Europe High Strength Steel Market

Market Size in USD Billion

CAGR :

%

USD

30.20 Billion

USD

38.90 Billion

2024

2032

USD

30.20 Billion

USD

38.90 Billion

2024

2032

| 2025 –2032 | |

| USD 30.20 Billion | |

| USD 38.90 Billion | |

|

|

|

|

Europe High Strength Steel Market Size

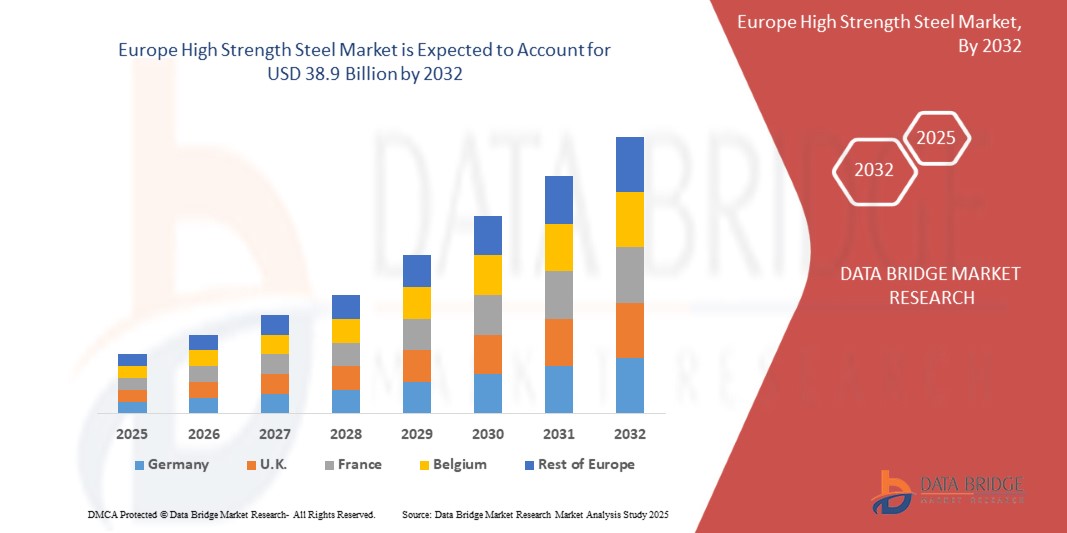

- The Europe High Strength Steel Market was valued at USD 30.2 billion in 2024 and is expected to reach USD 38.9 billion by 2032 during the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.50%, primarily driven by increasing demand from the automotive industry for lightweight materials to improve fuel efficiency and meet stringent emission standards.

- This growth is driven by factors such as increased construction activities and infrastructure modernization and increasing demand for steel in motors of hybrid/electrical vehicles

Europe High Strength Steel Market Analysis

- The Europe High Strength Steel Market is driven by rising demand for lightweight, high-strength materials in automotive, construction, and energy sectors. The need for materials that offer enhanced performance, fuel efficiency, and durability is fueling growth.

- High Strength Low Alloy (HSLA) steels are gaining popularity due to their superior strength-to-weight ratio and corrosion resistance, making them ideal for applications requiring high performance under demanding conditions.

- Germany dominates the market, driven by advanced manufacturing technologies and a strong automotive industry, while the region is also witnessing an increasing adoption of HSLA steels in infrastructure projects.

- The High Strength Low Alloy segment is expected to account for approximately 58% of the market share by grade in 2025, driven by its cost-effectiveness, light weight, and extensive use in the automotive and construction industries.

Report Scope and Europe High Strength Steel Market Segmentation

|

Attributes |

High Strength Steel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe High Strength Steel Market Trends

Automotive Light-weighting Demand Driving High Strength Steel Adoption in Europe

- A key trend in the European Europe High Strength Steel Market is the increasing demand from the automotive industry for lightweight materials to meet strict emission regulations and enhance fuel efficiency. This has led to growing adoption of high-strength steel (HSS) in vehicle production, offering both strength and durability while enabling weight reduction.

- European automakers are focused on utilizing advanced HSS to enhance vehicle performance, safety, and fuel efficiency, which is essential to meet stringent EU CO2 emissions standards. High-strength steel is used in the production of car body structures, chassis, and panels, contributing to the development of more eco-friendly vehicles.

- The demand for HSS also arises from the need for better crash safety performance without sacrificing design flexibility, as the steel provides both strength and lightness. This is particularly important in light of the EU’s growing focus on vehicle safety regulations.

- For instance, the European Steel Association (EUROFER) has highlighted the growing role of high-strength steel in reducing carbon emissions, particularly in the automotive sector, where lighter vehicles contribute to fuel efficiency and compliance with emissions standards.

Europe High Strength Steel Market Dynamics

Driver

Increased Construction Activities and Infrastructure Modernization

- The need for infrastructure upgrades and the construction of more resilient structures across Europe has significantly driven the demand for high-strength steel (HSS). With aging infrastructure, European governments and private sectors are increasingly investing in modernization projects.

- High-strength steel is widely utilized in the construction of commercial buildings, bridges, highways, and industrial facilities due to its superior strength, durability, and corrosion resistance. It is also becoming a popular choice in earthquake-resistant and weather-resistant applications.

- The trend toward sustainable and durable construction materials is motivating architects and engineers to choose advanced steel solutions for their long-term benefits.

- HSS offers significant advantages in reducing material usage, extending the lifespan of structures, and improving safety standards, particularly in areas prone to harsh weather or seismic activity.

For instance,

- The European Union is investing over €300 billion through its "Green Deal" to improve infrastructure and promote sustainability, with a focus on the construction of energy-efficient and resilient infrastructure. This initiative encourages the use of high-strength steel in construction projects to ensure sustainability, structural integrity, and resilience.

- As European countries work towards greener, more sustainable infrastructure, high-strength steel is emerging as a key material to support long-term, climate-resilient urbanization and infrastructure development.

Opportunity

Increasing Demand for Sustainable Construction Materials

- With Europe’s growing focus on sustainability and climate change mitigation, there is a rising demand for environmentally friendly and durable construction materials.

- High-strength steel (HSS) is increasingly being adopted as a sustainable material due to its recyclability, durability, and efficiency in reducing material waste while providing superior strength for structural applications.

- As European countries push toward carbon-neutral construction, HSS offers significant opportunities by reducing the overall carbon footprint of buildings and infrastructure projects, aligning with the EU’s green building regulations and sustainability goals.

- The increasing use of advanced HSS in construction helps in the reduction of operational energy consumption, making it a key material for the low-carbon economy.

For instance,

- The European Union's "Circular Economy Action Plan" aims to promote the recycling of materials, including metals like steel, to reduce waste and boost the use of sustainable materials. The plan has been instrumental in driving the demand for HSS in construction, as it is 100% recyclable and contributes to the reduction of environmental impact in building projects.

- As Europe advances its sustainability agenda, high-strength steel presents a significant opportunity for the construction industry to reduce its carbon footprint while delivering high-performance, long-lasting infrastructure.

Restraint/Challenge

Distortion in Properties of Steel Due to Temperature Variations

- The production of high strength steel (HSS) relies heavily on raw materials such as iron ore, coking coal, and alloying elements like manganese, chromium, and molybdenum, all of which are subject to Europe price volatility.

- Trade tensions, mining disruptions, and geopolitical uncertainties—especially involving major exporters like China, Brazil, and Australia—can impact the availability and cost of these inputs.

- Europen steel manufacturers face additional challenges from fluctuating energy prices, which raise production costs, and port congestion or logistics issues that delay material deliveries.

- These disruptions increase operational risks and reduce profit margins, especially for small and mid-sized steel producers that lack long-term supply contracts or diversified sourcing strategies.

For instance,

As per the article “Temperature Effects on the Magnetic Properties of Silicon-Steel Sheets Using Standardized Toroidal Frame” published by Cheng-Ju Wu, Shih-Yu Lin, Shang-Chin Chou, and Chia-Yun Tsai, the temperature is a very important parameter that determines the magnetic flux produced by steel. As per their discovery, a higher magnetic field strength is required to generate the same magnetic flux at high temperatures.

Europe High Strength Steel Market Scope

The market is segmented on the basis of grade, product type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Grade |

|

|

By Product Type |

|

|

By End User |

|

In 2025, the Automotive segment is projected to dominate the market with the largest share in the end-user segment.

The Automotive segment is expected to dominate the Europe High Strength Steel Market with the largest share of approximately 48% in 2025. This growth is driven by the increasing demand for lightweight, high-strength materials that contribute to enhanced fuel efficiency, vehicle safety, and performance in both traditional and electric vehicles.

In 2025, the High Strength Low Alloy (HSLA) segment is expected to account for the largest share during the forecast period in the grade segment.

The High Strength Low Alloy segment is projected to dominate the market by grade, accounting for approximately 55% of Europe revenue share in 2025. This growth is driven by the widespread use of HSLA steel in automotive manufacturing, construction, and energy sectors due to its excellent balance of strength, weight, and cost-effectiveness.

Europe High Strength Steel Market Regional Analysis

Germany is the Dominant Country in the Europe Region in the Europe High Strength Steel Market

- Germany dominates the Europe high strength steel (HSS) market, accounting for approximately 35% of the regional market share in 2025, driven by strong demand from the automotive, construction, and manufacturing industries.

- The automotive industry in Germany is one of the largest consumers of advanced high strength steel (AHSS), particularly in the production of lightweight vehicles to meet stringent emission regulations and fuel efficiency standards.

- Germany's emphasis on automotive safety, particularly crash safety, is encouraging the use of high-strength steel in vehicle body structures, chassis components, and other critical automotive parts.

- The country's well-established infrastructure and manufacturing sectors also drive the demand for high strength steel in construction projects, particularly in bridges, buildings, and energy infrastructure, where high performance and durability are required.

- Leading steel producers such as Thyssenkrupp, Salzgitter AG, and ArcelorMittal Germany contribute significantly to the country's dominance in the HSS market, fostering innovation and strong domestic production capabilities.

Germany is Projected to Register the Highest Growth Rate

- The Germany market for high strength steel is expected to grow at the fastest pace through 2032, spurred by ongoing automotive industry transformation, green construction initiatives, and rising demand for more efficient, durable materials.

- The production of electric vehicles (EVs) in Germany is accelerating, with a rising demand for advanced high strength steels (AHSS) and ultra-high strength steel (UHSS) for lightweight vehicle designs.

- Germany's national and regional investment in infrastructure, particularly in sustainable and resilient construction projects, is driving increased use of high strength steel in public works, including railways, bridges, and energy facilities.

- The country's focus on sustainability and innovation, including the development of steel grades with reduced carbon footprints, positions Germany for continued growth in the HSS market.

Europe High Strength Steel Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.)

- Palsgaard (Denmark)

- Nexira (France)

- Ingredion, Incorporated (U.S.)

- Kerry (Ireland)

- BASF (Germany)

- Ashland (U.S.)

- CP Kelco U.S. Inc. (U.S.)

- Glanbia Nutritionals (Ireland)

- Darling Ingredients, Inc. (U.S.)

- Tate & Lyle Plc (U.K.)

- Cargill, Incorporated (U.S.)

- Fuerst Day Lawson (U.K.)

- Koninklijke DSM N.V. (Netherlands)

- ADM (U.S.)

Latest Developments in Europe High Strength Steel Market

- In December 2019, ArcelorMittal and Nippon Steel & Sumitomo Metal Corporation jointly acquired Essar Steel India Limited, previously the fourth-largest steel producer in India. Following the acquisition, the two companies established a joint venture named ArcelorMittal Nippon Steel India Limited, with ArcelorMittal holding a 60% stake and Nippon Steel holding the remaining 40%.

- In December 2019, HBIS Group and POSCO Group signed a memorandum of understanding (MoU) to establish a joint venture focused on the development, production, and sale of high-end steel products for China’s automotive industry. The collaboration aims to capitalize on growth opportunities within the country’s expanding automotive sector.

- In June 2018, Nippon Steel & Sumitomo Metal Corporation acquired Sweden-based specialty steel producer Ovako AB, known for its advanced technology in high-cleanliness steel used in bearing steel and related products. Through this acquisition, the company aimed to strengthen its special steel segment and establish a Europe business development framework to address growing steel demand.

- In January 26, 2024 - Tempel, a Worthington Steel Company and a Europe leader in high-precision electrical steel laminations for motors, generators, and transformers, proudly announces receiving the Zero PPM (Parts per Million) award from Mahle Electric Drives India Pvt. This award recognizes Tempel's unwavering commitment to manufacturing excellence and quality assurance. MAHLE is a prominent international development partner and supplier in the automotive industry, pioneering electrification, thermal management, and clean combustion engines.

- Nippon Steel Corporation ("Nippon Steel") participated in the Offshore Technology Conference (OTC) in Houston, USA, from May 6 to May 9. OTC is a prominent exhibition that attracts offshore-related companies and organizations Europely, featuring over 1,300 exhibitors and drawing around 30,000 attendees annually.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe High Strength Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe High Strength Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe High Strength Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.