Europe Fluorspot And Elispot Assay Market

Market Size in USD Billion

CAGR :

%

USD

121.31 Billion

USD

366.76 Billion

2025

2033

USD

121.31 Billion

USD

366.76 Billion

2025

2033

| 2026 –2033 | |

| USD 121.31 Billion | |

| USD 366.76 Billion | |

|

|

|

|

Europe ELISpot and FluoroSpot Assay Market Size

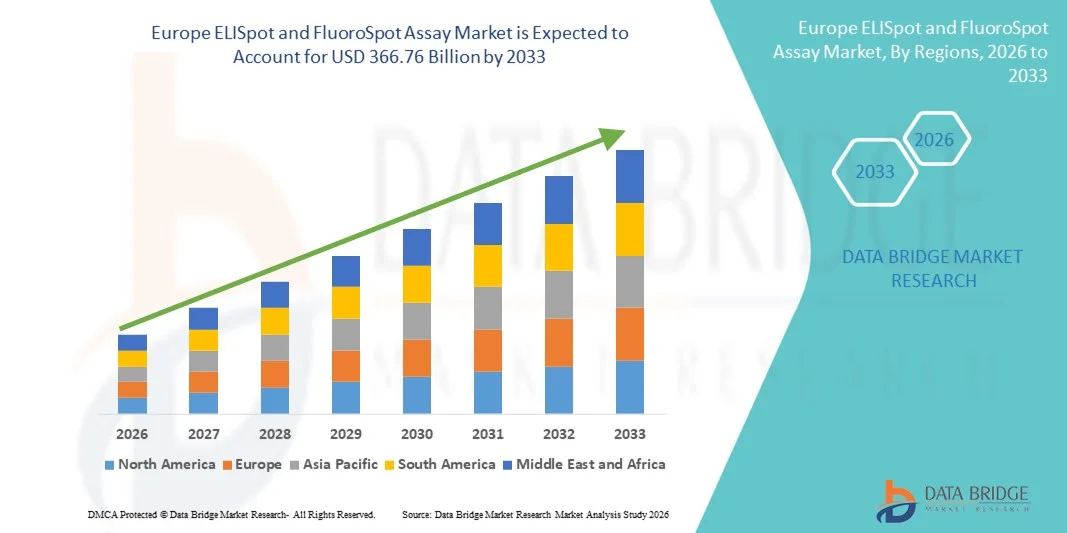

- The Europe ELISpot and fluorospot assay market size was valued at USD 121.31billion in 2025 and is expected to reach USD 366.76 billion by 2033, at a CAGR of 13.60% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced immunological research techniques and continuous technological advancements in assay platforms, leading to higher precision, sensitivity, and throughput in both academic research and clinical laboratory settings

- Furthermore, the rising demand for accurate, reproducible, and high-sensitivity immune monitoring tools in vaccine development, infectious disease research, cancer immunotherapy, and autoimmune disorder studies is establishing ELISpot and FluoroSpot assays as preferred solutions for cellular immune response analysis. These converging factors are accelerating the uptake of ELISpot and FluoroSpot assay solutions, thereby significantly boosting the overall market growth

Europe ELISpot and FluoroSpot Assay Market Analysis

- ELISpot and FluoroSpot assays, offering highly sensitive detection of cytokine-secreting cells at the single-cell level, are increasingly vital tools in immunology research, clinical diagnostics, and drug development due to their high accuracy, reproducibility, and ability to analyze multiple immune markers simultaneously.

- The escalating demand for ELISpot and FluoroSpot assays is primarily driven by the rapid growth in vaccine development, cancer immunotherapy, infectious disease research, and autoimmune disorder studies, along with the increasing need for robust immune monitoring in both preclinical and clinical settings

- U.K. dominated the ELISpot and FluoroSpot Assay market with the largest revenue share of approximately 36.2% in 2025, supported by strong government funding for life science research, a high concentration of biotechnology and pharmaceutical companies, advanced laboratory infrastructure, and rapid adoption of immunological assays across academic and clinical research institutions

- Germany is expected to be the fastest-growing region in the ELISpot and FluoroSpot Assay market during the forecast period, with a projected CAGR of 9.8%, driven by increasing investments in biotech R&D, rising prevalence of infectious diseases, expanding CRO services, and growing demand for advanced diagnostic and immunology research tools

- The research applications segment dominated with 62.1% revenue share in 2025, driven by extensive use in immunology research

Report Scope and ELISpot and FluoroSpot Assay Market Segmentation

|

Attributes |

ELISpot and FluoroSpot Assay Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

• Mabtech (Sweden) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe ELISpot and FluoroSpot Assay Market Trends

Rising Adoption of Advanced Cellular Immune Monitoring Techniques

- A significant and accelerating trend in the global ELISpot and FluoroSpot Assay market is the increasing adoption of advanced cellular immune response monitoring techniques across infectious disease research, oncology, and vaccine development. These assays are recognized for their high sensitivity in detecting antigen-specific T-cell and B-cell responses at the single-cell level

- For instance, during the COVID-19 pandemic (2021–2022), research institutions and pharmaceutical companies worldwide widely adopted ELISpot and FluoroSpot assays to evaluate T-cell responses and vaccine efficacy, supporting accelerated vaccine development and immune-response monitoring

- Technological advancements, including multi-parameter FluoroSpot assays, are enabling simultaneous detection of multiple cytokines, significantly improving assay efficiency and data depth. This has increased adoption in translational research and immunotherapy development

- The growing use of ELISpot and FluoroSpot assays in vaccine efficacy testing, particularly for infectious diseases such as COVID-19, tuberculosis, hepatitis, and emerging viral infections, is further strengthening global market demand across academic and clinical research institutions

- This trend toward high-precision, reproducible, and scalable immune monitoring tools is reshaping immunological research practices globally, encouraging assay manufacturers to expand manufacturing, distribution networks, and technical support capabilities across regions

- As a result, the global ELISpot and FluoroSpot Assay market is expected to grow at a CAGR of approximately 9.0%–10.5% during the forecast period, driven by rising research activity and immunotherapy development worldwide

Europe ELISpot and FluoroSpot Assay Market Dynamics

Driver

Expanding Immunology Research and Rising Burden of Infectious and Chronic Diseases

- The increasing prevalence of infectious diseases, cancer, and autoimmune disorders globally is a major driver of demand for ELISpot and FluoroSpot assays. These assays are extensively used to study cellular immune responses in both clinical diagnostics and research applications

- For instance, global vaccine research and clinical trials for infectious diseases such as COVID-19, HIV, and tuberculosis have significantly increased the procurement of ELISpot and FluoroSpot assay kits across North America, Europe, and Europe between 2021 and 2024

- Government-backed research initiatives and public-private partnerships aimed at strengthening biomedical research and pandemic preparedness are further accelerating assay adoption across academic institutes and biopharmaceutical companies

- The growing number of global clinical trials has directly boosted demand for immune monitoring assays used in safety and efficacy evaluations, especially in oncology and infectious disease vaccine development

- In addition, the expanding presence of global life science companies and contract research organizations (CROs) worldwide is supporting consistent growth in assay consumption across both diagnostic and research applications

Restraint/Challenge

High Assay Costs and Technical Complexity

- One of the key challenges restraining market growth is the relatively high cost of ELISpot and FluoroSpot assay kits, analyzers, and consumables, which can limit adoption among small laboratories and research centers with constrained budgets

- For instance, in many developing countries, limited funding for research and high costs of specialized FluoroSpot analyzers result in continued reliance on conventional ELISA testing, despite the higher sensitivity and data quality offered by ELISpot/FluoroSpot assays

- Variability in assay protocols, sample preparation requirements, and result interpretation can also affect reproducibility, necessitating standardized workflows and skilled technical expertise

- Furthermore, limited awareness and availability of advanced immune monitoring technologies in remote or underdeveloped regions continue to restrict broader market penetration

- Addressing these challenges through cost-effective assay kits, simplified workflows, enhanced training programs, and regional manufacturing expansion will be critical for sustaining long-term growth in the global ELISpot and FluoroSpot Assay market

Europe ELISpot and FluoroSpot Assay Market Scope

The market is segmented on the basis of product type, source, disease, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the ELISpot and FluoroSpot Assay market is segmented into assay kits, supplementary/ancillary products, and analyzers. The assay kits segment dominated the market with the largest revenue share of 56.8% in 2025, driven by high repeat consumption in research and clinical settings. Assay kits provide pre-optimized reagents, coated plates, and detection antibodies, ensuring consistent results and high reproducibility. They are extensively used in vaccine development, infectious disease monitoring, and immunotherapy research. Pharmaceutical and biopharma companies prefer assay kits for standardization across multiple labs. The segment benefits from strong demand in emerging markets due to increasing research funding. It also gains from continuous product launches and improved kit sensitivity. Many laboratories prefer kits to reduce assay setup time and operational complexity. Assay kits are widely adopted in both academic and industrial research. The presence of leading global manufacturers further strengthens its dominance. Growth is supported by rising immune profiling and T-cell response studies. The segment is expected to maintain its lead due to ongoing demand for standardized assays.

The analyzers segment is expected to grow fastest, registering a CAGR of 12.9% from 2026 to 2033. Growth is driven by increasing demand for automated spot counting and multiplex analysis. Analyzers improve workflow efficiency and reduce human error in manual counting. They support high-throughput screening needed for large clinical trials and vaccine studies. Advanced imaging systems also enable better data analytics and digital storage. The adoption of FluoroSpot assays, which require sophisticated analyzers, further boosts growth. Rising laboratory automation trends in developed economies accelerate adoption. In addition, growing investments in immuno-oncology research increase demand for precise immune monitoring. Analyzers are increasingly used in centralized labs to support multiple research projects. Their ability to integrate with laboratory information systems (LIMS) enhances operational efficiency. Continuous technological upgrades and AI-based spot recognition contribute to rapid growth.

- By Source

On the basis of source, the market is segmented into human, mouse, monkey, and others. The human source segment dominated with 48.3% revenue share in 2025, supported by extensive clinical usage. Human-based assays are essential for vaccine trials, infectious disease monitoring, and immunotherapy research. Rising prevalence of cancer, autoimmune diseases, and infectious diseases increases demand for human immune response profiling. Pharmaceutical companies prefer human sample assays for better translational relevance in clinical trials. The segment benefits from strong funding for clinical research and increased clinical trial activities. It is further supported by regulatory emphasis on human-relevant data. Human assays are widely used in diagnostic laboratories for immune monitoring. The growth of personalized medicine and immunotherapy strengthens adoption. Moreover, improved access to clinical samples boosts segment growth. The presence of advanced clinical laboratories in developed countries further supports dominance.

The mouse source segment is expected to grow fastest, with a CAGR of 11.7% from 2026 to 2033. Mouse models are widely used in preclinical immunology research and drug discovery. They provide vital data on immune mechanisms before human trials. The growth is supported by rising investments in preclinical studies and animal model research. Academic institutions and CROs rely on mouse assays for early-stage drug evaluation. Increasing focus on translational immunology and vaccine research boosts demand. Mouse assays are used to evaluate novel therapeutics and immune responses. The segment benefits from strong research activity in North America and Europe. Growing adoption of genetically modified mouse models further supports growth.

- By Disease

On the basis of disease, the market is segmented into infectious diseases, cancer, autoimmune diseases, allergy, and others. The infectious diseases segment dominated with 34.9% revenue share in 2025, due to rising global disease burden. ELISpot assays are essential for detecting antigen-specific T-cell responses. They are widely used for TB, HIV, hepatitis, and emerging infectious diseases. Government screening programs and public health initiatives drive adoption. Vaccine development and monitoring also contribute strongly. The segment benefits from increasing research funding for infectious diseases. Rapid outbreak response and pandemic preparedness further strengthen demand. Diagnostic laboratories increasingly use ELISpot for immune monitoring. The segment is supported by growing awareness of immune response analysis. The presence of leading assay manufacturers enhances product availability. Continuous innovation in assay sensitivity improves diagnostic reliability.

The cancer segment is expected to grow fastest, with a CAGR of 13.6% from 2026 to 2033. Growth is driven by rising immunotherapy and personalized cancer treatment. ELISpot and FluoroSpot assays are used to evaluate tumor-specific immune responses. They help monitor patient response to immunotherapy and vaccine-based treatments. Increasing oncology clinical trials and R&D spending supports rapid growth. Biopharma companies use these assays for biomarker discovery and immune profiling. Rising incidence of cancer globally further fuels demand. Growth is also driven by increasing focus on early detection and treatment monitoring.

- By Application

On the basis of application, the market is segmented into diagnostic applications and research applications. The research applications segment dominated with 62.1% revenue share in 2025, driven by extensive use in immunology research. Academic institutions and pharmaceutical companies rely on ELISpot and FluoroSpot assays for vaccine development and immune profiling. The segment benefits from growing research funding globally. It supports preclinical and clinical research in infectious diseases, cancer, and autoimmune disorders. The need for cellular immune response analysis drives strong demand. Research labs prefer standardized assays and kits for consistent results. The segment is supported by collaborations between universities and biotech companies. It also benefits from increasing immunology publications and research output.

The diagnostic applications segment is expected to grow fastest, at a CAGR of 12.4% from 2026 to 2033. Growth is driven by rising use in clinical diagnostics for infectious diseases and immune monitoring. ELISpot assays are increasingly used in diagnostic laboratories for disease screening. Improved validation and regulatory approvals support clinical adoption. The rise of personalized medicine boosts demand for immune monitoring tests. Expansion of clinical laboratories in emerging economies supports growth. Increasing healthcare expenditure and diagnostic infrastructure also contribute.

- By End User

On the basis of end user, the market is segmented into hospitals and clinical laboratories, research institutes, biopharmaceutical companies, and others. The research institutes segment dominated the market with a 41.7% revenue share in 2025, due to extensive academic research and strong funding. Research institutes are major hubs for immunology and vaccine development, driving demand for ELISpot and FluoroSpot assays. They utilize these assays for immune response profiling, vaccine efficacy studies, and translational research. The segment is supported by government-funded programs and collaborations with biotech firms. Research institutes often perform large-scale preclinical studies requiring high volumes of assay kits. Increased publication output and scientific interest in T-cell immunity further fuel growth. Specialized immunology labs in universities contribute to sustained demand. These institutions prefer standardized kits for reproducibility and cross-lab consistency. Bulk procurement agreements also boost revenue share. The segment benefits from long-term research projects and grants. Continuous expansion of immunology departments supports future demand. Research institutes also act as early adopters of advanced analyzers, strengthening market dominance.

The biopharmaceutical companies segment is expected to grow fastest, with a CAGR of 13.2% from 2026 to 2033, driven by rising investments in biologics and immunotherapies. Biopharma firms use ELISpot and FluoroSpot assays for drug discovery, biomarker validation, and clinical trial monitoring. Increasing focus on immune-oncology and vaccine development fuels demand. The segment benefits from the growing number of clinical trials and accelerated drug approval pathways. Biopharmaceutical companies prefer high-throughput analyzers for rapid screening and consistent results. They often partner with CROs for large-scale immunogenicity studies. Rising pipeline drugs in infectious disease and cancer also support rapid growth. The need for robust immune profiling in personalized medicine drives adoption. Biopharma companies prioritize assay standardization to meet regulatory requirements. The segment is strengthened by continuous innovation and automation in assay technology. Increasing collaborations with academic institutions further accelerate growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with a 52.6% revenue share in 2025, driven by bulk procurement by hospitals, research institutes, and government bodies. Direct tender offers cost advantages through long-term contracts and competitive pricing. Large institutions prefer this channel for reliable supply and consistent quality. Government-funded research projects and public health programs often procure through tenders. Tender-based purchasing also ensures access to the latest assay kits and analyzers. This channel supports large clinical trials and nationwide immunology initiatives. Major manufacturers prefer tender contracts for predictable demand and revenue stability. It reduces distribution overhead and improves supply chain efficiency. Hospitals and large labs benefit from standardized procurement processes. The direct tender channel is dominant in developed regions with established healthcare infrastructure. It also supports large-scale public health screening programs. The segment is expected to remain strong due to ongoing institutional demand.

The retail sales segment is expected to grow fastest, with a CAGR of 11.3% from 2026 to 2033, driven by expanding small labs and CROs purchasing kits through distributors. Growth is supported by increasing demand from emerging economies with growing research infrastructure. Online marketplaces and improved logistics make retail purchasing easier and faster. Retail sales enable smaller institutions to access advanced assay kits without long procurement cycles. Distributors provide localized support and training, increasing adoption. The segment benefits from growing private research facilities and biotech startups. Retail sales also support flexible ordering for seasonal research needs. Increased availability of assay kits in regional markets strengthens this channel. Retail sales help in quick adoption of new assay technologies. The growth is also supported by rising demand for point-of-care and decentralized research labs. The segment is expected to expand due to increasing awareness and accessibility.

Europe ELISpot and FluoroSpot Assay Market Regional Analysis

- The Europe ELISpot and FluoroSpot Assay market is expected to grow at a steady CAGR during the forecast period of 2026 to 2033, supported by strong investments in biotechnology, immunology research, and clinical diagnostics across the region

- Europe benefits from a well-established life sciences ecosystem, robust academic research networks, and advanced laboratory infrastructure. Increasing focus on infectious disease surveillance, cancer immunology, and autoimmune disorder research is driving demand for ELISpot and FluoroSpot assays. Rising government funding for translational research and public health programs further supports market growth. The region also witnesses growing adoption of immune monitoring assays in vaccine development and immunotherapy studies. Expansion of CRO and CDMO services across Europe is increasing assay utilization in clinical trials

- Strong regulatory frameworks ensure high assay quality and standardization. Increasing collaborations between universities, hospitals, and biopharmaceutical companies drive innovation. Growth in personalized medicine and precision diagnostics further boosts assay adoption. The presence of leading global assay manufacturers enhances technology penetration. Overall, Europe remains a mature yet steadily expanding market for ELISpot and FluoroSpot assays

U.K. ELISpot and FluoroSpot Assay Market Insight

The U.K. ELISpot and FluoroSpot Assay market dominated the Europe ELISpot and FluoroSpot Assay market with the largest revenue share of approximately 36.2% in 2025, supported by strong government funding for life science research and innovation. The presence of a high concentration of biotechnology and pharmaceutical companies drives consistent demand for advanced immunological assays. The U.K.’s well-developed academic research institutions and clinical laboratories extensively use ELISpot and FluoroSpot assays for immune response analysis. Rapid adoption of immunoassays in vaccine research and infectious disease studies contributes to market dominance. National healthcare and research initiatives promote early disease detection and immune profiling. Strong public-private partnerships accelerate assay development and commercialization. High clinical trial activity further supports assay consumption. Availability of advanced analyzers and skilled professionals strengthens market leadership. The U.K.’s focus on precision medicine enhances long-term demand. Overall, the country remains the cornerstone of the European ELISpot and FluoroSpot Assay market.

Germany ELISpot and FluoroSpot Assay Market Insight

Germany ELISpot and FluoroSpot Assay market is expected to be the fastest-growing market in Europe, registering a projected CAGR of 9.8% from 2026 to 2033, driven by increasing investments in biotechnology R&D and immunology research. The country’s strong pharmaceutical manufacturing base supports widespread assay adoption. Rising prevalence of infectious and autoimmune diseases is increasing demand for immune monitoring tools. Expansion of CRO services and clinical research organizations fuels assay usage in preclinical and clinical studies. Germany’s advanced laboratory infrastructure enables high-throughput immune profiling. Growing focus on cancer immunotherapy and vaccine development further accelerates growth. Government initiatives promoting biomedical innovation support market expansion. Increasing collaboration between research institutes and biopharma companies strengthens assay demand. Adoption of advanced diagnostic technologies in hospitals is rising steadily. Germany’s emphasis on scientific excellence positions it as the fastest-growing ELISpot and FluoroSpot Assay market in Europe.

Europe ELISpot and FluoroSpot Assay Market Share

The ELISpot and FluoroSpot Assay industry is primarily led by well-established companies, including:

• Mabtech (Sweden)

• Cellular Technology Limited (U.S.)

• BD (U.S.)

• Merck KGaA (Germany)

• Oxford Immunotec (U.K.)

• ImmunoSpot (U.S.)

• Bio-Rad Laboratories (U.S.)

• R&D Systems (U.S.)

• Tecan Group (Switzerland)

• Agilent Technologies (U.S.)

• PerkinElmer (U.S.)

• Lonza (Switzerland)

• Thermo Fisher Scientific (U.S.)

• Sartorius AG (Germany)

• Becton Dickinson (U.S.)

• Nexcelom Bioscience (U.S.)

• ELISpot.com (U.S.)

• CTL (Cellular Technology Limited) (U.S.)

• Cytiva (U.S.)

• AID GmbH (Germany)

Latest Developments in Europe ELISpot and FluoroSpot Assay Market

- In March 2023, Medline Industries introduced a new line of ergonomic crutches designed for enhanced comfort, stability, and ease of use during rehabilitation and mobility support, addressing user needs for longer-term assistive devices

- In June 2023, a breakthrough mobility aid product was announced by Medical Device Company Canes and Crutches (via press release) as a new mobility device in the global market, aiming to broaden the capabilities of traditional mobility aids and support increased independence for users with mobility impairments

- In August 2023, Cool Crutches & Walking Sticks in the UK launched the first walking aid recycling scheme, in collaboration with charity PhysioNet, to refurbish and redistribute used mobility aids, promoting sustainability and improved accessibility worldwide

- In July 2024, Cardinal Health completed an acquisition of a medical device manufacturer, enhancing its mobility aid product portfolio — including canes and crutches — and strengthening its global market presence in therapeutic mobility solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.