Europe Hepatitis B Infection Market

Market Size in USD Billion

CAGR :

%

USD

3.27 Billion

USD

4.73 Billion

2024

2032

USD

3.27 Billion

USD

4.73 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 4.73 Billion | |

|

|

|

|

Europe Hepatitis B Infection Market Size

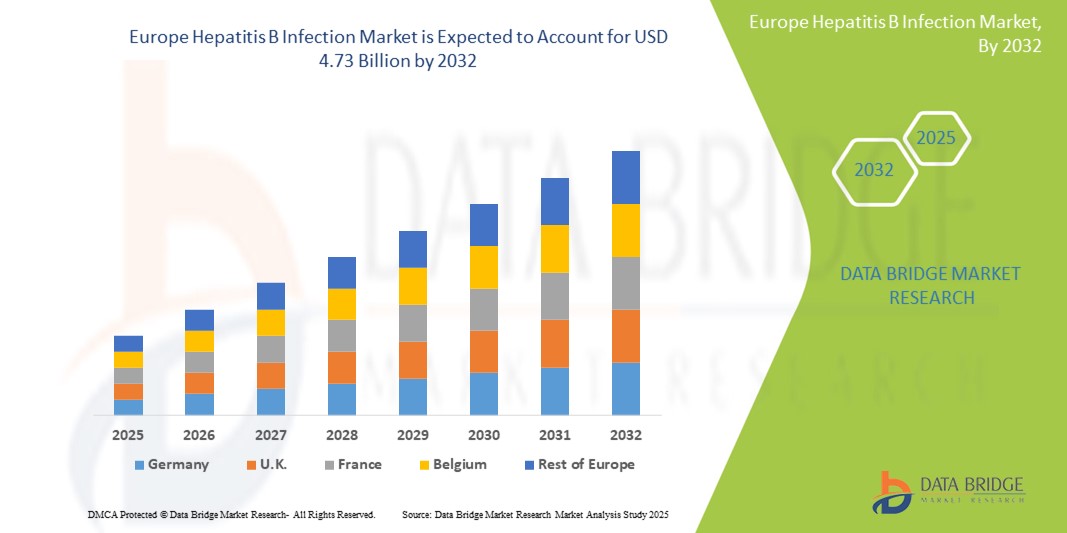

- The Europe hepatitis B infection market size was valued at USD 3.27 billion in 2024 and is expected to reach USD 4.73 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced diagnostic technologies and therapeutic innovations for Hepatitis B, coupled with increasing digitalization and integration of electronic health systems across Europe

- Furthermore, rising consumer and public health demand for accurate, accessible, and preventive solutions is establishing Hepatitis B management protocols as a central focus of healthcare policy. These converging factors are accelerating the adoption of vaccination, screening, and antiviral therapies, thereby significantly boosting the Hepatitis B Infection market growth across the region

Europe Hepatitis B Infection Market Analysis

- Hepatitis B treatments and diagnostics are increasingly vital components of Europe’s public health infrastructure, especially in both hospital and outpatient settings, due to rising infection awareness, improved testing accessibility, and advancements in antiviral therapies

- The escalating demand for effective Hepatitis B management is primarily fueled by government vaccination programs, an increase in HBV-HDV co-infection screening, and the growing burden of chronic liver diseases among aging populations

- Germany dominated the Europe hepatitis B infection market with the largest revenue share of 34.7% in 2024, characterized by strong public health policies, early adoption of advanced diagnostic tools, and high HBV testing rates. The country has also seen significant growth in treatment uptake, particularly among high-risk groups and immigrants, driven by awareness campaigns and improved reimbursement frameworks

- U.K. is expected to be the fastest growing region in the Europe Hepatitis B Infection market, driven by the integration of HBV testing into primary care settings and strong national immunization strategies. The NHS’s emphasis on adult and childhood immunization programs remains a key contributor to market expansion

- The chronic segment dominated the Europe Hepatitis B Infection market with a market share of 62.4% in 2024, driven by its persistent nature, the need for long-term monitoring and therapy, and rising detection rates from enhanced screening initiatives

Report Scope and Europe Hepatitis B Infection Market Segmentation

|

Attributes |

Europe Hepatitis B Infection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Hepatitis B Infection Market Trends

“Enhanced Convenience Through Integrated Care and Advanced Treatment Access”

- A significant and accelerating trend in the Europe hepatitis B infection market is the growing integration of multidisciplinary care models and advanced treatment access through centralized healthcare systems. This trend is significantly improving patient outcomes and adherence by enabling seamless communication between general practitioners, hepatologists, and public health institutions

- For instance, several Western European countries have implemented national hepatitis action plans that allow patients to receive early diagnosis, antiviral treatment, and regular follow-up care under one coordinated framework. Germany’s integrated care model, for example, enables efficient linkage from diagnosis to treatment, reducing disease progression rates

- Efforts such as centralized patient registries, digital health record systems, and streamlined referral pathways are optimizing hepatitis B infection management by enabling timely intervention and monitoring. These systems allow healthcare providers to track liver function, treatment response, and co-infections such as hepatitis D in real-time

- The integration of advanced diagnostics with routine primary care services facilitates early detection of both acute and chronic cases. This centralized approach, combined with affordable access to newer antiviral therapies, enhances both individual patient care and broader public health surveillance

- This trend toward more streamlined, coordinated, and technology-supported hepatitis B care is fundamentally reshaping expectations within national healthcare systems. As a result, many European governments are expanding access to viral hepatitis screening, particularly among vulnerable and high-risk populations such as migrants, intravenous drug users, and the elderly

- The demand for accessible, efficient, and integrated hepatitis B treatment models is rapidly growing across both public and private healthcare sectors, as stakeholders increasingly focus on long-term disease control and alignment with the World Health Organization’s 2030 hepatitis elimination goals

Europe Hepatitis B Infection Market Dynamics

Driver

“Growing Need Due to Rising Disease Burden and Preventive Healthcare Adoption”

- The increasing prevalence of hepatitis B infections across Europe, along with heightened awareness about liver diseases, is significantly driving the demand for early diagnosis, vaccination, and treatment solutions

- For instance, in April 2024, GlaxoSmithKline plc (GSK) expanded its European hepatitis B vaccine supply through a strategic partnership with regional healthcare systems, aiming to improve immunization rates across high-risk populations. Such initiatives by key market players are expected to fuel growth in the Europe Hepatitis B Infection market over the forecast period

- As public health authorities and consumers become more aware of the long-term complications associated with chronic hepatitis B—such as cirrhosis and liver cancer—the adoption of preventive strategies such as vaccination and early screening continues to rise

- Furthermore, the integration of hepatitis B testing into routine health check-ups and the growing popularity of point-of-care diagnostic technologies are making hepatitis B management more accessible and efficient across Europe

- The availability of effective vaccines, oral antiviral drugs, and the development of advanced immune modulators are enabling better disease control. Government funding, reimbursement policies, and WHO-led hepatitis elimination goals are also boosting adoption rates in both public and private healthcare settings

Restraint/Challenge

“Concerns Regarding Treatment Accessibility and High Cost of Advanced Therapies”

- Despite medical advancements, limited access to advanced antiviral therapies and immune modulators in certain parts of Europe remains a challenge, particularly in Eastern and Southern Europe where healthcare disparities persist

- For instance, studies published in early 2024 indicated that some EU member states still face shortages in hepatitis B vaccines and limited access to novel treatment regimens due to procurement and reimbursement issues

- Bridging this gap requires policy-level efforts to harmonize hepatitis B care standards across all European nations, particularly through EU-level funding support, price negotiations, and streamlined regulatory approvals

- Moreover, while first-line antiviral drugs are becoming more affordable, newer generation therapies with improved efficacy often come at a higher cost, potentially limiting their uptake among uninsured or low-income populations

- Public mistrust or vaccine hesitancy, especially in post-pandemic Europe, is another barrier that must be addressed through awareness campaigns and healthcare provider engagement

- Overcoming these challenges through expanded insurance coverage, public-private partnerships, and increased investment in regional healthcare infrastructure will be crucial to sustaining long-term growth in the Europe Hepatitis B Infection market

Europe Hepatitis B Infection Market Scope

The market is segmented on the basis of type, and treatment.

• By Type

On the basis of type, the Europe Hepatitis B Infection market is segmented into chronic and acute. The chronic segment dominated the largest market revenue share of 62.4% in 2024, primarily due to the high prevalence of chronic HBV cases and the need for lifelong disease management through antiviral therapies and monitoring.

The acute segment is anticipated to witness the fastest growth rate with a CAGR of 6.4% from 2025 to 2032, fueled by enhanced early screening efforts, public health initiatives, and growing awareness leading to timely diagnosis and treatment.

• By Treatment

On the basis of treatment, the Europe hepatitis B infection market is segmented into vaccine, antiviral drugs, immune modulator drugs, and surgery. The vaccine segment held the largest revenue share of 41.2% in 2024, supported by national vaccination drives, increased birth-dose immunization, and strong uptake among high-risk adult populations.

The antiviral drugs segment is projected to witness the fastest CAGR of 7.1% from 2025 to 2032, driven by the expanding chronic HBV patient pool, advancements in oral therapies, and favorable reimbursement policies.

Europe Hepatitis B Infection Market Regional Analysis

- Europe dominated the hepatitis B infection market with the largest revenue share of 33.27% in 2024, driven by strong public health infrastructure, high vaccination coverage, and increasing awareness about hepatitis B transmission and prevention

- The region is characterized by advanced diagnostic capabilities, well-established immunization programs, and active government-led hepatitis surveillance initiatives

- This widespread adoption of preventive and therapeutic measures is further supported by universal healthcare access, continuous R&D investments, and the growing focus on early screening and disease control, positioning Europe as a key contributor to the global Hepatitis B Infection market

Germany Hepatitis B Infection Market Insight

Germany hepatitis B infection market dominated in Europe with the largest revenue share of 34.7% in 2024, driven by its robust healthcare infrastructure, strong public health programs, and early adoption of hepatitis B vaccination and screening initiatives. The country benefits from an advanced diagnostic network, high awareness among healthcare professionals, and widespread access to antiviral therapies, supporting strong market demand. Germany’s national immunization strategy, combined with consistent funding for hepatitis B research and treatment, continues to enhance disease control outcomes.

France Hepatitis B Infection Market Insight

The France hepatitis B infection market accounted for 14.2% of the regional revenue share in 2024. Growth is supported by government-led hepatitis surveillance programs and high vaccine coverage. Effective antenatal screening and neonatal vaccination are contributing to early prevention. R&D investments in antiviral therapies and rising awareness campaigns are expected to fuel further market expansion.

U.K. Hepatitis B Infection Market Insight

The U.K. hepatitis B infection market held a 13.5% revenue share in the Europe hepatitis B infection market in 2024. The market is projected to grow at a CAGR of 6.8% during the forecast period, driven by integrated HBV testing into primary care and strong national immunization strategies. The NHS’s focus on adult and childhood immunization is a key growth factor.

Netherlands Hepatitis B Infection Market Insight

The Netherlands hepatitis B infection market accounted for 6.8% of the Europe hepatitis B infection market revenue in 2024. The market benefits from comprehensive vaccination campaigns and targeted screening initiatives, particularly for high-risk groups. Government-academic collaborations are enhancing innovation in diagnostics and early treatment strategies.

Europe Hepatitis B Infection Market Share

The Europe hepatitis B infection industry is primarily led by well-established companies, including:

- Gilead Sciences, Inc. (U.S.)

- GSK plc (U.K.)

- Dynavax Technologies (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Novartis AG (Switzerland)

- Arrowhead Pharmaceuticals Inc. (U.S.)

- Arbutus Biopharma (Canada)

- Teva Pharmaceuticals, Inc. (Israel)

- Zydus Pharmaceuticals (India)

- Aurobindo Pharma (India)

- Lupin Pharmaceuticals, Inc. (India)

Latest Developments in Europe Hepatitis B Infection Market

- In September 2024, Gilead Sciences and Genesis Therapeutics announced a strategic collaboration to discover and develop novel small molecule therapies using Genesis’ GEMS AI platform. Gilead gained exclusive rights to develop and commercialize products from this partnership

- In July 2024, Gilead Sciences, Inc. presented research data, showcasing long-term efficacy and safety of Biktarvy in diverse HIV populations, including Hispanic/Latine individuals and older adults with comorbidities. Investigational once-daily and weekly dosing regimens were also highlighted

- In February 2024, GSK completed its acquisition of Aiolos Bio, including the promising AIO-001 monoclonal antibody for severe asthma. GSK paid USD 1000 million upfront and up to USD 400 million in milestone payments, expanding its respiratory biologics portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEPATITIS B INFECTION MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 THERAPEUTICS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

5 EUROPE HEPATITIS B INFECTION MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

5.2 NORTH AMERICA REGULATORY SCENARIO

5.3 EUROPE REGULATORY SCENARIO

5.4 MIDDLE EAST AND AFRICA REGULATORY SCENARIO

5.5 SOUTH AMERICA REGULATORY SCENARIO

6 PIPELINE ANALYSIS

7 EPIDEMILIOGY

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING PREVALENCE OF HEPATITIS B INFECTIONS

8.1.2 TECHNOLOGICAL ADVANCEMENTS IN DIAGNOSTICS

8.1.3 DEVELOPMENT OF COMBINATION THERAPIES FOR HEPATITIS B

8.1.4 STRATEGIC INITIATIVES BY COMPANIES FOR HEPATITIS B INFECTION

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS AND DRUG RESISTANCE

8.2.2 INSUFFICIENT VACCINE COVERAGE FOR HEPATITIS B INFECTION

8.3 OPPORTUNITY

8.3.1 RISING NEW DRUG RELEASES AND INCREASING NEW DRUG PERMITS FOR HEPATITIS B

8.3.2 GOVERNMENT PROGRAMS TO RAISE AWARENESS OF HEPATITIS B INFECTION

8.3.3 ADVANCED RESEARCH AND DEVELOPMENT FOR CLINICAL TRIALS

8.4 CHALLENGES

8.4.1 THE COST OF HEPATITIS B TREATMENTS IS HIGH

8.4.2 STRINGENT REGULATORY POLICIES AND REGIONAL DISPARITIES IN TREATMENT ACCESS

9 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE

9.1 OVERVIEW

9.2 CHRONIC

9.3 ACUTE

10 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT

10.1 OVERVIEW

10.2 VACCINE

10.2.1 HOSPITAL PHARMACIES

10.2.2 DRUGS STORES AND RETAIL PHARMACIES

10.2.3 ONLINE PHARMACIES

10.3 ANTIVIRAL DRUGS

10.3.1 TENOFOVIR ALAFENAMIDE FUMARATE (TAF)

10.3.2 TENOFOVIR DISOPROXIL FUMARATE (TDF)

10.3.3 ENTECAVIR

10.3.4 OTHERS

10.4 IMMUNE MODULATOR DRUGS

10.4.1 PEGYLATED INTERFERON

10.4.2 INTERFERON ALPHA

10.5 SURGERY

11 EUROPE HEPATITIS B INFECTION MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K

11.1.3 TURKEY

11.1.4 RUSSIA

11.1.5 SPAIN

11.1.6 ITALY

11.1.7 SWEDEN

11.1.8 BELGIUM

11.1.9 POLAND

11.1.10 FRANCE

11.1.11 SWITZERLAND

11.1.12 NETHERLANDS

11.1.13 NORWAY

11.1.14 DENMARK

11.1.15 FINLAND

11.1.16 REST OF EUROPE

12 EUROPE HEPATITIS B TREATMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 GILEAD SCIENCES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 GLAXOSMITHKLINE PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 DYNAVAX TECHNOLOGIES CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 F. HOFFMAN-LA ROCHE LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BRISTOL-MYERS SQUIBB COMPANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ARROWHEAD PHARMACEUTICALS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ARBUTUS BIOPHARMA

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATES

14.8 AUROBINDO PHARMA

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATES

14.9 LUPIN PHARMACEUTICALS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 MERCK & CO., INC.,

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 NOVARTIS AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 TEVA PHARMACEUTICAL INDUSTRIES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ZYDUS PHARMACEUTICALS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE

14.13.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 EUROPE CLINICAL TRIAL AND PIPELINE A-LYSIS AS PER THE COMPANY

TABLE 2 DISTRIBUTION OF PRODUCTS OR PROJECTS BY PHASE

TABLE 3 COUNTRY WISE EPIDEMIOLOGY FOR HEPATITIS B

TABLE 4 COST OF HEPATITIS B MEDICATIONS: BRAND VS. GENERIC PRICES

TABLE 5 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 6 EUROPE CHRONIC IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 EUROPE ACUTE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 9 EUROPE VACCINE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 EUROPE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 11 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 13 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 15 EUROPE SURGERY IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 EUROPE HEPATITIS B INFECTION MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 17 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 18 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 19 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 20 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 21 EUROPE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 22 GERMANY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 23 GERMANY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 24 GERMANY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 25 GERMANY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 26 GERMANY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 27 U.K. HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 28 U.K. HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 29 U.K. ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 30 U.K. IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 31 U.K. IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 32 TURKEY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 33 TURKEY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 34 TURKEY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 35 TURKEY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 36 TURKEY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 37 RUSSIA HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 38 RUSSIA HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 39 RUSSIA ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 40 RUSSIA IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 41 RUSSIA VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 42 SPAIN HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 43 SPAIN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 44 SPAIN ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 45 SPAIN IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 46 SPAIN VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 47 ITALY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 48 ITALY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 49 ITALY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 50 ITALY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 51 ITALY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 52 SWEDEN HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 53 SWEDEN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 54 SWEDEN ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 55 SWEDEN IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 56 SWEDEN VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 57 BELGIUM HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 58 BELGIUM HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 59 BELGIUM ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 60 BELGIUM IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 61 BELGIUM VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 62 POLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 63 POLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 64 POLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 65 POLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 66 POLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 67 FRANCE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 68 FRANCE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 69 FRANCE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 70 FRANCE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 71 FRANCE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 72 SWITZERLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 73 SWITZERLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 74 SWITZERLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 75 SWITZERLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 76 SWITZERLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 77 NETHERLANDS HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 78 NETHERLANDS HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 79 NETHERLANDS ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 80 NETHERLANDS IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 81 NETHERLANDS VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 82 NORWAY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 83 NORWAY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 84 NORWAY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 85 NORWAY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 86 NORWAY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 DENMARK HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 88 DENMARK HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 89 DENMARK ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 90 DENMARK IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 91 DENMARK VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 92 FINLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 93 FINLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 94 FINLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 95 FINLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 96 FINLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 97 REST OF EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 EUROPE HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 2 EUROPE HEPATITIS B INFECTION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEPATITIS B INFECTION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEPATITIS B INFECTION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEPATITIS B INFECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEPATITIS B INFECTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE HEPATITIS B INFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE HEPATITIS B INFECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEPATITIS B INFECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE EUROPE HEPATITIS B INFECTION MARKET, BY TYPE

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 EUROPE HEPATITIS B INFECTION MARKET

FIGURE 15 CHRONIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEPATITIS B INFECTION MARKET IN 2024 & 2031

FIGURE 16 DROC ANALYSIS

FIGURE 17 BURDEN OF HBV INFECTION IN THE GENERAL POPULATION BY WHO REGION, 2019

FIGURE 18 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, 2023

FIGURE 19 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, 2024-2031 (USD MILLION)

FIGURE 20 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 21 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, 2023

FIGURE 23 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, 2024-2031 (USD MILLION)

FIGURE 24 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, CAGR (2024-2031)

FIGURE 25 EUROPE HEPATITIS B INFECTION MARKET BY TREATMENT, LIFELINE CURVE

FIGURE 26 EUROPE HEPATITIS B INFECTION MARKET, SNAPSHOT

FIGURE 27 EUROPE HEPATITIS B TREATMENT MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.