Europe Infection Control Market

Market Size in USD Million

CAGR :

%

USD

8,934.67 Million

USD

26,580.03 Million

2022

2030

USD

8,934.67 Million

USD

26,580.03 Million

2022

2030

| 2023 –2030 | |

| USD 8,934.67 Million | |

| USD 26,580.03 Million | |

|

|

|

|

Europe Infection Control Market Analysis and Size

According to the data provided by the WHO, Acute Respiratory Diseases (ARDs) are one of the main reasons for the high mortality rates experienced. Every year, ARDs are responsible for over 4.0 million deaths. The data given above demonstrate the critical necessity for strict prevention and control. The majority of all hospital-acquired infections are caused by illnesses such as pneumonia and infections of the bloodstream, urinary system, surgical site, and MRSA. The infections may be transmitted directly or indirectly from one person to another through contaminated or unsterilized surgical or medical equipment used to treat a patient or from a contaminated environment in a healthcare facility.

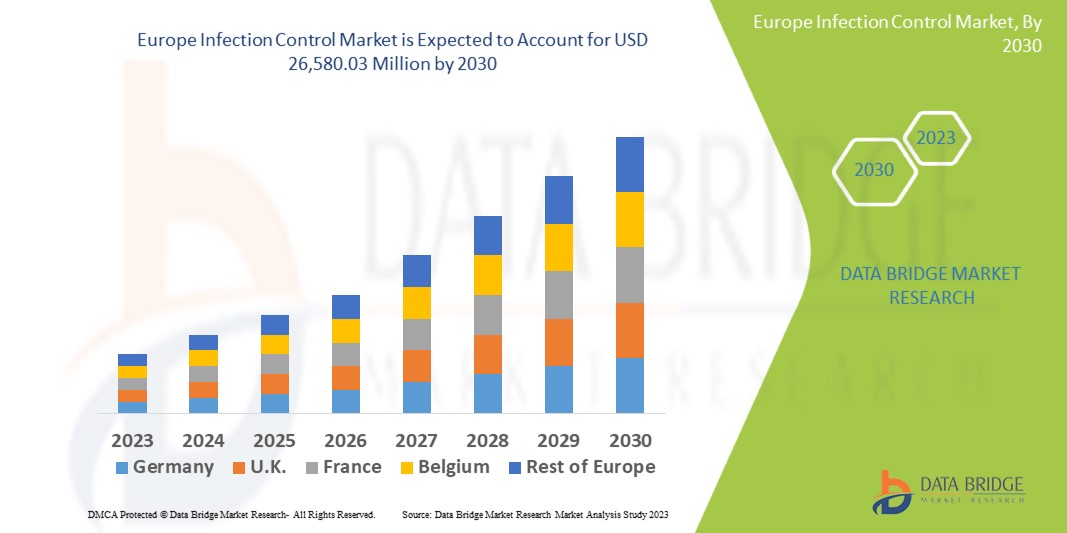

Data Bridge Market Research analyses that the infection control market which is USD 8,934.67 million in 2022, is expected to reach USD 26,580.03 million by 2030, at a CAGR of 14.60% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Europe Infection Control Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Sterilization, Cleaning and Disinfection, Personal Protective Barriers, Endoscope Reprocessing, Anti-Microbial Surfaces, Other Infection Control), Application (Surgical Instruments, Endoscopes, Ultrasound Probes, Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributors), End User (Hospitals, Clinics, Medical Device Companies, Pharmaceutical and Biotechnology Companies, Laboratories, Others) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

STERIS plc (U.S.), Sotera Health Company (U.S.), Getinge AB (Sweden), Advanced Sterilization Products (ASP) (U.S.), Ecolab Inc. (U.S.), 3M (U.S.), MATACHANA GROUP (Spain), MMM Group (Germany), Belimed AG (Switzerland), Reckitt Benckiser (U.K.), Metrex Research LLC (U.K.), Miele Group (Germany), Pal International (U.K.), MELAG Medizintechnik GmbH & Co. KG (Germany), Contec, Inc. (U.S.), MEDALKAN (Greece), Systec GmbH (Germany), C.B.M. S.r.l. Medical Equipment (Italy), Continental Equipment Company (U.S.), and BGS Beta-Gamma-Service GmbH & Co. KG (Germany) |

|

Market Opportunities |

|

Market Definition

The process of infection control is used in the healthcare sector to stop or prevent the spread of infections. The activity of infection control involves getting rid of bacteria from various surfaces and things. This procedure makes it possible for people to avoid disease transmission and pollution. A scientific strategy called infection control is intended to stop the harm infections can do to patients and healthcare professionals. In all healthcare settings, infection control is necessary to stop the spread of infectious diseases. It can be described as a set of generally accepted suggestions used to decrease the danger of infectious agents being transmitted by environmental or bodily fluids.

Europe Infection Control Market Dynamics

Drivers

- Rising government organizations

In the forecast period, the market is expected to develop as a result of the rising involvement of governmental organizations in the publication of recommendations to spread knowledge about practical preventative strategies. For instance, the World Health Organization (WHO) has issued guidelines in healthcare for the prevention and control of pandemic and epidemic-prone acute respiratory diseases. The guidelines cover everything from standard precautions such as hand hygiene and the use of personal protective equipment to disinfection and sterilization procedures.

- Increase in hospitalization

According to a WHO guidelines on HAI prevention, the increase in hospitalization duration with surgical infections was found to be approximately eight days. These extended stays are expected to contribute significantly to the overall costs incurred during the hospitalization, raising the clinical urgency for implementing infection prevention measures. It is assumed that a prolonged hospital stay is also not cost effective for hospitals and healthcare payers due to the excessive use of resources to treat the acquired infection. These additional costs are primarily caused by increased drug usage, additional diagnostic studies, and laboratory equipment, resulting in a resource allocation imbalance.

Opportunities

- Increasing use of e-beam sterilization

Beta radiation, often known as electron-beam irradiation, is frequently used to sterilize medical equipment and pharmaceutical packaging. It works by continuously passing electrons through the items being sterilized. The benefit of this treatment is that it offers quick-turn terminal sterilization using straightforward, hygienic on/off technology. The product can be distributed right away because no residuals or radioactive or carcinogenic gas sources are required. The market for infection control is anticipated to have considerable expansion during the forecast period as a result of the expanding applications of e-beam sterilization and its adoption among various end-user sectors.

Restraints/Challenges

- Concerns about the safety of the processed instruments

Concerns about the safety of the processed instruments used in surgeries are extremely dangerous for patients as well as healthcare workers or professionals, resulting in the spread of infection and acting as a restraint factor hampered the growth of the infection control market.

This infection control market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the infection control market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, Getinge AB launched superfast indicators to further ensure patient safety. The new Superfast 20 indicators are ISO 11138 compliant and compatible with most steam and hydrogen peroxide process sterilizers. This product launch will assist the company in increasing its market share in the global patient safety market.

- In 2019, Cardinal Health announced the acquisition of mscripts, a company that provides patient adherence and engagement solutions through an innovative, user-friendly mobile and web-based health management platform. This will assist the company in promoting patient adherence to prescriptions and improving overall health outcomes.

Europe Infection Control Market Scope

The infection control market is segmented on the basis of product, application, distribution channel and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Sterilization

- Cleaning and Disinfection

- Personal Protective Barriers

- Endoscope Reprocessing

- Anti-Microbial Surfaces

- Other Infection Control

Application

- Surgical Instruments

- Endoscopes

- Ultrasound Probes

- Others

Distribution Channel

- Direct Tender

- Retail Sales

- Third Party Distributors

End User

- Hospitals

- Clinics

- Medical Device Companies

- Pharmaceutical and Biotechnology Companies

- Laboratories

- Others

Infection Control Market Regional Analysis/Insights

The infection control market is analyzed and market size insights and trends are provided by country, product, application, distribution channel and end user as referenced above.

The countries covered in the infection control market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

France is expected to grow with the most promising growth rate in the forecast period of 2023 to 2030 due to rising healthcare spending and an increase in infectious disease prevalence in the area.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The infection control market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for infection control market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the infection control market. The data is available for historic period 2011-2021.

Competitive Landscape and Infection Control Market Share Analysis

The infection control market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to infection control market.

Some of the major players operating in the infection control market are:

- STERIS plc (U.S.)

- Sotera Health Company (U.S.)

- Getinge AB (Sweden)

- Advanced Sterilization Products (ASP) (U.S.)

- Ecolab Inc. (U.S.)

- 3M (U.S.)

- MATACHANA GROUP (Spain)

- MMM Group (Germany)

- Belimed AG (Switzerland)

- Reckitt Benckiser (U.K.)

- Metrex Research LLC (U.K.)

- Miele Group (Germany)

- Pal International (U.K.)

- MELAG Medizintechnik GmbH & Co. KG (Germany)

- Contec, Inc. (U.S.)

- MEDALKAN (Greece)

- Systec GmbH (Germany)

- C.B.M. S.r.l. Medical Equipment (Italy)

- Continental Equipment Company (U.S.)

- BGS Beta-Gamma-Service GmbH & Co. KG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE INFECTION CONTROL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE INFECTION CONTROL MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE INFECTION CONTROL MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 EUROPE INFECTION CONTROL MARKET, BY PRODUCT AND SERVICE

16.1 OVERVIEW

16.2 PRODUCTS

16.2.1 STERILIZATION PRODUCTS

16.2.1.1. STERILIZATION EQUIPMENT

16.2.1.1.1. HEAT STERILIZATION EQUIPMENT

16.2.1.1.1.1 MOIST HEAT STERILIZERS

16.2.1.1.1.1.1. MARKET SHARE (USD)

16.2.1.1.1.1.2. MARKET VOLUME (UNIT)

16.2.1.1.1.1.3. AVERAGE SELLING PRICE (USD)

16.2.1.1.1.2 DRY HEAT STERILIZERS

16.2.1.1.2. LOW TEMPERATURE STERILIZATION

16.2.1.1.2.1 HYDROGEN PEROXIDE STERILIZATION

16.2.1.1.2.2 ETHYLENE OXIDE STERILIZATION (ETO)

16.2.1.1.2.3 FORMALDEHYDE STERILIZATION

16.2.1.1.2.4 OTHER LOW-TEMPERATURE STERILIZATION

16.2.1.1.3. RADIATION STERILIZATION

16.2.1.1.4. FILTRATION STERILIZATION

16.2.1.1.5. OTHER EQUIPMENT

16.2.1.2. CONSUMABLES AND ACCESSORIES

16.2.1.2.1. STERILIZATION INDICATORS

16.2.1.2.2. CHEMICAL INDICATORS

16.2.1.2.3. BIOLOGICAL INDICATORS

16.2.1.2.4. PACKAGING ACCESSORIES

16.2.1.2.5. OTHERS

16.2.2 CLEANING AND DISINFECTION PRODUCTS

16.2.2.1. DISINFECTANTS

16.2.2.1.1. BY PRODUCT TYPE

16.2.2.1.1.1 HAND DISINFECTANTS

16.2.2.1.1.1.1. BY TYPE

A. ALCOHOL BASED

I. ETHANOL (ETHYL ALCOHOL)

II. ISOPROPYL ALCOHOL (ISOPROPANOL OR 2-PROPANOL)

III. OTHERS

B. ALCOHOL FREE

I. CHLORHEXIDINE

II. CHLOROXYLENOL

III. HYDROXYACETOPHENONE

IV. IODINE

V. TRICLOSAN

VI. OTHERS

16.2.2.1.1.1.2. BY DOSAGE

A. FOAM

B. GEL

C. LIQUID

D. WIPES

E. OTHERS

16.2.2.1.1.1.3. BY EPA CLASSIFICATION

A. LOW-LEVEL DISINFECTANTS

I. QUATERNARY AMMONIUM COMPOUNDS

II. IODOPHORS

III. PHENOLICS

B. INTERMEDIATE-LEVEL DISINFECTANTS

I. PHENOLS

II. CHLORINE COMPOUNDS

III. OTHERS

C. HIGH-LEVEL DISINFECTANTS

I. CHLORHEXIDINE

II. CHLOROXYLENOL

III. SUPEROXIDIZED WATER

IV. OTHERS

16.2.2.1.1.2 SURFACE DISINFECTANTS

16.2.2.1.1.2.1. ALCOHOL BASED

A. ETHANOL (ETHYL ALCOHOL)

B. ISOPROPYL ALCOHOL (ISOPROPANOL OR 2-PROPANOL)

16.2.2.1.1.2.2. ALCOHOL FREE

A. CHLORHEXIDINE

B. CHLOROXYLENOL

C. HYDROXYACETOPHENONE

D. IODINE

E. TRICLOSAN

F. OTHERS

16.2.2.1.1.2.3. BY DOSAGE

A. FOAM

B. GEL

C. LIQUID

D. WIPES

E. OTHERS

16.2.2.1.1.2.4. BY EPA CLASSIFICATION

A. LOW-LEVEL DISINFECTANTS

I. QUATERNARY AMMONIUM COMPOUNDS

II. IODOPHORS

III. PHENOLICS

B. INTERMEDIATE-LEVEL DISINFECTANTS

I. PHENOLS

II. CHLORINE COMPOUNDS

III. OTHERS

C. HIGH-LEVEL DISINFECTANTS

I. CHLORHEXIDINE

II. CHLOROXYLENOL

III. SUPEROXIDIZED WATER

IV. OTHERS

16.2.2.1.1.3 SKIN DISINFECTANTS

16.2.2.1.1.3.1. ALCOHOL BASED

16.2.2.1.1.3.2. ETHANOL (ETHYL ALCOHOL)

16.2.2.1.1.3.3. ISOPROPYL ALCOHOL (ISOPROPANOL OR 2-PROPANOL)

A. ALCOHOL FREE

I. CHLORHEXIDINE

II. CHLOROXYLENOL

III. HYDROXYACETOPHENONE

IV. IODINE

V. TRICLOSAN

VI. OTHERS

16.2.2.1.1.3.4. BY DOSAGE

A. FOAM

B. GEL

C. LIQUID

D. WIPES

E. OTHERS

16.2.2.1.1.3.5. BY EPA CLASSIFICATION

A. LOW-LEVEL DISINFECTANTS

I. QUATERNARY AMMONIUM COMPOUNDS

II. IODOPHORS

III. PHENOLICS

B. INTERMEDIATE-LEVEL DISINFECTANTS

I. PHENOLS

II. CHLORINE COMPOUNDS

III. OTHERS

C. HIGH-LEVEL DISINFECTANTS

I. CHLORHEXIDINE

II. CHLOROXYLENOL

III. SUPEROXIDIZED WATER

IV. OTHERS

16.2.2.1.1.4 INSTRUMENT DISINFECTANTS

A. ALCOHOL BASED

I. ETHANOL (ETHYL ALCOHOL)

II. ISOPROPYL ALCOHOL (ISOPROPANOL OR 2-PROPANOL)

B. ALCOHOL FREE

I. CHLORHEXIDINE

II. CHLOROXYLENOL

III. HYDROXYACETOPHENONE

IV. IODINE

V. TRICLOSAN

VI. OTHERS

16.2.2.1.1.4.2. BY DOSAGE

A. FOAM

B. GEL

C. LIQUID

D. WIPES

E. OTHERS

16.2.2.1.1.4.3. BY EPA CLASSIFICATION

A. LOW-LEVEL DISINFECTANTS

I. QUATERNARY AMMONIUM COMPOUNDS

II. IODOPHORS

III. PHENOLICS

B. INTERMEDIATE-LEVEL DISINFECTANTS

I. PHENOLS

II. CHLORINE COMPOUNDS

III. OTHERS

C. HIGH-LEVEL DISINFECTANTS

I. CHLORHEXIDINE

II. CHLOROXYLENOL

III. SUPEROXIDIZED WATER

IV. OTHERS

16.2.2.2. CLEANING AND DISINFECTION EQUIPMENT

16.2.2.2.1. WASHER DISINFECTORS

16.2.2.2.1.1 SINGLE-CHAMBER WASHERS

16.2.2.2.1.2 MULTI-CHAMBER WASHERS

16.2.2.2.1.3 GENERATION WASHER/DISINFECTORS

16.2.2.2.2. FLUSHER DISINFECTORS

16.2.2.2.2.1 FRONT LOADING

16.2.2.2.2.2 TOP LOADING

16.2.2.2.3. UV-RAY DISINFECTORS

16.2.2.2.3.1 BY TYPE OF RAYS

16.2.2.2.3.1.1. UV- RAY A

16.2.2.2.3.1.2. UV-RAY B

16.2.2.2.3.2 BY TYPE

16.2.2.2.3.2.1. FLOOR STANDING

16.2.2.2.3.2.2. BENCH TYPE

16.2.2.2.4. ULTRASONIC CLEANERS

16.2.2.2.4.1 BY TYPE

16.2.2.2.4.1.1. EQUIPMENTS

16.2.2.2.4.1.2. VIALS

16.2.2.2.4.1.3. BOTTLES

16.2.2.2.4.1.4. SYRINGES

16.2.2.2.4.2 BY ACCESSORIES

16.2.2.2.4.2.1. SINK

16.2.2.2.4.2.2. CLEANSER

16.2.2.2.5. OTHER CLEANING AND DISINFECTION EQUIPMENT

16.2.2.3. LUBRICANTS AND CLEANING SOLUTIONS

16.2.2.3.1. HYPOCHLORITE

16.2.2.3.2. ALCOHOLS

16.2.2.3.3. CHLORINE DIOXIDE

16.2.2.3.4. HYDROGEN PEROXIDE & PERACETIC ACID

16.2.2.3.5. IODOPHOR DISINFECTANT

16.2.2.3.6. QUATERNARY AMMONIUM COMPOUNDS

16.2.2.4. DISINFECTION AND CLEANING ACCESSORIES

16.2.2.4.1. CLEANING TROLLEYS

16.2.2.4.2. CLEANING STATIONS

16.2.3 PERSONAL PROTECTIVE BARRIERS

16.2.3.1. MEDICAL NONWOVENS

16.2.3.1.1. SURGICAL DRAPES

16.2.3.1.1.1 GENERAL SURGERY

16.2.3.1.1.2 ORTHOPEDIC SURGERY

16.2.3.1.1.3 CARDIAC SURGERY

16.2.3.1.1.4 FOR GYNECOLOGICAL SURGERY

16.2.3.1.1.5 UROLOGIC SURGERY

16.2.3.1.1.6 ANGIOGRAPHY

16.2.3.1.1.7 DENTAL SURGERY

16.2.3.1.1.8 CRANIOTOMY

16.2.3.1.1.9 OPHTHALMIC SURGERY

16.2.3.1.1.10 ENT SURGERY

16.2.3.1.1.11 OTHERS

16.2.3.1.2. SURGICAL GOWNS

16.2.3.1.2.1 BY USE

16.2.3.1.2.1.1. HEALTHCARE STAFF

16.2.3.1.2.1.2. PATIENT / VISITOR

16.2.3.1.2.1.3. LABORATORY STAFF

16.2.3.1.2.1.4. OTHERS

16.2.3.1.2.2 BY MATERIAL

16.2.3.1.2.2.1. POLYPROPYLENE

16.2.3.1.2.2.2. POLYETHYLENE

16.2.3.1.2.2.3. POLYESTER

16.2.3.1.2.2.4. COTTON

16.2.3.1.2.2.5. VISCOSE

16.2.3.1.2.2.6. OTHERS

16.2.3.1.3. FACE MASKS

16.2.3.1.3.1 FACIAL VENTILATION MASKS

16.2.3.1.3.2 FACIAL LARYNGEAL MASKS

16.2.3.1.3.3 HALF-MASKS FACE-SHIELDS

16.2.3.1.3.4 FACIAL ANESTHESIA MASKS

16.2.3.1.3.5 FACIAL NEBULIZATION MASKS

16.2.3.1.3.6 FACIAL RESUSCITATION MASKS

16.2.3.1.3.7 OTHERS

16.2.3.2. FACE SHIELDS

16.2.3.2.1. FULL FACE

16.2.3.2.2. HALF MASK

16.2.3.3. GOGGLES

16.2.3.3.1. SAFETY GLASSES

16.2.3.3.2. VIRTUAL REALITY GOGGLES

16.2.3.3.3. FRENZEL GOGGLES

16.2.3.4. OTHERS

16.2.4 ENDOSCOPE REPROCESSING PRODUCTS

16.2.4.1. ENDOSCOPE REPROCESSING

16.2.4.1.1. ELECTRODES

16.2.4.1.2. STORAGE DEVICES

16.2.4.1.3. CONNECTORS

16.2.4.1.4. OTHERS

16.2.4.2. ENDOSCOPE REPROCESSING EQUIPMENT

16.2.4.2.1. AUTOMATED ENDOSCOPE REPROCESSORS

16.2.4.2.2. ENDOSCOPE TRACKING SYSTEMS

16.2.4.2.3. OTHER ENDOSCOPE REPROCESSING PRODUCTS

16.2.5 CLEANERS & DETERGENTS

16.2.5.1. CLEANERS

16.2.5.1.1. LIQUID SOLUTIONS

16.2.5.1.2. FOAM-BASED CLEANERS

16.2.5.1.3. GEL-BASED CLEANERS

16.2.5.2. DETERGENTS

16.2.5.2.1. ENZYMATIC DETERGENTS

16.2.5.2.2. NEUTRAL DETERGENTS

16.2.5.2.3. ACIDIC DETERGENTS

16.2.5.2.4. ALKALINE DETERGENTS

16.2.6 DISINFECTANT SPRAYS

16.2.6.1. FLAVOURED

16.2.6.2. NON-FLAVOURED

16.2.7 OTHER INFECTION CONTROL PRODUCTS

16.3 SERVICES

16.3.1 CONTRACT SERVICES

16.3.2 INHOUSE SERVICES

17 EUROPE INFECTION CONTROL MARKET, BY APPLICATION

17.1 OVERVIEW

17.2 SURGICAL INSTRUMENTS

17.3 ENDOSCOPES

17.4 ULTRASOUND PROBES

17.5 OTHERS

18 EUROPE INFECTION CONTROL MARKET, BY END USER

18.1 OVERVIEW

18.2 CLINICS

18.3 HOSPITALS

18.3.1 BY FACILITY

18.3.1.1. CSSD

18.3.1.2. PATIENT ROOM

18.3.1.3. OPERATING ROOM

18.3.1.4. OTHERS

18.3.2 BY TYPE

18.3.2.1. PUBLIC

18.3.2.2. PRIVATE

18.3.3 BY LEVEL

18.3.3.1. TIER 1

18.3.3.2. TIER 2

18.3.3.3. TIER 3

18.4 MEDICAL DEVICE COMPANIES

18.5 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

18.6 RESEARCH LABORA

18.7 DIAGNOSTIC LABORATORIES

18.8 OTHERS

19 EUROPE INFECTION CONTROL MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDER

19.3 RETAIL SALES

19.3.1 OFFLINE

19.3.2 ONLINE

19.4 OTHERS

20 EUROPE INFECTION CONTROL MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: EUROPE

20.2 MERGERS & ACQUISITIONS

20.3 NEW PRODUCT DEVELOPMENT & APPROVALS

20.4 EXPANSIONS

20.5 REGULATORY CHANGES

20.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

21 EUROPE INFECTION CONTROL MARKET, BY REGION

21.1 EUROPE INFECTION CONTROL MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

21.1.1 EUROPE

21.1.1.1. GERMANY

21.1.1.2. FRANCE

21.1.1.3. U.K.

21.1.1.4. ITALY

21.1.1.5. SPAIN

21.1.1.6. RUSSIA

21.1.1.7. TURKEY

21.1.1.8. BELGIUM

21.1.1.9. NETHERLANDS

21.1.1.10. SWITZERLAND

21.1.1.11. REST OF EUROPE

21.1.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

22 EUROPE INFECTION CONTROL MARKET, SWOT & DBMR ANALYSIS

23 EUROPE INFECTION CONTROL MARKET, COMPANY PROFILE

23.1 3M

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 GEOGRAPHIC PRESENCE

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 ASP INTERNATIONAL GMBH

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 GEOGRAPHIC PRESENCE

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENTS

23.3 SOTERA HEALTH

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 GEOGRAPHIC PRESENCE

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 THE CLOROX COMPANY.

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 GEOGRAPHIC PRESENCE

23.4.4 PRODUCT PORTFOLIO

23.4.5 RECENT DEVELOPMENTS

23.5 TERRAGENE

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 GEOGRAPHIC PRESENCE

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENTS

23.6 CISA

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 GEOGRAPHIC PRESENCE

23.6.4 PRODUCT PORTFOLIO

23.6.5 RECENT DEVELOPMENTS

23.7 SCICAN LTD. (COLTENE)

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 GEOGRAPHIC PRESENCE

23.7.4 PRODUCT PORTFOLIO

23.7.5 RECENT DEVELOPMENTS

23.8 OLYMPUS CORPORATION

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 GEOGRAPHIC PRESENCE

23.8.4 PRODUCT PORTFOLIO

23.8.5 RECENT DEVELOPMENTS

23.9 B. BRAUN SE

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 GEOGRAPHIC PRESENCE

23.9.4 PRODUCT PORTFOLIO

23.9.5 RECENT DEVELOPMENTS

23.1 STRYKER

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 GEOGRAPHIC PRESENCE

23.10.4 PRODUCT PORTFOLIO

23.10.5 RECENT DEVELOPMENTS

23.11 CARDINAL HEALTH

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 GEOGRAPHIC PRESENCE

23.11.4 PRODUCT PORTFOLIO

23.11.5 RECENT DEVELOPMENTS

23.12 ZIMMER BIOMET

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 GEOGRAPHIC PRESENCE

23.12.4 PRODUCT PORTFOLIO

23.12.5 RECENT DEVELOPMENTS

23.13 STERIS PLC.

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 GEOGRAPHIC PRESENCE

23.13.4 PRODUCT PORTFOLIO

23.13.5 RECENT DEVELOPMENTS

23.14 GETINGE AB

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 GEOGRAPHIC PRESENCE

23.14.4 PRODUCT PORTFOLIO

23.14.5 RECENT DEVELOPMENTS

23.15 ECOLAB

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 GEOGRAPHIC PRESENCE

23.15.4 PRODUCT PORTFOLIO

23.15.5 RECENT DEVELOPMENTS

23.16 MATACHANA GROUP

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 GEOGRAPHIC PRESENCE

23.16.4 PRODUCT PORTFOLIO

23.16.5 RECENT DEVELOPMENTS

23.17 MMM GROUP

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 GEOGRAPHIC PRESENCE

23.17.4 PRODUCT PORTFOLIO

23.17.5 RECENT DEVELOPMENTS

23.18 BELIMED AG (METALL ZUG)

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 GEOGRAPHIC PRESENCE

23.18.4 PRODUCT PORTFOLIO

23.18.5 RECENT DEVELOPMENTS

23.19 METREX RESEARCH, LLC.

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 GEOGRAPHIC PRESENCE

23.19.4 PRODUCT PORTFOLIO

23.19.5 RECENT DEVELOPMENTS

23.2 RECKITT BENCKISER GROUP PLC

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 GEOGRAPHIC PRESENCE

23.20.4 PRODUCT PORTFOLIO

23.20.5 RECENT DEVELOPMENTS

23.21 STEELCO S.P.A. (MIELE)

23.21.1 COMPANY OVERVIEW

23.21.2 REVENUE ANALYSIS

23.21.3 GEOGRAPHIC PRESENCE

23.21.4 PRODUCT PORTFOLIO

23.21.5 RECENT DEVELOPMENTS

23.22 PAL INTERNATIONAL

23.22.1 COMPANY OVERVIEW

23.22.2 REVENUE ANALYSIS

23.22.3 GEOGRAPHIC PRESENCE

23.22.4 PRODUCT PORTFOLIO

23.22.5 RECENT DEVELOPMENTS

23.22.6 COMPANY OVERVIEW

23.22.7 REVENUE ANALYSIS

23.22.8 GEOGRAPHIC PRESENCE

23.22.9 PRODUCT PORTFOLIO

23.22.10 RECENT DEVELOPMENTS

23.23 MELAG MEDIZINTECHNIK GMBH & CO. KG

23.23.1 COMPANY OVERVIEW

23.23.2 REVENUE ANALYSIS

23.23.3 GEOGRAPHIC PRESENCE

23.23.4 PRODUCT PORTFOLIO

23.23.5 RECENT DEVELOPMENTS

23.24 CONTEC, INC.

23.24.1 COMPANY OVERVIEW

23.24.2 REVENUE ANALYSIS

23.24.3 GEOGRAPHIC PRESENCE

23.24.4 PRODUCT PORTFOLIO

23.24.5 RECENT DEVELOPMENTS

23.25 MEDALKAN

23.25.1 COMPANY OVERVIEW

23.25.2 REVENUE ANALYSIS

23.25.3 GEOGRAPHIC PRESENCE

23.25.4 PRODUCT PORTFOLIO

23.25.5 RECENT DEVELOPMENTS

23.26 C.B.M. S.R.L. MEDICAL EQUIPEMENT

23.26.1 COMPANY OVERVIEW

23.26.2 REVENUE ANALYSIS

23.26.3 GEOGRAPHIC PRESENCE

23.26.4 PRODUCT PORTFOLIO

23.26.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 RELATED REPORTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.