Europe Explosion Proof Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.24 Billion

USD

3.61 Billion

2024

2032

USD

2.24 Billion

USD

3.61 Billion

2024

2032

| 2025 –2032 | |

| USD 2.24 Billion | |

| USD 3.61 Billion | |

|

|

|

|

Europe Explosion-Proof Equipment Market Size

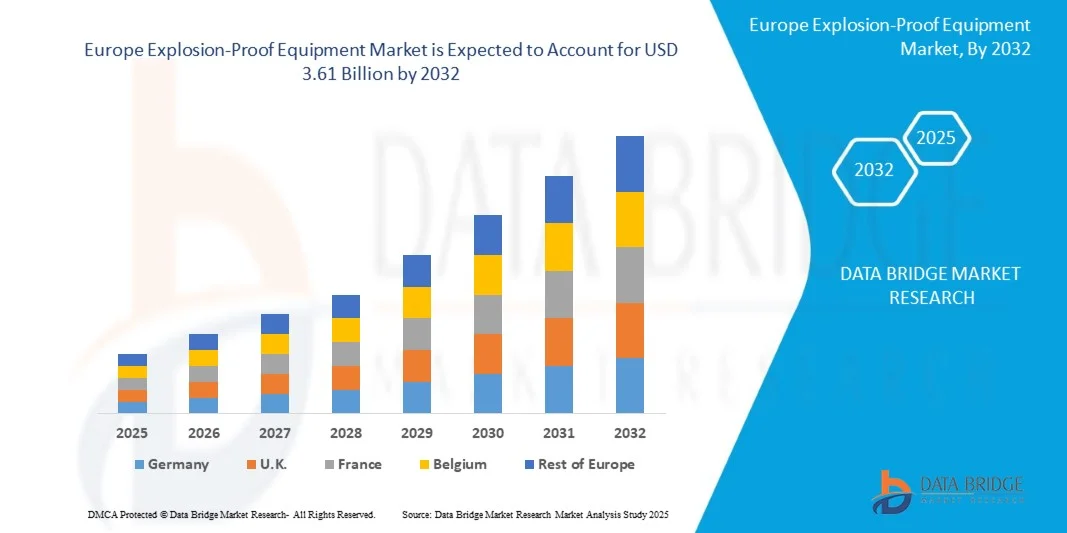

- The Europe explosion-proof equipment market size was valued at USD 2.24 billion in 2024 and is projected to reach USD 3.61 billion by 2032, growing at a CAGR of 6.10% during the forecast period.

- The market growth is primarily driven by increasing industrial automation and stringent safety regulations across sectors such as oil & gas, chemicals, and manufacturing, which demand reliable explosion-proof equipment to ensure workplace safety.

- Additionally, advancements in smart and connected explosion-proof devices, along with rising investments in hazardous environment infrastructure, are fueling the adoption of innovative solutions, thereby propelling the market expansion across Europe.

Europe Explosion-Proof Equipment Market Analysis

- Explosion-proof equipment, designed to prevent ignition in hazardous environments, is increasingly critical across industries such as oil & gas, chemical processing, and manufacturing, due to stringent safety regulations and the need for reliable protection in explosive atmospheres.

- The growing emphasis on workplace safety, regulatory compliance, and technological advancements in robust, connected explosion-proof solutions are driving higher adoption rates across Europe’s industrial sectors.

- Germany dominated the Europe explosion-proof equipment market with the largest revenue share of 36% in 2024, supported by well-established industrial infrastructure, strict safety standards, and significant investments in hazardous area equipment, with Germany and the UK leading in adoption due to their advanced manufacturing and energy sectors.

- U.K. is expected to be the fastest-growing region in the Europe Explosion-Proof Equipment Market during the forecast period, attributed to increasing industrialization, modernization of facilities, and expanding oil & gas exploration activities.

- The hardware segment dominated the market with the largest revenue share of around 62% in 2024, driven by the essential nature of physical explosion-proof devices such as control panels, motors, and sensors that provide fundamental safety and compliance in hazardous environments

Report Scope and Europe Explosion-Proof Equipment Market Segmentation

|

Attributes |

Explosion-Proof Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Europe Explosion-Proof Equipment Market Trends

“Enhanced Safety and Efficiency Through AI and IoT Integration”

- A significant and accelerating trend in the Europe Explosion-Proof Equipment Market is the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies with traditional explosion-proof devices, enhancing real-time monitoring, predictive maintenance, and operational efficiency in hazardous environments.

- For Instance, companies such as Pepperl+Fuchs and Eaton are incorporating AI-driven sensors and connected control systems that provide automated alerts and diagnostics, reducing downtime and improving safety compliance in industrial plants.

- AI integration enables equipment to analyze environmental data and predict potential explosion risks, allowing for proactive interventions. Some advanced models use machine learning to optimize equipment performance and generate intelligent reports, helping operators respond swiftly to anomalies.

- The IoT-enabled explosion-proof devices can be remotely monitored and controlled through centralized platforms, facilitating seamless integration with broader industrial automation systems. This connectivity supports better asset management and real-time decision-making across multiple hazardous sites.

- This trend towards smarter, interconnected explosion-proof solutions is transforming industry standards for safety and operational reliability. As a result, manufacturers such as Siemens and ABB are investing heavily in AI-enabled explosion-proof technologies with features like remote diagnostics, automated shutdowns, and integration with digital twin platforms.

- The demand for AI- and IoT-integrated explosion-proof equipment is rapidly increasing across Europe’s oil & gas, chemical, and manufacturing sectors, driven by the need for enhanced safety, regulatory compliance, and operational efficiency.

Europe Explosion-Proof Equipment Market Dynamics

Driver

“Growing Need Due to Increasing Industrial Safety Regulations and Digitalization”

- The tightening of industrial safety regulations across Europe, combined with the ongoing digital transformation in hazardous industries, is driving strong demand for advanced explosion-proof equipment.

- For instance, in early 2024, Siemens announced upgrades to its explosion-proof control panels featuring enhanced IoT connectivity and real-time monitoring capabilities, aimed at improving safety compliance and operational efficiency. Such innovations by leading manufacturers are expected to fuel market growth during the forecast period.

- As industries face growing pressure to prevent accidents and ensure worker safety, explosion-proof equipment with advanced diagnostics, remote monitoring, and automated shutdown features offer critical advantages over conventional solutions.

- Additionally, the push toward smart factories and Industry 4.0 adoption is encouraging the integration of explosion-proof devices with broader digital ecosystems, facilitating centralized control and data-driven safety management.

- The rising demand for reliable, connected explosion-proof equipment across sectors like oil & gas, chemical processing, and pharmaceuticals is further supported by the increasing modernization of industrial infrastructure and expanding hazardous area operations.

Restraint/Challenge

“Concerns Over Cybersecurity and High Implementation Costs”

- Cybersecurity risks associated with connected explosion-proof equipment present a significant challenge to wider adoption, as these devices rely on networked systems vulnerable to hacking and cyberattacks, raising concerns about operational safety and data integrity.

- For Instance, recent industry reports have highlighted vulnerabilities in industrial IoT devices, leading some companies to hesitate in fully integrating connected explosion-proof solutions.

- Addressing these concerns through enhanced encryption, secure communication protocols, and regular firmware updates is essential for gaining user confidence. Companies such as ABB and Eaton are emphasizing their robust cybersecurity frameworks to reassure clients.

- Additionally, the high initial investment required for state-of-the-art explosion-proof equipment compared to traditional alternatives can be a barrier, especially for small and medium-sized enterprises or industries in emerging European markets.

- Although costs are gradually decreasing with technological advancements, the upfront premium for smart explosion-proof devices may limit adoption where budgets are constrained or the benefits are not yet fully recognized.

- Overcoming these challenges through improved cybersecurity standards, targeted customer education, and the development of cost-effective solutions will be critical for sustained market expansion.

Europe Explosion-Proof Equipment Market Scope

The market is segmented on the basis of offering, temperature class, zone, connectivity service, location, method of protection, equipment, and end user.

- By Offering

On the basis of offering, the Europe explosion-proof equipment market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share of around 62% in 2024, driven by the essential nature of physical explosion-proof devices such as control panels, motors, and sensors that provide fundamental safety and compliance in hazardous environments. Hardware remains indispensable across industries requiring explosion protection.

The services segment is projected to register the fastest CAGR of 20.5% from 2025 to 2032, fueled by increasing demand for installation, maintenance, system integration, and consulting services as companies seek to optimize their explosion-proof equipment performance. Software, encompassing monitoring, diagnostics, and IoT-enabled platforms, is witnessing steady growth due to rising digitalization and remote asset management needs. The growth of smart factory concepts and Industry 4.0 adoption will further boost software and services demand, complementing the robust hardware segment.

- By Temperature Class

On the basis of Temperature Class, the market is classified into temperature classes T1 (> 450°C), T2 (> 300°C to < 450°C), T3 (> 200°C to < 300°C), T4 (> 135°C to < 200°C), T5 (> 100°C to < 135°C), and T6 (> 85°C to < 100°C). The T6 segment dominated the market in 2024 with a share of 38%, favored for applications demanding the highest safety standards with maximum surface temperatures below 85°C to prevent ignition. This segment is prevalent in pharmaceuticals, food processing, and electronics manufacturing.

The T4 segment is expected to be the fastest growing with a CAGR of 19.2% through 2032, supported by its flexibility for broader industrial applications including oil & gas and chemical sectors, where moderate temperature thresholds are sufficient yet explosion protection is critical. Increasing regulatory focus and technological advancements continue to drive adoption of both temperature classes across hazardous industries.

- By Zone

On the basis of zone, the Europe explosion-proof equipment market is segmented into Zone 0, Zone 1, Zone 2, Zone 20, Zone 21, and Zone 22 based on hazardous area classification. Zone 1 dominated with a market share of 42% in 2024, as it covers areas where explosive gases are likely to occur intermittently, such as oil refineries and chemical plants, necessitating robust explosion-proof solutions.

Zone 2 is expected to witness the fastest CAGR of 18.7% during the forecast period, driven by expanding industrial zones with lower frequency of explosive atmospheres, including warehouses and distribution centers. Companies are increasingly upgrading facilities to comply with evolving safety standards, which, coupled with technological improvements, is supporting growth across all zones, especially Zones 1 and 2.

- By Connectivity Service

On the basis of Connectivity Service, the market is divided into wired and wireless connectivity services. The wired segment dominated the market in 2024 with a revenue share of 58%, favored for its dependable, secure, and interference-resistant communication vital in critical industrial environments like petrochemical and mining sectors. Wired connections ensure consistent data transmission crucial for safety systems.

The wireless segment is projected to record the fastest CAGR of 22.3% from 2025 to 2032, benefiting from advances in industrial wireless technologies and the growing demand for flexible, scalable, and cost-effective installations in hard-to-reach or mobile hazardous areas. The integration of IoT and Industry 4.0 frameworks is significantly fueling wireless adoption for real-time monitoring and predictive maintenance.

- By Location

On the basis of location, the market segmentation by location includes indoor and outdoor applications. Indoor explosion-proof equipment accounted for the largest market share of 54% in 2024 due to predominant installation in controlled industrial environments such as manufacturing plants and processing units where hazardous atmospheres are contained. Indoor settings facilitate easier maintenance and integration with existing control systems.

The outdoor segment is anticipated to register the fastest CAGR of 20.1% during the forecast period, supported by increasing infrastructure development in oil & gas fields, mining sites, and marine operations requiring robust and weather-resistant explosion-proof devices. Growing investments in outdoor hazardous zone safety continue to drive demand.

- By Method of Protection

On the basis of Method of Protection, the market is segmented into explosion proof, explosion prevention, and explosion segregation. Explosion-proof equipment held the largest revenue share of 48% in 2024, due to its proven ability to contain explosions within enclosures and prevent ignition sources in volatile environments. This method is widely adopted in oil and gas, chemical, and energy sectors.

The explosion prevention segment is expected to register the fastest CAGR of 21.4%, propelled by innovations in technologies designed to reduce explosion risk proactively through continuous monitoring, inert gas systems, and ventilation. Explosion segregation, which physically isolates hazardous zones, remains a smaller segment but is gradually growing due to increasing safety mandates in manufacturing and processing industries.

- By Equipment

On the basis of Equipment, The Europe Explosion-Proof Equipment Market includes cable glands and accessories, process instruments, industrial controls, motors, strobe beacons, lightning products, sensors, bells and horns, fire alarms/call points, speakers and tone generators, and visual and audible combination units. Industrial controls dominated the market in 2024 with a 29% share, critical for managing electrical and operational safety in hazardous zones.

Sensors are anticipated to be the fastest-growing segment with a CAGR of 19.5%, driven by rising demand for advanced detection systems capable of real-time hazard identification and data analytics. Innovations in AI-enabled sensors further contribute to growth, enabling predictive maintenance and improved safety performance.

- By End User

On the basis of End User, The market serves diverse industries including oil and gas, chemical and petrochemical, energy and power, mining, pharmaceutical, food processing, marine and shipbuilding, aerospace, military and defense, and others. The oil and gas sector held the largest market share of 36% in 2024, reflecting its critical need for explosion-proof solutions in exploration, refining, and distribution activities.

The pharmaceutical sector is projected to be the fastest-growing end user with a CAGR of 18.3% through 2032, driven by stringent safety regulations, increasing production capacities, and the adoption of smart explosion-proof technologies to ensure contamination control and worker safety. Rising industrial automation across sectors is boosting overall demand.

Europe Explosion-Proof Equipment Market Regional Analysis

- Germany dominated the Explosion-Proof Equipment Market with the largest revenue share of 36% in 2024, driven by stringent safety regulations and high industrialization across key sectors such as oil and gas, chemical, and pharmaceuticals.

- The region’s focus on enhancing workplace safety and compliance with ATEX and IECEx standards has significantly boosted the adoption of explosion-proof equipment in hazardous environments.

- Additionally, Europe’s strong presence of major manufacturers, continuous technological advancements, and increasing investments in upgrading aging infrastructure support widespread deployment. Rising awareness of operational safety and the push for Industry 4.0 integration further establish explosion-proof equipment as critical in ensuring secure, efficient industrial operations across residential, commercial, and industrial applications.

U.K. Explosion-Proof Equipment Market Insight

The UK explosion-proof equipment market is expected to grow steadily, supported by stringent government regulations and heightened industrial safety standards. The country’s ongoing industrial modernization and expansion in oil and gas, power generation, and manufacturing sectors are key growth drivers. Increasing awareness about explosion hazards and the need to comply with international safety norms is prompting businesses to adopt reliable explosion-proof equipment. Additionally, the UK’s focus on smart factory initiatives enhances demand for explosion-proof products integrated with IoT-based safety monitoring.

France Explosion-Proof Equipment Market Insight

France is witnessing substantial growth in explosion-proof equipment demand, driven by its robust chemical, petrochemical, and energy industries. Strong regulatory frameworks and continuous investment in industrial safety contribute to this trend. The French market emphasizes innovation, focusing on explosion-proof solutions that combine safety with energy efficiency and operational reliability. The rising trend of upgrading existing industrial plants to meet higher safety standards further propels market expansion.

Europe Explosion-Proof Equipment Market Share

The industry is primarily led by well-established companies, including:

- R. STAHL AG (Germany)

- Extronics (U.K.)

- Honeywell International Inc (U.S.)

- ABB (Switzerland)

- BARTEC Top Holding GmbH (Germany)

- Eaton (Ireland)

- Pepperl+Fuchs (Germany)

- Bosch Rexroth AG (Germany)

- MarechalElectric (France)

- Pelco (U.S.)

- DEHN SE (Germany)

- Schneider Electric (France)

- nVent (U.K.)

- Axis Communications AB (Sweden)

- ClearView Communications LTD (U.K.)

- Zenitel (Norway)

- MIRETTI (Italy)

- Emerson Electric Co (U.S.)

What are the Recent Developments in Europe Explosion-Proof Equipment Market?

- In April 2023, Eaton Corporation, a global leader in electrical safety solutions, announced the launch of its new range of explosion-proof control panels designed specifically for hazardous environments in Europe’s oil and gas and chemical sectors. This strategic move reinforces Eaton’s commitment to enhancing industrial safety through innovative, certified equipment that meets stringent ATEX and IECEx standards. By leveraging advanced engineering and regional expertise, Eaton aims to address evolving safety requirements and solidify its presence in the expanding Europe Explosion-Proof Equipment Market.

- In March 2023, Pepperl+Fuchs GmbH, a prominent player in explosion-proof sensor technology, introduced its next-generation intrinsically safe sensor series tailored for the European mining and pharmaceutical industries. The new products are engineered to provide high reliability and precision under extreme hazardous conditions, ensuring compliance with rigorous safety regulations. This launch highlights Pepperl+Fuchs' dedication to advancing explosion-proof innovation, supporting safer industrial operations and meeting the growing demand across Europe’s safety-critical sectors.

- In March 2023, Siemens AG successfully completed the deployment of an integrated explosion-proof automation system for a large petrochemical facility in the Netherlands. The project utilized Siemens’ state-of-the-art explosion-proof motors, sensors, and control systems to enhance operational safety and efficiency. This initiative demonstrates Siemens’ leadership in delivering comprehensive explosion-proof solutions that comply with European safety mandates, contributing to the modernization and risk mitigation of hazardous industrial environments.

- In February 2023, R. Stahl AG, a leading manufacturer of explosion-proof equipment, announced a strategic collaboration with a major European energy provider to upgrade and retrofit aging industrial sites with certified explosion-proof lighting and control devices. This partnership aims to improve safety standards while minimizing downtime and operational costs. The collaboration underscores R. Stahl’s commitment to innovation and customer-focused solutions within the Europe Explosion-Proof Equipment Market.

- In January 2023, Abbott Safety Solutions, a specialist in explosion-proof enclosures and accessories, unveiled its latest range of explosion-proof cable glands and junction boxes at the European Safety Expo 2023. Designed to support harsh environmental conditions across multiple hazardous zones, these products offer enhanced durability and ease of installation. Abbott’s new product line reflects its focus on advancing explosion-proof infrastructure critical to maintaining safety and reliability in Europe’s industrial sectors.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Explosion Proof Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Explosion Proof Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Explosion Proof Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.