Europe Laboratory Filtration Market

Market Size in USD Million

CAGR :

%

USD

780.50 Million

USD

1,280.12 Million

2025

2033

USD

780.50 Million

USD

1,280.12 Million

2025

2033

| 2026 –2033 | |

| USD 780.50 Million | |

| USD 1,280.12 Million | |

|

|

|

|

Europe Laboratory Filtration Market Size

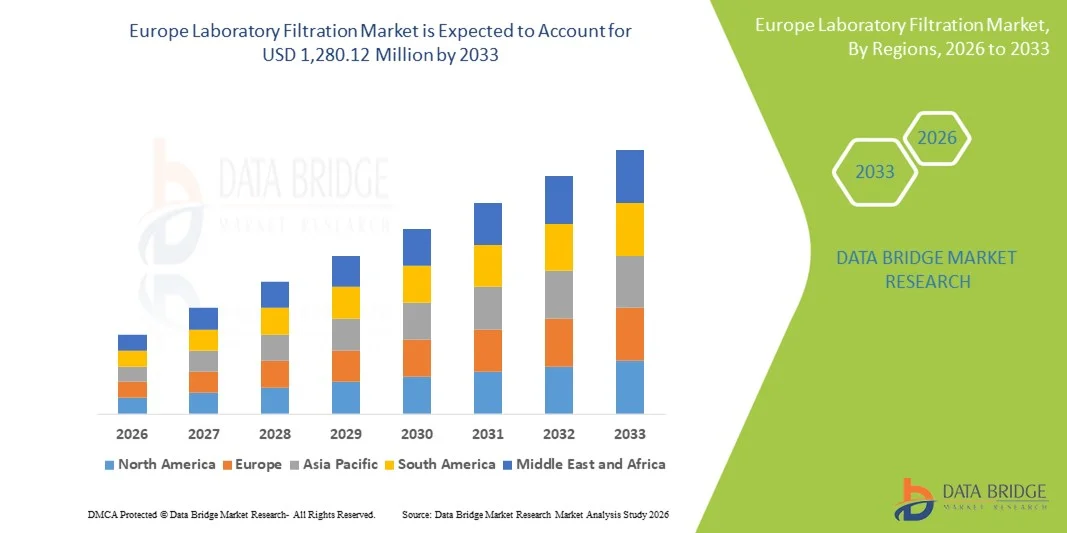

- The Europe laboratory filtration market size was valued at USD 780.50 million in 2025 and is expected to reach USD 1,280.12 million by 2033, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by increasing demand for efficient filtration solutions across pharmaceuticals, biotechnology, food & beverage, and research sectors, driving adoption of advanced membrane and consumable filtration technologies

- Furthermore, rising regulatory standards for lab safety, contamination control, and quality assurance, combined with the need for reliable and high-performance filtration systems in diagnostic, academic, industrial, and biopharma laboratories, are accelerating the uptake of laboratory filtration solutions, thereby significantly boosting the industry's growth

Europe Laboratory Filtration Market Analysis

- Laboratory filtration systems, providing separation, purification, and contamination control for liquids and gases, are increasingly vital components of modern research, pharmaceutical, and industrial laboratories in Europe due to their enhanced efficiency, reliability, and compatibility with automated lab processes

- The escalating demand for laboratory filtration is primarily fueled by growing biopharmaceutical and biotechnology research activities, rising regulatory requirements for lab safety and quality assurance, and increasing adoption of advanced filtration technologies such as microfiltration, ultrafiltration, and vacuum filtration

- Germany dominated the laboratory filtration market with the largest revenue share of 37.2% in 2025, characterized by a strong pharmaceutical and biotech sector, stringent regulatory compliance standards, and the presence of key industry players, with the U.K. and France also driving substantial adoption of high-performance filtration systems in research and industrial labs

- Poland is expected to be the fastest growing country in the laboratory filtration market during the forecast period due to expanding R&D activities, increasing investments in life sciences, and growing demand from emerging industrial sectors

- Filtration Media segment dominated the laboratory filtration market with a market share of 42.6% in 2025, driven by its critical role in ensuring efficient separation, reliability, and wide applicability across pharmaceuticals, diagnostics, biotechnology, and food & beverage laboratories

Report Scope and Europe Laboratory Filtration Market Segmentation

|

Attributes |

Europe Laboratory Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Laboratory Filtration Market Trends

Automation and Integration in Laboratory Filtration

- A significant and accelerating trend in the Europe laboratory filtration market is the increasing adoption of automated and integrated filtration systems, enabling high-throughput workflows and reducing manual intervention in research and industrial laboratories

- For instance, Sartorius’ Lab Filtration Workstation allows simultaneous processing of multiple samples with minimal human handling, improving efficiency and reproducibility in biotech and pharmaceutical labs

- Advanced filtration systems now incorporate smart sensors and IoT-enabled monitoring to track filter performance, detect clogging, and optimize usage, reducing operational downtime and increasing reliability

- The seamless integration of filtration systems with laboratory information management systems (LIMS) and automated liquid handling platforms facilitates centralized control over experiments, ensuring data integrity and streamlined operations

- This trend towards automation, smart monitoring, and interconnected lab equipment is fundamentally transforming laboratory workflows, with companies such as Merck developing automated filtration systems with integrated monitoring and reporting functionalities

- The demand for intelligent, high-throughput, and integrated filtration solutions is growing rapidly across biotechnology, pharmaceutical, and food & beverage laboratories as researchers and manufacturers prioritize efficiency, accuracy, and contamination control

- The rise of single-use/disposable filtration systems is further accelerating the trend, reducing contamination risks and turnaround time in biopharma and life sciences labs

- Increasing collaboration between filtration system manufacturers and lab automation providers is driving development of modular, customizable filtration platforms that can adapt to diverse laboratory applications

Europe Laboratory Filtration Market Dynamics

Driver

Increasing R&D Activities and Regulatory Compliance

- The growing number of biotechnology, pharmaceutical, and academic research activities, coupled with stringent European regulatory standards, is a significant driver for the heightened demand for laboratory filtration systems

- For instance, in March 2025, Merck launched a high-capacity filtration system tailored for GMP-compliant biotech manufacturing, aiming to support large-scale protein purification and sterile filtration processes

- As laboratories expand operations and work with sensitive biological materials, advanced filtration systems offer precise separation, contamination control, and reproducibility, providing a compelling solution over traditional manual filtration

- Furthermore, the rising focus on high-quality, contaminant-free products and adherence to ISO and EU regulations are making filtration systems an integral component of research and manufacturing workflows

- The convenience of automated processing, disposable filtration media for single-use applications, and compatibility with high-throughput laboratory setups are key factors propelling adoption across research, pharmaceutical, and industrial labs

- Growing adoption of microfiltration and ultrafiltration technologies in vaccine and biologics production is driving demand for high-precision filtration solutions

- Strategic partnerships between filtration providers and pharmaceutical companies to co-develop advanced filtration systems are enhancing market opportunities and adoption rates

Restraint/Challenge

High Costs and Technical Complexity

- The relatively high initial cost of advanced laboratory filtration systems compared to traditional filtration solutions poses a significant barrier to broader market adoption, particularly for small-scale or academic laboratories

- For instance, automated filtration workstations and high-performance ultrafiltration units can cost several times more than conventional vacuum filtration setups, limiting accessibility for budget-conscious labs

- Technical complexity and the need for trained personnel to operate and maintain advanced systems further hinder adoption, especially in smaller research or diagnostic centers with limited staff expertise

- While disposable filtration media reduce contamination risks, recurring consumable costs add to the total operational expenditure, discouraging long-term use in cost-sensitive environments

- Overcoming these challenges through the development of more affordable, user-friendly, and modular filtration systems, coupled with training and support services, will be vital for sustained growth in the European laboratory filtration market

- Limited standardization across filtration products and technologies can create integration challenges for labs adopting multiple systems from different manufacturers

- Environmental concerns regarding single-use filtration products and the need for sustainable solutions may constrain growth unless eco-friendly alternatives are developed

Europe Laboratory Filtration Market Scope

The market is segmented on the basis of products, technology, utility, and end user.

- By Products

On the basis of products, the Europe laboratory filtration market is segmented into filtration media, filtration assembly, and filtration accessories. Filtration Media segment dominated the market with the largest market revenue share of 42.6% in 2025, driven by its essential role in sample clarification, sterility assurance, and recurring consumable demand across biotech, pharmaceutical, and diagnostic labs. Filtration media (membranes, papers, depth filters) are widely used for protein purification, buffer clarification, and particle removal, making them critical to routine laboratory workflows. Regulatory emphasis on contamination control and sterility in EU-regulated facilities further increases reliance on high-performance media. Continuous innovation—low protein binding, high flow, and specialty chemistries—furthers adoption by improving recovery and consistency. The consumable nature of media ensures steady repeat purchases, supporting its revenue dominance. Its compatibility with diverse laboratory processes cements its top position in Europe.

Filtration Assembly segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by adoption of integrated and automated assemblies (manifolds, housings, bench-top systems) that increase throughput and reproducibility. Assemblies offer standardized, scalable workflows for high-volume sample processing in bioprocessing and CRO environments. Integration with automation and monitoring (LIMS/IoT) enhances data integrity and reduces manual error, attracting larger labs and manufacturers. Modular, configurable assemblies allow quick adaptation to different membrane types and applications, boosting utility. Investments in pilot and commercial scale bioprocessing increase demand for robust assemblies that support sterile operations. The trend toward “process-in-a-box” and turnkey filtration solutions accelerates assembly uptake.

- By Technology

On the basis of technology, the market is segmented into microfiltration, ultrafiltration, vacuum filtration, nano filtration, and reverse osmosis. Microfiltration segment dominated the market with the largest market revenue share in 2025, driven by its broad application for microbial removal, particulate clarification, and pre-sterilization across labs and production sites. Microfiltration membranes provide high throughput at relatively low pressures, suiting routine sample prep, cell harvest, and environmental testing. Widespread use in food safety, QC testing, and pharmaceutical sample clarification secures consistent demand. Regulatory requirements for sterility and particle control in Europe further entrench microfiltration’s role. Its cost-effectiveness and ease of integration into existing workflows underpin adoption. The technology’s reliability and simplicity make it a go-to for many laboratory processes.

Ultrafiltration segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by rising biologics, protein therapeutics, and vaccine manufacturing that require concentration, buffer exchange, and molecular separation. Ultrafiltration retains macromolecules (antibodies, enzymes), enabling downstream concentration and formulation steps critical to biologics workflows. Advances in membrane selectivity, fouling resistance, and scale-up designs improve performance for both R&D and commercial applications. Integration with continuous bioprocessing and automated purification lines increases ultrafiltration demand. The growing pipeline of large-molecule therapeutics across European biotech and pharma drives investment in ultrafiltration capacity. Its role in high-precision separations makes it the fastest expanding technology.

- By Utility

On the basis of utility, the market is segmented into disposable and reusable. Disposable segment dominated the market with the largest market revenue share in 2025, driven by rising preference for single-use consumables that minimize cross-contamination and eliminate cleaning validation in GMP and diagnostic workflows. Disposable filters and cartridges support sterile operations and rapid turnaround in high-throughput labs, reducing downtime between runs. The convenience and regulatory advantages of single-use systems appeal to contract manufacturers, biotechs, and clinical labs. Increased biologics and cell-therapy activity amplifies need for sterile disposables. Manufacturers’ development of validated single-use assemblies and kits further cements market dominance. Cost predictability of disposables for regulated processes also supports procurement.

Reusable segment is expected to grow the fastest during 2026–2033, supported by sustainability initiatives, cost containment strategies, and investments in durable filtration hardware (stainless steel housings, glass manifolds). Reusables reduce long-term consumable spend for academic institutions and large industrial labs that can manage cleaning/validation. Advances in cleaning-in-place (CIP) protocols and materials compatible with sterilization improve lifecycle performance. Heightened environmental scrutiny and waste reduction goals in Europe push some labs toward reusable options. Reusable systems’ compatibility with high-pressure and high-temperature processes also favors industrial applications. As labs balance cost, sustainability, and operational needs, reusable solutions gain traction.

- By End User

On the basis of end user, the market is segmented into biotechnology companies, pharmaceutical companies, food and beverage companies, contract research organizations, academic and research institutes, and diagnostic centers. Pharmaceutical Companies segment dominated the market with the largest market revenue share in 2025, driven by heavy demand for sterile filtration, API purification, and validated filtration processes across drug discovery, development, and manufacturing. Major EU pharma hubs (Germany, Switzerland, U.K., France) maintain large in-house R&D and manufacturing footprints requiring validated filtration solutions for compliance with EU GMP and pharmacopoeial standards. Pharmaceuticals’ investments in biologics, vaccines, and aseptic processing translate into sustained procurement of advanced filtration technologies and consumables. High regulatory scrutiny and product safety priorities push pharma to adopt premium filtration systems. Long development timelines and scale-up demands further reinforce pharma’s dominant share.

Biotechnology Companies segment is projected to register the fastest growth rate from 2026 to 2033, fueled by Europe’s expanding biotech ecosystem, rising VC funding, and proliferation of small-scale biologics and cell/gene therapy developers requiring specialized filtration for protein purification and sterile processing. Biotechs often require tailored, high-precision filtration platforms during development and scale-up, driving demand for innovative membranes and assemblies. Collaborations between filtration suppliers and biotech firms accelerate adoption of niche, high-performance solutions. The surge in regional incubators, CDMOs, and translational research centers increases decentralized filtration needs. As biotechs scale pipelines to clinical and commercial production, their filtration spend grows rapidly, making them the fastest-growing end-user group.

Europe Laboratory Filtration Market Regional Analysis

- Germany dominated the laboratory filtration market with the largest revenue share of 37.2% in 2025, characterized by a strong pharmaceutical and biotech sector, stringent regulatory compliance standards, and the presence of key industry players, with the U.K. and France also driving substantial adoption of high-performance filtration systems in research and industrial labs

- Laboratories and production facilities across the country emphasize precision, sterility, and regulatory compliance, increasing demand for high-performance filtration media, assemblies, and membrane technologies that support both routine testing and complex molecular separations

- This widespread adoption is further supported by significant investments in life sciences, a high concentration of research institutes, and growing biologics and bioprocessing activity, establishing Germany as the leading contributor to market revenues across Europe

The Germany Laboratory Filtration Market Insight

The Germany laboratory filtration market accounted for the largest revenue share in Europe in 2025, supported by the country’s robust pharmaceutical production capabilities and strong biotechnology ecosystem. High investments in R&D, advanced laboratory infrastructure, and widespread use of filtration technologies in biologics, vaccines, and cell-based research reinforce market growth. The increasing adoption of high-performance membrane systems, automated filtration units, and sterile filtration solutions continues to strengthen Germany’s leadership. Furthermore, growing regulatory emphasis on product purity and process validation drives continuous upgrades to modern filtration technologies.

Poland Laboratory Filtration Market Insight

The Poland laboratory filtration market is anticipated to grow at the fastest CAGR during the forecast period, driven by rapid expansion of pharmaceutical manufacturing, increasing foreign investments, and the strengthening of biotechnology and diagnostic sectors. The country is witnessing substantial upgrades in laboratory infrastructure, particularly within academic institutes, CROs, and clinical laboratories adopting advanced filtration technologies. Rising focus on high-quality sample preparation, sterile processing, and membrane-based purification solutions is accelerating adoption across research and industrial settings. In addition, Poland’s growing role as a regional hub for bioprocessing and medical testing is poised to significantly boost demand for modern laboratory filtration systems.

U.K. Laboratory Filtration Market Insight

The U.K. laboratory filtration market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by expanding biopharmaceutical research, rising diagnostic testing volumes, and increasing investments in life sciences. Growth in genomics, molecular diagnostics, and biomedical research is accelerating the demand for advanced filtration products across academic institutes and CROs. The country’s innovation-driven ecosystem and strong focus on quality assurance support the adoption of premium filtration assemblies and membrane technologies. In addition, the government’s continued support for research infrastructure upgrades is expected to drive further market expansion.

France Laboratory Filtration Market Insight

The France laboratory filtration market is projected to expand steadily during the forecast period due to rising pharmaceutical production, a strong network of public research laboratories, and increasing biologics development activities. The need for precise, reliable, and contamination-free filtration solutions is intensifying as laboratories handle more complex samples, including proteins, cell cultures, and environmental specimens. Moreover, advancements in microfiltration and ultrafiltration technologies, coupled with investments in analytical testing facilities, are contributing to market growth. France’s regulatory emphasis on quality and consistency further supports adoption across clinical, industrial, and academic environments.

Europe Laboratory Filtration Market Share

The Europe Laboratory Filtration industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- 3M (U.S.)

- GVS S.p.A. (Italy)

- Freudenberg Performance Materials (Germany)

- Amazon Filters Ltd (U.K.)

- Porvair Filtration Group Ltd (U.K.)

- Alfa Laval AB (Sweden)

- Eaton Corporation plc (Ireland)

- Parker Hannifin Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Veolia Water Technologies (France)

- Mann+Hummel International GmbH & Co. KG (Germany)

- Ahlstrom-Munksjö (Finland)

- Advantec (Japan)

- Steris plc (U.S.)

- Repligen Corporation (U.S.)

- GEA Group Aktiengesellschaft (Germany)

- Meissner Filtration Products, Inc. (U.S.)

What are the Recent Developments in Europe Laboratory Filtration Market?

- In September 2025, Merck opened its new fully climate-neutral manufacturing facility in Cork, Ireland a €150 million investment dedicated to producing advanced filtration devices including sterile filters, virus-filtration modules, and tangential-flow filtration systems. This facility strengthens Europe’s bioprocess supply chain by expanding capacity for critical life-science filtration components used in vaccines, monoclonal antibodies, and cell-based therapies

- In September 2025, Amazon Filters opened a new 2,800 m² production, warehouse and office facility near Warsaw, Poland a move that strengthens its European manufacturing and logistics footprint and improves supply-chain resilience for filtration systems used across pharmaceuticals, food & beverage, water treatment and industrial sectors

- In November 2023, SANI Membranes launched the Vibro-Lab280, a compact laboratory filtration system designed for flexible benchtop use with interchangeable membrane cartridges. The unit enhances precision and reproducibility for R&D labs working with proteins, cell cultures, and complex biological fluids

- In August 2023, SANI Membranes introduced the Vibro-Lab3500S, a sterile-filtration-focused upgrade of its Vibro® platform aimed at biopharma labs, pilot plants, and upstream/downstream development environments. This launch addresses the growing need for sterile, contamination-free filtration solutions used in cell culture preparation, media clarification, and buffer filtration. Its ability to operate under aseptic conditions makes it highly suitable for European laboratories that adhere to stringent GMP and cleanroom protocols

- In January 2023, Freudenberg Performance Materials introduced a new filter-media brand named Filtura, consolidating several of its existing media lines into a unified portfolio of high-performance filter media solutions for air and liquid filtration. This rebranding and product-line consolidation aims to boost innovation in filter media across industrial, laboratory, and environmental applications in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.