Europe Excipients Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

2.96 Billion

2024

2032

USD

1.89 Billion

USD

2.96 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.96 Billion | |

|

|

|

|

Europe Excipients Market Size

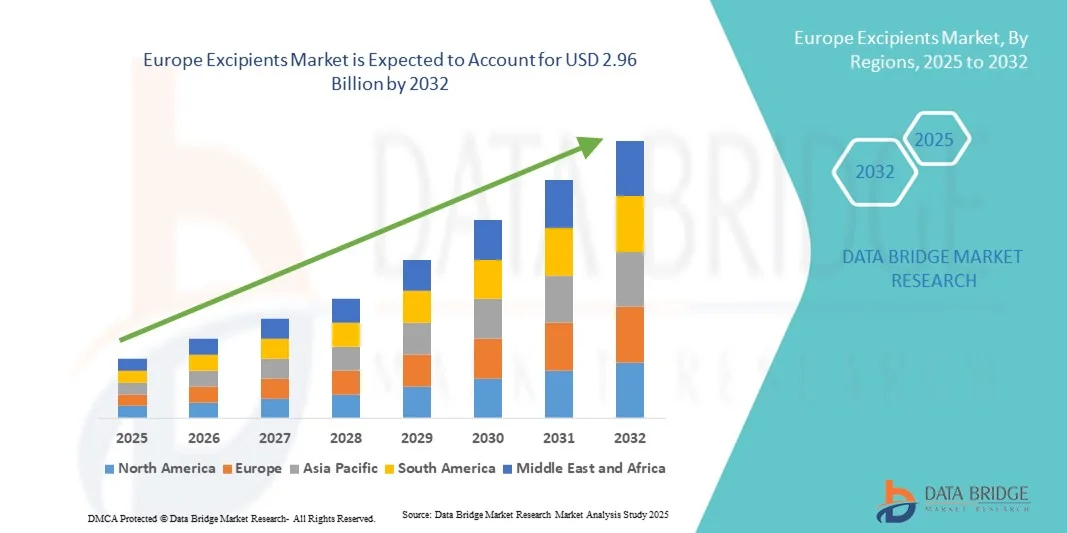

- The Europe excipients market size was valued at USD 1.89 billion in 2024 and is expected to reach USD 2.96 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the increasing demand for pharmaceutical formulations and the rising adoption of advanced drug delivery technologies across both developed and emerging markets

- Furthermore, growing emphasis on improving drug stability, efficacy, and patient compliance is driving the uptake of excipients solutions, thereby significantly boosting the industry's growth

Europe Excipients Market Analysis

- The Excipients market, comprising substances used to enhance the stability, bioavailability, and effectiveness of pharmaceutical formulations, is witnessing significant growth due to increasing demand for optimized drug delivery systems and expansion of the pharmaceutical industry

- The escalating demand for excipients is primarily fueled by the growing production of oral and injectable medications, rising focus on novel drug delivery systems, and increasing need for cost-effective formulation solutions

- Germany dominated the excipients market with the largest revenue share of 41.5% in 2024, characterized by a strong pharmaceutical manufacturing base, high healthcare expenditure, and presence of key industry players, with the country experiencing substantial growth in excipients applications across oral, injectable, and topical formulation

- France is expected to be the fastest growing region in the excipients market during the forecast period due to increasing pharmaceutical production, adoption of advanced drug delivery technologies, and rising investments in healthcare infrastructure

- The Primary Excipients segment held the largest revenue share of 47.3% in 2024, owing to their essential role in pharmaceutical formulations, including binders, diluents, and disintegrants. Primary excipients form the backbone of drug formulations, offering stability, improved handling, and optimized bioavailability

Report Scope and Excipients Market Segmentation

|

Attributes |

Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Excipients Market Trends

Rising Demand for High-Performance and Functional Excipients

- A significant and accelerating trend in the global Amyloid Neuropathy market is the increased emphasis on early diagnosis and development of personalized therapeutics to improve patient outcomes

- For instance, in March 2023, Ionis Pharmaceuticals reported progress in their Phase 2 trials for antisense oligonucleotide therapy targeting hereditary amyloid neuropathy, highlighting the market’s focus on targeted therapeutics

- Advances in diagnostic technologies, such as genetic testing and tissue biopsy, are enabling earlier detection and better characterization of amyloid neuropathies

- Personalized medicine approaches are driving tailored treatment regimens based on patient-specific genetic and clinical profiles

- Clinicians are increasingly adopting multi-modal treatment strategies, combining medication, lifestyle interventions, and supportive care to optimize patient outcomes

- There is a shift toward less invasive and safer therapeutic options that reduce side effects and enhance patient compliance

- Ongoing R&D is focused on developing novel molecules and drug delivery systems specifically targeting amyloid deposition and nerve degeneration. The market trend also includes combination therapies and multi-step treatment protocols designed to improve efficacy across diverse patient populations

- Real-world evidence studies and clinical trial data are influencing physician decisions and encouraging adoption of advanced treatment options. Patient education initiatives are improving awareness of disease progression and the importance of timely intervention

- Healthcare providers are collaborating with pharmaceutical companies to integrate genetic screening and biomarker analysis in routine clinical practice. The trend is bolstered by increasing healthcare investments and the development of specialized neurology centers in key regions

Europe Excipients Market Dynamics

Driver

Growing prevalence of amyloid neuropathies and rising patient awareness

- Enhanced diagnostic capabilities and increasing clinical research activities encourage early detection and intervention

- For instance, in June 2022, Alnylam Pharmaceuticals received FDA approval for Onpattro (patisiran), a treatment for hereditary transthyretin-mediated amyloid neuropathy, underlining the impact of innovative therapeutics on market growth

- Expansion of specialty clinics and neurology centers improves access to treatment and care for patients. The adoption of advanced therapeutics that target specific amyloid proteins is accelerating market growth

- Healthcare policies promoting rare disease awareness are contributing to higher diagnosis rates. Rising disposable incomes in developed regions allow patients to access advanced treatments more readily. Pharmaceutical companies are investing heavily in R&D to develop safer and more effective drugs

- Increasing collaboration between hospitals, research institutes, and biotech firms fosters innovation. Patient-centric care models are driving demand for tailored therapies. Telemedicine and digital health solutions are facilitating treatment management and monitoring

Restraint/Challenge

High costs associated with advanced diagnostics and targeted therapies

- Limited availability of specialized neurology centers in certain areas poses access challenges. Complex regulatory pathways for rare disease treatments can slow product approvals. Variability in patient response to therapeutics may hinder standardization of treatment protocols

- Ensuring adherence to long-term treatment regimens is challenging for both patients and providers. Limited awareness among general practitioners may result in delayed diagnosis and treatment. Supply chain challenges for specialized drugs and biologics can impact availability

- For instance, in September 2021, limited access to tafamidis in several European countries due to high cost highlighted affordability and accessibility issues in the amyloid neuropathy market

- Payers may impose restrictions or require evidence of cost-effectiveness before covering new therapies. Reimbursement issues for novel treatments may create barriers for patients in some regions. Continuous innovation requires substantial investment in clinical trials and manufacturing .Lack of large-scale epidemiological data in some regions makes market forecasting and clinical trial planning difficult

- Potential side effects and safety concerns with new therapeutics may slow adoption among cautious patients and physicians. Ethical and logistical challenges in conducting trials for rare hereditary forms of amyloid neuropathy can delay therapy development

- Limited patient population for clinical studies can reduce statistical significance and slow drug approval. Disparities in healthcare infrastructure between urban and rural regions can restrict access to diagnosis and treatment. Insurance coverage gaps and high out-of-pocket expenses may discourage patients from seeking timely care

- Reluctance among physicians to adopt newly approved therapies due to insufficient long-term safety data. Variability in disease progression complicates the creation of standardized treatment guidelines. Coordination between multidisciplinary care teams can be challenging for managing systemic manifestations of the disease

Europe Excipients Market Scope

The Excipients Market is segmented on the basis of origin, category, products, chemistry type, chemical synthesis, functionality, dosage form, route of administration, end user, and distribution channel.

- By Origin

On the basis of origin, the Europe Excipients market is segmented into Organic and Inorganic. The Organic segment dominated the largest market revenue share of 45.1% in 2024, driven by increasing preference for naturally derived excipients in pharmaceutical formulations. Manufacturers and formulators prefer organic excipients due to their biocompatibility, minimal side effects, and alignment with patient safety standards. Rising demand for clean-label and sustainable pharmaceutical products further reinforces the growth of this segment. Organic excipients also offer versatility across multiple dosage forms, including solid, semi-solid, and liquid formulations. Regulatory support for natural ingredients in drugs has positively influenced adoption, especially in Europe. In addition, organic excipients contribute to improved bioavailability, stability, and patient compliance, making them highly favorable for both generic and innovative drugs. Key players are actively investing in R&D to optimize the extraction and purification of plant- and animal-derived excipients. This trend is particularly prominent in the development of oral and parenteral formulations. The rising trend of patient-centric and eco-friendly drug formulations is sustaining the dominance of organic excipients. For instance, in 2023, a leading European supplier expanded its organic polymer portfolio to meet pharmaceutical demand.

The Inorganic segment is expected to witness the fastest CAGR of 22.4% from 2025 to 2032, fueled by increasing utilization in specialized formulations such as antacids, buffering agents, and tablet coatings. Inorganic excipients offer precise chemical stability, cost-effectiveness, and scalability advantages. Rising applications in large-scale production of generic drugs and nutraceuticals drive inorganic excipient adoption. Moreover, growing awareness regarding excipient functionality in enhancing solubility and dissolution profiles is boosting demand. Inorganic excipients are favored in applications requiring high purity and regulatory compliance. Manufacturers are innovating with modified minerals and salts to expand functionality across solid and semi-solid dosage forms. The increasing pharmaceutical production in emerging European countries is further contributing to growth. Regulatory approvals and standardization of inorganic excipients for therapeutic use enhance trust and acceptance among formulators.

- By Category

On the basis of category, the market is segmented into Primary Excipients and Secondary Excipients. The Primary Excipients segment held the largest revenue share of 47.3% in 2024, owing to their essential role in pharmaceutical formulations, including binders, diluents, and disintegrants. Primary excipients form the backbone of drug formulations, offering stability, improved handling, and optimized bioavailability. Manufacturers rely on primary excipients to ensure consistency, efficacy, and shelf-life of products. Increasing demand for solid dosage forms such as tablets and capsules has strengthened this segment. Primary excipients also support the development of controlled-release and immediate-release formulations. The segment benefits from regulatory focus on high-quality raw materials. Pharmaceutical companies prioritize primary excipients to meet Good Manufacturing Practice (GMP) compliance. Innovations in polymer-based excipients and naturally derived binders are further driving growth. For instance, in 2022, a European polymer supplier expanded its portfolio targeting oral solid formulations.

The Secondary Excipients segment is expected to witness the fastest CAGR of 21.9% from 2025 to 2032, driven by increasing use in advanced formulations such as coatings, solubilizers, flavors, and preservatives. Secondary excipients enable enhanced stability, patient acceptability, and targeted drug release. Growth is fueled by innovations in functional excipients for taste masking and solubility enhancement. Contract manufacturers and biopharmaceutical companies are incorporating secondary excipients to improve product differentiation. Expanding use in pediatric and geriatric formulations is contributing to rising demand. Regulatory approval and the need for excipient safety data accelerate adoption. Emerging trends in combination therapies and multi-component dosage forms further boost the segment. For example, in March 2023, a European company introduced a new coating excipient for improved stability in pediatric tablets.

- By Products

On the basis of products, the market is segmented into Polymers, Sugars, Alcohols, Minerals, Gelatin, and Others. The Polymers segment dominated the largest revenue share of 44.7% in 2024 due to their multifunctionality as binders, coatings, and controlled-release matrices. Polymers enhance stability, solubility, and manufacturability of formulations, making them highly sought after by pharmaceutical companies. Increasing adoption in oral, topical, and parenteral dosage forms drives the segment. Polymer excipients also facilitate the development of innovative delivery systems such as nanoparticles and hydrogels. Strong R&D in biocompatible polymers supports their sustained demand. Regulatory acceptance for pharmaceutical-grade polymers further encourages adoption. The ability to tailor polymer characteristics to drug properties increases formulation flexibility. Polymers are increasingly used in high-value therapies, including biologics. For example, in 2022, a European supplier expanded its hydroxypropyl methylcellulose portfolio for oral and topical applications.

The Sugars segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, owing to growing use as sweetening agents, fillers, and stabilizers in oral dosage forms. Rising demand for patient-friendly formulations, including chewable tablets and syrups, supports growth. Sugars also improve palatability and enhance stability of active ingredients. Increasing prevalence of pediatric and geriatric medications contributes to segment expansion. European pharmaceutical companies are focusing on naturally derived sugars due to sustainability trends. Functional sugars are gaining traction for their ability to modulate release and improve solubility. Market growth is also supported by the use of sugars in nutraceuticals and dietary supplements. In 2023, a manufacturer launched a pregelatinized sugar excipient tailored for chewable tablets.

- By Chemistry Type

On the basis of chemistry type, the market is segmented into Plant, Animals, Synthetic, and Minerals. The Plant-based segment held the largest revenue share of 45.8% in 2024 due to rising preference for natural, biocompatible excipients in pharmaceutical and nutraceutical formulations. Plant-based excipients offer safety, regulatory ease, and compatibility across multiple dosage forms. High consumer preference for clean-label and eco-friendly ingredients drives growth. Strong R&D in extraction and stabilization techniques enhances usability. Applications in tablets, capsules, and semi-solid forms reinforce adoption. Increasing awareness of patient safety and reduced adverse reactions supports plant-based excipients. Government and regulatory support for natural excipients boosts acceptance. For example, in 2023, a European firm expanded its plant-derived polymer portfolio for oral formulations.

The Synthetic segment is expected to witness the fastest CAGR of 22.7% from 2025 to 2032, driven by advantages including scalability, chemical stability, and cost-effectiveness. Synthetic excipients are widely used in high-volume production and controlled-release formulations. Innovations in synthetic polymers and surfactants are further driving growth. Adoption is accelerated by pharmaceutical companies aiming for precise formulation performance. Regulatory approval of synthetic excipients for novel therapeutics supports expansion. Synthetic excipients are increasingly applied in both solid and liquid dosage forms. Rising demand in contract manufacturing organizations also contributes. For instance, in 2024, a synthetic polymer excipient was launched in Europe for immediate-release tablets.

- By Chemical Synthesis

On the basis of chemical synthesis, the market is segmented into Lactose Monohydrate, Sucralose, Polysorbate, Benzyl Alcohol, Cetostearyl Alcohol, Soy Lecithin, Pregelatinized Starch, and Others. The Lactose Monohydrate segment dominated the largest revenue share of 43.5% in 2024, owing to its widespread application as a filler, diluent, and stabilizer in tablets and capsules. Its compatibility with multiple drug types and excellent flow properties make it a preferred choice for pharmaceutical manufacturers. Lactose monohydrate is also highly valued for its role in improving compressibility, ensuring consistent dosing, and enhancing product stability. The segment benefits from established regulatory acceptance in Europe, reducing formulation risks. Its versatility across solid and semi-solid dosage forms further drives adoption. Manufacturers also favor lactose monohydrate for pediatric and geriatric medications due to low toxicity and high palatability. For instance, in 2023, a leading European supplier expanded its lactose monohydrate portfolio to support high-volume oral dosage production.

The Sucralose segment is expected to witness the fastest CAGR of 24.0% from 2025 to 2032, driven by increasing use in sweetened formulations, chewable tablets, and syrups. Sucralose offers functional advantages including taste masking, improved patient compliance, and stability under various processing conditions. Growing demand for pediatric and geriatric formulations further fuels adoption. European manufacturers are increasingly incorporating sucralose into nutraceuticals and over-the-counter products. Innovations in sucralose derivatives allow better solubility and controlled release in oral dosage forms. Regulatory approval for use in pharmaceutical formulations enhances market confidence. Expanding applications in functional foods and dietary supplements also boost growth. For instance, in 2024, a European excipient company launched a sucralose-based sweetener excipient tailored for chewable tablets.

- By Functionality

On the basis of functionality, the market is segmented into Binders and Adhesives, Disintegrants, Coating Material, Solubilizers, Flavors, Sweetening Agents, Diluents, Lubricants, Buffers, Emulsifying Agents, Preservatives, Antioxidants, Sorbents, Solvents, Emollients, Glidients, Chelating Agents, Antifoaming Agents, and Others. The Binders and Adhesives segment dominated the largest revenue share of 44.9% in 2024 due to their essential role in maintaining tablet integrity, controlling drug release, and enhancing formulation stability. Binders ensure optimal compaction and cohesiveness, critical for high-volume tablet production. Rising adoption of solid oral dosage forms, along with regulatory compliance for excipient quality, supports this segment. Pharmaceutical companies focus on polymeric binders to achieve controlled release and improved bioavailability. Increasing preference for oral solid formulations in Europe reinforces demand. For instance, in 2023, a leading European supplier expanded its binder portfolio for both immediate and modified-release tablets.

The Disintegrants segment is expected to witness the fastest CAGR of 23.5% from 2025 to 2032, driven by increasing demand for rapid drug dissolution and improved bioavailability in oral formulations. Disintegrants facilitate quick tablet break-up and absorption, enhancing therapeutic efficacy. Growth is fueled by rising prevalence of chronic diseases requiring oral therapies, and the need for patient-friendly formulations. European formulators are adopting innovative superdisintegrants for enhanced performance. Expanding use in chewable, effervescent, and fast-dissolving tablets accelerates growth. Regulatory compliance and consistent quality are further boosting adoption. In 2024, a major excipient manufacturer launched a novel disintegrant optimized for pediatric tablets.

- By Dosage Form

On the basis of dosage form, the market is segmented into Solid, Semi-Solid, and Liquid. The Solid dosage form segment dominated the largest revenue share of 46.2% in 2024 due to its widespread use, cost-effectiveness, and convenience in storage, transport, and administration. Tablets and capsules are highly preferred by healthcare providers and patients due to ease of dosing and patient compliance. Solid dosage forms benefit from stable shelf life and scalability in manufacturing, making them suitable for generic and innovative drug formulations. Strong demand for oral medications and chronic disease management therapies supports segment dominance. For example, in 2023, a European excipient supplier expanded its polymer and sugar excipient lines for tablet production.

The Liquid dosage form segment is expected to witness the fastest CAGR of 24.1% from 2025 to 2032, fueled by growing demand for pediatric syrups, injectable solutions, and oral suspensions. Liquid formulations enhance patient compliance, particularly among children and the elderly. Increased adoption in parenteral and topical medications contributes to growth. Innovations in solubilizers, sweeteners, and stabilizers further enhance market potential. Regulatory approval for safe excipients in liquids accelerates adoption. Market expansion is also supported by growing prevalence of chronic diseases and nutritional supplements in liquid form. In early 2024, a European company launched a new solubilizer excipient optimized for oral syrups and suspensions.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral Excipients, Topical Excipients, Parenteral Excipients, and Other Excipients. The Oral Excipients segment dominated the largest revenue share of 45.6% in 2024, driven by the widespread preference for oral medications, tablets, capsules, and syrups. Oral excipients support taste masking, stability, controlled release, and enhanced bioavailability. Increasing chronic disease prevalence and patient adherence concerns boost segment dominance. Innovations in polymers, sugars, and disintegrants enhance oral formulation quality. For instance, in 2023, a European firm launched a polymer-based oral excipient enhancing solubility in tablets.

The Parenteral Excipients segment is expected to witness the fastest CAGR of 23.8% from 2025 to 2032, fueled by the growing demand for injectable biologics, vaccines, and high-value therapies. Parenteral excipients ensure sterility, stability, and compatibility of formulations. Growth is supported by increasing investment in biopharmaceutical R&D and contract manufacturing. Regulatory guidelines on injectable excipient safety enhance market confidence. Rising adoption in hospitals, specialty clinics, and home healthcare further drives segment expansion. In early 2024, a European supplier introduced a new stabilizing excipient optimized for parenteral biologics.

- By End-User

On the basis of end-user, the Europe Excipients market is segmented into Pharmaceutical and Biopharmaceutical Companies, Contract Formulators, Research Organization and Academics, and Others. The Pharmaceutical and Biopharmaceutical Companies segment held the largest revenue share of 47.0% in 2024, reflecting its dominant role in high-volume drug production, including oral, injectable, and topical formulations. These companies rely heavily on high-quality excipients to ensure product stability, regulatory compliance, and optimal bioavailability, which are critical for both generic and innovative medicines. The growing global demand for generics, coupled with a surge in innovative therapies, further reinforces the leadership of this segment. Continuous investments in research and development, particularly in advanced drug delivery systems and formulation technologies, have bolstered adoption of specialized excipients. For instance, in 2023, a leading European pharmaceutical company strategically expanded its excipient sourcing to enhance the quality and performance of oral solid dosage forms.

The Contract Formulators segment is anticipated to experience the fastest CAGR of 22.9% from 2025 to 2032, driven by the increasing trend of outsourcing pharmaceutical development and manufacturing. Contract formulators require versatile and multifunctional excipients to meet diverse client-specific formulation needs, including stabilizing, solubilizing, and functional roles. The expansion of contract manufacturing operations across Europe, supported by favorable regulatory frameworks and stringent quality standards, is further propelling segment growth. Additionally, the rising demand for faster time-to-market solutions, coupled with the industry’s emphasis on innovative dosage forms and personalized medicine, is encouraging contract formulators to adopt advanced excipient solutions. These factors collectively position contract formulators as the fastest-growing end-user segment in the Europe excipients market.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Retail Sales, and Others. The Direct Tender segment accounted for the largest revenue share of 46.5% in 2024, primarily due to bulk procurement by pharmaceutical and biopharmaceutical companies. This approach ensures consistent supply, reduces costs through economies of scale, and allows for rigorous quality control. Long-term contracts with reliable excipient manufacturers further strengthen the stability of supply chains. The increasing scale of pharmaceutical production and expansion of European companies into emerging markets reinforce the dominance of this channel. For example, in 2023, a prominent European excipient manufacturer secured multiple direct supply agreements with leading pharmaceutical firms, reinforcing its market position and reliability.

The Retail Sales segment is projected to achieve the fastest CAGR of 23.3% from 2025 to 2032, driven by rising demand for over-the-counter medications, nutraceuticals, and research applications. Retail channels provide accessibility to functional excipients for smaller-scale production, academic research, and niche formulation requirements. The rapid growth of e-commerce platforms and specialty distributors has further expanded the reach of retail channels, making excipients more readily available to smaller players in the pharmaceutical ecosystem. Regulatory approvals for excipients in consumer healthcare and OTC products also boost confidence and adoption. In early 2024, a European supplier launched a retail-oriented excipient line designed specifically for research labs and small-scale formulation developers, highlighting the increasing significance of retail distribution in the market.

Europe Excipients Market Regional Analysis

- The Europe excipients market is projected to grow at a substantial CAGR during the forecast period, driven by increasing pharmaceutical manufacturing activities, rising demand for high-quality excipients in oral, injectable, and topical formulations, and growing adoption of advanced drug delivery technologies

- The region benefits from robust healthcare infrastructure, well-established regulatory frameworks, and a strong focus on research and development, supporting innovation in excipient applications across various dosage forms

- European countries are witnessing significant investments in specialty excipients for controlled-release, solubility enhancement, and stability improvement, which are further boosting market growth

Germany Excipients Market Insight

Germany excipients dominated the excipients market with the largest revenue share of 41.5% in 2024, supported by a strong pharmaceutical manufacturing base, high healthcare expenditure, and the presence of key industry players. The country experiences substantial growth in excipient applications across oral, injectable, and topical formulations. Germany’s emphasis on quality compliance, continuous innovation in formulation technologies, and well-established supply chains further strengthen its market position. The growing demand for specialty excipients in advanced therapies, combined with strategic partnerships and collaborations among pharmaceutical companies, accelerates the adoption of innovative excipient solutions.

France Excipients Market Insight

France excipients is expected to be the fastest-growing region in the excipients market during the forecast period, driven by increasing pharmaceutical production, rising adoption of advanced drug delivery technologies, and expanding investments in healthcare infrastructure. The country’s focus on innovation and development of novel excipients for high-value formulations is boosting market penetration. In addition, the government’s support for biotechnology and pharmaceutical research, along with rising demand for generic and specialty formulations, fuels growth. France is witnessing rapid growth in excipient applications for controlled-release, targeted delivery, and enhanced bioavailability, positioning it as a key emerging market in Europe.

Europe Excipients Market Share

The Excipients industry is primarily led by well-established companies, including:

- Croda International (U.K.)

- ABITEC Corporation (Netherlands)

- Roquette Frères (France)

- DuPont Nutrition & Biosciences (France)

- BASF SE (Germany)

- DSM Nutritional Products (Netherlands)

- Ingredion Incorporated (Germany)

- FMC Corporation (Germany)

- Signet Chemical Corporation (U.K.)

- JRS Pharma GmbH & Co. KG (Germany)

- Merck KGaA (Germany)

- Azelis (Belgium)

- Gattefossé (France)

- IMCD Group (Netherlands)

- Ingredion Deutschland GmbH (Germany)

Latest Developments in Europe Excipients Market

- In October 2025, India's Central Drugs Standard Control Organisation (CDSCO) issued a directive to all state drug controllers to ensure that raw materials used in drug manufacturing, including excipients and active ingredients, meet prescribed standards. This action follows the deaths of several children linked to toxic cough syrups, highlighting the importance of stringent quality checks on excipients

- In October 2025, Asahi Kasei announced plans to supply pharmaceutical excipients manufactured in compliance with Good Manufacturing Practice (GMP) by 2027. The company aims to meet international guidelines for pharmaceutical excipients and impurities, supporting injectable drug formulations. Samples of both grades with guaranteed analytical values are now available for nonclinical development, laying the foundation for broader adoption in clinical development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.