Europe Infectious Disease Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

12.71 Billion

USD

20.19 Billion

2024

2032

USD

12.71 Billion

USD

20.19 Billion

2024

2032

| 2025 –2032 | |

| USD 12.71 Billion | |

| USD 20.19 Billion | |

|

|

|

|

Infectious Disease Diagnostics Market Size

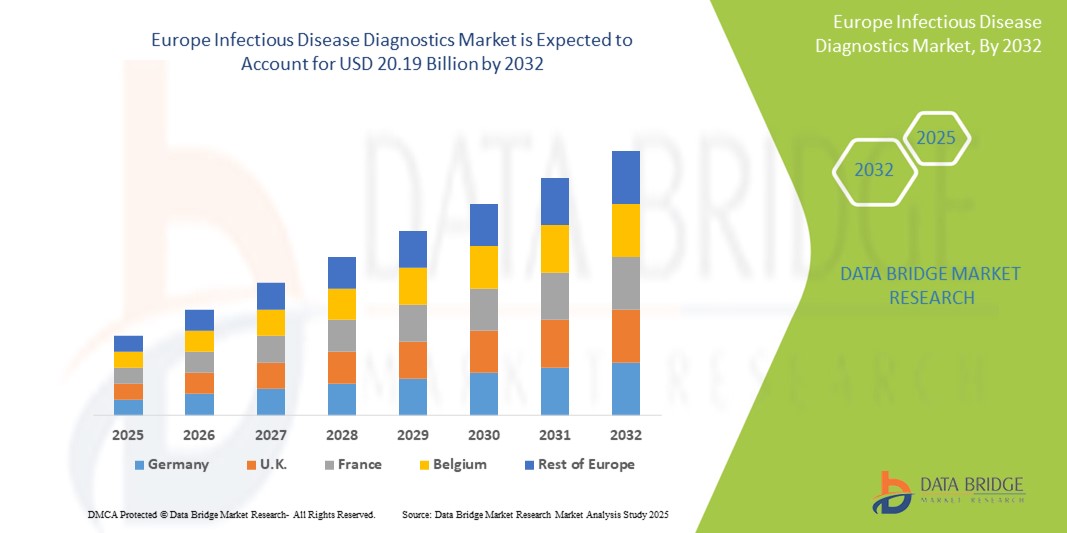

- The Europe Infectious Disease Diagnostics market size was valued at USD 12.71 Billion in 2024 and is expected to reach USD 20.19 Billion by 2032, at a CAGR of 5.9% during the forecast period

- The Europe infectious disease diagnostics market includes a wide array of advanced testing technologies and platforms designed to detect, identify, and monitor infectious pathogens such as bacteria, viruses, fungi, and parasites.

- These diagnostic tools are vital for early and accurate diagnosis, enabling effective treatment and containment of infectious diseases across healthcare settings. Key types of diagnostics include molecular assays (PCR, NAAT), immunoassays, rapid point-of-care tests, culture-based methods, and next-generation sequencing. They are applied in clinical microbiology, hospital laboratories, public health surveillance, and research institutions, targeting diseases like influenza, HIV/AIDS, tuberculosis, hepatitis, and emerging infectious threats.

Infectious Disease Diagnostics Market Analysis

- The Europe infectious disease diagnostics market is driven by the rising prevalence of infectious diseases, increased awareness of early diagnosis benefits, and rapid adoption of molecular and point-of-care technologies. The COVID-19 pandemic significantly accelerated demand for fast, reliable diagnostic solutions and strengthened diagnostic infrastructure. Technological advancements—including multiplex testing, digital diagnostics, AI-based data analysis, and integration with healthcare IT systems—are propelling market growth. Furthermore, government initiatives focused on disease surveillance, antimicrobial resistance, and vaccination campaigns are expanding diagnostic testing requirements.

- The increasing healthcare expenditure, growing elderly population vulnerable to infections, and rising incidence of hospital-acquired infections further support market expansion. Cross-sector collaborations among public health agencies, hospitals, and diagnostic companies are also enhancing the availability and uptake of innovative diagnostics.

- Germany dominates the Infectious Disease Diagnostics market in Europe, holding the largest revenue share of 27.9% in 2025, fueled by its advanced healthcare infrastructure, strong diagnostics industry, and extensive research and development activities. The country’s proactive infectious disease management programs, favorable reimbursement policies, and high adoption of cutting-edge molecular platforms continue to drive market leadership.

- Germany is also projected to be the fastest-growing country in this market during the forecast period, supported by investments in high-throughput testing, digital diagnostic integration, and response readiness for emerging infectious diseases. The country’s focus on antimicrobial resistance monitoring and public health preparedness further stimulates market growth.

- Molecular diagnostics is expected to be the largest segment in Europe’s infectious disease diagnostics market with a significant share of 31.2% in 2025, due to its high sensitivity, specificity, and rapid turnaround. PCR and nucleic acid amplification techniques are widely used for detecting viruses and bacteria, including novel pathogens.

Report Scope and Infectious Disease Diagnostics Market Segmentation

|

Attributes |

Infectious Disease Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Infectious Disease Diagnostics Market Trends

“Advancements in Personalized and Digital Diagnostic Technologies”

- Technological Advancements in Molecular Diagnostics and Personalized Testing: A significant and accelerating trend in the Europe Infectious Disease Diagnostics market is continuous innovation in molecular and genomic diagnostic technologies. These developments are enhancing accuracy, enabling rapid detection of pathogens, and allowing personalized treatment approaches, which improve patient outcomes.

- For instance, next-generation sequencing (NGS) platforms are increasingly used for precise pathogen identification and antibiotic resistance profiling.

- Integration with Digital Health Platforms and Wearable Devices: The market is witnessing increased integration of diagnostics with digital health platforms, wearable technologies, and mobile applications for continuous monitoring and real-time data analysis. This integration supports early disease detection and better management.

- For example, wearable biosensors combined with mobile apps enable remote monitoring of infectious disease symptoms and vital signs.

- Growth in Point-of-Care Testing: Rapid, point-of-care diagnostic tests are gaining traction, offering quick and reliable results outside of traditional laboratory settings, thus facilitating timely clinical decisions and controlling infectious disease spread.

- Rising awareness of antimicrobial resistance is driving demand for diagnostics that can identify resistant pathogens, promoting targeted antibiotic use and improved antimicrobial stewardship.

- AI and machine learning technologies are increasingly being used to analyze diagnostic data, enhancing predictive capabilities, diagnostic accuracy, and personalized treatment strategies.

Infectious Disease Diagnostics Market Dynamics

Driver

“Rising Prevalence of Infectious Diseases and Need for Rapid Diagnostics”

- Increasing prevalence of infectious diseases across Europe, including emerging viral outbreaks and drug-resistant infections, is fueling demand for rapid and accurate diagnostic tools

- For instance, the COVID-19 pandemic has underscored the critical need for quick, reliable infectious disease diagnostics to control spread and improve treatment outcomes.

- Growing healthcare provider and patient awareness regarding the benefits of early diagnosis is accelerating market adoption.

- Government initiatives and funding aimed at strengthening infectious disease surveillance and diagnostic infrastructure further support market growth.

- An aging population and increasing numbers of immunocompromised individuals elevate the risk of infections, increasing demand for effective diagnostics.

- Expansion of outpatient services and home-based testing solutions promotes the development of portable, easy-to-use diagnostic devices

Restraint/Challenge

“High Costs and Regulatory Barriers”

- High costs associated with advanced infectious disease diagnostic technologies limit accessibility, particularly for smaller clinics and laboratories.

- For instance, sophisticated molecular diagnostic platforms with integrated digital features are expensive and may be unaffordable for some healthcare providers.

- Strict regulatory requirements and lengthy approval processes in Europe can delay product launches and increase compliance costs.

- Shortage of trained healthcare professionals skilled in operating complex diagnostic equipment hinders widespread adoption.

- Concerns regarding variability in diagnostic accuracy and sensitivity may reduce confidence among clinicians and impact market growth.

- Data privacy and security issues related to digital health integration, especially compliance with GDPR, pose challenges to broader implementation

Infectious Disease Diagnostics Market Scope

The market is segmented on the basis product & Service, technology, Disease Type and end user.

- By Product

On the basis of Product, the Infectious Disease Diagnostics Market is into Assays, Kits, Reagents, Instruments, and Service & Software. The Assays and Kits segment is expected to dominate the market with the largest revenue share of 39.2% 2025, driven by their critical role in enabling rapid and accurate pathogen detection across laboratories and point-of-care settings. These kits offer convenience and efficiency in testing for a wide range of infectious diseases.

The Service & Software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of integrated digital solutions for data management, remote diagnostics, and AI-powered analytics that enhance diagnostic accuracy and workflow efficiency.

- By Technology

On the basis of Product, the Infectious Disease Diagnostics Market segmented into Immunodiagnostics, Molecular Diagnostics, Clinical Microbiology, PCR, INAAT (Isothermal Nucleic Acid Amplification Technology), DNA Sequencing & NGS (Next-Generation Sequencing), DNA Microarray, and Other Technologies. The Molecular Diagnostics segment is expected to dominate the market with the largest revenue share, owing to its high sensitivity and specificity in detecting a wide range of infectious agents, including viruses and bacteria. Molecular techniques like PCR and NGS are widely used for rapid and accurate diagnosis.

The DNA Sequencing & NGS segment is projected to witness the fastest CAGR from 2025 to 2032, driven by advances in genomics and personalized medicine approaches, allowing comprehensive pathogen identification and antimicrobial resistance profiling.

- By Disease Type

On the basis of Disease Type, the Infectious Disease Diagnostics market is segmented into Hepatitis, HIV, CT/NG (Chlamydia trachomatis/Neisseria gonorrhoeae), HAIs (Healthcare-Associated Infections), HPV (Human Papillomavirus), TB (Tuberculosis), Influenza, and Other Infectious Diseases. The HIV held the largest market revenue share in due to the high prevalence and extensive screening programs across Europe.

The TB is expected to witness the fastest CAGR from 2025 to 2032, supported by increased public health efforts for early detection and control, especially with the emergence of drug-resistant strains.

- By End users

On the basis of end users, the Infectious Disease Diagnostics market is segmented into Hospital/Clinical Laboratories, Reference Laboratories, Physician Offices, Academic/Research Institutes, and Other End Users. The Hospital/Clinical Laboratories segment accounted for the largest market revenue share in 2024, accounting for the largest revenue share, as these facilities conduct the majority of infectious disease testing with advanced diagnostic equipment and skilled personnel.

The Reference Laboratories segment is expected to witness the fastest CAGR from 2025 to 2032, during the forecast period, owing to their role in specialized and high-complexity testing, including genomic sequencing and outbreak investigations.

Infectious Disease Diagnostics Market Regional Analysis

- Germany dominates the Europe Infectious Disease Diagnostics Market, accounting for the largest revenue share of 27.9% in 2025, This leadership is driven by the country’s highly advanced healthcare infrastructure, extensive public health programs, and strong presence of specialized diagnostic laboratories. Germany is a pioneer in adopting cutting-edge molecular diagnostics, next-generation sequencing (NGS), and rapid point-of-care testing, particularly for diseases like HIV, tuberculosis, and healthcare-associated infections (HAIs).

- Germany’s dominance is further reinforced by significant investments in digital health platforms and integration of AI-based diagnostics, especially in major cities such as Berlin, Munich, and Hamburg. The presence of leading global and regional diagnostics manufacturers, alongside strong government funding for infectious disease control and research, accelerates market growth. Collaborative networks among academic institutions, biotech startups, and healthcare providers foster continuous innovation and advanced diagnostic solutions.

France Infectious Disease Diagnostics Market Insight

The France Infectious Disease Diagnostics market is expected to register robust growth during the forecast period, supported by national healthcare modernization efforts and increasing focus on infectious disease surveillance and management. France is expanding diagnostic capacities through upgraded clinical laboratories and adoption of rapid molecular tests across hospitals and outpatient settings. The government’s commitment to strengthening infectious disease control, combined with reimbursement reforms and public health initiatives, is encouraging wider use of advanced diagnostics such as PCR, immunodiagnostics, and digital reporting systems. Public and private healthcare facilities in cities like Paris, Lyon, and Marseille are investing in automated and integrated diagnostic platforms, particularly for HIV, hepatitis, and respiratory infections.

U.K. Infectious Disease Diagnostics Market Insight

The U.K. Infectious Disease Diagnostics market is poised for significant growth, driven by increased funding through the NHS for infectious disease control, rising incidence of antibiotic-resistant infections, and expanding use of point-of-care and digital diagnostics. Despite challenges related to regulatory alignment post-Brexit, the U.K. maintains robust import channels and regulatory standards compatible with international norms, facilitating access to advanced diagnostic technologies. Leading hospitals and reference laboratories in London, Manchester, and Edinburgh are rapidly adopting molecular diagnostic tools, rapid antigen tests, and integrated digital health solutions to enhance early detection and treatment of infectious diseases.

Infectious Disease Diagnostics Market Share

The Infectious Disease Diagnostics industry is primarily led by well-established companies, including:

- Abbott Laboratories (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- bioMérieux SA (France)

- DiaSorin S.p.A (Italy)

- Bio-Rad Laboratories, Inc. (U.S.)

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Netherlands)

- Siemens Healthineers AG (Germany)

- Hologic, Inc. (U.S.)

- Becton, Dickinson and Company (U.S.)

- Trinity Biotech Plc (Ireland)

- Sysmex Corporation (Japan)

Latest Developments in Europe Infectious Disease Diagnostics Market

-

In January 2025, Roche Diagnostics launched the cobas Liat PCR System across several European countries, offering rapid, fully automated molecular testing for infectious diseases such as influenza and COVID-19, reflecting a growing trend toward rapid point-of-care molecular diagnostics.

- In September 2024, Qiagen introduced its QIAstat-Dx Respiratory SARS-CoV-2 Panel in Europe, a multiplex molecular test capable of detecting multiple respiratory pathogens simultaneously, indicating advances in comprehensive syndromic testing.

- In June 2024, BioMérieux expanded its BIOFIRE® FILMARRAY® System portfolio with new panels for antimicrobial resistance (AMR) gene detection, highlighting the increasing focus on rapid identification of resistant pathogens to guide targeted therapy.

- In November 2023, Hologic launched the Aptima® Multitest Swab Collection Kit in Europe, improving specimen collection for sexually transmitted infections, which enhances test accuracy and patient comfort.

- In March 2023, Abbott introduced the ID NOW™ COVID-19 rapid molecular test platform to more European markets, emphasizing the ongoing demand for fast, portable diagnostic solutions in response to emerging infectious diseases.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.