Europe Flexible Printed Circuit Fpc Market

Market Size in USD Billion

CAGR :

%

USD

4.21 Billion

USD

10.18 Billion

2024

2032

USD

4.21 Billion

USD

10.18 Billion

2024

2032

| 2025 –2032 | |

| USD 4.21 Billion | |

| USD 10.18 Billion | |

|

|

|

|

Europe Flexible Printed Circuit (FPC) Market Size

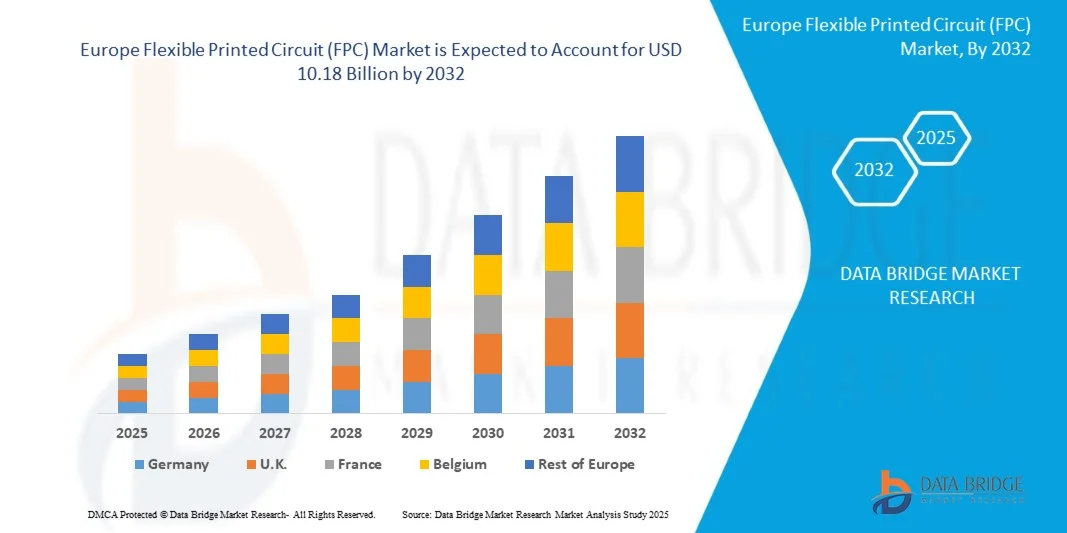

- The Europe Flexible Printed Circuit (FPC) market is expected to reach USD 10.18 billion by 2032 from USD 4.21 billion in 2024, growing with a substantial CAGR of 11.7% in the forecast period of 2025 to 2032

- The Europe Flexible Printed Circuit (FPC) market growth is significantly influenced by the rising demand for compact and lightweight electronic devices across various industries, necessitating high-performance and space-saving interconnect solutions.

- This expansion is further supported by increasing investments in the Europe consumer electronics and automotive sectors, including wearables and electric vehicles, which drive the demand for reliable and flexible FPC technology. In addition, there is a growing availability and adoption of advanced materials and manufacturing processes for FPCs, which contributes to market accessibility and sustained growth by offering improved flexibility, durability, and signal integrity.

Europe Flexible Printed Circuit (FPC) Market Analysis

- The escalating demand for compact and high-performance electronic devices, driven by Europe digitalization, IoT integration, and the push for miniaturization, is a major trend driving the demand for Flexible Printed Circuits (FPCs) in the Europe region. As electronic functionality continues to surge, traditional rigid PCBs face limitations in flexibility and space utilization.

- Flexible Printed Circuits, being the crucial interconnect solution for most modern electronic devices and modules, remain an essential infrastructure solution for modernizing consumer electronics, supporting automotive infotainment systems, and enabling seamless integration across the vast geography.

- The Europe flexible printed circuit market is primarily driven by the critical need for advanced interconnectivity and miniaturization in consumer electronics, automotive, and medical devices, and the high utilization rate of flexible components in industries like smartphones, wearables, and advanced display technologies. The market is influenced by the pace of technological innovation in material science and the regulatory environment for electronic device design, including Europe standards and product development cycles, which affects overall adoption.

- The Germany is expected to be the dominant and fastest growing country in the Europe Flexible Printed Circuit (FPC) market propelled by continuous advancements in material science and significant industrial investments in smart electronics. The regional focus on improving device performance and optimizing product design in a highly competitive environment is further driving demand for high-grade FPC solutions as a critical part of advanced electronic management and sustainable development strategies.

- The multi-layer segment is the dominant type in the Europe flexible printed circuit market with a market share of 36.60% in 2025, reflecting the robust growth in compact and cost-effective electronic devices necessitates the continued and strategic deployment of multi-layer segment for simplified interconnectivity and reduced manufacturing complexity, positioning these materials as a vital component in regional electronics and portable device future.

Report Scope and Europe Flexible Printed Circuit (FPC) Market Segmentation

|

Attributes |

Europe Flexible Printed Circuit (FPC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Europe Flexible Printed Circuit (FPC) Market Trends

“Growing Demand for Flexible Circuits in Electric and Hybrid Vehicles”

- The accelerating shift toward electric and hybrid vehicle production constitutes a significant driver for the Europe Flexible Printed Circuit (FPC) market. As Original Equipment Manufacturers (OEMs) and tier suppliers reengineer vehicle architectures to accommodate battery systems, advanced driver assistance, enhanced infotainment, and light weighting imperatives, the demand for highly integrated, thinner, and more conformable wiring and interconnect solutions rises

- Flexible printed circuits offer a compelling combination of reduced mass, compact form factor, and high routing density that suits the electrified mobility ecosystem. The growing recognition by governments and industry of these requirements, through targeted programmes and investments, further reinforces the upward trajectory of FPC adoption in automotive applications

- For instance, in April 2024, Ennovi introduced a new flexible circuit production process for low-voltage connectivity in electric vehicle battery cell contacting systems, explicitly framing the technology as a sustainable, size-optimized alternative to conventional flexible printed circuits

- The expanding transition to electric and hybrid vehicles is a key catalyst for the Europe Flexible Printed Circuit (FPC) market. As automotive manufacturers integrate advanced battery systems, driver-assistance technologies, and software-defined vehicle architectures, the demand for lightweight, high-density, and conformable interconnect solutions grows substantially.

- Flexible printed circuits are uniquely positioned to meet these requirements, offering reduced mass, compact form factor, and enhanced routing capabilities. Supported by government initiatives, research programs, and industry investments

Europe Flexible Printed Circuit (FPC) Market Dynamics

Driver

“Expanding FPC Adoption in Automotive and Medical Electronics ”

- The expanding adoption of Flexible Printed Circuits (FPCs) in automotive and medical electronics constitutes a significant driver for the Europe FPC market. In the automotive sector, vehicle electrification, advanced driver assistance systems, and increasing in-cabin functionality are prompting OEMs and tier suppliers to specify thinner, lighter, and more comfortable interconnects that reduce harness complexity and enable higher integration density, requirements that FPC technology satisfies

- In medical electronics, the growth of wearable monitors, implantable sensors, and minimally invasive diagnostic platforms is accelerating demand for bendable, biocompatible interconnects and embedded sensor arrays. Regulators and funding agencies are reinforcing this trajectory through targeted guidance and innovation programs

- Public-sector and industry innovation programmes that fund flexible hybrid electronics and support supply-chain resilience further lower technical and commercial barriers to scale, thereby converting application-level demand into procurable volumes for FPC suppliers

- For instance, in April 2024, a News release by the European Commission highlighted the BAYFLEX initiative (via the European Commission’s CORDIS database), which reported on the development of flexible organic electronic sensor patches engineered on bendable substrates for electrophysiological signal detection and classification

- The accelerating integration of Flexible Printed Circuits (FPCs) within automotive and medical electronics represents a pivotal force shaping the Europe FPC market. In automotive applications, the transition toward electrification, intelligent driver-assistance systems, and enhanced in-cabin digitalization continues to amplify the demand for lightweight, conformable, and space-efficient interconnect solutions that optimize performance while reducing wiring complexity

Restraint/Challenge

“Dependence of FPC Manufacturing on Costly Polyimide and Copper Materials”

- The Europe Flexible Printed Circuit (FPC) market has a heavy dependence on high-cost materials, such as polyimide films and copper foils. These materials play a critical role in achieving the required flexural durability, high thermal and electrical performance, and miniaturization capabilities demanded by modern FPCs

- Elevated and volatile raw-material costs, coupled with supply-chain bottlenecks for polyimide substrates and copper, increase manufacturing cost bases, reduce margin flexibility, and raise barriers for smaller entrants and volume-sensitive buyers

- As a result, the material cost burden can slow adoption in cost-sensitive segments and limit pricing competitiveness of FPCs relative to traditional rigid or semi-rigid interconnect solutions

- For instance, in May 2023, an article in EC Electronics stated that the electronics manufacturing industry commentary noted that PCB producers are facing supply-chain disruption and raw-material cost volatility for copper foils, resins, and glass fabrics, which are integral components of flex- and rigid-flex interconnect solutions

- The Europe Flexible Printed Circuit (FPC) market is significantly constrained by its dependence on high-cost materials, particularly polyimide films and copper foils. These materials are essential for ensuring thermal stability, electrical performance, and mechanical flexibility, yet their elevated and volatile pricing creates substantial cost pressures for manufacturers.

Europe Flexible Printed Circuit (FPC) Market Scope

The Europe Flexible Printed Circuit (FPC) market is segmented into seven notable segments which are type, manufacturing process, material, flexibility, form factor, end-user, and distribution channel.

- By Type

On the basis of type the Europe Flexible Printed Circuit (FPC) market is segmented into multi layer, double sided, single sided, rigid flexible circuit, dual access, sculptured FPC, and others. In 2025, the multi-layer segment is expected to dominate the market with 33.60% market share, as these circuits offer enhanced design flexibility and high circuit density within a compact structure. Additionally, they enable efficient interconnection of complex electronic components while maintaining superior performance and reliability.

The single-sided segment is expected to achieve the fastest growth, with a CAGR of 12.6%, driven by the rising demand for high-density interconnections and enhanced functionality in compact electronic devices, including smartphones, wearables, and medical implants.

- By Manufacturing Process

On the basis of manufacturing process, the Europe Flexible Printed Circuit (FPC) market is segmented into subtractive process, additive process, adhesive and adhesiveless lamination. In 2025, the subtractive process segment is expected to dominate the market with 80.39% market share due to the market owing to its widespread availability and cost-effectiveness compared to other manufacturing processes, making it a preferred choice for large-scale flexible circuit production.

The additive process segment is projected to be the fastest-growing CAGR of 12.0%, due to its ability to create finer lines and spaces, reduce material waste, and enable more complex and customized FPC designs, which are critical for advanced applications in medical devices and high-frequency communication.

- By Material

On the basis of material, the Europe Flexible Printed Circuit (FPC) market is segmented into base material and conductor material. In 2025, the base material segment is expected to dominate the market with 63.04% market share owing to its superior thermal stability, flexibility, and reliability, which enable efficient circuit performance and durability under varying environmental conditions.

The base material segment is projected to be the fastest-growing CAGR of 12.2% due to the increasing demand for enhanced signal integrity, higher current carrying capacity, and improved thermal management in FPCs, which are critical for high-speed data transmission and power applications.

- By Flexibility

On the basis of flexibility, the Europe Flexible Printed Circuit (FPC) market is segmented into static flex (flex-to-install), dynamic flex (flex-to-fit/move), rollable / foldable. In 2025, the static flex (flex-to-install) segment is expected to dominate the market with 62.03% market share due to its widespread use in applications where the FPC is bent or shaped once during assembly and remains in a fixed position. Its cost-effectiveness and reliability for such applications, common in consumer electronics and automotive modules, make it a preferred choice for integrating components in tight spaces.

The rollable / foldable segment is projected to grow with fastest-growing CAGR of 13.4% due to the increasing demand for FPCs that can withstand repeated bending and movement over their operational lifespan, which are critical for applications like flip phones, wearable devices, and robotic arms.

- By Form Factor

On the basis of form factor, the Europe Flexible Printed Circuit (FPC) market is segmented into standard thickness, ultra-thin (<50 µM), and thick (>200 µM). In 2025, standard thickness segment is expected to dominate the market with 67.26% market share due to its widespread use and balance of flexibility, durability, and cost-effectiveness for a broad range of electronic devices. Its suitability for conventional manufacturing processes makes it a preferred choice for general-purpose FPC applications in consumer electronics and automotive industries.

The ultra-thin (<50 µM) segment is projected grow with fastest-growing CAGR of 12.4% due to the increasing demand for extreme miniaturization and highly compact electronic devices, particularly in wearables, medical implants, and advanced display technologies.

- By End-User

On the basis of end user, the Europe Flexible Printed Circuit (FPC) market is segmented into consumer electronics, automotive, industrial & robotics, IoT & smart devices, medical devices, telecommunication, aerospace & defense, and others. In 2025, consumer electronics segment is expected to dominate the market with 42.65% market share due to the high volume production of smartphones, tablets, laptops, and other personal electronic devices that extensively utilize FPCs for compact design and advanced functionality.

The automotive segment is projected to be the fastest-growing CAGR of 13.5% due to the explosive growth of interconnected devices, smart home appliances, and various sensors that require flexible, miniature, and robust interconnections. This growth is also fueled by the need for FPCs in wearables, smart sensors, and remote monitoring systems that demand high levels of integration in a small form factor. Furthermore, the increasing adoption of 5G technology and the expansion of smart city initiatives may accelerate the adoption of this segment.

- By Distribution Channel

On the basis of distribution channel, the Europe Flexible Printed Circuit (FPC) market is segmented into the direct sales in-direct sales. In 2025, direct sales segment is expected to dominate the market with 70.57% market share due to market owing to the strong presence of established distribution networks and the growing demand for efficient, direct supply channels that ensure product availability and faster delivery across end-use industries.

The direct sales segment is expected to experience the fastest growth, with a projected CAGR of 11.9%, driven by increasing consumer preference for personalized and convenient purchasing experiences. This growth is fueled by the ability of brands to directly engage with customers, offer tailored promotions, and maintain stronger relationships without intermediaries.

Europe Flexible Printed Circuit (FPC) Market Regional Analysis

- The Europe region is recognized as a significant market for Flexible Printed Circuits (FPCs), driven by the high and increasing prevalence of advanced automotive electronics, massive growth in medical device manufacturing, and the expansion of industrial automation and IoT applications, making the material an essential component of the continent's innovation and high-reliability connectivity strategies

- The escalating rate of electronic device adoption and industrial modernization, coupled with the need for enhanced compact designs and improved signal integrity across diverse European economies, is a major catalyst for the essential and growing adoption of FPCs in the region

The steady expansion and modernization of electronics manufacturing and communication infrastructure, especially in major industrial centres and technological hubs, and the high burden of ensuring seamless data transmission and efficient device operation, are further accelerating the demand for potent, high-density FPC offerings in Europe

Europe Flexible Printed Circuit (FPC) Market Insight

Europe Flexible Printed Circuit (FPC) Market is poised for robust growth of 11.7% in the forecast period of 2025 to 2032, supported by rising demand across automotive, industrial, medical, and consumer‑electronics sectors. As European manufacturers accelerate adoption of electric vehicles, automation systems, and IoT‑enabled devices, FPCs are increasingly preferred for their flexibility, high‑density interconnections and compact form factor. In particular, countries such as Germany, France and the United Kingdom lead the region due to strong industrial‑electronics, automotive and electronics manufacturing bases, complemented by rigorous quality standards and a focus on sustainability. Multi‑layer and rigid‑flex FPC types are gaining traction, driven by demand for durable, miniaturised, high‑performance circuits in EVs, medical devices, industrial automation and 5G/telecom hardware. Standards, positioning Europe as a leading region for high-quality and energy-efficient soft magnetic material solutions.

Germany Flexible Printed Circuit (FPC) Market Insight

Germany’s FPC market is rapidly expanding and growing with the highest CAGR of 13.2% in the forecast period of 2025 to 2032, supported by strong demand from its advanced automotive, industrial‑electronics and consumer‑electronics sectors. The growing adoption of Electric Vehicles (EVs), Advanced Driver‑Assistance Systems (ADAS), factory automation and 5G/telecom equipment is driving need for compact, lightweight, high‑density flexible circuits. As domestic manufacturers and OEMs push for miniaturization and space‑efficient designs, multi‑layer and rigid‑flex FPCs are becoming increasingly preferred. Combined with Germany’s robust precision‑manufacturing ecosystem, sustainability regulations, and innovation in flexible‑electronics R&D, the FPC segment is poised for sustained growth over the coming years.

France Flexible Printed Circuit (FPC) Market Insight

France’s FPC market has been expanding rapidly, driven by growing demand from automotive, aerospace, telecommunications, industrial electronics, and consumer‑electronics sectors. As electric vehicles, 5G infrastructure, and advanced automation gain traction, multi‑layer and rigid‑flex FPCs are increasingly adopted for their compactness, lightweight design, and reliability under vibration or temperature stress. Domestic manufacturing clusters and a strong electronics‑R&D ecosystem support innovation in high‑density, high‑performance flexible circuitry. With rising need for miniaturized, energy‑efficient devices such as EV control units, telecom hardware, and wearable medical/industrial modules France’s FPC market is expected to sustain robust growth in coming years.

Flexible Printed Circuit (FPC) Market Share

The Flexible Printed Circuit (FPC) industry is primarily led by well-established companies, including:

- NOK CORPORATION (Japan)

- Zhen Ding Tech. Group Technology Holding Limited (China)

- Nitto Denko Corporation (Japan)

- Fujikura Printed Circuits Ltd. (Subsidiary of Fujikura Ltd.) (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- Flexium Interconnect.Inc (Taiwan)

- Amphenol Corporation (U.S.)

- IBIDEN (Japan)

- MFLEX (U.S.)

- Würth Elektronik eiSos GmbH & Co. KG (Germany)

- TTM Technologies Inc. (U.S.)

- Interflex co.,ltd. (South Korea)

- Cicor Group (Switzerland)

- MFS Technology (Singapore)

- Cirexx International (U.S.)

- AS&R Circuits India Pvt. Ltd. (India)

- PCB Power (U.S.)

- AdvancedPCB (U.S.)

- QDOS (Malaysia)

- MEKTEC Manufacturing Co. (Taiwan)

- FPCWAY (China)

- Tate Circuit Industries Ltd (U.K.)

- Millennium Circuits Limited (U.S.)

- Flexible Circuit (U.S.)

- Shah Circuitech (India)

Latest Developments in Europe Flexible Printed Circuit (FPC) Market

- In October 2025, Zhen Ding Technology unveiled its “One ZDT” strategic blueprint at the TPCA Show 2025, integrating semiconductor, advanced packaging, and PCB technologies under a unified growth model. The company emphasized its role in enabling AI and high-performance computing applications by showcasing next-generation IC substrates and high-end PCBs. This initiative reinforces Zhen Ding’s position in the evolving AI ecosystem, leveraging heterogeneous integration to enhance computing performance and establish a stronger foothold in advanced electronic packaging markets.

- In March, 2025, Nitto Denko Corporation was selected among the “Clarivate Top 100 Europe Innovators 2025,” recognizing its excellence in research and development capabilities and robust intellectual property strategy.

- In September 2025, Zhen Ding Technology showcased its advancements in IC heterogeneous integration and advanced packaging at SEMICON Taiwan’s High-Tech Smart Manufacturing Forum. The company emphasized its role in driving AI-powered digital transformation, aligning PCB technologies with semiconductor integration trends. By leveraging advanced packaging and heterogeneous integration, Zhen Ding aims to overcome the limitations of Moore’s Law and expand its ecosystem within the AI and high-performance computing sectors.

- In March, 2025, The Fujikura Printed Circuits Ltd announced the development of an FPC with a kirigami/origami structure in joint research with Waseda University, enabling expansion/contraction and curved-surface adaptability while maintaining the mounting plane.

- In August 2025, Amphenol announced a definitive agreement to acquire CommScope Connectivity and Cable Solutions (CCS) for US USD 10.5 billion in cash, significantly enhancing Amphenol’s fiber-optic interconnect and connectivity capabilities in the IT/datacom and communications networks markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS: EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.1.1 INTRODUCTION:

4.1.2 INTENSITY OF COMPETITIVE RIVALRY (MODERATE TO HIGH)

4.1.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.1.4 THREAT OF SUBSTITUTES (LOW)

4.1.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.1.6 BARGAINING POWER OF BUYERS (HIGH)

4.1.7 CONCLUSION

4.2 VALUE CHAIN ANALYSIS — EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.2.1 INTRODUCTION

4.2.2 RAW MATERIAL AND COMPONENT SUPPLY

4.2.3 MATERIAL INPUTS

4.2.4 SUPPLIER ROLES AND COLLABORATION

4.2.5 CHALLENGES AND RISKS

4.2.6 MANUFACTURING AND ASSEMBLY

4.2.7 DISTRIBUTION AND LOGISTICS

4.2.8 INTEGRATION AND SYSTEM ASSEMBLY

4.2.9 END-USE APPLICATIONS AND AFTERMARKET

4.2.10 CROSS-STAGE STRATEGIC CONSIDERATIONS

4.3 REGULATORY STANDARDS GOVERNING THE EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.3.1 MATERIAL AND DESIGN STANDARDS

4.3.2 ELECTRICAL AND MECHANICAL RELIABILITY TESTING

4.3.3 ENVIRONMENTAL AND SUSTAINABILITY COMPLIANCE

4.3.4 QUALITY MANAGEMENT AND MANUFACTURING PROCESS STANDARDS

4.3.5 SECTOR-SPECIFIC REGULATORY FRAMEWORKS

4.3.6 EMERGING STANDARDS AND INDUSTRY ADAPTATION

4.3.7 CONCLUSION

4.4 PENETRATION AND GROWTH PROSPECT MAPPING — EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.4.1 INTRODUCTION

4.4.2 FRAMEWORK AND METHODOLOGY (SUMMARY)

4.4.3 CURRENT PENETRATION ANALYSIS

4.4.3.1 GEOGRAPHIC PENETRATION

4.4.3.2 VERTICAL / APPLICATION PENETRATION

4.4.3.3 TECHNOLOGY & PRODUCT PENETRATION

4.4.4 GROWTH-PROSPECT MAPPING: DRIVERS AND ENABLERS

4.4.4.1 TECHNOLOGY AND PRODUCT DRIVERS

4.4.4.2 COMMERCIAL AND SUPPLY-CHAIN ENABLERS

4.4.4.3 POLICY & ECOSYSTEM ENABLERS

4.4.5 GROWTH LIMITATIONS AND CONSTRAINTS

4.4.5.1 TECHNICAL CONSTRAINTS

4.4.5.2 SUPPLY AND COST CONSTRAINTS

4.4.5.3 MARKET & COMMERCIAL CONSTRAINTS

4.4.6 MAPPING GROWTH PROSPECTS BY SCENARIO

4.4.7 STRATEGIC IMPLICATIONS AND PRIORITIZED ACTIONS

4.4.7.1 FOR FABRICATORS AND EQUIPMENT SUPPLIERS

4.4.7.2 FOR OEMS AND INTEGRATORS

4.4.7.3 FOR INVESTORS AND POLICYMAKERS

4.4.8 MEASURABLE KPIS FOR TRACKING PENETRATION AND GROWTH

4.5 NEW BUSINESS & EMERGING REVENUE OPPORTUNITIES — FUTURE OUTLOOK EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.5.1 INTRODUCTION

4.5.2 DEMAND PULL: APPLICATION-LED REVENUE POOLS

4.5.2.1 AUTOMOTIVE & EV ARCHITECTURES

4.5.2.2 WEARABLES, TEXTILE ELECTRONICS & CONSUMER IOT

4.5.2.3 MEDICAL & BIO-INTEGRATED DEVICES

4.5.2.4 AEROSPACE, SPACE & INDUSTRIAL ROBOTICS

4.5.3 ECHNOLOGY-DRIVEN BUSINESS MODELS & SERVICES

4.5.3.1 DESIGN-AS-A-SERVICE AND RAPID PROTOTYPING

4.5.3.2 MANUFACTURING-AS-A-SERVICE (MAAS) / FLEXIBLE CAPACITY LEASING

4.5.3.3 ADDITIVE & PRINTED ELECTRONICS LICENSING

4.5.3.4 SYSTEM INTEGRATION & MODULE SUPPLY

4.5.3.5 SUBSCRIPTION & DATA-DRIVEN SERVICES

4.5.4 MANUFACTURING & PROCESS INNOVATION — REVENUE LEVERS

4.5.4.1 ROLL-TO-ROLL AND HIGH-THROUGHPUT FABRICATION

4.5.4.2 ADVANCED SUBSTRATES & HIGH-RELIABILITY MATERIALS

4.5.4.3 HYBRID PRODUCTION (ADDITIVE + SUBTRACTIVE)

4.5.4.4 IN-PROCESS INSPECTION & DIGITAL TRACEABILITY

4.5.5 SUPPLY-CHAIN & LOCALIZATION OPPORTUNITIES

4.5.5.1 ON-SHORING AND REGIONAL HUBS

4.5.5.2 TIERED SUPPLIER ECOSYSTEMS

4.5.5.3 LOGISTICS AND VALUE-ADDED DISTRIBUTION

4.5.6 AFTERMARKET, RECYCLING & CIRCULAR ECONOMY REVENUE STREAMS

4.5.6.1 COMPONENT RECOVERY & MATERIAL REUSE

4.5.6.2 SERVICE & REPAIR PROGRAMS

4.5.7 BARRIERS, RISKS & MITIGATIONS (BUSINESS-LEVEL CONSIDERATIONS)

4.5.8 STRATEGIC RECOMMENDATIONS FOR NEW & EMERGING BUSINESSES

4.5.9 FUTURE OUTLOOK (5–10 YEAR HORIZON)

4.5.10 CONCLUSION

4.6 TECHNOLOGY MATRIX ANALYSIS–EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.7 COMPANY COMPARATIVE ANALYSIS – EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.8 COMPANY SERVICE PLATFORM MATRIX – EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.9 EMERGING PRODUCTION PROCESSES SHAPING THE FPC AND FHE INDUSTRIES

4.1 KEY INSIGHTS ON TECHNOLOGICAL ADVANCEMENTS

4.10.1 KEY TECHNOLOGICAL BREAKTHROUGHS IN FPC MANUFACTURING

4.10.1.1 ADHESIVELESS LAMINATION TECHNOLOGY

4.10.1.2 SEMI-ADDITIVE PROCESS (SAP) & MODIFIED SAP (MSAP)

4.10.1.3 LASER DIRECT IMAGING (LDI) & UV LASER MICROVIA DRILLING

4.10.2 MARKET IMPACT & STRATEGIC IMPLICATIONS

4.10.3 MATERIAL INNOVATION IN COPPER FOILS & POLYIMIDE FILMS — STRATEGIC DRIVER FOR FPC MARKET LEADERSHIP

4.10.4 SUPPLY CHAIN & STRATEGIC IMPLICATIONS OF FPC MATERIAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 EXPANDING FPC ADOPTION IN AUTOMOTIVE AND MEDICAL ELECTRONICS.

5.1.2 RISING DEMAND FOR COMPACT AND LIGHTWEIGHT ELECTRONIC DEVICES

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN FPC DESIGN AND MATERIALS

5.1.4 GROWING DEMAND FOR FLEXIBLE CIRCUITS IN ELECTRIC AND HYBRID VEHICLES

5.2 RESTRAINTS

5.2.1 DEPENDENCE OF FPC MANUFACTURING ON COSTLY POLYIMIDE AND COPPER MATERIALS

5.2.2 HIGH DEFECT RATES DURING PRECISION BENDING OPERATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF FPC CIRCUIT IN AEROSPACE AND DEFENSE SYSTEMS.

5.3.2 EXPANDING FPC APPLICATIONS IN NEXT-GENERATION FOLDABLE PHONES

5.3.3 STRATEGIC PARTNERSHIPS FOR ADVANCED RIGID-FLEX PRODUCT DEVELOPMENT

5.4 CHALLENGES

5.4.1 CONTINUOUS PRESSURE TO REDUCE COSTS WHILE SUSTAINING QUALITY STANDARDS

5.4.2 RAPID TECHNOLOGICAL CHANGES DEMANDING CONTINUOUS INNOVATION INVESTMENT

6 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE

6.1 OVERVIEW

6.2 MULTI-LAYER

6.3 DOUBLE SIDED

6.4 SINGLE SIDED

6.5 RIGID FLEXIBLE CIRCUIT

6.6 DUAL ACCESS

6.7 SCULPTURED FPC

6.8 OTHERS

7 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 SUBTRACTIVE PROCESS

7.3 ADDITIVE PROCESS

7.4 ADHESIVE AND ADHESIVELESS LAMINATION

8 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 BASE MATERIAL

8.3 CONDUCTOR MATERIAL

9 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 STATIC FLEX (FLEX-TO-INSTALL)

9.3 DYNAMIC FLEX (FLEX-TO-FIT/MOVE)

9.4 ROLLABLE / FOLDABLE

10 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR

10.1 OVERVIEW

10.2 STANDARD THICKNESS

10.3 ULTRA-THIN (<50 µM)

10.4 THICK (>200 µM)

11 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.3 AUTOMOTIVE

11.4 INDUSTRIAL & ROBOTICS

11.5 IOT & SMART DEVICES

11.6 MEDICAL DEVICES

11.7 TELECOMMUNICATION

11.8 AEROSPACE & DEFENSE

11.9 OTHERS

12 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 IN-DIRECT SALES

13 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 UNITED KINGDOM

13.1.4 ITALY

13.1.5 SWEDEN

13.1.6 NETHERLANDS

13.1.7 SWITZERLAND

13.1.8 SPAIN

13.1.9 FINLAND

13.1.10 NORWAY

13.1.11 DENMARK

13.1.12 TURKEY

13.1.13 BELGIUM

13.1.14 RUSSIA

13.1.15 REST OF EUROPE

14 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 NOK CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZHEN DING TECH. GROUP TECHNOLOGY HOLDING LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 NITTO DENKO CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 FUJIKURA PRINTED CIRCUITS LTD. (SUBSIDIARY OF FUJIKURA LTD.)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 SUMITOMO ELECTRIC INDUSTRIES, LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCED PCB

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMPHENOL CORPORATION..

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 AS&R CIRCUITS INDIA PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CIREXX INTERNATIONAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CICOR GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 FLEXIBLE CIRCUIT

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FPCWAY

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FLEXIUM INTERCONNECT.INC

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 INTERFLEX CO.,LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 IBIDEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 MILLENNIUM CIRCUITS LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MFS TECHNOLOGY

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MEKTEC MANUFACTURING CO.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MFLEX

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PCB POWER

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 QDOS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SHAH CRICUITECH

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 TATE CIRCUIT INDUSTRIES LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 TTM TECHNOLOGIES INC

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENT

16.25 WÜRTH ELEKTRONIK EISOS GMBH & CO. KG

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 COMPANY COMPARATIVE ANALYSIS

TABLE 4 COMPANY SERVICE PLATFORM MATRIX

TABLE 5 STRATEGIC IMPLICATIONS FOR OEMS, FPC MANUFACTURERS & INVESTORS

TABLE 6 TECHNOLOGY MAP

TABLE 7 SEMI-ADDITIVE PROCESS (SAP) & MODIFIED SAP (MSAP) PARAMETERS

TABLE 8 COPPER FOIL ADVANCEMENTS — ROLLED ANNEALED (RA) VS. ELECTRODEPOSITED (ED) VS. NEXT-GENERATION HIGH-FREQUENCY COPPER

TABLE 9 POLYIMIDE FILM EVOLUTION — FROM STANDARD PI TO TRANSPARENT & LOW-DK FLEX SUBSTRATES

TABLE 10 WHO IS INVESTING AND WHY IT MATTERS?

TABLE 11 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 13 EUROPE MULTI LAYER IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE MULTI LAYER IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE SINGLE SIDED IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE RIGID FLEXIBLE CIRCUIT IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE DUAL ACCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE SCULPTURED FPC IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE OTHERS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 22 EUROPE SUBTRACTIVE PROCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE ADDITIVE PROCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE ADHESIVE AND ADHESIVELESS LAMINATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE STATIC FLEX (FLEX-TO-INSTALL) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE DYNAMIC FLEX (FLEX-TO-FIT/MOVE) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE ROLLABLE / FOLDABLE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE STANDARD THICKNESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE ULTRA-THIN (<50 µM) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE THICK (>200 µM) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE AEROSPACE & DEFENCE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE OTHERS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 67 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 69 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 71 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 EUROPE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 95 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 97 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 GERMANY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 GERMANY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 GERMANY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 GERMANY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 GERMANY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 GERMANY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 GERMANY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 GERMANY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 GERMANY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 118 GERMANY IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 121 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 122 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 123 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 FRANCE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 FRANCE MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 FRANCE AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 FRANCE FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 UNITED KINGDOM PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 147 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 149 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED KINGDOM BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED KINGDOM CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 153 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 154 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 155 UNITED KINGDOM CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 UNITED KINGDOM CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 UNITED KINGDOM AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 UNITED KINGDOM AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 UNITED KINGDOM INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 UNITED KINGDOM INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 UNITED KINGDOM IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 UNITED KINGDOM IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 UNITED KINGDOM MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 UNITED KINGDOM MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 UNITED KINGDOM TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 UNITED KINGDOM TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 UNITED KINGDOM AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 UNITED KINGDOM AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 UNITED KINGDOM FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 170 UNITED KINGDOM IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 ITALY PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 173 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 174 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 175 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 176 ITALY BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 ITALY CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 180 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ITALY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 ITALY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ITALY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 ITALY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 ITALY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 ITALY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 ITALY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 ITALY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 ITALY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 ITALY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 196 ITALY IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SWEDEN PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 199 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 200 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 201 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 202 SWEDEN BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SWEDEN CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 205 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 206 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 207 SWEDEN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SWEDEN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SWEDEN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SWEDEN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SWEDEN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SWEDEN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SWEDEN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 SWEDEN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SWEDEN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SWEDEN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SWEDEN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SWEDEN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SWEDEN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SWEDEN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SWEDEN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 222 SWEDEN IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 NETHERLANDS PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 225 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 226 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 227 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 228 NETHERLANDS BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 NETHERLANDS CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 231 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 232 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 233 NETHERLANDS CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 NETHERLANDS CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 NETHERLANDS AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 NETHERLANDS IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NETHERLANDS MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NETHERLANDS MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NETHERLANDS TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 NETHERLANDS TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 NETHERLANDS AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 NETHERLANDS AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 NETHERLANDS FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 248 NETHERLANDS IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SWITZERLAND PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 251 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 252 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 253 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 254 SWITZERLAND BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 258 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 259 SWITZERLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SWITZERLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWITZERLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SWITZERLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SWITZERLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 SWITZERLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SWITZERLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SWITZERLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SWITZERLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SWITZERLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SWITZERLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SWITZERLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SWITZERLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 SWITZERLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 SWITZERLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 SWITZERLAND IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 SPAIN PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 277 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 278 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 279 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 280 SPAIN BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 SPAIN CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 283 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 SPAIN CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SPAIN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SPAIN AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SPAIN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SPAIN INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SPAIN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SPAIN IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 SPAIN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SPAIN MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SPAIN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SPAIN TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SPAIN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SPAIN AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SPAIN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 300 SPAIN IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 FINLAND PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 303 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 304 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 305 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 306 FINLAND BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 FINLAND CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 309 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 310 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 311 FINLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 FINLAND CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 FINLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 FINLAND AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 FINLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 FINLAND INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 FINLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 FINLAND IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 FINLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 FINLAND MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 FINLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 FINLAND TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 FINLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 FINLAND AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 FINLAND FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 326 FINLAND IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 NORWAY PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 329 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 330 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 331 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 332 NORWAY BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 NORWAY CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 335 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 336 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 337 NORWAY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 NORWAY CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 NORWAY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 NORWAY AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 NORWAY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 NORWAY INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 NORWAY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 NORWAY IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 NORWAY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 NORWAY MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 NORWAY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 NORWAY TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 NORWAY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 NORWAY AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 NORWAY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 352 NORWAY IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 DENMARK PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 355 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 356 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 357 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 358 DENMARK BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 DENMARK CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 361 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 362 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 363 DENMARK CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 DENMARK CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 DENMARK AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 DENMARK AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 DENMARK INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 DENMARK INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 DENMARK IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 DENMARK IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 DENMARK MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 DENMARK MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 DENMARK TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 DENMARK TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 DENMARK AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 DENMARK AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 DENMARK FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 378 DENMARK IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 TURKEY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 TURKEY PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 381 TURKEY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 382 TURKEY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 383 TURKEY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 384 TURKEY BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 TURKEY CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 TURKEY FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)