Europe Enzyme Immunoassay Eia Reagents And Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.31 Billion

USD

4.13 Billion

2024

2032

USD

3.31 Billion

USD

4.13 Billion

2024

2032

| 2025 –2032 | |

| USD 3.31 Billion | |

| USD 4.13 Billion | |

|

|

|

|

Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Size

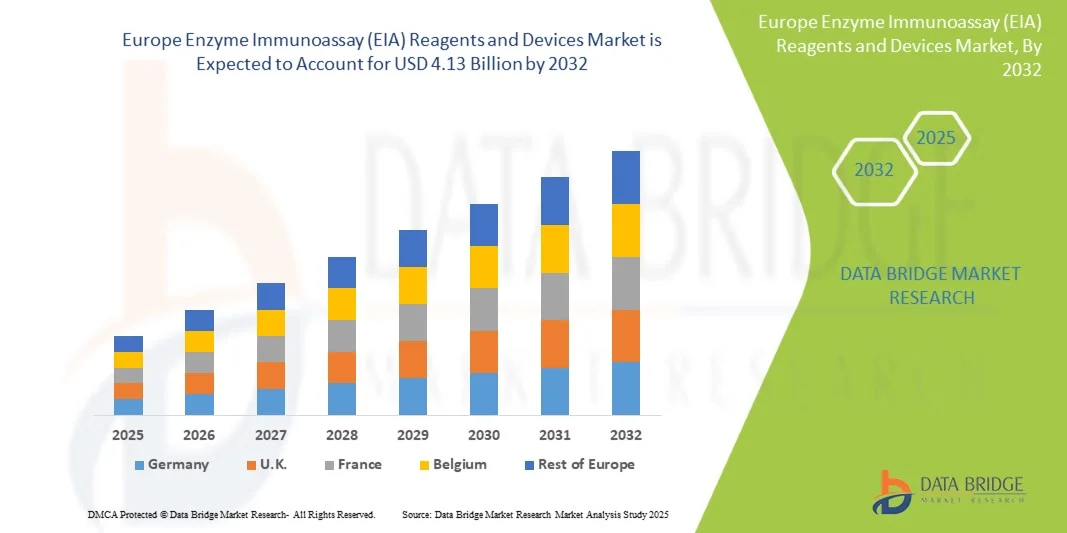

- The Europe Enzyme Immunoassay (EIA) Reagents and Devices Market size was valued at USD 3.31 billion in 2024 and is expected to reach USD 4.13 billion by 2032, at a CAGR of 2.82% during the forecast period

- The market growth is largely fueled by the increasing adoption of enzyme immunoassay techniques in clinical diagnostics, pharmaceutical research, and food safety testing, supported by continuous technological advancements in assay platforms and detection systems

- Furthermore, rising demand for accurate, rapid, and cost-effective diagnostic solutions across hospitals, laboratories, and research institutes is positioning enzyme immunoassay (EIA) reagents and devices as a preferred choice. These converging factors are accelerating the uptake of EIA-based solutions, thereby significantly boosting the industry's growth

Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Analysis

- Enzyme Immunoassay (EIA) reagents and devices, widely used for detecting antigens or antibodies in clinical diagnostics, food safety, and pharmaceutical research, are increasingly vital components of the European diagnostics landscape due to their high sensitivity, specificity, and adaptability across applications

- The escalating demand for EIA solutions in Europe is primarily fueled by the rising prevalence of chronic and infectious diseases, increasing adoption of automated diagnostic platforms, and strong emphasis on early disease detection and laboratory efficiency

- Germany dominated the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market with the largest revenue share of 28.4% in 2024, characterized by its robust biomedical research ecosystem, high diagnostic testing volumes, and strong collaborations between pharmaceutical and biotechnology firms

- U.K. is expected to be the fastest growing country in Europe Enzyme Immunoassay (EIA) Reagents and Devices Market during the forecast period, projected to record the highest CAGR of 8.2%, supported by government-led initiatives in preventive diagnostics, rising chronic disease prevalence, and rapid adoption of point-of-care testing and automated assay platforms

- The reagents segment dominated the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market revenue share with 62.5% in 2024, driven by their recurring demand across diagnostic testing for infectious diseases, oncology, endocrinology, and autoimmune disorders

Report Scope and Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Segmentation

|

Attributes |

Enzyme Immunoassay (EIA) Reagents and Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Trends

Enhanced Convenience Through Automation and Technological Advancements

- A significant and accelerating trend in the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market is the deepening integration of automated platforms and digital technologies within laboratory workflows. This shift is significantly enhancing user convenience, diagnostic accuracy, and efficiency across hospitals, diagnostic centers, and research laboratories

- For instance, advanced EIA analyzers now offer fully automated sample processing, reducing manual intervention, minimizing human error, and allowing laboratories to process higher volumes of tests in shorter turnaround times. Similarly, next-generation devices are being designed with compact, user-friendly interfaces for streamlined operation in both central labs and point-of-care settings

- Automation in EIA platforms enables features such as optimized assay calibration, real-time monitoring of test performance, and intelligent error detection. For example, several leading diagnostic companies are introducing systems that automatically adjust reagent usage, improve reproducibility, and flag anomalies in test results to ensure higher accuracy

- The seamless integration of EIA devices with laboratory information systems (LIS) and digital health platforms facilitates centralized control over data management, reporting, and connectivity with electronic health records. Through a single interface, clinicians and researchers can monitor test performance, manage multiple assays, and ensure compliance with regulatory standards

- This trend towards more intelligent, automated, and interconnected diagnostic solutions is fundamentally reshaping user expectations for laboratory testing. Consequently, companies such as bioMérieux, Roche Diagnostics, and Siemens Healthineers are developing advanced EIA platforms with enhanced automation, faster processing times, and greater connectivity for end users

- The demand for EIA reagents and devices that offer seamless automation and integration with laboratory ecosystems is growing rapidly across Europe, as healthcare providers increasingly prioritize accuracy, efficiency, and scalability in diagnostic testing

Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Dynamics

Driver

Growing Need for Accurate and Rapid Diagnostic Testing

- The increasing global prevalence of chronic and infectious diseases has significantly heightened the demand for precise and efficient diagnostic solutions, positioning enzyme immunoassay (EIA) reagents and devices as a cornerstone in modern diagnostics. With their ability to deliver high sensitivity and specificity, EIA technologies are becoming indispensable tools for clinicians in identifying a wide range of medical conditions

- In recent years, the adoption of automated EIA analyzers and ready-to-use reagent kits has transformed laboratory workflows, enabling high-throughput processing and reducing turnaround times for critical results. This has been particularly vital in hospitals and reference laboratories where timely diagnosis can directly impact treatment decisions and patient outcomes

- For instance, in March 2023, Thermo Fisher Scientific introduced an advanced EIA-based platform designed to enhance sensitivity and reproducibility in autoimmune disease diagnostics, demonstrating how continuous product innovation is reinforcing the market’s growth trajectory

- Beyond infectious disease testing, the application of EIA has expanded into diverse fields such as oncology, endocrinology, autoimmune disorder detection, and toxicology. The versatility of the technology, coupled with continuous innovations in assay design and detection methods, is driving broader adoption across healthcare and research domains

- As healthcare systems increasingly emphasize preventive care, early diagnosis, and personalized medicine, the role of EIA reagents and devices will continue to grow, making them one of the most reliable and widely adopted diagnostic platforms globally

Restraint/Challenge

High Cost of Advanced EIA Systems and Limited Access in Developing Regions

- Despite their diagnostic advantages, the high cost of advanced EIA systems and specialized reagent kits remains a significant barrier to widespread adoption. Automated analyzers require substantial initial investment and ongoing operational costs, which can be prohibitive for small- to medium-sized laboratories, particularly in low- and middle-income countries

- In many developing regions, healthcare facilities are constrained by tight budgets and limited infrastructure. These financial and logistical limitations force them to rely on less sophisticated and lower-cost diagnostic methods instead of deploying advanced EIA-based diagnostics

- For instance, a review of medical device access in LMICs published in PMC (National Center for Biotechnology Information) in 2020 highlights that many diagnostic devices, including immunoassays, are scarcely available in rural and underserved labs due to cost, cold-chain requirements, and maintenance/training needs

- Another challenge lies in the need for skilled personnel to operate, maintain, and interpret results from EIA systems. In regions with limited laboratory training infrastructure, even if devices are procured, they may remain under-utilized

- While manufacturers have begun developing more affordable, user-friendly EIA platforms, and some NGOs/government programs are subsidizing access, the perception of high initial investment and raising operational/maintenance costs continue to hinder large-scale deployment

- Strategies like volume purchasing, localized reagent production, and mobile/EIA-kit-based decentralization are needed to help mitigate these constraints

Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Scope

The market is segmented on the basis of product, technology, application, and end users.

• By Product

On the basis of product, the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market is segmented into analyzers and reagents. The reagents segment dominated the market revenue share with 62.5% in 2024, driven by their recurring demand across diagnostic testing for infectious diseases, oncology, endocrinology, and autoimmune disorders. Reagents are the backbone of EIA testing, as they are required in every assay, leading to continuous and large-scale consumption across hospitals and laboratories. Their wide usage in routine diagnostics, strong reliability, and the need for frequent replenishment ensure consistent revenue growth. Major players like Roche, bioMérieux, and Siemens Healthineers continue to innovate high-sensitivity reagents that enhance assay performance, further consolidating the dominance of this segment in the European market. The segment benefits from the increasing prevalence of chronic and infectious diseases, ongoing government health initiatives, and rising adoption of preventive and early diagnostic solutions across Europe.

The analyzers segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, fueled by the rising adoption of automated and high-throughput diagnostic platforms. Increasing emphasis on workflow efficiency, faster turnaround times, and standardization of results is encouraging hospitals and labs to invest in next-generation EIA analyzers. Technological advancements such as integrated systems with multiplexing capabilities, connectivity with laboratory information systems, and advanced software analytics are further accelerating adoption. In addition, smaller and portable analyzers are gaining traction in decentralized and point-of-care testing, positioning analyzers as the fastest-growing product category in Europe.

• By Technology

On the basis of technology, the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market is segmented into enzyme immunoassays, fluorescent immunoassays, chemiluminescence immunoassays, radioimmunoassay, and others. The enzyme immunoassays segment dominated the market with the largest revenue share of 54.3% in 2024, owing to their broad clinical applications, established reliability, and widespread use in infectious disease detection, endocrinology, and autoimmune testing. Their cost-effectiveness, adaptability to multiple analytes, and ease of integration into routine laboratory workflows have made enzyme immunoassays the gold standard in both hospital and reference laboratory settings across Europe. The segment benefits from long-standing adoption in public health screening, extensive availability of reagents, and continuous technological refinement by major players, ensuring its continued leadership.

The chemiluminescence immunoassays segment is expected to record the fastest CAGR of 10.2% from 2025 to 2032, supported by its superior sensitivity, ability to detect low-abundance biomarkers, and increasing application in oncology and cardiology diagnostics. Chemiluminescence offers faster reaction times, stronger signal-to-noise ratios, and enhanced diagnostic precision. Growing investment in automated chemiluminescence platforms by companies such as Abbott, Siemens, and Roche is boosting their adoption across European laboratories. Increasing demand for advanced, high-throughput testing systems, combined with the rising need for early disease detection, is driving the rapid growth of this technology segment.

• By Application

On the basis of application, the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market is segmented into oncology, infectious diseases, cardiology, bone and mineral, endocrinology, autoimmunity, toxicology, hematology, neonatal screening, and others. The infectious diseases segment dominated the Europe market with 41.8% in 2024, driven by the high demand for serological assays in detecting HIV, hepatitis, influenza, and emerging pathogens. The COVID-19 pandemic further underscored the importance of EIA-based diagnostics, strengthening adoption across healthcare systems. Europe’s ongoing investments in public health programs, vaccination monitoring, and blood screening have maintained infectious diseases as the largest contributor. The segment’s dominance is further reinforced by established diagnostic platforms, ongoing government-led testing initiatives, and the integration of EIA systems in hospital and reference laboratories across Germany, France, the U.K., and Italy.

The oncology segment is expected to witness the fastest CAGR of 11.0% from 2025 to 2032, propelled by the rising incidence of cancer across Europe and growing focus on biomarker-based screening and treatment monitoring. EIA-based tests are increasingly utilized to detect tumor markers and support personalized medicine approaches. Investments in cancer research, collaborations between diagnostic and pharmaceutical companies, and the integration of EIA devices with advanced molecular diagnostic techniques are further accelerating adoption. The segment’s growth is further supported by increasing patient awareness, government initiatives for early detection, and adoption of high-throughput automated systems in hospitals and laboratories.

• By End Users

On the basis of end users, the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market is segmented into hospitals, laboratories, academics, pharmaceutical industries, and others. The hospitals segment dominated the Europe market with 46.7% revenue share in 2024, accounting for the largest revenue contribution due to high patient testing volumes, extensive diagnostic infrastructure, and government funding supporting in-hospital diagnostic services. Hospitals act as the primary point of care, and the adoption of advanced EIA platforms enables accurate and rapid diagnostic support for critical conditions. Integration with hospital electronic health record (EHR) systems ensures seamless reporting and improves patient care, further reinforcing this segment’s dominance. The segment also benefits from ongoing investments in modern diagnostic facilities, growing awareness of early disease detection, and rising demand for routine monitoring of chronic conditions.

The laboratories segment is projected to record the fastest CAGR of 9.5% from 2025 to 2032, fueled by increasing outsourcing of diagnostic services, the rise of specialized reference labs, and demand for high-throughput automated testing. Independent laboratories are investing in advanced EIA platforms to expand their testing menus and accommodate growing sample volumes. Collaborations with pharmaceutical industries for clinical trials, biomarker testing, and research applications are also boosting laboratory adoption. This trend is particularly strong in Germany, the U.K., France, and Italy, where specialized diagnostic labs are expanding rapidly to support both routine and advanced diagnostics.

Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Regional Analysis

- The Europe Enzyme Immunoassay (EIA) Reagents and Devices Market is projected to expand at a substantial CAGR throughout the forecast period, driven by the growing adoption of advanced diagnostic technologies and the increasing demand for accurate, rapid, and high-throughput testing in clinical and research settings

- Germany dominated the Europe Enzyme Immunoassay (EIA) Reagents and Devices Market with the largest revenue share of 28.4% in 2024, characterized by its robust biomedical research ecosystem, high diagnostic testing volumes, and strong collaborations between pharmaceutical and biotechnology firms

- U.K. is expected to be the fastest growing country in Europe Enzyme Immunoassay (EIA) Reagents and Devices Market during the forecast period, projected to record the highest CAGR of 8.2%, supported by government-led initiatives in preventive diagnostics, rising chronic disease prevalence, and rapid adoption of point-of-care testing and automated assay platforms

U.K. Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Insight

The U.K. Europe Enzyme Immunoassay (EIA) Reagents and Devices Market is expected to be the fastest growing in Europe during the forecast period, projected to record the highest CAGR of 8.2%. This growth is supported by government-led initiatives promoting preventive diagnostics, increasing prevalence of chronic diseases, and rapid adoption of point-of-care testing and automated assay platforms. The country’s robust healthcare infrastructure, strong R&D ecosystem, and focus on precision medicine are accelerating the demand for high-quality EIA reagents and devices across hospitals, diagnostic laboratories, and pharmaceutical research institutions.

Germany Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Insight

The Germany Europe Enzyme Immunoassay (EIA) Reagents and Devices Market dominated the European EIA reagents and devices market in 2024 with the largest revenue share of 28.4%, driven by its well-established biomedical research ecosystem, high diagnostic testing volumes, and strong collaborations between pharmaceutical and biotechnology firms. The country’s emphasis on technological innovation and precision diagnostics promotes the adoption of automated EIA analyzers and advanced reagent kits. High demand in clinical laboratories, coupled with investments in state-of-the-art diagnostic infrastructure, is further strengthening Germany’s leadership position in the European market.

Europe Enzyme Immunoassay (EIA) Reagents and Devices Market Share

The Enzyme Immunoassay (EIA) Reagents and Devices industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthineers AG (Germany)

- Danaher Corporation (U.S.)

- Abbott (U.S.)

- QuidelOrtho Corporation (U.S.)

- BD (U.S.)

- Merck KGaA (Germany)

- PerkinElmer, Inc. (U.S.)

- BIOMÉRIEUX (France)

- Agilent Technologies, Inc. (U.S.)

- ZEUS Scientific, Inc. (U.S.)

- Enzo Life Sciences, Inc. (U.S.)

Latest Developments in Europe Enzyme Immunoassay (EIA) Reagents and Devices Market

- In July 2021, Sysmex Europe GmbH launched the CN-3500 and CN-6500 automated blood coagulation analysers in the EMEA region. These devices utilize chemiluminescence enzyme immunoassay (CLEIA) technology, enhancing testing workflows in clinical laboratories by providing rapid and accurate results for hemostasis testing

- In August 2025, Revvity, Inc. introduced innovative plate-based internalization reagents designed to deliver accurate, high-throughput, and scalable insights for G-protein-coupled receptor (GPCR) and antibody-drug conjugate (ADC) research. This advancement aims to accelerate the development of next-generation targeted therapeutics, supporting the growing demand for precise diagnostics and personalized medicine

- In October 2025, DiaSorin S.p.A., an Italian biotechnology company, announced the expansion of its in vitro diagnostics reagent kits used in immunodiagnostics and molecular diagnostics. Following the acquisition of Luminex, DiaSorin has enhanced its production capabilities with additional plants in the United States and Canada, reinforcing its position in the European and global diagnostics markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.