Europe Laxative Market

Market Size in USD Billion

CAGR :

%

USD

1.72 Billion

USD

2.69 Billion

2024

2032

USD

1.72 Billion

USD

2.69 Billion

2024

2032

| 2025 –2032 | |

| USD 1.72 Billion | |

| USD 2.69 Billion | |

|

|

|

|

Europe Laxative Market Size

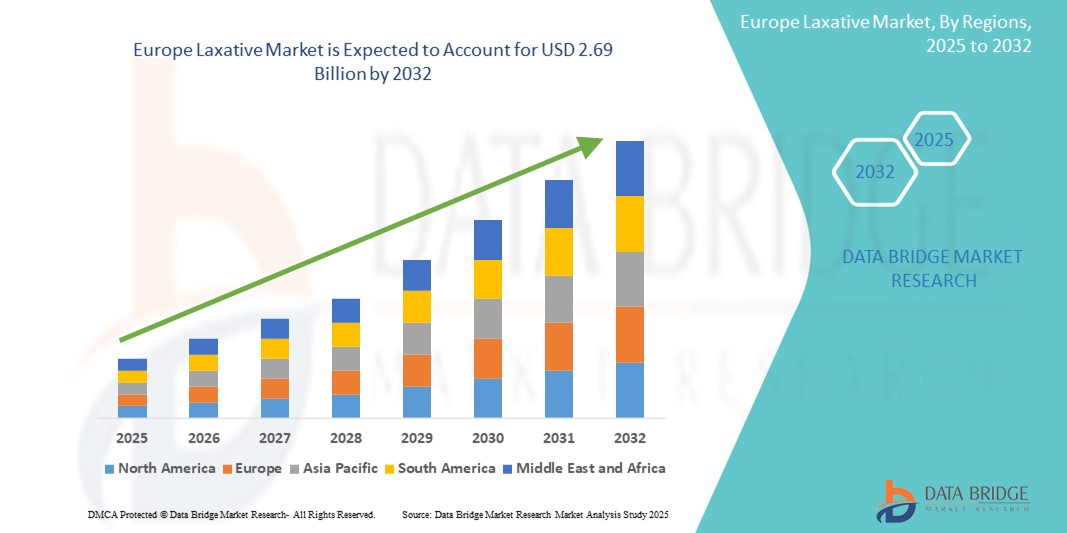

- The Europe laxative market size was valued at USD 1.72 billion in 2024 and is expected to reach USD 2.69 billion by 2032, at a CAGR of 5.81% during the forecast period

- The market growth is largely fueled by the growing awareness of gastrointestinal health, an aging population, and lifestyle-related digestive disorders such as constipation, which are becoming increasingly common across Europe. This rising burden of gastrointestinal issues is prompting more individuals to seek over-the-counter laxatives and prescription-based options for effective symptom management

- Furthermore, rising consumer demand for fast-acting, gentle, and natural solutions is driving innovation in product formulations, including fiber-based laxatives, osmotic agents, and stimulant laxatives. These converging factors are accelerating the uptake of laxative solutions across retail pharmacies, e-commerce platforms, and healthcare facilities, thereby significantly boosting the industry's growth in the region

Europe Laxative Market Analysis

- Laxatives, which help stimulate or facilitate bowel movements, are becoming increasingly essential in managing chronic constipation and digestive health disorders across both aging and younger populations in Europe. The demand for these products is supported by growing awareness around gut health and lifestyle-related digestive issues

- The escalating demand for laxatives is primarily driven by the rising prevalence of gastrointestinal conditions, sedentary lifestyles, inadequate fiber intake, and increasing use of medications that cause constipation as a side effect. Consumers are also increasingly seeking OTC (over-the-counter) and natural options for quick and effective relief

- U.K. dominated the Europe laxative market, driven by lifestyle-related digestive issues, a rising elderly population, and increasing preference for herbal and fiber-based laxatives

- Spain is expected to witness fastest growth in the Europe laxative market, driven by increasing awareness about colon health and a growing preference for over-the-counter (OTC) treatments for constipation management

- The with flavor segment dominated with a market share of 63.5% in 2024, since it is particularly preferred by pediatric and elderly patients.

Report Scope and Europe Laxative Market Segmentation

|

Attributes |

Europe Laxative Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Laxative Market Trends

“Increasing Demand Due to Changing Lifestyles and Rising Geriatric Population”

- A significant and accelerating trend in the Europe laxative market is the increasing demand driven by changing dietary habits, sedentary lifestyles, and rising cases of digestive disorders such as chronic constipation and irritable bowel syndrome. These factors are contributing to higher laxative usage across the region

- For instance, countries such as Germany, France, and the U.K. are witnessing a growing inclination toward self-medication and over-the-counter (OTC) digestive health products, propelling the market growth for laxatives

- The rapidly expanding geriatric population in Europe, which is more prone to constipation and related gastrointestinal issues, is further driving the market. Older adults often experience slower metabolism, reduced physical activity, and increased medication use, all of which contribute to the need for laxative therapy

- Europe is also observing a rise in health awareness, with consumers increasingly turning to both natural and synthetic laxative solutions. The availability of herbal and fiber-based options is expanding, particularly among consumers seeking gentle, long-term remedies

- Growing healthcare expenditure, supportive reimbursement policies in several European countries, and expanding pharmacy networks are also supporting increased accessibility and consumption of laxative products

- Moreover, the surge in demand for preventive healthcare and wellness solutions is pushing manufacturers to innovate in terms of dosage forms and flavor varieties to improve patient compliance and expand their consumer base

Europe Laxative Market Dynamics

Driver

“Growing Demand Due to Aging Population and Digestive Health Awareness”

- The increasing prevalence of constipation and digestive issues among Europe's aging population, coupled with a growing focus on gut health and preventive wellness, is a key driver for the laxative market’s growth

- For instance, the European Society of Neurogastroenterology and Motility (ESNM) has emphasized that nearly 17% of the general adult population in Europe suffers from functional constipation, with prevalence increasing notably in individuals aged 60 and above. This growing patient base is encouraging healthcare providers and pharmaceutical companies to introduce both prescription and over-the-counter (OTC) laxative products tailored for senior-friendly usage

- As consumers become more proactive about managing digestive discomfort, demand for gentle, fast-acting, and long-term safe solutions—such as fiber supplements, osmotic agents, and herbal remedies—is rising steadily

- Furthermore, the expansion of health and wellness trends across Europe, including the growing popularity of probiotic and prebiotic formulations, is making laxatives a central part of holistic digestive care. Retailers and e-commerce platforms are increasingly featuring laxative categories under wellness sections, reinforcing their preventive utility beyond acute episodes

- The convenience of OTC access, self-administration, and availability in various formats such as tablets, powders, gummies, and liquids is also boosting demand across all age groups. Emerging innovations in palatable formulations and combination products are creating new avenues for consumer adoption

Restraint/Challenge

“Regulatory Restrictions and Product Misuse Risks”

- The Europe laxative market faces challenges due to strict regulatory frameworks, especially in countries with robust pharmacovigilance systems like Germany and France. Health authorities closely monitor claims and labeling of laxatives to ensure patient safety and limit overuse

- Chronic laxative misuse, particularly in younger populations seeking weight management or colon cleansing, is raising health concerns including dependency, dehydration, and electrolyte imbalance. This has led to growing scrutiny from both healthcare professionals and regulators

In addtion, several European countries enforce prescription-only status for stimulant laxatives beyond a certain strength, which may limit accessibility and slow market expansion for high-potency products - The market must also contend with increasing consumer skepticism toward synthetic ingredients, leading to a preference for natural alternatives—though not all of these are clinically validated

- To sustain growth, manufacturers need to focus on consumer education, clearer product labeling, development of gentle and long-term safe formulations, and regulatory collaboration to ensure responsible product use while expanding access

Europe Laxative Market Scope

The market is segmented on the basis of dosage form, route of administration, population type, sales channel, and distribution channel.

• By Type

On the basis of type, the Europe laxative market is segmented into osmotic laxatives, stimulant laxatives, bulk laxatives, and lubricant and emollient laxatives. The osmotic laxatives segment held the largest market share of 38.4% in 2024, due to their proven efficacy and widespread use for chronic constipation.

The stimulant laxatives segment is projected to witness the fastest CAGR of 6.8% from 2025 to 2032, driven by rising demand for fast-acting bowel relief.

• By Flavor

On the basis of flavor, the market is segmented into with flavor and without flavor. The with flavor segment dominated with a market share of 63.5% in 2024, particularly preferred by pediatric and elderly patients.

The without flavor segment is expected to witness the fastest CAGR from 2025 to 2032, as it is primarily chosen by consumers with sensitivities or personal taste preferences.

• By Source

On the basis of source, the Europe Laxative Market is segmented into natural, synthetic, and others. The natural segment held the largest market share of 45.7% in 2024, supported by a growing inclination towards herbal and plant-based products.

The without synthetic segment is expected to witness the fastest CAGR from 2025 to 2032, as it is primarily chosen by consumers with sensitivities or personal taste preferences.

• By Indication

On the basis of indication, the Europe laxative market is segmented into chronic constipation, irritable bowel syndrome with constipation (IBS-C), opioid-induced constipation, acute constipation, and others. The chronic constipation segment dominated the market with the largest revenue share of 32.9% in 2024, owing to its high prevalence, particularly among the elderly population, and increasing sedentary lifestyles.

The IBS-C segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising diagnosis rates, awareness, and demand for personalized gastrointestinal treatments.

• By Mode of Purchase

On the basis of mode of purchase, the market is segmented into prescription and over-the-counter (OTC). The over-the-counter (OTC) segment led with a 69.1% market share in 2024, attributed to consumer preference for self-treatment, easy access, and availability of a wide range of OTC laxative options.

The prescription segment is expected to witness the fastest CAGR from 2025 to 2032, typically associated with chronic or severe conditions where physician supervision is required.

• By Dosage Form

On the basis of dosage form, the market is segmented into tablets, capsules, powder, liquid and gels, suppositories, and others. The tablet segment held the highest market revenue share of 29.8% in 2024, due to patient compliance, easy administration, and wide availability.

• By Route of Administration

On the basis of route of administration, the market is segmented into oral and rectal. The oral segment dominated with a market share of 84.7% in 2024, owing to convenience, better patient compliance, and widespread use of oral forms like tablets, liquids, and powders.

The rectal segment is expected to witness the fastest CAGR from 2025 to 2032, used primarily in hospital settings and for rapid relief situations.

• By Population Type

On the basis of population type, the market is segmented into adults and children. The adult segment led the market with a 73.5% share in 2024, driven by a higher incidence of chronic constipation and lifestyle-related bowel issues.

The children segment is expected to witness the fastest CAGR from 2025 to 2032, supported by product innovations in pediatric-friendly flavors and formats.

• By Sales Channel

On the basis of sales channel, the market is segmented into hospitals, elderly care centers, home healthcare, pharmacy stores, grocer/health and beauty stores, and others. Pharmacy stores led with the largest market share of 34.9% in 2024, driven by high foot traffic and broad product variety.

Grocer/health and beauty stores is expected to witness the fastest CAGR from 2025 to 2032, benefiting from increasing consumer preference for health products during routine shopping.

• By Distribution Channel

On the basis of distribution channel, the Europe laxative market is segmented into direct sales, wholesalers, and others. The wholesalers segment dominated the market with the largest revenue share of 62.7% in 2024, driven by bulk procurement and streamlined distribution to pharmacies, hospitals, and large retail chains.

The direct sales segment is expected to witness the fastest CAGR from 2025 to 2032, supported by strong relationships between manufacturers and institutional buyers such as hospitals and elderly care centers.

Europe Laxative Market Regional Analysis

- Europe dominated the laxative market with the largest revenue share of 32.6% in 2024, driven by rising prevalence of digestive disorders, increased use of over-the-counter medications, and heightened public awareness around gut health and wellness. The market is further supported by aging demographics and a growing demand for preventive healthcare products

- Consumers across European countries highly value access to gentle and effective laxative solutions, especially in the form of herbal or natural ingredients. The increasing preference for self-medication and expanding availability of laxatives through pharmacies and online platforms further contribute to the market’s strong performance

- This widespread adoption is reinforced by strong regulatory frameworks ensuring product quality, rising healthcare expenditure, and an increasing number of wellness-conscious individuals seeking long-term digestive health management

U.K. Europe Laxative Market Insight

The U.K. Laxative Market accounted for 17.4% of the European laxative market revenue share in 2024 and is anticipated to grow at a CAGR of 6.8% during the forecast period, fueled by a combination of lifestyle-related digestive issues, rising elderly population, and a growing inclination towards herbal and fiber-based laxatives. The country’s strong pharmacy networks and the NHS’s emphasis on gastrointestinal health management further bolster demand. Increasing public health campaigns around diet and digestion are also playing a key role in shaping consumption patterns.

Germany Europe Laxative Market Insight

The Germany Laxative Market held 20.2% of the European revenue share in 2024 and is expected to expand at a CAGR of 7.1% during the forecast period, driven by a high incidence of functional constipation and the availability of a wide range of both prescription and OTC laxatives. Germany’s well-established pharmaceutical industry, combined with increasing consumer preference for clinically validated and plant-based solutions, is fostering strong market growth. Additionally, digital health platforms are enhancing access to gastrointestinal care, contributing to sustained product demand.

France Europe Laxative Market Insight

The France Laxative Market accounted for 13.9% of the regional revenue share in 2024 and is projected to grow at a CAGR of 6.3% during the forecast period, supported by a health-conscious population and favorable reimbursement policies for digestive health products. The French market is characterized by increasing adoption of combination formulations that include probiotics or fiber supplements for holistic gut health. Moreover, pharmacy-led consultations and e-health platforms are playing an increasing role in guiding consumer choices.

Italy Europe Laxative Market Insight

The Italy Laxative Market represented 11.6% of the Europe market share in 2024 and is expected to grow at a CAGR of 5.9%, primarily due to changing dietary habits and the rising aging population. The growing trend toward natural and organic laxative products, especially among female and elderly users, is encouraging companies to introduce clean-label formulations. Additionally, widespread use of herbal and traditional remedies supports consistent product uptake.

Spain Europe Laxative Market Insight

The Spain Laxative Market held a 10.4% revenue share in 2024 and is projected to grow at a CAGR of 6.2%, owing to increasing awareness about colon health and a preference for OTC treatments for constipation management. An uptick in sedentary lifestyles and low fiber diets are contributing factors to the rising incidence of digestive issues in the country. The availability of laxatives across both retail chains and online channels is making them more accessible to diverse consumer segments.

Europe Laxative Market Share

The Europe Laxative industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Dr. Reddy's Laboratories Ltd. (India)

- Lupin (India)

- Fresenius Kabi AG (Germany)

- Aurobindo Pharma (India)

- Cipla Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Amneal Pharmaceuticals LLC. (U.S.)

- Apotex Inc. (Canada)

- Eli Lilly and Company (U.S.)

Latest Developments in Europe Laxative Market

- In March 2024, Bayer AG announced the launch of a new generation of natural-based osmotic laxatives under its Movicol brand across key European markets including Germany, France, and the U.K. This product aims to address rising consumer demand for plant-based and gut-friendly solutions for chronic constipation, particularly among the aging population. Bayer's innovation aligns with Europe's shift toward herbal alternatives and reinforces its stronghold in the gastrointestinal therapeutics segment

- In February 2024, Sanofi introduced an over-the-counter (OTC) version of its prescription-based laxative product in select European countries. This transition follows the success of the product in the prescription market and responds to growing demand for self-care gastrointestinal remedies. The move aims to expand access to effective bowel management solutions and tap into the expanding OTC pharmaceutical segment in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe laxative market

- Currency and pricing

- LIMITATIONs

- MARKETS COVERED

- Europe laxative market: SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- MULTIVARIATE MODELLING

- type LIFELINE CURVE

- DBMR MARKET POSITION GRID

- VENDOR SHARE ANALYSIS

- MARKET indication COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- porters five forces model

- pestel analysis

- epidemiology

- Europe LAXATIVE market: regulations

- Market Overview

- drivers

- INCREASED PREVALENCE OF CONSTIPATION

- RISE IN CLINICAL TRIALS

- ACCLIMATIZATION OF SEDENTARY LIFESTYLE

- RISE IN GERIATRIC POPULATION

- RISE IN PRODUCT APPROVALS

- RESTRAINTS

- LESS EFFICACY OF LAXATIVES FOR OPIOID-INDUCED CONSTIPATION

- AVAILABILITY OF ALTERNATIVES

- LAXATIVE ABUSE

- SIDE EFFECTS RELATED TO THE USE OF LAXATIVES

- opportunities

- RISE OF OTC LAXATIVE MEDICATIONS

- STRATEGIC INITIATIVES BY MARKET PLAYERS

- INCREASED USE OF BULK-LAXATIVES

- CHALLENGES

- RISE OF PRODUCT RECALL

- PATIENT COMPLIANCE REGARDING THE USE OF LAXATIVES

- IMPACT OF COVID-19 ON THE EUROPE LAXATIVE MARKET

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- STRATEGIC DECISIONS FOR MANUFACTURERS

- CONCLUSION

- Europe Laxative market, by TYPE

- overview

- OSMOTIC LAXATIVES

- oSMOTIC LAXATIVES WITHout ELECTROLYTES

- LACTULOSE

- MAGNESIUM HYDROXIDE SOLUTION

- EPSOM SALTS

- OTHERS

- OSMOTIC LAXATIVES WITH ELECTROLYTES

- GOLYTELY

- COLYTE

- OTHERS

- STIMULANT LAXATIVES

- BISACODYL

- CASTOR OIL

- sENNA

- PHENOLPhtALEIN

- OTHERS

- BULK LAXATIVES

- PSYLLIUM

- METHYL CELLULOSE

- POLYCARBOPHIL

- OTHERS

- LUBRICANT AND EMOLLIENT LAXATIVES

- MINERAL OIL

- GLYCERIN SUPPOSITORIES

- OTHERs

- Europe Laxative market, by FLAVORS

- overview

- WITH FLAVOR

- FRUIT FLAVOR

- HERBAL FLAVOR

- OTHERS

- WITHOUT FLAVOR

- Europe Laxative MARKET, BY source

- overview

- Synthetic

- Bisacodyl

- Picosulphate

- Phenolphthalein

- Oxyphenisatin

- Natural

- Psyllium

- Senna

- Rhubarb

- Slippery Elm

- Europe Laxative market, by INDICATION

- overview

- CHRONIC CONSTIPATION

- IRRITABLE BOWEL SYNDROME WITH CONSTIPATION

- OPIOID-INDUCED CONSTIPATION

- ACUTE CONSTIPATION

- OTHERS

- Europe Laxative MARKET, BY Mode of Purchase

- overview

- Over The Counter

- Prescription

- Europe Laxative MARKET, BY Dosage Form

- overview

- Tablets

- capsules

- powder

- liquid & Gels

- suppositories

- others

- Europe Laxative MARKET, BY route of administration

- overview

- Oral

- rectal

- Europe Laxative MARKET, BY Population Type

- overview

- Adults

- children

- Europe Laxative MARKET, BY Sales Channel

- overview

- Hospitals

- Pharmacy Stores

- Elderly Care Centers

- Home Healthcare

- Grocery/Health and Beauty Stores

- others

- Europe Laxative MARKET, BY distribution channel

- overview

- Direct Sales

- Whole Salers

- others

- EUROPE LAXATIVE MARKET, BY REGION

- EUROPE

- FRANCE

- U.K

- ITALY

- GERMANY

- SPAIN

- NETHERLANDS

- RUSSIA

- SWITZERLAND

- TURKEY

- AUSTRIA

- NORWAY

- HUNGARY

- LITHUANIA

- IRELAND

- POLAND

- Rest of Europe

- Europe laxative market: COMPANY landscape

- company share analysis: Europe

- swot analysis

- company profile

- BAYER AG

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PROCTER & GAMBLE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- FRESENIUS KABI AUSTRIA GMBH (A SUBSIDIARY OF FRESENIUS KABI AG)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SANOFI-AVENTIS U.S. LLC (A SUBSIDIARY OF SANOFI)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ABBOTT

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ALBERT DAVID LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ASPEN PHARMACARE AUSTRALIA PTY LTD. (A SUBSIDIARY OF ASPEN HOLDINGS)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- AVRIO HEALTH L.P.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- BIOCHEMIX HEALTHCARE PVT. LTD.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- CIPLA INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- DR. REDDY’S LABORATORIES LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GLAXOSMITHKLINE PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HERMES PHARMA

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HIKMA PHARMACEUTICALS PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- LNK INTERNATIONAL, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MALLINCKRODT

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PRESTIGE CONSUMER HEALTHCARE INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- RECORDATI S.P.A.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SALIX PHARMACEUTICALS (A SUBSIDIARY OF BAUSCH HEALTH COMPANIES INC.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TORRENT PHARMACEUTICALS LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

List of Table

TABLE 1 Europe LAXATIVE Market, by type, 2019-2028 (USD million)

TABLE 2 Europe LAXATIVE Market, by type, 2019-2028 (UNITS)

TABLE 3 Europe OSMOTIC LAXATIVES IN LAXATIVES Market, By Region, 2019-2028 (USD Million)

TABLE 4 Europe OSMOTIC LAXATIVES IN LAXATIVE Market, BY type, 2019-2028 (USD million)

TABLE 5 Europe OSMOTIC LAXATIVES WITHout ELECTROLYTES IN LAXATIVE Market, BY type, 2019-2028 (USD million)

TABLE 6 Europe OSMOTIC LAXATIVES WITH ELECTROLYTES IN LAXATIVE Market, BY type, 2019-2028 (USD million)

TABLE 7 Europe STIMULANT LAXATIVE in Laxative Market, by region, 2019-2028 (USD million)

TABLE 8 Europe STIMULANT LAXATIVE in Laxative Market, BY type, 2019-2028 (USD million)

TABLE 9 Europe BULK LAXATIVES in Laxative Market, by region, 2019-2028 (USD million)

TABLE 10 Europe BULK LAXATIVE IN LAXATIVE Market, BY type, 2019-2028 (USD million)

TABLE 11 Europe LUBRICANT AND EMOLLIENT LAXATIVES in Laxative Market, by region, 2019-2028 (USD million)

TABLE 12 Europe LUBRICANT AND EMOLLIENT LAXATIVE Market, by type, 2019-2028 (USD million)

TABLE 13 Europe Laxative Market, BY FLAVORS, 2019-2028 (USD million)

TABLE 14 Europe WITH FLAVOR in Laxative Market, by region, 2019-2028 (USD million)

TABLE 15 Europe WITH FLAVOR IN LAXATIVE Market, BY FLAVOR, 2019-2028 (USD million)

TABLE 16 Europe WITHOUT FLAVOR in Laxative Market, by REGION, 2019-2028 (USD million)

TABLE 17 Europe Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 18 Europe Synthetic in Laxative Market, By REGION, 2019-2028 (USD Million)

TABLE 19 Europe Synthetic in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 20 Europe Natural in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 21 Europe Natural in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 22 Europe Laxative Market, INDICATION, 2019-2028 (USD million)

TABLE 23 Europe CHRONIC CONSTIPATION in Laxative Market, by region, 2019-2028 (USD million)

TABLE 24 Europe IRRITABLE BOWEL SYNDROME WITH CONSTIPATION in Laxative Market, by region, 2019-2028 (USD million)

TABLE 25 Europe OPIOID-INDUCED CONSTIPATION in Laxative Market, by region, 2019-2028 (USD million)

TABLE 26 Europe ACUTE CONSTIPATION in Laxative Market, by region, 2019-2028 (USD million)

TABLE 27 Europe OTHERS in Laxative Market, by region, 2019-2028 (USD million)

TABLE 28 Europe Laxative Market, By Mode of Purchase, 2019-2028 (USD Million)

TABLE 29 Europe Laxative Market, By Mode of Purchase, 2019-2028 (UNITS)

TABLE 30 Europe Over the Counter in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 31 Europe Prescription in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 32 Europe Laxative Market, By Dosage Form, 2019-2028 (USD Million)

TABLE 33 Europe Tablets in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 34 Europe Capsules in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 35 Europe Powder in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 36 Europe Liquid & Gels in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 37 Europe Suppositories in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 38 Europe Others in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 39 Europe Laxative Market, By Route of Administration, 2019-2028 (USD Million)

TABLE 40 Europe Oral in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 41 Europe Rectal in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 42 Europe Laxative Market, By Population Type, 2019-2028 (USD Million)

TABLE 43 Europe Adults in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 44 Europe Children in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 45 Europe Laxative Market, By Sales channel, 2019-2028 (USD Million)

TABLE 46 Europe Hospitals in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 47 Europe pharmacy stores in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 48 Europe elderly care centers in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 49 Europe home healthcare in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 50 Europe grocery/health and beauty stores in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 51 Europe others in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 52 Europe Laxative Market, By Distribution channel, 2019-2028 (USD Million)

TABLE 53 Europe Direct Sales in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 54 Europe whole salers in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 55 Europe others in Laxative Market, By Region, 2019-2028 (USD Million)

TABLE 56 EUROPE LAXATIVE Market, By Country, 2019-2028 (USD Million)

TABLE 57 EUROPE LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 58 EUROPE LAXATIVE MARKET, By TYPE, 2019-2028 (units)

TABLE 59 EUROPE STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (usd million)

TABLE 60 EUROPE OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 61 EUROPE OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 62 EUROPE OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 63 EUROPE BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 64 EUROPE LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 65 EUROPE LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 66 EUROPE WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 67 EUROPE LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 68 EUROPE SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 69 EUROPE NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 70 EUROPE LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 71 EUROPE LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 72 EUROPE LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 73 EUROPE LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 74 EUROPE LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 75 EUROPE LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 76 EUROPE LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 77 EUROPE LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 78 FRANCE LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 79 FRANCE LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 80 FRANCE STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 81 FRANCE OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 82 FRANCE OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 83 FRANCE OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 84 FRANCE BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 85 FRANCE LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 86 FRANCE LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 87 FRANCE WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 88 FRANCE LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 89 FRANCE SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 90 FRANCE NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 91 FRANCE LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 92 FRANCE LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 93 FRANCE LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 94 FRANCE LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 95 FRANCE LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 96 FRANCE LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 97 FRANCE LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 98 FRANCE LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 99 U.K LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 100 U.K LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 101 U.K STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 102 U.K OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 103 U.K OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 104 U.K OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 105 U.K BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 106 U.K LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 107 U.K LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 108 U.K WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 109 U.K LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 110 U.K SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 111 U.K NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 112 U.K LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 113 U.K LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 114 U.K LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 115 U.K LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 116 U.K LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 117 U.K LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 118 U.K LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 119 U.K LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 120 ITALY LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 121 ITALY LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 122 ITALY STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 123 ITALY OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 124 ITALY OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 125 ITALY OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 126 ITALY BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 127 ITALY LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 128 ITALY LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 129 ITALY WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 130 ITALY LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 131 ITALY SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 132 ITALY NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 133 ITALY LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 134 ITALY LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 135 ITALY LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 136 ITALY LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 137 ITALY LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 138 ITALY LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 139 ITALY LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 140 ITALY LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 141 GERMANY LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 142 GERMANY LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 143 GERMANY STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 144 GERMANY OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 145 GERMANY OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 146 GERMANY OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 147 GERMANY BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 148 GERMANY LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 149 GERMANY LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 150 GERMANY WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 151 GERMANY LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 152 GERMANY SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 153 GERMANY NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 154 GERMANY LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 155 GERMANY LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 156 GERMANY LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 157 GERMANY LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 158 GERMANY LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 159 GERMANY LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 160 GERMANY LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 161 GERMANY LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 162 SPAIN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 163 SPAIN LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 164 SPAIN STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 165 SPAIN OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 166 SPAIN OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 167 SPAIN OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 168 SPAIN BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 169 SPAIN LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 170 SPAIN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 171 SPAIN WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 172 SPAIN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 173 SPAIN SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 174 SPAIN NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 175 SPAIN LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 176 SPAIN LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 177 SPAIN LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 178 SPAIN LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 179 SPAIN LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 180 SPAIN LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 181 SPAIN LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 182 SPAIN LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 183 NETHERLANDS LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 184 NETHERLANDS LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 185 NETHERLANDS STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 186 NETHERLANDS OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 187 NETHERLANDS OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 188 NETHERLANDS OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 189 NETHERLANDS BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 190 NETHERLANDS LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 191 NETHERLANDS LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 192 NETHERLANDS WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 193 NETHERLANDS LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 194 NETHERLANDS SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 195 NETHERLANDS NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 196 NETHERLANDS LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 197 NETHERLANDS LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 198 NETHERLANDS LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 199 NETHERLANDS LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 200 NETHERLANDS LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 201 NETHERLANDS LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 202 NETHERLANDS LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 203 NETHERLANDS LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 204 RUSSIA LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 205 RUSSIA LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 206 RUSSIA STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 207 RUSSIA OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 208 RUSSIA OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 209 RUSSIA OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 210 RUSSIA BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 211 RUSSIA LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 212 RUSSIA LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 213 RUSSIA WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 214 RUSSIA LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 215 RUSSIA SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 216 RUSSIA NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 217 RUSSIA LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 218 RUSSIA LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 219 RUSSIA LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 220 RUSSIA LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 221 RUSSIA LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 222 RUSSIA LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 223 RUSSIA LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 224 RUSSIA LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 225 SWITZERLAND LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 226 SWITZERLAND LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 227 SWITZERLAND STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 228 SWITZERLAND OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 229 SWITZERLAND OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 230 SWITZERLAND OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 231 SWITZERLAND BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 232 SWITZERLAND LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 233 SWITZERLAND LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 234 SWITZERLAND WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 235 SWITZERLAND LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 236 SWITZERLAND SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 237 SWITZERLAND NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 238 SWITZERLAND LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 239 SWITZERLAND LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 240 SWITZERLAND LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 241 SWITZERLAND LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 242 SWITZERLAND LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 243 SWITZERLAND LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 244 SWITZERLAND LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 245 SWITZERLAND LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 246 TURKEY LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 247 TURKEY LAXATIVE MARKET, By TYPE, 2019-2028 (UNITS)

TABLE 248 TURKEY STIMULANT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 249 TURKEY OSMOTIC LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 250 TURKEY OSMOTIC LAXATIVE WITH ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 251 TURKEY OSMOTIC LAXATIVE WITHOUT ELECTROLYTES IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 252 TURKEY BULK LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 253 TURKEY LUBRICANT AND EMOLLIENT LAXATIVE IN LAXATIVE MARKET, By TYPE, 2019-2028 (USD Million)

TABLE 254 TURKEY LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 255 TURKEY WITH FLAVOR IN LAXATIVE MARKET, By FLAVOR, 2019-2028 (USD Million)

TABLE 256 TURKEY LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 257 TURKEY SYNTHETIC IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 258 TURKEY NATURAL IN LAXATIVE MARKET, By SOURCE, 2019-2028 (USD Million)

TABLE 259 TURKEY LAXATIVE MARKET, By INDICATION, 2019-2028 (USD Million)

TABLE 260 TURKEY LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (USD Million)

TABLE 261 TURKEY LAXATIVE MARKET, By MODE OF PURCHASE, 2019-2028 (UNITS)

TABLE 262 TURKEY LAXATIVE MARKET, By DOSAGE FORM, 2019-2028 (USD Million)

TABLE 263 TURKEY LAXATIVE MARKET, By ROUTE OF ADMINISTRATION, 2019-2028 (USD Million)

TABLE 264 TURKEY LAXATIVE MARKET, By POPULATION TYPE, 2019-2028 (USD Million)

TABLE 265 TURKEY LAXATIVE MARKET, By SALES CHANNEL, 2019-2028 (USD Million)

TABLE 266 TURKEY LAXATIVE MARKET, By DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 267 AUSTRIA Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 268 AUSTRIA STIMULANT LAXATIVE IN LAXATIVE MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 269 AUSTRIA Osmotic Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 270 AUSTRIA Osmotic Laxative With Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 271 AUSTRIA Osmotic Laxative Without Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 272 AUSTRIA Bulk Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 273 AUSTRIA Lubricant and Emollient Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 274 AUSTRIA Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 275 AUSTRIA With Flavor in Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 276 AUSTRIA Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 277 AUSTRIA Synthetic in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 278 AUSTRIA Natural in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 279 AUSTRIA Laxative Market, By Indication, 2019-2028 (USD Million)

TABLE 280 AUSTRIA Laxative Market, By Mode of Purchase, 2019-2028 (USD Million)

TABLE 281 AUSTRIA Laxative Market, By Mode of Purchase, 2019-2028 (UNITS)

TABLE 282 AUSTRIA Laxative Market, By Dosage Form, 2019-2028 (USD Million)

TABLE 283 AUSTRIA Laxative Market, By Route of Administration, 2019-2028 (USD Million)

TABLE 284 AUSTRIA Laxative Market, By Population Type, 2019-2028 (USD Million)

TABLE 285 AUSTRIA Laxative Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 286 AUSTRIA Laxative Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 287 NORWAY Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 288 NORWAY Laxatives Market, By Type, 2019-2028 (UNITS)

TABLE 289 NORWAY STIMULANT LAXATIVE IN LAXATIVE MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 290 NORWAY Osmotic Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 291 NORWAY osmotic Laxative With Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 292 NORWAY Osmotic Laxative Without Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 293 NORWAY Bulk Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 294 NORWAY Lubricant and Emollient Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 295 NORWAY Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 296 NORWAY With Flavor in Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 297 NORWAY Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 298 NORWAY Synthetic in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 299 NORWAY Natural in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 300 NORWAY Laxative Market, By Indication, 2019-2028 (USD Million)

TABLE 301 NORWAY Laxative Market, By Mode of Purchase, 2019-2028 (USD Million)

TABLE 302 NORWAY Laxative Market, By Mode of Purchase, 2019-2028 (UNITS)

TABLE 303 NORWAY Laxative Market, By Dosage Form, 2019-2028 (USD Million)

TABLE 304 NORWAY Laxative Market, By Route of Administration, 2019-2028 (USD Million)

TABLE 305 NORWAY Laxative Market, By Population Type, 2019-2028 (USD Million)

TABLE 306 NORWAY Laxative Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 307 NORWAY Laxative Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 308 HUNGARY Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 309 HUNGARY Laxatives Market, By Type, 2019-2028 (UNITS)

TABLE 310 HUNGARY STIMULANT LAXATIVE IN LAXATIVE MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 311 HUNGARY Osmotic Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 312 HUNGARY Osmotic Laxative With Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 313 HUNGARY Osmotic Laxative Without Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 314 HUNGARY Bulk Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 315 HUNGARY Lubricant and Emollient Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 316 HUNGARY Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 317 HUNGARY With Flavor in Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 318 HUNGARY Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 319 HUNGARY Synthetic in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 320 HUNGARY Natural in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 321 HUNGARY Laxative Market, By Indication, 2019-2028 (USD Million)

TABLE 322 HUNGARY Laxative Market, By Mode of Purchase, 2019-2028 (USD Million)

TABLE 323 HUNGARY Laxative Market, By Mode of Purchase, 2019-2028 (UNITS)

TABLE 324 HUNGARY Laxative Market, By Dosage Form, 2019-2028 (USD Million)

TABLE 325 HUNGARY Laxative Market, By Route of Administration, 2019-2028 (USD Million)

TABLE 326 HUNGARY Laxative Market, By Population Type, 2019-2028 (USD Million)

TABLE 327 HUNGARY Laxative Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 328 HUNGARY Laxative Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 329 LITHUANIA Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 330 LITHUANIA Laxatives Market, By Type, 2019-2028 (UNITS)

TABLE 331 LITHUANIA STIMULANT LAXATIVE IN LAXATIVE MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 332 LITHUANIA Osmotic Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 333 LITHUANIA Osmotic Laxative With Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 334 LITHUANIA Osmotic Laxative Without Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 335 LITHUANIA Bulk Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 336 LITHUANIA Lubricant and Emollient Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 337 LITHUANIA Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 338 LITHUANIA With Flavor in Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 339 LITHUANIA Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 340 LITHUANIA Synthetic in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 341 LITHUANIA Natural in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 342 LITHUANIA Laxative Market, By Indication, 2019-2028 (USD Million)

TABLE 343 LITHUANIA Laxative Market, By Mode of Purchase, 2019-2028 (USD Million)

TABLE 344 LITHUANIA Laxative Market, By Mode of Purchase, 2019-2028 (UNITS)

TABLE 345 LITHUANIA Laxative Market, By Dosage Form, 2019-2028 (USD Million)

TABLE 346 LITHUANIA Laxative Market, By Route of Administration, 2019-2028 (USD Million)

TABLE 347 LITHUANIA Laxative Market, By Population Type, 2019-2028 (USD Million)

TABLE 348 LITHUANIA Laxative Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 349 LITHUANIA Laxative Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 350 IRELAND Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 351 IRELAND Laxatives Market, By Type, 2019-2028 (UNITS)

TABLE 352 IRELAND STIMULANT LAXATIVE IN LAXATIVE MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 353 IRELAND Osmotic Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 354 IRELAND Osmotic Laxative With Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 355 IRELAND Osmotic Laxative Without Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 356 IRELAND Bulk Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 357 IRELAND Lubricant and Emollient Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 358 IRELAND Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 359 IRELAND With Flavor in Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 360 IRELAND Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 361 IRELAND Synthetic in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 362 IRELAND Natural in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 363 IRELAND Laxative Market, By Indication, 2019-2028 (USD Million)

TABLE 364 IRELAND Laxative Market, By Mode of Purchase, 2019-2028 (USD Million)

TABLE 365 IRELAND Laxative Market, By Mode of Purchase, 2019-2028 (UNITS)

TABLE 366 IRELAND Laxative Market, By Dosage Form, 2019-2028 (USD Million)

TABLE 367 IRELAND Laxative Market, By Route of Administration, 2019-2028 (USD Million)

TABLE 368 IRELAND Laxative Market, By Population Type, 2019-2028 (USD Million)

TABLE 369 IRELAND Laxative Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 370 IRELAND Laxative Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 371 POLAND Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 372 POLAND Laxatives Market, By Type, 2019-2028 (UNITS)

TABLE 373 POLAND STIMULANT LAXATIVE IN LAXATIVE MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 374 POLAND Osmotic Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 375 POLAND Osmotic Laxative With Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 376 POLAND Osmotic Laxative Without Electrolytes in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 377 POLAND Bulk Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 378 POLAND Lubricant and Emollient Laxative in Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 379 POLAND Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 380 POLAND With Flavor in Laxative Market, By Flavors, 2019-2028 (USD Million)

TABLE 381 POLAND Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 382 POLAND Synthetic in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 383 POLAND Natural in Laxative Market, By Source, 2019-2028 (USD Million)

TABLE 384 POLAND Laxative Market, By Indication, 2019-2028 (USD Million)

TABLE 385 POLAND Laxative Market, By Mode of Purchase, 2019-2028 (USD Million)

TABLE 386 POLAND Laxative Market, By Mode of Purchase, 2019-2028 (UNITS)

TABLE 387 POLAND Laxative Market, By Dosage Form, 2019-2028 (USD Million)

TABLE 388 POLAND Laxative Market, By Route of Administration, 2019-2028 (USD Million)

TABLE 389 POLAND Laxative Market, By Population Type, 2019-2028 (USD Million)

TABLE 390 POLAND Laxative Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 391 POLAND Laxative Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 392 Rest of EUROPE Laxative Market, By Type, 2019-2028 (USD Million)

TABLE 393 Rest of EUROPE Laxative Market, By Type, 2019-2028 (UNITS)

List of Figure

FIGURE 1 Europe laxative market: segmentation

FIGURE 2 Europe laxative MARKET: data triangulation

FIGURE 3 EUROPE LAXATIVE MARKET: DROC ANALYSIS

FIGURE 4 Europe laxative MARKET: Europe VS REGIONAL MARKET ANALYSIS

FIGURE 5 Europe laxative market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe laxative market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe laxative market: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE LAXATIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 Europe laxative market: MARKET indication COVERAGE GRID

FIGURE 10 EUROPE LAXATIVE MARKET: SEGMENTATION

FIGURE 11 rising prevalence of constipation, geriatric populace and increased use of otc laxative is expected to drive the Europe laxative market in the forecast period of 2021 to 2028

FIGURE 12 OSMOTIC LAXATIVES segment is expected to account for the largest share of the Europe LAXATIVE market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTs, OPPORTUNITies AND CHALLENGEs OF Europe laxative market

FIGURE 14 PREVALENCE OF CONSTIPATION IN THE AMERICAs, EUROPE AND INDIA

FIGURE 15 PREVALENCE DATA INFOGRAPHICS IN ELDERLY MALES AND FEMALES REPORTED IN THE FOLLOWING COUNTRIES

FIGURE 16 Europe LAXATIVE Market: BY Type, 2020

FIGURE 17 Europe LAXATIVE Market: BY Type, 2019-2028 (USD MILLION)

FIGURE 18 Europe LAXATIVE Market: BY Type, CAGR (2021-2028)

FIGURE 19 Europe LAXATIVE Market: BY Type, LIFELINE CURVE

FIGURE 20 Europe Laxative Market: BY FLAVORS, 2020

FIGURE 21 Europe Laxative Market: BY FLAVORS, 2019-2028 (USD MILLION)

FIGURE 22 Europe Laxative Market: BY FLAVORS, CAGR (2021-2028)

FIGURE 23 Europe Laxative Market: BY FLAVORS, LIFELINE CURVE

FIGURE 24 Europe Laxative market: BY source, 2020

FIGURE 25 Europe Laxative market: BY source, 2019-2028 (USD Million)

FIGURE 26 Europe Laxative market: BY source, CAGR (2021-2028)

FIGURE 27 Europe Laxative market: BY source, LIFELINE CURVE

FIGURE 28 Europe Laxative Market: BY INDICATION, 2020

FIGURE 29 Europe Laxative Market: BY INDICATION, 2019-2028 (USD MILLION)

FIGURE 30 Europe Laxative Market: BY INDICATION, CAGR (2021-2028)

FIGURE 31 Europe Laxative Market: BY INDICATION, LIFELINE CURVE

FIGURE 32 Europe Laxative market: BY mode of purchase, 2020

FIGURE 33 Europe Laxative market: BY mode of purchase, 2019-2028 (USD Million)

FIGURE 34 Europe Laxative market: BY mode of purchase, CAGR (2021-2028)

FIGURE 35 Europe Laxative market: BY mode of purchase, LIFELINE CURVE

FIGURE 36 Europe Laxative market: BY dosage form, 2020

FIGURE 37 Europe Laxative market: BY dosage form, 2019-2028 (USD Million)

FIGURE 38 Europe Laxative market: BY dosage form, CAGR (2021-2028)

FIGURE 39 Europe Laxative market: BY dosage form, LIFELINE CURVE

FIGURE 40 Europe Laxative market: BY route of administration, 2020

FIGURE 41 Europe Laxative market: BY route of administration, 2019-2028 (USD Million)

FIGURE 42 Europe Laxative market: BY route of administration, CAGR (2021-2028)

FIGURE 43 Europe Laxative market: BY route of administration, LIFELINE CURVE

FIGURE 44 Europe Laxative market: BY population type, 2020

FIGURE 45 Europe Laxative market: BY population type, 2019-2028 (USD Million)

FIGURE 46 Europe Laxative market: BY population type, CAGR (2021-2028)

FIGURE 47 Europe Laxative market: BY population type, LIFELINE CURVE

FIGURE 48 Europe Laxative market: BY sales channel, 2020

FIGURE 49 Europe Laxative market: BY sales channel, 2019-2028 (USD Million)

FIGURE 50 Europe Laxative market: BY sales channel, CAGR (2021-2028)

FIGURE 51 Europe Laxative market: BY sales channel, LIFELINE CURVE

FIGURE 52 Europe Laxative market: BY distribution channel, 2020

FIGURE 53 Europe Laxative market: BY distribution channel, 2019-2028 (USD Million)

FIGURE 54 Europe Laxative market: BY distribution channel, CAGR (2021-2028)

FIGURE 55 Europe Laxative market: BY distribution channel, LIFELINE CURVE

FIGURE 56 EUROPE LAXATIVE MARKET: SNAPSHOT (2020)

FIGURE 57 EUROPE LAXATIVE MARKET: BY COUNTRY (2020)

FIGURE 58 EUROPE LAXATIVE MARKET: BY COUNTRY (2021 & 2028)

FIGURE 59 EUROPE LAXATIVE MARKET: BY COUNTRY (2020 & 2028)

FIGURE 60 EUROPE LAXATIVE MARKET: BY TYPE (2021-2028)

FIGURE 61 Europe laxative Market: company share 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.