Europe Infusion Pump Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.52 Billion

2024

2032

USD

1.58 Billion

USD

2.52 Billion

2024

2032

| 2025 –2032 | |

| USD 1.58 Billion | |

| USD 2.52 Billion | |

|

|

|

|

Europe Infusion Pumps Market Size

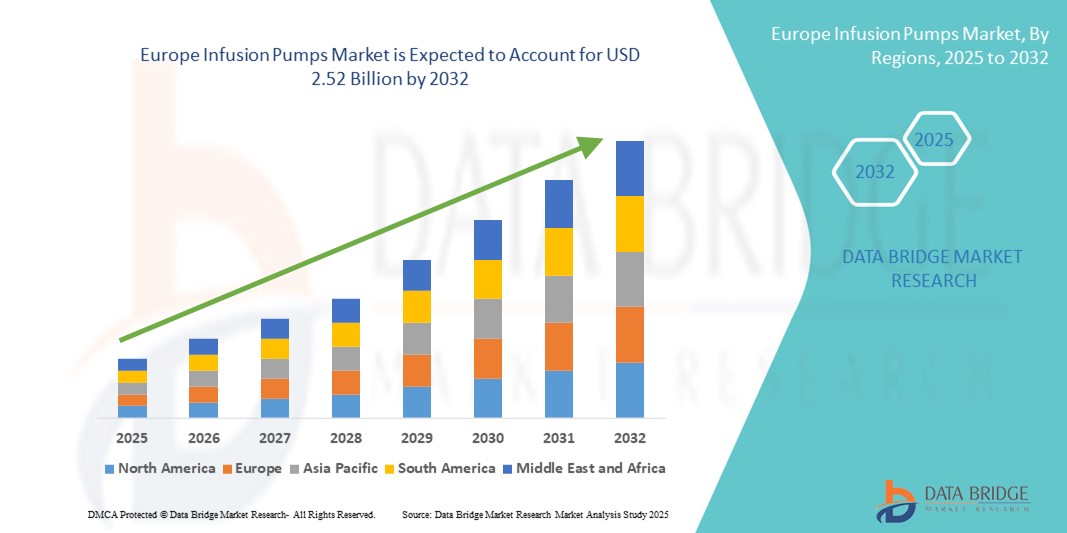

- The Europe infusion pumps market size was valued at USD 1.58 billion in 2024 and is expected to reach USD 2.52 billion by 2032, at a CAGR of 6.05% during the forecast period

- The market growth is largely fueled by increasing prevalence of chronic conditions such as diabetes, cancer, and cardiovascular diseases across Europe, which necessitate long-term and precise drug delivery systems such as infusion pumps. This has led to a surge in demand for advanced infusion technologies across hospitals, home care, and ambulatory settings, thereby supporting market expansion

- Furthermore, growing investments in healthcare infrastructure, along with favorable reimbursement policies and increasing adoption of portable and smart infusion systems, are accelerating innovation in the field. These factors are driving the uptake of technologically advanced and user-friendly infusion pumps, significantly boosting the growth of the Europe infusion pumps market

Europe Infusion Pumps Market Analysis

- Infusion pumps, essential for delivering precise volumes of fluids, medications, and nutrients to patients, are increasingly integral to modern European healthcare, especially in chronic disease management, intensive care, and post-operative recovery. The demand is being driven by advancements in infusion technology, rising hospital admissions, and the growing prevalence of conditions requiring long-term medication delivery such as cancer, diabetes, and neurological disorders

- The shift from traditional manual infusion methods to smart and programmable infusion systems is gaining momentum, supported by healthcare digitization, the need for improved patient safety, and efforts to reduce medication errors in hospital and home care settings

- Germany dominated the Europe infusion pumps market, accounting for the largest revenue share of 28.6% in 2024, driven by its advanced healthcare infrastructure, early adoption of smart infusion devices, and strong presence of global infusion pump manufacturers offering a wide portfolio of infusion solutions across therapeutic areas

- France is projected to register the fastest CAGR of 11.2% in Europe infusion pumps market, during the forecast period, supported by government investments in healthcare innovation, an increasing aging population, and expanding use of infusion therapy in ambulatory and homecare settings to reduce hospital burden

- The Devices segment dominated the Europe infusion pumps market in 2024 with the largest revenue share of 62.4%, attributed to the widespread use of advanced infusion pump systems in hospitals and ambulatory settings

Report Scope and Europe Infusion Pumps Market Segmentation

|

Attributes |

Europe Infusion Pumps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Infusion Pumps Market Trends

Technological Integration and Evolving Clinical Practices Fuel Growth in the Europe Infusion Pumps Market

- The Europe infusion pumps market is witnessing robust growth, driven by the integration of advanced digital technologies such as wireless connectivity, real-time monitoring, and closed-loop feedback systems in next-generation infusion devices

- Increasing demand for precision drug delivery, particularly in critical care, oncology, and chronic disease management, is encouraging hospitals and clinics across Europe to adopt smart infusion pumps that support programmable dosing and safety alerts

- Healthcare systems in countries such as Germany, France, and the Netherlands are prioritizing automation and digital transformation in patient care, leading to widespread implementation of infusion systems equipped with barcode scanning, EMR compatibility, and remote access features

- A surge in research activities and pilot programs across Europe—especially in university hospitals and government-funded institutions—is accelerating the development and approval of innovative infusion technologies, including wearable and implantable pumps for home-based care

- The growing burden of aging populations and associated long-term conditions such as diabetes, cancer, and neurological disorders is expanding the demand for continuous, ambulatory, and patient-controlled analgesia (PCA) pumps across outpatient and homecare settings

- Furthermore, European healthcare providers are increasingly adopting value-based care models that emphasize reduced hospital stays, personalized medicine, and post-acute care management—creating strong incentives for the use of infusion pumps in day surgeries and transitional care units

- Supportive regulatory frameworks by the European Medicines Agency (EMA) and national bodies are streamlining device approvals and improving market access, while public-private collaborations are aiding clinician training and expanding infrastructure for infusion therapy

- With a strong emphasis on safety, automation, and mobility, the Europe Infusion Pumps market is well-positioned for sustained innovation and adoption, especially as healthcare providers pivot toward precision treatment delivery and long-term patient monitoring

Europe Infusion Pumps Market Dynamics

Driver

Accelerating Demand Due to Rising Chronic Illness and Precision Therapies

- The growing prevalence of chronic diseases such as cancer, diabetes, and gastrointestinal disorders across Europe is significantly fueling the need for reliable, continuous drug delivery solutions such as infusion pumps. Early diagnosis and expanding treatment programs in countries such as Germany, France, and the U.K. are enabling timely administration of therapies, contributing to market growth

- In April 2024, Anavex Life Sciences announced encouraging Phase III results for Anavex 2-73 (blarcamesine), showcasing its potential in precision therapy. Such advancements highlight the need for smart infusion technologies capable of delivering complex biologics and targeted treatments with controlled precision

- Healthcare providers across Europe are increasingly favoring programmable infusion pumps due to their ability to offer dose accuracy, patient safety, and real-time monitoring—particularly in oncology, intensive care, pain management, and neonatology

- Further boosting the market are supportive regulatory frameworks such as EMA’s fast-track approval processes, innovation grants, and post-marketing surveillance initiatives, which are encouraging the development and adoption of next-generation infusion systems

- Growing collaboration between medical device manufacturers, hospitals, and research institutes is driving integration with digital health ecosystems—supporting smart, remote-controlled infusion devices and improving patient adherence and outcomes

Restraint/Challenge

Infrastructural Gaps and Cost Barriers Hampering Equitable Access

- The upfront capital cost of deploying advanced infusion pumps, coupled with recurring expenses for consumables and system maintenance, remains a major challenge in underfunded healthcare systems—especially in parts of Eastern and Southern Europe

- Reimbursement hurdles and the complexity of integrating newer systems with existing hospital infrastructure often deter smaller clinics and public hospitals from adopting high-end infusion technologies

- There is also a regional shortage of trained personnel capable of operating programmable pumps, particularly in rural areas. This skill gap can lead to underutilization or clinical errors, further impacting adoption rates

- In addition, fragmented healthcare procurement policies and differing certification standards across European countries create inconsistencies in market penetration and device availability

- Addressing these challenges will require pan-European funding initiatives, harmonized regulations, targeted healthcare professional training, and the creation of infusion therapy centers of excellence to promote best practices and ensure uniform access to advanced care solutions

Europe Infusion Pumps Market Scope

The market is segmented on the basis of product type, application and end use.

- By Product Type

On the basis of product type, the Europe infusion pumps market is segmented into devices and accessories & consumables. The devices segment dominated the market in 2024 with the largest revenue share of 62.4%, attributed to the widespread use of advanced infusion pump systems in hospitals, ambulatory care centers, and specialty clinics. These devices provide precise control over drug delivery, improving patient outcomes in complex therapies such as chemotherapy and pain management. In addition, technological advancements such as smart pumps with wireless connectivity and safety features are accelerating their adoption.

The accessories and consumables segment is projected to grow at the fastest CAGR of 7.9% from 2025 to 2032, driven by recurring demand for tubing, catheters, infusion sets, and disposable kits essential for continuous and long-term treatment cycles. The frequent replacement requirement of consumables due to hygiene and safety standards further supports this segment’s growth.

- By Application

On the basis of application, the Europe infusion pumps market is segmented into chemotherapy/oncology, diabetes management, gastroenterology, pain management/analgesia, pediatrics/neonatology, hematology, and other applications. The chemotherapy/oncology segment led the market with a 28.6% share in 2024, driven by the rising incidence of cancer and the adoption of ambulatory infusion pumps for precise and controlled drug administration. Increasing preference for outpatient cancer care and advancements in targeted therapies are also bolstering market growth in this segment.

Diabetes management is expected to witness the highest CAGR of 9.1% during the forecast period, fueled by the increasing prevalence of diabetes and greater use of insulin infusion pumps across Europe. Continuous glucose monitoring integration with infusion pumps and rising awareness of advanced insulin delivery methods among patients and healthcare providers are key factors contributing to this growth.

- By End Use

On the basis of end use, the Europe infusion pumps market is segmented into hospitals, home care settings, ambulatory care settings, and academic & research institutes. Hospitals held the largest share at 53.2% in 2024, owing to high patient volumes, availability of trained healthcare professionals, and the adoption of smart infusion systems in critical care settings. Hospitals also serve as hubs for clinical trials and early adoption of innovative infusion technologies.

The home care settings segment is projected to grow at the fastest CAGR of 8.7% from 2025 to 2032, supported by the rise in chronic illnesses and the growing preference for cost-effective, patient-centric care outside traditional healthcare facilities. The shift towards home-based care, increased reimbursement policies for home infusion therapies, and the convenience of self-administration are driving factors for this segment.

Europe Infusion Pumps Market Regional Analysis

- Europe dominated the global infusion pumps market with the largest revenue share of 30.35% in 2024, driven by a well-established healthcare infrastructure, rising incidence of chronic diseases, and strong demand for technologically advanced infusion systems across the region. The widespread adoption of ambulatory infusion pumps and portable devices is further supporting home care trends, especially for oncology and diabetes management

- Supportive reimbursement frameworks, increased healthcare funding, and the expansion of home-based care services across countries such as Germany, France, and the U.K. are boosting the deployment of smart infusion devices. The region’s emphasis on value-based care and patient-centric treatment models also promotes the adoption of programmable and wearable infusion solutions

- Furthermore, Europe serves as a hub for several leading infusion pump manufacturers and academic institutions engaged in clinical innovation, contributing to the development and regulatory approval of next-generation infusion technologies

Germany Infusion Pumps Market Insight

The Germany infusion pumps market accounted for the largest market share within Europe at 28.6% in 2024, attributed to its robust medical device manufacturing sector, advanced hospital infrastructure, and high prevalence of chronic illnesses requiring long-term drug delivery. The country’s universal insurance model, along with widespread implementation of national treatment guidelines for diseases such as cancer and diabetes, has encouraged the uptake of infusion pumps in both inpatient and outpatient settings. In addition, partnerships between hospitals and medical technology firms are fostering research on precision dosing, enhancing patient outcomes through smart, integrated infusion systems.

U.K. Infusion Pumps Market Insight

The U.K. infusion pumps market held a 22.6% share of the Europe market in 2024 and is expected to witness substantial growth during the forecast period. The market is being driven by NHS initiatives aimed at modernizing chronic disease treatment, coupled with the expansion of remote patient monitoring programs. Rising demand for infusion therapy in oncology, pain management, and palliative care is encouraging healthcare providers to adopt compact, programmable devices that allow for greater flexibility and patient mobility. Growth in outpatient infusion centers, increasing use of infusion therapy in community healthcare settings, and investments in digital healthcare platforms are further accelerating market expansion in the U.K.

France Infusion Pumps Market Insight

The France infusion pumps market accounted for 18.2% with a CAGR of 11.2% of the Europe market revenue in 2024, supported by robust public healthcare policies and nationwide chronic disease management programs. The country is seeing increased adoption of infusion pumps in areas such as pediatric care, gastroenterology, and diabetes management, driven by patient safety protocols and demand for precise medication delivery. Favorable government incentives for telehealth and home infusion therapies, combined with growing collaborations between public hospitals and private device manufacturers, are contributing to steady market expansion across France.

Europe Infusion Pumps Market Share

The Europe infusion pumps industry is primarily led by well-established companies, including:

- B. Braun SE (Germany)

- Fresenius Kabi AG (Germany)

- Smiths Medical plc (U.K.)

- Medtronic (Ireland)

- Baxter International Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- Terumo Corporation (Japan)

- Nipro Corporation (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Ypsomed Holding AG (Switzerland)

Latest Developments in Europe Infusion Pumps market

- In June 2025, BD (Becton, Dickinson and Company) launched its advanced BD neXus infusion platform across the U.K. and Ireland. Designed with frontline clinicians, the solution aims to improve workflow efficiency, minimize medication errors, and enhance patient safety through integrated pump software, IV sets, and intelligent analytics. This launch demonstrates BD’s strategic focus on hospital automation and clinical connectivity in Europe

- In January 2025, the European Medicines Agency (EMA) approved new administration methods for UCB’s RYSTIGGO (rozanolixizumab), enabling self-infusion through a syringe pump after initial professional guidance. This move supports the growing shift toward home-based infusion therapy and expands access to treatment for patients with generalized myasthenia gravis across Europe

- In July 2025, Baxter International Inc. issued an urgent safety notification regarding its Novum IQ large-volume infusion pumps in Europe due to software and alarm malfunctions. The issue was associated with 79 serious injuries and 2 patient deaths. Healthcare providers were advised to discontinue use and return affected devices. This recall emphasizes the need for heightened vigilance and robust post-market surveillance

- In April 2024, Alcon, a leader in surgical and vision care solutions, showcased innovations in infusion and implantable devices during the ASCRS 2024 Annual Meeting held in Boston. The presentation included the SMARTCataract surgical planner and enhanced IOL-compatible infusion tools, aimed at increasing procedural accuracy and optimizing patient outcomes. The event reinforced Alcon’s innovation leadership in the European ophthalmology infusion space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.