Europe Hematology Analyzers Reagents Market

Market Size in USD Billion

CAGR :

%

USD

5.98 Billion

USD

9.39 Billion

2024

2032

USD

5.98 Billion

USD

9.39 Billion

2024

2032

| 2025 –2032 | |

| USD 5.98 Billion | |

| USD 9.39 Billion | |

|

|

|

|

Haematology Analysers and Reagents Market Size

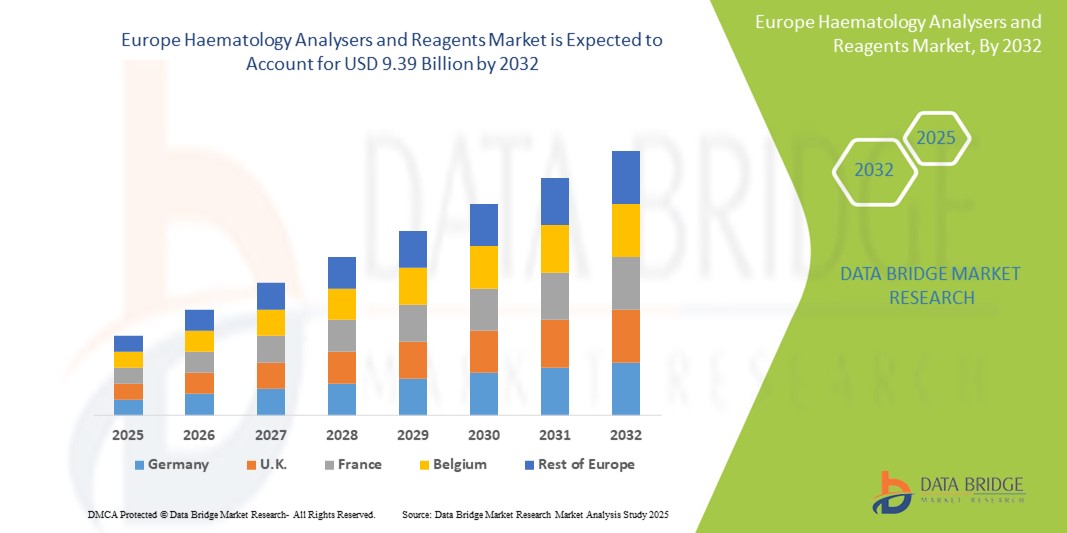

- The Europe Haematology Analysers and Reagents market size was valued at USD 5.98 billion in 2024 and is expected to reach USD 9.39 billion by 2032, at a CAGR of 5.8% during the forecast period

- he Europe Hematology Analyzers and Reagents market encompasses a broad range of automated instruments and specialized reagents used to analyze blood components, including red and white blood cells, platelets, hemoglobin, and hematocrit levels. These tools are vital for diagnosing conditions such as anemia, infections, clotting disorders, leukemia, and other hematologic abnormalities.

- Key types of analyzers include 3-part and 5-part differential cell counters, automated reticulocyte analyzers, and integrated slide preparation systems, equipped with features such as touchscreen interfaces, autoloaders, and LIS connectivity. These devices are deployed across hospitals, clinical laboratories, research institutes, and point-of-care settings throughout Europe.

- The adoption of high-throughput hematology platforms capable of delivering rapid, accurate, and multi-parameter results has risen sharply. Additionally, demand for reliable and compatible reagents is growing in line with routine testing volumes and the shift toward personalized and preventive diagnostics. Enhanced automation, compact system designs, and reagent standardization are further driving operational efficiency across healthcare facilities.

Haematology Analysers and Reagents Market Analysis

- The Europe Hematology Analyzers and Reagents market is primarily driven by the increasing prevalence of blood-related disorders such as anemia, leukemia, and infections, alongside the rising demand for complete blood count (CBC) tests in routine diagnostics. The growing emphasis on preventive healthcare, along with expanding diagnostic laboratory networks, supports the continued adoption of automated hematology systems.

- Technological advancements—including 5-part and 6-part differential analyzers, integrated slide makers/stainers, and AI-powered image analysis tools—are revolutionizing hematology workflows. Innovations in microfluidics, reagent optimization, and smart data connectivity are enabling higher throughput, greater precision, and faster turnaround in diagnostic settings.

- Germany leads the Haematology Analysers and Reagents market in Europe, capturing the largest revenue share of 26.4% in 2025, driven by its comprehensive public healthcare coverage, robust infrastructure of diagnostic labs, and high testing volumes in oncology and chronic care settings. The country's early adoption of automated hematology platforms and investments in digital pathology and lab automation further fuel growth.

- Germany is also projected to be the fastest-growing country in the region’s diagnostic imaging market during the forecast period. supported by government-backed modernization of diagnostic laboratories, a growing elderly population, and enhanced focus on personalized hematologic diagnostics. Collaborations between healthcare institutions and manufacturers are driving innovation and accessibility.

- Haematology Products and Services is anticipated to be the largest imaging modality segment in the Europe Haematology Analysers and Reagents Market, holding a significant market share of 39.7% in 2025 due to their cost-effectiveness, ease of use in mid-sized laboratories, and flexibility in both resource-rich and resource-limited settings. These analyzers provide a balance between automation and manual oversight, making them suitable for laboratories transitioning towards fully automated hematology testing workflows.

Report Scope and Haematology Analysers and Reagents Market Segmentation

|

Attributes |

Haematology Analysers and Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Haematology Analysers and Reagents Market Trends

“Automation, Digitalization, and Personalized Hematology”

- A key trend in the Europe Hematology Analyzers and Reagents market is the increasing deployment of fully automated, multi-parameter hematology analyzers with enhanced throughput and minimal sample handling. These systems reduce turnaround time and human error, making them ideal for high-volume diagnostic laboratories.

- For instance, Sysmex’s XN-Series analyzers offer automated slide preparation, reticulocyte counting, and differential white blood cell analysis, optimizing operational efficiency and diagnostic accuracy.

- Integration of AI-powered image analysis and machine learning algorithms in hematology platforms enables precise cell classification and supports early detection of hematological malignancies and infections. These tools are reshaping diagnostic precision and supporting clinical decision-making.

- There is rising demand for compact, user-friendly hematology devices in outpatient and primary care settings, as well as mobile healthcare units. These analyzers support rapid, on-site complete blood count (CBC) testing, improving diagnostic access in rural and decentralized environments.

- Enhanced connectivity with LIS and EMRs is becoming standard, allowing seamless transfer of hematology data, remote result review, and integration into digital patient records, ultimately strengthening patient management workflows.

- Increasing prevalence of blood-related disorders—such as anemia, leukemia, and thrombocytopenia—combined with the aging population and expanded routine screening programs across Europe, is driving demand for both hematology analyzers and specialized reagents used in disease monitoring and prevention.

Haematology Analysers and Reagents Market Dynamics

Driver

“Rising Incidence of Hematological Disorders and Demand for Accurate Blood Diagnostics”

- The increasing prevalence of hematological conditions such as anemia, leukemia, lymphoma, and clotting disorders is a major factor propelling demand for advanced hematology analyzers and reagents across Europe. These diseases require continuous monitoring through complete blood count (CBC) and differential tests.

- For instance, rising cases of iron-deficiency anemia and blood cancers in aging populations are boosting test volumes in hospitals and specialty clinics

- The growing geriatric population, particularly in countries like Germany, Italy, and France, has amplified the need for routine hematologic screening due to age-associated comorbidities and weakened immune responses.

- Healthcare systems are increasingly emphasizing early disease detection and treatment planning, leading to higher utilization of automated hematology platforms that provide rapid, reproducible, and comprehensive results from minimal blood samples.

- Advancements in analyzer technologies, including multi-parameter analysis, integrated slide preparation, and flagging of abnormal cells, are enhancing diagnostic precision, especially in oncology, hematopathology, and infectious disease management.

- Expansion of decentralized care models and point-of-care testing in rural clinics, ambulatory centers, and home care settings is driving the demand for portable hematology analyzers and pre-packaged reagent kits optimized for remote diagnostics.

- Government initiatives promoting early screening and routine health checks, along with increased reimbursement for diagnostic testing, are further reinforcing market growth across Europe.

Restraint/Challenge

“High Equipment Costs, Regulatory Complexities, and Operational Constraints”

- The high capital investment required for advanced hematology analyzers—particularly multi-parameter flow cytometry systems and integrated slide staining modules—poses a significant barrier to adoption, especially in smaller diagnostic labs and primary healthcare settings across Europe.

- For instance, 5-part differential analyzers with advanced flagging algorithms can be cost-prohibitive for rural and independent laboratories.

- Complex regulatory requirements under the European Union Medical Device Regulation (EU MDR) and In Vitro Diagnostic Regulation (IVDR) extend product development cycles and add to certification and compliance costs, slowing down innovation and market entry.

- There is a growing shortage of trained laboratory personnel skilled in operating next-generation hematology systems and interpreting complex results, particularly in underserved regions, limiting the clinical adoption of these technologies.

- Variability in test results due to differences in analyzer calibration, reagent formulations, or sample handling procedures can lead to diagnostic discrepancies, reducing trust among clinicians and impeding widespread use.

- As hematology devices increasingly integrate with hospital networks, cybersecurity and data protection challenges under GDPR become more pronounced. Concerns over data breaches and compliance issues can delay the deployment of digital and cloud-based hematology solutions

Haematology Analysers and Reagents Market Scope

The market is segmented on the basis product and services, price range and end users.

- By Product and services

On the basis of Product type, the Haematology Analysers and Reagents Market is into Hematology Products and Services, Hemostasis Products and Services, and Immunohematology Products and Services. The Hematology Products and Services segment is expected to dominate the market with the largest revenue share of 29.7% 2025, owing to the widespread use of automated hematology analyzers in complete blood count (CBC), differential counts, and red blood cell morphology assessments. The demand is further fueled by the increasing incidence of anemia, infections, and hematologic malignancies.

The Immunohematology Products and Services segment is anticipated to grow at the fastest rate during the forecast period (2025–2032), driven by a rise in blood transfusion procedures, advancements in blood typing and cross-matching technologies, and the growing need for immunoassay-based diagnostics in complex hematological disorders.

- By Price range

On the basis of Portability, the Haematology Analysers and Reagents market is segmented into High-End Analyzers, Mid-Range Analyzers, and Low-End Analyzers. High-End Analyzers dominate the segment supported by their advanced features such as multi-parameter detection, real-time result interpretation, and LIS integration. These systems are widely adopted by large hospital laboratories and reference centers handling high testing volumes.

Mid-Range Analyzers are expected to grow at a fastest growth rate, due to their balance of affordability and functionality. These analyzers are increasingly adopted by mid-sized diagnostic labs and community hospitals across Europe, especially in countries modernizing their diagnostic infrastructure.

- By End users

On the basis of end users, the Haematology Analysers and Reagents market is segmented into Hospital Laboratories, Commercial Service Providers, Government Reference Laboratories, and Research and Academic Institutes. Hospital Laboratories are expected to dominate with the largest revenue share in 2025, due to the growing need for rapid and accurate hematological diagnostics in both inpatient and emergency settings. These institutions prioritize automated analyzers for routine CBCs, coagulation studies, and patient monitoring.

The Commercial Service Providers segment is projected to witness the fastest growth during the forecast period driven by increasing outsourcing of diagnostic services, rapid turnaround time, and cost efficiency. Rising demand from private clinics and insurance-backed diagnostics further supports this trend.

Haematology Analysers and Reagents Market Regional Analysis

- Germany dominates the Europe Haematology Analysers and Reagents Market, accounting for the largest revenue share of 26.4% in 2025, This dominance is driven by the country’s robust healthcare infrastructure, widespread adoption of automated hematology analyzers, and strong presence of key diagnostic equipment manufacturers. Major clinical laboratories and hospital networks in cities like Berlin, Frankfurt, and Munich are at the forefront of integrating high-throughput hematology analyzers with laboratory information systems (LIS) and digital health platforms, optimizing workflow efficiency and diagnostic accuracy.

- Significant government investments in laboratory modernization, coupled with initiatives to enhance early detection and management of hematologic disorders such as anemia, leukemia, and coagulation abnormalities, support sustained market growth. Collaborative research and innovation between manufacturers, academic institutions, and healthcare providers foster the development of multiplex hematology assays and advanced reagent formulations, fueling technological advancements in the region.

France Haematology Analysers and Reagents Market Insight

The France Hematology Analyzers and Reagents market is projected to experience steady growth throughout the forecast period, driven by national healthcare programs aimed at expanding diagnostic automation and capacity in hospitals and private laboratories. Leading healthcare facilities in Paris, Lyon, and Marseille are adopting next-generation hematology analyzers featuring multi-parameter testing, automated sample handling, and enhanced reagent systems. Government reimbursement policies and healthcare reforms provide strong support for broader deployment of hematology testing, including complete blood count (CBC), coagulation profiles, and immunohematology assays. An increasing focus on early diagnosis of blood disorders and management of chronic hematologic conditions is propelling demand for sophisticated analyzers and reagents. Moreover, the expansion of outpatient diagnostic centers is fostering the use of compact, user-friendly hematology analyzers that offer rapid results and support decentralized patient care.

U.K. Haematology Analysers and Reagents Market Insight

The U.K. hematology analyzers and reagents market is set for robust growth, supported by increased NHS investment in laboratory infrastructure upgrades and the rising prevalence of blood disorders, anemia, and clotting abnormalities. Despite regulatory adjustments post-Brexit, the U.K. maintains stringent quality standards for diagnostic devices, facilitating the continuous introduction of innovative hematology analyzers with automated features such as reagent management, sample tracking, and integration with hospital automation systems. Key medical hubs including London, Manchester, and Edinburgh are leading adoption of advanced hematology platforms that enable rapid, accurate diagnostics to support personalized treatment strategies. The growing emphasis on point-of-care hematology testing in emergency rooms and outpatient settings is driving market expansion by enabling faster clinical decision-making and improving patient outcomes.

Haematology Analysers and Reagents Market Share

The Haematology Analysers and Reagents industry is primarily led by well-established companies, including:

- Sysmex Corporation (Japan)

- Beckman Coulter, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- HORIBA Ltd. (Japan)

- Abbott Laboratories (U.S.)

- Boule Diagnostics AB (Sweden)

- Mindray Medical International Limited (China)

- Nihon Kohden Corporation (Japan)

- Drew Scientific (U.S.)

- Diatron MI Zrt. (Hungary)

Latest Developments in Europe Haematology Analysers and Reagents Market

- In March 2025, Siemens Healthineers unveiled the ADVIA 2120i Hematology System across major European markets, featuring enhanced automation, improved accuracy, and faster processing times for complete blood counts (CBC) and differential analysis, catering to the rising demand for efficient hematology testing solutions.

- In November 2024, Beckman Coulter launched the UniCel DxH 900 Hematology Analyzer in Europe, integrating advanced reagent management and real-time data connectivity to streamline laboratory workflows and improve result reliability in clinical and reference laboratories.

- In August 2024, Sysmex Europe expanded its XN-Series portfolio by introducing new assays for coagulation and immunohematology testing, highlighting the growing focus on multiparametric testing and comprehensive blood disorder diagnostics on a unified platform.

- In January 2024, Abbott Laboratories enhanced its CELL-DYN Sapphire Hematology Analyzer with cloud-based analytics and remote service capabilities, facilitating predictive maintenance and reducing instrument downtime in European healthcare facilities.

- In May 2023, Horiba Medical introduced new reagent kits optimized for its Yumizen H2500 hematology analyzer, supporting expanded testing panels for anemia and platelet function, addressing the increasing need for chronic disease monitoring and personalized patient management across Europe.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.