Europe Insulin Market For Type 1 And Type 2 Diabetes Market

Market Size in USD Billion

CAGR :

%

USD

4.79 Billion

USD

6.56 Billion

2024

2032

USD

4.79 Billion

USD

6.56 Billion

2024

2032

| 2025 –2032 | |

| USD 4.79 Billion | |

| USD 6.56 Billion | |

|

|

|

|

Insulin Market for Type 1 And Type 2 Diabetes Market Size

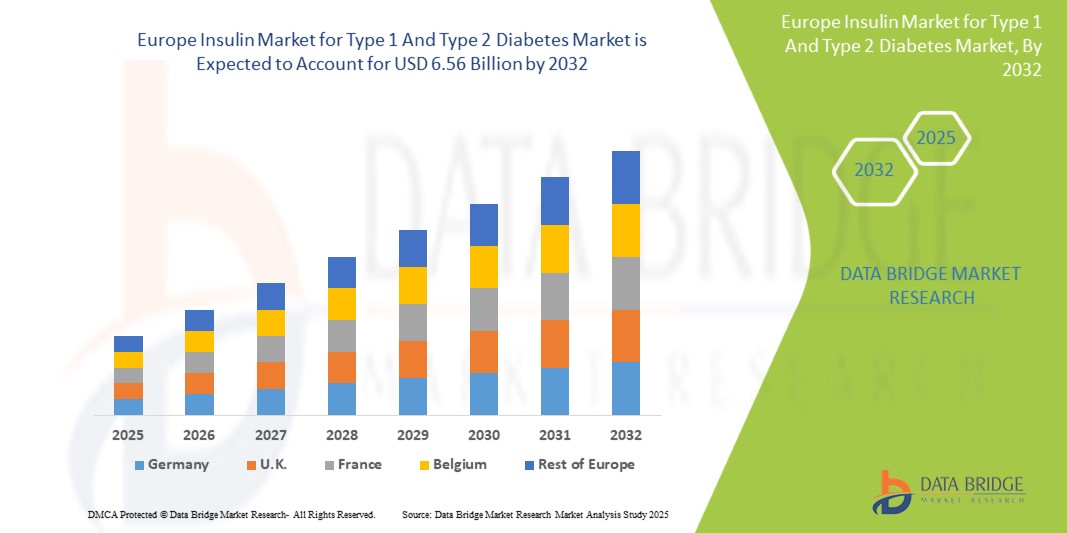

- The Europe insulin market for type 1 and type 2 diabetes market was valued at USD 4.79 billion in 2024 and is expected to reach USD 6.56 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.0%, primarily driven by the anticipated launch of therapies

- This growth is driven by factors such as the growing prevalence of diabetes, particularly Type 1 and Type 2, drives the demand for insulin. Additionally, advancements in insulin delivery systems and the increasing adoption of personalized diabetes care

Insulin Market for Type 1 And Type 2 Diabetes Market Analysis

- Type 1 diabetes is an autoimmune condition where the body’s immune system attacks and destroys insulin-producing beta cells in the pancreas, leading to an insulin deficiency. Type 2 diabetes occurs when the body becomes resistant to insulin or doesn't produce enough. Insulin therapy is used to regulate blood glucose levels in both conditions, improving glycemic control and preventing complications like cardiovascular diseases, kidney failure, and nerve damage

- Type 1 diabetes (T1D) is typically diagnosed in childhood or adolescence and requires lifelong insulin therapy, as the pancreas produces little to no insulin. It is an autoimmune disorder where the immune system mistakenly attacks insulin-producing beta cells. Type 2 Diabetes (T2D) is more common and primarily occurs in adults, although it is increasingly seen in children due to rising obesity rates. T2D is characterized by insulin resistance, where the body does not use insulin effectively. Over time, the pancreas cannot produce enough insulin to maintain normal blood glucose levels. Both types of diabetes require regular monitoring and insulin therapy to manage blood sugar levels effectively. Insulin treatment helps in preventing long-term complications like retinopathy, neuropathy, and cardiovascular diseases, improving the overall quality of life for patients

- The Germany stands out as one of the dominant region for Insulin Market for Type 1 And Type 2 Diabetes, driven by its advanced healthcare infrastructure and high adoption of innovative insulin delivery technologies

- For instance, Germany continues to lead in the use of insulin pumps and continuous glucose monitoring systems, enabling better diabetes management

- With a growing focus on diabetes treatment and patient-centric solutions, the region drives significant advancements in insulin therapies, contributing greatly to Europe market growth.

Report Scope and Insulin Market for Type 1 and Type 2 Diabetes Market Segmentation

|

Attributes |

Insulin Market for Type 1 and Type 2 Diabetes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insulin Market for Type 1 And Type 2 Diabetes Market Trends

“Increased Adoption of Smart Insulin Delivery Systems”

- One prominent trend in the Europe Insulin Market for Type 1 and Type 2 Diabetes is the growing adoption of smart insulin delivery systems.

- These advanced devices enhance diabetes management by offering real-time monitoring and insulin dose adjustments based on glucose levels, improving precision and overall treatment outcomes

- For instance, insulin pumps integrated with continuous glucose monitoring (CGM) systems allow for automated insulin delivery, adjusting doses based on real-time data, which helps maintain optimal glucose control with minimal manual intervention

- Digital platforms also facilitate seamless data tracking, enabling patients and healthcare providers to monitor trends, improve treatment plans, and prevent complications

- This trend is transforming diabetes care, promoting better patient compliance and outcomes, and driving the demand for advanced insulin delivery technologies in the market

Insulin Market for Type 1 And Type 2 Diabetes Market Dynamics

Driver

“Rising Prevalence of Diabetes”

- The increasing number of individuals diagnosed with diabetes creates a substantial demand for effective insulin therapies, which in turn drives growth in the Europe insulin market. Factors such as sedentary lifestyles, unhealthy diets, and an aging population contribute to this trend, resulting in a larger patient base requiring diabetes management solutions

- The heightened need for insulin products spurs innovation and competition among pharmaceutical companies, leading to the development of new formulations and delivery methods. This dynamic environment supports existing therapies and encourages the introduction of affordable biosimilars and improved technologies, further expanding market opportunities

For instance,

- In 2024, as per WHO, the number of people living with diabetes rose from 200 million in 1990 to 830 million in 2022. This rise was more rapid in low- and middle-income countries than in high-income countries. Diabetes caused over 2 million deaths in 2021, with significant complications like kidney failure and heart disease

- In March 2024, as per NCBI, diabetes prevalence has significantly increased, with 537 million adults affected in 2021, representing 10.5% of the population. By 2030, this number is projected to rise to 643 million (11.3%). Diabetes-related healthcare costs were $966 billion in 2021, expected to exceed $1054 billion by 2045

- The rising Europe prevalence of diabetes is fueling the need for innovative and convenient treatments, which can significantly improve patient quality of life and adherence to therapy. While challenges related to bioavailability and production costs remain, the market potential is vast, offering a promising solution for both Type 1 and Type 2 diabetes management

Opportunity

“Advancements in Insulin Formulation and Delivery Technologies”

- Advancements in insulin drug formulation, including nanoparticle carriers, mucoadhesive agents, and pH-sensitive coatings, have significantly improved the bioavailability of oral insulin, making it a viable alternative to traditional injections. Innovations such as insulin analogs and smart drug delivery systems enhance absorption and enable real-time glucose monitoring. These breakthroughs address patient adherence, particularly in emerging markets with increasing diabetes prevalence, creating significant growth opportunities for the oral insulin market

For instance,

- A July 2020 article by NCBI highlighted that the urgent need for innovative treatments to address the growing diabetes burden. Key needs include improving patient adherence to treatment regimens, reducing healthcare costs, and providing effective, non-invasive solutions for diabetes management. Advancements like oral insulin and smart drug delivery systems present promising opportunities to meet these challenges and improve patient outcomes

- In August 2024, MDPI reported that advancements in drug delivery systems, such as nanoparticles and liposomes, to improve oral insulin bioavailability. These innovations offer a significant opportunity to enhance diabetes management by providing non-invasive, effective treatments. As Europe diabetes rates rise, such advancements meet the increasing demand for patient-centric solutions. These advancements in drug delivery systems cater to the need for more accessible, patient-focused treatments

- The ongoing advancements in drug formulation and technology are transforming the oral insulin landscape, providing significant opportunities for better management of diabetes. Innovations in bioavailability enhancement, novel drug delivery systems, and the integration of digital health tools pave the way for oral insulin to become a reliable, non-invasive alternative to injectable therapies. As the Europe diabetes epidemic continues to rise, these technological innovations not only boost patient adherence but also enable more efficient, tailored diabetes management, ultimately improving the quality of life

Restraint/Challenge

“Adverse Effects of High Dosage Of Insulin”

- High dosages of insulin can result in considerable adverse effects such as hypoglycemia, weight gain, and potential cardiovascular issues, which may discourage both patients and healthcare providers from embracing insulin therapies.

- As a result, concerns over these complications can lead to greater caution in prescribing practices, ultimately hindering the expansion of the Europe insulin market for Type 1 and Type 2 diabetes, as patients increasingly turn to alternative treatments or management strategies.

For instance,

- In July 2023, NCBI stated that Hypoglycemia is the most common adverse effect of insulin therapy. The other adverse effects of insulin therapy include weight gain and rarely electrolyte disturbances such as hypokalemia, especially when used along with other drugs causing hypokalemia. Moreover, pain at the injection site and lipodystrophy at the injection site are the most common adverse effects of daily subcutaneous injections

- Moreover, the fear of adverse reactions from high dosages can result in increased healthcare costs due to hospitalization or the need for additional medications to manage side effects. This financial burden can limit access to insulin therapies, particularly in developing regions where healthcare resources are constrained, further contributing to a restrained Europe insulin market. Increased awareness and education about these risks are essential, but they also underline the challenges the market faces in encouraging widespread adherence to insulin regimens

Europe Insulin Market for Type 1 and Type 2 Diabetes Market Scope

The market is segmented on the basis type, product type, absorption site, age group, source, delivery method, gender, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product Type |

|

|

By Absorption Site |

|

|

By Age Group

|

|

|

By Source |

|

|

By Delivery Method |

|

|

By Gender

|

|

|

By Distribution Channel

|

|

Insulin Market for Type 1 and Type 2 Diabetes Market Regional Analysis

“Germany is the Dominant Country in the Insulin Market for Type 1 and Type 2 Diabetes”

- Germany dominates the insulin market for type 1 and type 2 diabetes, driven by advanced healthcare infrastructure, high adoption of innovative insulin therapies, and the strong presence of leading pharmaceutical companies.

- The Germany holds a significant share due to the rising prevalence of diabetes, increased demand for advanced insulin delivery systems, and continuous innovations in diabetes management technologies

- The availability of well-established healthcare policies and robust reimbursement structures, along with substantial investments in research & development by top insulin manufacturers, further strengthens the market

- Additionally, the growing focus on personalized diabetes care, along with an increase in the adoption of insulin pumps and continuous glucose monitoring (CGM) systems, is fueling market expansion across the region

“Germany is Projected to Register the Highest Growth Rate”

- The Germany is expected to witness the highest growth rate in the Insulin Market for Type 1 and Type 2 Diabetes, driven by rapid improvements in healthcare infrastructure, increasing awareness about diabetes management, and rising adoption of advanced insulin therapies

- Countries such as Germany, France, and U.K. are emerging as key markets due to the growing aging population, which is more susceptible to diabetes-related complications

- Germany, with its advanced healthcare systems and increasing number of diabetes specialists, remains a crucial market for insulin therapies. The country continues to lead in the adoption of innovative insulin delivery devices, such as insulin pumps and continuous glucose monitoring (CGM) systems

- Germany and France, with their large diabetic populations and rising rates of diabetes-related health complications, are witnessing increased government and private sector investments in modern diabetes care solutions. The expanding presence of Europe insulin manufacturers and improving access to advanced diabetes treatment options further contribute to market growth

Insulin Market for Type 1 and Type 2 Diabetes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- Eli Lilly and Company (U.S.)

- Sanofi (France)

- Biocon (India)

- Lupin (India)

- Shanghai Fosun Wanbang (Jiangsu) Pharmaceutical Group Co., Ltd. (China)

- Diasome Pharmaceuticals, Inc. (U.S.)

- SciGen Pte. Ltd. (Singapore)

- Wockhardt (India)

- MJ Biopharma Pvt. Ltd. (India)

- Oramed Pharmaceuticals (U.S.)

- Adocia (France)

- Nektar Therapeutics (U.S.)

Latest Developments in Europe Insulin Market for Type 1 and Type 2 Diabetes

- In September 2024, Novo Nordisk has announced a new partnership to establish human insulin production in South Africa, strengthening its commitment to diabetes care in Africa. Currently reaching 500,000 people in Sub-Saharan Africa, this initiative aims to expand insulin access, with a goal of supplying 4.1 million people with type 1 and type 2 diabetes across the continent by 2026

- In August, Eli Lilly announced positive results from the SURMOUNT-1 study, showing that weekly tirzepatide (Zepbound/Mounjaro) reduced the risk of type 2 diabetes by 94% in adults with pre-diabetes and obesity or overweight. The 15 mg dose led to a 22.9% average weight loss over 176 weeks, demonstrating sustained efficacy

- In December 2022, Sanofi expanded its collaboration with Innate Pharma, focusing on natural killer (NK) cell engagers in oncology. Sanofi licensed the B7H3-targeting NK cell engager program from Innate's ANKET platform, with the option to add two more targets. This partnership aims to develop new cancer therapies, including treatments for solid tumors, enhancing Sanofi's immuno-oncology pipeline. The collaboration is expected to provide innovative cancer treatment options with a strong safety profile, benefiting patients by offering potential therapies for multiple cancer types. Sanofi will handle further development, manufacturing, and commercialization responsibilities

- In December 2024, Lupin Acquired Huminsulin from Lilly to Enhance Diabetes Portfolio. It was performed in the aim to expand diabetes portfolio and provide high-quality, affordable health care to our patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 COMPETITIVE INTELLIGENCE

4.4 EUROPE AND REGIONAL PREVALENCE:

4.5 INDUSTRY INSIGHTS

4.6 KEY MARKETING STRATEGIES FOR THE EUROPE INSULIN MARKET TYPE 1 & TYPE 2 DIABETES

4.7 MARKETED DRUG ANALYSIS

5 PIPELINE ANALYSIS

6 REGULATORY FRAMEWORK

6.1 REGULATORY FRAMEWORK FOR THE ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.1.1 REGULATORY APPROVAL PROCESS

6.1.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.1.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.1.4 LICENSING AND REGISTRATION

6.1.5 POST-MARKETING SURVEILLANCE

6.1.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.2 REGULATORY FRAMEWORK FOR THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.2.1 REGULATORY APPROVAL PROCESS

6.2.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.2.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.2.4 LICENSING AND REGISTRATION

6.2.5 POST-MARKETING SURVEILLANCE

6.2.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.3 REGULATORY FRAMEWORK FOR THE SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.3.1 REGULATORY APPROVAL PROCESS

6.3.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.3.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.3.4 LICENSING AND REGISTRATION

6.3.5 POST-MARKETING SURVEILLANCE

6.3.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.4 REGULATORY FRAMEWORK FOR THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.4.1 REGULATORY APPROVAL PROCESS

6.4.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.4.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.4.4 LICENSING AND REGISTRATION

6.4.5 POST-MARKETING SURVEILLANCE

6.4.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.5 REGULATORY FRAMEWORK FOR THE MIDDLE EAST & AFRICA (MEA) INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.5.1 REGULATORY APPROVAL PROCESS

6.5.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.5.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.5.4 LICENSING AND REGISTRATION

6.5.5 POST-MARKETING SURVEILLANCE

6.5.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF DIABETES

7.1.2 GROWING ADOPTION OF INSULIN THERAPIES FOR TYPE 1 AND TYPE 2 DIABETES

7.1.3 INTEGRATION OF AUTOMATED INSULIN DELIVERY (AID)

7.1.4 INCREASING TECHNOLOGICAL INNOVATIONS FOR INSULIN

7.2 RESTRAINTS

7.2.1 ADVERSE EFFECTS OF HIGH DOSAGE OF INSULIN

7.2.2 HIGH PRODUCTION AND DEVELOPMENT COSTS ASSOCIATED WITH INSULIN

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN INSULIN FORMULATION AND DELIVERY TECHNOLOGIES

7.3.2 REVOLUTIONIZING DIABETES MANAGEMENT WITH NEEDLE-FREE INSULIN

7.3.3 INCREASING PHARMACEUTICAL INVESTMENTS AND STRATEGIC COLLABORATIONS

7.4 CHALLENGES

7.4.1 INSULIN ACCESSIBILITY CHALLENGES IN RURAL AND UNDERSERVED REGIONS

7.4.2 LIMITED SHELF LIFE ASSOCIATED WITH ORAL INSULIN

8 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

8.1 OVERVIEW

8.2 TYPE 2 DIABETES

8.3 TYPE 1 DIABETES

9 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE

9.1 OVERVIEW

9.2 ANALOG INSULIN

9.3 HUMAN INSULIN

9.4 OTHERS

10 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 LONG ACTING INSULIN

10.3 RAPID-ACTING INSULIN

10.4 SHORT ACTING INSULIN

10.5 OTHERS

11 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER

11.1 OVERVIEW

11.2 MALE

11.3 FEMALE

12 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD

12.1 OVERVIEW

12.2 INSULIN PENS

12.3 VIAL & SYRINGE

12.4 INSULIN PUMPS

12.5 INHALABLE INSULIN

12.6 IMPLANTABLE INSULIN DELIVERY SYSTEMS

13 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT PATIENTS

13.3 GERIATRIC PATIENTS

13.4 PEDIATRIC PATIENTS

14 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE

14.1 OVERVIEW

14.2 BASAL

14.3 BOLUS

14.4 OTHERS

15 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL PHARMACIES

15.3 HOSPITAL PHARMACIES

15.4 ONLINE PHARMACIES

15.5 DIABETES CLINICS & SPECIALTY PHARMACIES

16 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES MARKET, BY REGION

16.1 EUROPE

16.1.1 GERMANY

16.1.2 FRANCE

16.1.3 U.K

16.1.4 ITALY

16.1.5 RUSSIA

16.1.6 SPAIN

16.1.7 TURKEY

16.1.8 NETHERLANDS

16.1.9 SWITZERLAND

16.1.10 AUSTRIA

16.1.11 IRELAND

16.1.12 NORWAY

16.1.13 POLAND

16.1.14 REST OF EUROPE

17 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: EUROPE

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 NOVO NORDISK A/S

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 SWOT ANALYSIS

19.1.5 PIPELINE PORTFOLIO

19.1.6 RECENT DEVELOPMENT/ NEWS

19.2 LILLY

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 SWOT ANALYSIS

19.2.5 PRODUCT PORTFOLIO

19.2.6 RECENT DEVELOPMENT

19.3 SANOFI

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 SWOT ANALYSIS

19.3.5 PRODUCT PORTFOLIO

19.3.6 RECENT DEVELOPMENT

19.4 BIOCON

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 SWOT ANALYSIS

19.4.5 PIPELINE PRODUCT PORTFOLIO

19.4.6 RECENT DEVELOPMENT

19.5 LUPIN

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 SWOT ANALYSIS

19.5.5 PRODUCT PORTFOLIO

19.5.6 RECENT DEVELOPMENT

19.6 ADOCIA

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 SWOT ANALYSIS

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENT

19.7 DIASOME PHARMACEUTICALS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 SWOT ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 MJ BIOPHARM PVT LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 SWOT ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 NEKTAR

19.9.1 COMPANY SNAPSHOT

19.9.2 SWOT ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT NEWS

19.1 ORAMED

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 SWOT ANALYSIS

19.10.4 PIPELINE PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENT

19.11 SCIGEN PTE. LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 SWOT ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 SHANGHAI FOSUN PHARMACEUTICAL(GROUP)CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 SWOT ANALYSIS

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENT

19.13 WOCKHARDT

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 SWOT ANALYSIS

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENT

20 QUESTIONNAIRE

List of Table

TABLE 1 THE TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

TABLE 2 DISTRIBUTION OF EXPENDITURE ACROSS REGIONS:

TABLE 3 NUMBER OF ADULTS WITH DIABETES IS EXPECTED TO INCREASE SIGNIFICANTLY IN SEVERAL COUNTRIES:

TABLE 4 REGIONAL DIABETES STATISTICS: PREVALENCE, TREATMENT, AND OUTCOMES

TABLE 5 EUROPE CLINICAL TRIAL MARKET FOR ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 6 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE EUROPE ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 7 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE EUROPE ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 8 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE TYPE 2 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE TYPE 1 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE ANALOG INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE HUMAN INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE LONG ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE RAPID-ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE SHORT ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE MALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE FEMALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE INSULIN PENS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE VIAL & SYRINGE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE INSULIN PUMPS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE INHALABLE INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE IMPLANTABLE INSULIN DELIVERY SYSTEMS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE ADULT PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE GERIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE PEDIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE BASAL IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE BOLUS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE RETAIL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE HOSPITAL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE ONLINE PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE DIABETES CLINICS & SPECIALTY PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 54 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 55 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 56 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 57 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 58 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 59 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 62 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 63 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 64 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 65 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 66 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 70 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 71 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 72 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 73 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 74 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 75 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 78 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 79 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 80 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 81 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 82 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 86 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 87 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 88 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 89 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 90 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 94 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 95 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 96 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 97 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 98 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 99 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 102 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 103 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 104 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 105 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 106 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 113 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 114 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 115 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 118 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 119 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 120 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 121 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 122 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 123 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 126 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 127 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 128 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 129 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 130 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 131 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 134 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 135 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 136 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 137 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 138 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 139 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 142 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 143 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 144 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 145 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 146 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 147 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 150 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 151 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 152 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 153 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 154 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 155 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 158 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 159 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 160 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 161 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 162 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 2 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DATA TRIANGULATION

FIGURE 3 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DROC ANALYSIS

FIGURE 4 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 10 TWO SEGMENTS COMPRISE THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

FIGURE 11 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING PREVALENCE OF DIABETES IS EXPECTED TO DRIVE THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 TYPE 2 DIABETES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 15 TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

FIGURE 16 EUROPE HEALTHCARE EXPENDITURE FOR DIABETES

FIGURE 17 NUMBER OF PEOPLE WITH DIABETES IN 2045 (MILLIONS)

FIGURE 18 DROC ANALYSIS

FIGURE 19 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2024

FIGURE 20 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 21 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, CAGR (2025-2032)

FIGURE 22 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, LIFELINE CURVE

FIGURE 23 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2024

FIGURE 24 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, CAGR (2025-2032)

FIGURE 26 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, LIFELINE CURVE

FIGURE 27 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, 2024

FIGURE 28 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 30 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 31 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, 2024

FIGURE 32 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 33 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, CAGR (2025-2032)

FIGURE 34 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, LIFELINE CURVE

FIGURE 35 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, 2024

FIGURE 36 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, CAGR (2025-2032)

FIGURE 38 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, LIFELINE CURVE

FIGURE 39 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, 2024

FIGURE 40 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, CAGR (2025-2032)

FIGURE 42 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, LIFELINE CURVE

FIGURE 43 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, 2024

FIGURE 44 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, 2025 TO 2032 (USD THOUSAND)

FIGURE 45 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, CAGR (2025-2032)

FIGURE 46 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, LIFELINE CURVE

FIGURE 47 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, 2024

FIGURE 48 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 49 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 50 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 51 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SNAPSHOT (2024)

FIGURE 52 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.