Europe Foot Ankle Allograft Market

Market Size in USD Billion

CAGR :

%

USD

209.42 Billion

USD

420.37 Billion

2024

2032

USD

209.42 Billion

USD

420.37 Billion

2024

2032

| 2025 –2032 | |

| USD 209.42 Billion | |

| USD 420.37 Billion | |

|

|

|

|

Europe Foot and Ankle Allografts Market Size

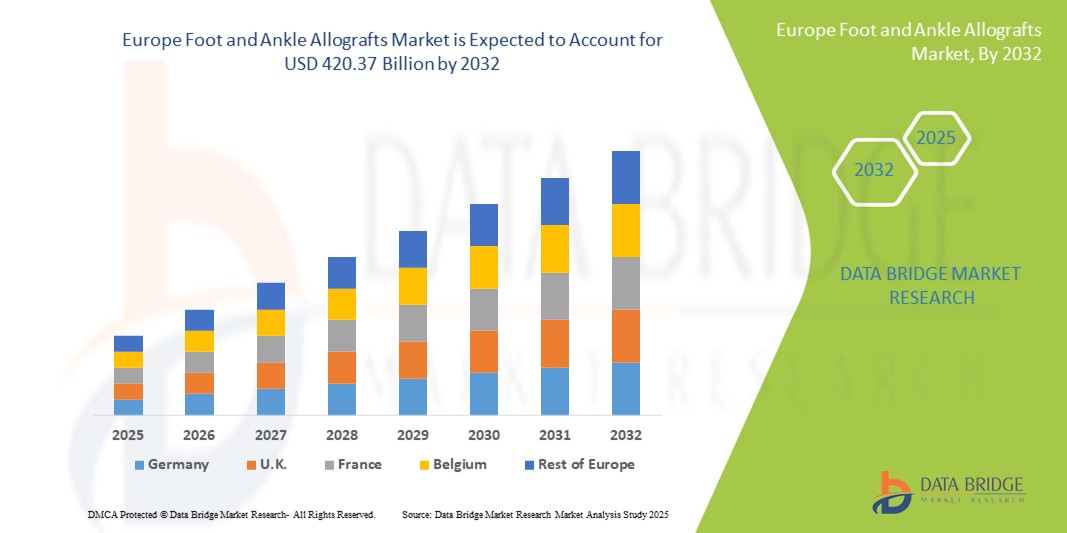

- The Europe foot and ankle allografts market size was valued at USD 209.42 billion in 2024 and is expected to reach USD 420.37 billion by 2032, at a CAGR of 9.10% during the forecast period

- This growth is driven by factors such as the increasing incidence of orthopedic conditions, rising geriatric population, advancements in surgical techniques, and growing awareness of the benefits of allograft procedures among healthcare providers and patients

Europe Foot and Ankle Allografts Market Analysis

- The Europe foot and ankle allografts market is witnessing steady expansion due to the rising adoption of biological grafts over synthetic alternatives due to better integration and healing outcomes

- Hospitals and surgical centers are increasingly favoring allograft procedures for foot and ankle reconstruction as they offer reduced surgical time and minimal donor site morbidity

- Germany is expected to dominate the Europe foot and ankle allografts market with 6.1% market share due to its advanced healthcare infrastructure and high adoption of innovative medical technologies

- U.K. is expected to be the fastest growing region in the Europe Foot and Ankle Allografts market during the forecast period due to increasing awareness of the benefits of allograft procedures and a rising prevalence of foot and ankle disorders

- The orthopaedic reconstruction segment is expected to dominate the Europe Foot and Ankle Allografts market with the largest share of 34.05% in 2025 due to the increasing prevalence of foot and ankle disorders that require reconstructive surgeries. With a rising aging population and a higher incidence of sports-related injuries, the demand for effective solutions to restore joint function is growing.

Report Scope and Europe Foot and Ankle Allografts Market Segmentation

|

Attributes |

Europe Foot and Ankle Allografts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Foot and Ankle Allografts Market Trends

“Growing Adoption of Minimally Invasive Allograft Procedures”

- The current market trend shows a rising preference for minimally invasive procedures using foot and ankle allografts

- Surgeons are increasingly opting for less invasive grafting techniques to reduce hospital stays and recovery time

- These procedures are gaining popularity for offering better aesthetic results and lower postoperative complications

- Medical device companies are focusing on developing allograft products tailored for minimally invasive surgeries

- Educational workshops and training sessions are promoting the use of these advanced techniques among orthopedic professionals

- For instance, minimally invasive allograft procedures are being adopted in outpatient surgical centers to improve patient turnover and satisfaction

- In conclusion, this growing shift toward minimally invasive allograft techniques reflects the market’s focus on enhancing surgical efficiency and patient outcomes

Europe Foot and Ankle Allografts Market Dynamics

Driver

“Rising Incidence of Sports-Related Foot and Ankle Injuries”

- Rising cases of foot and ankle trauma due to sports such as football, basketball, and running are increasing the demand for surgical interventions using allografts

- Allografts are being preferred in cases of tendon ruptures and ligament tears as they eliminate the need for harvesting patient tissue and reduce surgical time

- For instance, professional athletes in European football leagues undergoing ankle ligament reconstructions are increasingly treated with fresh frozen allografts for quicker recovery

- Sports medicine centers and orthopedic hospitals are investing in advanced allograft inventories to meet the growing need for rapid treatment and return-to-play outcomes

- The availability of sterilized and regulatory-compliant allografts from certified tissue banks ensures safe use and boosts surgeon and patient confidence

- In conclusion, as sports participation grows across age groups the use of allografts in treating athletic injuries is expected to be a long-term growth factor for the market

Opportunity

“Technological Advancements in Tissue Preservation and Processing”

- Advanced preservation methods such as cryopreservation and gamma irradiation have improved the safety and longevity of foot and ankle allografts

- Hospitals are now able to store and use high-quality allografts more efficiently for scheduled and emergency procedures without compromising on clinical outcomes

- For instance, tissue banks in Germany and the Netherlands are supplying long-preserved, sterilized grafts to surgical centers across Europe with consistent quality standards

- Emerging technologies such as 3D printing and patient-specific graft customization are enhancing surgical precision and post-operative recovery

- Companies are developing pre-treated grafts with biocompatible coatings to improve integration and reduce immune response for better healing outcomes

- In conclusion, with continued innovation and regulatory support technological advancements are paving the way for wider clinical adoption and global distribution of allografts

Restraint/Challenge

“High Cost of Allograft Procedures and Limited Reimbursement”

- The high cost of sourcing, processing, and storing foot and ankle allografts contributes to elevated procedure expenses compared to traditional surgical options

- Patients in healthcare systems with limited or partial insurance often face high out-of-pocket costs that discourage the use of allografts despite their clinical benefits

- For instance, in countries such as Italy and Spain where public reimbursement for biological implants is limited, many patients are steered toward cheaper synthetic alternatives

- Budget-constrained public hospitals and small clinics may avoid stocking allografts due to their short shelf life and high upfront investment

- Inconsistent reimbursement policies and lack of financial support for advanced graft procedures create unequal access across healthcare facilities and patient demographics

- In conclusion, cost-related barriers continue to limit the widespread clinical adoption of allografts despite their long-term advantages in surgical outcomes and recovery

Europe Foot and Ankle Allografts Market Scope

The market is segmented on the basis of product type, surgery type, procedure, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Surgery Type |

|

|

By Procedure |

|

|

By End User

|

|

In 2025, the orthopaedic reconstruction segment is projected to dominate the market with a largest share in product type segment

The orthopaedic reconstruction segment is expected to dominate the Europe foot and ankle allografts market with the largest share of 34.05% in 2025 due to the increasing prevalence of foot and ankle disorders that require reconstructive surgeries. With a rising aging population and a higher incidence of sports-related injuries, the demand for effective solutions to restore joint function is growing. Allografts are favored in these procedures due to their ability to provide long-lasting, biologically compatible tissue replacement, reducing complications related to autografts. Furthermore, advancements in surgical techniques and allograft preservation are enhancing the success rates of these procedures, further contributing to the segment's growth.

The allograft wedges segment is expected to account for the largest share during the forecast period in product type segment

In 2025, the allograft wedges segment is expected to dominate the market with the largest market share of 57.31% due to their crucial role in foot and ankle surgeries, particularly in procedures such as joint reconstruction and deformity correction. Allograft wedges are preferred for their ability to provide structural support and facilitate proper alignment during surgery, offering better integration with the patient's tissue. With the increasing demand for minimally invasive procedures and shorter recovery times, these wedges are becoming the go-to solution in both orthopedic and trauma surgeries.

Europe Foot and Ankle Allografts Market Regional Analysis

“Germany Holds the Largest Share in the Europe Foot and Ankle Allografts Market”

- Germany holds a leading position in the Europe foot and ankle allografts market with 6.1% market share due to its advanced healthcare infrastructure and high adoption of innovative medical technologies

- The country’s robust regulatory framework and emphasis on quality standards have facilitated the widespread acceptance of allograft procedures among healthcare professionals

- Germany’s significant investment in research and development has led to the introduction of cutting-edge allograft products, improving surgical outcomes and patient satisfaction

- The presence of key market players and specialized orthopedic centers has further strengthened Germany's dominance in this sector

- Germany's proactive approach to medical education and training ensures a skilled workforce adept at utilizing advanced allograft techniques

“U.K. is Projected to Register the Highest CAGR in the Europe Foot and Ankle Allografts Market”

- The U.K. is experiencing rapid growth in the foot and ankle allografts market, due to increasing awareness of the benefits of allograft procedures and a rising prevalence of foot and ankle disorders

- The UK’s National Health Service (NHS) initiatives and funding have improved access to advanced surgical options, including allografts, across the country

- Collaborations between academic institutions and medical device companies have accelerated the development and adoption of innovative allograft solutions

- The UK’s commitment to continuous professional development ensures that healthcare providers stay updated on the latest advancements in allograft procedures

- The country’s strategic focus on enhancing patient outcomes and reducing recovery times aligns with the advantages offered by allograft surgeries, propelling market growth

Europe Foot and Ankle Allografts Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- CONMED Corporation (U.S.)

- Arthrex (U.S.)

- Integra LifeSciences (U.S.)

- Smith+Nephew (UK)

- Zimmer Biomet (U.S.)

- AlloSource (U.S.)

- Amniox Medical, Inc. (U.S.)

- RTI Surgical Holdings, Inc. (U.S.)

- JRF Ortho (U.S.)

- Bone Bank Allografts (U.S.)

- Smith & Nephew. (UK)

- Paragon 28 (U.S.)

- Bioventus, (U.S.)

- NVision Biomedical Technologies (U.S.)

- DePuy Synthes Companies (U.S.)

Latest Developments in Europe Foot and Ankle Allografts Market

- In December 2022, Enovis Corporation announced that they have received the U.S. FDA approval for the STAR PSI System. The STAR PSI System provides a personalized pre-operative plan helps to review a 3D visualization of the patient’s ankle joint, including information about any existing implants and/or bone defects, to plan for the total ankle replacement case. This regulatory approval helped the company to enhance their R&D capabilities and increase their business revenue

- In February 2022, DePuy Synthes a subsidiary of Johnson & Johnson announced the acquisition of CrossRoads Extremity Systems, a manufacturer of foot and ankle devices. This acquisition helped the company to enhance their capabilities in orthopaedic, podiatric and medtech advancements through both internal and external innovation and deliver technologically advanced products

- In March 2016, Xtant Medical Holdings, Inc. entered into a distribution agreement with Vivex Biomedical, Inc. This collaboration introduced OsteoVive, a cellular allograft containing marrow-isolated adult multilineage inducible (MIAMI) cells, designed to support the body's natural bone healing process. Vivex processes the allograft, while Xtant Medical manages its national distribution, focusing on spine and orthopedic applications. This partnership marked Xtant's entry into the rapidly growing cellular bone graft market

- In March 2012, Wright Medical Group, Inc. announced a supply and distribution agreement with AlloSource for FUSIONFLEX Bone Matrix, a flexible cancellous scaffold designed for primary fusion procedures in the foot and ankle, as well as other orthopedic bone grafting applications. The FUSIONFLEX graft serves as a carrier and matrix for new bone repair, offering surgeons intraoperative flexibility to graft prepared fusion sites, provide carrying capacity for bone marrow aspirate, and create a matrix that conforms intimately to the fusion site

- In May 2023, Paragon 28 introduced its Gorilla Supramalleolar Osteotomy (SMO) Plating and PRESERVE SMO Allograft System. This system offers surgeons versatile options for plate selection and surgical approaches in supramalleolar osteotomies. It includes patent-pending drilling and cutting guides for controlled anterior dome, medial opening, and closing wedge osteotomies, along with an allograft cutting jig to shape the PRESERVE™ SMO Allograft Wedge, aiming to reduce procedure time and complexity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.