Europe Footwear Sole Material Market

Market Size in USD Billion

CAGR :

%

USD

4.37 Billion

USD

6.61 Billion

2024

2032

USD

4.37 Billion

USD

6.61 Billion

2024

2032

| 2025 –2032 | |

| USD 4.37 Billion | |

| USD 6.61 Billion | |

|

|

|

|

Europe Footwear Sole Materials Market Size

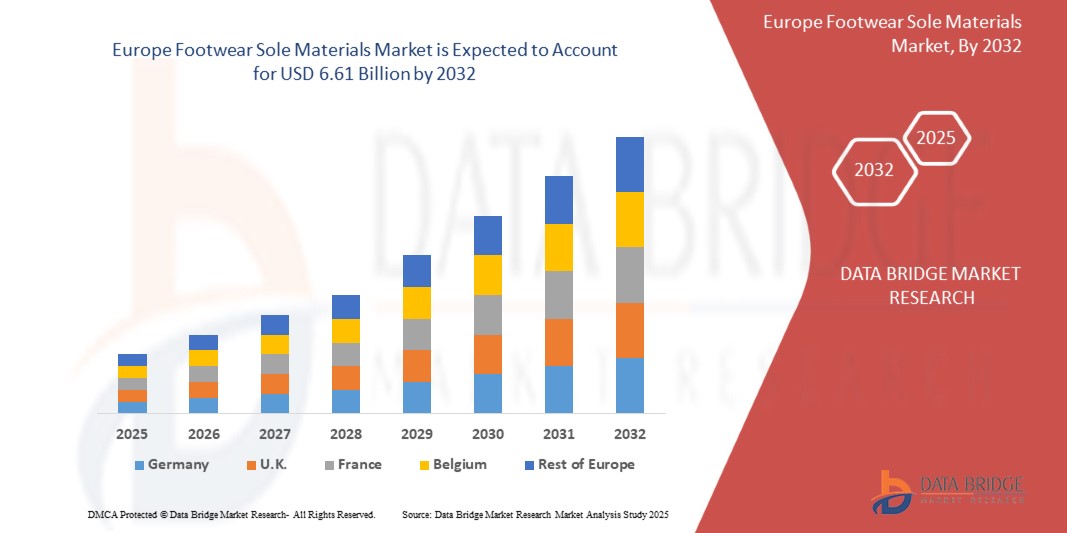

- The Europe footwear sole materials market size was valued at USD 4.37 billion in 2024 and is expected to reach USD 6.61 billion by 2032, at a CAGR of 5.31% during the forecast period

- The market growth is largely fuelled by the increasing demand for innovative, durable, and lightweight materials in performance and casual footwear, coupled with rising consumer awareness of sustainable and eco-friendly sole alternatives

- In addition, the expansion of e-commerce platforms and direct-to-consumer footwear brands is driving demand for diverse sole material options to cater to evolving consumer preferences across different regions

Europe Footwear Sole Materials Market Analysis

- The market is experiencing notable transformation due to the shift towards advanced sole materials such as thermoplastic polyurethane (TPU), ethylene vinyl acetate (EVA), rubber, and polyurethane (PU), which offer better grip, flexibility, and longevity

- Growing urbanization and lifestyle changes have boosted the demand for comfortable and functional footwear, especially in developing economies

- Germany footwear sole materials market dominates the regional landscape in 2024, driven by its advanced manufacturing infrastructure, strong presence of established footwear brands, and growing demand for high-performance and sustainable materials

- Italy is expected to witness the highest compound annual growth rate (CAGR) in the Europe footwear sole materials market due to the country’s global reputation for high-end fashion footwear, growing adoption of bio-based materials in designer collections, and increasing demand for both luxury and sustainable sole solutions across domestic and international markets

- The EVA segment held the largest market revenue share in 2024, attributed to its lightweight nature, superior cushioning, and cost-effectiveness, making it widely used in both athletic and casual footwear. EVA’s shock-absorbing properties and flexibility have made it the preferred choice for high-volume shoe production, especially in running shoes and lifestyle sneakers

Report Scope and Europe Footwear Sole Materials Market Segmentation

|

Attributes |

Europe Footwear Sole Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Footwear Sole Materials Market Trends

“Increased Use of Eco-Friendly and Recycled Sole Materials”

- Rising popularity of bio-based and recycled EVA and rubber compounds as consumers seek lower environmental impact and manufacturers respond with alternatives that maintain durability and performance, supported by brands such as Veja using Amazonian rubber in eco-sneakers

- Footwear companies are launching green collections to align with eco-conscious branding and appeal to Gen Z and millennial buyers, with Timberland unveiling its GreenStride soles made from sugarcane and natural rubber as part of its sustainability commitment

- Government mandates and ESG goals are accelerating the shift toward sustainable sole materials as countries enforce plastic bans and carbon targets, prompting brands to future-proof operations through circular design models

- For instance, Nike incorporates recycled sole materials under its sustainability initiative “Move to Zero” aiming for zero carbon and zero waste, showcasing that recycled content can be both high-performing and scalable across product categories

- As innovation continues in green material development and consumer interest intensifies, the demand for eco-friendly soles will likely dominate future product strategies and become a competitive differentiator in the global footwear market

Europe Footwear Sole Materials Market Dynamics

Driver

“Surge in Athletic and Casual Footwear Demand”

- The rise in fitness and wellness awareness is encouraging people to invest in athletic footwear with performance-enhancing soles that offer improved cushioning and flexibility as seen in Reebok’s Floatride and Under Armour’s Flow series designed for runners and gym-goers

- Athleisure as a fashion movement continues to boost the demand for versatile sole materials that combine aesthetics with comfort allowing consumers to wear sporty shoes in daily life without sacrificing style or durability

- Outdoor activity trends such as hiking, trail running, and walking are pushing brands to innovate in soles that provide strong grip, weather resistance, and support for uneven terrains which is being leveraged by brands such as Merrell and Salomon

- Rising middle-class income and urbanization is accelerating the demand for both premium and affordable footwear options that use EVA and PU soles to deliver a balance between price and comfort as consumers seek products that offer long-term value without compromising on performance or style

- For instance, brands such as Bata and Skechers are expanding their product lines using EVA and PU soles to offer cost-effective yet comfortable footwear options that cater to the growing demand for versatile everyday shoes among value-conscious consumers

- With evolving consumer preferences and the crossover between function and fashion becoming mainstream the demand for adaptable high-performance sole materials will continue to drive long-term growth in the global footwear market

Restraint/Challenge

“Volatility in Raw Material Prices and Supply Chain Disruptions”

- Fluctuations in crude oil prices directly impact the cost of synthetic materials such as EVA and PU making it difficult for manufacturers to maintain stable pricing models and profit margins as raw input spikes reduce cost predictability and disrupt inventory planning cycles

- Geopolitical tensions and regional lockdowns in supplier hubs have led to raw material shortages and shipping delays increasing freight costs and causing production halts especially among small-scale manufacturers who lack alternative sourcing channels

- Over-reliance on a limited number of sourcing partners amplifies vulnerability to external shocks such as export bans or compliance regulation changes which can severely restrict access to key materials used in footwear soles

- For instance, during the COVID-19 pandemic prolonged port closures and labor shortages disrupted footwear material shipments resulting in delayed deliveries and unmet retailer demands across global markets

- Without strategic diversification of suppliers and material sources the market will continue to face operational bottlenecks and profit instability hindering scalability and timely innovation in footwear sole material production

Europe Footwear Sole Materials Market Scope

The Europe footwear sole materials market is segmented on the basis of product, sole component, sole product, application, and end-user.

• By Product

On the basis of product, the Europe footwear sole materials market is segmented into polyurethane, rubber, SBS/thermoplastic elastomeric block copolymers, EVA, PVC, and bio-materials. The EVA segment held the largest market revenue share in 2024, attributed to its lightweight nature, superior cushioning, and cost-effectiveness, making it widely used in both athletic and casual footwear. EVA’s shock-absorbing properties and flexibility have made it the preferred choice for high-volume shoe production, especially in running shoes and lifestyle sneakers.

The bio-materials segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing environmental awareness and the push for sustainable manufacturing practices. Materials derived from algae, sugarcane, and recycled sources are gaining traction as major brands adopt eco-conscious designs to meet consumer demand and regulatory expectations. Bio-based soles also offer performance benefits while reducing the carbon footprint of the final product.

• By Sole Component

Based on sole component, the Europe footwear sole materials market is segmented into innersole and outsole. The outsole segment accounted for the largest revenue share in 2024 due to its critical role in providing traction, durability, and structural support across various types of footwear. Outsoles are designed to withstand wear and environmental exposure, which makes them a central focus for innovation in materials such as rubber, PU, and TPU.

The innersole segment is expected to witness the fastest growth rate from 2025 to 2032, as consumers increasingly prioritize comfort and ergonomic support. Innersoles made with memory foam, gel, or antimicrobial fabrics are being widely integrated into footwear to enhance foot health and reduce fatigue, especially in athletic and occupational shoes.

• By Sole Product

On the basis of sole product, the Europe footwear sole materials market is divided into new soles and repair soles. The new soles segment dominated the market with the largest revenue share in 2024, supported by the rising demand for new footwear across both fashion and functional categories. With frequent product launches and changing trends, consumers are more inclined to purchase new shoes rather than repair older pairs, sustaining strong demand for newly manufactured soles.

The repair soles segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in cost-sensitive markets and among environmentally conscious consumers. Shoe repair services and DIY repair kits are gaining popularity as sustainable options to extend product lifespan and reduce waste, driving increased usage of replacement soles.

• By Application

By application, the Europe footwear sole materials market is segmented into athletic and non-athletic. The athletic segment held the largest share in 2024, driven by the booming sportswear industry and the growing culture of fitness and wellness. Footwear designed for running, training, and sports requires advanced soles with features such as impact absorption, flexibility, and traction, increasing the demand for performance-focused materials.

The non-athletic segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for stylish, comfortable everyday footwear. Lifestyle, formal, and casual shoes with well-cushioned soles are becoming essential in both urban and semi-urban settings, contributing to higher usage of lightweight and durable sole materials.

• By End-User

Based on end-user, the Europe footwear sole materials market is categorized into men, women, and kids. The men segment driven by strong consumption of both athletic and casual footwear, especially in workwear and outdoor categories. Manufacturers are focusing on high-performance soles tailored for men’s activities and lifestyle preferences, reinforcing growth in this segment.

The women segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing participation in sports and fitness, as well as rising interest in fashionable yet comfortable footwear. Customized sole technologies and ergonomic designs targeting female consumers are helping brands expand their women’s collections. The kids segment also remains significant, with continuous demand for safe, lightweight, and flexible soles suitable for growing feet.

Europe Footwear Sole Materials Market Regional Analysis

- Germany footwear sole materials market dominates the regional landscape in 2024, driven by its advanced manufacturing infrastructure, strong presence of established footwear brands, and growing demand for high-performance and sustainable materials

- Consumers in Germany increasingly prefer soles made from polyurethane and thermoplastic elastomers due to their durability, comfort, and adaptability across various footwear categories

- In addition, the country’s strict environmental standards and rising awareness around sustainable fashion are encouraging the use of recycled and bio-based sole materials, supporting continued market leadership

Italy Footwear Sole Materials Market Insight

The Italy footwear sole materials market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s rich tradition in shoemaking and growing focus on premium and luxury footwear. The demand for innovative sole materials is rising as Italian manufacturers look to combine aesthetics, durability, and eco-friendliness in their product offerings. In addition, the increase in footwear exports and consumer preference for comfortable yet stylish shoes are accelerating the adoption of high-quality and sustainable sole materials across Italy.

Europe Footwear Sole Materials Market Share

The Europe Footwear Sole Materials industry is primarily led by well-established companies, including:

- Vibram S.p.A. (Italy)

- BASF SE (Germany)

- Covestro AG (Germany)

- INEOS Group Limited (U.K.)

- Hexpol AB (Sweden)

- Solvay S.A. (Belgium)

- Arkema S.A. (France)

- Trinseo PLC (Switzerland)

- Lanxess AG (Germany)

- Evonik Industries AG (Germany)

Latest Developments in Europe Footwear Sole Materials Market

- In September 2023, BASF unveiled a range of sustainable footwear solutions at Simac Tanning Tech 2023 under the theme "Say hello to the Footure!". Highlights included mechanical recycling of PU waste into new soles, lightweight PU-based insoles, and advancements in Infinergy E-TPU for energy return. BASF also showcased how traditional processes combined with 3D printing can lead to innovative, futuristic footwear, reinforcing the brand’s sustainability and design leadership

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Footwear Sole Material Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Footwear Sole Material Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Footwear Sole Material Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.