Europe Gelcoat Market

Market Size in USD Million

CAGR :

%

USD

814.42 Million

USD

1,151.27 Million

2024

2032

USD

814.42 Million

USD

1,151.27 Million

2024

2032

| 2025 –2032 | |

| USD 814.42 Million | |

| USD 1,151.27 Million | |

|

|

|

|

Europe Gelcoat Market Size

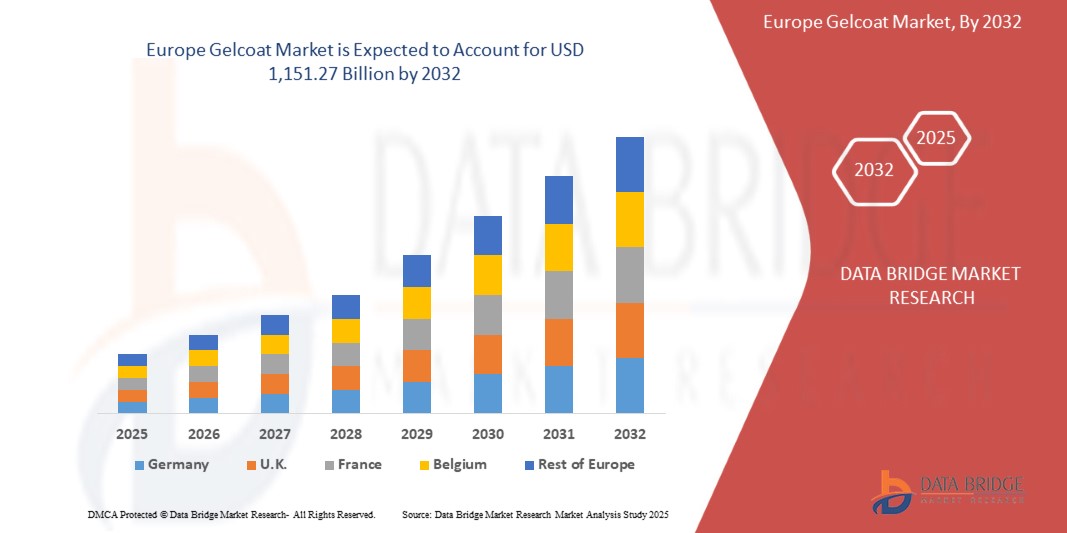

- The Europe Gelcoat Market size was valued at USD 814.42 Million in 2024 and is expected to reach USD 1,151.27 Million by 2032, at a CAGR of 4.5% during the forecast period

- The market growth is largely fueled by increasing demand from the marine, transportation, and wind energy sectors, driven by rising need for corrosion resistance, superior surface finish, and enhanced durability of composite structures.

- Furthermore, rising investments in R&D and technological innovation, such as the development of eco-friendly gelcoats, UV-resistant formulations, and high-performance resin blends, are propelling product demand across diverse end-use industries.

Europe Gelcoat Market Analysis

- Gelcoats are increasingly integral to composite applications, particularly in marine, transportation, and wind energy industries, where they enhance surface finish, provide superior resistance to UV radiation, chemicals, and water ingress, and extend product lifespan. These coatings now combine functional durability with aesthetic appeal, aligning with the growing demand for lightweight yet high-performance materials in both industrial and consumer-facing sectors. Gelcoats also support the creation of glossy, weather-resistant surfaces, making them indispensable in boats, automobiles, wind turbine blades, and sanitary ware products.

- Demand growth is driven by four converging trends: rising adoption of composites in lightweight transport and renewable energy; growing preference for eco-friendly, low-emission coatings due to regulatory pressures; increasing investments in infrastructure and marine leisure activities; and advancements in resin chemistry enabling gelcoats with enhanced UV stability, reduced styrene emissions, and improved sustainability credentials.

- Gelcoats are integral in delivering high-performance protective and aesthetic finishes, especially in marine vessels, construction panels, sanitary ware, and wind turbines, where they offer superior weatherability, durability, and long-term cost efficiency. Their ability to meet both technical performance standards and evolving sustainability goals ensures their continued relevance across diverse industrial applications.

Report Scope and Europe Gelcoat Market Segmentation

|

Attributes |

Europe Gelcoat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Gelcoat Market Trends

Rising Demand for Eco-Friendly And Low-Styrene Emission Formulations

- stricter environmental regulations and increasing sustainability commitments across industries. Manufacturers are investing in bio-based and waterborne gelcoats that maintain durability, gloss retention, and UV resistance, while minimizing volatile organic compound (VOC) emissions.

- Gelcoats are also playing a crucial role in supporting the shift toward renewable energy and lightweight mobility solutions. In wind energy, advanced gelcoats provide erosion resistance and extended service life for turbine blades exposed to harsh weather, while in automotive and aerospace, they enable lighter structures with superior surface finishes. This aligns with broader industry megatrends focused on decarbonization and efficiency.

- Additionally, the trend is influencing product development and application methods, with growing adoption of sprayable gelcoats for large-scale composite structures, and the emergence of digital monitoring technologies to ensure uniform thickness and performance consistency during application. Such innovations improve manufacturing efficiency, reduce material waste, and enhance long-term performance reliability.

- This premiumization and sustainability trend is reshaping the Europe Gelcoat Market by driving innovation in resin chemistry, encouraging collaborations between gelcoat suppliers and composite manufacturers, and expanding adoption in high-growth sectors like wind energy, marine leisure, and modern infrastructure projects. Companies that can deliver customized, high-performance, and environmentally responsible gelcoat solutions are positioned to gain a competitive edge in this evolving landscape.

Europe Gelcoat Market Dynamics

Driver

Rising Demand from the Marine and Renewable Energy Sectors

- The increasing adoption of gelcoats in marine applications—such as boat hulls, decks, and leisure yachts—is a key driver of market growth, owing to their superior resistance to saltwater, UV radiation, and weathering. Gelcoats not only extend vessel longevity but also enhance surface gloss and aesthetics, which are critical in both commercial and recreational marine industries.

- For example, in 2024, Scott Bader partnered with European boatbuilders to launch a new range of low-styrene emission gelcoats that combine high durability with eco-compliance, strengthening its position in the sustainable marine coatings segment.

- In parallel, the renewable energy sector, particularly wind power, is witnessing rising gelcoat consumption. Gelcoats are applied on turbine blades to deliver erosion resistance, UV protection, and smooth finishes that reduce drag and improve performance efficiency. This is crucial in harsh environments such as offshore wind farms, where long-term durability directly impacts energy output and maintenance costs.

- As governments and energy firms increase investments in clean energy infrastructure, gelcoats are becoming indispensable materials for ensuring the longevity and cost-effectiveness of wind turbines.

- Additionally, global trends toward lightweight and sustainable composites in transportation and construction are further accelerating gelcoat demand, positioning the material as a critical enabler of both aesthetic and functional performance in modern engineering applications.

Restraint/Challenge

Volatility in Raw Material Prices and Environmental Concerns Over Styrene Emissions

- The dependency of gelcoat production on petrochemical-derived resins such as polyester, epoxy, and vinyl ester makes the market highly vulnerable to raw material price fluctuations. Crude oil price volatility directly impacts resin availability and cost, creating challenges for manufacturers in maintaining competitive pricing. This particularly affects small and mid-scale producers in price-sensitive regions, limiting their ability to compete with established multinational players.

- For instance, during recent oil price fluctuations, unsaturated polyester resin (UPR) costs surged significantly, squeezing margins for gelcoat suppliers and increasing costs for downstream industries like marine and automotive manufacturing.

- Additionally, styrene emissions from traditional gelcoat formulations are raising environmental and health concerns. Stricter regulatory frameworks in North America and Europe—such as limits on volatile organic compound (VOC) emissions—are pressuring manufacturers to transition toward low-styrene or styrene-free alternatives, which often involve higher R&D and production costs.

- The lack of awareness and adoption of eco-friendly gelcoats in developing markets also slows penetration, as end-users in cost-sensitive regions continue to prefer conventional, lower-cost formulations despite sustainability challenges.

- Overcoming these restraints will require greater investment in bio-based and waterborne gelcoat technologies, strategic supplier partnerships to stabilize raw material supply chains, and educational outreach to raise awareness among customers about the long-term cost savings and environmental benefits of sustainable gelcoat solutions.

Europe Gelcoat Market Scope

The market is segmented on the basis of resin type, application method and end-use

- By Resin Type

On the basis of resin type, the Europe Gelcoat Market is segmented into polyester, epoxy, vinyl ester, and others. Polyester-based gelcoats dominate the market, accounting for the largest revenue share estimated at around 29%.

- By application method

On the basis of application method, the Europe Gelcoat Market is segmented into spray gun, brush & roller, and others. Spray-applied gelcoats account for the largest revenue share estimated at around 45%.

- By End-Use Industry

On the basis of end-use industry, the Europe Gelcoat Market is segmented into marine, automotive, construction, aerospace, wind energy, and sanitary ware. Marine applications account for the largest revenue share, estimated at around 40%

Europe Gelcoat Market Regional Insight

Europe holds a significant share of the global Europe Gelcoat Market, supported by a well-established marine industry, advanced automotive manufacturing hubs, and growing adoption of composite materials in construction and wind energy.

Demand is further driven by stringent EU regulations promoting high-performance, low-VOC, and environmentally sustainable coatings, encouraging innovation in bio-based and eco-friendly gelcoat formulations.

Germany Europe Gelcoat Market Insight

Germany leads the regional market, supported by its strong automotive and wind energy sectors, where lightweight composites and high-durability coatings are increasingly utilized.

Continuous R&D in advanced resins, coupled with government-backed renewable energy initiatives, reinforces gelcoat demand across industrial applications.

U.K Europe Gelcoat Market Insight

The U.K. market benefits from a robust marine sector, particularly in leisure boating and yacht manufacturing, alongside growing use of gelcoats in construction for architectural applications.

Increasing demand for aesthetic, glossy finishes and long-lasting performance materials fuels market growth, supported by a strong network of distributors and composite manufacturers.

Europe Gelcoat Market Share

The Gelcoat is primarily led by well-established companies, including:

- Ashland Inc. (U.S.)

- Scott Bader Company Ltd. (U.K.)

- Allnex Netherlands B.V. (Netherlands)

- BUFA GmbH & Co. KG (Germany)

- Polynt-Reichhold Group (Italy)

- Interplastic Corporation (U.S.)

- Reichhold LLC 2 (U.S.)

- HK Research Corporation (U.S.)

- Nuplex Industries Ltd. (New Zealand)

- INEOS Composites (U.K.)

- Axson Technologies (France)

- Sicomin Epoxy Systems (France)

- TenCate Advanced Composites (Netherlands)

- Polycor Canada Inc. (Canada)

- AOC, LLC (U.S.)

Latest Developments in Europe Gelcoat Market

- In June 2024, Polynt-Reichhold Group announced an expansion of its gelcoat production facility in Italy to meet the rising demand from the European marine and wind energy sectors. The investment strengthens its supply chain resilience and enhances its ability to serve regional customers with faster lead times.

- In April 2024, Ashland Global Holdings Inc. introduced a new line of low-styrene emission (LSE) gelcoats designed for marine and transportation applications, aligning with stricter EU environmental regulations while improving worker safety and performance consistency.

- In March 2024, Scott Bader Company Ltd. launched its next-generation Crystic® gelcoats formulated with bio-based content, targeting sustainability-conscious customers in construction and sanitary ware industries. The innovation supports the company’s goal of achieving carbon neutrality by 2036.

- In January 2024, Reichhold partnered with a leading aerospace composites manufacturer to co-develop fire-retardant gelcoats tailored for aerospace interiors, addressing safety standards and growing demand for lightweight, high-performance materials in aviation.

- In December 2023, Allnex unveiled its new waterborne gelcoat technology, offering enhanced durability, gloss retention, and environmental compliance. The launch reflects the increasing market shift toward sustainable coatings in automotive and industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Gelcoat Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Gelcoat Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Gelcoat Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.