Europe Health Screening Market

Market Size in USD Billion

CAGR :

%

USD

104.26 Billion

USD

236.82 Billion

2025

2033

USD

104.26 Billion

USD

236.82 Billion

2025

2033

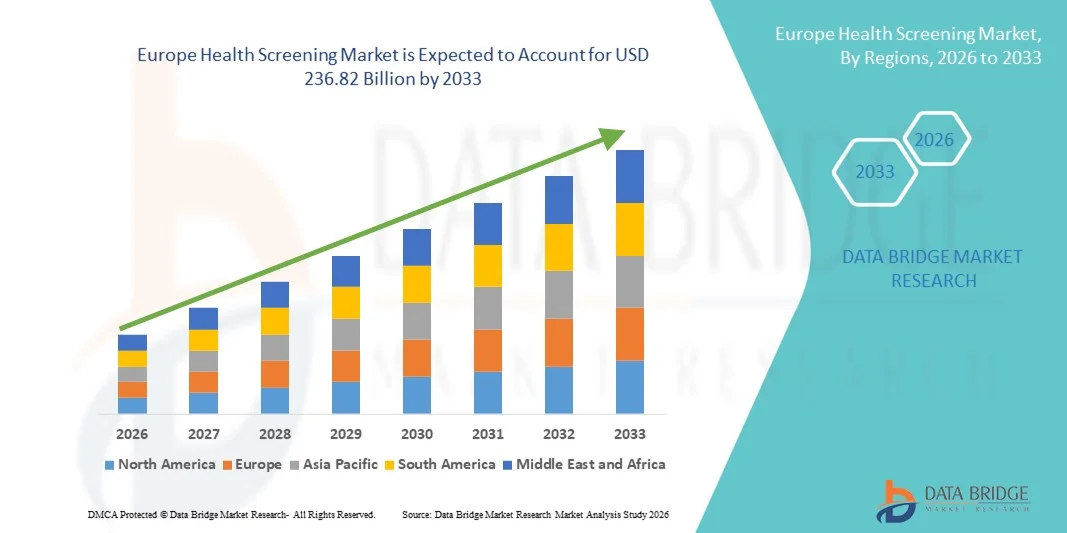

| 2026 –2033 | |

| USD 104.26 Billion | |

| USD 236.82 Billion | |

|

|

|

|

Europe Health Screening Market Size

- The Europe health screening market size was valued at USD 104.26 billion in 2025 and is expected to reach USD 236.82 billion by 2033, at a CAGR of 10.8% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, increasing geriatric population, and growing awareness regarding preventive healthcare and early disease detection across European countries

- Furthermore, supportive government initiatives, expansion of corporate wellness programs, and advancements in diagnostic technologies such as AI-based imaging and biomarker testing are positioning health screening services as a critical component of modern healthcare systems. These converging factors are accelerating the adoption of preventive screening programs, thereby significantly boosting the industry's growth

Europe Health Screening Market Analysis

- Health screening services, encompassing preventive diagnostic tests, routine medical check-ups, and early disease detection programs, are increasingly vital components of modern healthcare systems across Europe due to their role in reducing long-term treatment costs, improving patient outcomes, and promoting proactive health management in both public and private healthcare settings

- The escalating demand for health screening services is primarily fueled by the rising prevalence of chronic diseases such as cardiovascular disorders, cancer, and diabetes, growing geriatric population, and increasing awareness among individuals regarding the importance of early diagnosis and preventive care

- Germany dominated the Europe health screening market with the largest revenue share of 24.8% in 2025, characterized by a well-established healthcare infrastructure, comprehensive statutory health insurance coverage, and strong government-backed national screening programs, with high participation rates in routine cancer and cardiovascular screening initiatives supported by advanced diagnostic technologies

- Poland is expected to be the fastest growing country in the Europe health screening market during the forecast period due to improving healthcare access, rising healthcare expenditure, and expanding private diagnostic service providers across urban centers

- Cancer screening segment dominated the Europe health screening market with a market share of 38.6% in 2025, driven by widespread implementation of breast, colorectal, and cervical cancer screening programs, along with increasing adoption of advanced imaging and biomarker-based diagnostic techniques

Report Scope and Europe Health Screening Market Segmentation

|

Attributes |

Europe Health Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Health Screening Market Trends

Digitalization and AI-Driven Preventive Screening Programs

- A significant and accelerating trend in the Europe health screening market is the deepening integration of artificial intelligence (AI), digital health records, and telehealth platforms into preventive screening pathways. This fusion of technologies is significantly enhancing early detection accuracy, patient engagement, and healthcare system efficiency across public and private providers

- For instance, several European healthcare systems are incorporating AI-supported imaging tools for breast and lung cancer screening, enabling radiologists to prioritize high-risk cases and improve diagnostic turnaround times. Similarly, digital appointment platforms in countries such as Germany and the U.K. allow citizens to schedule routine health checks seamlessly

- AI integration in health screening enables features such as predictive risk stratification based on patient data, automated reminders for periodic tests, and more personalized preventive care pathways. For instance, some hospitals utilize AI algorithms to flag abnormal results in cardiovascular or oncology screenings and generate intelligent alerts for follow-up care. Furthermore, digital platforms offer patients secure access to screening reports and remote consultations

- The seamless integration of screening services with national electronic health record systems facilitates centralized data management and continuity of care. Through unified digital infrastructures, healthcare providers can coordinate screening outcomes with primary care, specialty referrals, and chronic disease management programs, creating a more connected and preventive healthcare ecosystem

- This trend towards more data-driven, accessible, and patient-centric screening systems is fundamentally reshaping expectations for preventive healthcare across Europe. Consequently, healthcare providers and diagnostic companies are developing AI-enabled screening solutions with automated risk assessment, digital reporting, and integration with national health databases

- The demand for technologically advanced and easily accessible health screening services is growing rapidly across both urban and semi-urban populations, as governments and individuals increasingly prioritize early diagnosis, cost containment, and long-term health outcomes

Europe Health Screening Market Dynamics

Driver

Rising Chronic Disease Burden and Government-Led Preventive Initiatives

- The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes, coupled with expanding government-backed preventive health initiatives, is a significant driver for the heightened demand for health screening services across Europe

- For instance, multiple European countries have strengthened national cancer screening programs and introduced publicly funded cardiovascular risk assessments to enhance early diagnosis and reduce long-term treatment costs. Such strategies by health authorities are expected to drive the health screening market growth in the forecast period

- As populations age and lifestyle-related risk factors rise, individuals are becoming more proactive about routine check-ups and early detection services, recognizing the long-term benefits of timely medical intervention

- Furthermore, favorable reimbursement frameworks and mandatory occupational health assessments in several European countries are making preventive screening more accessible and financially feasible for large population groups

- Increased investment in advanced diagnostic technologies, including molecular testing, AI-based imaging, and mobile labs, is driving the availability and effectiveness of screening programs, further boosting market adoption

- The convenience of bundled health check-up packages, corporate wellness programs, and expanding private diagnostic networks are key factors propelling the adoption of health screening services in both public and private healthcare sectors. The trend toward personalized preventive healthcare and value-based care models further contributes to market growth

Restraint/Challenge

Data Privacy Concerns and Healthcare Resource Constraints

- Concerns surrounding patient data privacy, cybersecurity risks in digital health systems, and strict regulatory compliance requirements pose significant challenges to broader market expansion. As screening services increasingly rely on digital platforms and data sharing, they are subject to stringent data protection regulations such as GDPR

- For instance, heightened scrutiny regarding cross-border health data transfers and compliance with European data protection standards has made some healthcare providers cautious about rapid digital integration in screening programs

- Addressing these data protection and compliance concerns through robust encryption, secure health information systems, and transparent consent mechanisms is crucial for maintaining patient trust. Healthcare providers emphasize adherence to European regulatory frameworks and secure IT infrastructures to reassure patients and authorities

- In addition, disparities in healthcare infrastructure and shortages of trained medical professionals in certain countries can limit the scalability of large-scale screening initiatives, particularly in rural or underserved regions

- Variability in national healthcare policies, reimbursement rates, and regulatory approvals across European countries can slow the adoption of new screening technologies and services, affecting market harmonization and growth

- While investments in healthcare modernization are increasing, operational costs associated with advanced diagnostic equipment and digital integration can still restrict rapid expansion.

- Overcoming these challenges through strengthened cybersecurity frameworks, workforce development, and sustained public health funding will be vital for long-term market growth

Europe Health Screening Market Scope

The market is segmented on the basis of test type, package type, panel type, sample type, technology, condition, sample collection sites, and distribution channel.

- By Test Type

On the basis of test type, the Europe health screening market is segmented into cholesterol tests, diabetes tests, cancer screening, general check-up tests, STDs, blood pressure tests, and others. The cancer screening segment dominated the market with the largest revenue share of 38.6% in 2025, driven by government-backed national cancer screening programs in countries such as Germany, the U.K., and France. The high prevalence of breast, colorectal, and cervical cancers has resulted in strong demand for preventive screening programs. Advanced diagnostic technologies, including AI-based imaging and biomarker detection, are further increasing the adoption of cancer screening. In addition, rising awareness campaigns and regular health check initiatives have made cancer screening a critical component of preventive healthcare in Europe. The segment’s dominance is also reinforced by strong reimbursement coverage and inclusion in routine health packages offered by both public and private providers.

The diabetes test segment is anticipated to witness the fastest growth rate from 2026 to 2033 due to the rising prevalence of type 2 diabetes across Europe, particularly in countries such as Poland and Italy. Early detection through blood glucose monitoring, HbA1c testing, and continuous glucose monitoring solutions is gaining traction among high-risk populations. Growing awareness about lifestyle diseases and government-driven screening campaigns for metabolic disorders are fueling demand. In addition, advancements in non-invasive and point-of-care diabetes testing technologies are increasing patient convenience and accessibility. The integration of digital reporting and telehealth consultations further supports the rapid adoption of diabetes testing services.

- By Package Type

On the basis of package type, the Europe health screening market is segmented into basic health screening, senior citizen profile, women health check, men health check, heart check, diabetes check, and others. The women health check segment dominated the market with the largest revenue share in 2025, driven by increasing awareness about preventive screenings for breast, cervical, and ovarian cancers. Programs targeting reproductive health, hormonal disorders, and preventive cardiovascular screening for women are expanding the adoption of these packages. Health service providers often bundle multiple tests into comprehensive women’s health profiles, improving convenience and compliance. In addition, government and private initiatives emphasizing early detection of gender-specific diseases contribute to sustained demand. Digital platforms that allow scheduling, reminders, and report access are further supporting market growth.

The senior citizen profile segment is expected to witness the fastest growth during the forecast period due to the growing geriatric population in Europe, particularly in Germany, Italy, and France. This package typically includes tests for cardiovascular, metabolic, musculoskeletal, and neurological disorders, which are highly prevalent among older adults. Increased awareness about age-related diseases and preventive health management is driving adoption. Providers are offering tailored packages for elderly patients, integrating telehealth monitoring and follow-up services. Rising disposable income among senior citizens and supportive insurance frameworks further encourage uptake of these packages. The convenience of comprehensive, one-stop health evaluations makes this segment increasingly popular.

- By Panel Type

On the basis of panel type, the Europe health screening market is segmented into multi-test panels and single-test panels. The multi-test panels segment dominated the market with the largest revenue share in 2025, as they provide comprehensive health assessments in a single package, improving convenience for patients and efficiency for healthcare providers. These panels often combine tests for cardiovascular risk, metabolic disorders, liver and kidney function, and cancer markers, appealing to both preventive and routine health check users. Multi-test panels are increasingly integrated into corporate wellness programs and insurance-covered health plans. Digital platforms and laboratory networks facilitate easier scheduling and result tracking, further driving adoption. Their growing popularity is supported by technological advancements that reduce sample volume and testing time while improving accuracy.

The single-test panels segment is expected to witness the fastest growth rate from 2026 to 2033 due to the increasing demand for targeted, cost-effective testing options. Patients seeking specific disease monitoring or follow-up diagnostics prefer single-test options for simplicity and affordability. Point-of-care testing, home-based sample collection, and rapid diagnostics are also boosting single-test panel adoption. Healthcare providers are increasingly offering modular testing solutions that allow patients to select individual tests based on risk factors. The segment’s growth is reinforced by rising awareness of early disease detection and personalized preventive care.

- By Sample Type

On the basis of sample type, the Europe health screening market is segmented into blood, urine, serum, saliva, and others. The blood sample segment dominated the market with the largest revenue share in 2025, driven by its wide application across various tests, including cholesterol, diabetes, cancer markers, and cardiovascular assessments. Blood tests are highly reliable and form the backbone of most preventive health programs. Hospitals and diagnostic labs routinely use blood samples due to their high accuracy, reproducibility, and adaptability to advanced technologies such as immunoassays, PCR, and biomarker detection. Growing awareness about routine blood testing in corporate and community wellness programs further strengthens this segment.

The saliva sample segment is expected to witness the fastest growth during the forecast period due to its non-invasive nature, ease of collection, and growing adoption in genetic, viral, and hormonal testing. Saliva-based screening solutions are increasingly used for early disease detection, home collection kits, and rapid diagnostics. Advances in molecular testing and AI-driven analysis have improved accuracy, making saliva a preferred sample type for patient-friendly preventive screening. The segment benefits from rising consumer preference for less invasive methods and remote testing options.

- By Technology

On the basis of technology, the Europe health screening market is segmented into immunoassays, medical imaging, QPCR (Quantitative Polymerase Chain Reaction), Q-FISH (Quantitative Fluorescence, in Situ Hybridization), TRF (Terminal Restriction Fragment), STELA (Single Telomere Length Analysis), and others. The medical imaging segment dominated the market with the largest revenue share in 2025, driven by the widespread adoption of imaging techniques such as MRI, CT scans, and ultrasound in cancer, cardiovascular, and musculoskeletal screenings. Advanced imaging technologies offer high accuracy, early detection capabilities, and real-time monitoring, which is increasingly integrated into national screening programs. Hospitals and diagnostic labs invest heavily in imaging infrastructure to cater to rising patient demand. Digital reporting, AI-assisted image analysis, and tele-radiology further enhance adoption. Government-backed reimbursement schemes and preventive health policies in countries such as Germany, France, and the U.K. support the dominance of this segment.

The QPCR (Quantitative Polymerase Chain Reaction) segment is expected to witness the fastest growth rate from 2026 to 2033 due to the rising demand for genetic, viral, and molecular diagnostics. QPCR enables precise detection of DNA/RNA targets, making it critical for early disease identification, infectious disease monitoring, and cancer biomarker analysis. The COVID-19 pandemic accelerated the adoption of QPCR-based testing infrastructure in Europe, which is now being leveraged for preventive health applications. The integration of automated QPCR systems in labs reduces turnaround time and increases testing efficiency. Patients and providers are increasingly preferring molecular diagnostics for targeted screening and personalized preventive care.

- By Condition

On the basis of condition, the Europe health screening market is segmented into cardiovascular disease, metabolic disorders, cancer, inflammatory conditions, musculoskeletal disorders, neurological conditions, hepatitis-C complications, immunology-related conditions, and others. The cancer segment dominated the market with the largest revenue share in 2025, driven by high incidence rates of breast, colorectal, and cervical cancers in Europe. National screening programs, government-funded preventive initiatives, and private diagnostic campaigns are widely implemented in countries such as Germany, France, and the U.K. Early detection through imaging, biomarker testing, and genetic screening is increasing patient participation. The availability of bundled cancer screening packages and insurance coverage further fuels demand. Healthcare providers leverage AI and data analytics to improve diagnostic accuracy and follow-up care, reinforcing the segment’s dominance.

The cardiovascular disease segment is expected to witness the fastest growth during the forecast period due to increasing prevalence of heart-related disorders in countries such as Poland, Italy, and Spain. Routine blood pressure monitoring, cholesterol testing, echocardiography, and ECG screenings are driving adoption. Public health awareness campaigns and preventive cardiac check programs are promoting early detection. Technological advancements in wearable cardiac monitoring devices and AI-assisted diagnostics further boost adoption. Lifestyle changes, aging population, and government-backed preventive initiatives contribute to strong growth prospects.

- By Sample Collection Sites

On the basis of sample collection sites, the Europe health screening market is segmented into hospitals, homes, diagnostic laboratories, offices, and others. The hospital segment dominated the market with the largest revenue share in 2025, due to the availability of comprehensive diagnostic facilities, trained medical personnel, and advanced testing infrastructure. Hospitals serve as primary hubs for preventive health check-ups, corporate wellness programs, and government-sponsored screening initiatives. Patients prefer hospital-based testing for reliability, accuracy, and immediate consultation. Integration with electronic health records and centralized reporting enhances patient follow-up and continuity of care. The presence of specialized diagnostic centers within hospital networks further supports dominance.

The home sample collection segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for convenient, contactless, and remote health screening options. Home collection services for blood, saliva, or urine samples are increasingly popular among urban populations and elderly patients. Telehealth-enabled reporting and courier services facilitate sample transport to diagnostic labs. Growing awareness of preventive healthcare and lifestyle monitoring is driving adoption. Companies offering home sample kits are partnering with digital platforms for scheduling, result delivery, and physician consultations, creating a scalable growth model.

- By Distribution Channel

On the basis of distribution channel, the Europe health screening market is segmented into direct tenders, retail sales, and others. The direct tenders segment dominated the market with the largest revenue share in 2025, primarily driven by bulk contracts from government healthcare programs, corporate wellness schemes, and hospital networks. Direct tendering ensures consistent demand and large-scale implementation of preventive screening initiatives. National healthcare authorities in countries such as Germany and France leverage tender-based procurement for diagnostic equipment and health screening packages. Long-term contracts and high-value procurement enhance market stability for providers. Efficient logistics and established vendor relationships further reinforce dominance.

The retail sales segment is expected to witness the fastest growth during the forecast period due to the increasing availability of preventive screening packages and home-based test kits through pharmacies, online platforms, and diagnostic chains. Direct-to-consumer models allow patients to purchase health screening solutions conveniently, enhancing accessibility and adoption. Growing awareness of personalized health monitoring, lifestyle-related testing, and rapid diagnostics is boosting retail sales. Integration with mobile apps, telehealth consultations, and subscription models supports recurring revenue opportunities. Retail channels are particularly popular in urban and semi-urban populations seeking convenient preventive care options.

Europe Health Screening Market Regional Analysis

- Germany dominated the Europe health screening market with the largest revenue share of 24.8% in 2025, characterized by a well-established healthcare infrastructure, comprehensive statutory health insurance coverage, and strong government-backed national screening programs, with high participation rates in routine cancer and cardiovascular screening initiatives supported by advanced diagnostic technologies

- Consumers and patients in Germany highly value comprehensive screening services that offer accurate diagnostics, personalized preventive care, and seamless integration with electronic health records and telehealth platforms

- This widespread adoption is further supported by favorable reimbursement policies, high healthcare expenditure, and strong participation in national screening programs for cancer, cardiovascular diseases, and metabolic disorders, establishing preventive health screening as a critical component of public and private healthcare systems

The U.K. Health Screening Market Insight

The U.K. health screening market captured a significant revenue share in 2025, driven by growing awareness of preventive healthcare and government-backed national screening programs. Consumers are increasingly prioritizing early detection of chronic diseases such as cancer, cardiovascular disorders, and diabetes. The widespread availability of advanced diagnostic technologies, coupled with telehealth and digital reporting platforms, further propels the market. Moreover, the integration of personalized preventive care packages and corporate wellness initiatives is significantly contributing to the expansion of health screening services across the country.

Germany Health Screening Market Insight

The Germany health screening market is expected to expand at a substantial CAGR during the forecast period, fueled by well-established healthcare infrastructure and increasing adoption of AI-enabled diagnostic tools. Rising awareness of early disease detection and preventive care, supported by government programs for cancer, cardiovascular, and metabolic disorder screening, drives market growth. Germany’s emphasis on innovation, data-driven healthcare, and patient-centric solutions promotes the adoption of comprehensive health screening packages. The growing integration of screening services with digital health records and telemedicine platforms further enhances accessibility and convenience for patients.

France Health Screening Market Insight

The France health screening market is projected to grow steadily during the forecast period, driven by strong government-led preventive healthcare initiatives and high participation in routine check-ups. The rising prevalence of lifestyle-related diseases and chronic conditions is encouraging adoption of comprehensive screening packages. French consumers increasingly value personalized preventive care, digital reporting, and access to advanced diagnostic technologies. Expansion of private diagnostic laboratories and public-private partnerships is supporting the widespread availability of health screening services. Furthermore, reimbursement policies and insurance coverage contribute to higher uptake across urban and semi-urban populations.

Poland Health Screening Market Insight

The Poland health screening market is expected to witness the fastest growth rate during the forecast period, driven by improving healthcare access, rising awareness of preventive healthcare, and expanding private diagnostic service providers. The increasing prevalence of chronic and lifestyle-related diseases is encouraging individuals to adopt routine screenings. Poland’s growing urbanization and digital health infrastructure are supporting telehealth-enabled diagnostics and home sample collection services. Government initiatives promoting preventive care and public-private partnerships are further boosting market adoption. The availability of affordable, targeted screening packages contributes to rapid market growth in both residential and workplace segments.

Europe Health Screening Market Share

The Europe Health Screening industry is primarily led by well-established companies, including:

- Eurofins Scientific SE (Luxembourg)

- SYNLAB Group (Germany)

- Cerba HealthCare (France)

- QIAGEN (Netherlands)

- Medicover SA (Poland)

- GENEPOC Ltd. (U.K.)

- BioMérieux (France)

- Nuffield Health (U.K.)

- Trinity Biotech Plc (Ireland)

- ACM Global Laboratories (Europe)

- LabPLUS Laboratories (Europe)

- NeoGenomics Laboratories (Europe)

- Quidel Corporation (Europe operations)

- Innova Medical Group (Europe)

- Amedes Holding GmbH (Germany)

- Labor Berlin (Germany)

- SCM BioGroup (Europe)

- Unilabs (Switzerland)

- Siemens Healthcare GmbH (Germany)

What are the Recent Developments in Europe Health Screening Market?

- In November 2025, the European Cancer Organisation released a press release highlighting major disparities in cancer screening uptake across the EU and called for scaling up screening programmes to reach more populations and reduce inequities in early detection

- In October 2025, the European Health and Digital Executive Agency (HaDEA) announced the launch of three new EU4Health projects under the Europe’s Beating Cancer Plan to improve breast cancer screening awareness and AI‑driven diagnostics across multiple EU countries, aiming to expand data sharing, enhance early detection tools, and strengthen screening infrastructure

- In March 2025, the EUCanScreen project announced a European training course on low‑dose CT lung cancer screening for young radiologists, strengthening professional capacity for early detection technologies

- In September 2024, the National Screening Service (Ireland) joined partners from 29 countries to launch the EU‑wide Joint Action on Cancer Screening (EUCanScreen) project under Europe’s Beating Cancer Plan to enhance quality, access, and equity of screening for major cancers

- In October 2023, the European Health and Digital Executive Agency (HaDEA) under EU4Health announced new early detection projects (PRAISE U, TOGAS, SOLACE, and CanScreen‑ECIS) aimed at improving access and sustainability of cancer screening programmes across EU countries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.