Europe Insulin Delivery Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.20 Billion

USD

11.65 Billion

2025

2033

USD

7.20 Billion

USD

11.65 Billion

2025

2033

| 2026 –2033 | |

| USD 7.20 Billion | |

| USD 11.65 Billion | |

|

|

|

|

Europe Insulin Delivery Devices Market Size

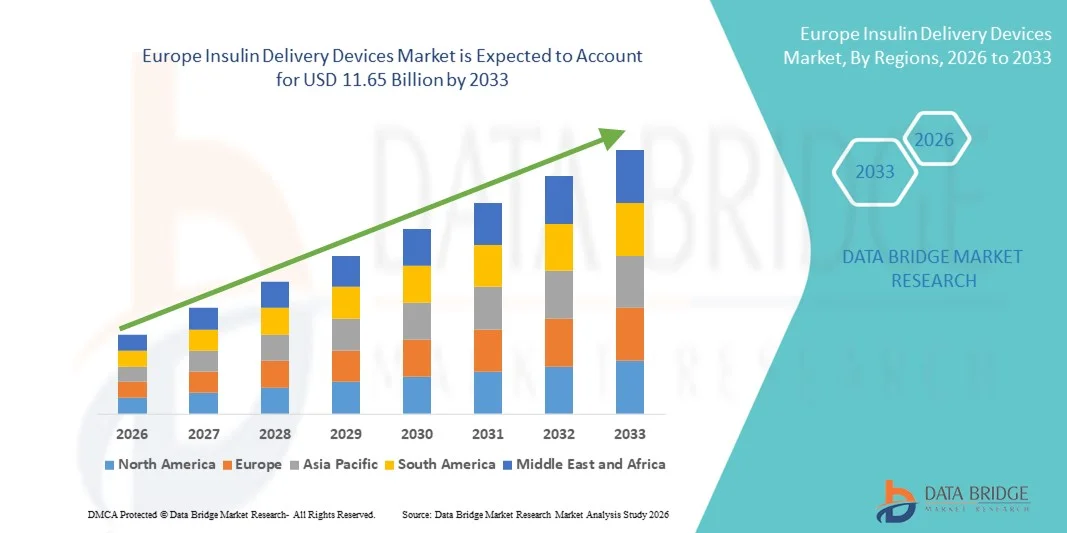

- The Europe insulin delivery devices market size was valued at USD 7.20 billion in 2025 and is expected to reach USD 11.65 billion by 2033, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the rising global prevalence of diabetes, increasing incidence of type 1 and type 2 diabetes, and growing awareness regarding effective blood glucose management, leading to higher adoption of advanced insulin delivery solutions across hospitals and homecare settings

- Furthermore, rising patient preference for convenient, accurate, and minimally invasive insulin administration methods, along with continuous technological advancements such as smart insulin pens, insulin pumps, and continuous glucose monitoring (CGM)-integrated delivery systems, is establishing insulin delivery devices as a critical component of modern diabetes management. These converging factors are accelerating the uptake of Insulin Delivery Devices solutions, thereby significantly boosting overall market growth

Europe Insulin Delivery Devices Market Analysis

- Insulin delivery devices, including insulin pens, insulin pumps, insulin syringes, and patch pumps, are increasingly vital components of modern diabetes management across hospitals and homecare settings due to their ability to ensure accurate dosing, improved glycemic control, enhanced patient convenience, and integration with continuous glucose monitoring (CGM) systems

- The escalating demand for insulin delivery devices is primarily fueled by the rising global prevalence of diabetes, increasing awareness regarding early disease management, growing adoption of technologically advanced smart insulin pens and pumps, and a strong preference for minimally invasive and user-friendly drug delivery solutions

- The U.K. dominated the insulin delivery devices market with the largest revenue share of 26.9% in 2025, characterized by strong reimbursement policies, widespread diabetes screening programs, advanced healthcare infrastructure, and high adoption of insulin pens and pump therapies among both type 1 and insulin-dependent type 2 diabetic patients

- Germany is expected to be the fastest growing country in the insulin delivery devices market during the forecast period, driven by increasing diabetic population, growing preference for insulin pump therapy, rising healthcare expenditure, and expanding adoption of digitally connected insulin delivery systems integrated with glucose monitoring technologies

- The Type II diabetes segment accounted for the largest market revenue share of 61.5% in 2025, driven by the significantly higher global prevalence of Type II diabetes

Report Scope and Insulin Delivery Devices Market Segmentation

|

Attributes |

Insulin Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Insulin Delivery Devices Market Trends

Advancement of Smart and Connected Insulin Delivery Systems

- A significant and accelerating trend in the Insulin Delivery Devices market is the growing adoption of smart, connected insulin delivery systems integrated with continuous glucose monitoring (CGM) technologies

- These advanced systems enable automated insulin dosing adjustments based on real-time glucose readings, enhancing glycemic control and reducing the risk of hypoglycemia and hyperglycemia

- For instance, in 2023, Medtronic launched its MiniMed™ 780G system in additional global markets, featuring automated insulin correction boluses and adaptive algorithms that continuously adjust insulin delivery based on glucose trends. Such innovations reflect the increasing shift toward closed-loop or hybrid closed-loop systems, often referred to as artificial pancreas technology

- The integration of Bluetooth connectivity and smartphone applications in insulin pumps and smart insulin pens allows patients to track dosage history, glucose levels, and insulin-on-board data in real time. This seamless data sharing supports remote monitoring by healthcare professionals and enhances patient engagement in diabetes self-management

- Technological advancements in patch pumps, tubeless designs, and reusable smart pens are improving patient comfort and convenience. Miniaturization, improved battery life, and user-friendly interfaces are making devices more discreet and easier to operate, particularly for pediatric and elderly populations

- The increasing use of data analytics and digital health platforms is enabling personalized treatment regimens, optimizing insulin dosing strategies, and improving long-term clinical outcomes. As a result, connected insulin delivery ecosystems are reshaping diabetes management worldwide

Europe Insulin Delivery Devices Market Dynamics

Driver

Rising Prevalence of Diabetes and Growing Awareness of Intensive Insulin Therapy

- The growing global prevalence of type 1 and type 2 diabetes is a primary driver fueling demand for insulin delivery devices. Sedentary lifestyles, unhealthy dietary patterns, obesity, and aging populations are contributing to the rising incidence of diabetes, thereby increasing the need for effective insulin administration solutions

- For instance, according to international diabetes health reports published in recent years, the global diabetic population continues to rise steadily, prompting healthcare systems to expand access to advanced insulin pumps and smart pen technologies for better glycemic management

- Increasing awareness regarding intensive insulin therapy and the benefits of tight glucose control is encouraging patients and clinicians to shift from conventional vial-and-syringe methods to more precise and convenient delivery systems such as insulin pens and pumps

- Favorable reimbursement policies in developed countries, expanding healthcare infrastructure in emerging economies, and growing government initiatives for diabetes management programs are further supporting market growth

- Moreover, rising adoption of home-based healthcare solutions and telemedicine services is strengthening demand for user-friendly insulin delivery devices that support remote consultation and continuous monitoring

Restraint/Challenge

High Device Costs and Risk of Device-Related Complications

- The high cost associated with advanced insulin pumps, continuous glucose monitoring integration, and smart insulin pens remains a significant barrier, particularly in low- and middle-income countries. Upfront device expenses, recurring consumable costs, and maintenance requirements can limit affordability for many patients

- For instance, automated insulin pump systems with integrated CGM functionality can involve substantial annual expenditures, which may not be fully covered by insurance in certain regions, restricting widespread adoption

- Technical issues such as infusion set failures, device malfunctions, software errors, or inaccurate glucose readings may pose clinical risks if not promptly addressed. These concerns can affect patient confidence and adherence to device-based therapy

- In addition, strict regulatory approval processes and post-market surveillance requirements increase development timelines and compliance costs for manufacturers

- Addressing affordability challenges, improving device reliability, and expanding reimbursement coverage will be critical to ensuring sustained growth and broader accessibility in the Insulin Delivery Devices market

Europe Insulin Delivery Devices Market Scope

The market is segmented on the basis of type, application, distribution channel, and end use.

- By Type

On the basis of type, the Insulin Delivery Devices market is segmented into insulin syringes, insulin jet injectors, pen needles, and insulin pumps. The insulin pens and pen needles category (pen needles segment) dominated the largest market revenue share of 38.9% in 2025, driven by their ease of use, accuracy in dosing, and widespread adoption among diabetic patients. Pen needles are highly preferred due to minimal pain, convenience, and compatibility with reusable and disposable insulin pens. Increasing global prevalence of diabetes significantly supports segment growth. Rising awareness regarding self-administration of insulin further accelerates demand. Technological improvements such as ultra-thin and shorter needles enhance patient comfort and adherence. Strong availability across retail pharmacies and hospital channels strengthens market penetration. Cost-effectiveness compared to insulin pumps also contributes to high usage rates. Growing elderly population requiring daily insulin therapy further sustains dominance.

The insulin pumps segment is anticipated to witness the fastest growth rate of 22.8% CAGR from 2026 to 2033, fueled by increasing adoption of advanced continuous insulin infusion systems. Insulin pumps offer precise and programmable insulin delivery, improving glycemic control in patients. Rising demand for smart and automated insulin delivery devices supports rapid segment expansion. Integration with continuous glucose monitoring (CGM) systems enhances therapeutic outcomes. Growing awareness regarding closed-loop “artificial pancreas” systems further accelerates adoption. Increasing healthcare expenditure in developed markets supports pump affordability. Technological advancements improving portability and battery life strengthen patient preference. Expanding reimbursement coverage for advanced diabetes devices also boosts growth. As diabetes management shifts toward personalized and technology-driven solutions, insulin pumps are expected to expand at the fastest pace.

- By Application

On the basis of application, the Insulin Delivery Devices market is segmented into Type I diabetes and Type II diabetes. The Type II diabetes segment accounted for the largest market revenue share of 61.5% in 2025, driven by the significantly higher global prevalence of Type II diabetes. Sedentary lifestyles, obesity, and aging populations contribute to rising diagnosis rates. Many Type II patients eventually require insulin therapy for effective glucose control. Increasing awareness regarding early treatment initiation further strengthens demand. Growing screening programs and improved access to healthcare facilities also support segment dominance. Rising incidence in emerging economies contributes to volume growth. Continuous education campaigns about diabetes management enhance patient adherence. Expanding availability of affordable insulin delivery options further sustains market share.

The Type I diabetes segment is expected to witness the fastest CAGR of 20.4% from 2026 to 2033, supported by increasing adoption of advanced insulin delivery technologies. Type I patients require lifelong insulin therapy, driving consistent device demand. Growing preference for insulin pumps and smart pens accelerates growth in this segment. Technological integration with digital monitoring platforms enhances disease management. Rising pediatric diabetes cases further strengthen demand. Increasing awareness about tight glycemic control reduces long-term complications. Favorable reimbursement policies in developed countries support advanced device adoption. Improved patient education programs also contribute to higher compliance rates. As innovation continues in automated insulin systems, the Type I segment is projected to grow steadily.

- By Distribution Channel

On the basis of distribution channel, the Insulin Delivery Devices market is segmented into hospital pharmacy, retail pharmacy, online sales, and diabetes clinics. The retail pharmacy segment held the largest market revenue share of 42.7% in 2025, driven by easy accessibility and widespread geographic presence. Retail pharmacies serve as primary distribution points for insulin syringes and pen needles. Growing patient preference for convenient refill options supports segment dominance. Strong supply chain networks ensure consistent product availability. Increasing chronic disease burden leads to recurring purchases through retail outlets. Expansion of chain pharmacies in urban and semi-urban areas strengthens revenue generation. Competitive pricing strategies and insurance coverage further boost adoption. Retail channels remain central to daily diabetes management needs.

The online sales segment is projected to register the fastest CAGR of 23.6% from 2026 to 2033, fueled by increasing digitalization and e-commerce penetration. Patients prefer online platforms for convenience and home delivery services. Growing smartphone usage and digital payment adoption support rapid expansion. Competitive pricing and subscription-based refill models enhance customer retention. Increasing telemedicine consultations also promote online purchasing behavior. Availability of product comparisons and discounts attracts price-sensitive consumers. Expanding internet access in emerging markets further accelerates growth. As healthcare purchasing shifts toward digital platforms, online sales are expected to expand at the fastest rate during the forecast period.

- By End Use

On the basis of end use, the Insulin Delivery Devices market is segmented into hospitals, clinics, homecare, and specialty centers. The homecare segment dominated the largest market revenue share of 47.8% in 2025, driven by the growing trend of self-administration and home-based diabetes management. Most insulin-dependent patients prefer administering doses at home for convenience and privacy. Increasing availability of user-friendly devices strengthens segment growth. Technological advancements such as smart pens and portable pumps support safe home usage. Rising awareness regarding routine glucose monitoring further enhances demand. Aging population requiring long-term care contributes significantly to market share. Supportive reimbursement for home-use devices in developed regions also strengthens adoption.

The specialty centers segment is anticipated to witness the fastest CAGR of 21.5% from 2026 to 2033, driven by increasing focus on comprehensive diabetes care. Specialty centers offer personalized treatment plans and advanced device training programs. Growing number of dedicated diabetes management centers enhances device utilization. Rising patient preference for expert-guided therapy adjustments supports growth. Integration of digital monitoring systems improves clinical outcomes. Expanding investments in specialized endocrinology services further strengthen segment expansion. Increasing collaboration between device manufacturers and specialty clinics supports innovation adoption. As structured diabetes care programs expand globally, specialty centers are expected to grow at the fastest pace during the forecast period.

Europe Insulin Delivery Devices Market Regional Analysis

- The Europe insulin delivery devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of diabetes, increasing patient awareness about intensive insulin therapy, and growing adoption of technologically advanced insulin delivery solutions

- The region is witnessing significant uptake of connected insulin pumps and smart pen systems that offer real-time glucose tracking, automated dosing, and integration with digital health platforms. Increasing urbanization, coupled with the emphasis on remote patient monitoring and telemedicine, is further supporting market growth

- European healthcare providers are focusing on improving patient outcomes through innovative, user-friendly, and energy-efficient devices suitable for both home and clinical settings. The market is seeing robust growth across hospital, clinic, and home-based applications, with both new device implementations and upgrades to existing insulin delivery technologies driving adoption

U.K. Insulin Delivery Devices Market Insight

The U.K. insulin delivery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong reimbursement policies, widespread diabetes screening programs, and the high adoption of insulin pens and pump therapies among type 1 and insulin-dependent type 2 diabetic patients. Advanced healthcare infrastructure and patient education programs further facilitate market expansion. The demand for convenient, connected insulin delivery devices is rising as patients and caregivers increasingly seek solutions that support real-time monitoring, automated insulin dosing, and integration with mobile applications for diabetes management. In addition, the UK’s robust e-commerce and retail distribution channels enable easier access to these devices, encouraging both patients and healthcare providers to adopt smart insulin delivery systems for better disease control and lifestyle management.

Germany Insulin Delivery Devices Market Insight

The Germany insulin delivery devices market is expected to expand at a considerable CAGR during the forecast period, driven by the rising diabetic population, increasing preference for insulin pump therapy, and growing adoption of digitally connected insulin delivery systems integrated with continuous glucose monitoring technologies. Germany’s well-developed healthcare infrastructure, combined with high patient awareness and government-supported diabetes care initiatives, promotes the uptake of advanced insulin delivery solutions. The market is further supported by rising healthcare expenditure, innovation-focused medical technology investment, and the trend toward minimally invasive, patient-friendly, and eco-conscious insulin delivery devices. Integration with digital health platforms and telemedicine services is becoming increasingly common, aligning with German consumers’ preference for secure, connected, and personalized diabetes management solutions.

Europe Insulin Delivery Devices Market Share

The Insulin Delivery Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Novo Nordisk A/S (Denmark)

- Insulet Corporation (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Sanofi S.A. (France)

- Eli Lilly and Company (U.S.)

- Ypsomed AG (Switzerland)

- Roche Diabetes Care (Switzerland)

- SOOIL Development Co., Ltd. (South Korea)

- Jiangsu HengRui Medicine Co., Ltd. (China)

- Owen Mumford Ltd. (U.K.)

- Cellnovo Group (France)

- AdaptHealth, Inc. (U.S.)

- Becton Dickinson and Company (U.S.)

- Medisana AG (Germany)

Latest Developments in Europe Insulin Delivery Devices Market

- In February 2024, Insulet announced that it had received CE mark approval under the European Medical Device Regulation for enhanced compatibility of the Abbott FreeStyle Libre 2 Plus sensor with its Omnipod 5 Automated Insulin Delivery System. This regulatory milestone enabled broader integration of continuous glucose monitoring (CGM) with the tubeless pump platform for individuals aged two years and older with type 1 diabetes across European markets, strengthening the usability and appeal of combined insulin delivery and glucose monitoring solutions

- In January 2025, Insulet Corporation launched the Omnipod 5 Automated Insulin Delivery System in five additional European countries — Italy, Denmark, Finland, Norway, and Sweden — expanding access to its flagship tubeless insulin pump integrated with both Abbott FreeStyle Libre 2 Plus and Dexcom G6 CGM sensors. This expansion marked a significant step forward in making advanced automated insulin delivery technology more widely available to people with type 1 diabetes across the region

- In May 2025, Tandem Diabetes Care received CE mark approval for its Tandem Mobi insulin pump, featuring advanced Control-IQ+ technology. This regulatory authorization confirmed the device’s safety and performance for use in Europe and positioned the company to broaden

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.