Europe Foam Insulation Market

Market Size in USD Billion

CAGR :

%

USD

5.25 Billion

USD

8.31 Billion

2024

2032

USD

5.25 Billion

USD

8.31 Billion

2024

2032

| 2025 –2032 | |

| USD 5.25 Billion | |

| USD 8.31 Billion | |

|

|

|

|

Europe Foam Insulation Market Size

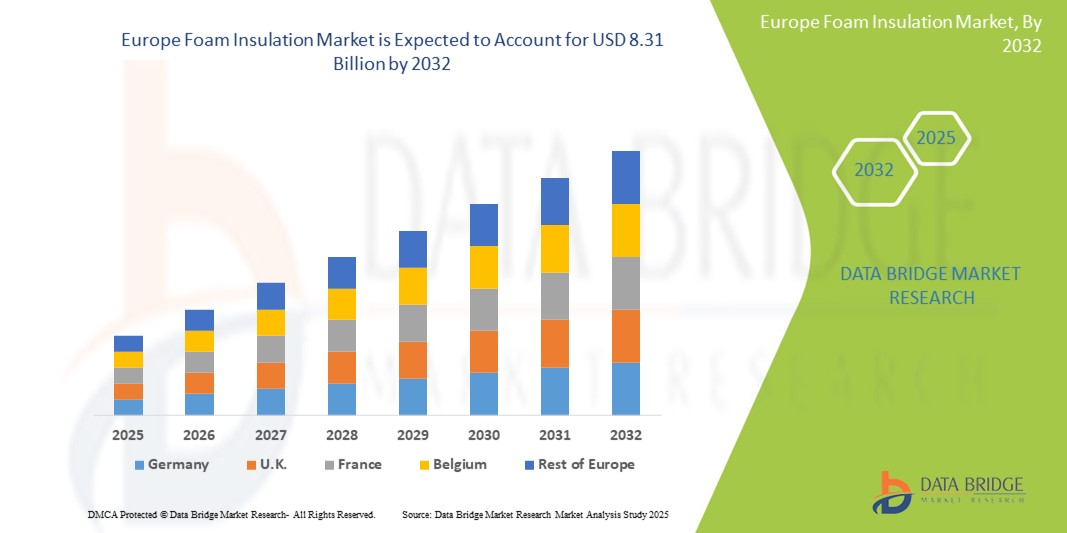

- The Europe foam insulation market size was valued at USD 5.25 billion in 2024 and is expected to reach USD 8.31 billion by 2032, at a CAGR of 5.90% during the forecast period

- This growth is driven by factors such as the increasing emphasis on energy-efficient buildings, stringent building codes and regulations promoting thermal insulation, rising renovation activities across residential and commercial sectors, and growing awareness about environmental sustainability and carbon footprint reduction

Europe Foam Insulation Market Analysis

- The Europe foam insulation market continues to expand steadily due to rising utilization across applications such as wall cavities, roofing systems, and industrial setups where thermal performance is critical

- Market players are focusing on product innovation that enhances durability and performance in demanding environments including retrofitting and new construction

- Germany is expected to dominate the Europe Foam Insulations market with share of 21.05% due to its strong construction sector and commitment to energy-efficient building practices

- France is expected to be the fastest growing region in the Europe Foam Insulation market during the forecast period due to its growing construction activities and energy efficiency programs

- The building and construction segment is expected to dominate the Europe foam insulation market with the largest share of 72.05% in 2025 due to the increasing demand for energy-efficient buildings, stringent environmental regulations, and a growing focus on reducing carbon emissions in the construction sector. In addition, the adoption of foam insulation materials helps improve thermal performance and energy conservation in both residential and commercial buildings

Report Scope and Europe Foam Insulation Market Segmentation

|

Attributes |

Europe Foam Insulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Foam Insulation Market Trends

“Shift Toward Eco-Friendly Foam Insulation Solutions”

- The Europe foam insulation market is witnessing a growing trend toward sustainable product development with a strong shift to eco-friendly insulation solutions

- Many manufacturers are investing in foam materials derived from plant-based sources and recycled inputs to meet green construction goals

- For instance, companies are offering insulation made from renewable materials such as soybean oil or recycled plastic to support low-impact building practices

- This trend is also being shaped by consumer preference for energy-efficient yet environmentally responsible construction products

- In conclusion, as a result, the market is evolving toward a future where innovation and sustainability go hand in hand, transforming how insulation is produced and applied

Europe Foam Insulation Market Dynamics

Driver

“Increasing Demand for Energy-Efficient Construction Solutions”

- Energy-efficient construction is accelerating foam insulation demand as buildings account for around 40 percent of total energy consumption in Europe especially for heating and cooling according to the European Commission

- Foam insulation helps minimize energy loss by creating thermal barriers and enhancing indoor temperature stability which aligns with EU directives such as the Energy Performance of Buildings Directive

- For instance, countries like Germany and France have enforced strict insulation requirements in new residential and commercial projects to meet national energy-saving targets

- High-performance materials such as spray polyurethane foam and expanded polystyrene foam are increasingly used to comply with green building certifications and lower long-term energy costs

- As awareness grows among homeowners and businesses about reduced energy bills and improved comfort foam insulation is no longer optional but essential for meeting modern building standards

- In conclusion regulatory mandates and energy savings are jointly making foam insulation a preferred solution across construction projects in Europe

Opportunity

“Rising Renovation and Retrofitting Activities in Aging Infrastructure”

- Retrofitting and renovation of aging buildings presents a major opportunity for foam insulation as many structures built before the 1990s lack modern insulation standards resulting in high energy costs

- Foam insulation is ideal for upgrades due to its ability to fit irregular shapes and deliver high thermal resistance without requiring major structural modifications

- For instance, the European Union’s Renovation Wave strategy aims to renovate over 35 million buildings by 2030 providing massive scope for insulation system installations

- Financial support such as subsidies tax credits and green loans are encouraging property owners to improve energy performance through insulation upgrades especially in residential and public infrastructure

- Foam-based external insulation systems are being adopted in refurbishment of schools healthcare centers and government buildings improving both efficiency and external appearance

- In conclusion the push to renovate Europe’s outdated building stock is unlocking steady long-term demand for advanced foam insulation solutions

Restraint/Challenge

“Volatility in Raw Material Prices and Supply Chain Disruptions”

- Volatile raw material prices remain a major challenge for the foam insulation market as key inputs like polyurethane and polystyrene are derived from oil and gas which are prone to global price fluctuations

- For instance, during the 2021 energy crisis in Europe insulation manufacturers faced sharp increases in raw material costs due to surging crude oil prices and reduced petrochemical output

- Supply chain disruptions triggered by events like the COVID-19 pandemic the Russia-Ukraine conflict and container shortages have led to inconsistent delivery schedules and inflated costs

- This unpredictability makes it difficult for manufacturers to offer stable pricing or secure long-term contracts and can lead to project delays re-bidding or a shift to more price-stable alternatives

- Smaller players especially struggle to absorb cost increases and maintain competitiveness creating a barrier for consistent foam insulation adoption in cost-sensitive construction segments

- In conclusion the industry’s reliance on fossil-based inputs makes it vulnerable to economic and geopolitical shocks emphasizing the need for diversification and more resilient sourcing strategies

Europe Foam Insulation Market Scope

The market is segmented on the basis of form, application, type, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By Application |

|

|

By Type |

|

|

By End-Use

|

|

In 2025, the building and construction segment is projected to dominate the market with a largest share in end use segment

The building and construction segment is expected to dominate the Europe foam insulation market with the largest share of 72.05% in 2025 due to the increasing demand for energy-efficient buildings, stringent environmental regulations, and a growing focus on reducing carbon emissions in the construction sector. In addition, the adoption of foam insulation materials helps improve thermal performance and energy conservation in both residential and commercial buildings.

The floors segment is expected to account for the largest share during the forecast period in application segment

In 2025, the floors segment is expected to dominate the market with the largest market due to its critical role in minimizing energy loss through building foundations and improving overall thermal performance in residential and commercial structures.

Europe Foam Insulation Market Regional Analysis

“Germany Holds the Largest Share in the Europe Foam Insulation Market”

- Germany is the leading market for foam insulation in Europe with share of 21.05% due to its strong construction sector and commitment to energy-efficient building practices

- The country has stringent energy regulations that push for the adoption of advanced insulation materials in both new builds and renovation projects

- The demand for foam insulation is high in Germany as both residential and commercial sectors focus on enhancing energy performance

- Government incentives and green building initiatives further drive the growth of foam insulation products across various sectors

- Major foam insulation manufacturers are based in Germany, bolstering its dominant position in the market with continuous innovation and high product availability

“France is Projected to Register the Highest CAGR in the Europe Foam Insulation Market”

- France is witnessing the fastest growth in the foam insulation market, fueled by its growing construction activities and energy efficiency programs

- The government’s commitment to reducing carbon emissions and promoting sustainable building practices has led to an increased demand for insulation solutions

- Renovation projects, particularly in older buildings, have seen significant adoption of foam insulation for enhanced thermal efficiency and comfort

- The French market is benefiting from new infrastructure developments that require high-performance insulation to meet modern building standards

- Financial incentives and subsidies for energy-efficient building materials are further accelerating the uptake of foam insulation products across residential and commercial sectors

Europe Foam Insulation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Rogers Corporation (U.S.)

- Sealed Air (U.S.)

- DuPont (U.S.)

- Dow (U.S.)

- NOVA Chemicals Corporate (Canada)

- JSP (Japan)

- KANEKA CORPORATION (Japan)

- Loyal Group (India)

- JIANGSU LEASTY CHEMICAL CO., LTD. (China)

- Wuxi Xingda foam plastic new material Limited (China)

- Taita Chemical Co., Ltd. (Taiwan)

- Reliance Industries Limited (India)

- BASF SE (Germany)

- ARMACELL (Luxembourg)

- Recticel NV (Belgium)

- Arkema (Germany)

- Zotefoams Plc (U.K.)

- Synthos (Poland)

- Versalis S.p.A (Italy)

- SABIC (Saudi Arabia)

Latest Developments in Europe Foam Insulation Market

- In May 2025, Armacell opened a new aerogel insulation plant in India and launched its next-generation aerogel product line. This new facility will enable the company to meet the growing demand for high-performance insulation materials in the region. The product line is designed to offer superior thermal and acoustic insulation properties for various industries, including energy, oil and gas, and construction

- In December 2023, Saint-Gobain has announced its intention to divest a majority stake in its UK foam insulation business, Celotex, as part of its strategic disposal plan. In this move, Celotex's assets will be transferred to a newly established independent company, with Soprema, a private French firm specializing in waterproofing and insulation, acquiring a 75% ownership stake. Saint-Gobain will maintain a 25% minority stake in the new entity. This decision reflects Saint-Gobain's strategic realignment and optimization of its business portfolio, aligning with the expertise of Soprema in the insulation sector

- In June 2022, Owens Corning acquired Natural Polymers LLC, strategically utilizing spray polyurethane foam insulation for building and construction applications, reinforcing its market position, and fostering growth and innovation capabilities

- In August 2021, Owens Corning launched PINK Next Gen Fiberglas insulation, boasting advanced fiber technology for up to 23% faster installation, showcasing its commitment to innovation and efficiency in the insulation market

- In May 2021, DuPont launched a HFC-free version of its spray polyurethane foam insulation, enhancing its product portfolio with eco-friendly solutions, catering to sustainability-conscious consumers and widening its market reach

- In July 2021, Xtratherm, a Unilin Insulation subsidiary, completed the acquisition of Ballytherm's Ireland and U.K. operations, including a PIR insulation plant and plans for expansion, fortifying its presence in the U.K. and Ireland and positioning for sustained market expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.