Europe Hla Typing Transplant Diagnostics Services Market

Market Size in USD Million

CAGR :

%

USD

406.18 Million

USD

839.52 Million

2024

2032

USD

406.18 Million

USD

839.52 Million

2024

2032

| 2025 –2032 | |

| USD 406.18 Million | |

| USD 839.52 Million | |

|

|

|

|

Europe HLA Typing Transplant Diagnostics Services Market Size

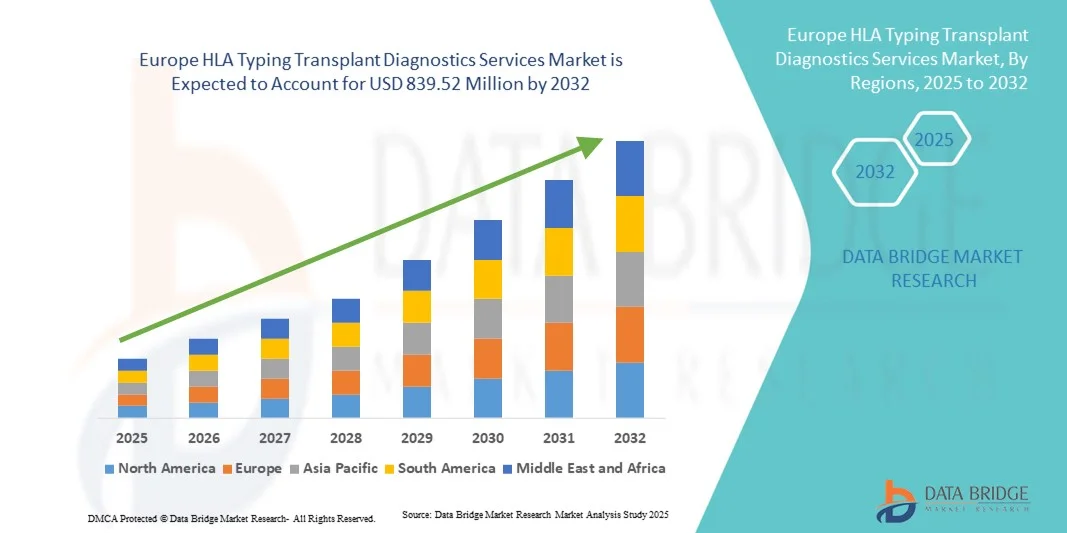

- The Europe HLA typing transplant diagnostics services market size was valued at USD 406.18 Million in 2024 and is expected to reach USD 839.52 Million by 2032, at a CAGR of 9.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced HLA typing technologies and rising demand for precise compatibility testing in organ and stem cell transplantation, leading to improved transplant success rates and patient outcomes

- Furthermore, growing awareness among healthcare providers and patients about the importance of accurate HLA matching, coupled with technological innovations such as next-generation sequencing (NGS) and high-resolution typing, is accelerating the uptake of HLA Typing Transplant Diagnostics Services solutions, thereby significantly boosting the industry's growth

Europe HLA Typing Transplant Diagnostics Services Market Analysis

- HLA Typing Transplant Diagnostics Services, which involve advanced molecular and immunogenetic techniques to match donors and recipients for organ and stem cell transplantation, are becoming increasingly critical in improving transplant success rates and reducing the risk of graft-versus-host disease. These services are widely used in hospitals, transplant centers, and specialized diagnostic laboratories due to their precision, reliability, and ability to guide personalized treatment decisions

- The rising demand for HLA typing transplant diagnostics services is primarily driven by the increasing number of organ and stem cell transplants globally, growing awareness among healthcare providers about the importance of donor-recipient compatibility, and technological advancements in molecular diagnostics, including next-generation sequencing (NGS) and high-resolution HLA typing platforms

- Germany dominated the HLA typing transplant diagnostics services market with the largest revenue share of 41.2% in 2024, supported by a strong healthcare infrastructure, a high volume of transplant procedures, government support for advanced diagnostics, and a well-established network of specialized laboratories. German hospitals and transplant centers have been early adopters of high-resolution HLA typing technologies, enabling precise donor-recipient matching and better patient outcomes. The presence of key industry players and ongoing R&D investments further reinforce Germany’s dominant position in the market

- The U.K. is expected to be the fastest-growing region in the HLA typing transplant diagnostics services market during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032, driven by the increasing number of organ and hematopoietic stem cell transplants, rising investments in next-generation sequencing and immunogenetic testing technologies, and growing awareness among clinicians and patients regarding the benefits of accurate HLA matching. The U.K. market growth is also supported by private healthcare providers and transplant networks expanding access to advanced HLA typing services

- The Diagnostic Applications segment dominated the HLA typing transplant diagnostics services market with the largest market revenue share of 62.3% in 2024, driven by widespread use in pre-transplant donor-recipient matching, post-transplant monitoring, and disease management

Report Scope and HLA Typing Transplant Diagnostics Services Market Segmentation

|

Attributes |

HLA Typing Transplant Diagnostics Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe HLA Typing Transplant Diagnostics Services Market Trends

Advancements in Molecular and High-Resolution HLA Typing

- A significant and accelerating trend in the Europe HLA typing transplant diagnostics services market is the growing adoption of advanced high-resolution molecular HLA typing and next-generation sequencing (NGS) technologies, which are fundamentally transforming transplant diagnostics

- These technologies allow for precise donor-recipient matching, improved detection of rare allelic variants, and a reduction in post-transplant complications such as graft-versus-host disease. Laboratories are increasingly integrating these technologies into automated workflows, which not only enhances efficiency but also ensures higher accuracy in reporting and compliance with regulatory standards

- For instance, in March 2024, Thermo Fisher Scientific launched a high-throughput NGS HLA typing platform specifically designed for clinical laboratories, allowing for rapid, accurate donor-recipient matching and enabling transplant centers to make faster, data-driven decisions that improve patient outcomes

- Integration of high-resolution HLA typing into hospital information systems and electronic health records further streamlines patient data management, allowing clinicians to monitor results in real time and coordinate transplant schedules more effectively. This trend is encouraging continuous innovation, including AI-assisted bioinformatics for analyzing complex HLA data and predictive analytics to optimize transplant compatibility

- The demand for increasingly precise, automated, and reliable HLA typing solutions is reshaping laboratory practices and expectations in the European transplant diagnostics market

Europe HLA Typing Transplant Diagnostics Services Market Dynamics

Driver

Growing Demand for Transplant Compatibility Testing

- The increasing number of organ and hematopoietic stem cell transplants worldwide, combined with the need to minimize post-transplant complications and maximize graft survival rates, is a primary driver for the HLA typing transplant diagnostics services market

- High-resolution typing and molecular diagnostics are becoming essential for hospitals, transplant centers, and specialized laboratories to ensure optimal donor-recipient matching and improved clinical outcomes

- For instance, in April 2024, a leading U.S. transplant center implemented comprehensive high-resolution HLA typing for all bone marrow donors, significantly improving patient matching accuracy, reducing complications, and enhancing long-term transplant success

- Furthermore, rising awareness among healthcare providers and patients about the critical role of HLA compatibility, coupled with technological advancements in sequencing platforms and immunogenetic testing, is accelerating adoption across globe

- Regulatory mandates requiring standardized testing and quality control in transplant procedures are also driving the integration of advanced HLA typing systems. Hospitals and laboratories increasingly prioritize the use of precise, automated, and scalable solutions, ensuring that the growing transplant volume can be managed efficiently without compromising safety or accuracy

- This combination of clinical necessity, technological innovation, and regulatory support continues to propel market growth

Restraint/Challenge

High Costs and Regulatory Complexities

- Despite the clear advantages of high-resolution HLA typing and advanced molecular diagnostics, the relatively high cost of next-generation sequencing platforms, reagents, and associated laboratory infrastructure remains a key barrier to widespread adoption. Smaller hospitals, clinics, and laboratories, particularly in developing regions, often face budget constraints that limit access to these advanced technologies

- In addition, the regulatory framework for clinical implementation of new HLA typing methods can be complex and time-consuming, creating delays in adoption and increasing operational costs

- For instance, several regional hospitals in Europe have postponed upgrading to NGS-based HLA typing due to budget limitations and the lengthy regulatory approval process, highlighting how cost and compliance challenges can hinder market expansion

- To overcome these barriers, companies and healthcare institutions are exploring cost-effective solutions, including collaborative models, leasing or shared-use programs, and training initiatives for laboratory personnel

- Ina ddition, efforts to simplify regulatory compliance, standardize protocols, and provide education on the clinical benefits of advanced HLA typing are critical for encouraging adoption

- Addressing both financial and regulatory challenges will be essential to ensure broader accessibility, foster innovation, and sustain long-term growth in the HLA Typing Transplant Diagnostics Services market

Europe HLA Typing Transplant Diagnostics Services Market Scope

The market is segmented on the basis of technology, product and service, application, and end-user.

- By Technology

On the basis of technology, the HLA typing transplant diagnostics services market is segmented into Molecular Assay Technologies and Non-molecular Assay Technologies. The Molecular Assay Technologies segment dominated the largest market revenue share of 57.8% in 2024, driven by the high sensitivity, accuracy, and reliability of PCR, next-generation sequencing (NGS), and other molecular methods in detecting HLA compatibility for transplant patients. These assays are preferred in hospitals and transplant centers due to their ability to provide precise and reproducible results in shorter turnaround times. Molecular technologies help reduce the risk of graft rejection, improve patient outcomes, and support complex organ and stem cell transplant procedures. They are critical for detecting rare alleles and ensuring high-resolution typing. Continuous innovation in assay design, automation, and workflow integration further strengthens their dominance. Adoption is also supported by regulatory requirements and clinical guidelines emphasizing molecular testing. Their application spans pre-transplant matching, post-transplant monitoring, and clinical research. The segment benefits from widespread acceptance in developed healthcare systems and high-volume transplant programs.

The Non-molecular Assay Technologies segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, fueled by increasing adoption in emerging markets and laboratories seeking cost-effective solutions. Non-molecular assays, including serological and flow cytometry-based methods, complement molecular assays by providing rapid and reliable HLA typing. These technologies are easier to implement in smaller labs, require less specialized infrastructure, and provide results suitable for routine screening and research applications. Integration with automated platforms is improving throughput and accuracy. The segment is also supported by the development of enhanced reagents and instruments that optimize performance. Laboratories in regions with limited access to high-end molecular platforms are increasingly using these assays. Their affordability, simplicity, and versatility are key drivers for adoption. Growth is further propelled by training programs, technical support from vendors, and increased awareness about HLA matching importance.

- By Product and Service

On the basis of product and service, the HLA typing transplant diagnostics services market is segmented into Reagents and Consumables, Instruments, and Software and Services. The Reagents and Consumables segment held the largest market revenue share of 49.6% in 2024, driven by the recurring need for high-quality reagents in both molecular and non-molecular assays. Reagents and consumables are essential for accurate, standardized, and reproducible results in transplant diagnostics. Hospitals, transplant centers, and reference laboratories rely on a consistent supply to manage high testing volumes. Continuous innovation in reagent formulations improves stability, sensitivity, and specificity. The segment benefits from the global increase in organ and stem cell transplant procedures. Adoption is supported by established vendor networks and strong customer relationships. Reagents are indispensable for pre-transplant, post-transplant, and research applications. High demand in developed markets ensures sustained revenue growth. Their use is critical for both routine and complex HLA typing workflows. The segment’s dominance is reinforced by compatibility with multiple assay platforms.

The Software and Services segment is expected to witness the fastest CAGR of 12.5% from 2025 to 2032, driven by the growing integration of laboratory information management systems (LIMS), cloud-based platforms, and automated reporting tools. These solutions allow seamless management of HLA typing results, reduce human error, and enhance operational efficiency. Software enables remote monitoring, data storage, and secure sharing of results with clinical teams. Adoption is rising in both diagnostic and research laboratories seeking workflow optimization. Vendors are offering integrated solutions that combine analysis, interpretation, and reporting. Increasing demand for digitalization, data standardization, and connectivity with electronic medical records supports growth. Automated reporting and analytics help laboratories meet regulatory compliance and accreditation requirements. The segment also benefits from growing use in translational research and academic projects. Enhanced cybersecurity features and user-friendly interfaces further accelerate adoption. Market expansion is supported by partnerships between software providers and HLA assay manufacturers.

- By Application

On the basis of application, the HLA typing transplant diagnostics services market is segmented into Diagnostic Applications and Research Applications. The Diagnostic Applications segment dominated the largest market revenue share of 62.3% in 2024, driven by widespread use in pre-transplant donor-recipient matching, post-transplant monitoring, and disease management. Hospitals and transplant centers rely heavily on diagnostic applications for accurate HLA typing to reduce graft-versus-host disease and improve transplant outcomes. The segment benefits from the high volume of organ and stem cell transplants globally. Integration of molecular and non-molecular assays ensures high-resolution typing and faster turnaround times. Adoption is supported by clinical guidelines emphasizing precision in transplant matching. Advanced instrumentation and reagents enhance efficiency, reliability, and reproducibility. Increasing awareness about the importance of HLA matching in improving survival rates drives market demand. Diagnostic applications are also critical for personalized medicine initiatives. Continuous innovation and regulatory support strengthen this segment’s market position.

The Research Applications segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, fueled by rising investments in immunogenetics, assay development, and personalized medicine research. Academic and translational research laboratories are increasingly adopting HLA typing to study transplant immunology, disease associations, and therapeutic outcomes. Collaboration between research institutes, hospitals, and diagnostic companies drives adoption. Research applications include validation of new assays, high-throughput studies, and bioinformatics analysis of HLA datasets. Growing focus on understanding genetic diversity and allele frequency in different populations supports expansion. Funding for transplant research and clinical trials is accelerating the segment. Integration of advanced molecular and non-molecular techniques enhances data accuracy and throughput. Emerging markets are adopting HLA typing in research programs for improved healthcare solutions. Technological innovation, digital tools, and bioinformatics platforms further propel growth.

- By End-User

On the basis of end-user, the HLA typing transplant diagnostics services market is segmented into Independent Reference Laboratories, Hospitals and Transplant Centers, and Research Laboratories and Academic Institutes. The Hospitals and Transplant Centers segment dominated the largest market revenue share of 53.7% in 2024, supported by the high number of transplant procedures and the critical requirement for accurate HLA matching. Hospitals remain the primary end-users, relying on HLA typing for pre-transplant compatibility, post-transplant monitoring, and clinical decision-making. Integration of molecular and non-molecular assays into hospital workflows ensures precise and timely results. Adoption is further strengthened by regulatory requirements, accreditation standards, and clinical guidelines. High throughput, reproducibility, and the availability of advanced platforms enhance efficiency. The segment’s dominance is fueled by increasing organ and stem cell transplant volumes globally. HLA typing is crucial to reduce graft rejection, optimize patient outcomes, and support personalized transplant strategies. Strong vendor support, training, and maintenance services also reinforce the market share.

The Research Laboratories and Academic Institutes segment is expected to witness the fastest CAGR of 11.7% from 2025 to 2032, driven by the growing focus on translational research, assay development, and personalized medicine initiatives in transplant immunology. Academic centers and research laboratories increasingly utilize HLA typing for understanding transplant immunology, allele frequency studies, and therapeutic response monitoring. Collaboration with diagnostic companies accelerates access to high-resolution typing technologies. Funding for research projects and clinical trials supports growth. Research applications include novel assay validation, bioinformatics analysis, and high-throughput studies. Expansion of personalized medicine programs drives adoption. Academic initiatives and government-supported programs further boost market penetration. Emerging markets are showing increasing interest in research-focused HLA typing. Technological innovations, including NGS and automated platforms, enhance efficiency. Integration of software solutions facilitates data management and result interpretation.

Europe HLA Typing Transplant Diagnostics Services Market Regional Analysis

- Germany dominated the HLA typing transplant diagnostics services market with the largest revenue share of 41.2% in 2024, supported by a strong healthcare infrastructure, a high volume of transplant procedures, government support for advanced diagnostics, and a well-established network of specialized laboratories. German hospitals and transplant centers have been early adopters of high-resolution HLA typing technologies, enabling precise donor-recipient matching and better patient outcomes. The presence of key industry players and ongoing R&D investments further reinforce Germany’s dominant position in the market

- The U.K. is expected to be the fastest-growing region in the HLA typing transplant diagnostics services market during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032, driven by the increasing number of organ and hematopoietic stem cell transplants, rising investments in next-generation sequencing and immunogenetic testing technologies, and growing awareness among clinicians and patients regarding the benefits of accurate HLA matching

- The region is witnessing notable expansion across clinical applications, academic research, and hospital-based laboratories, with German institutions playing a key role in setting standards for high-resolution HLA typing and ensuring better patient outcomes

Germany HLA Typing Transplant Diagnostics Services Market Insight

The Germany HLA typing transplant diagnostics services market is expected to dominate the European landscape with the largest revenue share of 41.2% in 2024, supported by a robust healthcare infrastructure, a high volume of transplant procedures, government support for advanced diagnostics, and a well-established network of specialized laboratories. German hospitals and transplant centers have been early adopters of high-resolution HLA typing technologies, enabling precise donor-recipient matching and improved patient outcomes. Ongoing R&D investments, the presence of key industry players, and emphasis on innovation and quality further reinforce Germany’s leading position in the market.

U.K. HLA Typing Transplant Diagnostics Services Market Insight

The U.K. HLA typing transplant diagnostics services market is expected to be the fastest-growing region during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032. This growth is primarily driven by the increasing number of organ and hematopoietic stem cell transplants, rising adoption of next-generation sequencing (NGS) and immunogenetic testing technologies, and growing awareness among clinicians and patients regarding the benefits of precise HLA matching. Academic and research institutions, along with major hospital networks, are actively expanding their diagnostic capabilities to enhance transplant success rates. Furthermore, the market is supported by private healthcare providers and transplant networks that are improving access to advanced HLA typing services. Government initiatives and funding programs aimed at advancing transplant diagnostics are also expected to stimulate growth, ensuring broader adoption of high-resolution HLA typing technologies across clinical and research applications in the U.K.

Europe HLA Typing Transplant Diagnostics Services Market Share

The HLA Typing Transplant Diagnostics Services industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Qiagen (Germany)

- Immucor, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- CareDx, Inc. (U.S.)

- GenDx (Netherlands)

- Olerup SSP (Sweden)

- Ortho Clinical Diagnostics (U.S.)

- Eurofins Scientific (Luxembourg)

- HistoGenetics, Inc. (U.S.)

Latest Developments in Europe HLA Typing Transplant Diagnostics Services Market

- In September 2021, Thermo Fisher Scientific launched advancements in organ transplant matching during the American Society for Histocompatibility and Immunogenetics (ASHI) 2021 conference. These advancements aimed to enhance the accuracy and efficiency of HLA typing for deceased donor organs, supporting improved transplant outcomes across Europe

- In March 2025, Thermo Fisher Scientific introduced a next-generation HLA typing kit utilizing hybrid capture next-generation sequencing (NGS). This kit offers enhanced accuracy, flexible testing for HLA Class I/II, and a streamlined workflow, aiming to improve immunogenetics research and clinical diagnostics in Europe

- In June 2025, the European Commission launched the GenAI4EU initiative, providing funding opportunities to integrate generative Artificial Intelligence (AI) in Europe's strategic sectors, including healthcare and diagnostics. This initiative aims to support the development and deployment of AI technologies, potentially enhancing HLA typing processes and transplant diagnostics in Europe

- In July 2025, the European Medicines Agency (EMA) approved a new stem cell therapy, Zemcelpro, for patients with blood cancers who require a blood stem cell transplant but have no suitable donor. This approval underscores the growing importance of HLA typing in identifying compatible donors for stem cell transplants in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.