Europe Facial Cleanser Market

Market Size in USD Billion

CAGR :

%

USD

6.12 Billion

USD

8.92 Billion

2024

2032

USD

6.12 Billion

USD

8.92 Billion

2024

2032

| 2025 –2032 | |

| USD 6.12 Billion | |

| USD 8.92 Billion | |

|

|

|

|

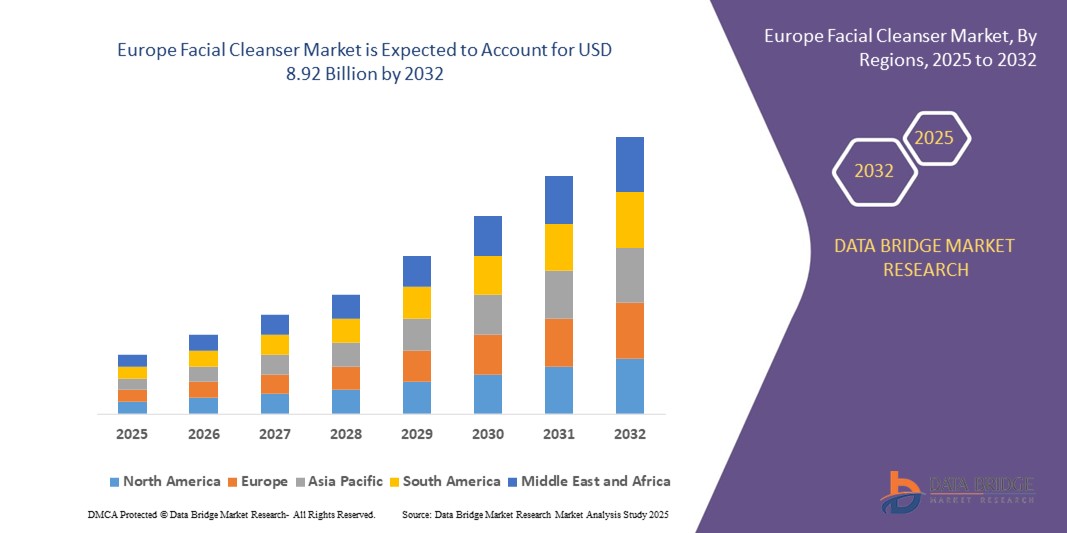

What is the Europe Facial Cleanser Market Size and Growth Rate?

- The Europe facial cleanser market size was valued at USD 6.12 billion in 2024 and is expected to reach USD 8.92 billion by 2032, at a CAGR of 4.83% during the forecast period

- The Europe facial cleanser market is expected to grow significantly in the forecast period of 2024 to 2031. Increasing awareness of the benefits of skincare products, increasing expenditure on skincare products, and the growth in the beauty and personal care industry are some of the driving factors expected to propel the market growth

What are the Major Takeaways of Facial Cleanser Market?

- In recent years, consumers have become increasingly conscious of the ingredients in their skincare products, fueling a significant shift towards cleaner and greener choices. This trend is underpinned by a growing understanding of the potential benefits of organic and natural formulations

- Consumers are actively seeking facial cleansers that leverage the power of botanical extracts, essential oils, and plant-based ingredients. This demand is spurred by the desire for skincare routines that not only cleanse effectively but also align with environmentally sustainable and health-conscious lifestyles

- Germany is expected to dominate the facial cleanser market with a significant revenue share of 45.78% in 2024, driven by highly health-conscious population and strong demand for clean-label, vegan, and dermatologist-recommended products

- France is expected to witness the highest compound annual growth rate (CAGR) in the facial cleanser market due to the country’s heritage in luxury skincare and cosmetics

- Foaming Facial Cleanser dominated the market with the largest revenue share of 31.4% in 2024, attributed to its deep-cleaning properties, consumer familiarity, and high demand among individuals with oily and acne-prone skin

Report Scope and Facial Cleanser Market Segmentation

|

Attributes |

Facial Cleanser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Facial Cleanser Market?

Rising Demand for Natural and Sustainable Ingredients

- A significant and accelerating trend in the global facial cleanser market is the increasing consumer preference for natural, organic, and eco-friendly formulations, driven by rising awareness about skin health and environmental sustainability

- For instance, L'Oréal Paris launched its Revitalift Cleanser with 96% natural-origin ingredients, catering to eco-conscious consumers while maintaining effectiveness

- The demand for vegan, cruelty-free, and paraben-free products is also on the rise, with brands reformulating existing lines and introducing new clean-label cleansers

- Packaging innovation is another driver, with brands adopting biodegradable, refillable, and recyclable formats, aligning with sustainability goals

- This shift toward greener skincare solutions is reshaping consumer expectations, pushing companies to invest in R&D for plant-based formulations and sustainable sourcing practices

- As a result, natural and eco-friendly cleansers are expected to hold a larger market share, especially among millennials and Gen Z, who prioritize ethical and transparent beauty brands

What are the Key Drivers of Facial Cleanser Market?

- The rising prevalence of skin concerns such as acne, sensitivity, and premature aging, coupled with increased awareness of skincare routines, is a major driver for facial cleanser demand

- For instance, in March 2024, Estée Lauder Inc. expanded its Clinique Take the Day Off cleanser range, targeting consumers seeking dermatologist-tested, allergy-safe solutions

- Growing popularity of K-beauty and multi-step skincare routines is fueling demand for specialized cleansers such as foam-based, oil-based, micellar water, and gel formats

- The surge in male grooming products and personalized skincare solutions is further expanding the consumer base

- Increasing e-commerce penetration and direct-to-consumer (D2C) brand strategies are boosting accessibility and market growth

- Rising disposable income in emerging economies and the premiumization of skincare products are further propelling market expansion, particularly in Asia-Pacific

Which Factor is Challenging the Growth of the Facial Cleanser Market?

- Concerns regarding skin irritation, allergies, and side effects caused by harsh chemicals in some cleansers present a significant challenge to broader market adoption

- For instance, reports of paraben and sulfate-linked skin dryness have led to consumer skepticism toward mass-market cleansers

- Regulatory scrutiny and stricter labeling laws in regions such as Europe and the U.S. are compelling brands to reformulate products, increasing production costs

- The high price of premium cleansers compared to generic alternatives remains a barrier in price-sensitive markets, limiting adoption beyond affluent urban consumers

- Intense competition from local brands offering affordable and herbal alternatives is another factor challenging established multinational players

- Overcoming these barriers through dermatologically tested, transparent labeling, and affordable natural options will be vital for sustained growth

How is the Facial Cleanser Market Segmented?

The market is segmented on the basis of product type, source, packaging type, skin type, application, price range, age group, cost, target customer, end use, and distribution channel.

- By Product Type

The Facial Cleanser market is segmented into Foaming Facial Cleanser, Gel Facial Cleanser, Cream & Lotion Facial Cleanser, Oil Facial Cleanser, No Foam Cleanser, Micellar Water, Bar Facial Cleanser, Solvent Facial Cleanser, Collagen Type Cleanser, Cleansing Cotton Pads, and Others. Foaming Facial Cleanser dominated the market with the largest revenue share of 31.4% in 2024, attributed to its deep-cleaning properties, consumer familiarity, and high demand among individuals with oily and acne-prone skin. The product’s compatibility with various formulations, including sulfate-free and sensitive-skin variants, further boosted adoption.

Micellar Water is projected to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by its convenience, multifunctionality, and rising preference for gentle, rinse-free cleansers. Its popularity is particularly strong among younger consumers and working professionals seeking quick skincare solutions. Collectively, diverse product innovations across segments are enhancing market

- By Skin Type

The market by skin type is divided into Combination Skin, Oily Skin, Neutral Skin, Dry Skin, Sensitive Skin, Mixed Skin, and Others. Combination Skin accounted for the largest revenue share in 2024 at 28.9%, as multifunctional cleansers designed for both oily and dry zones gained popularity, especially among younger consumers. Sensitive Skin products are projected to grow at the fastest CAGR of 23.1% from 2025 to 2032, driven by rising skin sensitivity concerns linked to pollution, stress, and lifestyle habits. Clean-label, fragrance-free, and dermatologist-tested cleansers are in high demand for this segment. Dry skin-focused cleansers also maintain steady demand due to aging populations and rising cosmetic use.

- By Application

On the basis of application, the facial cleanser market is segmented into Moisturizing, Skin Whitening, Oiliness, Anti-aging, Blackheads, Dark Spots, Repair, Dryness, and Others. Moisturizing cleansers dominated the market with a share of 32.6% in 2024, driven by their universal appeal across demographics and skin types. Hydration-focused formulas enriched with hyaluronic acid, ceramides, and aloe vera are leading sales.

Anti-aging cleansers are projected to witness the fastest CAGR of 22.7% from 2025 to 2032, fueled by growing demand from consumers aged 35+ seeking wrinkle reduction, elasticity improvement, and preventive care. Whitening and dark spot applications also remain significant in Asia-Pacific and Latin American regions, driven by cultural beauty preferences. Overall, targeted solutions addressing skin-specific problems will remain central, with anti-aging and multifunctional cleansers gaining momentum globally.

- By Price Range

By price range, the facial cleanser market is segmented into Mass and Premium. Mass products dominated in 2024 with a 64.8% revenue share, largely due to affordability and wide availability across supermarkets, pharmacies, and e-commerce platforms. Consumer trust in drugstore skincare lines supports this segment’s strong performance.

Premium cleansers are expected to witness the fastest CAGR of 20.9% during 2025–2032, as rising disposable incomes and lifestyle upgrades drive demand for luxury skincare products. Premium brands emphasize natural ingredients, dermatologist testing, and advanced formulations. Premium adoption is particularly strong in developed markets like the U.S., Japan, South Korea, and Western Europe. The balance between affordability and luxury appeal is likely to sustain long-term growth for both mass and premium ranges.

- By Age Group

The market by age group is segmented into 13–19 Years, 20–30 Years, 31–45 Years, 46–60 Years, and Above 60 Years. 20–30 Years dominated the market in 2024 with a 36.7% revenue share, as this group represents the highest skincare engagement.

Social media influence, beauty trends, and preventive skincare adoption drive demand among millennials and Gen Z. 31–45 Years is expected to grow at the fastest CAGR of 22.4% from 2025 to 2032, fueled by rising concerns around anti-aging, hydration, and targeted skincare solutions. This group also has higher purchasing power compared to younger consumers. Teenagers (13–19 years) maintain steady demand, especially for acne-focused and oil-control cleansers.

- By Cost

The Facial Cleanser market by cost is segmented into Economy, Mid-range, and Premium. Mid-range products dominated in 2024 with a 41.5% market share, as they strike a balance between affordability and quality, attracting middle-class consumers across emerging and developed economies.

Premium cleansers are expected to grow at the fastest CAGR of 21.6% during 2025–2032, driven by increased disposable income, demand for organic/natural products, and brand prestige. Economy products continue to see strong adoption in price-sensitive markets, but consumer upgrades to mid-range and premium categories are accelerating globally. This shift reflects a broader premiumization trend in skincare, where consumers are prioritizing ingredient transparency and dermatological efficacy.

- By Target Customer

On the basis of target customer, the market is segmented into Male, Female, and Unisex. Female consumers dominated the market in 2024 with a 68.2% revenue share, driven by higher skincare adoption, diverse product ranges, and long-standing beauty routines.

Male-focused cleansers are projected to grow at the fastest CAGR of 23.3% between 2025 and 2032, fueled by rising grooming awareness, celebrity endorsements, and the influence of men’s skincare influencers. Unisex cleansers also continue gaining traction, especially among younger consumers preferring gender-neutral brands. The overall shift toward inclusive skincare is expected to balance the market, with unisex and male-targeted products expanding faster in the coming years.

- By End Use

The market by end use is segmented into Personal Use, Commercial (Spas, Salons, Wellness Centers), and Others. Personal use dominated the segment with a 73.6% revenue share in 2024, as skincare routines have become daily essentials across global households. Accessibility through online and offline retail strengthens this category.

Commercial use is expected to grow at the fastest CAGR of 20.8% during 2025–2032, driven by the rise of professional skincare treatments, premium spa experiences, and salon facial cleansing services. The commercial expansion is especially strong in urban Asia-Pacific and Middle Eastern regions, where beauty services are growing rapidly. Overall, DIY skincare remains the backbone, while commercial treatments provide high-value opportunities.

- By Distribution Channel

The distribution channel market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others. Supermarkets/Hypermarkets led the market in 2024 with a 38.9% share, benefiting from mass consumer reach, bulk purchasing, and frequent product launches.

Online retail is expected to record the fastest CAGR of 24.7% between 2025 and 2032, fueled by e-commerce expansion, influencer-driven purchases, subscription models, and discounts. Specialty beauty stores continue to play a crucial role in premium product distribution, offering expert consultation and product trials. The ongoing shift toward digital-first shopping is reshaping the competitive landscape, particularly among Gen Z and millennials.

Which Region Holds the Largest Share of the Facial Cleanser Market?

- Germany facial cleanser market captured a significant revenue share of 45.78% in 2024, driven by a highly health-conscious population and strong demand for clean-label, vegan, and dermatologist-recommended products

- Germany’s robust cosmetics manufacturing sector and consumer preference for sustainable packaging fuel growth. The country’s focus on innovation and natural ingredients ensures steady adoption across retail and online platforms

U.K. Facial Cleanser Market Insight

U.K. facial cleanser market is projected to grow at a notable CAGR of 8.41%, supported by rising awareness of skin health, pollution effects, and anti-aging needs. Demand for premium and organic facial cleansers is rising, particularly among urban millennials. The U.K.’s strong e-commerce infrastructure and high adoption of subscription-based beauty boxes are further propelling market penetration across all income groups.

France Facial Cleanser Market Insight

France facial cleanser market holds a dominant position within Europe, owing to the country’s heritage in luxury skincare and cosmetics. French consumers emphasize dermatological safety, natural actives, and premium formulations. Major global beauty brands headquartered in France strengthen domestic availability, while pharmacy-based skincare sales remain a significant channel for growth.

Italy Facial Cleanser Market Insight

Italy facial cleanser market is expanding steadily, supported by a strong beauty culture and rising consumer interest in organic and artisanal skincare brands. Italy’s role as a trendsetter in fashion and lifestyle extends to beauty products, boosting the appeal of cleansers with natural, Mediterranean-sourced ingredients. Increasing tourism also drives sales of luxury skincare products, further enhancing market demand.

Spain Facial Cleanser Market Insight

Spain facial cleanser market is witnessing rapid growth due to a rising middle-class population, increasing awareness of UV-related skin damage, and the growing popularity of affordable yet effective skincare brands. Spanish consumers are highly responsive to dermatologist-backed cleansers and moisturizing solutions tailored for dry and sensitive skin types. Retail chains and online beauty platforms are key growth drivers.

Which are the Top Companies in Facial Cleanser Market?

The facial cleanser industry is primarily led by well-established companies, including:

- Unilever (U.K.)

- Procter & Gamble (U.S.)

- L'Oréal Paris (France)

- Estée Lauder Inc. (U.S.)

- Johnson & Johnson Consumer Inc. (U.S.)

- Amorepacific (South Korea)

- Kao Corporation (Japan)

- Shiseido Co., Ltd. (Japan)

- Group L’OCCITANE (Switzerland)

- Coty Inc. (U.S.)

- Clarins (France)

- Caudalie (France)

- Natura & Co (Brazil)

- Beiersdorf AG (Germany)

What are the Recent Developments in Europe Facial Cleanser Market?

- In October 2024, Kenvue announced that its Neutrogena brand is strengthening its presence in dermatological beauty through multi-year partnerships with the world’s most-followed dermatologist, Dr. Muneeb Shah, and skincare innovator, Dr. Dhaval Bhanusali. This move highlights Neutrogena’s commitment to merging advanced science with beauty for delivering exceptional skincare results and clinical efficacy

- In May 2024, Mary Kay reinforced its dedication to women’s empowerment in Scandinavia by expanding into Denmark, one of the most egalitarian societies and a founding member of the European Union, ranking third on the EU Gender Equality Index. This expansion underlines Mary Kay’s strategy of advancing inclusivity and equality within its global growth initiatives

- In May 2024, Olay introduced its Cleansing Melts, a concentrated water-activated facial cleanser that transforms into a rich lather when mixed with water and rubbed between the hands. This launch reflects Olay’s ongoing focus on innovation and providing convenient yet effective skincare solutions

- In February 2024, Shiseido is set to debut its new brand, Shiseido Beauty Wellness (SBW), entering the wellness category with products designed to help consumers embrace their individual beauty and well-being. This initiative emphasizes Shiseido’s strategic diversification and alignment with growing wellness-driven consumer trends

- In September 2023, Shiseido announced its entry into the wellness market with the introduction of Shiseido Beauty Wellness (SBW), marking a significant step beyond traditional skincare. This development demonstrates Shiseido’s commitment to blending beauty and wellness in response to evolving consumer lifestyles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.