systems, enabling more efficient and accurate patient outcome measurement.

Germany Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Insight

Germany electronic clinical outcome assessment (eCOA) for content licensed market is expected to be the fastest-growing region in the Electronic Clinical Outcome Assessment (eCOA) for Content Licensed market during the forecast period, with strong double-digit CAGR growth projected. This growth is driven by increasing clinical trial activity, rising healthcare expenditure, expanding access to digital health solutions, and the growing adoption of electronic data capture and patient-reported outcome technologies across hospitals, research centers, and pharmaceutical organizations. In addition, Germany’s emphasis on technological innovation and digital healthcare infrastructure further supports rapid market expansion.

Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market Share

The Electronic Clinical Outcome Assessment (eCOA) for Content Licensed industry is primarily led by well-established companies, including:

• Medidata Solutions, Inc. (U.S.)

• CRF Health (U.K.)

• Signant Health (U.S.)

• Clinion (U.S.)

• Celegence (U.S.)

• Icon plc (Ireland)

• PPD, Inc. (U.S.)

• Veeva Systems (U.S.)

• Oracle Health Sciences (U.S.)

• Synteract (U.S.)

• Bioclinica, Inc. (U.S.)

• Complion (U.S.)

• Curebase (U.S.)

• ClinOne (U.S.)

• CRF Bracket (U.S.)

• Datatrak International (U.S.)

• Electronic Data Capture, LLC (U.S.)

• PAREXEL International (U.S.)

• Health Solutions International (U.K.)

Latest Developments in Europe Electronic Clinical Outcome Assessment (eCOA) for Content Licensed Market

- In June 2023, ICON plc launched its ICON Digital Platform, an integrated solution that includes patient mobile apps, eConsent, eCOA, direct data capture for home services, and digital health technology management to streamline patient engagement and data collection across clinical trials, marking a major expansion of eCOA capabilities into broader digital clinical trial operations

- In July 2023, Signant Health acquired DSG, Inc., expanding its eCOA and hybrid trial technology portfolio to include enhanced EDC/DDC capabilities and strengthening its presence in complex clinical research environments, especially in Europe

- In November 2023, Clinical Ink expanded its patient engagement solutions by integrating the SPUR behavioral diagnostic tool with its eCOA and digital biomarkers suite, offering deeper insights into patient behavior and improving the holistic assessment of clinical outcomes across trials

- In November 2024, uMotif completed the acquisition of ClinOne, combining eCOA/ePRO capabilities with site productivity and consent management tools to create a unified platform that reduces administrative overhead and boosts trial engagement efficiency

- In February 2025, YPrime announced the launch of its Automated Data Change Form (DCF) feature as part of its eCOA 7.x platform, offering streamlined, efficient clinical data management and improving accuracy in trial data workflows

- In 2025, Medable Inc. was named a Leader in the Everest Group’s Life Sciences eCOA Products PEAK Matrix Assessment, recognized for AI innovation, real‑time analytics, and multimodal data capture that streamline clinical outcome assessments and enhance patient engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.