Europe Indoor Led Lighting Market

Market Size in USD Billion

CAGR :

%

USD

12.88 Billion

USD

34.58 Billion

2024

2032

USD

12.88 Billion

USD

34.58 Billion

2024

2032

| 2025 –2032 | |

| USD 12.88 Billion | |

| USD 34.58 Billion | |

|

|

|

|

Indoor led lighting Market Size

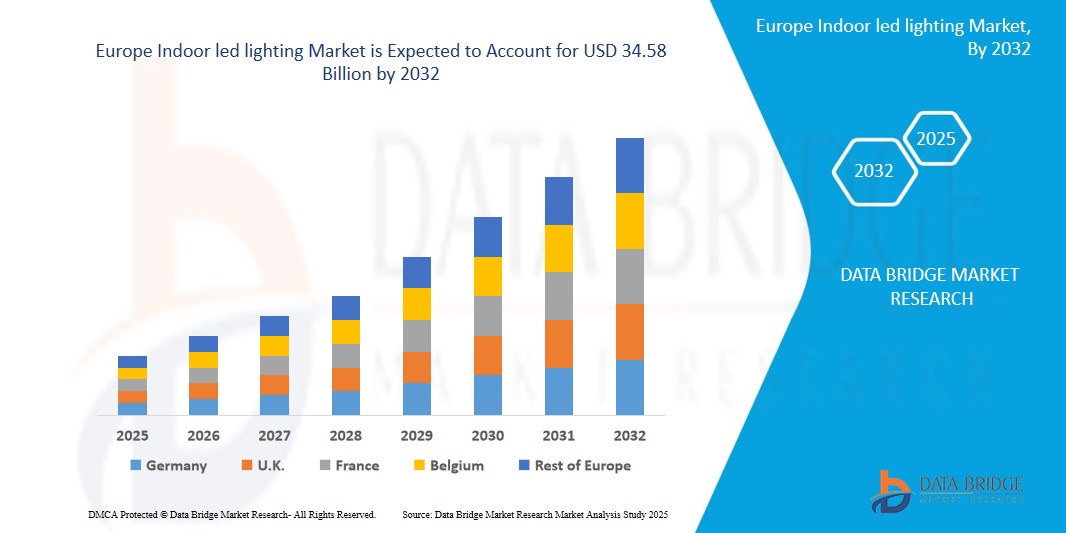

- The Europe indoor led lighting market size was valued at USD 12.88 billion in 2024 and is expected to reach USD 34.58 billion by 2032, at a CAGR of 15.2% during the forecast period

- This significant market growth is primarily driven by stringent energy efficiency regulations, increasing demand for sustainable lighting solutions, and supportive government policies across the region that promote the adoption of green technologies to reduce carbon emissions.

- Additionally, the rising integration of smart lighting systems, offering advanced automation and user-friendly controls, is fueling consumer and business interest across residential, commercial, and institutional sectors. The declining cost of LED components, coupled with growing environmental consciousness, is further establishing indoor LED lighting as the preferred illumination solution, accelerating market expansion.

Indoor led lighting Market Analysis

- Indoor LED lighting, encompassing a wide array of energy-efficient lamps and luminaires, has emerged as a pivotal technology in modern illumination across Europe, delivering superior energy savings, exceptional durability, and versatile design options compared to traditional incandescent and fluorescent lighting systems.

- The surge in market demand is propelled by regional initiatives aimed at energy conservation, rapid adoption of smart building technologies, and increasing retrofitting of existing infrastructure with LED solutions, enhancing both functionality and aesthetic appeal in diverse settings.

- Germany dominates the European market, capturing 25.6% of regional revenue in 2025, driven by its leadership in sustainable building technologies, advanced infrastructure, and strong consumer demand for eco-conscious lighting. The United Kingdom is witnessing rapid growth, fueled by government-backed energy efficiency programs and rising smart home adoption.

- The luminaires segment is expected to lead the market with a share of 61.5% in 2025, attributed to its widespread use in commercial and institutional applications, where it offers enhanced lighting performance, design flexibility, and compatibility with smart control systems.

- The market is further supported by Europe’s strong focus on sustainability, with initiatives like the EU’s Green Deal and Ecodesign Directive encouraging the transition to energy-efficient lighting solutions across urban and rural areas.

Report Scope and Indoor led lighting Market Segmentation

|

Attributes |

Indoor led lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Indoor led lighting Market Trends

“Advancements in Smart Lighting with IoT and Voice-Controlled Ecosystems”

- A defining trend in the Europe indoor LED lighting market is the deepening integration of LED lighting systems with Internet of Things (IoT) platforms and voice-controlled ecosystems, such as Amazon Alexa, Google Assistant, and Apple HomeKit, significantly enhancing user convenience, energy efficiency, and personalized lighting experiences.

- For instance, Signify’s Philips Hue ecosystem enables users to control LED lighting through voice commands or intuitive mobile applications, offering customized lighting scenes, automated schedules, and dynamic ambiance adjustments tailored to individual preferences. Similarly, Osram’s LIGHTIFY system provides seamless compatibility with smart home platforms popular across Europe.

- IoT-enabled LED lighting systems introduce advanced features such as occupancy sensing, daylight harvesting, and real-time energy monitoring, optimizing energy consumption in residential, commercial, and institutional environments. For example, Zumtobel’s LITECOM platform leverages IoT to deliver data-driven lighting management for commercial buildings, enhancing operational efficiency.

- The integration of LED lighting with smart building management systems facilitates centralized control of lighting, heating, ventilation, air conditioning (HVAC), and security through unified interfaces, creating sustainable and user-centric environments, particularly in modern urban centers like Berlin, London, and Paris.

- Companies like Thorn Lighting are developing AI-enhanced LED solutions that intelligently adapt to user behavior and environmental conditions, such as adjusting brightness and color temperature based on natural light levels or occupancy patterns, improving comfort and energy savings.

- The growing demand for interconnected, intelligent, and environmentally sustainable lighting solutions is reshaping the market, with consumers and businesses prioritizing systems that combine advanced functionality, sustainability, and compatibility with European smart home and building standards.

Indoor led lighting Market Dynamics

Driver

“Stringent Energy Efficiency Regulations and Sustainability Goals”

- The robust emphasis on energy conservation across Europe, coupled with stringent regulatory frameworks like the EU’s Ecodesign Directive and Energy Labeling Regulation, serves as a primary catalyst for the growth of the indoor LED lighting market.

- For instance, in June 2024, the European Union updated its eco-design requirements for lighting products, incentivizing the adoption of LED solutions to meet ambitious carbon neutrality goals by 2050. Similarly, the UK’s Energy Saving Trust programs promote LED adoption to reduce energy consumption.

- LED lighting consumes up to 80% less energy than traditional lighting, offering significant cost savings and a reduced carbon footprint, making it a preferred choice for sustainable buildings, commercial facilities, and residential properties.

- The increasing adoption of smart building and home automation systems, which rely on LED lighting for energy-efficient operations and advanced control features, is further accelerating demand across applications, from office complexes to heritage buildings.

- The continuous decline in LED component costs, combined with the availability of retrofit solutions, is making energy-efficient lighting more accessible, particularly in countries with high energy costs like Germany and France.

Restraint/Challenge

“High Initial Costs and Compatibility Challenges in Legacy Infrastructure”

- The high upfront cost of advanced LED lighting systems, particularly those equipped with smart and IoT-enabled features, remains a significant barrier to adoption, especially for small businesses, budget-conscious homeowners, and public institutions in less affluent European regions.

- For example, premium smart LED systems from brands like Philips Hue or Artemide can be costly compared to conventional lighting, deterring price-sensitive consumers despite long-term energy savings.

- Compatibility issues with legacy electrical infrastructure and diverse smart home ecosystems pose challenges, as some LED systems require specific protocols (e.g., Zigbee, DALI) or hubs, which may not align with older buildings or regional standards in countries like Italy or Spain.

- Addressing these challenges through cost-reduction strategies, standardized protocols, and consumer education on the long-term financial and environmental benefits of LED lighting is essential for sustained market growth and broader adoption across Europe.

Indoor led lighting Market Scope

The market is segmented based on product type, application, installation type, connectivity, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into lamps and luminaires. The luminaires segment dominates, holding a substantial market share of 61.5% in 2025, driven by its widespread adoption in commercial, institutional, and industrial applications across urban centers like Frankfurt, London, and Milan. Luminaires offer superior design flexibility, high energy efficiency, and seamless integration with smart lighting systems, making them ideal for large-scale installations in offices, retail spaces, and educational facilities. The lamps segment, including retrofit LED bulbs and tubes, is projected to grow at a robust CAGR of 13.8% from 2025 to 2032, fueled by increasing demand for cost-effective replacements for traditional lighting in residential and small commercial settings..

- By Application

On the basis of application, the market is segmented into commercial, residential, industrial, institutional, and others. The commercial segment holds the largest share in 2025, driven by the adoption of LED lighting in office buildings, retail stores, hospitality venues, and healthcare facilities, where energy efficiency and aesthetic appeal are paramount. The residential segment is anticipated to witness the fastest CAGR of 14.6% from 2025 to 2032, propelled by the growing popularity of smart home lighting, increasing consumer awareness of energy savings, and the rising trend of home automation in urban households.

- By Installation Type

On the basis of installation type, the market is segmented into new installation and retrofit. The retrofit segment dominates in 2025, as businesses and homeowners replace outdated lighting with LED solutions to reduce energy costs and comply with stringent EU energy regulations. The new installation segment is expected to grow rapidly, driven by the surge in construction of smart buildings, green-certified projects, and modern residential complexes in cities like Amsterdam, Stockholm, and Madrid.

- By Connectivity

On the basis of connectivity, the market is segmented into wired and wireless. The wireless segment holds the largest share in 2025, driven by the rapid adoption of IoT-enabled and smart lighting systems that offer remote control, automation, and integration with platforms like Apple HomeKit and Google Assistant. The wired segment remains relevant for industrial and institutional applications, where stable connectivity is essential for large-scale deployments in factories and universities.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The online segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the convenience of e-commerce platforms like Amazon, El Corte Inglés, and Bauhaus, and the growing trend of online purchasing among tech-savvy consumers in urban areas. The offline segment, including traditional retail and specialty lighting stores, remains significant for commercial and institutional buyers who prefer in-person consultations and bulk purchasing.

Indoor led lighting Market Regional Analysis

- Germany dominates the Europe indoor LED lighting market, capturing a revenue share of 25.6% in 2025, driven by its leadership in sustainable building technologies, advanced infrastructure, and strong government support for energy efficiency.

- The region benefits from widespread adoption of smart lighting in commercial, residential, and public sectors, supported by stringent EU regulations, increasing consumer awareness, and a focus on sustainability across countries like France, the United Kingdom, and the Netherlands.

Germany Indoor LED Lighting Market Insight

Germany accounts for the largest share of the European market in 2025, fueled by its advanced technological ecosystem, strong focus on smart city and green building initiatives, and high consumer demand for eco-conscious lighting solutions. The integration of LED lighting with IoT platforms and the availability of high-quality, domestically produced LED products are driving market growth in commercial, residential, and institutional applications.

United Kingdom Indoor LED Lighting Market Insight

The United Kingdom’s indoor LED lighting market is projected to grow at the fastest CAGR of 14.2% during the forecast period, driven by government programs like the Energy Saving Trust, increasing adoption of smart home technologies, and rising consumer awareness of energy-efficient lighting. The demand for retrofit LED solutions in historic buildings and commercial properties is also contributing to market expansion.

France Indoor LED Lighting Market Insight

France’s market is anticipated to grow at a significant CAGR, driven by its commitment to sustainability, government incentives for energy-efficient lighting, and growing adoption of smart building systems. The demand for aesthetically pleasing LED solutions in residential and hospitality sectors is gaining traction, particularly in Paris and other urban centers.

Netherlands Indoor LED Lighting Market Insight

The Netherlands’ indoor LED lighting market is expected to expand at a notable CAGR, fueled by its leadership in smart city development, strong focus on green building certifications, and consumer demand for innovative lighting solutions. The integration of LED lighting with advanced building management systems is prevalent, driven by the country’s emphasis on energy efficiency and sustainability.

Indoor led lighting Market Share

The indoor led lighting industry is primarily led by well-established companies, including:

- Signify (Philips Lighting) (Netherlands)

- Osram GmbH (Germany)

- Zumtobel Group AG (Austria)

- Thorn Lighting (United Kingdom)

- Fagerhult Group (Sweden)

- Trilux GmbH & Co. KG (Germany)

- Siteco GmbH (Germany)

- Legrand SA (France)

- Regiolux GmbH (Germany)

- Ridi Lighting (Germany)

- Flos S.p.A. (Italy)

- Artemide S.p.A. (Italy)

- iGuzzini Illuminazione S.p.A. (Italy)

- ERCO GmbH (Germany)

- Louis Poulsen (Denmark)

- Delta Light (Belgium)

- Modular Lighting Instruments (Belgium)

- Glamox AS (Norway)

- Nordeon Group (Netherlands)

- Schréder SA (Belgium)

Latest Developments in Europe Indoor led lighting Market

- In September 2024, Signify (Philips Lighting) launched its EcoLumen Smart LED series, a next-generation lighting solution designed for commercial and residential applications across Europe. Featuring advanced IoT integration, compatibility with Amazon Alexa, Google Assistant, and Apple HomeKit, and up to 40% energy savings, this series addresses the region’s demand for sustainable and connected lighting systems.

- In August 2024, Osram GmbH introduced its IntelliLux LED platform, a smart lighting solution tailored for large-scale commercial installations, such as office buildings and retail spaces in Germany and France. This platform incorporates AI-driven controls and DALI compatibility, enhancing energy efficiency and user comfort.

- In July 2024, Zumtobel Group AG partnered with Siemens to integrate its LITECOM Infinity system with Siemens’ Building X platform, enabling real-time lighting management and energy optimization for smart buildings across Europe, reinforcing the push toward intelligent infrastructure.

- In June 2024, Thorn Lighting unveiled its UrbanGlow LED series, a tunable lighting solution designed for institutional applications, such as schools and hospitals in the UK. This series supports circadian rhythm alignment, promotes occupant well-being, and delivers significant energy savings, aligning with EU sustainability goals.

- In May 2024, Fagerhult Group launched its FlexiLED system, a modular and customizable LED lighting solution for industrial and commercial environments in Scandinavia. Featuring IoT-enabled controls and compliance with EU eco-design standards, this system enhances operational efficiency and supports green building certifications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Indoor Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Indoor Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Indoor Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.