Europe Electrostatic Chucks Market

Market Size in USD Billion

CAGR :

%

USD

21.68 Billion

USD

30.10 Billion

2024

2032

USD

21.68 Billion

USD

30.10 Billion

2024

2032

| 2025 –2032 | |

| USD 21.68 Billion | |

| USD 30.10 Billion | |

|

|

|

|

Electrostatic Chucks Market Size

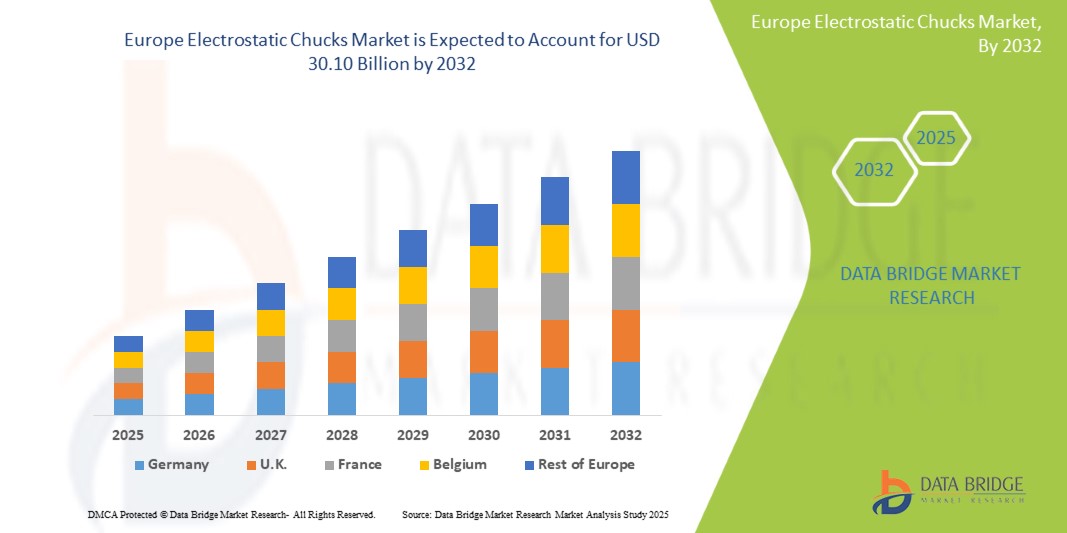

- The Europe Electrostatic Chucks Market size was valued at USD 21.68 billion in 2024 and is expected to reach USD 30.10 billion by 2032, at a CAGR of 4.8% during the forecast period

- This growth is driven by the increasing demand for precision wafer handling in semiconductor manufacturing, advancements in automotive electronics, and the adoption of energy-efficient electrostatic chucks (ESCs) in high-tech industries.

Electrostatic Chucks Market Analysis

- The Electrostatic Chucks market encompasses devices that use electrostatic forces to securely hold and position substrates, primarily silicon wafers, during semiconductor manufacturing processes like photolithography, etching, and deposition, offering high accuracy and minimal contamination.

- The demand for ESCs is significantly driven by the growth of the semiconductor industry, with Europe’s semiconductor market projected to reach USD 70 billion by 2025, and the increasing adoption of ESCs in automotive electronics, with 60% of European automakers integrating advanced semiconductor components by 2024.,

- Germany is expected to dominate the Europe Electrostatic Chucks market due to its strong semiconductor and automotive industries, holding a 30.0% market share in 2024.

- The Netherlands is expected to be the fastest-growing country during the forecast period due to investments in semiconductor fabrication and research, particularly by companies like ASML.

- The Semiconductor LCD/CVD segment is expected to dominate the market with a market share of 55.0% in 2025 due to the critical role of ESCs in precise wafer processing for semiconductor production.

Report Scope and Electrostatic Chucks Market Segmentation

|

Attributes |

Electrostatic Chucks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electrostatic Chucks Market Trends

“Adoption of Energy-Efficient Electrostatic Chucks in Semiconductor Manufacturing”

- A prominent trend in the Europe Electrostatic Chucks market is the increasing adoption of energy-efficient ESCs, which reduce power consumption by 15% during wafer handling, driven by sustainability regulations in Europe.

- The Coulomb Type segment is estimated to hold the highest market share of 60.0% in 2025, owing to its superior electrostatic force for holding wafers, supporting advanced semiconductor processes.

For instance, in 2024, a European semiconductor manufacturer adopted ceramic-based ESCs with advanced cooling mechanisms, improving thermal uniformity by 10%.

- This trend is driving demand for sustainable, high-performance ESCs in precision manufacturing.

Electrostatic Chucks Market Dynamics

Driver

“Growing Demand for Semiconductors in Automotive and Electronics”

- The increasing demand for semiconductors, with Europe’s automotive sector projected to consume 20% of global semiconductor output by 2025, and the rise in consumer electronics production are significantly contributing to the Electrostatic Chucks market growth.,

- ESCs provide precise wafer handling, reducing contamination by 25% compared to mechanical chucks, critical for advanced processes like EUV lithography.

For instance, in 2024, a German automaker integrated ESC-enabled semiconductor components in electric vehicles, enhancing performance by 15%.

- As Europe invests in semiconductor self-sufficiency, the need for ESCs continues to grow, ensuring high-yield production.

Opportunity

“Expansion of Renewable Energy and Nanotechnology Applications”

- The focus on renewable energy, with Europe aiming for 45% renewable energy by 2030, and the growing interest in nanotechnology offer significant opportunities for market growth by increasing demand for ESCs in solar panel and nanoscale device production.,

- ESCs support precise handling in photovoltaic cell manufacturing, improving production efficiency by 10% by 2025.

- For instance, in 2023, a Dutch research institute adopted ESCs for nanotechnology applications, enhancing precision in nanoscale fabrication.

- This opportunity drives market expansion by enabling innovative applications in clean energy and advanced manufacturing.

Restraint/Challenge

“High Production and Maintenance Costs”

- High production costs, with 35% of manufacturers citing advanced materials like ceramics as a cost barrier in 2024, and maintenance expenses for ensuring ESC longevity in demanding fabrication environments pose significant barriers to the market.,

- These challenges require substantial investments in R&D and maintenance protocols, increasing costs for organizations.

For instance, in 2024, 25% of small European fabs reported high ESC maintenance costs as a barrier to adoption.

- These issues can hinder market growth, necessitating cost-effective and durable ESC solutions.

Electrostatic Chucks Market Scope

The market is segmented on the basis material, product, electrode, poles and application.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Product |

|

|

By Electrode |

Quadrupole Electrode, Bipolar Electrode |

|

By Poles

|

|

|

By Application |

|

In 2025, the Semiconductor LCD/CVD segment is projected to dominate the market with the largest share in the application segment

The Semiconductor LCD/CVD segment is expected to dominate the Electrostatic Chucks market in Europe with the largest share of 56.22% in 2025, driven by the increasing adoption of semiconductor fabrication and flat-panel display manufacturing technologies across the region. Electrostatic chucks are essential for accurately securing wafers during plasma etching, CVD, and lithography processes, ensuring precision and efficiency. The rise in demand for advanced nodes, EUV lithography, and OLED/LCD displays is fostering equipment upgrades and boosting the need for high-performance ESCs across major foundries and IDMs in Europe.

The Ceramics segment is expected to account for the largest share during the forecast period in the material segment

In 2025, the Ceramics segment is expected to dominate the European Electrostatic Chucks market with the largest market share of 51.31%, attributed to ceramics’ excellent thermal conductivity, electrical insulation, and mechanical strength—key properties for handling extreme environments in semiconductor processing. Ceramic ESCs are increasingly used in advanced etching and deposition tools due to their durability and compatibility with high-temperature plasma environments. Furthermore, European equipment makers and research labs are investing in innovative ceramic materials, such as AlN (aluminum nitride) and alumina, to improve chuck reliability and extend product lifespan in next-generation wafer processing.

Electrostatic Chucks Market Country Analysis

“U.K. Holds the Largest Share in the Electrostatic Chucks Market”

- The U.K. dominates the Electrostatic Chucks market in Europe, driven by its strong semiconductor R&D ecosystem, government support for chip manufacturing, and robust collaborations between universities, foundries, and equipment suppliers.

- The country has seen significant investments under initiatives like the UK National Semiconductor Strategy, which focuses on boosting domestic capabilities in advanced materials, fabrication, and wafer handling technologies—including electrostatic chucks used in etching and deposition equipment.

- Furthermore, the growing demand for AI chips, quantum computing, and silicon photonics in the U.K. is fueling the need for high-precision wafer processing equipment, thereby supporting ESC market expansion.

- Leading equipment OEMs and fabless design firms are increasingly sourcing advanced electrostatic chucks to enable high-yield, low-defect wafer processing, reinforcing the U.K.'s position as a key market within the region.

“Germany is Projected to Register the Highest CAGR in the Electrostatic Chucks Market”

- Germany is expected to witness the highest growth rate in the European Electrostatic Chucks market, propelled by its leadership in semiconductor manufacturing equipment, particularly in automotive-grade and power electronics.

- The country is home to major players such as Infineon Technologies, Bosch, and ASML’s supply chain partners, all of which are expanding their fabs and integrating advanced wafer handling solutions for SiC and GaN-based devices—sectors where ESCs are crucial.

- The German government’s strong support through the European Chips Act and public-private partnerships is attracting significant investment in wafer-level innovation, further driving demand for high-performance electrostatic chucks.

- Additionally, Germany’s emphasis on Industry 4.0 and sustainable semiconductor manufacturing practices is pushing for precision-driven, low-energy ESC solutions across its fabs and research institutes.

Electrostatic Chucks Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SHINKO ELECTRIC INDUSTRIES CO., LTD. (Japan)

- Applied Materials (U.S.)

- Kyocera Corporation (Japan)

- TOTO Ltd. (Japan)

- NTK CERATEC CO., LTD. (Japan)

- Sumitomo Osaka Cement Co., Ltd. (Japan)

- Creative Technology Corporation (Japan)

- Tsukuba Seiko Co., Ltd. (Japan)

- CoorsTek Inc. (U.S.)

- Entegris, Inc. (U.S.)

Latest Developments in Europe Electrostatic Chucks Market

- In March 2025, SHINKO Electric Industries Co., Ltd., a major player in electrostatic chuck technology, announced the opening of a new R&D center in Dresden, Germany, aimed at advancing wafer handling systems and electrostatic chuck designs for EUV lithography. This move supports Europe's growing semiconductor equipment ecosystem under the EU Chips Act initiative.

- In January 2025, Lam Research, a leading global semiconductor equipment supplier, expanded its presence in Villach, Austria, with investments focused on enhancing plasma etching and deposition tools. These tools integrate advanced ESC systems, which are critical for processing next-gen semiconductor wafers used in AI, automotive, and HPC applications.

- In November 2024, SEMITEC Corporation partnered with a European-based semiconductor OEM to supply ceramic-based bipolar electrostatic chucks for high-temperature plasma processing. The deal strengthens SEMITEC’s position in Europe and aligns with demand for robust ESCs compatible with SiC and GaN wafer processing.

- In October 2024, Applied Materials announced a collaboration with imec (Belgium) to co-develop next-generation electrostatic clamping technologies to support sub-3nm node semiconductor manufacturing. The partnership targets improvements in wafer flatness control and thermal uniformity, both critical to maintaining EUV lithography precision.

- In August 2024, Germany-based TRUMPF Hüttinger introduced an advanced RF power supply system optimized for electrostatic chucks used in plasma etchers and CVD equipment. The new system enhances power control and temperature stability during wafer processing, addressing challenges in high-aspect-ratio etching.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Electrostatic Chucks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Electrostatic Chucks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Electrostatic Chucks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.