Europe Heat Pump Market

Market Size in USD Billion

CAGR :

%

USD

34.25 Billion

USD

61.54 Billion

2024

2032

USD

34.25 Billion

USD

61.54 Billion

2024

2032

| 2025 –2032 | |

| USD 34.25 Billion | |

| USD 61.54 Billion | |

|

|

|

|

Heat Pumps Market Size

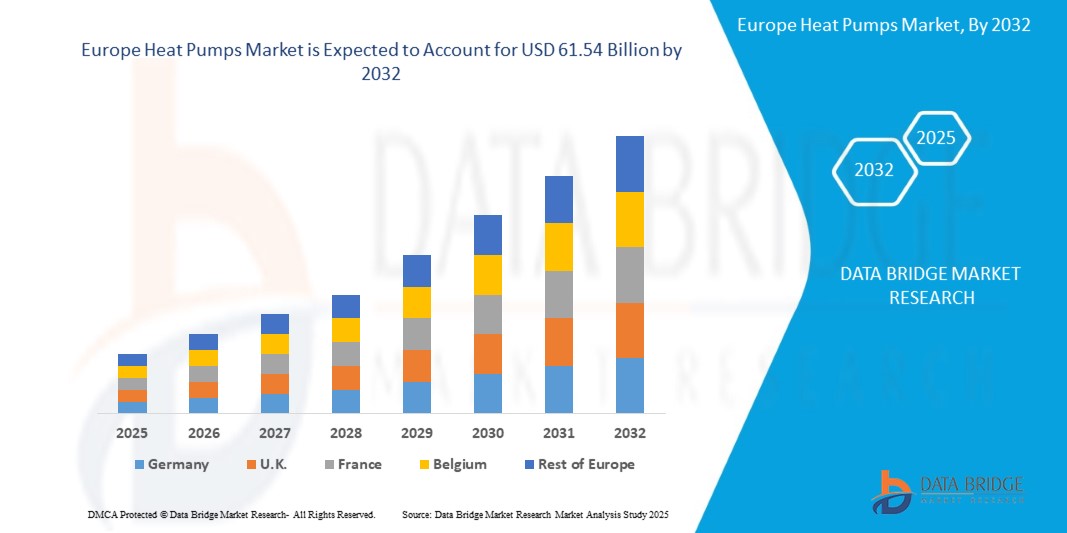

- The Europe Heat Pumps market size was valued at USD 34.25 billion in 2024 and is expected to reach USD 61.54 billion by 2032, at a CAGR of 7.6% during the forecast period

- This robust growth is primarily fueled by stringent environmental regulations, increasing demand for sustainable heating and cooling solutions, and significant government incentives promoting energy efficiency across residential, commercial, and industrial sectors. The rising adoption of renewable energy systems, coupled with advancements in heat pump technologies, is further accelerating market expansion.

- Europe’s commitment to achieving net-zero emissions by 2050, supported by substantial investments in green building initiatives, strong HVAC manufacturing ecosystems, and growing consumer awareness of decarbonization, is a key driver of the market’s upward trajectory. Additionally, the integration of heat pumps in smart homes, district heating networks, and industrial applications is driving significant demand for innovative and efficient heat pump solutions throughout the region.

Heat Pumps Market Analysis

- Heat pumps are energy-efficient systems that transfer heat to provide heating, cooling, and hot water, serving as a sustainable alternative to fossil fuel-based HVAC systems. These systems, including air-to-air, air-to-water, water-source, ground-source, and hybrid heat pumps, are critical for applications in residential buildings, commercial complexes, industrial facilities, and hospitality sectors across Europe.

- The market is significantly propelled by Europe’s leadership in energy efficiency, with buildings accounting for 40% of the region’s energy consumption in 2023, driving demand for heat pumps to reduce carbon footprints and energy costs. The rapid adoption of smart home technologies, with over 100 million smart homes projected in Europe by 2027, boosts demand for IoT-integrated heat pumps.

- Technological advancements, such as inverter-driven compressors, low-global warming potential (GWP) refrigerants, and hybrid heat pump designs, are enhancing system efficiency, performance, and environmental sustainability, supporting applications in cold climates and high-demand industrial settings. Government initiatives, such as the EU’s REPowerEU plan, Germany’s Energiewende, and the UK’s Net Zero Strategy, are fostering innovation and adoption through subsidies, tax incentives, and regulatory frameworks.

- Germany dominates the market with a commanding 32.8% revenue share in 2024, valued at USD 11.23 billion, driven by its robust green building sector, government support, and the presence of key players like Bosch and Vaillant. The Netherlands is expected to witness the fastest growth rate, with a projected CAGR of 8.2% from 2025 to 2032, propelled by aggressive decarbonization policies and widespread adoption in residential and commercial sectors.

- Among product types, the air-to-water heat pumps segment held the largest market share of 42.6% in 2024, valued at USD 14.59 billion, attributed to their versatility, high efficiency, and widespread use in residential heating and hot water applications.

Report Scope and Heat Pumps Market Segmentation

|

Attributes |

Heat Pumps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Germany

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Heat Pumps Market Trends

“Low-GWP Refrigerants, Smart Heat Pumps, Hybrid Systems, and Cold-Climate Solutions”

- The adoption of low-Europe warming potential (GWP) refrigerants, such as R32 and R454B, is a prominent trend, with over 30% of new heat pump deployments in 2024 using eco-friendly refrigerants, aligning with Europe environmental regulations like the EU F-Gas Regulation.

- The rise of smart heat pumps integrated with IoT and automation systems, with 25% of new installations in 2024 featuring remote control and energy monitoring, is gaining traction in residential and commercial buildings for optimized energy use.

- Increasing focus on hybrid heat pump systems, with 15% of new deployments in 2024 combining heat pumps with gas boilers, offering flexibility and cost savings in regions with fluctuating energy prices.

- The adoption of cold-climate heat pumps is growing rapidly, with a 20% increase in demand in 2024, driven by advancements in inverter technology and enhanced performance in sub-zero temperatures, particularly in Europe and North America.

- Integration of heat pumps with renewable energy sources, such as solar panels and geothermal systems, is expanding, with 18% of new installations in 2024 designed for hybrid renewable energy applications in residential and industrial settings.

- Growing consumer demand for energy-efficient and sustainable heating solutions, driven by rising energy costs and environmental awareness, is fueling innovation in heat pump designs and applications worldwide.

Heat Pumps Market Dynamics

Driver

“Energy Efficiency Demand, Decarbonization Goals, Urbanization, Government Incentives, and Technological Advancements”

- The growing demand for energy-efficient heating and cooling solutions, with buildings consuming 40% of Europe energy in 2023, drives significant adoption of heat pumps to reduce energy costs and carbon emissions in residential and commercial sectors.

- The Europe push for decarbonization, with over 70 countries committing to net-zero emissions by 2050, fuels the need for heat pumps as a sustainable alternative to fossil fuel-based heating systems.

- Rapid urbanization and construction activities, with Europe construction output projected to reach USD 15 trillion by 2030, increase demand for heat pumps in new residential, commercial, and industrial buildings.

- Government incentives, such as the EU’s REPowerEU plan, the U.S. Inflation Reduction Act, and China’s carbon neutrality policies, provide substantial subsidies, tax credits, and regulatory support for heat pump adoption, fostering market growth.

- Advancements in heat pump technologies, such as inverter-driven compressors, low-GWP refrigerants, and smart controls, enhance efficiency, reliability, and performance, enabling applications in diverse climates and high-demand settings.

- The rising demand for smart home and building automation, with 65% of new residential buildings in 2023 incorporating smart HVAC systems, drives the integration of heat pumps with IoT and energy management platforms.

Restraint/Challenge

“High Installation Costs, Skilled Labor Shortages, Energy Price Volatility, Regulatory Compliance, and Consumer Awareness”

- The high upfront cost of heat pump installation, particularly for ground-source and hybrid systems, poses a challenge to adoption among cost-sensitive consumers and small businesses, limiting market scalability.

- Shortages of skilled labor for heat pump installation and maintenance, with a projected deficit of 300,000 HVAC technicians Asia-Pacificly by 2026, pose challenges to implementation and service quality in key markets.

- Volatility in energy prices, particularly in regions dependent on electricity for heat pumps, increases operational costs for end-users, impacting adoption rates in price-sensitive markets.

- Stringent regulatory requirements, such as the EU F-Gas Regulation and U.S. EPA refrigerant standards, increase compliance costs and complexity for manufacturers, particularly in transitioning to low-GWP refrigerants.

- Rapid technological obsolescence, driven by continuous advancements in heat pump efficiency and refrigerants, pressures manufacturers to invest heavily in R&D, reducing profitability for smaller players.

- Limited consumer awareness about heat pump benefits, particularly in developing regions, creates challenges for market penetration and adoption, requiring extensive education and marketing efforts.

Heat Pumps Market Scope

The Europe Heat Pump Market is segmented based on product type, technology, application, end-user, distribution channel.

- By Product Type

On the basis of product type, the market is segmented by air-to-air heat pumps, air-to-water heat pumps, water-source heat pumps, ground-source heat pumps, and hybrid heat pumps. The air-to-air heat pumps segment dominated with a 42.6% revenue share in 2024, valued at USD 39.98 billion, driven by their cost-effectiveness and widespread use in residential and small commercial applications.

The ground-source heat pumps segment is expected to grow at the fastest CAGR of 10.8% from 2025 to 2032, fueled by their high efficiency and growing adoption in sustainable buildings.

- By Technology

On the basis of technology, the market is segmented by electric heat pumps and gas-driven heat pumps. The electric heat pumps segment held the largest share of 82.5% in 2024, driven by their energy efficiency and compatibility with renewable energy sources.

The gas-driven heat pumps segment is expected to grow at the fastest CAGR of 9.9% from 2025 to 2032, fueled by demand in regions with access to natural gas.

- By Application

On the basis of application, the market is segmented by residential, commercial, and industrial. The residential segment accounted for the largest revenue share of 55.6% in 2024, driven by demand for heating and cooling in households.

The industrial segment is expected to grow at the fastest CAGR of 10.3% from 2025 to 2032, fueled by adoption in manufacturing and process heating.

- By End-User

On the basis of end-user, the market is segmented by households, commercial buildings, manufacturing facilities, hospitality, and others. The households segment dominated with a 50.8% revenue share in 2024, driven by residential heating and cooling demand.

The commercial buildings segment is expected to grow at the fastest CAGR of 10.1% from 2025 to 2032, fueled by green building initiatives.

- By Distribution Channel

On the basis of distribution channel, the market is segmented by direct sales, distributors, and online retail. The distributors segment held the largest share of 60.3% in 2024, driven by established HVAC supply chains.

The online retail segment is expected to grow at the fastest CAGR of 11.0% from 2025 to 2032, fueled by e-commerce growth.

Heat Pumps Market Regional Analysis

Europe Heat Pump Market Insight

Europe led the market with a commanding 38.7% revenue share in 2024, valued at USD 34.25 billion, driven by stringent energy efficiency regulations, widespread adoption in residential and commercial buildings, and strong government support. The region’s focus on decarbonization, led by the EU’s REPowerEU plan, solidifies its dominance in the global heat pump market.

Germany Heat Pump Market Insight

Germany held the largest individual country share within Europe in 2024, driven by its leadership in energy-efficient building technologies and significant government subsidies for heat pump installations. The country’s Energiewende initiative and demand for heat pumps in residential and industrial applications fuel market growth.

France Heat Pump Market Insight

France accounted for a significant portion of the European market in 2024, supported by its focus on renewable energy and green building standards. Government incentives like MaPrimeRénov’ and demand for air-to-water heat pumps in residential sectors drive market expansion.

Heat Pumps Market Share

- The Heat Pumps industry is primarily led by well-established companies, including:

- Daikin Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Carrier Europe Corporation (United States)

- Trane Technologies plc (Ireland)

- LG Electronics Inc. (South Korea)

- Panasonic Corporation (Japan)

- NIBE Industrier AB (Sweden)

- Bosch Thermotechnology (Germany)

- Vaillant Group (Germany)

- Danfoss A/S (Denmark)

- Lennox International Inc. (United States)

- Fujitsu General Limited (Japan)

- Stiebel Eltron GmbH & Co. KG (Germany)

- Gree Electric Appliances, Inc. (China)

- Midea Group Co., Ltd. (China)

- Hitachi, Ltd. (Japan)

Latest Developments in Europe Heat Pumps Market

- In November 2023, Daikin Industries introduced the Altherma 4 air-to-water heat pump, engineered to deliver high energy efficiency with an eco-friendly R32 refrigerant. The unit offers a 20% improvement in operational efficiency compared to previous models and has been adopted in over 100 residential projects across Europe. This launch reinforces Daikin’s commitment to sustainable home heating solutions.

- In January 2024, Mitsubishi Electric rolled out the Ecodan Smart heat pump, featuring integrated IoT-enabled controls for real-time monitoring and energy optimization. This innovation reduces energy consumption by 15%, providing an efficient solution for modern smart homes. The product has quickly gained market traction in Japan and North America, particularly among energy-conscious consumers.

- In March 2024, Carrier Europe Corporation announced a strategic partnership with Bosch to co-develop hybrid heat pumps for commercial applications. Designed for flexibility and reduced environmental impact, the new systems cut emissions by up to 25%. Deployed in both the U.S. and Germany, the partnership aims to address growing demand for sustainable HVAC solutions in commercial real estate.

- In June 2024, NIBE Industrier launched a next-generation ground-source heat pump equipped with inverter technology, specifically designed for high efficiency in colder climates. The unit improves heating performance by 18% and has already been adopted in residential and institutional projects across Sweden and Canada, solidifying NIBE’s position in the geothermal heating segment.

- In August 2024, LG Electronics introduced a new air-to-air heat pump featuring a low Europe Warming Potential (GWP) refrigerant, fully certified for EU F-Gas compliance. This environmentally friendly solution is optimized for residential use and is gaining popularity in eco-conscious markets such as France and the UK, supporting the transition to greener home energy systems.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEAT PUMP MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE HEAT PUMP MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE HEAT PUMP MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 PRICING ANALYSIS

5.8 COMPANY COMPARITIVE ANALYSIS

6 EUROPE HEAT PUMP MARKET, BY TYPE

6.1 OVERVIEW

6.2 WATER SOURCE HEAT PUMP

6.3 AIR-TO-AIR HEAT PUMP

6.4 AIR-TO-WATER HEAT PUMP

6.5 GROUND SOURCE HEAT PUMP

6.6 HYBRID HEAT PUMP

7 EUROPE HEAT PUMP MARKET, BY COMPONENTS

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 HEAT EXCHANGERS

7.2.2 COMPRESSOR

7.2.3 RECIEVER

7.2.4 REVERSING VALVE

7.2.5 SENSORS

7.2.6 OTHERS

7.3 SERVICES

7.3.1 INSTALLATION

7.3.1.1. NEW

7.3.1.2. RETROFIT

7.3.2 MAINTENANCE & SUPPORT

8 EUROPE HEAT PUMP MARKET, BY CAPACITY

8.1 OVERVIEW

8.2 UPTO 10 KW

8.3 10 TO 20 KW

8.4 20 TO 30 KW

8.5 ABOVE 30 KW

9 EUROPE HEAT PUMP MARKET, BY POWER SOURCE

9.1 OVERVIEW

9.2 ELECTRIC

9.3 GAS DRIVEN

10 EUROPE HEAT PUMP MARKET, BY REFRIGERANT TYPE

10.1 OVERVIEW

10.2 R410A

10.3 R744

10.4 R407C

10.5 R134A

10.6 R600 AND R600A

10.7 R717 (AMMONIA)

10.8 OTHERS

11 EUROPE HEAT PUMP MARKET, BY CYCLE TYPE

11.1 OVERVIEW

11.2 VAPOR COMPRESSION

11.3 TRANSCRITICAL

11.4 ABSORPTION

12 EUROPE HEAT PUMP MARKET, BY SYSTEM TYPE

12.1 OVERVIEW

12.2 AIR SOURCE HEAT PUMPS

12.2.1 BY CATEGORY

12.2.1.1. PORTABLE WINDOW

12.2.1.2. DUCTLESS MINISPLIT

12.2.1.3. DUCTED SPLIT AND PACKAGED TYPE

12.3 GEOTHERMAL HEAT PUMPS

12.3.1 BY LOOP

12.3.1.1. VERTICAL

12.3.1.2. HORIZONTAL

13 EUROPE HEAT PUMP MARKET, BY END USER

13.1 OVERVIEW

13.2 RESIDENTIAL

13.2.1 RESIDENTIAL, BY TYPE

13.2.1.1. SINGLE HOME

13.2.1.2. MULTI HOME

13.2.2 BY TYPE

13.2.2.1. WATER SOURCE HEAT PUMP

13.2.2.2. AIR-TO-AIR HEAT PUMP

13.2.2.3. AIR-TO-WATER HEAT PUMP

13.2.2.4. GROUND SOURCE HEAT PUMP

13.2.2.5. HYBRID HEAT PUMP

13.3 COMMERCIAL

13.3.1 COMMERCIAL, BY TYPE

13.3.1.1. HEALTHCARE

13.3.1.2. RETAIL

13.3.1.3. OFFICES

13.3.1.4. HOSPITALITY

13.3.1.5. LOGISTICS & TRANSPORTATION

13.3.1.6. EDUCATION

13.3.1.7. OTHERS

13.3.2 BY TYPE

13.3.2.1. WATER SOURCE HEAT PUMP

13.3.2.2. AIR-TO-AIR HEAT PUMP

13.3.2.3. AIR-TO-WATER HEAT PUMP

13.3.2.4. GROUND SOURCE HEAT PUMP

13.3.2.5. HYBRID HEAT PUMP

13.4 INDUSTRIAL

13.4.1 INDUSTRIAL, BY TYPE

13.4.1.1. CHEMICAL AND PETROLEUM

13.4.1.2. FOOD AND BEVERAGES

13.4.1.2.1. ALCOHOL

13.4.1.2.2. CORN MILING

13.4.1.2.3. DAIRY PRODUCTS

13.4.1.2.4. SOFT DRINK

13.4.1.2.5. JUICES

13.4.1.2.6. GENERAL FOOD PRODUCTS

13.4.1.3. WOOD PRODUCTS

13.4.1.3.1. PULP &

13.4.1.4. METAL

13.4.1.5. TEXTILE AND LEATHER

13.4.1.6. GENERAL MANUFACTURING

13.4.1.7. UTILITIES

13.4.1.8. OTHERS

13.4.2 BY TYPE

13.4.2.1. WATER SOURCE HEAT PUMP

13.4.2.2. AIR-TO-AIR HEAT PUMP

13.4.2.3. AIR-TO-WATER HEAT PUMP

13.4.2.4. GROUND SOURCE HEAT PUMP

13.4.2.5. HYBRID HEAT PUMP

14 EUROPE HEAT PUMP MARKET, BY REGION

EUROPE HEAT PUMP MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 ITALY

14.1.4 FRANCE

14.1.5 SPAIN

14.1.6 RUSSIA

14.1.7 SWITZERLAND

14.1.8 TURKEY

14.1.9 BELGIUM

14.1.10 NETHERLANDS

14.1.11 DENMARK

14.1.12 SWEDEN

14.1.13 POLAND

14.1.14 NORWAY

14.1.15 FINLAND

14.1.16 REST OF EUROPE

14.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 EUROPE HEAT PUMP MARKET,COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.4 EXPANSIONS

15.5 REGULATORY CHANGES

15.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 EUROPE HEAT PUMP MARKET, SWOT & DBMR ANALYSIS

17 EUROPE HEAT PUMP MARKET, COMPANY PROFILE

17.1 TRANE TECHNOLOGIES PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 JOHNSON CONTROLS

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CARRIER

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 MIDEA GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LENNOX INTERNATIONAL INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 DAIKIN INDUSTRIES, LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENT

17.7 DANFOSS INDUSTRIES PVT. LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENT

17.8 MITSUBISHI ELECTRIC CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENT

17.9 NIBE INDUSTRIER AB

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENT

17.1 ROBERT BOSCH GMBH

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENT

17.11 THERMAX LIMITED

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENT

17.12 VIVRECO GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENT

17.13 KENSA HEAT PUMPS

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENT

17.14 SAMSUNG

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENT

17.15 GLEN DIMPLEX UK LIMITED

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENT

17.16 PANASONIC CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENT

17.17 VAILLANT GROUP

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENT

17.18 WOLF

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENT

17.19 SMARTHEAT DEUTSCHLAND GMBH

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENT

17.2 WATERKOTTE

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Heat Pump Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Heat Pump Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Heat Pump Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.