Europe High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Market Size in USD Billion

CAGR :

%

USD

1.81 Billion

USD

2.89 Billion

2025

2033

USD

1.81 Billion

USD

2.89 Billion

2025

2033

| 2026 –2033 | |

| USD 1.81 Billion | |

| USD 2.89 Billion | |

|

|

|

|

Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Size

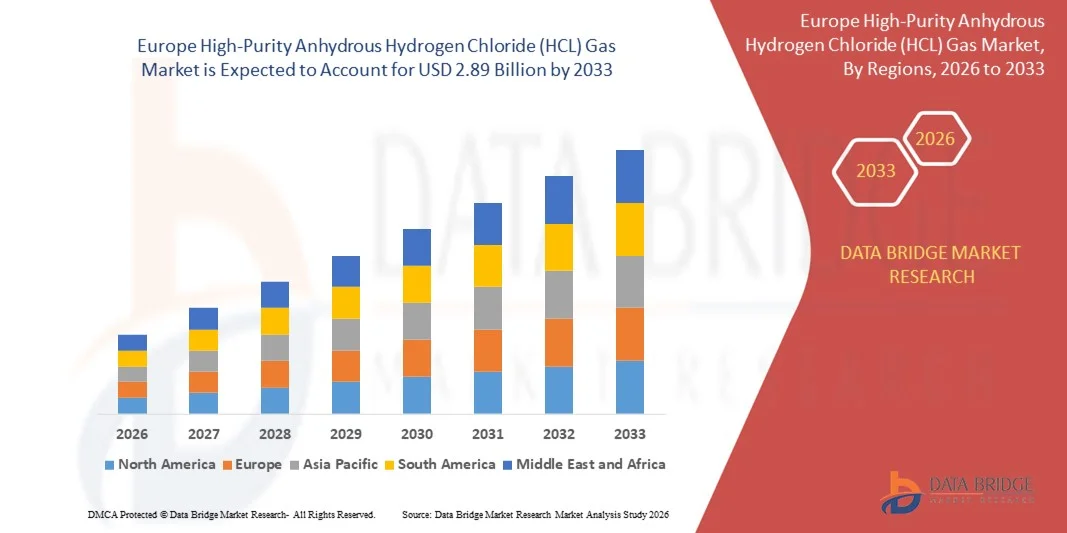

- The Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market size was valued at USD 1.81 billion in 2025 and is expected to reach USD 2.89 billion by 2033, at a CAGR of 6.06% during the forecast period.

- The market growth is primarily driven by the increasing demand for high-purity chemicals in pharmaceuticals, electronics, and chemical manufacturing industries, coupled with stringent quality requirements and regulatory standards across Europe.

- Moreover, ongoing technological advancements in chemical processing and the rising need for precise, contamination-free production processes are fueling the adoption of high-purity HCL gas. These factors collectively are propelling the market forward, supporting significant growth over the forecast period.

Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Analysis

- High-purity anhydrous hydrogen chloride (HCL) gas, used extensively in chemical synthesis, semiconductor manufacturing, and pharmaceutical applications, is a critical industrial gas due to its high reactivity, purity, and ability to meet stringent manufacturing standards in Europe.

- The growing demand for high-purity HCL gas is primarily driven by expansion in electronics, pharmaceutical, and specialty chemical sectors, where contamination-free processes and precise chemical reactions are crucial for product quality and safety.

- Germany dominated the Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market with the largest revenue share of 35% in 2025, supported by a well-established chemical industry, stringent regulatory standards, and a strong presence of leading HCL gas manufacturers, with Germany and France witnessing substantial growth in production and consumption across pharmaceutical and semiconductor sectors.

- U.K. is expected to be the fastest-growing region in the Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market during the forecast period due to increasing industrialization, foreign investment in chemical plants, and rising demand for high-purity chemicals in electronics and specialty manufacturing.

- The electronics-grade segment dominated the market with the largest revenue share of 51.8% in 2025, driven by its critical applications in semiconductor manufacturing, etching processes, and high-precision electronics production.

Report Scope and Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Segmentation

|

Attributes |

High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Trends

Enhanced Efficiency Through Advanced Purification and Process Automation

- A significant and accelerating trend in the Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is the integration of advanced purification technologies and automated gas handling systems. These innovations are enhancing product consistency, reducing contamination risks, and improving overall operational efficiency for industrial users.

- For instance, high-purity HCL production facilities increasingly employ membrane-based purification and continuous monitoring systems, ensuring ultra-low impurity levels suitable for semiconductor, pharmaceutical, and specialty chemical applications. Similarly, automated gas delivery and leak-detection systems streamline supply management while maintaining strict safety standards.

- Advanced process automation in HCL gas production enables features such as real-time quality monitoring, predictive maintenance, and optimized reaction control, minimizing downtime and waste. For example, some leading European manufacturers utilize automated feedback loops to maintain target concentration levels, ensuring batch-to-batch consistency and regulatory compliance.

- The seamless integration of high-purity HCL gas production with digital control systems allows centralized management of multiple production lines, facilitating precise regulation of flow rates, pressure, and temperature. This contributes to safer, more efficient, and scalable industrial operations.

- This trend toward more precise, automated, and reliable HCL production is reshaping expectations for chemical manufacturing standards. Consequently, companies such as Linde, Air Liquide, and Messer are investing in AI-assisted process control and smart purification technologies to meet the growing demand for ultra-high-purity HCL.

- The demand for HCL gas with enhanced purity, automated handling, and consistent performance is rising rapidly across the semiconductor, pharmaceutical, and specialty chemical sectors, driven by increasing regulatory standards and the need for contamination-free industrial processes.

Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Dynamics

Driver

Growing Demand Driven by Expanding Industrial Applications and Regulatory Standards

- The increasing demand for high-purity anhydrous hydrogen chloride (HCL) gas across pharmaceuticals, specialty chemicals, and semiconductor manufacturing, combined with stringent European regulatory standards, is a significant driver for market growth.

- For instance, in early 2025, Linde plc announced the expansion of its high-purity HCL production capacity to cater to the growing requirements of semiconductor and pharmaceutical manufacturers, reflecting strategic investments by key players to meet rising industrial demand.

- As industries increasingly adopt precision manufacturing processes, high-purity HCL gas offers critical advantages, including contamination-free chemical reactions, reliable product quality, and compliance with strict regulatory limits on impurities.

- Furthermore, the growing emphasis on digitalization and automation in chemical processing plants is driving the adoption of HCL gas in tightly controlled production environments, ensuring consistent purity levels and process reliability.

- The demand for high-purity HCL gas is further fueled by its essential role in applications such as etching in semiconductor fabrication, active pharmaceutical ingredient (API) production, and specialty chemical synthesis. Ongoing expansion of industrial facilities and the need for uninterrupted, high-quality supply are key factors propelling market growth across Europe.

Restraint/Challenge

Safety Concerns and High Production Costs

- Concerns regarding the corrosive nature and hazardous handling requirements of high-purity HCL gas pose a significant challenge to market expansion. Due to its highly reactive and toxic nature, strict safety protocols are required during storage, transport, and usage, increasing operational complexity and cost.

- For instance, high-profile incidents of industrial chemical accidents have prompted regulatory authorities to impose stringent handling and safety standards, raising compliance costs for manufacturers and end-users.

- Addressing these safety challenges through advanced containment systems, automated leak detection, and rigorous training protocols is crucial to ensure worker safety and maintain uninterrupted supply. Companies such as Air Liquide and Messer emphasize robust safety management practices and high-quality equipment to mitigate risks.

- Additionally, the high cost of producing ultra-high-purity HCL gas, which requires specialized equipment, purification technologies, and continuous quality monitoring, can limit adoption, particularly for smaller industrial operators or price-sensitive markets.

- While technological advancements and economies of scale are gradually reducing production costs, the perceived high investment and operational requirements may still hinder market growth in certain segments. Overcoming these challenges through enhanced safety measures, cost-efficient production methods, and industry education will be vital for sustained growth in the Europe High-Purity HCL gas market.

Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Scope

The market is segmented on market based on product, application

- By Product

On the basis of product, the Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is segmented into electronics grade and chemical grade. The electronics-grade segment dominated the market with the largest revenue share of 51.8% in 2025, driven by its critical applications in semiconductor manufacturing, etching processes, and high-precision electronics production. The demand for ultra-high-purity HCL in these processes, where even trace impurities can impact product quality, has positioned electronics-grade HCL as the preferred choice among manufacturers. In addition, stringent quality standards and certifications in the electronics industry further support the dominance of this segment.

The chemical-grade segment is expected to witness the fastest CAGR of 18.6% from 2026 to 2033, fueled by its increasing adoption in large-scale chemical synthesis, specialty chemicals, and pharmaceutical production. The relatively lower cost and wider applicability of chemical-grade HCL make it attractive for industries seeking reliable, high-purity gas for standard chemical processes.

- By Application

On the basis of application, the Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is segmented into electronics and electricals, pharmaceuticals, chemicals, and others. The electronics and electricals segment accounted for the largest market revenue share of 48.9% in 2025, driven by the expansion of semiconductor fabrication plants, growing demand for microchips, and high-purity requirements in etching and cleaning processes. The stringent quality and purity standards in electronics manufacturing ensure consistent demand for HCL gas in this segment.

The pharmaceuticals segment is expected to witness the fastest CAGR of 19.3% from 2026 to 2033, owing to the increasing production of active pharmaceutical ingredients (APIs), laboratory-grade chemicals, and stringent regulatory requirements for purity in drug manufacturing. Rising investments in pharmaceutical R&D and expanding production capacities in Europe are further accelerating demand in this segment.

Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Regional Analysis

- Germany dominated the Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market with the largest revenue share of 35% in 2025, driven by the presence of a well-established chemical industry and stringent regulatory standards for high-purity industrial gases.

- The region’s demand is primarily fueled by the electronics, pharmaceutical, and specialty chemical sectors, where contamination-free processes and precise chemical reactions are critical for product quality and compliance.

- This strong market position is further supported by advanced manufacturing infrastructure, high technological expertise, and the presence of leading HCL gas manufacturers such as Linde, Air Liquide, and Messer. The combination of industrial expansion, rising quality requirements, and continuous investments in production capacity ensures Western Europe remains the dominant region for high-purity HCL gas consumption in Europe.

Germany High-Purity HCL Gas Market Insight

The Germany High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s robust chemical, pharmaceutical, and electronics manufacturing sectors. High-purity HCL is increasingly utilized in semiconductor fabrication, specialty chemical production, and active pharmaceutical ingredient (API) synthesis, where contamination-free processes are critical. Germany’s well-established industrial infrastructure, emphasis on technological innovation, and stringent regulatory standards for chemical purity support market growth. The integration of automated production and advanced purification systems further enhances efficiency and ensures consistent quality, fostering adoption in both new and upgraded manufacturing facilities.

France High-Purity HCL Gas Market Insight

The France High-Purity Anhydrous HCL Gas Market is witnessing steady growth, primarily fueled by the expansion of pharmaceutical, semiconductor, and specialty chemical industries. Increasing regulatory compliance requirements and demand for contamination-free production processes are key drivers. French manufacturers are investing in high-purity HCL for precision applications, while automation and advanced gas-handling systems ensure operational efficiency and safety. The market is supported by leading suppliers and growing domestic and export demand for high-quality chemical inputs, making France a critical market in Europe.

U.K. High-Purity HCL Gas Market Insight

The U.K. High-Purity Anhydrous HCL Gas Market is projected to grow at a noteworthy CAGR, driven by rising adoption in electronics, pharmaceutical, and specialty chemical sectors. Stringent quality standards, combined with the country’s focus on industrial modernization and automation, are increasing the demand for high-purity HCL. The market is further supported by research and development activities, expansion of chemical manufacturing facilities, and investments in high-precision production technologies. Both residential and commercial pharmaceutical and chemical production applications are contributing to market growth across the region.

Netherlands High-Purity HCL Gas Market Insight

The Netherlands High-Purity Anhydrous HCL Gas Market is poised for significant growth due to the country’s strategic position in chemical manufacturing and export-oriented industries. The demand for ultra-pure HCL is increasing across pharmaceutical, electronics, and specialty chemical production, where precision and contamination-free processes are essential. Investments in advanced purification systems, automated production, and stringent regulatory compliance support market adoption. The Netherlands’ strong industrial infrastructure, high technological expertise, and active participation in European chemical supply chains position it as a key market for high-purity HCL gas.

Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Share

The High-Purity Anhydrous Hydrogen Chloride (HCL) Gas industry is primarily led by well-established companies, including:

• Linde plc (Germany)

• Air Liquide (France)

• Messer Group (Germany)

• Air Products and Chemicals (U.S.)

• Matheson Tri-Gas (U.S.)

• Praxair (U.S.)

• Taiyo Nippon Sanso (Japan)

• Showa Denko (Japan)

• Mitsubishi Gas Chemical (Japan)

• OCI Nitrogen (Netherlands)

• National Industrial Gases (U.K.)

• Sasol (South Africa)

• Shanghai Huayi (China)

• Shandong Hua Chem (China)

• Shenzhen J&L (China)

• Haldor Topsoe (Denmark)

• Cambridge Chemicals (U.K.)

• Valerus (Belgium)

• PanGas (Switzerland)

• Linde Gas (Austria)

What are the Recent Developments in Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market?

- In April 2024, Linde plc, a global leader in industrial gases, announced the expansion of its high-purity HCL production facility in Germany to meet the growing demand from semiconductor and pharmaceutical manufacturers. This initiative underscores Linde’s commitment to providing ultra-pure, reliable chemical inputs for precision applications, while reinforcing its position in the rapidly expanding Europe High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market. By leveraging advanced purification technologies and automated production systems, Linde is addressing both industrial growth and stringent regulatory requirements in Europe.

- In March 2024, Air Liquide launched its upgraded high-purity HCL supply chain solutions for European pharmaceutical companies. The initiative aims to ensure uninterrupted supply of HCL with superior purity standards for API production, highlighting Air Liquide’s dedication to supporting critical pharmaceutical processes while maintaining compliance with EU chemical regulations.

- In March 2024, Messer Group successfully commissioned a new automated HCL purification and delivery system in the Netherlands, designed to serve semiconductor and specialty chemical manufacturers. This project demonstrates Messer’s commitment to operational efficiency, safety, and high product quality, contributing to the growth of smart, contamination-free chemical production in Europe.

- In February 2024, OCI Nitrogen entered a strategic partnership with multiple European chemical manufacturers to provide high-purity HCL for specialty chemical synthesis. This collaboration aims to streamline supply, enhance operational reliability, and meet rising industry demand, showcasing OCI Nitrogen’s focus on innovative solutions and customer-centric service.

- In January 2024, Taiyo Nippon Sanso launched its latest high-purity HCL gas product line in France, featuring advanced purity monitoring and automated quality control. The initiative highlights the company’s commitment to integrating cutting-edge technology into industrial gas production, offering European manufacturers improved process efficiency, consistency, and regulatory compliance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe High Purity Anhydrous Hydrogen Chloride Hcl Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe High Purity Anhydrous Hydrogen Chloride Hcl Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe High Purity Anhydrous Hydrogen Chloride Hcl Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.