Europe Heartstring Device And Enclosure Device Market

Market Size in USD Million

CAGR :

%

USD

30.87 Million

USD

56.82 Million

2024

2032

USD

30.87 Million

USD

56.82 Million

2024

2032

| 2025 –2032 | |

| USD 30.87 Million | |

| USD 56.82 Million | |

|

|

|

|

Europe Heartstring Device and Enclosure Device Market Size

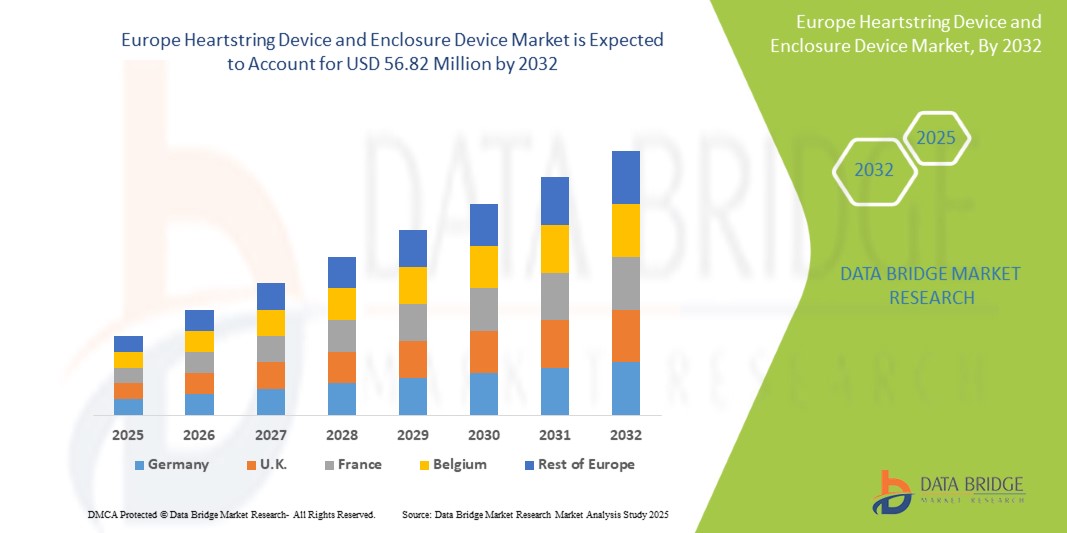

- The Europe Heartstring Device and Enclosure Device Market size was valued at USD 30.87 million in 2024 and is expected to reach USD 56.82 million by 2032, at a CAGR of 7.9% during the forecast period

- The expansion of the Heartstring and Enclosure Device market is directly propelled by the increasing integration of smart home ecosystems and the widespread digitalization of commercial properties. This evolution is fueling strong demand for sophisticated, interconnected access control solutions.

- Additionally, shifting consumer expectations toward highly secure, intuitive, and seamless technologies are establishing Heartstring and Enclosure Devices as the benchmark for modern access systems, thereby accelerating market-wide adoption and growth.

Europe Heartstring Device and Enclosure Device Market Analysis

- Heartstring device and enclosure device refer to specialized components used across medical and technological applications to enhance safety, precision, and system integrity. The Heartstring device is primarily utilized in cardiovascular surgeries to temporarily seal blood vessels during procedures like coronary artery bypass grafting, minimizing the risk of complications such as embolism.

- Enclosure devices function as critical protective housings, safeguarding sensitive components within medical and smart technology systems from environmental hazards and unauthorized access. The synergy between Heartstring and Enclosure devices is therefore fundamental to ensuring procedural safety, optimizing device performance, and bolstering operational reliability across the healthcare and smart infrastructure sectors.

Germany dominates and expected to dominate the Europe Heartstring Device and Enclosure Device Market with the largest revenue share of 18.48% in 2025, primarily due to the presence of advanced healthcare infrastructure, high adoption of innovative surgical technologies, and increased investment in cardiac care solutions. Additionally, the region benefits from the presence of key market players, favorable reimbursement policies, and rising prevalence of cardiovascular diseases, all contributing to sustained market growth.

- Enclose device segment is expected to dominate the Europe Heartstring Device and Enclosure Device Market with a market share of 64.04 in 2025, due to its critical role in facilitating safe, the enclosure device segment minimally invasive cardiac procedures. Its ability to ensure controlled vascular access and reduce procedural complications is driving widespread clinical adoption

Report Scope and Europe Heartstring Device and Enclosure Device Market Segmentation

|

Attributes |

Heartstring Device and Enclosure Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Heartstring Device and Enclosure Device Market Trends

GROWTH POTENTIAL IN EMERGING HEALTHCARE REGIONS

- Progress is accelerating through the expansion of healthcare infrastructure and the rising prevalence of cardiovascular disease in emerging regions.

- Device manufacturers are increasingly collaborating with local hospitals and healthcare providers to introduce heartstring and enclosure systems tailored to the specific needs and resource constraints of these markets.

- These partnerships focus on training healthcare professionals, improving procedural workflows, and facilitating access to advanced cardiac surgical technologies.

For instance,

- In June 2024, a study published in Asian Cardiovascular & Thoracic Annals highlighted the significant strides made by the Cardiac Surgery Intersociety Alliance (CSIA) over five years in enhancing cardiac surgical care across emerging regions, including Asia and Africa. The study emphasized the importance of collaborative efforts in training, resource sharing, and capacity building to address the rising burden of cardiovascular diseases in these regions. By focusing on skill development and infrastructure improvement, the CSIA has played a pivotal role in expanding access to advanced cardiac surgical procedures, thereby tapping into the vast growth potential of these emerging healthcare markets

- In March 2022, a study published in the International Journal of Environmental Research and Public Health examined the implementation of telecardiology in rural areas across various countries. The research highlighted that telecardiology platforms, including remote monitoring and virtual consultations, have significantly improved access to cardiovascular care in underserved regions. Hospitals in these areas have partnered with telemedicine providers to train healthcare professionals, integrate digital health tools, and enhance patient outcomes. This collaboration has been crucial in addressing the rising demand for cardiac services in emerging healthcare regions

Emerging healthcare regions are rapidly upgrading their cardiac care capabilities through investments in infrastructure, training of their workforce, and strategic collaborations. These developments are opening significant opportunities for the adoption of advanced surgical tools like heartstring and enclosure devices.

Europe Heartstring Device and Enclosure Device Market Dynamics

Driver

RISING PREVALENCE OF CHRONIC VENOUS DISORDERS (CVDs) GLOBALLY

- Chronic Venous Disorders (CVDs) — including varicose veins, chronic venous insufficiency, edema, and venous leg ulcers — are costly, debilitating, and typically progressive.

- Compression therapy is the frontline non-surgical treatment recommended by vascular health experts. Because CVDs often require lifelong management, demand for compression garments and devices continues to grow sustainably.

- This escalating demand underscores the need for ongoing innovation in compression technologies, providing more comfortable and effective solutions.

For instance,

In May 2023, according to the National Center for Biotechnology Information, a scoping review was conducted to assess the prevalence of chronic venous disease (CVD) among healthcare workers. This review, adhering to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses guidelines, analyzed 15 publications. The findings revealed a mean CVD prevalence of 58.5% and a mean varicose vein prevalence of 22.1% among healthcare workers. These figures suggest an elevated prevalence of CVD in this group compared to the general population, highlighting the need for early diagnosis and preventative measures

- Furthermore, increased awareness and early diagnosis are crucial for slowing disease progression and improving patient quality of life. The economic impact of CVDs also underscores the importance of preventative measures and accessible, long-term management strategies. Ultimately, a multi-pronged approach involving lifestyle modifications, early intervention, and advanced compression therapies is essential to mitigate the rising global burden of CVDs

Oppurtunity

ADVANCEMENTS IN HEART STRING DEVICE TECHNOLOGY AND USABILITY

- Continuous innovation in off-pump CABG (Coronary Artery Bypass Grafting) systems, often exemplified by advancements like the Heartstring device, is significantly enhancing surgical accessibility and outcomes.

- These innovations focus on several key areas that directly benefit both the surgical team and the patient. Improvements in stabilizers enable a more precise and steady surgical field on the beating heart, which is crucial for delicate anastomoses. Integrated imaging provides surgeons with enhanced visualization, improving accuracy and reducing complications

For instance,

In October 2024, the National Center for Biotechnology Information highlighted that wearable devices are revolutionizing the management and diagnosis of Cardio vascular Disease (CVD). These cost-effective tools offer continuous, real-time monitoring of vital parameters, addressing limitations of traditional methods. The review discusses advancements in wearable technologies, categorized by galvanic contact, Photoplethysmography (PPG), and Radio Frequency (RF) waves, also emphasizing the role of AI in CVD diagnostics and future device perspectives

- Technological advancements are lowering technical barriers and enhancing the reproducibility of off-pump CABG procedures. These innovations support wider adoption by reducing surgeon training time, procedural risks, and hospital stays—aligning well with healthcare efficiency objectives.

- By investing in R&D that improves usability and reliability, device makers can justify premium pricing and drive wider procurement by healthcare systems

Restraint/Challenge

GROWING PREFERENCE FOR MINIMALLY INVASIVE CARDIAC PROCEDURES

- Minimally invasive cardiac interventions are becoming the preferred approach over traditional open-heart surgery due to their alignment with critical clinical goals. Procedures like Off-Pump Coronary Artery Bypass (OPCAB), transcatheter closure of congenital defects, and percutaneous valve repair offer substantial benefits to both patients and healthcare systems.

- These advanced techniques aim to significantly reduce patient trauma by utilizing smaller incisions or catheter-based methods, bypassing the need for a large chest incision. This less invasive approach results in shorter recovery periods, enabling patients to return to their daily lives more quickly with reduced pain and fewer complications.

- Ultimately, the adoption of these minimally invasive procedures also optimizes health system efficiency by potentially reducing hospital stays, lowering the risk of readmissions, and freeing up resources, demonstrating a clear advantage in modern cardiac care.

For instance,

- In December 2024, according to the National Center for Biotechnology Information, a comprehensive review was conducted to evaluate the utilization and outcomes of off-pump coronary artery bypass grafting (OPCAB). The study highlighted several concerns regarding the overuse of OPCAB, particularly in settings where surgeon experience and institutional volume are limited. It was noted that OPCAB is associated with higher rates of incomplete revascularization and inferior graft patency compared to on-pump CABG.

The shift toward minimally invasive cardiac procedures creates a growing market for related device technologies. Manufacturers who focus on compact, integrated, image-guided solutions stand to gain. Continued evidence generation and guideline adoption, coupled with surgeon training and reimbursement realignment, will help establish these procedures as default standards of care globally.

Europe Heartstring Device and Enclosure Device Market Scope

The market is segmented into five notable segments which are based on product type, application, technology type, end-user, and distribution channel.

- By Product Type

On the basis of product type, North America Europe Heartstring Device and Enclosure Device Market is segmented into enclose device, and heartstring device. In 2025, the enclosure device segment is expected to dominate with 64.04% market share due to its critical role in facilitating safe, the enclosure device segment minimally invasive cardiac procedures. Its ability to ensure controlled vascular access and reduce procedural complications is driving widespread clinical adoption.\

However, the heartstring device segment is projected to grow at the highest CAGR of 8.2% during the forecast period. This rapid growth is fueled by the increasing adoption of these devices in complex, off-pump cardiac surgeries to improve patient outcomes. Continuous innovation in heartstring technology, leading to enhanced ease of use and greater reliability in creating secure anastomoses, is directly driving its expanding preference among cardiac surgeons.

- By Application

On the basis of application, the North America Europe Heartstring Device and Enclosure Device Market is segmented into Coronary Artery Bypass Grafting (CABG), Aortic Anastomosis, Valve Surgery, and Other. Coronary Artery Bypass Grafting (CABG) is further segmented into Coronary Artery Bypass Grafting (CABG), aortic anastomosis, valve surgery, and other. In 2025, the Coronary Artery Bypass Grafting (CABG) segment is expected to dominate with 73.17% market share due to the growing burden of coronary artery disease and the increasing preference for off-pump surgical techniques. CABG procedures benefit significantly from heartstring and enclosure devices that enhance safety and reduce operative risks.

The Coronary Artery Bypass Grafting (CABG) segment is anticipated to exhibit the fastest growth, This growth is driven by the rising incidence of Coronary Artery in aging populations and the development of less invasive valve repair and replacement techniques. These advanced procedures demand precise and reliable tools like heartstring devices to ensure secure and effective outcomes, thereby accelerating adoption in this application.

- By Technology Type

On the basis of technology type, the North America Europe Heartstring Device and Enclosure Device Market is segmented into manual, automated or semi-automated, and others. In 2025, the manual segment is expected to dominate with 64.07% market share due to its widespread clinical acceptance, cost-effectiveness, and ease of use in diverse surgical settings. Stapling systems and clip-based closure devices offer reliable performance with minimal training requirements, driving their continued preference

The manual segment is poised to register the highest CAGR. This growth is propelled by the increasing demand for enhanced surgical precision, reduced procedural times, and superior safety outcomes. The integration of automated technologies with robotic-assisted surgical platforms and the drive to minimize human error in complex cardiac procedures are key factors fueling its rapid market expansion.

- By End User

On the basis of end user, the North America Europe Heartstring Device and Enclosure Device Market is segmented into hospitals, cardiac surgery centers, academic & research institutes, and others. In 2025, hospitals segment is expected to dominate with 62.20% market share due to the high volume of cardiac surgeries performed in Tier 1 and Tier 2 facilities and their access to advanced surgical infrastructure. These institutions also benefit from greater funding, skilled personnel, and integration of cutting-edge cardiovascular technologies.

Meanwhile, Hospitals are projected to be the fastest-growing segment, with a CAGR of 8.4%. Their growth is attributed to a rising trend of procedural specialization, which allows these centers to achieve higher efficiency, superior patient outcomes, and quicker adoption of niche technologies. As healthcare shifts towards value-based models, these specialized centers are becoming increasingly preferred for complex cardiovascular interventions.

- By Distribution Channel

On the basis of distribution channel, the North America Europe Heartstring Device and Enclosure Device Market is segmented into direct tenders, distributors & dealers, online procurement platforms, and others. In 2025, the direct tenders segment is expected to dominate the market with 46.39% market share due to bulk purchasing by government-sponsored hospitals and large private hospital networks. This channel ensures cost efficiency, streamlined procurement, and faster access to advanced surgical devices.

The direct tenders segment is expected to record the highest CAGR over the forecast period. This trend is a direct result of the increasing digitalization of healthcare supply chains. These platforms offer greater price transparency, enhanced accessibility for a wider range of buyers (including smaller clinics and research institutes), and simplified logistics, making them an increasingly attractive channel for sourcing medical devices.

Europe Heartstring Device and Enclosure Device Market Regional Analysis

- Europe dominates and expected to dominate the Europe Heartstring Device and Enclosure Device Market with the largest revenue share of 28.47% in 2025, primarily due to the presence of advanced healthcare infrastructure, high adoption of innovative surgical technologies, and increased investment in cardiac care solutions.

- Additionally, the region benefits from the presence of key market players, favorable reimbursement policies, and rising prevalence of cardiovascular diseases, all contributing to sustained market growth

Europe Heartstring Device and Enclosure Device Market Insight

The European Heartstring and Enclosure Device market is poised for robust growth, driven primarily by the region's aging demographic and the corresponding rise in cardiovascular diseases. This is fueling a strong demand for advanced and minimally invasive cardiac surgeries, where Heartstring devices are critical for ensuring procedural safety and efficacy, particularly in off-pump CABG. Furthermore, Europe's stringent regulatory landscape, including the Medical Device Regulation (MDR), mandates high standards for device performance and safety, reinforcing the need for reliable enclosure devices to protect sensitive surgical support systems. This combination of clinical need and regulatory pressure is accelerating the adoption of these technologies across European healthcare systems.

U.K. Europe Heartstring Device and Enclosure Device Market Insight

The U.K. market is anticipated to show notable growth, propelled by the National Health Service's (NHS) strategic initiatives to tackle the high prevalence of cardiovascular disease. There is a strong clinical drive towards adopting safer, minimally invasive cardiac procedures that reduce post-operative complications and hospitalization costs. Heartstring devices are integral to this shift, particularly in off-pump surgeries, as they enhance procedural safety and efficacy. Consequently, technologies that are clinically proven and deemed cost-effective by bodies such as NICE (National Institute for Health and Care Excellence) are seeing accelerated adoption within the U.K.'s structured healthcare system.

Germany Europe Heartstring Device and Enclosure Device Market Insight

Germany's market for Heartstring and Enclosure Devices is expected to grow steadily, underpinned by the country's reputation for medical excellence and its early adoption of high-precision surgical technologies. The German healthcare system places a strong emphasis on quality, reliability, and superior patient outcomes, creating a fertile ground for advanced devices. The demand for Heartstring devices is driven by their ability to enable more controlled and secure cardiac surgeries, aligning with Germany's high standards. This growth is further supported by a robust network of specialized cardiac centers and a favorable reimbursement environment for innovative and effective medical technologies.

Europe Heartstring Device and Enclosure Device Market Share

The heartstring device and enclosure device industry is primarily led by well-established companies, including:

- Peters Surgical (France)

- Getinge (Sweden)

- KARL STORZ (Germany)

Latest Developments in Europe Heartstring Device and Enclosure Device Market

- In July 2025, Getinge entered a strategic partnership with Zimmer Biomet to expand their offerings in the Ambulatory Surgical Center (ASC) sector. This collaboration combines Getinge’s OR infrastructure and sterilization solutions with Zimmer Biomet’s surgical technologies, enabling integrated, turnkey solutions for outpatient centers. The partnership enhances Getinge’s market reach, strengthens its ASC positioning, and supports growth in minimally invasive surgical care.

- In July 2024, Getinge announced the opening of its new Experience Center in India as part of its expansion strategy in Asia. This facility offers hands-on demonstrations of advanced surgical, intensive care, and sterile reprocessing solutions. The development enhances Getinge’s customer engagement, training capabilities, and strengthens its presence in a rapidly growing healthcare market.

- In October 2023, Getinge acquired Healthmark Industries Co. Inc. for approximately USD 320 million. Healthmark is a key provider of instrument care and infection control consumables. This acquisition strengthens Getinge’s position in sterile reprocessing, particularly in the U.S., while supporting global expansion of Healthmark’s product offerings.

- In December 2024, Artivion, Inc. received FDA Humanitarian Device Exemption (HDE) approval for its AMDS Hybrid Prosthesis, marking a key regulatory milestone. This allows the early U.S. commercialization of AMDS for treating acute DeBakey Type I aortic dissections with malperfusion—representing roughly 40% of such cases. The device also holds Breakthrough and Humanitarian Use Designation due to its life-saving potential in a rare, high-risk condition. This development strengthens Artivion’s leadership in the structural heart and aortic surgery market, expands its clinical footprint, and paves the way for broader Premarket Approval (PMA) coverage in the future.

- In November 2023, Artivion announced the completion of patient enrollment in its PERSEVERE clinical trial for the AMDS Hybrid Prosthesis, intended for treating acute DeBakey Type I aortic dissections. The 93-patient, U.S.-based study will support a PMA (Premarket Approval) application to the FDA by 2025. This milestone strengthens Artivion’s position in the aortic and structural heart device market, targeting reduced mortality and complications in high-risk aortic surgery cases.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 BRAND OUTLOOK

4.5.1 BRAND POSITIONING AND CLINICAL TRUST

4.5.2 COMPETITIVE DIFFERENTIATION IN A TECHNOLOGICALLY EVOLVING MARKET

4.5.3 PHYSICIAN-CENTRIC APPROACH AND BRAND ADAPTABILITY

4.5.4 INSTITUTIONAL PROCUREMENT, BRAND EQUITY, AND FINANCIAL STRENGTH

4.5.5 DIGITAL INTEGRATION AND EUROPE BRAND VISIBILITY

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 CONSUMER BUYING BEHAVIOUR FOR HEARTSTRING DEVICE

4.7.1 CLINICAL EFFECTIVENESS AND SAFETY

4.7.2 COST AND VALUE-BASED PURCHASING

4.7.3 SURGEON PREFERENCES AND TRAINING SUPPORT

4.7.4 REGULATORY APPROVALS AND COMPLIANCE

4.7.5 BRAND REPUTATION AND VENDOR RELATIONSHIPS

4.8 CONSUMER BUYING BEHAVIOR FOR ENCLOSURE DEVICE

4.8.1 INNOVATION AND CLINICAL NEED

4.8.2 COST CONSIDERATIONS AND BUDGET IMPACT

4.8.3 TRUST IN MATERIAL SAFETY AND BIOCOMPATIBILITY

4.8.4 SURGEON EXPERTISE AND TRAINING REQUIREMENTS

4.8.5 REGULATORY ACCEPTANCE AND MARKET ADOPTION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT AND SUPPLIER LANDSCAPE

4.9.2 MANUFACTURING AND ASSEMBLY OPERATIONS

4.9.3 REGULATORY COMPLIANCE AND QUALITY ASSURANCE

4.9.4 DISTRIBUTION, LOGISTICS, AND INVENTORY MANAGEMENT

4.9.5 AFTER-SALES SERVICES, TRAINING, AND LIFECYCLE MANAGEMENT

4.9.6 CONCLUSION

4.1 COST ANALYSIS BREAKDOWN

4.10.1 MANUFACTURING, ASSEMBLY, AND QUALITY CONTROL

4.10.2 R&D AND REGULATORY COMPLIANCE COSTS

4.10.3 PACKAGING, STERILIZATION, AND LOGISTICS

4.10.4 MARKETING, DISTRIBUTION, AND AFTER-SALES SUPPORT

4.10.5 CONCLUSION

4.11 INDUSTRY ECOSYSTEM ANALYSIS

4.11.1 PROMINENT COMPANIES

4.11.2 SMALL & MEDIUM SIZED COMPANIES

4.11.3 END USERS

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.12.1 JOINT VENTURES

4.12.2 MERGERS AND ACQUISITIONS (M&A)

4.12.3 LICENSING AND PARTNERSHIPS

4.12.4 TECHNOLOGY COLLABORATIONS

4.12.5 COMPANY’S OVERVIEW

4.12.6 CONCLUSION

4.13 PRICING ANALYSIS – EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET

4.13.1 PREMIUM PRICING STRATEGY FOR SPECIALIZED CARDIAC DEVICES

4.13.2 PRICING BASED ON DEVICE TYPE AND APPLICATION

4.13.3 MANUFACTURER INFLUENCE ON PRICE POSITIONING

4.13.4 REGULATORY AND QUALITY COMPLIANCE COSTS

4.13.5 MARKET-SPECIFIC PRICING STRATEGIES

4.13.6 PROCUREMENT MODELS AND TENDERING SYSTEMS

4.13.7 INNOVATION AND ADDED FEATURES IMPACT ON PRICING

4.13.8 CONCLUSION

4.14 PROFIT MARGIN SCENARIO

4.14.1 GROSS PROFIT MARGIN

4.14.2 OPERATING PROFIT MARGIN ASSESSMENT

4.14.3 NET PROFIT MARGIN ANALYSIS

4.14.4 SCENARIO MODELING: BEST, BASE, AND WORST CASES

4.14.5 STRATEGIES TO OPTIMIZE PROFIT MARGINS

4.15 RAW MATERIAL COVERAGE

4.15.1 SILICONE ELASTOMER (HEARTSTRING DEVICE)

4.15.2 RADIOPAQUE POLYESTER (HEARTSTRING DEVICE)

4.15.3 STAINLESS STEEL (ENCLOSURE DEVICES)

4.15.4 NITINOL (ENCLOSURE DEVICES)

4.15.5 ULTRA-HIGH-MOLECULAR-WEIGHT POLYETHYLENE (UHMWPE) (ENCLOSURE DEVICES)

4.16 TECHNOLOGICAL ADVANCEMENTS

4.16.1 ADVANCED ATRAUMATIC SEALING MECHANISMS

4.16.2 COMPACT, ERGONOMIC, AND USER-FRIENDLY DESIGNS

4.16.3 RAPID-DEPLOYMENT DELIVERY SYSTEMS

4.16.4 HYBRID BIOCOMPATIBLE MATERIALS FOR IMPROVED OUTCOMES

4.16.5 ENHANCED VISUALIZATION THROUGH IMAGING INTEGRATION

4.16.6 INTEGRATION WITH ROBOTIC AND MINIMALLY INVASIVE PLATFORMS

4.16.7 DATA-DRIVEN FEEDBACK AND DIGITAL INTEGRATION

4.17 VALUE CHAIN ANALYSIS

4.17.1 RAW MATERIAL PROCUREMENT

4.17.2 RESEARCH & DEVELOPMENT (R&D)

4.17.3 PRODUCT DESIGN AND PROTOTYPING

4.17.4 MANUFACTURING AND ASSEMBLY

4.17.5 REGULATORY APPROVALS AND QUALITY ASSURANCE

4.17.6 DISTRIBUTION AND LOGISTICS

4.17.7 MARKETING AND SALES

4.17.8 TRAINING AND TECHNICAL SUPPORT

4.17.9 AFTER-SALES SERVICE AND FEEDBACK INTEGRATION

4.18 VENDOR SELECTION CRITERIA

4.18.1 TECHNOLOGICAL CAPABILITIES AND INNOVATION PIPELINE

4.18.2 REGULATORY COMPLIANCE AND QUALITY CERTIFICATIONS

4.18.3 MANUFACTURING INFRASTRUCTURE AND SUPPLY CHAIN STRENGTH

4.18.4 CLINICAL SUPPORT, CUSTOMIZATION, AND AFTER-SALES SERVICE

4.18.5 MARKET REPUTATION, CUSTOMER BASE, AND FINANCIAL STABILITY

4.19 TARIFFS AND THEIR IMPACT ON MARKET

4.19.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.19.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.19.3 VENDOR SELECTION CRITERIA DYNAMICS

4.19.4 IMPACT ON SUPPLY CHAIN

4.19.4.1 COMPONENT PROCUREMENT

4.19.4.2 MANUFACTURING AND PRODUCTION

4.19.4.3 LOGISTICS AND DISTRIBUTION

4.19.4.4 PRICE PITCHING AND POSITION OF MARKET

4.19.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.19.5.1 SUPPLY CHAIN OPTIMIZATION

4.19.5.2 REGIONAL MANUFACTURING AND NEARSHORING

4.19.6 IMPACT ON PRICES

4.19.7 REGULATORY INCLINATION

4.19.7.1 INDUSTRY LOBBYING FOR EXEMPTIONS

4.19.7.2 LONG-TERM POLICY RESPONSE

4.19.7.3 TRADE AGREEMENTS & REGIONAL ALIGNMENT

4.19.8 CONCLUSION

5 REGULATORY FRAMEWORK

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HAZARD IDENTIFICATION

5.4 PRODUCT CODES

5.5 CERTIFIED STANDARDS

5.6 SAFETY STANDARDS

5.6.1 MATERIAL HANDLING & STORAGE

5.6.2 HAZARD IDENTIFICATION

5.7 PRODUCT CODES (ASIA PACIFIC CLASSIFICATION)

5.8 CERTIFIED STANDARDS

5.9 SAFETY STANDARDS

5.9.1 MATERIAL HANDLING & STORAGE

5.9.2 TRANSPORT & PRECAUTIONS

5.9.3 HAZARD IDENTIFICATION

5.1 PRODUCT CODES (DEVICE CLASSIFICATION)

5.11 CERTIFIED STANDARDS

5.12 SAFETY STANDARDS

5.12.1 MATERIAL HANDLING & STORAGE

5.12.2 TRANSPORT & PRECAUTIONS

5.12.3 HAZARD IDENTIFICATION

5.13 PRODUCT CODES

5.14 CERTIFIED STANDARDS

5.15 SAFETY STANDARDS

5.15.1 MATERIAL HANDLING & STORAGE

5.15.2 TRANSPORT & PRECAUTIONS

5.15.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC VENOUS DISORDERS (CVDS) GLOBALLY

6.1.2 RISING PREVALENCE OF CARDIOVASCULAR DISEASES (CVDS) GLOBALLY

6.1.3 INCREASING ADOPTION OF OFF-PUMP CABG (“HEART STRING”) TECHNIQUES

6.1.4 ADVANCEMENTS IN HEART STRING DEVICE TECHNOLOGY AND USABILITY

6.2 RESTRAINTS

6.2.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE CARDIAC PROCEDURES

6.2.2 HIGH COST OF DEVICES & LIMITED REIMBURSEMENT IN DEVELOPING MARKETS

6.3 OPPORTUNITIES

6.3.1 GROWTH POTENTIAL IN EMERGING HEALTHCARE REGIONS

6.3.2 INTEGRATION OF AI FOR SURGICAL PRECISION IMPROVEMENT

6.3.3 GROWTH OF TELECARDIOLOGY AND REMOTE PROCEDURE PLANNING

6.4 CHALLENGES

6.4.1 INCONSISTENT ADOPTION ACROSS FACILITIES

6.4.2 RISK OF COMPLICATIONS WITH IMPROPER DEVICE USAGE

7 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ENCLOSE DEVICE

7.3 HEARTSTRING DEVICE

8 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE

8.1 OVERVIEW

8.2 MANUAL

8.3 AUTOMATED OR SEMI-AUTOMATED

8.4 OTHERS

9 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CORONARY ARTERY BYPASS GRAFTING (CABG)

9.3 AORTIC ANASTOMOSIS

9.4 VALVE SURGERY

9.5 OTHER

10 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 CARDIAC SURGERY CENTERS

10.4 ACADEMIC & RESEARCH INSTITUTES

10.5 OTHERS

11 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDERS

11.3 DISTRIBUTORS & DEALERS

11.4 ONLINE PROCUREMENT PLATFORMS

11.5 OTHERS

12 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 ITALY

12.1.3 FRANCE

12.1.4 SPAIN

12.1.5 U.K.

12.1.6 SWITZERLAND

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 TURKEY

12.1.10 RUSSIA

12.1.11 DENMARK

12.1.12 NORWAY

12.1.13 FINLAND

12.1.14 SWEDEN

12.1.15 REST OF EUROPE

13 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 GETINGE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS/NEWS

15.2 PETERS SURGICAL

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 KARL STORZ

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 ARTIVION, INC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 CARDINAL HEALTH

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FUMEDICA MEDIZINTECHNIK GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 HENRY SCHEIN, INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 JOHNSON & JOHNSON

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 KLS MARTIN GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 MEDLINE INDUSTRIES, LP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MEDTRONIC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 OWENS & MINOR, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SANTAIR AE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 SONTEC INSTRUMENTS, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 TELEFLEX INCORPORATED

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 TERUMO CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 UNIPHAR GROUP PLC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 SERVICE PORTFOLIO

15.17.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 STRATEGIC INNOVATION TYPES AND THEIR IMPACT

TABLE 2 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE HEARTSTRING DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE AUTOMATED OR SEMI-AUTOMATED IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE OTHER IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE DISTRIBUTORS & DEALER IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE ONLINE PROCUREMENT PLATFORMS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 COUNTRY

TABLE 36 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 52 GERMANY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 GERMANY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 GERMANY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 GERMANY CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 GERMANY AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 GERMANY VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 GERMANY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 GERMANY MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 GERMANY OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 GERMANY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 62 GERMANY HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 GERMANY CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 GERMANY ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 GERMANY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 66 GERMANY DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 68 ITALY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ITALY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 ITALY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 ITALY CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ITALY AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ITALY VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 ITALY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ITALY MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 ITALY OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 ITALY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 78 ITALY HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 ITALY CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 ITALY ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 ITALY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 ITALY DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 ITALY DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 84 FRANCE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 FRANCE ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 FRANCE ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 FRANCE CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 FRANCE AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 FRANCE VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 FRANCE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 FRANCE MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 FRANCE OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 FRANCE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 94 FRANCE HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 FRANCE CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 FRANCE ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 FRANCE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 100 SPAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SPAIN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SPAIN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SPAIN CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SPAIN AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SPAIN VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SPAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SPAIN MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SPAIN OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SPAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 110 SPAIN HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SPAIN CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 SPAIN ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SPAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 114 SPAIN DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 SPAIN DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 116 U.K. HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 U.K. ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 U.K. ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 U.K. CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 U.K. AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 U.K. VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 U.K. HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 U.K. MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.K. OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.K. HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 U.K. HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.K. CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.K. ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.K. HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 130 U.K. DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.K. DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 132 SWITZERLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SWITZERLAND ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SWITZERLAND ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SWITZERLAND CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SWITZERLAND AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SWITZERLAND VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SWITZERLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SWITZERLAND MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SWITZERLAND OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SWITZERLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 142 SWITZERLAND HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SWITZERLAND CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SWITZERLAND ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SWITZERLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 SWITZERLAND DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SWITZERLAND DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 NETHERLANDS HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 NETHERLANDS ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NETHERLANDS ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 NETHERLANDS CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 NETHERLANDS AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 NETHERLANDS VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 NETHERLANDS HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 NETHERLANDS MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 NETHERLAND OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 NETHERLANDS HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 158 NETHERLAND HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 NETHERLAND CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 NETHERLAND ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NETHERLANDS HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 NETHERLANDS DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 NETHERLAND DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 164 BELGIUM HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 BELGIUM ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 BELGIUM ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 BELGIUM CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 BELGIUM AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 BELGIUM VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 BELGIUM HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 BELGIUM MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 BELGIUM OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 BELGIUM HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 174 BELGIUM HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 BELGIUM CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 BELGIUM ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 BELGIUM HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 178 BELGIUM DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 BELGIUM DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 180 TURKEY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 TURKEY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 TURKEY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 TURKEY CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 TURKEY AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 TURKEY VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 TURKEY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 TURKEY MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 TURKEY OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 TURKEY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 190 TURKEY HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 TURKEY CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 TURKEY ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 TURKEY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 194 TURKEY DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 TURKEY DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 196 RUSSIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 RUSSIA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 RUSSIA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 RUSSIA CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 RUSSIA AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 RUSSIA VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 RUSSIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 RUSSIA MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 RUSSIA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 RUSSIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 206 RUSSIA HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 RUSSIA CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 RUSSIA ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 RUSSIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 210 RUSSIA DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 RUSSIA DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 212 DENMARK HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 DENMARK ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 DENMARK ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 DENMARK CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 DENMARK AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 DENMARK VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 DENMARK HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 DENMARK MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 DENMARK OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 DENMARK HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 222 DENMARK HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 DENMARK CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 DENMARK ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 DENMARK HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 226 DENMARK DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 DENMARK DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 228 NORWAY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 NORWAY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NORWAY ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 NORWAY CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 NORWAY AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 NORWAY VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 NORWAY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 NORWAY MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 NORWAY OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NORWAY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 238 NORWAY HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NORWAY CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 NORWAY ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NORWAY HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 242 NORWAY DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NORWAY DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 244 FINLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 FINLAND ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 FINLAND ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 FINLAND CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 FINLAND AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 FINLAND VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 FINLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 FINLAND MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 FINLAND OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 FINLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 254 FINLAND HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 FINLAND CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 FINLAND ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 FINLAND HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 258 FINLAND DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 FINLAND DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 260 SWEDEN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWEDEN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SWEDEN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SWEDEN CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 SWEDEN AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SWEDEN VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SWEDEN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SWEDEN MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SWEDEN OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SWEDEN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 270 SWEDEN HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SWEDEN CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 SWEDEN ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 SWEDEN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 SWEDEN DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 SWEDEN DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 276 REST OF EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: SEGMENTATION

FIGURE 2 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: EUROPE VS. REGIONAL ANALYSIS

FIGURE 5 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 TWO SEGMENTS COMPRISE THE EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 RISING PREVALENCE OF CARDIOVASCULAR DISEASES (CVDS) GLOBALLY EXPECTED TO DRIVE THE EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET IN 2025 & 2032

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRODUCTION CONSUMPTION ANALYSIS: EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET

FIGURE 18 DROC ANALYSIS

FIGURE 19 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 21 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 22 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 23 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, 2024

FIGURE 24 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, CAGR (2025- 2032)

FIGURE 26 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, LIFELINE CURVE

FIGURE 27 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, 2024

FIGURE 28 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 30 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, 2024

FIGURE 32 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 33 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 34 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 36 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 38 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: SNAPSHOT (2024)

FIGURE 40 EUROPE HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.