Europe Internet Of Medical Things Iomt Market

Market Size in USD Billion

CAGR :

%

USD

27.33 Billion

USD

135.89 Billion

2025

2033

USD

27.33 Billion

USD

135.89 Billion

2025

2033

| 2026 –2033 | |

| USD 27.33 Billion | |

| USD 135.89 Billion | |

|

|

|

|

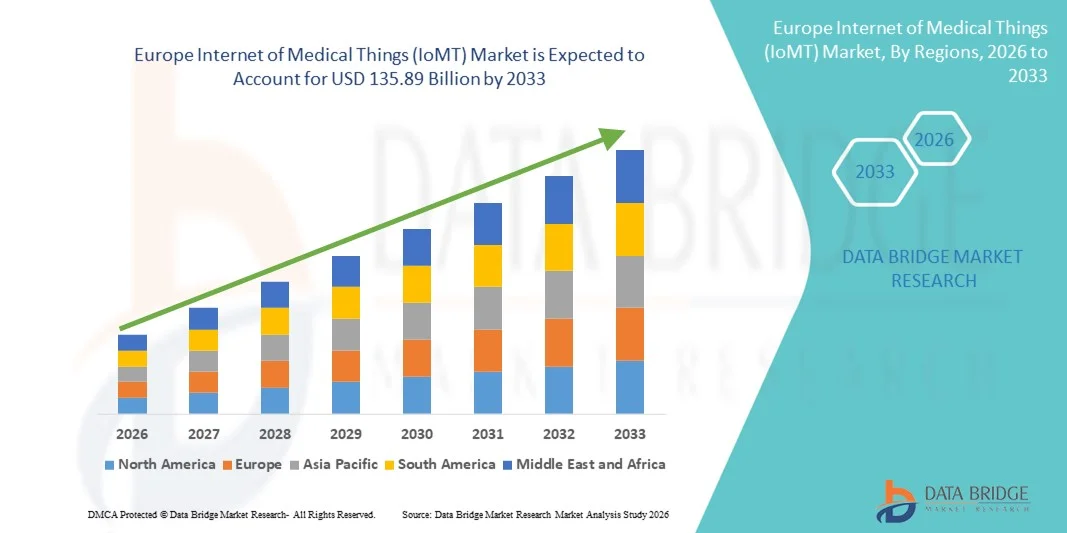

Europe Internet of Medical Things (IoMT) Market Size

- The Europe Internet of Medical Things (IoMT) market size was valued at USD 27.33 billion in 2025 and is expected to reach USD 135.89 billion by 2033, at a CAGR of 22.2% during the forecast period

- The market growth is largely driven by the rising adoption of connected medical devices, remote patient monitoring solutions, and the rapid digital transformation of healthcare systems across hospitals, clinics, and homecare settings

- Furthermore, increasing demand for real-time health data, improved clinical outcomes, and efficient care delivery supported by advancements in cloud computing, AI, and interoperability standards is positioning IoMT as a core component of modern European healthcare, thereby significantly accelerating overall market growth

Europe Internet of Medical Things (IoMT) Market Analysis

- Europe Internet of Medical Things (IoMT), comprising connected medical hardware, software platforms, and healthcare services, is becoming an integral part of the region’s digital healthcare ecosystem across hospitals, clinics, and homecare settings due to its ability to enable real-time monitoring, data-driven clinical decisions, and improved patient outcomes

- The rising demand for Europe Internet of Medical Things (IoMT) solutions is primarily driven by the growing burden of chronic diseases, aging populations, increasing adoption of digital health technologies, and a strong preference for remote, connected, and value-based healthcare delivery models

- Germany dominated the Europe Internet of Medical Things (IoMT) market with the largest revenue share of 28.6% in 2025, supported by advanced healthcare infrastructure, strong regulatory support for digital health, and early adoption of connected medical technologies

- Poland is expected to be the fastest growing Europe Internet of Medical Things (IoMT) market during the forecast period due to accelerating healthcare digitization initiatives and increasing investments in telehealth and connected care solution

- The hardware segment dominated the Europe Internet of Medical Things (IoMT) market with a share of 44.2% in 2025, driven by high adoption of connected medical devices, wearable sensors, and monitoring equipment across hospitals and homecare settings for continuous data collection and patient monitoring

Report Scope and Europe Internet of Medical Things (IoMT) Market Segmentation

|

Attributes |

Europe Internet of Medical Things (IoMT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Internet of Medical Things (IoMT) Market Trends

Expansion of AI-Enabled Remote Patient Monitoring and Data Integration

- A significant and accelerating trend in the Europe Internet of Medical Things (IoMT) market is the expanding integration of artificial intelligence (AI), cloud platforms, and connected medical devices to enable advanced remote patient monitoring and data-driven clinical decision-making across healthcare systems

- For instance, connected cardiac monitors, glucose monitoring systems, and wearable vital-sign sensors deployed across European hospitals and homecare settings are increasingly integrated with AI-based analytics platforms to support early diagnosis and continuous patient assessment

- AI integration within IoMT ecosystems enables capabilities such as predictive analytics for disease progression, automated anomaly detection in patient data, and personalized treatment insights. For instance, AI-powered IoMT platforms can flag irregular heart rhythms or abnormal glucose levels in real time, enabling clinicians to intervene earlier and reduce hospital readmissions

- The seamless integration of IoMT devices with electronic health records (EHRs) and hospital information systems facilitates centralized data access and improved interoperability across care pathways. Through unified digital platforms, healthcare providers can manage connected devices, patient data, and clinical workflows within a single interface

- This trend toward intelligent, interconnected, and data-centric healthcare infrastructure is reshaping care delivery models across Europe. Consequently, companies such as Philips and Siemens Healthineers are expanding AI-enabled IoMT portfolios that support remote monitoring, predictive maintenance, and clinical intelligence across hospital and homecare environments

- The demand for AI-enabled IoMT solutions is growing rapidly across hospitals, outpatient clinics, and home healthcare settings, as European healthcare systems increasingly prioritize efficiency, outcome-based care, and digital transformation

Europe Internet of Medical Things (IoMT) Market Dynamics

Driver

Rising Burden of Chronic Diseases and Digital Healthcare Adoption

- The increasing prevalence of chronic diseases and aging populations across Europe, combined with the accelerating adoption of digital healthcare solutions, is a major driver fueling demand for IoMT technologies

- For instance, in March 2025, several European healthcare providers expanded remote patient monitoring programs using connected devices to manage chronic conditions such as cardiovascular diseases and diabetes, supporting long-term care outside traditional hospital settings

- As healthcare systems face growing pressure to improve patient outcomes while controlling costs, IoMT solutions enable continuous monitoring, early intervention, and reduced hospital stays, offering a compelling alternative to conventional care models

- Furthermore, strong government support for digital health initiatives, interoperability standards, and data-driven healthcare is positioning IoMT as a foundational component of modern European healthcare infrastructure

- The increasing penetration of wearable medical devices and connected diagnostics among patients is expanding data availability and strengthening preventive and personalized care approaches across Europe

- The integration of IoMT solutions into hospital asset management and workflow optimization is improving operational efficiency, reducing equipment downtime, and enhancing overall healthcare productivity

- The ability to remotely monitor patients, share real-time clinical data, and enable collaborative care among providers is driving IoMT adoption across hospitals, clinics, and homecare environments. The shift toward value-based care and telehealth services further accelerates market growth

Restraint/Challenge

Data Privacy Concerns and Regulatory Compliance Complexity

- Concerns related to data privacy, cybersecurity risks, and compliance with stringent European healthcare regulations pose a significant challenge to widespread IoMT adoption. As IoMT systems collect and transmit sensitive patient data, they are exposed to potential cyber threats and unauthorized access

- For instance, heightened scrutiny around compliance with GDPR and medical device regulations has increased caution among healthcare providers when deploying large-scale IoMT networks

- Addressing these challenges requires robust data encryption, secure device authentication, and continuous compliance monitoring to protect patient information and maintain trust. Companies such as Medtronic and GE HealthCare emphasize secure data architectures and regulatory-aligned design in their IoMT offerings to mitigate these concerns

- In addition, the high initial investment required for IoMT infrastructure, system integration, and staff training can be a barrier for smaller hospitals and resource-constrained healthcare facilities. While scalable and cloud-based solutions are emerging, cost considerations remain a key restraint

- The lack of uniform interoperability standards across different IoMT devices and healthcare IT systems can lead to data silos, integration challenges, and delayed clinical decision-making

- Limited digital literacy among healthcare professionals and patients in certain regions may slow IoMT adoption, requiring additional training, change management efforts, and organizational investment

- Overcoming these challenges through strengthened cybersecurity frameworks, regulatory harmonization, and cost-effective deployment models will be critical for sustaining long-term growth of the Europe IoMT market

Europe Internet of Medical Things (IoMT) Market Scope

The market is segmented on the basis of component, platform, mode of service delivery, connectivity devices, application, and end-user.

- By Component

On the basis of component, the Europe Internet of Medical Things (IoMT) market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest market revenue share of 44.2% in 2025, driven by extensive deployment of connected medical devices such as patient monitoring systems, wearable sensors, implantable devices, and diagnostic equipment across hospitals and homecare settings. Healthcare providers continue to prioritize hardware investments to enable real-time data capture and continuous monitoring. The frequent replacement cycle of medical devices and growing installed base further support dominance. Hardware components also benefit from established regulatory pathways in Europe. Rising prevalence of chronic diseases has increased demand for monitoring devices. These factors collectively reinforce the hardware segment’s leading position.

The software segment is anticipated to witness the fastest growth rate during the forecast period, fueled by increasing demand for advanced analytics, AI-driven insights, and interoperability across connected healthcare systems. IoMT software enables processing and interpretation of large volumes of patient data generated by hardware devices. Growing focus on predictive diagnostics and personalized treatment plans is accelerating adoption. Cloud-based software platforms enhance scalability and reduce operational costs. Integration with electronic health records improves workflow efficiency. These advantages are driving rapid growth of the software segment.

- By Platform

On the basis of platform, the Europe Internet of Medical Things (IoMT) market is segmented into device management, application management, and cloud management. The device management segment held the largest market revenue share in 2025, driven by the need for centralized monitoring, configuration, and maintenance of connected medical devices. Hospitals rely on device management platforms to ensure device performance, security, and regulatory compliance. These platforms enable firmware updates and lifecycle management across large IoMT networks. Increasing device volumes within healthcare facilities further strengthen demand. Regulatory emphasis on device traceability also supports adoption. As a result, device management remains the dominant platform.

The cloud management segment is expected to witness the fastest CAGR during the forecast period, driven by rising adoption of cloud infrastructure in European healthcare systems. Cloud platforms support scalable data storage, advanced analytics, and real-time data access. Healthcare organizations are adopting cloud management to reduce IT complexity and costs. Improved cybersecurity and GDPR-compliant cloud environments are boosting confidence. Cloud platforms also enable seamless AI integration. These factors are accelerating growth of cloud management solutions.

- By Mode of Service Delivery

On the basis of mode of service delivery, the Europe Internet of Medical Things (IoMT) market is segmented into on-premise and cloud. The on-premise segment dominated the market in 2025, owing to strong data privacy concerns and strict regulatory requirements across European healthcare systems. Many hospitals prefer on-premise deployment to maintain full control over sensitive patient data. Integration with existing hospital IT infrastructure supports adoption. Large healthcare institutions with established data centers continue to favor this model. On-premise systems also offer customization flexibility. These factors contribute to continued dominance.

The cloud segment is projected to grow at the fastest rate from 2026 to 2033, supported by the expanding telehealth services and remote patient monitoring initiatives. The cloud deployment enables real-time data sharing across care settings. Lower upfront costs make cloud solutions attractive for smaller facilities. Advances in encryption and cybersecurity are reducing adoption barriers. Cloud platforms also support scalability and innovation. These advantages are driving rapid cloud adoption.

- By Connectivity Devices

On the basis of connectivity devices, the Europe Internet of Medical Things (IoMT) market is segmented into wired and wireless. The wireless segment dominated the market in 2025, driven by widespread use of wearable devices, mobile health applications, and remote monitoring solutions. Wireless connectivity enables patient mobility and flexible care delivery. Technologies such as Wi-Fi, Bluetooth, and cellular networks support real-time data transmission. Reduced installation complexity further enhances adoption. Wireless systems are particularly important for homecare applications. These factors support segment dominance.

The wired segment is expected to witness the fastest growth during the forecast period, driven by its reliability and stable data transmission in critical care environments. Wired connectivity is preferred in intensive care units and diagnostic settings. Hospitals continue investing in wired networks for high-precision applications. Lower latency and minimal interference offer performance advantages. Compatibility with existing infrastructure supports adoption. These factors contribute to steady growth.

- By Application

On the basis of application, the Europe Internet of Medical Things (IoMT) market is segmented into on-body devices, healthcare providers, home-use medical devices, community, and others. The healthcare providers segment dominated the market in 2025, driven by extensive IoMT adoption across hospitals and clinics. Providers utilize IoMT for patient monitoring, workflow optimization, and asset tracking. Strong financial capacity supports large-scale deployment. Integration with hospital information systems enhances efficiency. Regulatory encouragement for digital health further supports growth. These factors position healthcare providers as the leading application segment.

The home-use medical devices segment is anticipated to witness the fastest growth rate during the forecast period, fueled by the increasing demand for remote and home-based care. The aging populations and chronic disease prevalence are accelerating adoption. IoMT enables continuous monitoring outside hospital settings. The patients benefit from convenience and reduced hospital visits. The healthcare systems benefit from the cost efficiency. These factors drive rapid growth of this segment.

- By End-User

On the basis of end-user, the Europe Internet of Medical Things (IoMT) market is segmented into hospitals, clinics, research institutes & academics, homecare, and others. The hospitals segment dominated the market in 2025, owing to high adoption of connected medical technologies across diagnostic and monitoring applications. Hospitals leverage IoMT to improve patient outcomes and operational efficiency. Strong infrastructure supports deployment. Integration with advanced IT systems enhances care delivery. Regulatory initiatives further encourage adoption. As a result, hospitals remain the largest end-user.

The homecare segment is projected to witness the fastest growth during the forecast period, driven by increasing emphasis on decentralized care delivery. IoMT enables continuous monitoring of patients in home settings. Rising healthcare costs are encouraging alternatives to hospital-based care. Technological advancements are improving device usability for patients. Government support for aging-in-place initiatives also contributes. These factors are propelling rapid growth in the homecare segment.

Europe Internet of Medical Things (IoMT) Market Regional Analysis

- Germany dominated the Europe Internet of Medical Things (IoMT) market with the largest revenue share of 28.6% in 2025, supported by advanced healthcare infrastructure, strong regulatory support for digital health, and early adoption of connected medical technologies

- Healthcare providers in Germany highly value IoMT solutions for enabling real-time patient monitoring, improving clinical decision-making, and seamless integration with hospital information systems and electronic health records

- This strong adoption is further supported by high healthcare expenditure, a technologically advanced healthcare ecosystem, and a growing focus on value-based and remote care models, establishing Germany as the leading IoMT market in Europe

The Germany Internet of Medical Things (IoMT) Market Insight

The Germany Internet of Medical Things (IoMT) market dominated Europe in 2025 with the largest revenue share, fueled by early adoption of connected medical technologies, advanced healthcare infrastructure, and high healthcare expenditure. Hospitals and clinics in Germany prioritize IoMT for real-time patient monitoring, predictive analytics, and workflow optimization. Growing emphasis on value-based healthcare and remote patient management is supporting adoption. Germany’s well-established regulatory framework and strong focus on data security are encouraging providers to invest in IoMT platforms. Integration with hospital information systems and electronic health records enhances operational efficiency. The country also benefits from a technologically skilled workforce driving innovation in connected healthcare solutions.

United Kingdom Internet of Medical Things (IoMT) Market Insight

The United Kingdom Internet of Medical Things (IoMT) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on digital health initiatives and remote monitoring programs. Rising chronic disease prevalence, aging populations, and government support for telehealth services are key growth factors. Hospitals and homecare providers in the U.K. are leveraging IoMT devices for continuous patient monitoring and data-driven clinical decision-making. Integration with electronic health records and healthcare analytics platforms enhances care quality and operational efficiency. The country’s robust healthcare infrastructure and emphasis on innovation support continued market expansion. Adoption is also encouraged by rising awareness of digital health benefits among patients and providers.

France Internet of Medical Things (IoMT) Market Insight

The France Internet of Medical Things (IoMT) market is witnessing steady growth due to government initiatives promoting digital healthcare transformation and the increasing deployment of connected medical devices in hospitals. Healthcare providers are adopting IoMT for remote monitoring, chronic disease management, and clinical workflow optimization. The French healthcare system’s strong IT infrastructure supports integration with electronic health records and hospital information systems. Increasing awareness of patient safety, efficiency, and value-based care is accelerating adoption. Homecare applications are also growing, supported by telehealth programs. France’s favorable reimbursement policies further enhance market uptake.

Poland Internet of Medical Things (IoMT) Market Insight

The Poland Internet of Medical Things (IoMT) market is expected to be the fastest-growing country in Europe during the forecast period, driven by rapid healthcare digitization and increasing adoption of connected medical devices. Hospitals and clinics are implementing IoMT solutions to improve patient monitoring, reduce hospital readmissions, and optimize clinical workflows. Government initiatives promoting telehealth and remote care are further supporting adoption. Rising awareness of chronic disease management and the need for value-based healthcare is fueling growth. Homecare and outpatient applications are also expanding rapidly, aided by affordable IoMT solutions. Integration with electronic health records and analytics platforms is enhancing operational efficiency and patient outcomes.

Europe Internet of Medical Things (IoMT) Market Share

The Europe Internet of Medical Things (IoMT) industry is primarily led by well-established companies, including:

- Biotronik SE & Co. KG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (U.S.)

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Baxter (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Omron Healthcare Inc. (Japan)

- Cerner Corporation (U.S.)

- SAP SE ADR (Germany)

- NEC Corporation (Japan)

What are the Recent Developments in Europe Internet of Medical Things (IoMT) Market?

- In June 2025, insights from HIMSS25 Europe highlighted the acceleration of digital health technologies, including IoMT, across European healthcare systems, with healthcare leaders gathering in Paris to discuss advancements in AI, remote monitoring, interoperability, and digital transformation that are expected to further drive adoption of connected medical devices and IoMT platforms

- In May 2025, MedTech Europe published “One year of AI Act: MedTech Europe calls for coherent implementation to unlock the full potential of AI in healthcare,” stressing the importance of legislative clarity for AI‑integrated IoMT solutions and digital health applications across European healthcare systems

- In October 2024, the Budapest Declaration was published as a joint effort to boost Europe’s resilience and competitiveness in medical technology, including digital health and IoMT deployments, pushing for collaborative regulatory and innovation frameworks

- In September 2024, Berg Insight reported that 76.7 million patients worldwide were remotely monitored using connected medical devices in 2023 a trend deeply reflecting the accelerated adoption of IoMT‑enabled remote patient monitoring in European healthcare settings

- In March 2021, the transition to the European Medical Device Regulation (MDR) took effect across the EU, significantly impacting IoMT device approvals and accelerating adoption of connected medical technologies under stricter safety, cybersecurity, and interoperability standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.