Europe Flexible Digital Video Cystoscopes Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.86 Billion

2025

2033

USD

1.20 Billion

USD

1.86 Billion

2025

2033

| 2026 –2033 | |

| USD 1.20 Billion | |

| USD 1.86 Billion | |

|

|

|

|

Europe Flexible Digital Video Cystoscopes Market Size

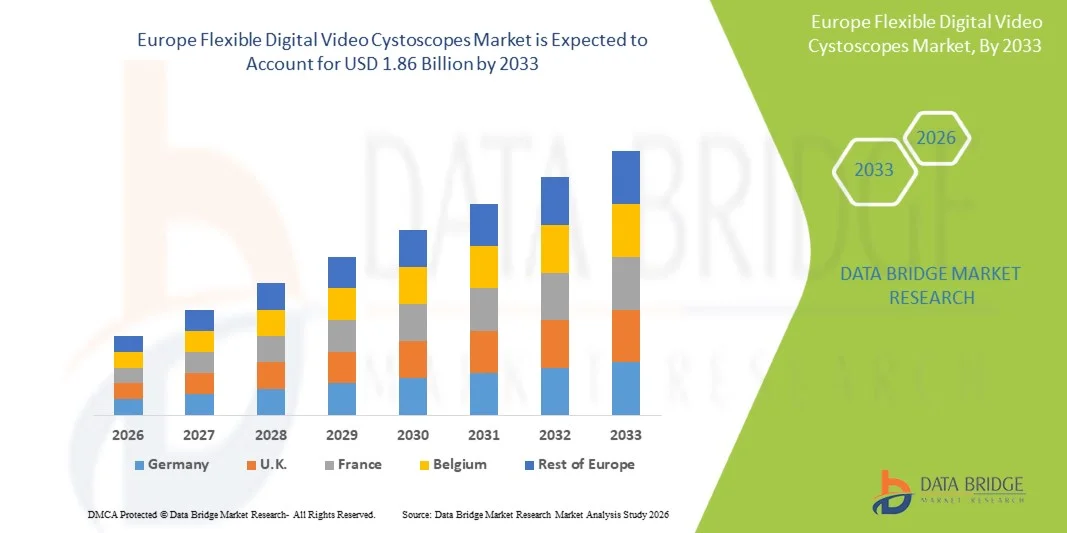

- The Europe flexible digital video cystoscopes market size was valued at USD 1.20 billion in 2025 and is expected to reach USD 1.86 billion by 2033, at a CAGR of 5.70% during the forecast period

- The market growth is primarily driven by the increasing prevalence of urological disorders, coupled with rising awareness about minimally invasive diagnostic procedures across hospitals and clinics

- In addition, technological advancements in imaging quality, durability, and sterilization of flexible cystoscopes, along with the rising demand for patient-friendly and precise diagnostic tools, are positioning flexible digital video cystoscopes as the preferred choice in urology. These combined trends are accelerating adoption, thereby significantly propelling the market's growth

Europe Flexible Digital Video Cystoscopes Market Analysis

- Flexible digital video cystoscopes, providing high-resolution imaging and minimally invasive diagnostic capabilities for the urinary tract, are increasingly essential tools in modern urology practices across hospitals, clinics, and outpatient centers due to their precision, patient comfort, and seamless integration with hospital IT systems

- The rising demand for flexible digital video cystoscopes is primarily driven by increasing prevalence of urological disorders, growing awareness of minimally invasive diagnostics, and preference for procedures that reduce patient discomfort and recovery time

- Germany dominated the market with the largest revenue share of 36.2% in 2025, supported by advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and the presence of leading medical device manufacturers, with hospitals and clinics experiencing substantial growth in cystoscopy procedures fueled by continuous product innovations in imaging, sterilization, and ergonomics

- France is expected to be the fastest-growing country in the flexible digital video cystoscopes market during the forecast period due to increasing hospital investments, growing awareness of early diagnosis, and expanding urology services

- Reusable flexible digital cystoscopes segment dominated the Europe market with a share of 46.7% in 2025, driven by cost-effectiveness over multiple procedures, established adoption in hospitals, and continuous improvements in sterilization and imaging technologies

Report Scope and Europe Flexible Digital Video Cystoscopes Market Segmentation

|

Attributes |

Europe Flexible Digital Video Cystoscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Flexible Digital Video Cystoscopes Market Trends

Enhanced Diagnostic Precision Through Imaging and Connectivity

- A significant and accelerating trend in the Europe flexible digital video cystoscopes market is the integration of high-resolution imaging with digital connectivity for data storage, telemedicine, and AI-assisted diagnostics, significantly enhancing procedural precision and workflow efficiency

- For instance, the Olympus CYF-VH flexible cystoscope offers seamless integration with hospital imaging systems, allowing urologists to capture, store, and share patient data for collaborative review. Similarly, Karl Storz flexible cystoscopes support live video streaming and remote consultations for improved patient management

- AI-assisted imaging in flexible cystoscopes enables enhanced lesion detection and predictive analysis, providing urologists with intelligent insights for diagnosis. For instance, some Pentax models utilize AI algorithms to highlight abnormal tissue patterns and can alert clinicians if unusual findings are detected during the procedure. Furthermore, digital connectivity allows for hands-free documentation, enabling physicians to focus on real-time observation while automatically recording procedure data

- The seamless integration of flexible cystoscopes with hospital IT platforms facilitates centralized patient management, allowing healthcare providers to link cystoscopy data with electronic medical records, imaging systems, and diagnostic reports for a unified clinical workflow

- This trend towards more precise, intelligent, and interconnected cystoscopy systems is fundamentally reshaping clinical expectations for urological diagnostics. Consequently, companies such as Boston Scientific are developing AI-enabled flexible cystoscopes with features such as real-time tissue analysis and seamless data integration with hospital networks

- The demand for flexible digital video cystoscopes that offer enhanced imaging, AI support, and digital connectivity is growing rapidly across hospitals and specialty clinics, as clinicians increasingly prioritize diagnostic accuracy and integrated workflow solutions

Europe Flexible Digital Video Cystoscopes Market Dynamics

Driver

Rising Need Due to Increasing Urological Disorders and Minimally Invasive Diagnostics

- The increasing prevalence of urological disorders among the European population, coupled with the growing preference for minimally invasive diagnostic procedures, is a significant driver for the heightened demand for flexible digital video cystoscopes

- For instance, in March 2025, Karl Storz launched an advanced AI-assisted flexible cystoscope designed to improve lesion detection and procedural efficiency in hospitals. Such innovations by key companies are expected to drive market growth during the forecast period

- As clinicians become more aware of the benefits of minimally invasive procedures, flexible digital video cystoscopes offer advanced features such as high-resolution imaging, improved maneuverability, and patient comfort, providing a compelling upgrade over traditional rigid cystoscopes

- Furthermore, the growing adoption of hospital IT integration and telemedicine solutions is making flexible digital cystoscopes an integral component of modern diagnostic workflows, offering seamless connectivity with EMRs and imaging databases

- The convenience of reusable and portable designs, combined with real-time imaging capabilities and AI-assisted insights, are key factors propelling the adoption of flexible digital video cystoscopes in hospitals and outpatient centers across Europe

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The high cost of flexible digital video cystoscopes, especially those with advanced imaging, AI, and connectivity features, poses a significant challenge to broader adoption, particularly in smaller clinics or budget-constrained hospitals

- For instance, high purchase and maintenance costs of AI-enabled Pentax and Olympus cystoscopes have limited adoption in certain European healthcare facilities, causing some institutions to rely on conventional or reusable rigid cystoscopes

- Addressing these cost concerns through cost-effective solutions, leasing models, and hospital procurement programs is crucial for expanding market penetration. In addition, stringent European medical device regulations and compliance standards create entry barriers for new manufacturers, affecting the availability and adoption of advanced devices

- While some mid-range cystoscope models have become more accessible, premium models with integrated AI, high-definition imaging, and sterilization features still carry a substantial price tag, restricting adoption to larger hospitals and specialty centers

- Overcoming these challenges through innovation in cost management, regulatory compliance, and targeted clinician education will be vital for sustained growth of the flexible digital video cystoscopes market in Europe

Europe Flexible Digital Video Cystoscopes Market Scope

The market is segmented on the basis of product, application, end user, and distribution channel.

- By Product

On the basis of product, the Europe flexible digital video cystoscopes market is segmented into reusable flexible digital video cystoscopies and single-use cystoscopes. The reusable flexible digital video cystoscopies segment dominated the market with the largest revenue share of 46.7% in 2025, driven by their cost-effectiveness over multiple procedures and established adoption in hospitals and clinics. These devices are preferred due to their high-quality imaging, long-term durability, and compatibility with advanced sterilization systems. Hospitals benefit from reusable cystoscopes as they provide consistent performance, lower per-procedure cost, and integration with hospital IT systems for patient data management. They are also widely used in teaching hospitals and large urology centers that require frequent procedures and high-definition imaging for both diagnostics and training purposes. The segment continues to see strong demand due to continuous innovations in ergonomics, optics, and reprocessing efficiency.

The single-use cystoscope segment is expected to witness the fastest growth during the forecast period, driven by increasing awareness of infection control and cross-contamination risks. These devices eliminate the need for reprocessing, reduce hospital-associated infection risks, and enable deployment in outpatient clinics or small hospitals. The rising adoption of point-of-care diagnostics and regulatory encouragement for single-use devices in Europe also supports rapid growth. Moreover, their portability, ease of use, and reduced maintenance costs make them attractive to clinics and ambulatory centers. Technological advancements in disposable imaging and cost-efficient materials further enhance adoption across various healthcare facilities.

- By Application

On the basis of application, the market is segmented into diagnostic and treatment procedures. The diagnostic segment dominated the market in 2025 due to the increasing prevalence of urological disorders and early screening programs across Europe. Diagnostic flexible cystoscopy is widely used for bladder cancer detection, monitoring recurrence, and identifying urinary tract abnormalities. Hospitals and specialized urology centers rely on these devices for real-time observation, high-resolution imaging, and seamless integration with electronic reporting systems, which improves clinical decision-making and workflow efficiency. The segment benefits from continuous technological improvements in imaging, maneuverability, and patient comfort. Growing awareness among patients about early detection and minimally invasive procedures also drives adoption in outpatient clinics.

The treatment segment is expected to witness the fastest growth, driven by technological advances allowing flexible cystoscopes to perform minor therapeutic procedures such as tumor resections, stone removal, and localized drug delivery. These interventions reduce patient recovery time, procedural complications, and hospital stay, making them suitable for both hospitals and ambulatory surgery centers. The ability to combine diagnostics and treatment in a single procedure enhances procedural efficiency and clinical outcomes. Increasing clinician awareness about minimally invasive therapies and hospital preference for multipurpose devices further accelerates segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgery centers (ASCs), and others. The hospitals segment dominated the Europe market in 2025 due to advanced healthcare infrastructure, high procedure volumes, and the presence of experienced urologists. Hospitals prefer flexible cystoscopes for their versatility, reliable imaging, and integration with electronic medical records (EMR) and hospital IT systems. Centralized sterilization facilities, bulk procurement practices, and higher budgets also support adoption in large hospital networks. High-volume hospitals value reusable devices for long-term cost efficiency and consistent performance. In addition, hospitals often engage in teaching or research programs that require advanced imaging capabilities, further strengthening market dominance.

The clinics segment is expected to witness the fastest growth, driven by increasing outpatient diagnostic services, rising patient preference for minimally invasive procedures, and the expanding number of private urology practices in Europe. Clinics benefit from portable and single-use flexible cystoscopes, which reduce sterilization requirements, operational costs, and patient turnover time. Growing awareness of outpatient diagnostic convenience, technological improvements in small-form-factor cystoscopes, and regulatory support for safe single-use devices further accelerate adoption. Clinics also prefer devices that can integrate with local EMR systems for patient data management.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retailer. The direct tender segment dominated the market in 2025 due to large hospitals and healthcare systems procuring cystoscopes directly from manufacturers or via centralized contracts. Direct procurement ensures product authenticity, warranty support, and bulk pricing advantages. Manufacturers can provide on-site training, after-sales services, and integration assistance for hospital IT systems. This channel is especially preferred by high-volume hospitals and teaching centers that require long-term partnerships with manufacturers. The segment benefits from strong relationships between leading device manufacturers and hospital networks.

The retailer segment is expected to witness the fastest growth due to increasing availability of flexible cystoscopes through medical equipment distributors and e-commerce platforms. Retail channels enable smaller clinics, ambulatory surgery centers, and private practices to access cystoscopes without direct manufacturer contracts. They offer faster delivery, product variety, and flexible financing options. Retailers also support product demonstrations, training, and after-sales service, which enhances adoption in emerging and underserved European markets. The growing preference for convenient purchasing and leasing options further accelerates growth in this segment.

Europe Flexible Digital Video Cystoscopes Market Regional Analysis

- Germany dominated the market with the largest revenue share of 36.2% in 2025, supported by advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and the presence of leading medical device manufacturers

- Hospitals and specialized urology centers in the country prioritize high-resolution flexible cystoscopes due to their accuracy, patient comfort, and seamless integration with electronic medical records (EMRs) and imaging systems

- This strong adoption is further supported by continuous product innovations, experienced urologists, and centralized hospital procurement practices, making flexible digital cystoscopes the preferred choice for both diagnostic and minor therapeutic procedures in Germany

The Germany Flexible Digital Video Cystoscopes Market Insight

The Germany flexible digital video cystoscopes market captured the largest revenue share in Europe in 2025, fueled by advanced healthcare infrastructure, high procedure volumes, and growing awareness of minimally invasive urological diagnostics. Hospitals and specialty urology centers prioritize high-resolution flexible cystoscopes for accurate imaging, patient comfort, and seamless integration with electronic medical records (EMRs). The strong presence of medical device manufacturers and research hospitals further accelerates adoption. Both reusable and single-use devices are widely utilized to optimize cost and operational efficiency. Technological innovations, including AI-assisted imaging and improved sterilization methods, are driving further uptake. Government and private sector support for advanced diagnostic equipment ensures Germany remains a dominant market in Europe.

France Flexible Digital Video Cystoscopes Market Insight

The France flexible digital video cystoscopes market is anticipated to grow at the fastest CAGR during the forecast period due to increasing hospital investments, expansion of outpatient diagnostic services, and rising patient awareness about urological health. Minimally invasive procedures are gaining popularity in public and private healthcare facilities. Single-use cystoscopes are increasingly preferred in clinics and ambulatory centers to reduce cross-contamination risks. Integration with hospital IT systems for EMR and imaging data management enhances workflow efficiency. Technological improvements and availability of advanced devices in mid-sized hospitals accelerate adoption. Government health initiatives and private healthcare expansion position France as a key growth driver in Europe.

U.K. Flexible Digital Video Cystoscopes Market Insight

The U.K. flexible digital video cystoscopes market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising urological disorder prevalence and adoption of minimally invasive diagnostics. Hospitals and private clinics are increasingly implementing flexible cystoscopes for both diagnostic and minor therapeutic procedures. Concerns regarding patient comfort and infection control are encouraging adoption of single-use devices in outpatient settings. Integration with EMRs and hospital IT networks enhances workflow efficiency. Continuous product innovation and clinician training programs further support market growth. Growing awareness among patients regarding early detection and precision diagnostics is also propelling demand in the U.K.

Italy Flexible Digital Video Cystoscopes Market Insight

The Italy flexible digital video cystoscopes market is witnessing steady growth, driven by rising investments in hospital infrastructure, modernization of urology departments, and increasing patient awareness regarding minimally invasive procedures. Hospitals are adopting high-resolution flexible cystoscopes for improved diagnostic accuracy and treatment outcomes. Single-use devices are gaining popularity in private clinics to minimize infection risks and simplify workflow. Technological advancements, including AI-assisted imaging, are enhancing procedural efficiency. Supportive government healthcare programs and growing reimbursement policies for advanced diagnostics contribute to market expansion. Rising hospital budgets and patient preference for comfort and safety strengthen adoption across Italy.

Europe Flexible Digital Video Cystoscopes Market Share

The Europe Flexible Digital Video Cystoscopes industry is primarily led by well-established companies, including:

- Boston Scientific Corporation (U.S.)

- Olympus Corporation (Japan)

- PENTAX (Japan)

- KARL STORZ SE & Co. KG (Germany)

- Ambu A/S (Denmark)

- Richard Wolf GmbH (Germany)

- Vision-Sciences Inc. (U.S.)

- Zhuhai Seesheen Medical Technologies Co. Ltd. (China)

- Uroviu Corporation (U.S.)

- Neoscope Inc. (U.S.)

- Laborie (U.S.)

- Coloplast Group (Denmark)

- Stryker (U.S.)

- MOSS S.p.A (Italy)

- Endoservice GmbH (Germany)

- Maxer Endoscopy GmbH (Germany)

- OPTEC Endoscopy Systems GmbH (Germany)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

What are the Recent Developments in Europe Flexible Digital Video Cystoscopes Market?

- In June 2025, Photocure was reported to host a “Bladder Cancer Roadshow” in Germany and Austria to raise awareness of bladder cancer and the importance of advanced diagnostic equipment among urology teams. Business Norway

- In February 2025, Ambu expanded the CE mark of its aScope 5 Cysto HD in Europe to include a new indication: single use flexible cysto nephroscopy. This expansion enables the device to be used for a broader procedural category beyond standard cystoscopy, namely PCNL—where a small tract is created to access and remove kidney stone

- In February 2025, Photocure and Richard Wolf announced an interim flexible BLC solution is now available in countries (including Europe) where the System blue platform and Richard Wolf reusable flexible scopes are already cleared. This interim setup combines existing components to allow earlier access to blue light flexible cystoscopy while the fully optimised 4K system is under development

- In July 2024, Photocure ASA and Richard Wolf GmbH announced a strategic partnership to develop and commercialise a next generation 4K LED high definition reusable flexible blue light cystoscope (BLC®) for global markets including Europe.Under the agreement, Richard Wolf will develop the hardware (flexible BLC system) and own the IP, while Photocure will contribute its knowledge of bladder cancer surveillance procedures and marketing capabilities

- In October 2023, Ambu A/S announced that its single use HD cystoscope solution, the Ambu® aScope™ 5 Cysto HD (in combination with the Ambu® aView™ 2 Advance endoscopy system), received the European CE mark for regulated use across Europe. With this clearance, Ambu expanded its urology portfolio to include a premium single use flexible cystoscope device offering superior imaging quality (full HD) compared to its earlier model

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.