Europe Foot And Ankle Devices Market

Market Size in USD Million

CAGR :

%

USD

973.60 Million

USD

1,749.70 Million

2024

2032

USD

973.60 Million

USD

1,749.70 Million

2024

2032

| 2025 –2032 | |

| USD 973.60 Million | |

| USD 1,749.70 Million | |

|

|

|

|

Foot and Ankle Devices Market Size

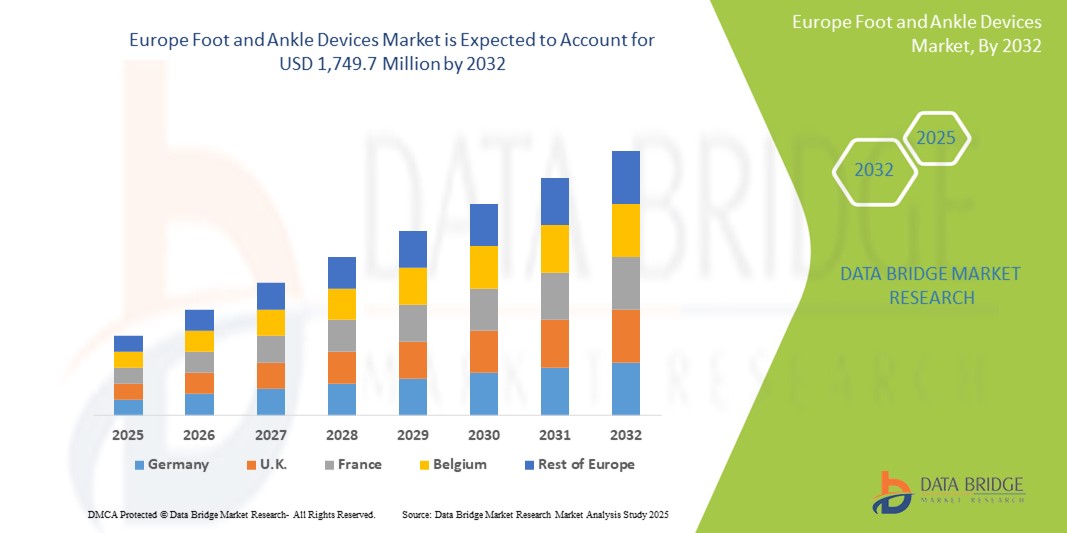

- The Europe Foot and Ankle Devices market size was valued at USD 973.6 million in 2024 and is expected to reach USD 1,749.7 million by 2032, at a CAGR of 7.6% during the forecast period

- The market growth is largely fueled by the rising prevalence of foot and ankle disorders, an increasing number of accident-related road traffic injuries and sports injuries, and the growing geriatric population across Europe.

- Furthermore, technological advancements in foot and ankle devices, such as improved biomaterials, minimally invasive surgical techniques, and personalized 3D-printed orthotics and prosthetics, are driving market expansion. These converging factors are accelerating the adoption of foot and ankle devices, thereby significantly boosting the industry's growth.

Foot and Ankle Devices Market Analysis

- Foot and Ankle Devices market encompasses a wide array of medical devices designed for the diagnosis, treatment, and rehabilitation of conditions affecting the foot and ankle. This includes orthopedic implants and devices (such as joint implants, fixation devices), bracing and support devices, and prosthetics. These devices are crucial for addressing a range of issues, including trauma, sports injuries, diabetic foot complications, arthritis (osteoarthritis and rheumatoid arthritis), and various deformities. The market is driven by the increasing incidence of these conditions, the aging population, and continuous advancements in surgical techniques and device technology.

- The escalating demand for foot and ankle devices is primarily fueled by the increasing awareness about foot and ankle health, the growing demand for effective rehabilitation and preventive care, and the rising healthcare expenditure in the region.

- Germany dominates the Foot and Ankle Devices market in Europe, holding the largest revenue share of 26.7% in 2025, supported by a robust orthopedic care infrastructure, high surgical volumes, and strong demand for technologically advanced implants and fixation devices. The country's well-established reimbursement system and early adoption of minimally invasive foot and ankle procedures have contributed to the growing utilization of plates, screws, and joint replacement systems across both public and private hospitals.

- Germany is also expected to be the fastest-growing country in the Europe Foot and Ankle Devices market during the forecast period, driven by its aging population, increasing prevalence of osteoarthritis and sports-related injuries, and strong emphasis on post-trauma rehabilitation. Continued investment in orthopedic innovation and expansion of specialized orthopedic centers further support market growth, alongside collaborations between research institutions and medtech manufacturers.

- Orthopedic Implants and Devices, including plates, screws, and intramedullary nails, are expected to dominate the Europe Foot and Ankle Devices market with a market share of 39.2% in 2025, owing to their extensive use in treating fractures, deformities, and complex reconstructive procedures. The segment benefits from ongoing advancements in biomaterials, including titanium and bioresorbable polymers, and from growing adoption of patient-specific surgical planning tools that improve procedural outcomes and reduce recovery times.

Report Scope and Foot and Ankle Devices Market Segmentation

|

Attributes |

Foot and Ankle Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Foot and Ankle Devices Market Trends

“Advancements in minimally invasive surgical techniques”

- Technological Advancements in Minimally Invasive Procedures and Personalized Devices: A significant and accelerating trend in the Europe foot and ankle devices market is the continuous technological advancement, particularly in minimally invasive surgical techniques and the development of personalized devices. This evolution is significantly enhancing patient outcomes, reducing recovery times, and improving overall treatment efficacy.

- For instance, innovations in orthopedic implants and fixation devices allow surgeons to perform complex procedures with fewer complications and faster recovery. The increasing adoption of minimally invasive procedures, which offer benefits like reduced pain and scarring, is expanding the use of specialized foot and ankle devices.

- The market is also seeing a growing trend towards personalized devices, driven by 3D printing technology. This allows for the creation of custom-designed orthotics and prosthetics tailored to the specific needs of each patient, offering better fit, support, and function.

- Furthermore, there's an increased focus on rehabilitation and preventive care, leading to demand for orthotic devices, braces, and smart rehabilitation tools that aid in recovery and prevent future injuries. Wearable technology is playing a significant role in this area, providing real-time feedback and monitoring.

- This trend towards more precise, less invasive, and patient-specific solutions is fundamentally reshaping the treatment landscape for foot and ankle conditions in Europe

Foot and Ankle Devices Market Dynamics

Driver

“Increasing prevalence of foot and ankle disorders (trauma, diabetes, arthritis)”

- Rising Incidence of Foot and Ankle Disorders and Aging Population: The increasing prevalence of foot and ankle disorders, including those caused by trauma, diabetes, and age-related conditions like arthritis and osteoporosis, is a major driver for the growth of the foot and ankle devices market in Europe

- For instance, the growing geriatric population in the European region is more prone to suffering from foot and ankle-related issues, such as arthritis and fractures, which directly boosts the demand for these devices

- The increasing number of sports injuries and road accidents also significantly contributes to the demand for foot and ankle devices for treatment and rehabilitation.

- Additionally, the growing awareness about foot and ankle health among the general population and healthcare professionals is leading to earlier diagnosis and intervention, further propelling market growth.

- Technological advancements making devices more effective, comfortable, and user-friendly, along with increased healthcare expenditure, also act as key drivers

Restraint/Challenge

“High cost of advanced foot and ankle devices”

- High Cost of Devices and Stringent Regulations: The expensive cost of some advanced foot and ankle devices, coupled with stringent regulatory guidelines, presents a significant challenge to widespread market adoption in Europe.

- For instance, the manufacturing of various foot and ankle goods can significantly raise the cost of capital for medical device businesses. The high initial investment for advanced implants and prosthetics can limit their accessibility, especially in publicly funded healthcare systems or for patients without comprehensive insurance coverage.

- Strict regulatory frameworks, such as the EU Medical Device Regulations (MDR), are replacing older directives, leading to major changes in market access and requiring extensive validation and documentation, which adds to time and cost for manufacturers.

- Furthermore, the scarcity of skilled practitioners specializing in foot and ankle surgery and rehabilitation can hinder the effective utilization and adoption of these advanced devices. Concerns regarding the loosening of bone plates over time, requiring replacement, also pose a challenge

Foot and Ankle Devices Market Scope

The market is segmented on the basis product type, application and end user.

- By Product

On the basis of Product, the Foot and Ankle Devices Market is into Orthopedic Fixation Devices, Joint Implants, Soft Tissue Orthopedic Devices, Bracing & Support Devices, and Prostheses. The Orthopedic Fixation Devices segment is expected to dominate the market with the largest revenue share of 39.2% 2025 driven by their widespread use in fracture repair, deformity correction, and reconstructive surgeries. These devices—including plates, screws, wires, and intramedullary nails—are frequently used across trauma and elective procedures. Technological advancements such as anatomically contoured implants and bioresorbable materials have improved clinical outcomes and patient recovery, reinforcing this segment's leadership.

The Bracing & Support Devices segment is anticipated to witness the fastest growth rate of 5.2% from 2025 to 2032, supported by the rising incidence of osteoarthritis and rheumatoid arthritis in the aging population. Growing demand for total ankle replacement and advancements in implant design—such as 3D-printed components and customized solutions—are driving adoption across surgical centers in Germany, the UK, and France.

- By Application

On the basis of application, the Foot and Ankle Devices market is segmented into Trauma, Osteoarthritis, Deformity Correction, Rheumatoid Arthritis, and Others. The Trauma held the largest market revenue share in 2025 owing to the high number of foot and ankle injuries associated with sports, road accidents, and workplace incidents. Prompt surgical intervention using fixation devices and implants is critical for optimal recovery and mobility, making trauma the dominant application area across Europe.

The Osteoarthritis is expected to witness the fastest CAGR from 2025 to 2032, driven by the aging European population and increased prevalence of degenerative joint disorders. Minimally invasive surgical techniques and innovations in joint replacement devices are supporting the adoption of foot and ankle solutions tailored to long-term mobility and pain management.

- By End users

On the basis of end users, the Foot and Ankle Devices market is segmented into Hospitals, Ambulatory Surgical Centers (ASCs), and Orthopedic Clinics. The Hospitals segment accounted for the largest market revenue share in 2024, supported by high procedural volumes, multidisciplinary care settings, and access to advanced imaging and surgical navigation tools. Public hospitals across countries like Germany, Italy, and the Netherlands benefit from centralized procurement policies and government investments in orthopedic infrastructure.

The Ambulatory Surgical Centers (ASCs) segment is expected to witness the fastest CAGR from 2025 to 2032, as same-day surgeries become more prevalent across Europe. ASCs are increasingly equipped to perform minimally invasive foot and ankle procedures, offering cost-effective care, shorter patient recovery times, and operational efficiency. The shift toward outpatient orthopedic surgeries is particularly notable in the UK, Spain, and Nordic countries.

Foot and Ankle Devices Market Regional Analysis

- Germany dominates the Europe Foot and Ankle Devices market, capturing the largest revenue share of 26.7% in 2025, attributed to its advanced orthopedic care infrastructure, high volume of trauma and reconstructive surgeries, and strong reimbursement landscape for joint implants and fixation devices. The country leads in the adoption of innovative orthopedic solutions, including patient-specific implants and minimally invasive fixation technologies.

- Germany’s orthopedic excellence is supported by a robust network of specialized surgical centers, academic hospitals, and collaborations with global medtech manufacturers such as Zimmer Biomet, Stryker, and Waldemar Link. These partnerships ensure consistent access to cutting-edge devices and surgical systems.

- Furthermore, the aging population and increasing prevalence of osteoarthritis and diabetic foot complications are driving procedural growth. Germany’s emphasis on post-operative rehabilitation and mobility preservation is also fostering demand for high-performance foot and ankle implants.

France Foot and Ankle Devices Market Insight

The France Foot and Ankle Devices market is projected to grow at a significant CAGR during the forecast period, supported by a well-established public healthcare system and national strategies aimed at improving musculoskeletal health. France is seeing increased demand for surgical interventions in trauma, sports injuries, and degenerative foot and ankle disorders, particularly among the elderly. Public hospitals and orthopedic units in France are increasingly integrating 3D imaging and surgical navigation for accurate implant placement and better outcomes in deformity correction and joint reconstruction procedures. Regulatory support from the French National Agency for the Safety of Medicines and Health Products (ANSM) and collaborative R&D projects between orthopedic surgeons and local manufacturers are enabling faster market access for advanced devices and implants.

U.K. Foot and Ankle Devices Market Insight

The U.K. Foot and Ankle Devices market is poised for robust growth, driven by NHS initiatives focused on reducing surgical backlogs, improving orthopedic wait times, and enhancing access to minimally invasive surgeries across public and private healthcare settings. The growing incidence of diabetes-related foot complications, sports-related injuries, and osteoarthritis is significantly increasing demand for implants, fixation devices, and bracing systems. Foot and ankle procedures are increasingly performed in ambulatory surgical centers and outpatient clinics, supporting adoption of compact, efficient surgical tools. The British Orthopaedic Foot & Ankle Society (BOFAS) and related professional bodies are playing a pivotal role in promoting best practices, surgical training, and the adoption of innovative technologies such as customized implants, navigation systems, and regenerative orthopedic products.

Foot and Ankle Devices Market Share

The Foot and Ankle Devices industry is primarily led by well-established companies, including:

- Stryker Corporation (U.S.)

- Johnson & Johnson (DePuy Synthes) (U.S.)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Smith & Nephew plc (U.K.)

- Enovis Corporation (U.S.)

- Acumed, LLC (U.S.)

- Arthrex, Inc. (U.S.)

- Paragon 28 Inc. (U.S.)

- Orthofix Medical Inc. (U.S.)

- Medtronic plc (Ireland)

- DJO LLC (U.S.)

- Össur hf. (Iceland)

- B. Braun Melsungen AG (Germany)

- Bauerfeind AG (Germany)

- Otto Bock Healthcare GmbH (Germany)

- Thuasne Group (France)

- Fillauer LLC (U.S.)

Latest Developments in Europe Foot and Ankle Devices Market

- In May 2023, Paragon 28 launched its Gorilla Supramalleolar Osteotomy (SMO) Plating and PRESERVE SMO Allograft System, offering surgeons customizable plate configurations and grafting options to improve outcomes and flexibility in supramalleolar osteotomies for complex foot and ankle deformity corrections.

- In December 2022 Enovis Corporation received FDA approval for its STAR PSI System, enabling surgeons to create personalized 3D pre-operative plans for total ankle replacements, enhancing implant positioning accuracy, surgical efficiency, and patient-specific outcomes in orthopedic procedures.

- In February 202, DePuy Synthes, part of Johnson & Johnson, acquired CrossRoads Extremity Systems to expand its foot and ankle portfolio. The acquisition strengthens its position in orthopedic care with advanced technologies for joint fusion, bunion correction, and soft tissue reconstruction.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.