Europe Hearing Aid Market

Market Size in USD Billion

CAGR :

%

USD

3.06 Billion

USD

5.06 Billion

2025

2033

USD

3.06 Billion

USD

5.06 Billion

2025

2033

| 2026 –2033 | |

| USD 3.06 Billion | |

| USD 5.06 Billion | |

|

|

|

|

Europe Hearing Aid Market Size

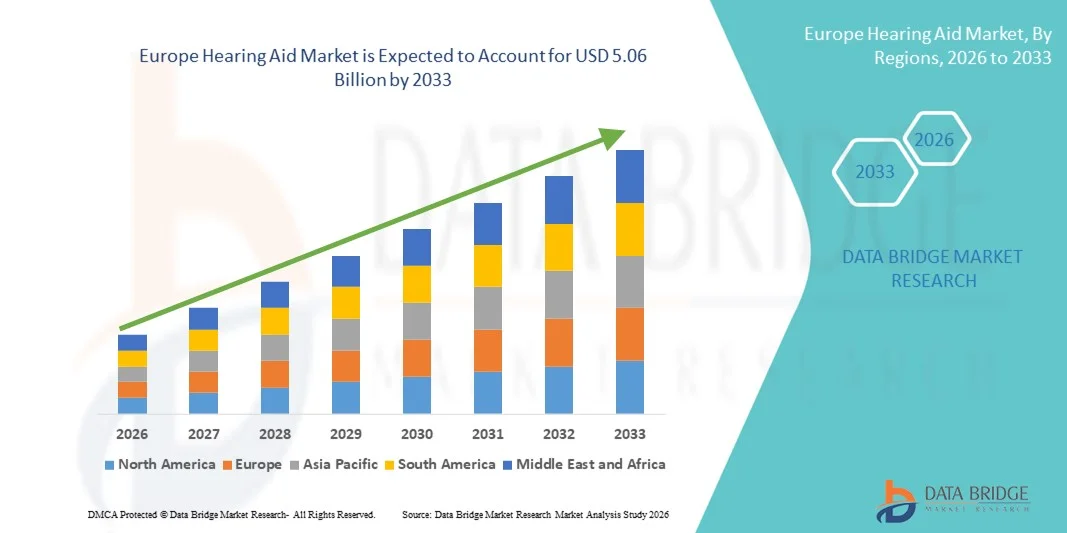

- The Europe hearing aid market size was valued at USD 3.06 billion in 2025 and is expected to reach USD 5.06 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of hearing loss across all age groups, coupled with increasing awareness about early diagnosis and treatment

- Furthermore, technological advancements in hearing aids—such as digital sound processing, AI-driven customization, Bluetooth connectivity, and rechargeable solutions—are enhancing user convenience and driving adoption in both developed and emerging markets. These converging factors are accelerating the uptake of Hearing Aid solutions, thereby significantly boosting the industry's growth

Europe Hearing Aid Market Analysis

- Hearing aids, including behind-the-ear (BTE), in-the-ear (ITE), and receiver-in-canal (RIC) devices, are increasingly essential medical devices that improve communication, social engagement, and quality of life for individuals experiencing mild to profound hearing loss

- The escalating demand for hearing aids is primarily driven by the rising geriatric population, increasing prevalence of noise-induced hearing loss, growing awareness regarding early diagnosis, and continuous technological advancements such as AI-enabled sound processing and Bluetooth connectivity

- The U.K. dominated the hearing aid market with the largest revenue share of approximately 34.6% in 2025, supported by strong public healthcare coverage, high adoption of advanced digital hearing aids, and growing awareness programs for hearing health

- Germany is expected to be the fastest-growing region in the hearing aid market, projected to register a CAGR of approximately 8.7% during the forecast period, driven by rising aging population, technological innovation, and expanding reimbursement policies

- The adults segment dominated the largest market revenue share of 83.4% in 2025, driven by the rapidly expanding geriatric population worldwide

Report Scope and Hearing Aid Market Segmentation

|

Attributes |

Hearing Aid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Hearing Aid Market Trends

Rising Adoption of Advanced Digital and Rechargeable Hearing Aids

- A major trend in the global hearing aid market is the increasing adoption of advanced digital and rechargeable hearing aids, offering enhanced sound quality, noise reduction, and longer battery life

- For instance, in February 2023, Sonova Group launched its Phonak Audéo Paradise Rechargeable Hearing Aid in Europe, featuring improved speech understanding in noisy environments and extended battery life, catering to the growing preference for convenient and high-performance hearing solutions

- Digital signal processing in modern hearing aids allows for personalized sound adjustments and automatic environmental adaptation

- Rechargeable models are reducing the dependency on disposable batteries, improving sustainability and user convenience

- The integration of wireless connectivity for mobile devices and streaming is also gaining traction, supporting seamless connectivity for music, calls, and tele-audiology services

- Companies are increasingly focusing on compact designs and lightweight materials to improve comfort and user compliance

Europe Hearing Aid Market Dynamics

Driver

Growing Prevalence of Hearing Loss and Aging Population

- The rising prevalence of hearing impairment worldwide, particularly among the aging population, is a key driver for the growth of the hearing aid market

- For instance, in July 2022, GN Hearing introduced its ReSound ONE hearing aid globally, targeting age-related hearing loss, and emphasizing improved speech comprehension and individualized fitting, which accelerated adoption among older adults

- Increasing awareness of the health impacts of untreated hearing loss is motivating both patients and healthcare providers to opt for advanced hearing solutions

- Government healthcare initiatives and insurance coverage in developed countries are supporting market expansion by improving accessibility

- The demand for discreet, behind-the-ear, and in-ear solutions is driving innovation and product differentiation in the market

- Technological advancements such as feedback suppression, directional microphones, and tinnitus relief features are further attracting users seeking premium solutions

Restraint/Challenge

High Cost and Limited Awareness in Developing Regions

- High prices for advanced digital and rechargeable hearing aids and limited awareness in emerging markets pose significant challenges for market growth

- For instance, in October 2021, a study by World Health Organization (WHO) highlighted that less than 10% of people with hearing loss in low-income countries have access to hearing aids, citing high costs and limited audiology infrastructure as key barriers

- The cost of personalized fitting and professional audiology services adds to the total expense, deterring price-sensitive consumers

- Lack of trained audiologists and limited distribution networks in certain regions further restrict market penetration

- Consumer hesitation regarding device maintenance, adaptation period, and perceived complexity may also slow adoption

- Efforts to introduce affordable hearing solutions, increase awareness campaigns, and expand professional audiology services will be crucial for driving sustained market growth

Europe Hearing Aid Market Scope

The market is segmented on the basis of product, device type, type of hearing loss, patient type, and distribution channel.

- By Product

On the basis of product, the Hearing Aids market is segmented into hearing aid devices and hearing implants. The hearing aid devices segment dominated the largest market revenue share of 64.8% in 2025, driven by their widespread adoption among patients suffering from mild to moderate hearing impairment. These devices are non-invasive, cost-effective, and easily accessible compared to surgical implants, making them the first line of treatment globally. Increasing geriatric population, rising cases of noise-induced hearing loss, and growing awareness regarding early diagnosis significantly contribute to segment dominance. Technological advancements such as AI-powered sound processing, Bluetooth connectivity, rechargeable batteries, and nearly invisible designs have enhanced product appeal. Additionally, supportive reimbursement policies in developed economies and over-the-counter (OTC) availability in certain regions have expanded accessibility. The presence of major manufacturers continuously innovating digital hearing solutions further strengthens market penetration. Growing demand for discreet, comfortable, and high-performance devices ensures sustained leadership of this segment.

The hearing implants segment is anticipated to witness the fastest CAGR of 9.8% from 2026 to 2033, fueled by rising prevalence of severe to profound hearing loss cases globally. Increasing adoption of cochlear implants and bone-anchored hearing systems, particularly among pediatric and elderly patients, supports growth. Technological advancements improving implant efficiency, durability, and sound clarity are encouraging acceptance. Expanding healthcare infrastructure in emerging economies and rising government funding for hearing restoration programs further drive demand. Improved surgical outcomes and shorter recovery times have increased physician confidence in implant procedures. Growing awareness among parents regarding early pediatric implantation also contributes significantly to market expansion.

- By Device Type

On the basis of device type, the Hearing Aids market is segmented into digital hearing aids and analog hearing aids. The digital hearing aids segment held the largest market revenue share of 72.3% in 2025, driven by superior sound processing capabilities and customizable features. Digital devices provide enhanced noise reduction, feedback cancellation, multi-channel processing, and wireless connectivity options, significantly improving user experience. Increasing consumer preference for technologically advanced healthcare devices further accelerates demand. Integration with smartphones and remote adjustment capabilities through mobile applications enhance convenience and personalization. Rising disposable income levels and greater awareness regarding hearing health also support adoption. Continuous innovation by leading manufacturers in miniaturization and rechargeable battery technology strengthens segment dominance.

The analog hearing aids segment is expected to witness the fastest CAGR of 7.6% from 2026 to 2033, particularly in cost-sensitive markets across developing regions. Analog devices remain affordable and simple to operate, making them suitable for elderly populations unfamiliar with advanced digital technologies. Government-led distribution programs and public healthcare initiatives in low-income countries further support growth. Although digital devices dominate globally, analog models continue to cater to rural and underserved populations. Increasing efforts to provide affordable hearing solutions in emerging economies are expected to sustain steady growth.

- By Type of Hearing Loss

On the basis of type of hearing loss, the Hearing Aids market is segmented into sensorineural hearing loss and conductive hearing loss. The sensorineural hearing loss segment accounted for the largest market revenue share of 78.5% in 2025, driven by its high global prevalence, particularly among the aging population. Age-related degeneration, prolonged noise exposure, and genetic factors significantly contribute to this condition. Patients with sensorineural hearing loss typically require long-term use of hearing aids or implants, increasing recurring demand. Technological advancements in digital amplification systems have significantly improved management outcomes. Growing awareness campaigns and early diagnostic programs also support market growth.

The conductive hearing loss segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, supported by improved diagnostic capabilities and increasing access to ENT specialists. Rising pediatric cases due to infections and structural abnormalities are contributing to segment growth. Advancements in bone conduction devices and minimally invasive surgical implants further accelerate adoption. Government initiatives promoting early hearing screening programs also play a significant role in driving demand.

- By Patient Type

On the basis of patient type, the Hearing Aids market is segmented into adults and pediatrics. The adults segment dominated the largest market revenue share of 83.4% in 2025, driven by the rapidly expanding geriatric population worldwide. Age-related hearing loss, occupational noise exposure, and lifestyle-related auditory damage contribute significantly to segment dominance. Adults are increasingly seeking early treatment to maintain communication abilities and quality of life. Technological advancements such as discreet designs and rechargeable devices further boost adoption among working professionals and elderly users alike.

The pediatrics segment is anticipated to witness the fastest CAGR of 10.4% from 2026 to 2033, fueled by expanding newborn hearing screening programs globally. Increasing parental awareness and early diagnosis initiatives have significantly improved treatment rates. Governments and healthcare organizations are investing in pediatric audiology services and cochlear implantation programs. Continuous innovation in child-friendly hearing devices with enhanced safety and comfort features supports growth.

- By Distribution Channel

On the basis of distribution channel, the Hearing Aids market is segmented into large retail chains, manufacturer owned retail chains, public, and others. The manufacturer owned retail chains segment accounted for the largest market revenue share of 39.7% in 2025, driven by strong brand presence, professional audiologist support, and customized fitting services. These channels ensure product authenticity, warranty coverage, and high-quality after-sales services. Increasing expansion of exclusive brand outlets across urban centers further strengthens segment dominance.

The large retail chains segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by growing consumer preference for convenient purchasing options and competitive pricing structures. Expansion of organized retail healthcare chains and partnerships with audiology professionals enhance accessibility. The integration of online sales platforms and omnichannel strategies further accelerates growth. Rising awareness and improved affordability across developing regions are also contributing to rapid expansion.

Europe Hearing Aid Market Regional Analysis

- The Europe hearing aid market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of hearing loss, a rapidly aging population, and strong government support for hearing healthcare services

- Increasing awareness regarding early diagnosis and treatment of hearing impairment is encouraging greater adoption of advanced digital hearing aids across the region. Technological advancements such as rechargeable devices, Bluetooth-enabled hearing aids, and improved sound processing technologies are further strengthening market growth

- Favorable reimbursement frameworks in several European countries are also supporting patient access to premium devices. The region is witnessing increasing demand across hospitals, audiology clinics, and retail hearing care centers, with hearing aids being incorporated into both public healthcare systems and private healthcare services

U.K. Hearing Aid Market Insight

The U.K. hearing aid market dominated the Hearing Aid market with the largest revenue share of approximately 34.6% in 2025, supported by strong public healthcare coverage, high adoption of advanced digital hearing aids, and growing awareness programs for hearing health. The presence of the National Health Service (NHS), which provides access to hearing assessments and subsidized hearing aids, significantly contributes to widespread adoption. Additionally, increasing awareness regarding age-related hearing loss and early intervention programs has improved diagnosis rates. The growing elderly population and rising cases of noise-induced hearing impairment are further boosting demand. The U.K.’s well-established audiology infrastructure, combined with the availability of technologically advanced rechargeable and wireless hearing aids, continues to support steady market expansion during the forecast period.

Germany Hearing Aid Market Insight

Germany hearing aid market is expected to be the fastest-growing region in the Hearing Aid market, projected to register a CAGR of approximately 8.7% during the forecast period, driven by a rising aging population, technological innovation, and expanding reimbursement policies. Germany’s strong healthcare system and emphasis on preventive care are encouraging early screening and treatment of hearing disorders. Increasing demand for premium digital and rechargeable hearing aids, along with growing consumer preference for discreet and high-performance devices, is accelerating adoption. Furthermore, advancements in sound amplification technologies and integration with mobile connectivity features are gaining popularity among tech-savvy consumers. The expansion of audiology clinics and specialized hearing care centers across urban and semi-urban areas is also supporting market growth. Germany’s focus on healthcare innovation and supportive insurance coverage framework positions it as the fastest-growing market within Europe.

Europe Hearing Aid Market Share

The Hearing Aid industry is primarily led by well-established companies, including:

- Sonova Holding AG (Switzerland)

- Demant A/S (Denmark)

- WS Audiology (Denmark)

- GN Store Nord A/S (Denmark)

- Starkey Laboratories, Inc. (U.S.)

- Cochlear Limited (Australia)

- MED-EL (Austria)

- Widex A/S (Denmark)

- RION Co., Ltd. (Japan)

- Amplifon S.p.A. (Italy)

- Eargo, Inc. (U.S.)

- Audina Hearing Instruments, Inc. (U.S.)

- Arphi Electronics Private Limited (India)

- Sivantos Pte. Ltd. (Singapore)

- Horentek (China)

Latest Developments in Europe Hearing Aid Market

- In August 2022, the U.S. Food and Drug Administration (FDA) finalized a landmark rule establishing a new category of over-the-counter (OTC) hearing aids for adults with mild to moderate hearing loss, allowing consumers to purchase hearing aids directly without a medical exam, prescription, or fitting by an audiologist. This regulatory shift significantly lowered entry barriers, improved affordability, and expanded accessibility, marking one of the most transformative developments in the global hearing aid industry

- In January 2023, Sony Electronics announced the launch of its first over-the-counter hearing aids, CRE-C10 and CRE-E10, developed in partnership with WS Audiology, designed to provide discreet form factors, rechargeable batteries, and app-based self-fitting capabilities. This launch signaled the entry of major consumer electronics brands into the regulated hearing healthcare market, accelerating competition and innovation

- In February 2023, Starkey launched its Genesis AI hearing aid platform, featuring a newly engineered processor, advanced Neuro Sound Technology, improved speech clarity, and enhanced durability against moisture and sweat. The Genesis AI platform represented a significant technological advancement focused on artificial intelligence, sound processing speed, and user comfort

- In March 2024, Oticon introduced the Oticon Intent hearing aids, incorporating innovative 4D sensor technology that adapts to user movement, conversation intent, and environmental changes in real time. This development strengthened Oticon’s position in AI-enabled hearing solutions by improving speech understanding in complex listening environments

- In March 2024, GN Hearing expanded its ReSound Nexia product family, recognized as the world’s first hearing aids compatible with Bluetooth LE Audio and Auracast broadcast audio technology. This advancement enhanced wireless connectivity, improved streaming quality, and enabled users to connect directly to public audio broadcasts, reflecting a major step forward in digital integration

- In September 2024, Apple received FDA authorization for the Hearing Aid Feature in AirPods Pro (2nd generation), enabling the device to function as an over-the-counter hearing aid for adults with perceived mild to moderate hearing loss. This development blurred the lines between consumer electronics and medical hearing devices, significantly expanding mainstream awareness and adoption potential

- In February 2025, Beltone introduced its Beltone Envision hearing aids, designed with advanced noise management algorithms, improved voice clarity features, and enhanced connectivity capabilities. The launch reinforced the growing trend toward AI-driven personalization and seamless smartphone integration

- In June 2025, Demant A/S announced the acquisition of KIND Group for approximately €700 million, strengthening its retail footprint in Germany and expanding its global distribution network. This strategic acquisition underscored ongoing consolidation within the hearing aid market and highlighted companies’ focus on vertical integration and global expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.