Europe Hernia Repair Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

2.38 Billion

2024

2032

USD

1.44 Billion

USD

2.38 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 2.38 Billion | |

|

|

|

|

Europe Hernia Repair Devices (Permanent and Absorbable Hernia Fixation) Market Size

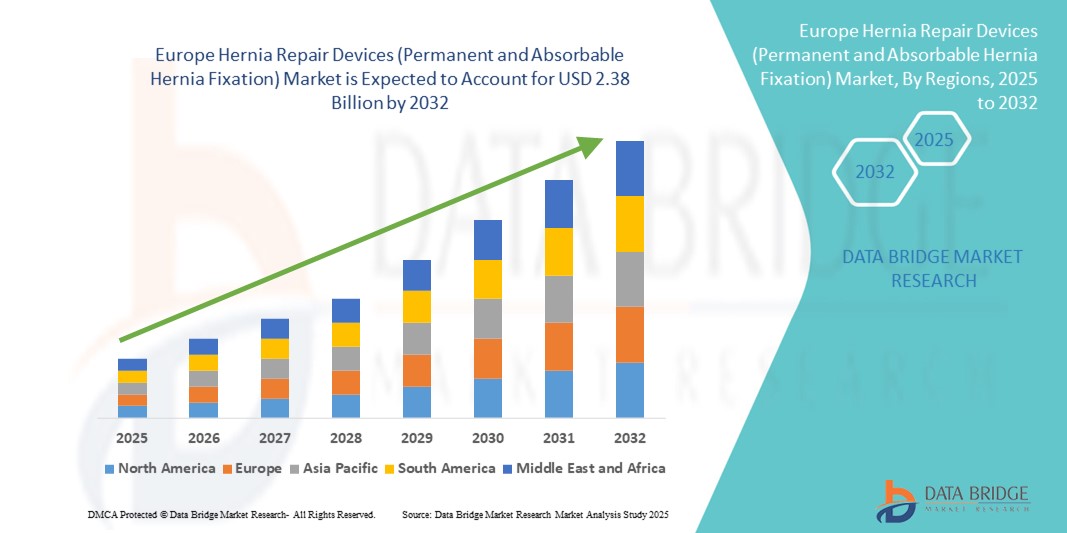

- The Europe hernia repair devices (permanent and absorbable hernia fixation) market size was valued at USD 1.44 billion in 2024 and is expected to reach USD 2.38 billion by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hernias, technological advancements in surgical techniques, and the rising adoption of minimally invasive procedures across Europe

- Furthermore, an aging population combined with improving healthcare infrastructure and reimbursement policies in key countries such as Germany, France, and the UK is driving strong demand for both permanent and absorbable hernia fixation devices. These converging factors are accelerating the uptake of advanced hernia repair solutions, thereby significantly boosting the industry's growth

Europe Hernia Repair Devices (Permanent And Absorbable Hernia Fixation) Market Analysis

- Hernia repair devices, including permanent and absorbable fixation solutions, are critical components in surgical treatment across Europe, used extensively in hospitals, specialty clinics, and ambulatory surgical centers due to their effectiveness in reducing recurrence and improving patient recovery

- The escalating demand for hernia repair devices is primarily fueled by the rising prevalence of inguinal and incisional hernias, advancements in biomaterials, and increasing adoption of minimally invasive surgical techniques

- Germany dominated the Europe hernia repair devices market with the largest revenue share of 28.5% in 2024, driven by advanced healthcare infrastructure, favorable reimbursement policies, and a high volume of hernia surgeries. The U.K. and France are also key contributors with significant market shares

- Poland is expected to be the fastest-growing country in the Europe hernia repair devices market during the forecast period, owing to increasing healthcare investments and rising patient awareness

- The inguinal hernia segment dominated the Europe hernia repair devices market with a market share of 48.5% in 2024, attributed to its high incidence rate and the frequent need for surgical intervention

Report Scope and Europe Hernia Repair Devices (Permanent And Absorbable Hernia Fixation) Market Segmentation

|

Attributes |

Europe Hernia Repair Devices (Permanent And Absorbable Hernia Fixation) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Hernia Repair Devices (Permanent and Absorbable Hernia Fixation) Market Trends

Advancements in Biomaterials and Minimally Invasive Techniques

- A significant and accelerating trend in the Europe hernia repair devices market is the development and adoption of advanced biomaterials, including lightweight polypropylene meshes, composite meshes, and absorbable fixation devices. These innovations are designed to minimize foreign body reactions, reduce postoperative pain, and improve patient recovery times

- Alongside biomaterial innovations, the growing preference for minimally invasive laparoscopic and robotic-assisted surgeries is transforming hernia repair procedures. These techniques require specialized fixation devices compatible with smaller incisions and enhanced precision

- For instance, absorbable tack fixation systems have gained traction as they dissolve over time, reducing chronic inflammation risks and improving patient comfort compared to permanent fixation methods. Companies such as Ethicon and Medtronic are leading R&D efforts to develop these patient-friendly devices

- Furthermore, integration of digital surgical navigation and imaging systems enhances the accuracy of mesh placement and fixation, driving adoption of technologically advanced hernia repair solutions

- This trend toward biocompatibility, surgical precision, and minimally invasive approaches is fundamentally reshaping surgeon preferences and patient expectations, fostering increased demand across European healthcare settings

Europe Hernia Repair Devices (Permanent and Absorbable Hernia Fixation) Market Dynamics

Driver

Rising Hernia Incidence and Aging Population

- The rising incidence of hernias, especially inguinal and incisional types, coupled with Europe’s aging demographic, is a primary driver for market growth. Aging tissues are more prone to hernia formation, leading to increased surgical intervention rates

- For instance, Germany and the UK, with well-established healthcare infrastructures, report a high volume of hernia repairs annually, reflecting both a large patient base and proactive healthcare policies

- In addition, growing patient awareness about the benefits of early surgical repair and minimally invasive procedures fuels demand for advanced hernia repair devices

- Hospitals and specialty clinics are investing significantly in innovative hernia repair technologies that enhance surgical outcomes, reduce recurrence rates, and shorten recovery periods, thereby supporting the market expansion

- The shift towards outpatient and ambulatory surgical centers for hernia repair is driving demand for advanced fixation devices that enable faster procedures and quicker patient recovery, easing hospital burdens

- Favorable government policies and enhanced reimbursement schemes in countries such as France, Germany, and the UK are encouraging hospitals and clinics to adopt state-of-the-art hernia repair devices, further propelling market growth

Restraint/Challenge

Regulatory Hurdles and Postoperative Complication Concerns

- The strict regulatory frameworks such as the EU Medical Device Regulation (MDR) pose significant challenges for manufacturers, often causing delays in product approvals and increasing compliance costs. This can slow the introduction of innovative devices into the market

- Concerns regarding postoperative complications such as mesh rejection, chronic pain, infection, and adhesion formation especially related to permanent fixation devices, limit the adoption rate among certain patient groups and healthcare providers

- For instance, in 2022, the European Commission issued updated guidelines highlighting the need for stringent clinical evaluation of hernia meshes due to reported cases of mesh-related complications. This has heightened scrutiny and affected market dynamics

- Moreover, advanced absorbable fixation devices tend to have higher price points compared to conventional meshes and sutures, which can strain healthcare budgets, particularly in cost-sensitive public health systems

- To overcome these restraints, manufacturers need to invest in robust clinical trials, surgeon education programs, and cost-effective innovations that balance safety with affordability, ensuring sustained market growth

Europe Hernia Repair Devices (Permanent and Absorbable Hernia Fixation) Market Scope

The market is segmented on the basis of type, end-user, and distribution channel.

- By Type

On the basis of type, the Europe hernia repair devices market is segmented into inguinal hernia, femoral hernia, umbilical hernia, hiatal (hiatus) hernia, incisional hernia, epigastric hernia, spigelian hernia, and diaphragmatic hernia. The inguinal hernia segment dominated the market with the largest revenue share of 48.5% in 2024, driven by its high prevalence and frequent requirement for surgical intervention. The widespread occurrence of inguinal hernias, especially among the aging population, makes this segment the most significant revenue contributor.

The incisional hernia segment is anticipated to witness the fastest growth rate over the forecast period, fueled by the increasing number of abdominal surgeries leading to postoperative hernias. Improved diagnostic capabilities and surgical interventions are accelerating demand in this segment. Other segments such as umbilical and femoral hernias collectively contribute a moderate market share, supported by rising awareness and advancements in repair technologies.

- By End-User

On the basis of end-user, the Europe hernia repair devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others. The hospitals segment held the largest market revenue share of 68% in 2024, owing to the complexity of hernia surgeries which require advanced surgical infrastructure and experienced surgical teams. Hospitals are also the primary adopters of new fixation technologies due to higher procedure volumes.

The specialty clinics and ambulatory surgical centers segments are expected to register faster growth, driven by a growing preference for minimally invasive and outpatient surgeries. Ambulatory centers offer benefits such as lower costs and faster patient turnover, making them attractive for hernia repair procedures, thus expanding their market share during the forecast period.

- By Distribution Channel

On the basis of distribution channel, the Europe hernia repair devices market is segmented into direct tender and retail sales. The direct tender segment dominated the market with a share of 62% in 2024, supported by bulk procurement by government hospitals and healthcare institutions through tenders and contracts. This channel ensures cost efficiency and steady supply, making it the preferred choice for large healthcare providers.

The retail sales segment is anticipated to witness steady growth during forecast period, due to increasing demand from private hospitals, specialty clinics, and ambulatory surgical centers, which often procure devices through distributors and medical device suppliers for smaller or specific orders.

Europe Hernia Repair Devices (Permanent and Absorbable Hernia Fixation) Market Regional Analysis

- Germany dominated the Europe hernia repair devices market with the largest revenue share of 28.5% in 2024, driven by advanced healthcare infrastructure, favorable reimbursement policies, and a high volume of hernia surgeries. The U.K. and France are also key contributors with significant market shares

- Patients and healthcare providers in Germany highly value the availability of innovative fixation devices, minimally invasive surgical options, and the presence of leading medical device manufacturers, which contribute to improved patient outcomes and reduced postoperative complications

- This widespread adoption is further supported by strong government healthcare funding, comprehensive insurance coverage, and a large pool of trained surgeons, establishing Germany as the most significant market for hernia repair devices in Europe, with other countries such as the U.K. and France also contributing substantially to market growth

The Germany Hernia Repair Devices Market Insight

The Germany dominated the Europe hernia repair devices market with the largest revenue share in 2024, fueled by high surgical volumes and advanced healthcare facilities. The country’s emphasis on research and development, along with reimbursement policies favoring novel hernia repair technologies, is encouraging the adoption of both permanent and absorbable fixation devices. The demand is further bolstered by increasing patient preference for minimally invasive surgery and reduced postoperative complications.

U.K. Hernia Repair Devices Market Insight

The U.K. hernia repair devices market is expected to grow steadily during the forecast period, supported by rising hernia incidence and increased focus on outpatient and ambulatory surgeries. The strong presence of specialty clinics and advanced hospital networks facilitates the adoption of innovative hernia repair solutions. Growing patient education and awareness regarding improved surgical outcomes contribute to the demand for absorbable fixation devices alongside traditional permanent meshes.

France Hernia Repair Devices Market Insight

The France hernia repair devices market is witnessing significant growth in the hernia repair devices market, driven by increasing surgical volumes and healthcare investments. The availability of skilled surgeons and progressive healthcare policies promoting minimally invasive hernia repair are key growth factors. In addition, the focus on patient safety and reduced recovery times is leading to a rising preference for absorbable fixation devices and advanced mesh technologies.

Poland Hernia Repair Devices Market Insight

The Poland hernia repair devices market is the fastest-growing market in Europe, driven by expanding healthcare infrastructure, increased healthcare spending, and rising patient awareness. Government initiatives aimed at modernizing hospitals and increasing surgical capacity are boosting the adoption of advanced hernia repair technologies. The growing number of ambulatory surgical centers and training programs for surgeons further support the rapid market expansion in Poland.

Europe Hernia Repair Devices (Permanent And Absorbable Hernia Fixation) Market Share

The Europe hernia repair devices (permanent and absorbable hernia fixation) industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Johnson & Johnson and its affiliates (U.S.)

- BD (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- B. Braun SE (Germany)

- Cook (U.S.)

- Stryker (U.S.)

- Conmed Corporation (U.S.)

- Smith & Nephew (U.K.)

- AbbVie Inc. (U.S.)

- Cousin Biotech (France)

- Herniamesh S.r.l. (Italy)

- Integra LifeSciences Holdings Corporation (U.S.)

- MicroPort Scientific Corporation (China)

- Xenco Medical (U.S.)

- Acumed LLC (U.S.)

What are the Recent Developments in Europe Hernia Repair Devices (Permanent And Absorbable Hernia Fixation) Market?

- In April 2025, BD announced the commercial launch of its Phasix ST Umbilical Hernia Patch, following FDA 510(k) clearance. This patch is the first and only fully absorbable mesh designed specifically for umbilical hernia repair. Made from a biologically-derived material with a hydrogel barrier, the patch provides temporary support for tissue healing and is then absorbed by the body. This product offers a non-permanent alternative to traditional mesh, aligning with patient preferences for bioabsorbable options

- In June 2023, the U.S. Food and Drug Administration (FDA) approved Advanced Medical Solutions Limited's LIQUIFIX Hernia Mesh Fixation (HMF) Devices. The devices, which include a laparoscopic and open version, use a liquid adhesive to secure surgical mesh. This technology provides a non-penetrating fixation method, eliminating the need for traditional tacks or sutures and potentially reducing the risk of nerve damage and pain for patients

- In April 2022, Ariste Medical received U.S. Food and Drug Administration (FDA) 510(k) clearance for its drug-embedded, polypropylene hernia mesh. This new mesh, which carries two antibiotics, is designed to reduce the risk of microbial colonization and infection following open hernia repair. The clearance allows the company to market and sell the device, which aims to improve patient outcomes and lower the economic burden of reoperations

- In July 2021, BD (Becton, Dickinson and Company) announced its acquisition of Tepha, Inc., a company that develops and manufactures proprietary resorbable polymer technology. This acquisition was a strategic move to strengthen BD's surgical mesh portfolio and enable future innovations in soft tissue repair. Tepha's polymer technology is a key component of BD's existing Phasix Mesh products, and the acquisition provides BD with vertical integration of a crucial part of its supply chain

- In February 2021, W. L. Gore & Associates introduced the GORE SYNECOR Intraperitoneal Biomaterial in Europe, the Middle East, and South Africa. This device was designed to address unmet needs in complex hernia repair, providing rapid vascularity and permanent strength with a low profile for single, effective hernia repair. The GORE SYNECOR Intraperitoneal Biomaterial is conceived for ease of use during laparoscopic, robotic, and open surgical procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.