Europe Hepatitis Delta Virus Hdv Infection Market

Market Size in USD Million

CAGR :

%

USD

21.62 Million

USD

33.19 Million

2024

2032

USD

21.62 Million

USD

33.19 Million

2024

2032

| 2025 –2032 | |

| USD 21.62 Million | |

| USD 33.19 Million | |

|

|

|

|

Europe Hepatitis Delta Virus (HDV) Infection Market Size

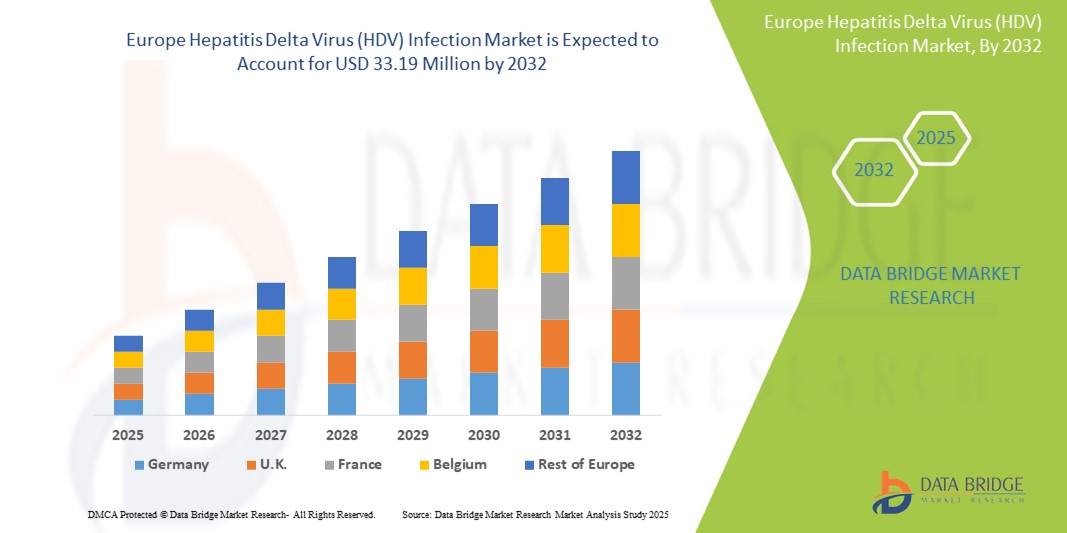

- The Europe hepatitis delta virus (HDV) infection market size was valued at USD 21.62 million in 2024 and is expected to reach USD 33.19 million by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is primarily driven by increasing awareness, improved diagnostics, and enhanced surveillance systems across Europe, leading to earlier detection and more effective management of HDV infections

- In addition, rising investments in antiviral research, government initiatives for hepatitis elimination, and the introduction of novel therapeutics are fostering significant advancements in treatment accessibility and patient outcomes. These combined factors are steadily fueling demand for HDV infection solutions, thereby contributing substantially to the market’s expansion

Europe Hepatitis Delta Virus (HDV) Infection Market Analysis

- Hepatitis Delta Virus (HDV) infection, a severe co-infection with Hepatitis B, poses a significant public health concern due to its aggressive progression to liver cirrhosis and hepatocellular carcinoma, thereby driving increasing demand for early detection, effective therapeutics, and public health intervention strategies across Europe

- The market growth is primarily fueled by rising awareness, improved diagnostic capabilities, and an increasing number of HDV-targeted research initiatives across leading European nations with robust healthcare systems.

- Germany dominated the Europe hepatitis delta virus (HDV) infection market with the largest revenue share of 29.9% in 2024, supported by its comprehensive hepatitis screening programs, government-backed disease elimination plans, and presence of key pharmaceutical players focused on liver diseases

- Italy is expected to be the fastest-growing country in the Europe hepatitis delta virus (HDV) infection market during the forecast period due to its historically higher HDV prevalence, improved patient outreach programs, and increasing healthcare investments in managing chronic liver diseases

- Chronic Hepatitis D segment dominated the Europe hepatitis delta virus (HDV) infection market with a market share of 73% in 2024, driven by its long-term disease burden requiring continuous treatment, monitoring, and higher healthcare resource utilization

Report Scope and Europe Hepatitis Delta Virus (HDV) Infection Market Segmentation

|

Attributes |

Europe Hepatitis Delta Virus (HDV) Infection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Hepatitis Delta Virus (HDV) Infection Market Trends

“Shift Toward Targeted Therapies and Precision Diagnostics”

- A major and evolving trend in the Europe HDV infection market is the transition from conventional interferon-based treatments to targeted antiviral therapies and precision diagnostic approaches, aiming for better disease management and improved patient outcomes

- For instance, the European Medicines Agency (EMA) granted conditional approval for Hepcludex (bulevirtide), the first-in-class entry inhibitor for HDV, marking a significant breakthrough in treatment for chronic HDV patients. Its growing clinical acceptance is reshaping treatment protocols across Europe

- In addition, the adoption of advanced molecular diagnostic tools, including HDV RNA quantification assays and genotyping, is enabling earlier and more accurate diagnosis, essential for initiating timely intervention and improving prognosis

- National health systems in countries such as Germany, Italy, and France are increasingly integrating HDV screening into broader hepatitis B programs, particularly among high-risk populations such as migrants, intravenous drug users, and individuals co-infected with HIV

- This trend toward personalized medicine is being supported by rising research funding, real-world evidence collection, and strategic partnerships between academic institutions and pharmaceutical companies

- As healthcare systems prioritize elimination goals for viral hepatitis, the demand for novel treatment options and sensitive diagnostics is expected to surge, setting the stage for continued innovation and market expansion

Europe Hepatitis Delta Virus (HDV) Infection Market Dynamics

Driver

“Rising Prevalence and National Elimination Strategies for Viral Hepatitis”

- The increasing burden of HDV co-infection, particularly among chronic HBV patients, combined with growing public health focus on hepatitis elimination programs, is a key driver accelerating market growth across Europe

- For instance, Germany’s national hepatitis strategy includes integrated screening for HBV and HDV, alongside subsidized access to innovative antiviral therapies, driving early diagnosis and higher treatment uptake

- WHO’s target to eliminate viral hepatitis by 2030 has prompted several European countries to strengthen surveillance, awareness, and linkage-to-care efforts, creating more opportunities for pharmaceutical and diagnostic companies

- Moreover, the rising availability of reimbursed therapies such as bulevirtide and ongoing clinical trials for combination regimens are encouraging more patients to seek treatment

- This coordinated response across healthcare systems, research organizations, and policymakers is significantly expanding the HDV treatment and diagnostic landscape

Restraint/Challenge

“Low Disease Awareness and Diagnostic Limitations in Key Markets”

- A major challenge hampering the HDV infection market in Europe is insufficient disease awareness among both healthcare providers and at-risk populations, resulting in underdiagnosis and delayed treatment initiation

- Many patients with chronic hepatitis B remain unaware of possible HDV co-infection, as HDV testing is not consistently included in standard HBV management across all countries

- For instance, Eastern and some parts of Southern Europe continue to experience gaps in screening coverage and diagnostic infrastructure, especially in rural areas and among migrant communities

- In addition, the high cost and limited availability of specialized HDV RNA testing in low-resource settings make it difficult to track prevalence accurately and scale up treatment programs

- Overcoming these hurdles will require concerted efforts to improve clinical education, expand national screening protocols, and ensure equitable access to diagnostics and treatment options across diverse healthcare settings

Europe Hepatitis Delta Virus (HDV) Infection Market Scope

The market is segmented on the basis of type, treatment, drug type, route of administration, age group, gender, transmission, end user, and distribution channel.

- By Type

On the basis of type, the Europe hepatitis delta virus (HDV) infection market is segmented into acute hepatitis d and chronic hepatitis d. The Chronic Hepatitis D segment dominated the market with the largest market revenue share of 73% in 2024, driven by its long-term nature requiring sustained clinical care and pharmaceutical intervention. Chronic HDV poses a higher risk of liver cirrhosis and hepatocellular carcinoma, necessitating more aggressive and prolonged treatment strategies.

The Acute Hepatitis D segment is expected to grow at fastest CAGR rate during forecast period, as diagnostic advancements allow for earlier detection and intervention before chronic progression occurs.

- By Treatment

On the basis of treatment, the Europe hepatitis delta virus (HDV) infection market is segmented into surgery (liver transplant) and medication. The Medication segment led the market with a dominant share of 85.7% in 2024, fueled by the increasing use of antiviral drugs such as pegylated interferons and the adoption of newer targeted therapies such as bulevirtide. These non-invasive treatments provide an effective approach for long-term disease management.

The Surgery (Liver Transplant) segment is expected to witness fastest growth during forecast period, as it serves a niche portion of the population with end-stage liver failure, and while critical, is limited by donor availability and procedural complexity.

- By Drug Type

On the basis of drug type, the Europe hepatitis delta virus (HDV) infection market is segmented into branded and generic. The Branded drugs segment accounted for the largest market share of 66.2% in 2024, due to the dominance of novel therapies under patent protection and limited generic competition. These branded drugs are supported by robust clinical data and are often preferred in national healthcare systems.

The Generic segment segment is expected to witness the fastest CAGR from 2025 to 2032, with the expiration of patents on interferon-based therapies and efforts to reduce treatment costs across Europe.

- By Route of Administration

On the basis of route of administration, the Europe hepatitis delta virus (HDV) infection market is segmented into oral and parenteral. The Parenteral segment held the highest market share of 69.4% in 2024, primarily due to the administration of pegylated interferons and bulevirtide via subcutaneous injection. Parenteral delivery is preferred for its efficacy in managing chronic HDV.

The Oral segment, segment is expected to witness the fastest CAGR from 2025 to 2032, as ongoing research develops orally available antiviral agents, enhancing patient compliance and convenience.

- By Age Group

On the basis of age group, the Europe hepatitis delta virus (HDV) infection market is segmented into adults, geriatric, and pediatric. The Adults segment dominated the market with a share of 61.8% in 2024, as HDV infections are more prevalent in middle-aged populations due to long-term HBV co-infection. Adults are also the primary recipients of HDV screening and treatment services.

The Geriatric and Pediatric segments are expected to grow at fastest CAGR rate during the forecast period, with expanded screening and early intervention strategies.

- By Gender

On the basis of gender, the Europe hepatitis delta virus (HDV) infection market is segmented into female and male. The Male segment accounted for a higher market share of 54.6% in 2024, driven by epidemiological trends showing greater HDV prevalence in men due to risk factors such as intravenous drug use and occupational exposures.

The Female segment is expected to grow at fastest CAGR during the forecast period, supported by increasing awareness and improved access to care across healthcare systems.

- By Transmission

On the basis of transmission, the Europe hepatitis delta virus (HDV) infection market is segmented into contaminated needles, exposure to infected blood, blood and plasma product transfusion, and others. Exposure to Infected Blood held the leading market share of 38.1% in 2024, reflecting a broad range of risk situations including healthcare procedures, injuries, and improper sterilization.

Contaminated Needles is expected to witness fastest growth during the forecast period, as it remains a major source of transmission, especially among drug-using populations, while Blood and Plasma Product Transfusion cases have declined with improved screening protocols.

- By End User

On the basis of end user, the Europe hepatitis delta virus (HDV) infection market is segmented into hospitals, specialty clinics, home care setting, research institutes and academic centers, ambulatory surgical centers, and others. The Hospitals segment dominated with the highest market share of 46.9% in 2024, as these facilities manage the majority of diagnostic testing, medication administration, and liver transplants.

Specialty Clinics segment is expected to witness the fastest CAGR from 2025 to 2032, due to their focus on infectious disease and hepatology care, offering specialized services and follow-up programs.

- By Distribution Channel

On the basis of distribution channel, the Europe hepatitis delta virus (HDV) infection market is segmented into direct tender, retail sales, and others. Direct Tender emerged as the dominant channel with a market share of 53.3% in 2024, owing to bulk purchasing by public hospitals and health authorities under centralized procurement models across Europe.

Retail Sales segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing availability of branded and generic medications in pharmacies and private healthcare settings.

Europe Hepatitis Delta Virus (HDV) Infection Market Regional Analysis

- Germany dominated the Europe hepatitis delta virus (HDV) infection market with the largest revenue share of 29.9% in 2024, supported by its comprehensive hepatitis screening programs, government-backed disease elimination plans, and presence of key pharmaceutical players focused on liver diseases

- The country’s proactive approach to co-infection management, including routine HDV testing for hepatitis B patients and early access to innovative treatments such as bulevirtide, has significantly enhanced diagnosis and care outcomes

- This leadership is further reinforced by the presence of major pharmaceutical and biotech companies engaged in liver disease research, along with high public health investment and clinician awareness, positioning Germany as a key growth hub for the HDV infection market in Europe

The Germany Hepatitis Delta Virus (HDV) Infection Market Insight

The Germany hepatitis delta virus (HDV) infection market held the largest revenue share in Europe in 2024, supported by a robust public health system, early access to innovative therapies, and national-level strategies targeting viral hepatitis elimination. The country’s emphasis on preventive screening, comprehensive HBV care integration, and pharmaceutical innovation fosters a favorable environment for HDV diagnosis and treatment. Continued support for real-world evidence studies and academic collaborations positions Germany as a regional leader in HDV management.

Italy Hepatitis Delta Virus (HDV) Infection Market Insight

The Italy hepatitis delta virus (HDV) infection market is projected to grow at a significant CAGR during the forecast period, due to historically higher HDV prevalence rates and government-led awareness campaigns targeting co-infected populations. Italy’s hepatitis elimination roadmap emphasizes expanded testing, public health outreach, and the availability of antiviral therapies through the national health system. Increased focus on vulnerable groups, including migrants and people who inject drugs (PWID), is expected to further drive screening and treatment demand.

France Hepatitis Delta Virus (HDV) Infection Market Insight

The France hepatitis delta virus (HDV) infection market is anticipated to expand steadily, supported by its proactive stance on hepatitis surveillance, integration of HDV testing in HBV care, and ongoing clinical research initiatives. Access to EMA-approved therapies and government reimbursement mechanisms enhances treatment uptake. France’s well-established liver disease centers and involvement in European-wide hepatitis strategies contribute to a cohesive approach to HDV prevention and management.

Spain Hepatitis Delta Virus (HDV) Infection Market Insight

The Spain hepatitis delta virus (HDV) infection market is set to grow consistently during the forecast period, fueled by national strategies focusing on hepatitis elimination, improved testing protocols, and outreach in high-risk communities. Public-private partnerships and regional health initiatives aimed at expanding access to diagnostics and treatment are driving growth. Spain’s emphasis on decentralized care and community-based interventions plays a vital role in reaching underserved populations.

U.K. Hepatitis Delta Virus (HDV) Infection Market Insight

The U.K. hepatitis delta virus (HDV) infection market is expected to grow at a steady CAGR during the forecast period, supported by the country’s commitment to viral hepatitis elimination and its strong public healthcare infrastructure. National health guidelines recommend HDV testing for all HBV-positive individuals, driving early diagnosis and linkage to care. The U.K.’s participation in European HDV surveillance programs, access to EMA-approved treatments such as bulevirtide, and ongoing clinical research contribute to an expanding treatment landscape. In addition, targeted screening in high-risk populations—such as people who inject drugs and migrants from endemic regions—is enhancing patient identification and access to care.

Europe Hepatitis Delta Virus (HDV) Infection Market Share

The Europe hepatitis delta virus (HDV) infection industry is primarily led by well-established companies, including:

- Gilead Sciences, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- GSK plc (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Sanofi S.A. (France)

- Zydus Lifesciences Limited (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Alnylam Pharmaceuticals, Inc. (U.S.)

- Eiger BioPharmaceuticals, Inc. (U.S.)

- Bayer AG (Germany)

- Biotest AG (Germany)

- Grifols, S.A. (Spain)

- Sigma-Tau Industrie Farmaceutiche Riunite S.p.A. (Italy)

- Abivax SA (France)

What are the Recent Developments in Europe Hepatitis Delta Virus (HDV) Infection Market?

- In September 2023, Hepcludex (bulevirtide)—developed by Gilead Sciences—received full European Medicines Agency (EMA) approval as the first-in-class entry inhibitor for chronic HDV infection. This development marked a pivotal moment for HDV treatment across Europe, as the therapy demonstrated significant improvements in viral suppression and liver enzyme normalization. The full approval reinforces its role as a central treatment option and reflects growing regulatory and clinical support for HDV-targeted therapeutics

- In June 2023, the European Association for the Study of the Liver (EASL) updated its clinical practice guidelines to include broader HDV screening recommendations for all HBsAg-positive individuals. This shift in clinical policy underscores a continent-wide push for early detection, aligning with WHO’s viral hepatitis elimination goals and driving demand for advanced diagnostics and antiviral therapies

- In May 2023, Italy’s Ministry of Health launched a nationwide hepatitis awareness and screening campaign, emphasizing HDV testing among high-risk populations such as migrants, people who inject drugs (PWID), and incarcerated individuals. This public health initiative significantly expanded the reach of diagnostic services and bolstered the early identification of co-infected patients, promoting timely clinical intervention

- In April 2023, Germany’s Robert Koch Institute published new epidemiological data highlighting a gradual increase in HDV testing across healthcare centers. The findings, coupled with state-sponsored digital tracking systems for hepatitis cases, are improving real-time surveillance and enhancing the responsiveness of national healthcare systems in addressing HDV burden

- In February 2023, INSERM (France’s National Institute of Health and Medical Research) initiated a multi-center clinical study assessing the long-term effectiveness of novel combination therapies for HDV. The study involves academic hospitals across France, Germany, and Spain, and represents a significant step forward in evidence generation for next-generation HDV treatments, strengthening Europe’s leadership in liver disease research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

4.3 EUROPE CLINICAL TRIAL MARKET FOR EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET

4.4 DISTRIBUTION OF PRODUCTS BY PHASE

5 EPIDEMIOLOGY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING PREVALENCE OF HEPATITIS

6.1.2 INCREASE IN HEALTHCARE EXPENDITURE

6.1.3 ONGOING RESEARCH AND DEVELOPMENT INITIATIVES

6.1.4 ADVANCES IN DIAGNOSTIC TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS OF HEPATITIS DELTA VIRUS (HDV)

6.2.2 HIGH COST OF TREATMENT

6.3 OPPORTUNITIES

6.3.1 RISING INNOVATIVE DRUG DEVELOPMENT

6.3.2 INCREASING DEVELOPMENT OF COMBINATION THERAPIES

6.3.3 GROWING ADVANCEMENTS IN DIGITAL HEALTH SOLUTIONS

6.4 CHALLENGES

6.4.1 SIDE EFFECTS OF CURRENT TREATMENTS

6.4.2 SLOW REGULATORY APPROVALS

7 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE

7.1 OVERVIEW

7.2 ACUTE HEPATITIS D

7.3 CHRONIC HEPATITIS D

8 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT

8.1 OVERVIEW

8.2 SURGERY (LIVER TRANSPLANT)

8.3 MEDICATION

8.3.1 APPROVED THERAPIES

8.3.1.1 PEGYLATED INTERFERON ALPHA

8.3.1.2 ENTRY INHIBITOR (BULEVIRTIDE)

8.3.2 EMERGING THERAPIES

9 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM

9.1 OVERVIEW

9.2 TABLET

9.3 CAPSULE

9.4 INJECTABLE

10 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 BRANDED

10.3 GENERIC

11 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.2.1 TABLET

11.2.2 CAPSULE

11.2.3 OTHERS

11.3 PARENTERAL

12 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER

12.1 OVERVIEW

12.2 FEMALE

12.3 MALE

13 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULTS

13.3 GERIATRIC

13.4 PEDIATRIC

14 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION

14.1 OVERVIEW

14.2 CONTAMINATED NEEDLES

14.3 EXPOSURE TO INFECTED BLOOD

14.4 BLOOD AND PLASMA PRODUCT TRANSFUSION

14.5 OTHERS

15 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.3 SPECIALTY CENTERS

15.4 HOME CARE SETTING

15.5 RESEARCH INSTITUTES & ACADEMIC CENTERS

15.6 AMBULATORY SURGICAL CENTERS

15.7 OTHERS

16 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.3.1 HOSPITAL PHARMACY

16.3.2 RETAIL PHARMACY

16.3.3 ONLINE PHARMACY

16.4 OTHERS

17 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION

17.1 EUROPE

17.1.1 GERMANY

17.1.2 FRANCE

17.1.3 U.K

17.1.4 ITALY

17.1.5 SPAIN

17.1.6 NETHERLANDS

17.1.7 SWITZERLAND

17.1.8 RUSSIA

17.1.9 BELGIUM

17.1.10 TURKEY

17.1.11 DENMARK

17.1.12 SWEDEN

17.1.13 POLAND

17.1.14 NORWAY

17.1.15 FINLAND

17.1.16 REST OF EUROPE

18 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: EUROPE

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 GILEAD SCIENCES, INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PIPELINE PRODUCT

20.1.5 RECENT DEVELOPMENTS

20.2 GENENTECH, INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 RECENT DEVELOPMENT

20.3 ALNYLAM PHARMACEUTICALS, INC.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PIPELINE PRODUCT

20.3.4 RECENT DEVELOPMENTS

20.4 ASSEMBLY BIOSCIENCES, INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PIPELINE PRODUCT

20.4.4 RECENT DEVELOPMENTS

20.5 EIGER BIOPHARMACEUTICALS

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 PIPELINE PRODUCT

20.5.6 RECENT DEVELOPMENT

20.6 GLOBEIMMUNE INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 PIPELINE PRODUCT

20.6.3 RECENT DEVELOPMENT

20.7 HUAHUI HEALTH LTD.

20.7.1 COMPANY SNAPSHOT

20.7.2 PIPELINE PRODUCT

20.7.3 RECENT DEVELOPMENT

20.8 JOHNSON & JOHNSON SERVICES, INC.

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PIPELINE PRODUCT

20.8.4 RECENT DEVELOPMENT

20.9 PHARMAESSENTIA CORPORATION

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PIPELINE PRODUCT

20.9.4 RECENT DEVELOPMENT

20.1 REPLICOR

20.10.1 COMPANY SNAPSHOT

20.10.2 PIPELINE PRODUCT

20.10.3 RECENT DEVELOPMENTS

20.11 VIR BIOTECHNOLOGY, INC.

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALAYSIS

20.11.3 PRODUCT PIPELINE

20.11.4 RECENT DEVELOPMENTS

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 EMERGING NOVEL THERAPIES FOR HDV

TABLE 2 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 3 EUROPE ACUTE HEPATITIS D IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 4 EUROPE CHRONIC HEPATITIS D IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 6 EUROPE SURGERY (LIVER TRANSPLANT) IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 EUROPE MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 EUROPE APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 11 EUROPE TABLET IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE CAPSULE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 EUROPE INJECTABLE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 EUROPE BRANDED IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE GENERIC IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 EUROPE PARENTERAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 22 EUROPE FEMALE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 EUROPE MALE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 24 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 25 EUROPE ADULTS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 EUROPE GERIATRIC IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 EUROPE PEDIATRIC IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 29 EUROPE CONTAMINATED NEEDLES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 EUROPE EXPOSURE TO INFECTED BLOOD IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 EUROPE BLOOD AND PLASMA PRODUCT TRANSFUSION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 EUROPE OTHERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 34 EUROPE HOSPITALS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 EUROPE SPECIALTY CLINICS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 EUROPE HOME CARE SETTING IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 EUROPE RESEARCH INSTITUTES AND ACADEMIC CENTERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 EUROPE AMBULATORY SURGICAL CENTERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 EUROPE OTHERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 41 EUROPE DIRECT TENDER IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 EUROPE RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE OTHERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 49 EUROPE MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 EUROPE APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 53 EUROPE ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 55 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 56 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 57 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 58 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 59 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 60 EUROPE RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 63 GERMANY MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 GERMANY APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 67 GERMANY ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 69 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 70 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 71 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 72 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 73 GERMANY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 77 FRANCE MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 FRANCE APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 81 FRANCE ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 83 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 84 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 85 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 86 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 87 FRANCE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 88 FRANCE RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 91 U.K. MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 U.K. APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 95 U.K. ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 97 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 98 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 99 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 100 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 101 U.K. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 102 U.K. RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 105 ITALY MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 ITALY APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 109 ITALY ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 111 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 112 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 113 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 114 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 115 ITALY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 116 ITALY RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 119 SPAIN MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 SPAIN APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 123 SPAIN ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 125 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 126 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 127 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 128 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 129 SPAIN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 130 SPAIN RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 133 NETHERLANDS MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 NETHERLANDS APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 137 NETHERLANDS ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 139 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 140 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 141 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 142 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 143 NETHERLANDS HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 144 NETHERLANDS RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 146 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 147 SWITZERLAND MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 SWITZERLAND APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 151 SWITZERLAND ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 153 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 154 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 155 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 156 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 157 SWITZERLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 158 SWITZERLAND RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 161 RUSSIA MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 RUSSIA APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 163 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 164 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 165 RUSSIA ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 166 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 167 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 168 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 169 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 170 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 171 RUSSIA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 172 RUSSIA RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 175 BELGIUM MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 176 BELGIUM APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 179 BELGIUM ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 181 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 182 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 183 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 184 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 185 BELGIUM HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 186 BELGIUM RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 187 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 189 TURKEY MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 TURKEY APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 193 TURKEY ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 195 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 196 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 197 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 198 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 199 TURKEY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 200 TURKEY RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 203 DENMARK MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 204 DENMARK APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 205 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 206 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 207 DENMARK ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 209 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 210 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 211 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 212 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 213 DENMARK HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 214 DENMARK RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 216 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 217 SWEDEN MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 SWEDEN APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 221 SWEDEN ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 223 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 224 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 225 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 226 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 227 SWEDEN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 228 SWEDEN RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 231 POLAND MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 POLAND APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 234 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 235 POLAND ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 236 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 237 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 238 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 239 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 240 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 241 POLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 242 POLAND RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 243 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 244 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 245 NORWAY MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 246 NORWAY APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 249 NORWAY ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 251 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 252 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 253 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 254 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 255 NORWAY HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 256 NORWAY RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 259 FINLAND MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 260 FINLAND APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 263 FINLAND ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 264 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 265 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 266 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 267 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 268 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 269 FINLAND HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 270 FINLAND RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 271 REST OF EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: SEGMENTATION

FIGURE 2 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE

FIGURE 12 GROWING PREVALENCE OF HEPATITIS IS DRIVING THE GROWTH OF THE EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET FROM 2024 TO 2031

FIGURE 13 THE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET IN 2024 AND 2031

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET

FIGURE 15 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, 2023

FIGURE 16 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, 2024-2031 (USD THOUSAND)

FIGURE 17 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 18 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, 2023

FIGURE 20 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, 2024-2031 (USD THOUSAND)

FIGURE 21 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, CAGR (2024-2031)

FIGURE 22 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, LIFELINE CURVE

FIGURE 23 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, 2023

FIGURE 24 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, 2024-2031 (USD THOUSAND)

FIGURE 25 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, CAGR (2024-2031)

FIGURE 26 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 27 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, 2023

FIGURE 28 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, 2024-2031 (USD THOUSAND)

FIGURE 29 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, CAGR (2024-2031)

FIGURE 30 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 31 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, 2023

FIGURE 32 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, 2024-2031 (USD THOUSAND)

FIGURE 33 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2024-2031)

FIGURE 34 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 35 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER,2023

FIGURE 36 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER, 2024-2031 (USD THOUSAND)

FIGURE 37 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER, CAGR (2024-2031)

FIGURE 38 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER, LIFELINE CURVE

FIGURE 39 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, 2023

FIGURE 40 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, 2024-2031 (USD THOUSAND)

FIGURE 41 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, CAGR (2024-2031)

FIGURE 42 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 43 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, 2023

FIGURE 44 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, 2024-2031 (USD THOUSAND)

FIGURE 45 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, CAGR (2024-2031)

FIGURE 46 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, LIFELINE CURVE

FIGURE 47 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, 2023

FIGURE 48 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, 2024-2031 (USD THOUSAND)

FIGURE 49 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, CAGR (2024-2031)

FIGURE 50 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, LIFELINE CURVE

FIGURE 51 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 52 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD THOUSAND)

FIGURE 53 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 54 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 55 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: SNAPSHOT (2023)

FIGURE 56 EUROPE HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.